MEV, or Maximal Extractable Value, is no longer just a technical curiosity for Ethereum mainnet. It’s now a headline issue in Layer 2 (L2) networks, where the stakes are arguably even higher for decentralized exchange (DEX) routing, user experience, and protocol economics. As L2 rollups like Base and Arbitrum race to capture DEX volume, the way MEV is handled is rapidly evolving – and so are the incentives for traders, searchers, and protocols.

Layer 2 MEV: A New Battleground for DEX Routing

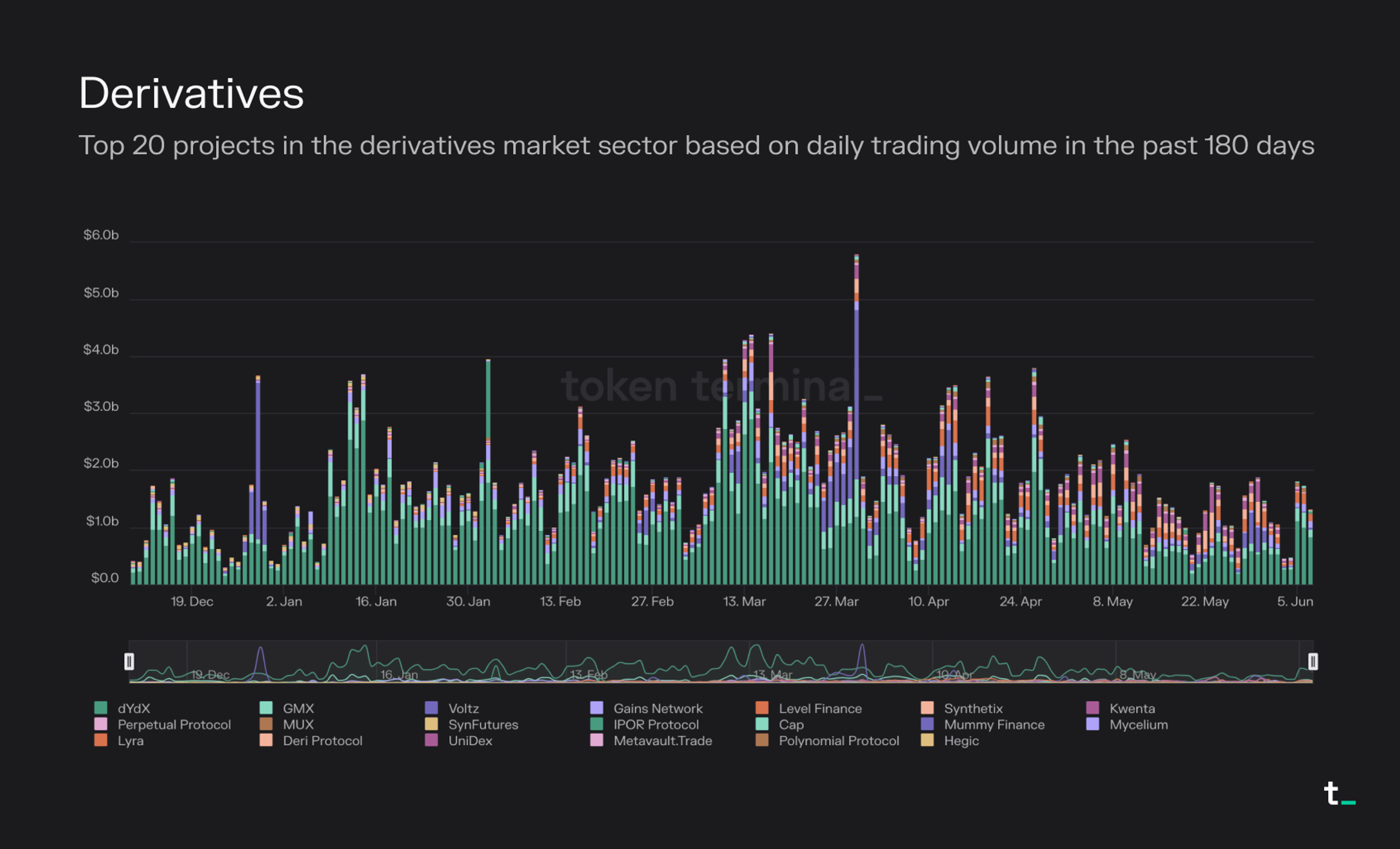

On Ethereum mainnet, MEV has long been seen as a hidden tax on users – an invisible cost extracted by validators or miners who reorder transactions for profit. But L2s change the game. With faster finality and lower fees, they enable new attack vectors but also new forms of protection against predatory MEV strategies. According to recent research, Base has prioritized both time and gas fees in its design and is now leading other L2s in DEX transaction activity.

