Maximal Extractable Value (MEV) has emerged as a critical topic in decentralized finance, with far-reaching implications for fairness and efficiency. As MEV extraction becomes more sophisticated, the need for transparent and equitable MEV redistribution protocols is no longer theoretical, it’s essential for the long-term health of DeFi ecosystems. In this article, we analyze how these protocols are enhancing fairness in DeFi by leveling the playing field for all participants.

Why MEV Matters: The Challenge of Equitable Value Capture

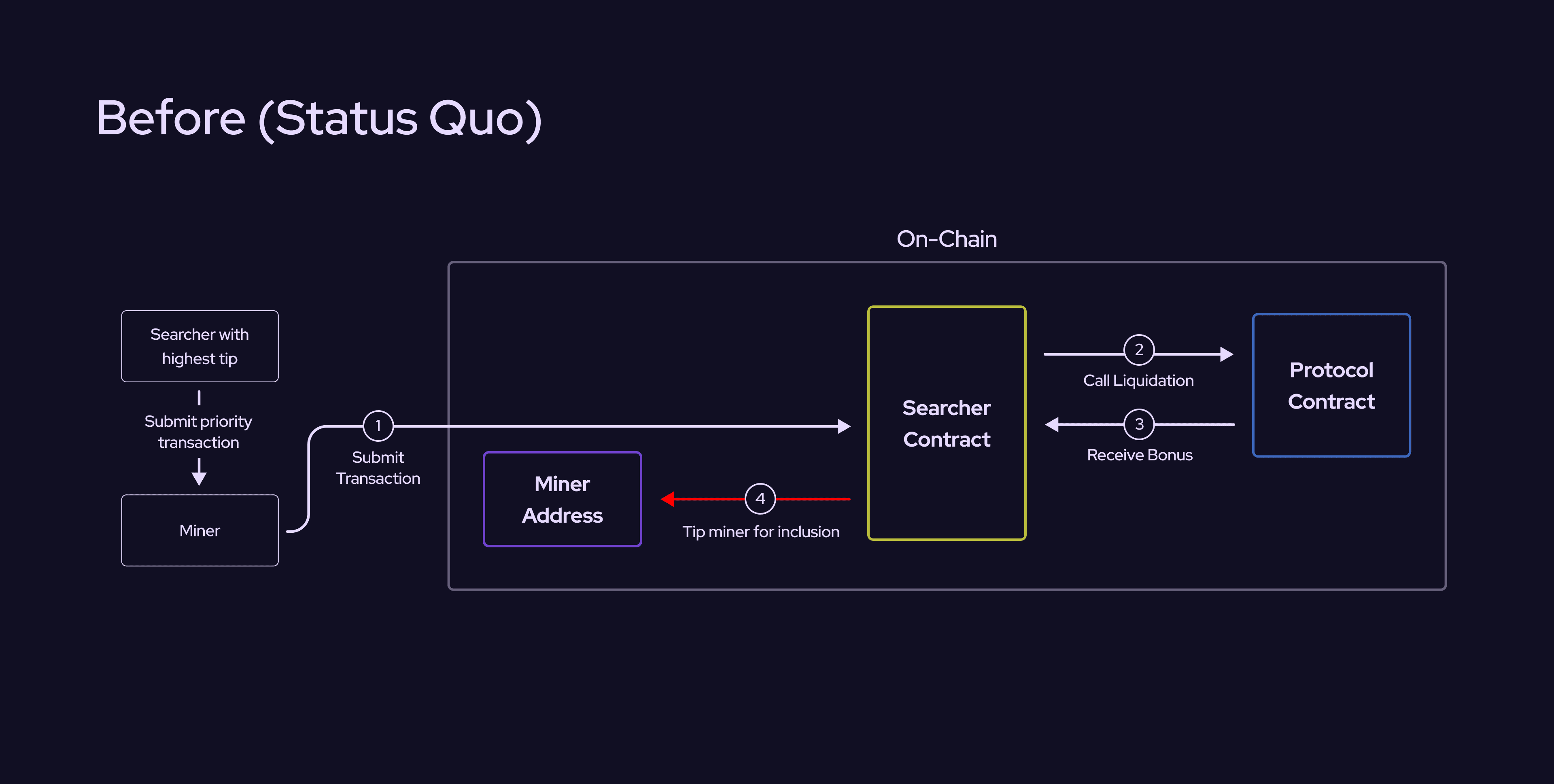

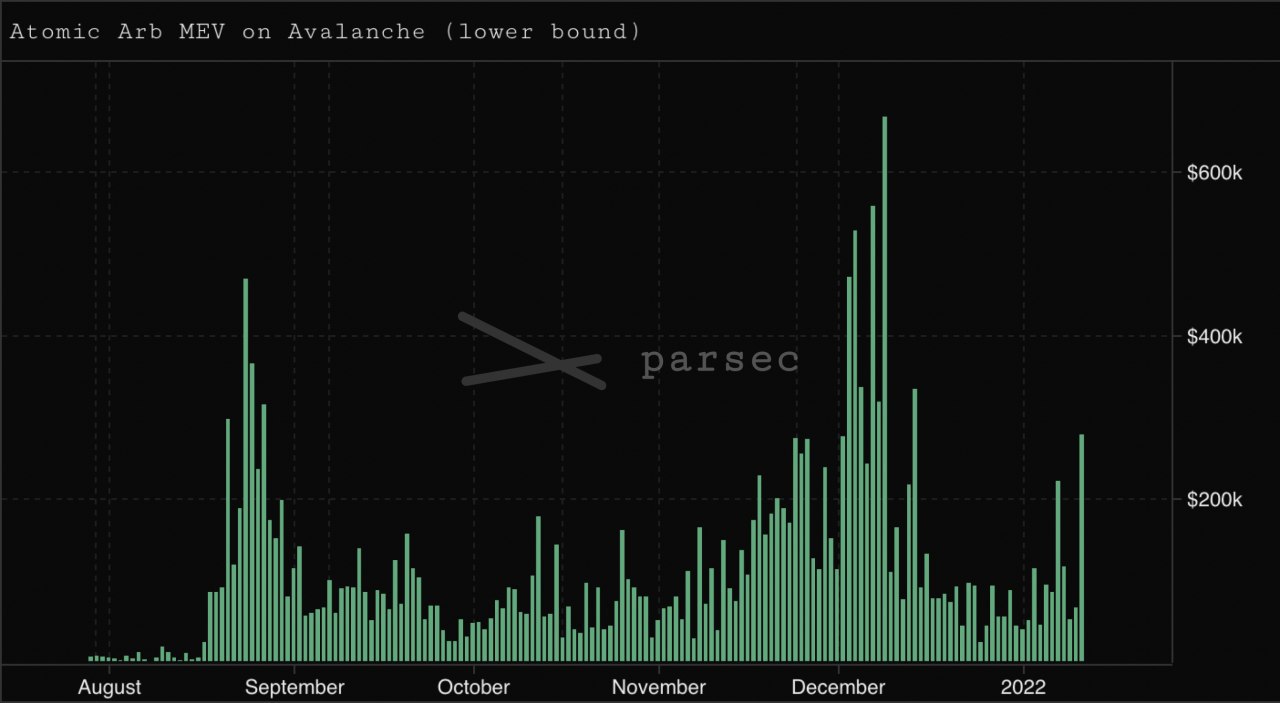

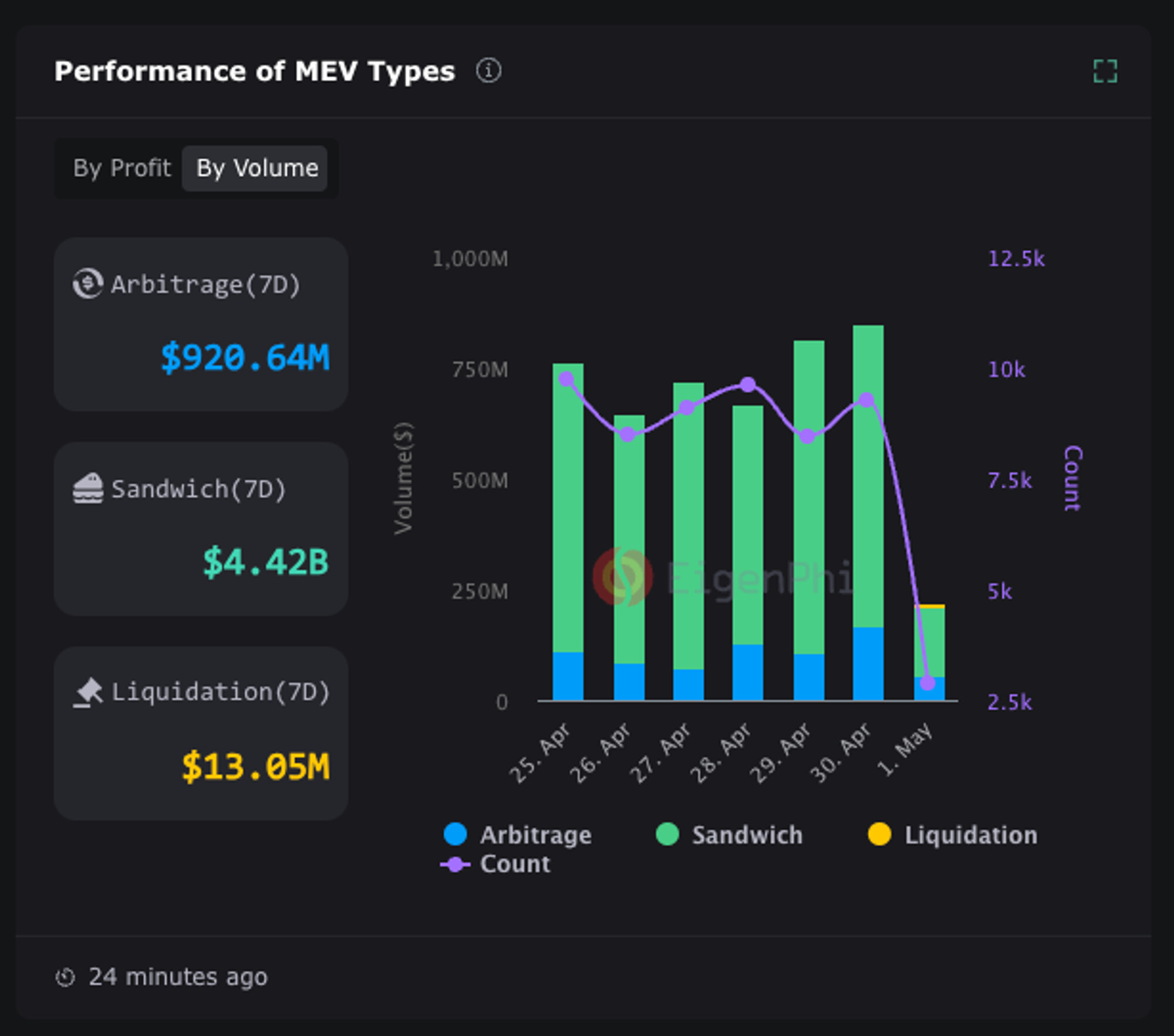

At its core, MEV refers to profit opportunities that arise from manipulating the order or inclusion of transactions within a block. Validators, miners, or even sophisticated bots can exploit public mempools through techniques like front-running and sandwich attacks. As highlighted by recent research, unchecked MEV extraction leads to:

- Increased transaction costs for regular users

- Erosion of trust in DeFi platforms

- Centralization risks as larger players dominate extraction strategies

This landscape makes it clear: a system that only rewards those with technical prowess or privileged network access undermines the foundational values of DeFi. The solution lies in redistributing MEV so that value accrues not just to extractors but to liquidity providers (LPs), traders, and network participants.

The Mechanics Behind Modern MEV Redistribution Protocols

Several innovative approaches are now shaping the future of equitable MEV sharing. Let’s break down some key mechanisms currently deployed or under active research:

Types of MEV Redistribution Protocols in DeFi

-

MEV Smoothing: This protocol pools MEV rewards from block production and distributes them evenly among all validators, reducing income disparities and discouraging collusion. By sharing MEV earnings, MEV Smoothing promotes fairness and network stability.

