Decentralized finance (DeFi) has witnessed a paradigm shift in how value is captured and distributed, particularly with the emergence of MEV rebates. Traditionally, maximal extractable value (MEV) was a source of tension in DeFi markets, as it enabled sophisticated actors to profit from transaction reordering, insertion, or censorship, often at the expense of everyday users. This dynamic not only undermined user trust but also threatened the sustainable growth and perceived fairness of DeFi protocols.

Redefining User Incentives with MEV Rebates in DeFi

The introduction of MEV rebates has fundamentally altered the calculus for DeFi participants. By returning a portion of extracted value to users affected by MEV activities, these mechanisms are transforming user incentives and reshaping platform dynamics:

- Enhanced Trust: Protocols that implement MEV rebate systems signal a commitment to user protection, directly addressing concerns around front-running and sandwich attacks.

- Increased Participation: When users know they are shielded from predatory MEV extraction, they are more likely to engage in trading and liquidity provision.

- Aligned Interests: Rebates align the incentives of traders, liquidity providers, and validators, reducing adversarial behaviors that have historically plagued DeFi ecosystems.

This shift is not just theoretical. According to mevwatch.com, 2024 saw a surge in platforms adopting MEV redistribution strategies as part of their core value proposition. The result? A measurable uptick in user retention and transaction volume across leading protocols.

