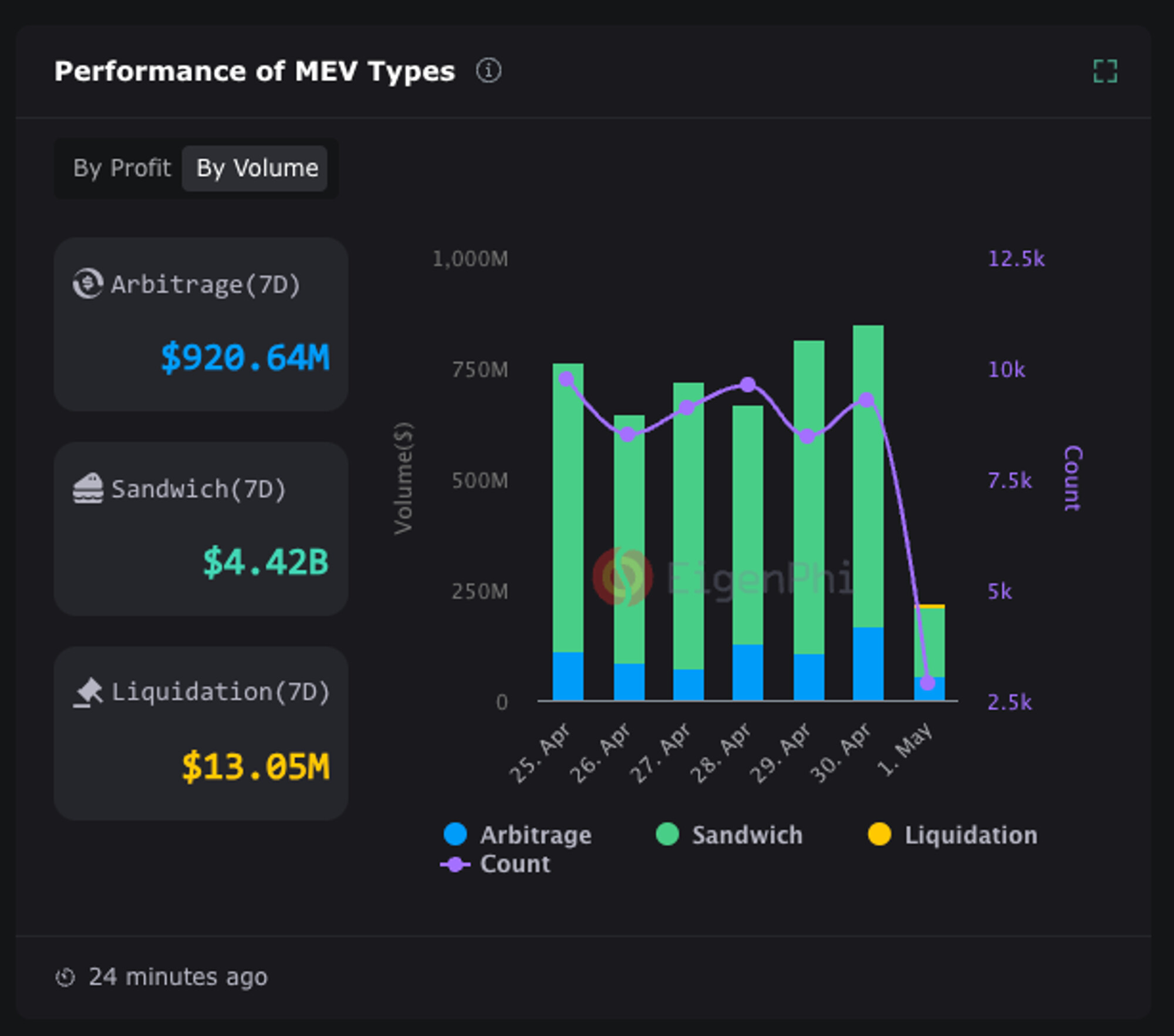

Maximal Extractable Value (MEV) has long been the elephant in the DeFi room: a source of profit for miners and validators, but often at the direct expense of users and protocols. Today, however, a new wave of MEV redistribution protocols is flipping this dynamic. By using innovative mechanisms to capture and share MEV at the application level, platforms like Wallchain are putting value back into the hands of users and dApps, where it belongs.

Why MEV Redistribution Matters for DeFi Value Sharing

Traditional MEV flows have created a zero-sum game: searchers and validators extract profits by reordering or censoring transactions, while ordinary users face slippage, failed trades, or outright losses. This undermines trust in DeFi protocols and stifles innovation. The rise of MEV redistribution solutions directly addresses these pain points by introducing transparent mechanisms that share value across all participants.