-

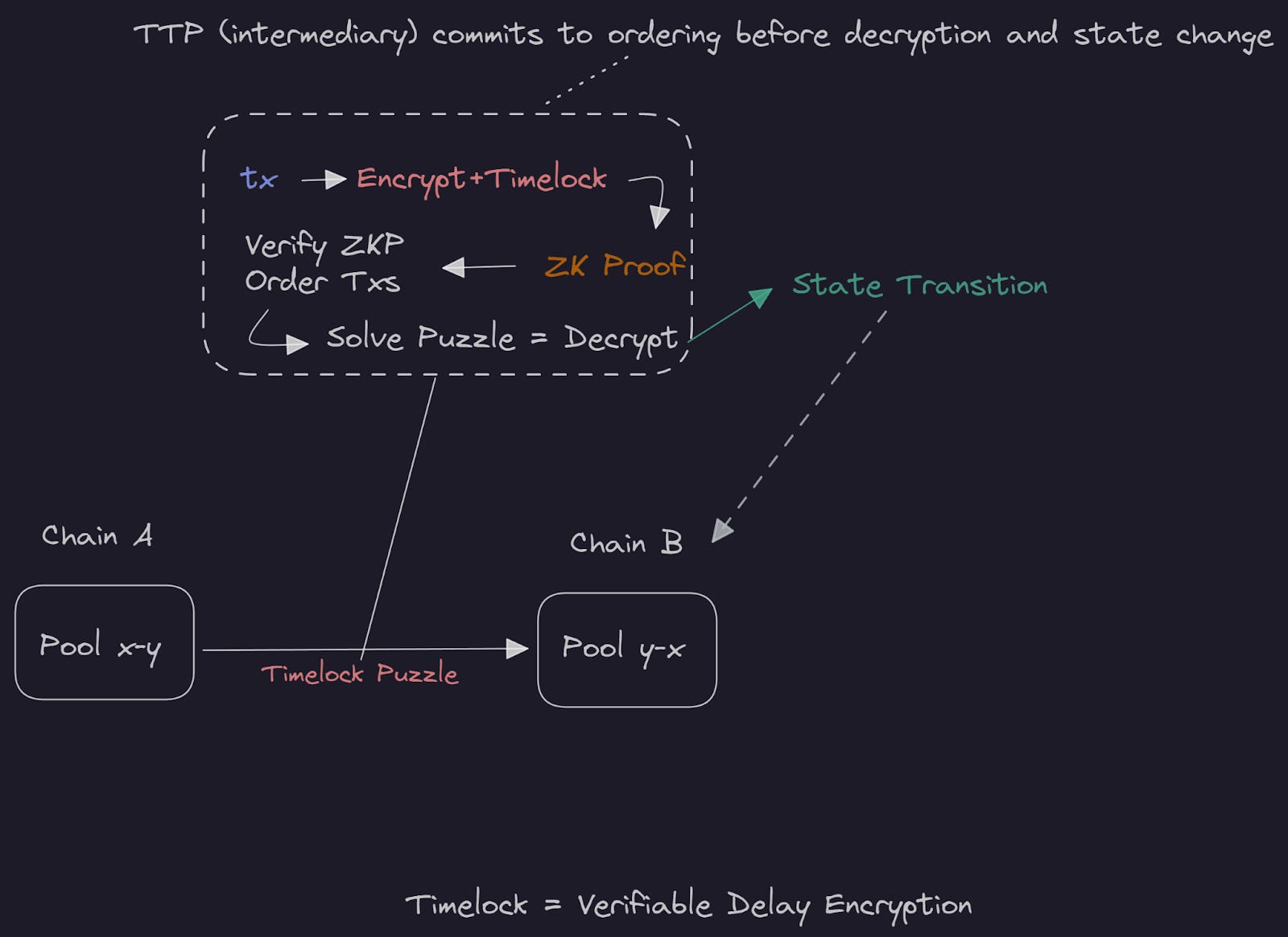

Protected Order Flow (PROF): PROF enforces a predetermined ordering of transactions, making it impossible for validators or miners to reorder, insert, or censor transactions for personal gain. This approach maintains the integrity of transaction sequencing and prevents MEV extraction through manipulation.

