In the rapidly evolving world of decentralized finance (DeFi), Miner Extractable Value (MEV) has emerged as both a lucrative opportunity and a profound challenge. MEV refers to the additional profit that miners, validators, or network participants can extract by reordering, including, or excluding transactions within blocks. While MEV can drive innovation, unchecked extraction often leads to unfair advantages for sophisticated actors at the expense of everyday users and liquidity providers. To address these imbalances, a new wave of MEV redistribution protocols is redefining how value is shared across DeFi ecosystems.

The Case for MEV Redistribution: Why It Matters

The core mission behind MEV redistribution protocols is simple: empower users and dApps by rerouting value that would otherwise be siphoned off by searchers or validators. This not only enhances fairness but also bolsters trust in DeFi platforms. As DeFi matures, protocol designers are prioritizing mechanisms that mitigate predatory extraction while ensuring efficient market operations.

Three protocols have recently gained prominence for their innovative approaches: Wallchain, Reflex Finance, and Angstrom Protocol. Each brings a unique architecture to the table, reflecting different philosophies on how MEV should be captured and redistributed.

Wallchain: Flow Auctions at the User Interface Layer

Wallchain stands out for its user-centric approach, integrating directly with decentralized applications (dApps) and wallets. The protocol’s signature innovation is the Meta-Intent Flow Auction. Here’s how it works:

- User swap intents are bundled with searcher strategies into single transactions.

- This auction mechanism connects order flow providers with MEV searchers in real time.

- The winning searcher’s strategy is executed alongside the user’s transaction, capturing potential MEV while minimizing risk.

- A portion of this value is then redistributed back to dApps or users themselves.

This model has already seen significant adoption on BNB Chain, integrated with major platforms like PancakeSwap and ApeSwap, and reportedly facilitates over 90% of order flow on that network. Wallchain’s design minimizes slippage and frontrunning risks while transforming what was once an adversarial dynamic into a collaborative marketplace for value sharing.

