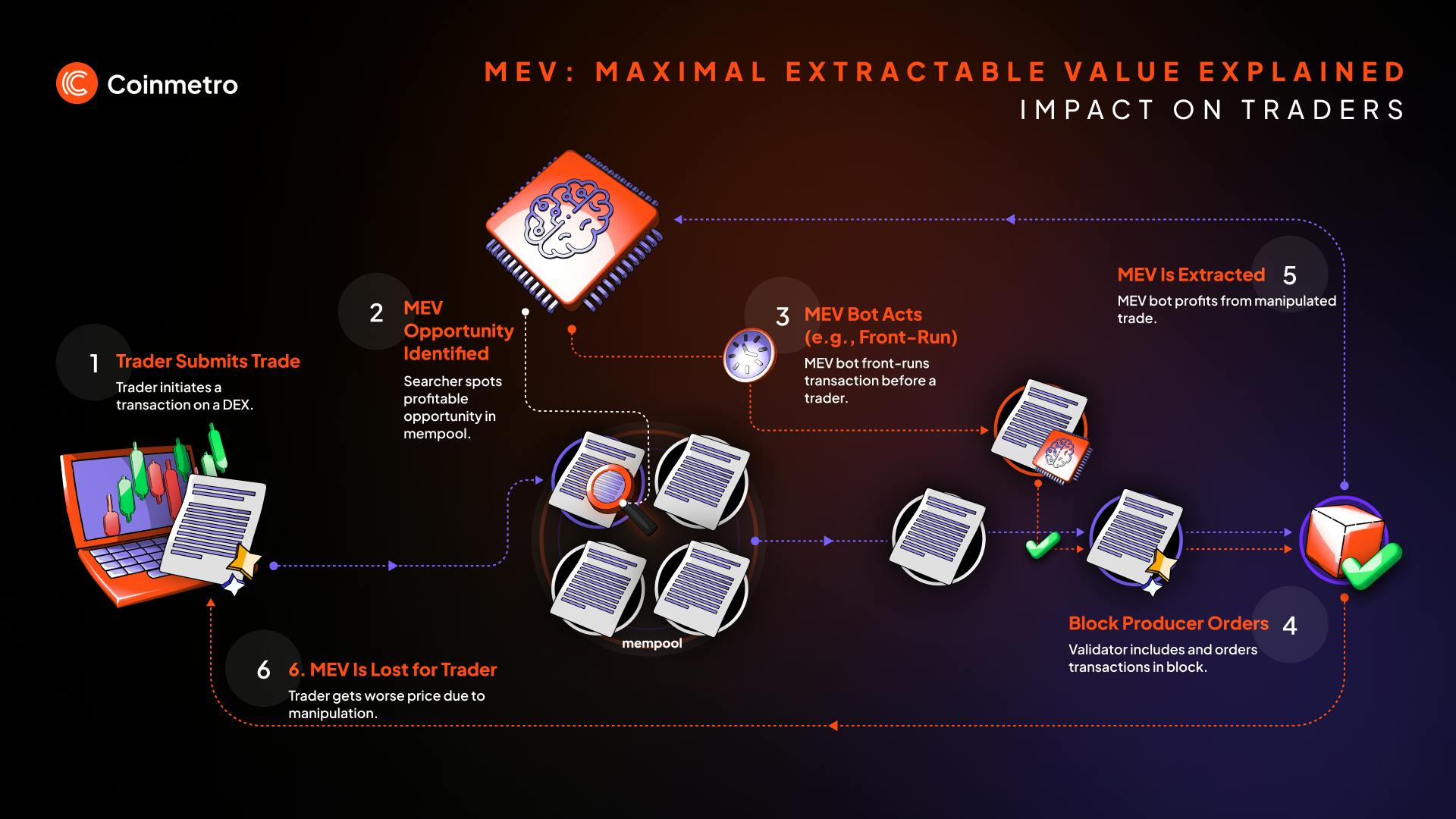

DeFi was built on the promise of open access and equal opportunity, but for years, the reality has been clouded by the shadow of MEV (Maximal Extractable Value). While early MEV extraction mostly benefited whales and sophisticated searchers, 2024 has marked a dramatic shift. MEV rebates are now transforming DeFi user rewards, putting real value back into the hands of everyday traders and stakers.