The Mechanics Behind Fairness: How Protocols Implement MEV Redistribution

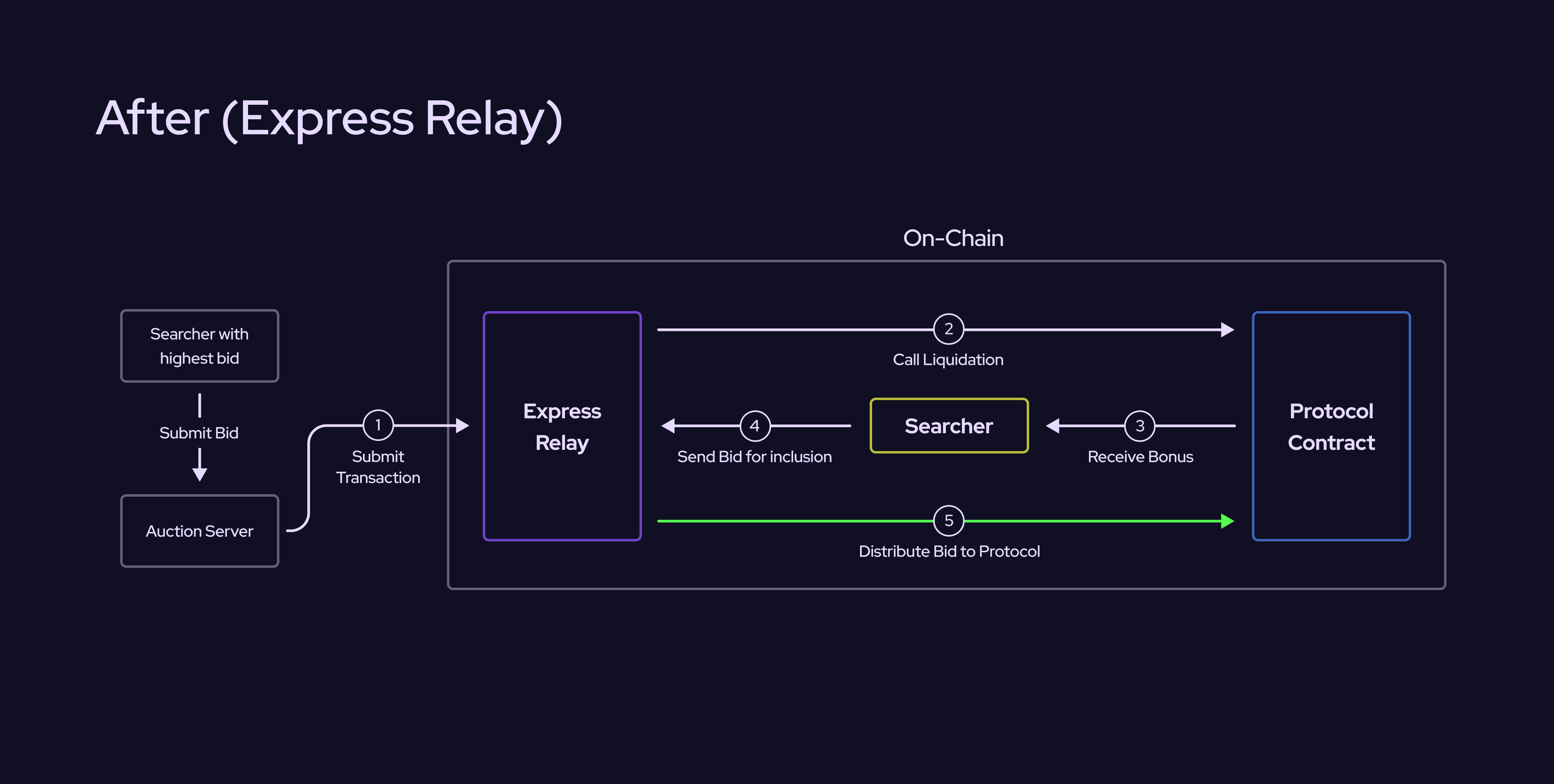

The core innovation behind MEV rebates lies in their ability to equitably redistribute profits that would otherwise accrue solely to searchers or validators. Rather than allowing these actors to capture all surplus through opportunistic transaction ordering, modern protocols now employ various mechanisms for sharing this value:

Leading DeFi Platforms Pioneering MEV Rebates

-

MEV Blocker: In 2024, MEV Blocker returned 4,079 ETH to users through its anti-MEV protection service, forwarding at least 90% of backrunning value back to users and setting a new standard for user-centric MEV redistribution.

-

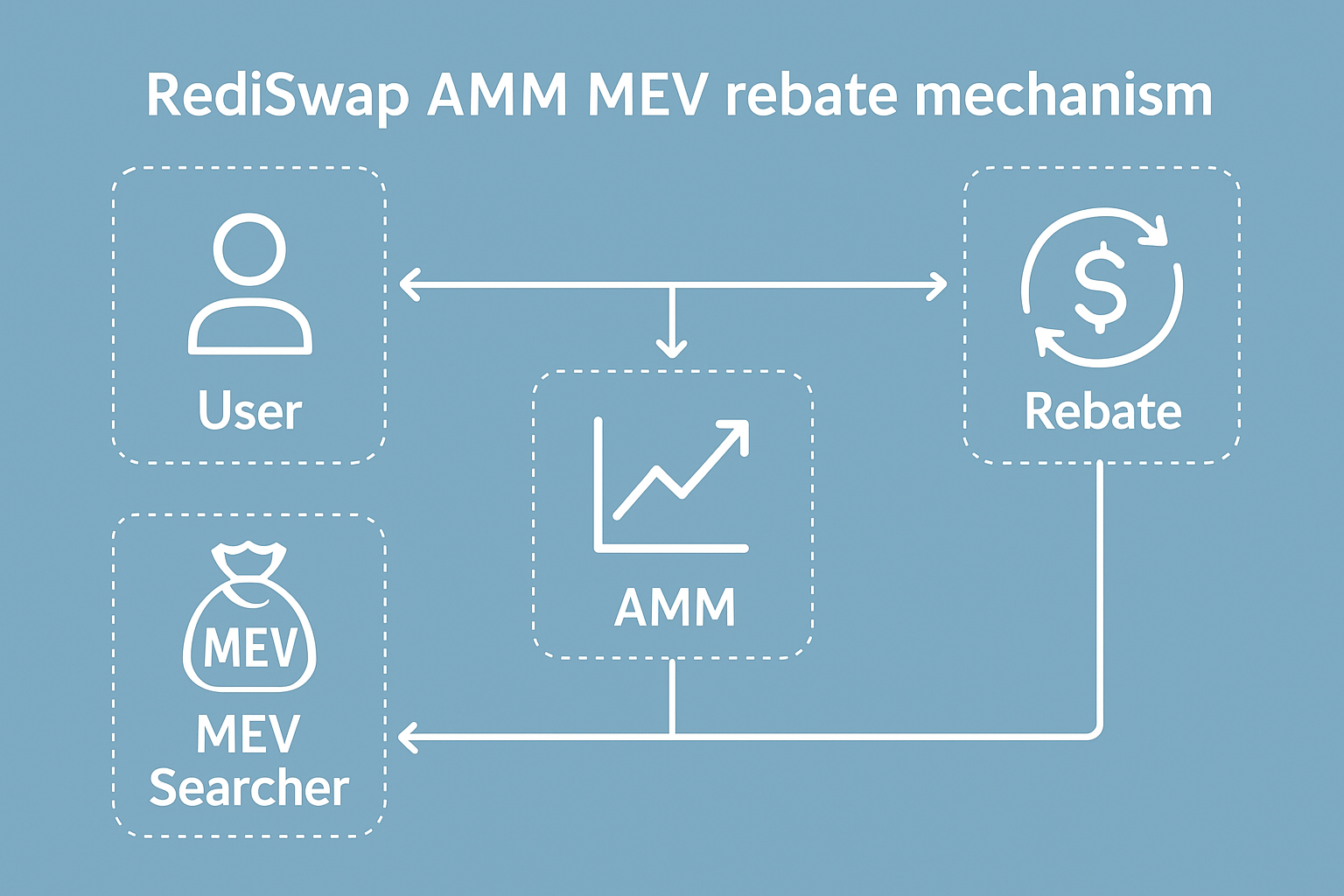

RediSwap: This innovative Automated Market Maker (AMM) integrates an application-level MEV redistribution mechanism, capturing MEV and fairly refunding it among users and liquidity providers to enhance fairness and participation.