Wallchain MEV stands out for its practical approach to fair value flows. Instead of letting miners pocket all the profit from arbitrage or sandwich attacks, Wallchain’s Meta-Intent Flow Auction system integrates directly with dApps and wallets. This means users’ intents are bundled with searcher strategies into a single transaction, maximizing captured MEV while minimizing extraction risks.

How Wallchain’s Meta-Intent Flow Auction Works

The core innovation behind Wallchain is its application-level integration. Instead of requiring custom RPC endpoints or complex user configurations, Wallchain operates natively inside dApps and wallets. Here’s how it works:

Key Steps in Wallchain’s Meta-Intent Flow Auction

-

1. User Intent Submission: Users or dApps initiate a transaction or swap via an integrated DeFi platform or wallet, submitting their intent to the Wallchain protocol.

-

2. Intent Bundling and Optimization: Wallchain aggregates these user intents, combining them with others to create optimized transaction bundles that maximize MEV capture and efficiency.

-

3. Searcher Participation: MEV searchers review the bundled intents and submit strategies or bids to extract value from the combined transactions, competing in an auction format.

-

4. Auction Execution and Selection: Wallchain executes the Meta-Intent Flow Auction, selecting the most competitive searcher bid that offers the best value redistribution for users and dApps.

-

5. Transaction Settlement and MEV Redistribution: The winning searcher’s bundle is executed on-chain, and the captured MEV is programmatically redistributed to users and dApps, ensuring fair value flow.

This design delivers several concrete benefits:

- User empowerment: By capturing MEV at the intent stage, end-users receive a share of value that would otherwise be siphoned by miners or bots.

- dApp incentives: Protocols integrating Wallchain can offer improved execution quality and even share in redistributed rewards, driving user loyalty.

- No extra gas or bribes: Because operations happen before transactions hit the mempool, there’s no need for costly validator incentives or additional gas fees.

- Multichain support: Wallchain easily deploys across EVM-compatible Layer 1s, Layer 2s, and Layer 3s, making its benefits accessible throughout the ecosystem.