Ethereum Holds Strong at $4,196.16: A New Era for DeFi User Rewards

As of September 23,2025, Ethereum is trading at $4,196.16, reflecting renewed confidence in both its security and its ability to deliver fairer outcomes for users. This price milestone is not just a number – it’s a signal that the market is responding positively to innovations like MEV rebates that address longstanding fairness concerns in DeFi.

MEV Blocker: Setting the Standard for Rebates and Protection

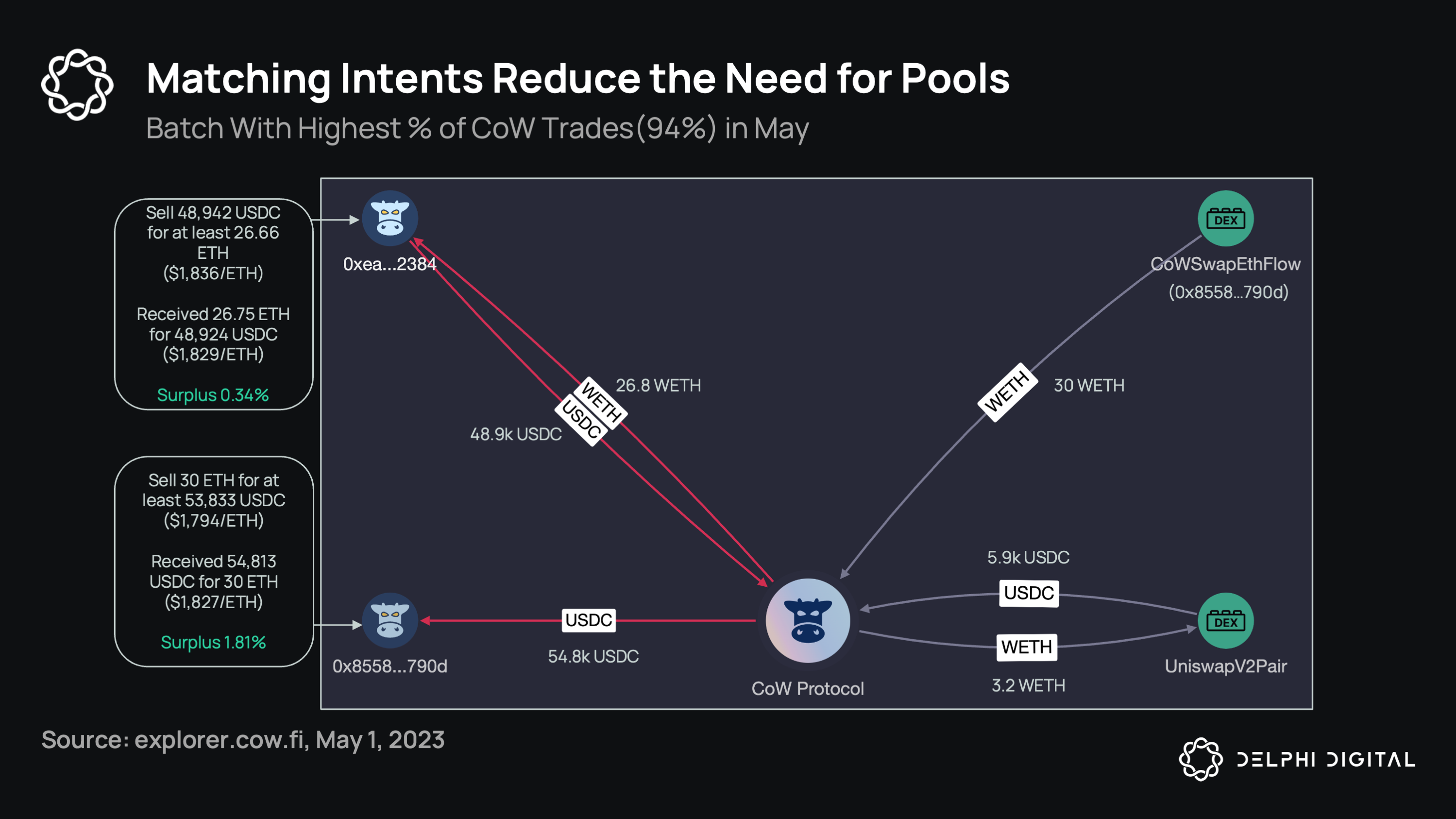

The launch of MEV Blocker by CoW Protocol, Agnostic Relay, and Beaver Build was a watershed moment in 2024. By introducing an RPC endpoint that routes transactions through a network of competing searchers, MEV Blocker actively protects users from frontrunning and sandwich attacks – two of the most common forms of MEV exploitation.