-

FAIR Blockchain: Developed by the SKALE Network team, FAIR Blockchain embeds Blockchain Integrated Threshold Encryption (BITE) at the consensus layer, keeping transactions encrypted until block finalization and effectively neutralizing MEV exploitation for DeFi users.

A standout example is MEV Blocker, which returned 4,079 ETH in user rebates during 2024, a tangible demonstration of how anti-MEV protection can be both practical and impactful. Similarly, application-level solutions like RediSwap are pioneering methods that capture and refund extracted value among users and liquidity providers at the point of trade execution (see research on RediSwap’s approach).

The Ripple Effect: Protocol Fairness and Ecosystem Health

The broader implications for fairness in DeFi protocols cannot be overstated. By embedding redistribution at the protocol layer or via application-level modules, platforms can:

- Distribute Value More Equitably: Ensuring that profits from transaction ordering are shared with those who actually create market opportunities, users themselves.

- Deter Exploitative Practices: By reducing the profitability of harmful strategies like sandwich attacks or backrunning, rebates discourage malicious actors from targeting regular users.

- Strengthen Protocol Integrity: Fair distribution mechanisms enhance reputational capital among developers and investors alike.

This evolution is not going unnoticed by regulators or institutional players either. As highlighted by ESMA’s recent commentary on MEV’s role in addressing inefficiencies but also creating user detriment, there is growing consensus around the need for transparent redistribution frameworks within permissionless systems.

While MEV rebates are still a relatively new concept, their rapid adoption is driving a wave of experimentation and best practices across the DeFi sector. Early data suggests that protocols offering transparent MEV rewards for users are outperforming peers in both liquidity depth and user retention. The competitive landscape is shifting: platforms that proactively share extracted value are setting new standards for fairness in DeFi protocols, forcing others to follow suit or risk losing market share.

Yet, the technical challenges of implementing effective MEV redistribution strategies should not be underestimated. Protocol designers must balance efficiency with transparency, ensuring that rebate mechanisms do not introduce new attack surfaces or slow down transaction processing. Solutions like Blockchain Integrated Threshold Encryption (BITE), as pioneered by FAIR Blockchain, offer a promising path forward by encrypting transactions until block finalization, removing the informational edge that enables predatory MEV bots. (Learn more about BITE and FAIR Blockchain)

Looking Ahead: The Future of MEV Rebates and User-Centric DeFi

The trajectory for MEV rebates DeFi solutions is clear: as more protocols integrate these mechanisms, user expectations will continue to rise. Platforms that fail to adopt fairer value capture models may find themselves at a distinct disadvantage, especially as regulatory scrutiny increases and institutional capital demands greater accountability.

- Protocol Differentiation: Early movers in MEV rewards for users are building powerful network effects, attracting sophisticated traders and retail participants alike.

- Regulatory Alignment: Transparent redistribution frameworks preempt potential regulatory intervention by demonstrating a commitment to equitable value sharing.

- Community Engagement: User-centric models foster deeper community loyalty and participation, critical for sustainable protocol governance.