-

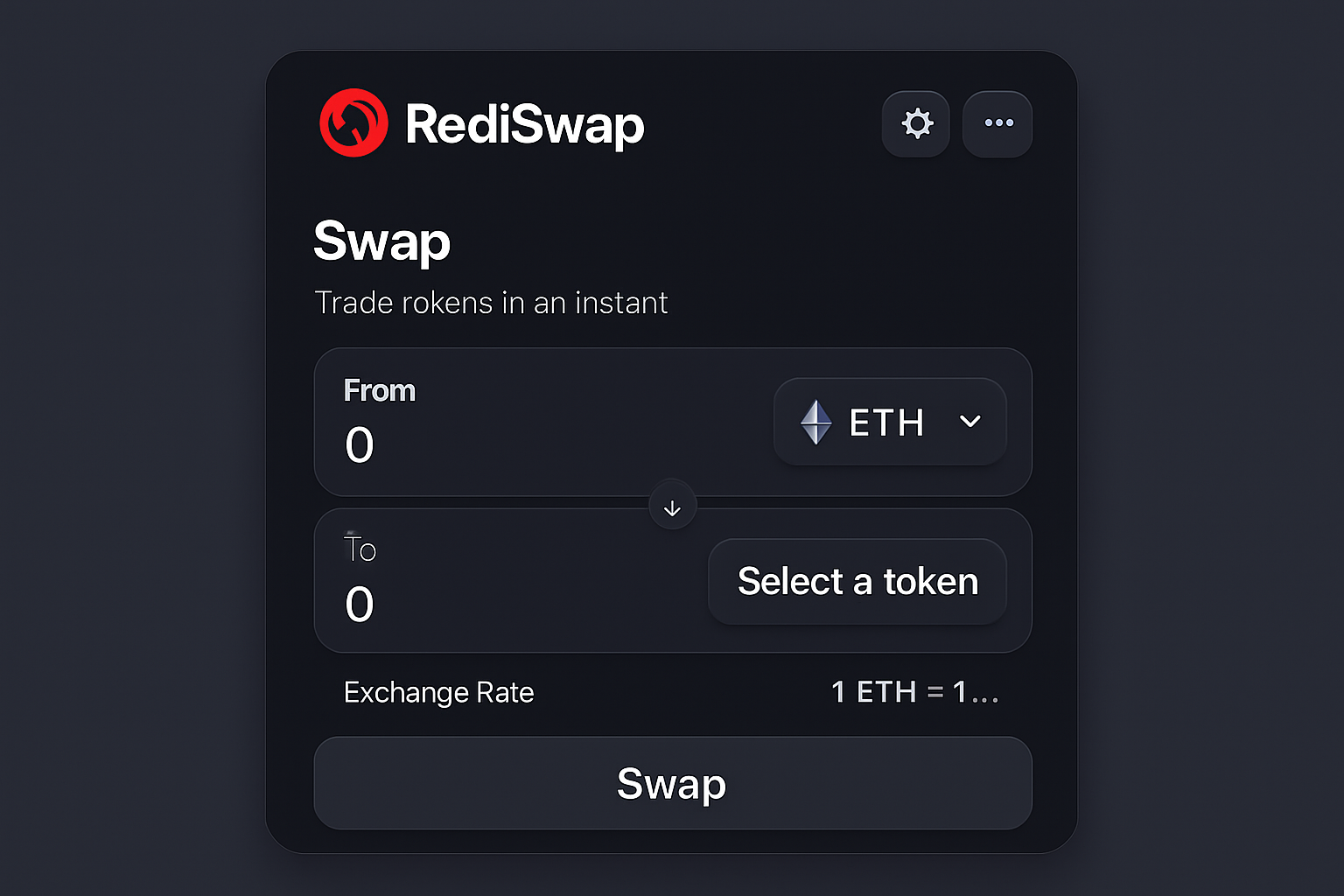

RediSwap: Operating at the application level within Automated Market Makers (AMMs), RediSwap captures MEV and redistributes it among users and liquidity providers. This mechanism reduces losses from MEV exploitation and enhances the fairness of decentralized trading platforms.

-

MEV Blocker: MEV Blocker is a multi-transaction MEV redistribution system that refunds up to 90% of builder rewards directly to users. By returning a significant portion of MEV-derived value, it mitigates the impact of MEV exploitation and ensures users benefit from their transactions.

1. MEV Smoothing: This protocol pools all extracted MEV over a set period and then distributes rewards evenly among validators or stakers. By smoothing out income disparities, it discourages collusion and centralization while promoting network stability. For example, Gate. io’s analysis demonstrates how smoothing can restrict undue proposer influence.