Real-World Integrations: Where Users See MEV Community Rewards

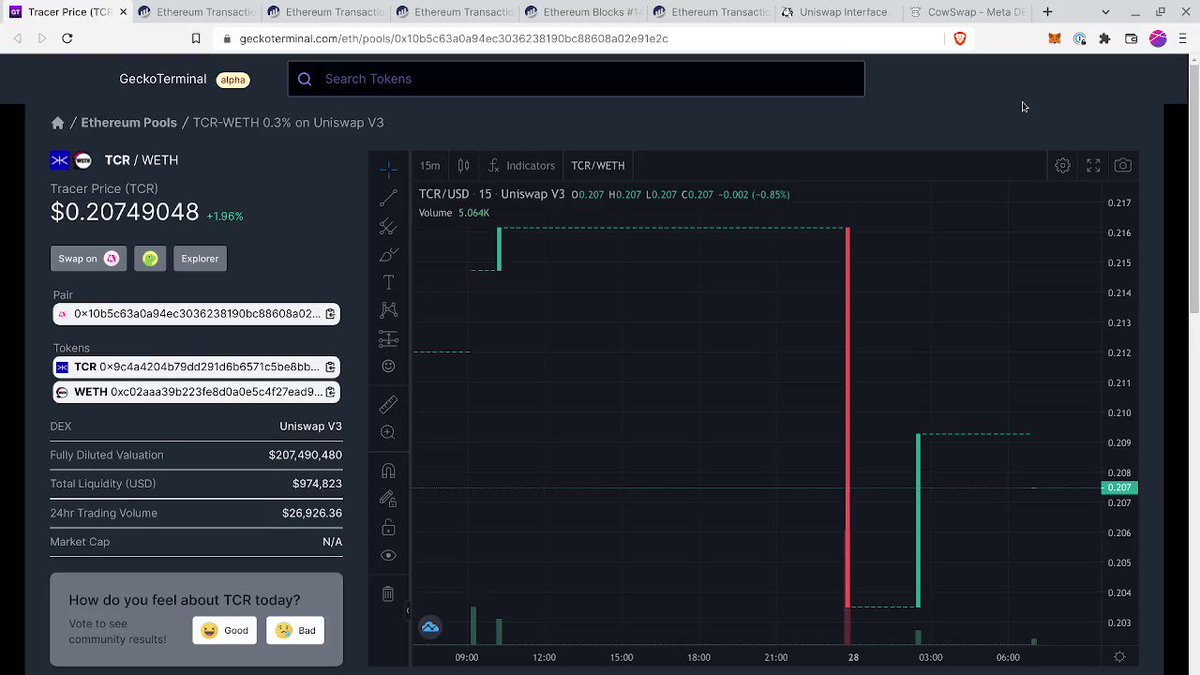

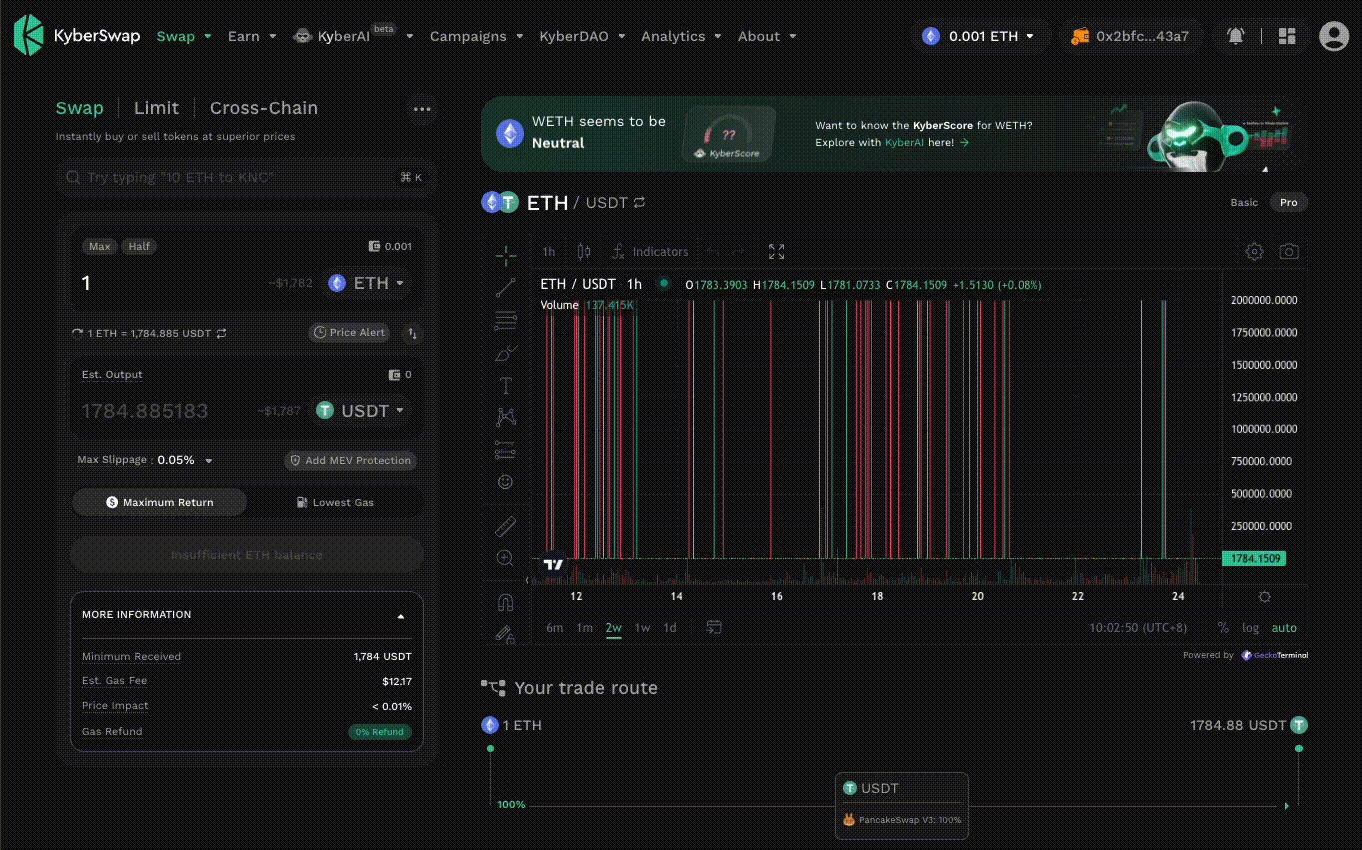

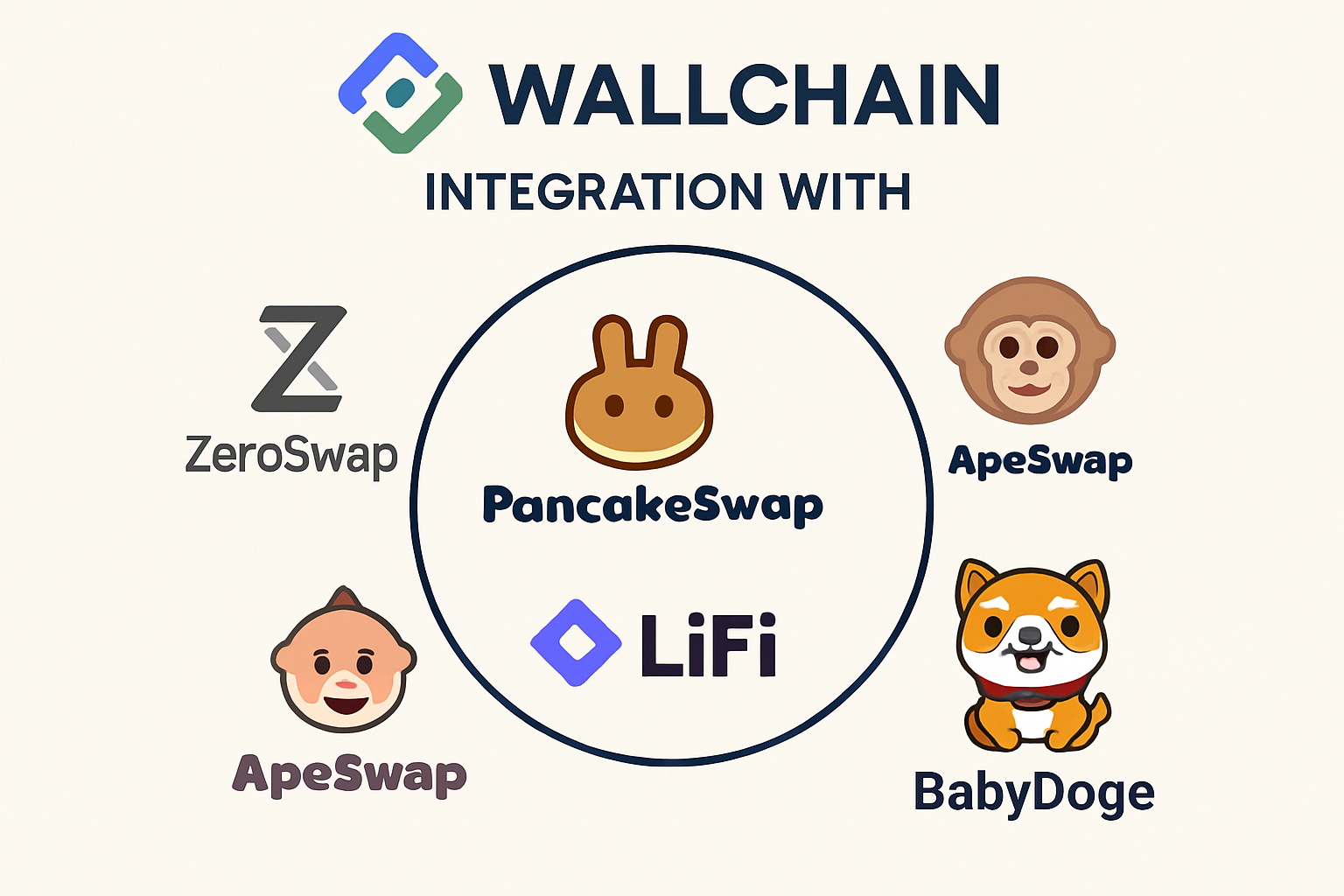

The impact isn’t theoretical. Platforms like ZeroSwap have integrated Wallchain to offer gas-free trades protected from MEV attacks, ensuring that recovered value flows back to traders instead of being lost to predatory bots (see more here). On BNB Chain alone, major protocols including PancakeSwap, ApeSwap, LiFi, and BabyDoge now leverage Wallchain’s Meta-Intent Flow Auction to combat millions in annual losses from MEV attacks (full breakdown here). These integrations represent over 90% of BNB chain order flow, a sign that community-driven redistribution is quickly becoming the new standard.

The Broader Landscape: Other Blockchain MEV Protocols

The push for equitable blockchain MEV protocols doesn’t stop with Wallchain. Flashbots’ MEV-Share protocol lets Ethereum users selectively share transaction data with searchers who bid for inclusion in bundles, putting order flow control back in user hands (details here). Infura has also rolled out on-chain transaction processing enhancements designed to route transactions through virtual mempools before public broadcast, protecting developers against front-running and sandwich attacks.