The real innovation? Ninety percent of searcher bids are returned as rebates directly to users, while validators receive the remaining ten percent. This approach flips the script on traditional MEV extraction by making user protection profitable for everyone involved.

The numbers speak volumes:

- $13.8 billion in trading volume protected (July 2024)

- 416,000 users served

- 2.8 million transactions processed

- 213 ETH in user rebates (July alone), totaling 4,079 ETH by year-end

This isn’t just theory – it’s direct cash flow back to DeFi participants who previously had no defense against predatory MEV tactics. For more details on rebate impact, see this Outposts analysis.

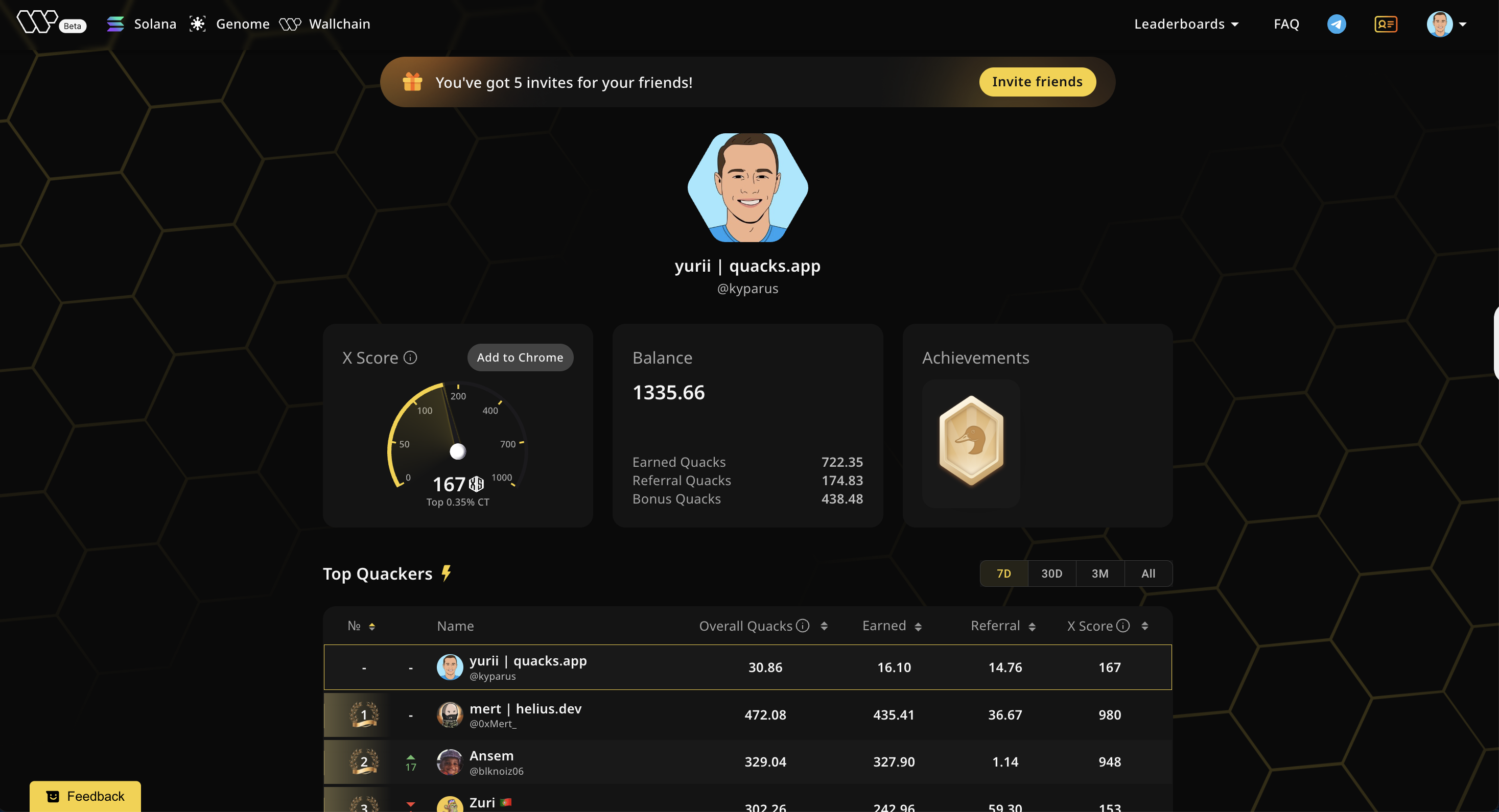

Wallchain and Reflex: Expanding the Reach of MEV Redistribution Platforms

The momentum didn’t stop with MEV Blocker. New platforms like Wallchain are gaining traction by integrating directly with DeFi protocols to capture hidden value from swaps and arbitrage opportunities – then rebating a portion back to users.

Key Features of Wallchain and Reflex for MEV Redistribution

-

Direct MEV Rebates to Users: Wallchain integrates with DeFi platforms to return a portion of captured Maximal Extractable Value (MEV) directly to users on every eligible transaction, turning hidden blockchain value into tangible rewards.

-

Seamless DeFi Platform Integration: Wallchain is designed for easy integration with leading DeFi protocols, enabling platforms to offer MEV rebates without disrupting user experience or requiring technical expertise from end-users.

-

Real-Time, Transparent Payouts: Users receive real-time rebates with full transparency into the value captured and redistributed, building trust and incentivizing continued participation.

-

Enhanced Fairness in DeFi: By redistributing MEV profits that would otherwise go to searchers or validators, Wallchain levels the playing field and reduces the advantage of whales and bots.

-

Reflex: Automated MEV Capture and Distribution: Reflex is an on-chain MEV redistribution platform that automatically captures MEV from user transactions and redistributes it back to users and liquidity providers in supported protocols.

-

Non-Custodial and Permissionless Design: Reflex operates without taking custody of user funds and is accessible to anyone, ensuring user security and broad participation.

-