This surge in usage has made L2s fertile ground for innovative MEV mitigation tools. The two most impactful developments so far? Rebates via Order Flow Auctions (OFAs) and private order flow channels. Both are fundamentally reshaping how value flows through DEX routers and who ultimately gets to keep it.

The Mechanics: Rebates and Private Orderflow Explained

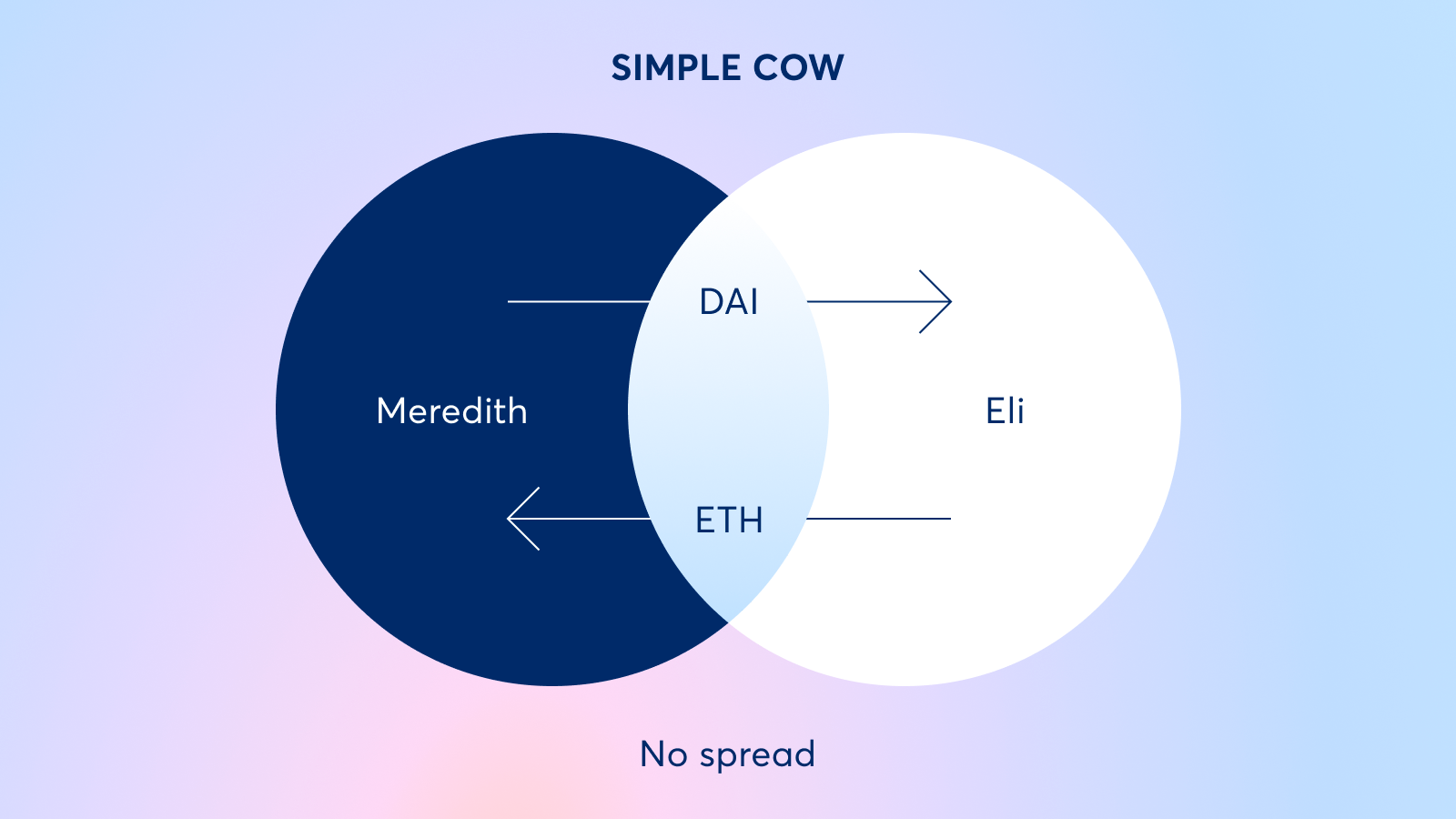

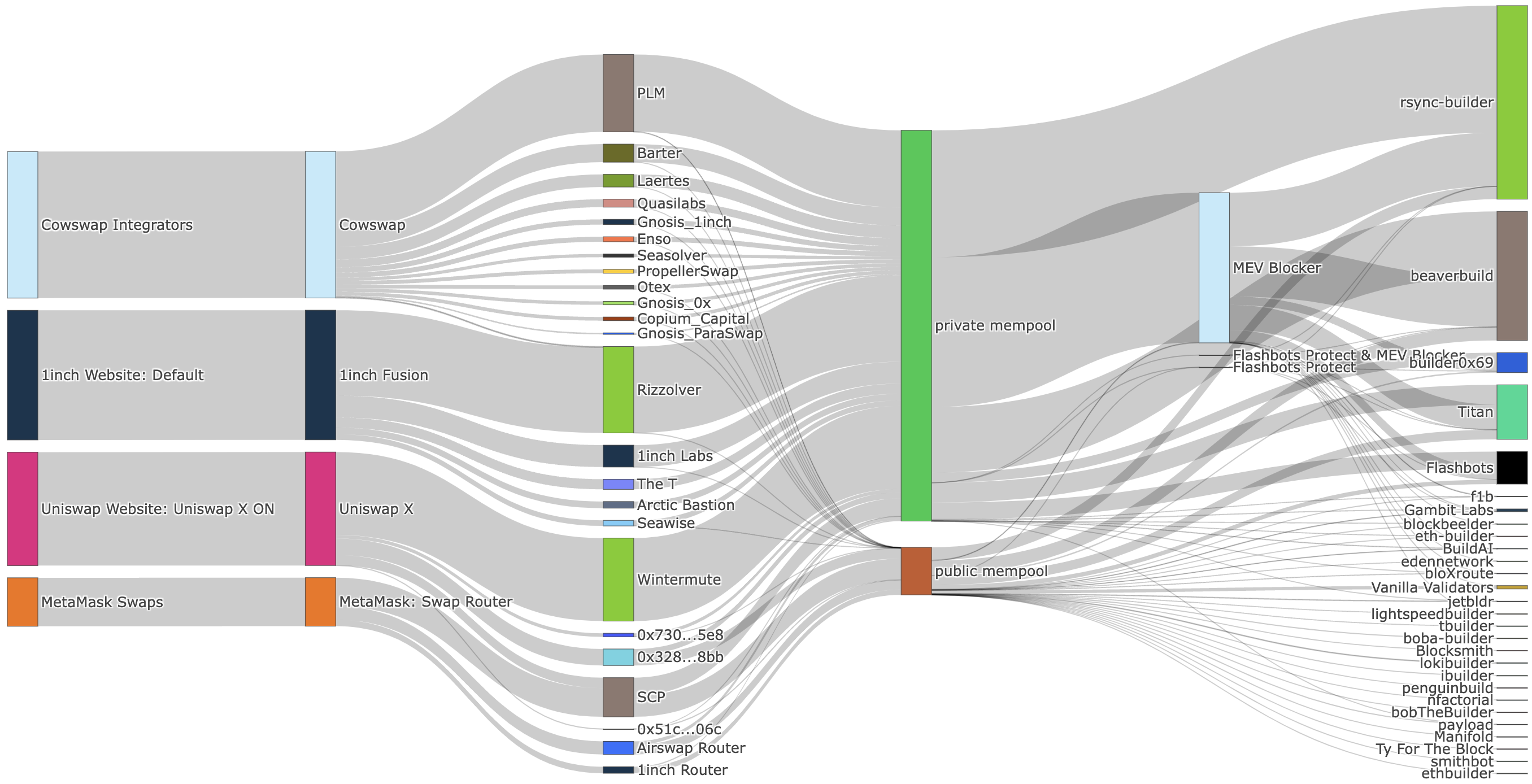

Private order flow lets users submit trades directly to trusted relays or private mempools, bypassing the public mempool where traditional MEV bots lurk. This approach drastically reduces front-running and sandwich attacks – a major win for active traders seeking reliable execution.