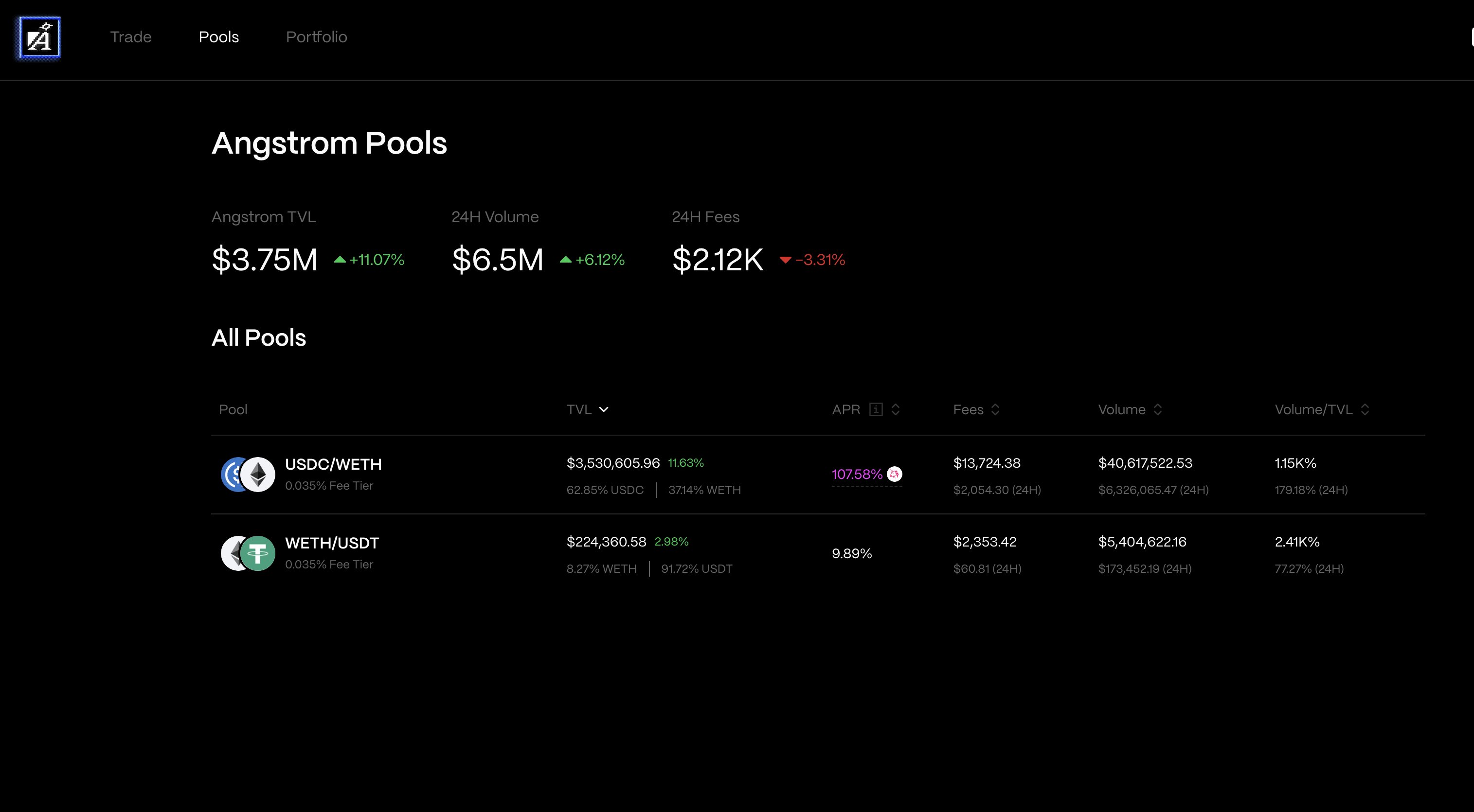

Angstrom Protocol: Protocol-Level Defense Against MEV

Angstrom Protocol, developed by Sorella Labs with backing from the Uniswap Foundation, takes a fundamentally different approach. Rather than operating at the wallet or aggregator level, Angstrom integrates MEV mitigation directly into its decentralized exchange (DEX) protocol. Key features include:

- A uniform matching engine that ensures trades execute at agreed prices without leakage to arbitrageurs or sequencers.

- An internal auction system designed to calibrate fair execution even during volatile periods.

- Tight integration with Uniswap v4’s modular hooks architecture for enhanced composability and protection against front-running attacks.

This protocol-level defense aims to restore confidence among liquidity providers and traders who have grown wary of unpredictable losses due to sandwich attacks or slippage. With $7.5 million in seed funding secured from Paradigm and Uniswap Ventures in August 2024, Angstrom’s testnet deployment planned for early 2025 will be closely watched as a potential blueprint for future DEX designs.

Comparing Leading MEV Redistribution Protocols

-

Wallchain: Utilizes a Meta-Intent Flow Auction that integrates directly with dApps and wallets, allowing user transactions and intents to be bundled with MEV searcher strategies. Wallchain acts as a marketplace connecting order flow providers and searchers, enabling seamless MEV capture and redistribution. Notably, it has been adopted by major BNB Chain platforms such as PancakeSwap and ApeSwap, covering over 90% of the chain’s order flow.

-

Reflex Finance: As of September 2025, there is limited publicly available information on Reflex Finance’s specific MEV redistribution mechanisms. While referenced as a protocol in the MEV space, Reflex Finance’s technical approach and adoption remain less documented compared to Wallchain and Angstrom. Further research or official updates are necessary for a comprehensive evaluation.

-

Angstrom Protocol: Developed by Sorella Labs and backed by the Uniswap Foundation, Angstrom is a DEX-level protocol focused on mitigating MEV risks through built-in protections for token swaps and liquidity providers. Leveraging Uniswap v4’s modular design, Angstrom employs a uniform matching engine and internal auction mechanisms to prevent order leakage and front-running, ensuring fair trade execution. The protocol received $7.5 million in seed funding and is set for testnet deployment in 2025.