Support for Multiple DeFi Protocols: Reflex is compatible with a range of popular DeFi applications, maximizing the reach and impact of MEV rebates across the ecosystem.

This new generation of MEV redistribution platforms, including Wallchain and Reflex MEV, leverages advanced routing logic to combine user swaps with searcher bids efficiently. The result is a more competitive environment where users benefit from both reduced slippage and direct profit sharing.

User Experience: From Passive Victims to Active Beneficiaries

A major advantage for traders is simplicity: there’s no need to become an expert in block mechanics or run your own node. By simply using integrated wallets or dApps that support these rebate mechanisms, any user can start earning back what would once have been quietly siphoned away by bots.

Ethereum (ETH) Price Prediction 2026-2031: Impact of MEV Rebates and DeFi Innovation

Forecast based on MEV rebate adoption, DeFi user reward mechanisms, and evolving market trends (Baseline: ETH at $4,196.16 as of Sep 2025)

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Yearly % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,800 | $4,650 | $5,600 | +10.8% | Continued MEV rebate adoption; steady DeFi growth, moderate volatility |

| 2027 | $4,000 | $5,400 | $6,800 | +16.1% | DeFi rewards attract new users; ETH 2.0 scaling impacts; regulatory clarity improves |

| 2028 | $4,400 | $6,350 | $8,200 | +17.6% | MEV protocols become standard; institutional adoption rises; competition intensifies |

| 2029 | $4,900 | $7,200 | $9,600 | +13.4% | Macro uptrend; ETH as DeFi backbone; global regulatory progress |

| 2030 | $5,300 | $8,150 | $11,000 | +13.2% | ETH ecosystem matures; new staking/yield use cases; Layer 2 innovations |

| 2031 | $6,000 | $9,200 | $12,500 | +12.9% | Mainstream DeFi integration; cross-chain MEV solutions; ETH solidifies blue-chip status |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is optimistic, reflecting the transformative impact of MEV rebate adoption and continued DeFi innovation. With baseline confidence established in 2025, ETH is projected to see steady appreciation—driven by improved user rewards, rising adoption, and evolving technology. While short-term volatility and regulatory risks persist, the long-term trend is upward as Ethereum reinforces its role as the core infrastructure of decentralized finance.