Top Tips to Maximize MEV Rebates in DeFi

-

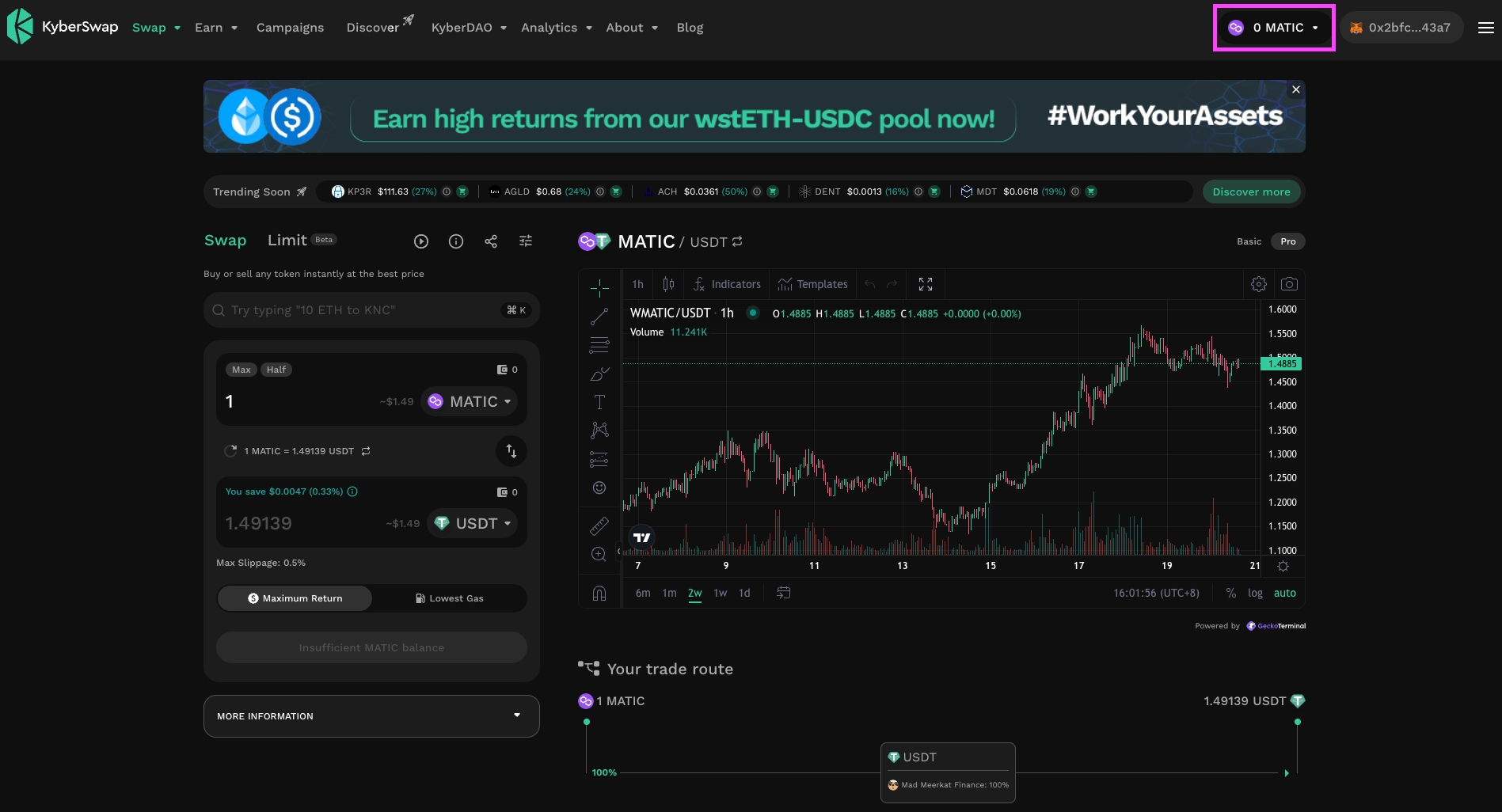

Choose Platforms with Proven MEV Rebate MechanismsOpt for DeFi platforms that have established MEV rebate systems, such as MEV Blocker and RediSwap. These platforms transparently redistribute a portion of MEV profits back to users, enhancing fairness and potential rewards.

-

Monitor Rebate Distribution RatesStay informed about how much value is being returned to users. For instance, MEV Blocker returned 4,079 ETH in rebates in 2024, showcasing a tangible commitment to user incentives. Regularly review platform statistics and community updates to gauge ongoing effectiveness.

-

Utilize Encrypted Transaction ProtocolsEngage with protocols like FAIR Blockchain that employ transaction encryption (e.g., BITE) to neutralize MEV exploitation before block finalization, ensuring your trades are protected from front-running and sandwich attacks.

-

Participate in Governance and Feedback LoopsContribute to platform governance forums or token holder votes to advocate for transparent MEV rebate policies and improvements. User feedback can influence the evolution of rebate mechanisms and ensure protocols remain user-centric.

-

Stay Updated on Regulatory and Security DevelopmentsFollow news from reputable sources like ESMA and leading DeFi research outlets to understand evolving best practices and compliance requirements for MEV rebates. This helps you adapt strategies and avoid platforms with opaque or risky rebate models.

The next frontier involves composability, integrating MEV rebates seamlessly with other DeFi primitives such as lending markets, perpetuals, and cross-chain bridges. As infrastructure matures, we can expect smarter aggregation layers that route transactions through the most user-aligned pathways, maximizing both efficiency and fairness.

This shift toward equitable redistribution is not just a technical upgrade but a philosophical one. By ensuring that value generated within decentralized markets accrues broadly rather than narrowly, the industry can fulfill its promise of open finance for all participants, not just those with privileged access or advanced algorithms.