Top Features of Leading MEV Redistribution Solutions

-

Application-Level Integration – Wallchain enables seamless integration with dApps and wallets, allowing users and protocols to construct optimized transactions before signing. This reduces the need for custom RPCs and ensures MEV value flows directly to users.

-

Meta-Intent Flow Auction System – Wallchain’s Meta-Intent Flow Auction bundles user intents, transactions, and searcher strategies into a single transaction, streamlining MEV capture and redistribution for maximum user benefit.

-

Multichain Adaptability – Wallchain’s protocol-level design supports deployment across EVM-compatible chains, including Layer 1, Layer 2, and Layer 3 solutions, making MEV redistribution accessible on multiple networks.

-

Cost-Effective MEV Capture – By operating at the transaction level and avoiding external validator interactions, Wallchain eliminates extra gas or bribe payments, maximizing user returns.

-

Flashbots MEV-Share Protocol – Flashbots’ MEV-Share lets users selectively share transaction data with searchers, control privacy settings, and receive a share of MEV profits, all while protecting against front-running.

-

MEV Protection in Infura – Infura’s MEV protection routes transactions through a virtual mempool, shielding developers and users from harmful MEV strategies like sandwich attacks and ensuring fairer value distribution.

-

Major DeFi Platform Integrations – Wallchain’s solutions are integrated with leading platforms like ZeroSwap, PancakeSwap, ApeSwap, LiFi, and BabyDoge, collectively covering over 90% of BNB chain order flow and redistributing MEV to users at scale.

These advances are not just technical upgrades, but a shift in the underlying economics of DeFi. By prioritizing MEV user benefits and transparency, protocols are turning what was once an opaque tax into a clear community reward. The practical upshot: users and dApps now have real agency over their transaction flows, while searchers compete to add value rather than simply extract it.

For developers and protocol designers, the opportunity is clear. Integrating MEV redistribution mechanisms like Wallchain or MEV-Share can:

- Boost user retention by offering tangible rewards for participation.

- Reduce MEV extraction risks, lowering slippage and failed trades.

- Enhance protocol security by making malicious MEV strategies less profitable.

- Cultivate sustainable MEV markets, aligning incentives across all stakeholders.

What’s Next for MEV Redistribution?

The future of DeFi value sharing will be shaped by how quickly these models reach mainstream adoption. The rapid expansion of Wallchain across EVM chains is a sign that protocols recognize both the risk and opportunity in controlling their own order flow destiny. Meanwhile, cross-chain MEV solutions and new staking-economy integrations are poised to further decentralize value capture, ensuring that even as DeFi grows more complex, its rewards remain accessible to all participants.

If you’re building or trading in today’s DeFi markets, now is the time to demand transparency around MEV flows. Seek out protocols with robust redistribution frameworks – not only will this protect your capital from extraction risks, but it will also help foster a fairer and more resilient ecosystem for everyone involved.

Practical Tips to Maximize MEV Redistribution Benefits

-

Integrate with Wallchain-enabled dApps and wallets to automatically capture and receive redistributed MEV profits. Look for integrations on platforms like ZeroSwap, PancakeSwap, ApeSwap, LiFi, and BabyDoge for seamless protection and MEV sharing.

-

Leverage application-level MEV protection by using wallets and dApps that support Wallchain’s Meta-Intent Flow Auction. This minimizes the risk of front-running and sandwich attacks while maximizing your share of redistributed MEV.

-

For developers: Integrate Wallchain’s SDK or APIs into your DeFi project to offer users MEV protection and value redistribution natively, without the need for custom RPC endpoints or extra gas fees.

-

Utilize Flashbots’ MEV-Share protocol via Flashbots Protect to customize privacy settings and control order flow sharing. This helps users protect themselves from harmful MEV extraction while participating in MEV profit sharing.

-

Route transactions through Infura’s MEV Protection when using supported wallets and dApps. This feature leverages a virtual mempool to shield your transactions from common MEV exploits before they reach the public blockchain.

-

Stay informed about supported chains and integrations. Wallchain and similar protocols support multiple EVM-compatible chains, including Layer 1, Layer 2, and Layer 3 solutions. Check for the latest supported networks to maximize coverage and benefits.

-

Monitor MEV redistribution statistics on community forums like r/wallchain to track recent distributions, platform updates, and user experiences.