Key Factors Affecting Ethereum Price

- MEV rebate protocols (e.g., Wallchain, MEV Blocker) driving user adoption and higher on-chain activity

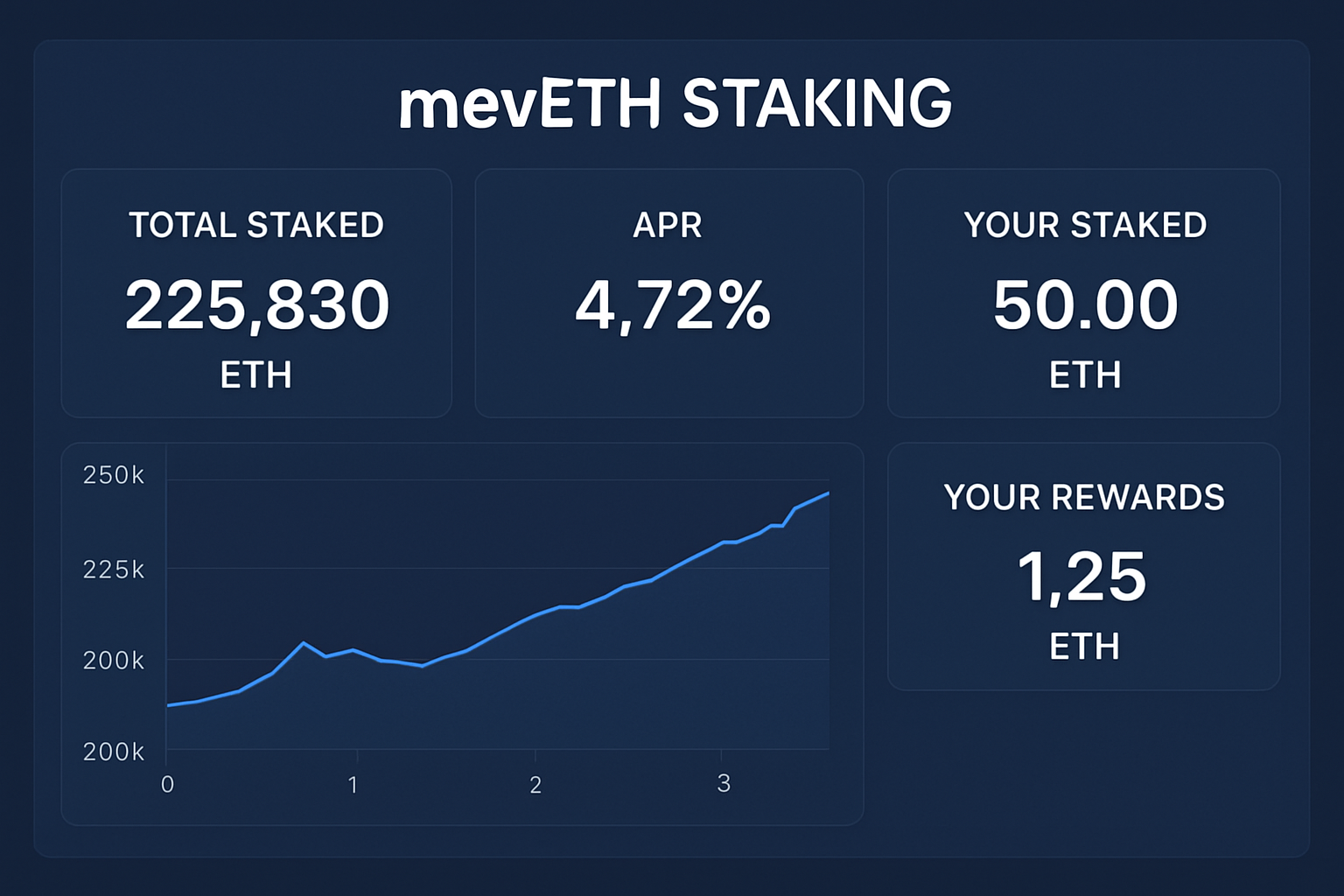

- Enhanced staking rewards (mevETH, similar protocols) increasing ETH lockup and scarcity

- DeFi security improvements reducing exploit risk and boosting investor confidence