Reflex Finance: The Enigmatic Contender in MEV Redistribution

The third protocol on our list provides Reflex Finance: remains something of an enigma in the current landscape. As of September 2025, there is limited public technical documentation or market data available regarding Reflex’s specific mechanisms for MEV capture or redistribution. However, its inclusion among leading contenders suggests either emerging traction within certain DeFi niches or innovative features yet to be fully disclosed. Observers should keep an eye on official releases from Reflex Finance as competition intensifies in this sector.

MEV redistribution is not a one-size-fits-all challenge. The diversity of approaches among Wallchain, Reflex Finance, and Angstrom Protocol highlights the ongoing experimentation and evolution within DeFi’s most critical infrastructure layer. Each protocol is responding to the unique trade-offs between decentralization, efficiency, user incentives, and security.

Comparing MEV Redistribution Models

When evaluating these three protocols side by side, several key distinctions emerge:

Comparing Leading MEV Redistribution Protocols

-

Wallchain: Wallchain utilizes the Meta-Intent Flow Auction system, integrating directly with dApps and wallets to capture and redistribute MEV. By bundling user transactions and intents with MEV searcher strategies into a single transaction, Wallchain minimizes risk and maximizes returns for users and protocols. Its adoption on major BNB Chain platforms like PancakeSwap and ApeSwap highlights its impact on over 90% of the chain’s order flow.

-

Reflex Finance: As of September 2025, Reflex Finance is referenced as a potential MEV redistribution protocol, but there is limited publicly available information regarding its specific mechanisms or adoption. Further research or official announcements are needed to provide a detailed comparison with more established solutions like Wallchain and Angstrom.

-

Angstrom Protocol: Developed by Sorella Labs and backed by the Uniswap Foundation, Angstrom Protocol is a DEX designed to mitigate MEV risks at the protocol level. Leveraging a uniform matching engine and internal auction mechanisms, Angstrom ensures fair trade execution and protects against front-running and order leakage. The protocol’s integration with Uniswap v4’s modular design and its $7.5 million seed funding underscore its significance in advancing DeFi MEV protections.

Wallchain excels in immediate user empowerment by integrating at the wallet and dApp interface. Its auction-based design creates a competitive environment for searchers while ensuring that a portion of captured MEV cycles back to the originators of order flow. This not only reduces toxic flow but also aligns incentives across users, dApps, and searchers, potentially setting a new standard for MEV marketplaces on high-throughput chains like BNB.

Angstrom Protocol, in contrast, opts for deep protocol-level integration. By embedding MEV mitigation into the DEX core itself, rather than as an add-on or external service, Angstrom aims to offer robust protection against both known and emerging forms of value extraction. The use of internal auctions and uniform pricing mechanisms could set a precedent for future DEXs seeking to balance efficiency with fairness. Angstrom’s close collaboration with Uniswap v4’s hook system also signals a trend toward more modular and customizable DeFi primitives.

Reflex Finance, while less transparent at this stage, serves as a reminder that the MEV landscape is in constant flux. New entrants may introduce hybrid models or novel incentive schemes that challenge current leaders. For those tracking market innovation or designing next-generation protocols, monitoring Reflex’s evolution will be essential.

The Road Ahead: Navigating Evolving Standards

The trajectory of MEV redistribution will ultimately be shaped by user demand for transparency and fairness, and by how well protocols can deliver these without sacrificing composability or capital efficiency. For developers and researchers alike, keeping pace with these innovations is non-negotiable if they wish to remain competitive in DeFi’s next phase.

If you’re building or trading in this space, now is the time to engage with community discussions around MEV value sharing standards and experiment with integration points offered by leaders like Wallchain and Angstrom Protocol. And don’t overlook emerging players such as Reflex Finance, today’s dark horse may be tomorrow’s paradigm shifter.