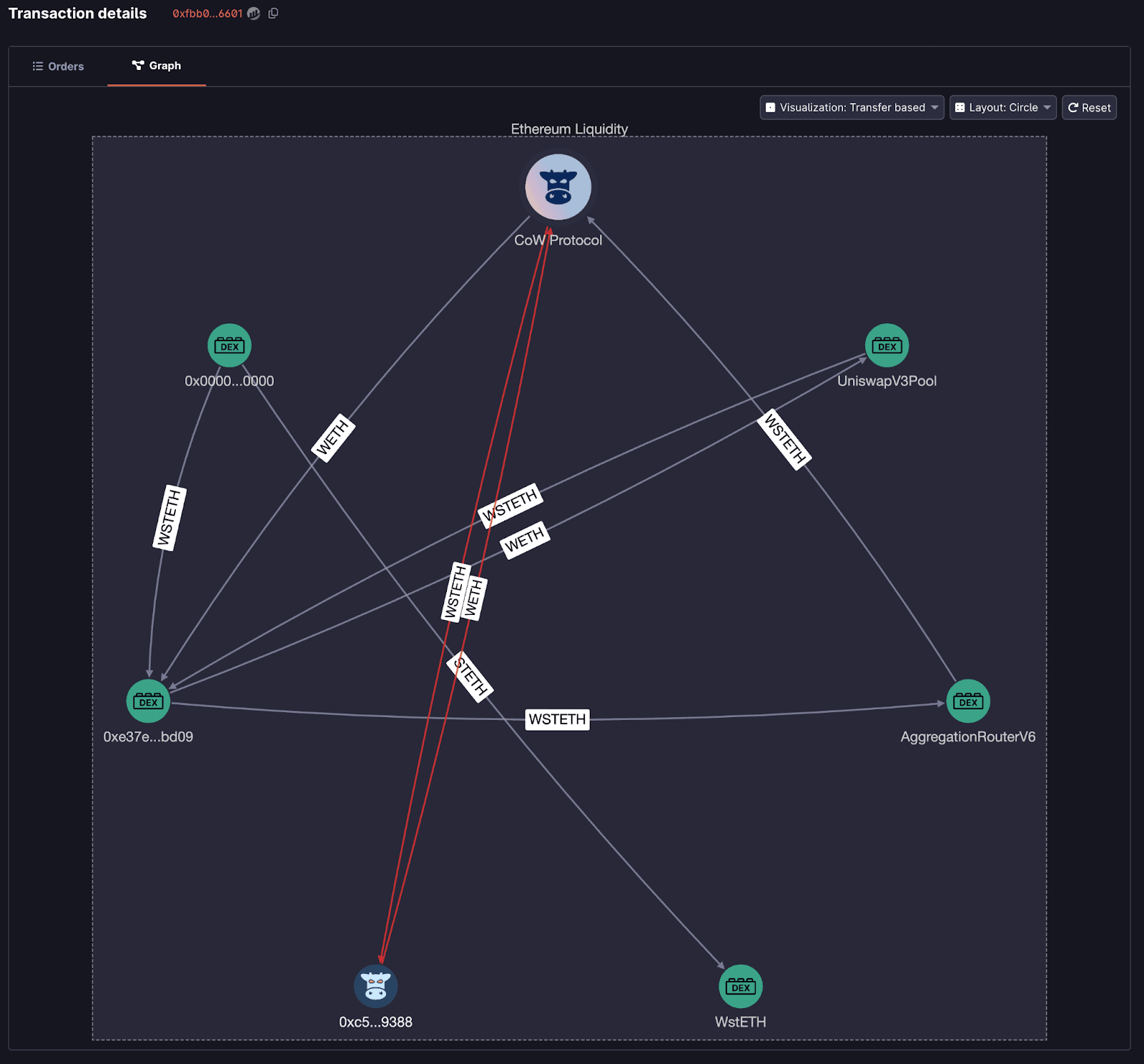

Order Flow Auctions (OFAs), like those pioneered by CoW Protocol, take things further by letting searchers bid for the right to execute user transactions. The winning bidder shares a portion of any extracted MEV back with the user as a rebate. This flips the script: instead of being exploited by searchers, users can now participate in the upside of their own order flow (source).

How These Innovations Are Changing DEX Routing Economics

The combined effect of rebates and private order flow is threefold:

How Rebates & Private Order Flow Are Changing DEX Routing

-

Private Order Flow Reduces MEV Attacks: Submitting trades through private channels—such as CoW Protocol’s MEV Blocker—conceals transaction details from MEV bots. This minimizes front-running and sandwich attacks, resulting in fairer and more predictable trade execution for users.