- Broader institutional adoption as transparency and fairness improve

- Emergence of intent-based trading and protected order flow (PROF) limiting MEV exploitation

- Potential regulatory developments impacting DeFi and ETH status in global markets

- Competition from other smart contract platforms and Layer 2 solutions

- Macro market cycles and global economic conditions influencing crypto investment flows

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

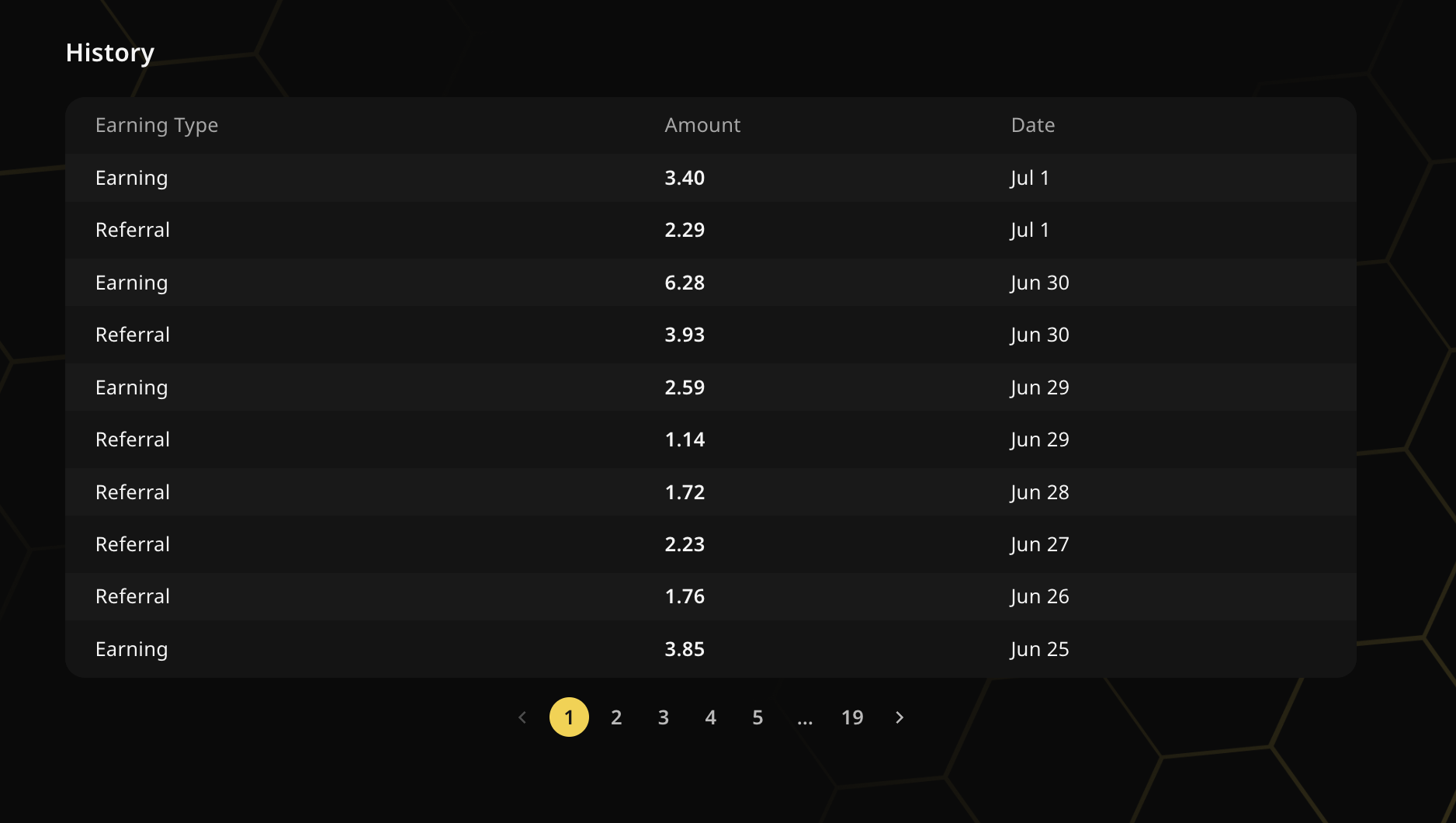

The Data Behind DeFi Fairness: How Rebates Are Changing User Behavior

The data shows clear behavioral shifts as more users flock to protocols offering transparent rebate structures:

- User retention rates have climbed sharply among platforms supporting rebates.