2. Protected Order Flow (PROF): PROF enforces strict transaction sequencing rules at either the protocol or application layer, making it harder for any actor to reorder transactions opportunistically. This preserves market integrity by ensuring users cannot be systematically disadvantaged.

3. Application-Level Redistribution (RediSwap): Some AMMs now integrate mechanisms like RediSwap that capture value from potential arbitrage or sandwich attacks at the pool level and return it directly to LPs and honest traders rather than letting it leak out to external actors.

4. User Refund Systems (MEV Blocker): By refunding up to 90% of builder rewards back to end users, rather than allowing full capture by block builders, these systems ensure ordinary DeFi users benefit from their own transaction flow’s value creation (source).

Tangible Benefits: Fairness Gains Across the DeFi Stack

The impact of widespread adoption of MEV redistribution protocols is already visible across several dimensions:

- User Trust: When users see direct rewards or reduced slippage due to redistributed MEV, confidence in platform fairness increases.

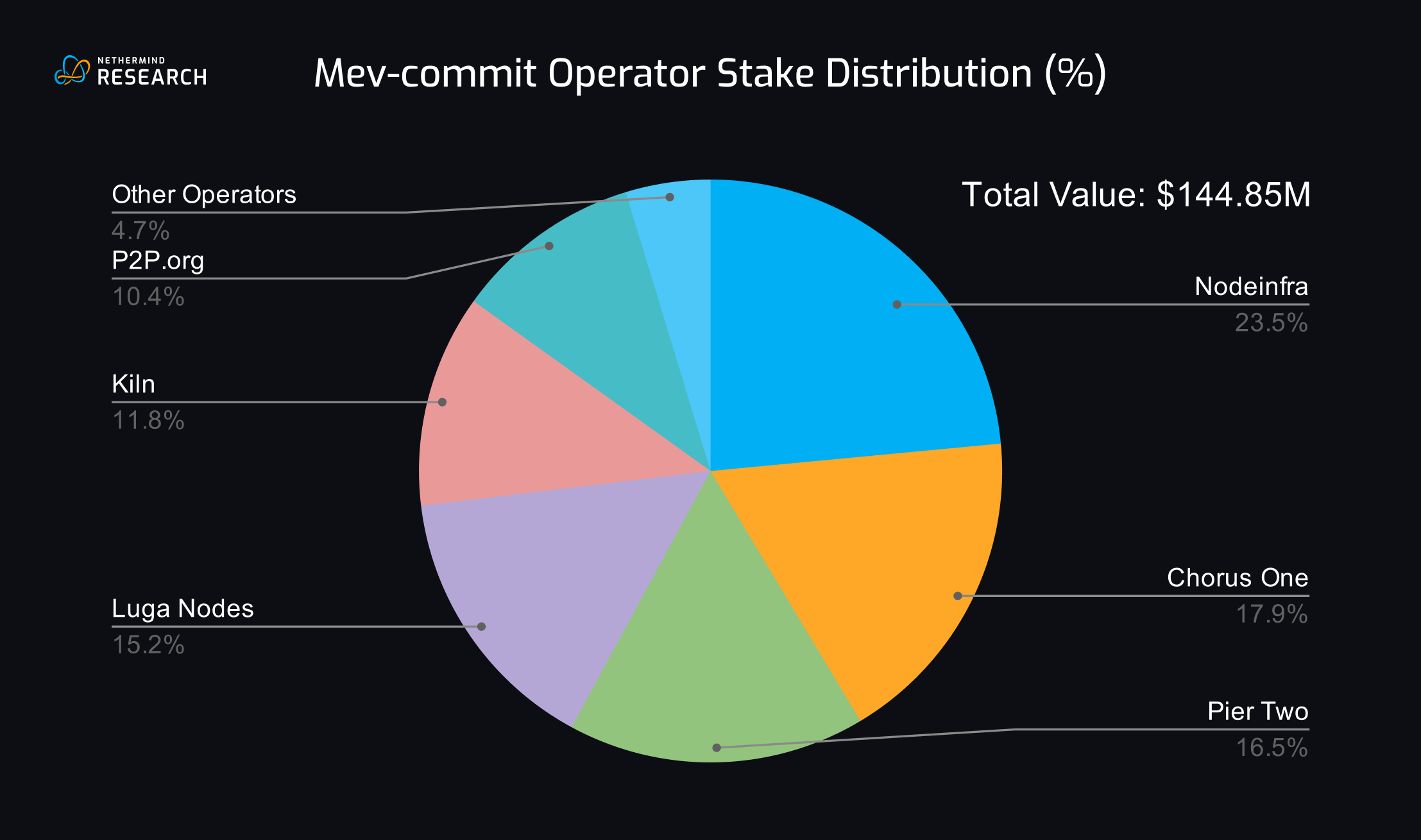

- Ecosystem Participation: Redistributed incentives encourage more staking and liquidity provision, as shown by formal studies on competitive equilibria (Gate.io analysis, ACM SIGSAC proceedings).