-

Order Flow Auctions (OFAs) Enable User Rebates: Platforms like CoW Protocol conduct auctions where searchers bid for the right to execute user orders. Winning bidders share MEV profits with users, effectively turning hidden fees into visible rebates and boosting user participation.

-

DEXs Gain Competitive Edge With MEV Protection: Adoption of MEV protection and rebate mechanisms—like those on Base and CoW Protocol—attracts users seeking safer, more profitable trades. This shifts routing preferences and increases market share for DEXs offering these features.

-

Increased Trading Volume and Liquidity: By offering rebates and MEV protection, DEXs incentivize users to trade more frequently. This boosts overall liquidity and deepens order books, improving routing efficiency and price execution for everyone.

-

Enhanced User Trust and Platform Transparency: Rebates and private order flow mechanisms empower users with more control over their trades and rewards. This transparency fosters trust and encourages long-term engagement with DEX platforms.

User Protection: By shielding trades from public view until inclusion, these tools make execution outcomes more predictable – critical for swing traders timing breakouts or arbitrageurs seeking edge.

User Incentives: Rebates transform what used to be an unavoidable loss into potential profit-sharing opportunities.

DEX Competition: Platforms that integrate these protections stand to capture more market share as traders migrate toward fairer venues.

The numbers speak volumes: By mid-2024, roughly 30% of Ethereum transactions were submitted privately but accounted for over 50% of network gas usage (source). That’s not just a technical shift – it’s a wholesale change in how value circulates through DeFi’s core infrastructure.

As these mechanisms mature, the competitive landscape for DEXs on Layer 2s is evolving rapidly. Traders are no longer just chasing the lowest fees or fastest execution – now, the hidden economics of MEV rebates and private order flow are influencing routing decisions. This means DEX aggregators and protocols must adapt their algorithms to route through paths that maximize user rebates or minimize MEV risk, not just optimize for slippage or gas.

For protocol designers, this shift demands a rethink of incentive structures. Integrating OFA support or private order flow compatibility can be a significant differentiator, especially for new L2-native DEXs competing against established incumbents. The result? A more dynamic, user-centric market where value flows back to traders instead of being quietly siphoned off by searchers and validators.

“MEV rebates have turned what used to be an invisible tax into a visible reward for savvy users. The next phase will see DEXs compete not just on UI or liquidity but on how much value they can return to their traders. “

What’s Next for MEV Sharing in L2 DeFi?

The big question is how far these trends will go as L2 ecosystems mature. If private order flow becomes the default and OFAs are widely adopted, we could see a future where MEV is less extractive and more symbiotic – with users, protocols, and searchers all sharing in the upside. But this outcome isn’t guaranteed: there’s still plenty of experimentation ahead as protocols balance transparency, efficiency, and fairness.

For traders looking to capitalize on these shifts, here are some practical moves:

Top Actions for Traders to Leverage MEV Rebates & Private Order Flow in L2 DEXes

-

Use CoW Protocol for Order Flow Auctions (OFAs): Submit trades through CoW Protocol to participate in OFAs, where searchers bid to execute your transaction and share MEV profits as rebates. This approach directly rewards you for your order flow and minimizes exposure to front-running.

-

Route Trades via MEV-Blocking Aggregators: Utilize platforms like MEV Blocker or Matcha that aggregate DEX liquidity and offer MEV protection by routing orders through private relays, reducing the risk of sandwich attacks on L2s such as Base and Arbitrum.

-

Submit Transactions Privately with Flashbots Protect: Send your L2 trades via Flashbots Protect RPC endpoints to keep transaction details out of the public mempool, lowering the chance of MEV extraction and improving execution outcomes.

-

Monitor and Optimize for L2s with High MEV Rebate Activity: Focus trading on Layer 2s like Base, which has prioritized time and gas efficiency and is currently the most active L2 for DEX transactions. Higher activity often means more robust rebate and private order flow infrastructure.

Keep an eye on which DEXs offer native support for OFAs or private relays – early adopters often enjoy outsized rewards. Use tools that surface real-time rebate stats when routing trades across Layer 2s. And don’t underestimate the power of community feedback: platforms that listen closely to trader pain points tend to iterate faster on MEV protection features.

The bottom line? MEV Layer 2 dynamics are changing fast. Rebates and private orderflow aren’t just technical upgrades; they’re rewiring the incentives that underpin DEX routing economics across Ethereum L2 networks. As this new equilibrium forms, expect smarter routing algorithms, sharper competition among aggregators, and more opportunities for users to claim a fairer share of DeFi’s hidden value flows.