- Total transaction volumes have increased as traders seek out fairer execution environments.

- Staking protocols like mevETH are attracting record inflows by promising higher yields through redistributed MEV gains (see blog. mev. io for details).

This isn’t just about incremental improvement; it’s about fundamentally realigning incentives so that efficiency doesn’t come at the cost of fairness.

Innovations aren’t limited to rebates alone. Academic and protocol-level breakthroughs are also raising the bar for what users can expect in terms of DeFi fairness and efficiency. Systems like PROF (Protected Order Flow) are now being explored to lock in transaction ordering from input to block production, drastically reducing manipulation opportunities that previously eroded user trust. Meanwhile, RediSwap’s approach of capturing and redistributing arbitrage profits within AMM pools is already making waves among liquidity providers seeking more predictable returns.

These technical advances are translating into real-world benefits: less value is leaking from user trades, and more is being returned transparently. The result? A more level playing field where power users and newcomers alike can participate without fear of being exploited by invisible hands.

What’s Next? MEV Rebates as the New Baseline

The trajectory is clear: MEV rebates are rapidly becoming a standard feature across top DeFi platforms. As protocols race to integrate these mechanisms, the competitive landscape is shifting toward those who can offer not just high yields but also provable fairness and transparency. For traders and liquidity providers, this means it’s no longer enough to chase APY, now, it pays to ask how much hidden value you’re getting back every time you interact with a protocol.

For developers, embracing MEV redistribution isn’t just about compliance or optics, it’s about building sticky products that attract loyal users in an increasingly discerning market. Expect to see even more creative rebate structures emerge as competition heats up between MEV redistribution platforms like Wallchain, Reflex MEV, and others.

Top Reasons DeFi Users Are Switching to MEV Rebate Protocols

-

Direct Rebates from MEV Blocker: Platforms like MEV Blocker return up to 90% of searcher bids directly to users, turning hidden MEV profits into tangible rewards. In 2024 alone, MEV Blocker distributed 4,079 ETH in rebates, significantly boosting user returns.

-

Protection Against MEV Attacks: Protocols with MEV rebates, such as MEV Blocker and ParaSwap’s intent-based trading, actively shield users from frontrunning and sandwich attacks, creating a safer and more predictable trading environment.

-

Enhanced Staking Rewards with mevETH: MEV Protocol’s mevETH integrates MEV capture into staking, allowing users to earn higher yields. Since August 2023, mevETH has attracted over 28,000 ETH in stakes, making it a popular choice for yield-seeking users.

-

Greater Fairness and Value Redistribution: Solutions like Wallchain and RediSwap focus on redistributing MEV profits more equitably among all users and liquidity providers, addressing fairness concerns that have long plagued DeFi.

-

Academic Innovations Enhancing User Trust: New mechanisms such as PROF (Protected Order Flow) ensure transaction order integrity and reduce manipulation, further increasing user confidence in DeFi platforms that adopt these protections.

Action Steps for Traders: How to Capture Your Share of MEV

If you’re trading or staking in DeFi today, don’t leave money on the table. Here’s how you can start benefiting from the new wave of MEV fairness:

- Choose wallets or dApps that support MEV rebates. Look for integrations with platforms like Wallchain or protocols using intent-based order routing.

- Monitor your rewards. Many platforms now offer dashboards so you can track exactly how much extra value you’re earning via rebates.

- Compare staking options. Solutions like mevETH have proven that integrating MEV capture into staking can significantly boost your returns (see details here).

- Stay informed on new launches. The landscape is evolving fast, early adopters often benefit most from new rebate programs as they roll out.

The bottom line: In 2024 and beyond, maximizing DeFi rewards means understanding where hidden value flows, and choosing protocols that give it back to you.

As Ethereum maintains its position at $4,196.16, the narrative around DeFi is changing from one of zero-sum extraction to one of shared prosperity. Platforms that prioritize transparency, efficiency, and equitable value distribution aren’t just winning mindshare, they’re setting a new benchmark for what decentralized finance can deliver at scale.