- Sustainable Market Efficiency: Properly aligned incentives reduce exploitative behavior while maintaining healthy arbitrage and price discovery mechanisms.

This shift toward equitable sharing is also reflected in ongoing protocol development; new blockchain designs like BITE Protocol aim to eliminate exploitable ordering at consensus level entirely, a technological leap outlined by recent research on fairness breakthroughs.

Despite the technical complexity, the core principle behind MEV redistribution protocols is simple: value generated within DeFi should flow back to all contributors, not just those with privileged access or sophisticated tools. This ethos is increasingly shaping both protocol design and user expectations.

Challenges and Trade-Offs: Balancing Efficiency With Fairness

No solution comes without trade-offs. Implementing robust MEV redistribution mechanisms can introduce new layers of protocol overhead or latency. For example, enforcing protected order flow (PROF) may require additional cryptographic proofs or consensus steps, potentially affecting throughput. Similarly, pooling and smoothing MEV rewards could dilute incentives for validators to act honestly if not carefully calibrated. Nevertheless, these are engineering challenges, not fundamental roadblocks, and ongoing research continues to refine these systems for optimal performance.

It’s also important to recognize that redistribution does not eliminate MEV entirely. Instead, it changes who benefits from it. Protocols like RediSwap and MEV Blocker demonstrate that even partial redistribution can meaningfully align incentives between users and infrastructure providers.

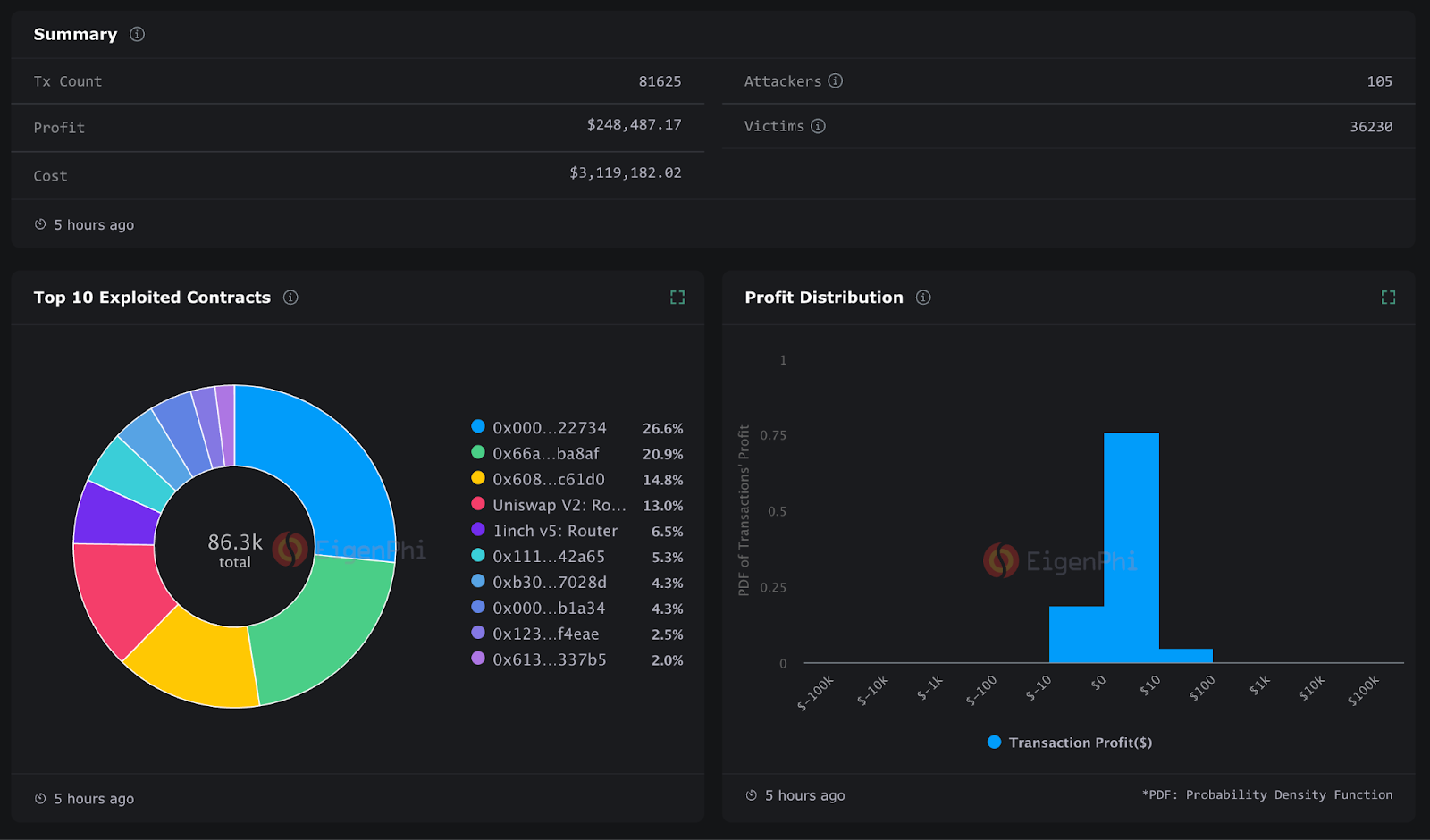

Evolving Analytics: Transparency Tools for Equitable MEV Sharing

The push for fairness in DeFi is tightly coupled with advances in MEV analytics tools. These platforms provide real-time insights into where value is being extracted, and crucially, how much is being returned to users versus retained by intermediaries. Enhanced transparency empowers both developers and traders to make informed decisions about which protocols best align with their values and risk profiles.

Top 5 MEV Analytics Tools for Fair Value Monitoring

-

EigenPhi: A leading analytics platform offering comprehensive MEV flow tracking, sandwich attack detection, and real-time profit attribution. EigenPhi empowers DeFi users to monitor MEV extraction and redistribution across major blockchains.

-

Flashbots Explorer: This open-source tool provides transparent access to MEV-Relay data, block builder activity, and bundle submissions. It helps users and researchers analyze MEV distribution and the impact of MEV-Boost on validator rewards.

-

BloXroute MEV Dashboard: BloXroute’s dashboard delivers real-time insights into MEV opportunities, block builder performance, and transaction ordering, enabling users to assess fairness and value capture in DeFi protocols.

-

EigenLayer MEV Monitoring: As part of the EigenLayer protocol, this tool tracks MEV redistribution mechanisms and validator earnings, supporting transparency and equitable value sharing in restaking ecosystems.

-

MEV-Share by Flashbots: MEV-Share enables users to privately submit transactions and monitor the redistribution of MEV rewards. It offers analytics on how value is shared between searchers, builders, and users, promoting fairer outcomes.

As more protocols adopt open reporting standards, it becomes easier for the community to audit outcomes and hold projects accountable for their claims around fairness. This transparency is a prerequisite for sustainable growth in the sector.

The Road Ahead: Sustainable Market Efficiency Through Equitable Incentives

The future of DeFi will be shaped by how effectively protocols address the tension between efficiency and fairness. MEV redistribution protocols are a cornerstone of this evolution, offering a pragmatic path forward that preserves the benefits of competitive markets while protecting ordinary participants from systemic disadvantage.

Emerging designs such as BITE Protocol’s threshold encryption at the consensus layer signal a shift toward eliminating exploitable ordering at its root, potentially rendering many traditional forms of MEV extraction obsolete (see latest arXiv research). Until such breakthroughs become widespread, ongoing refinement of smoothing pools, protected order flows, and user refund systems will remain critical tools in the quest for equitable DeFi markets.

Ultimately, as more stakeholders demand transparency and fair value capture, we can expect continued innovation at both the protocol and application layers. The endgame isn’t just reducing harm from MEV, it’s unlocking a new era where every participant has a stake in the value they help create.