Maximal Extractable Value (MEV) has long been a double-edged sword for decentralized finance. While it represents the hidden profits that can be squeezed out of transaction ordering on blockchains, it also exposes DeFi users to predatory practices such as front-running and sandwich attacks. As the DeFi ecosystem matures, MEV rebate mechanisms are emerging as a transformative force, aiming to rewire value flows and establish fairer market structures.

What Is MEV and Why Does It Matter?

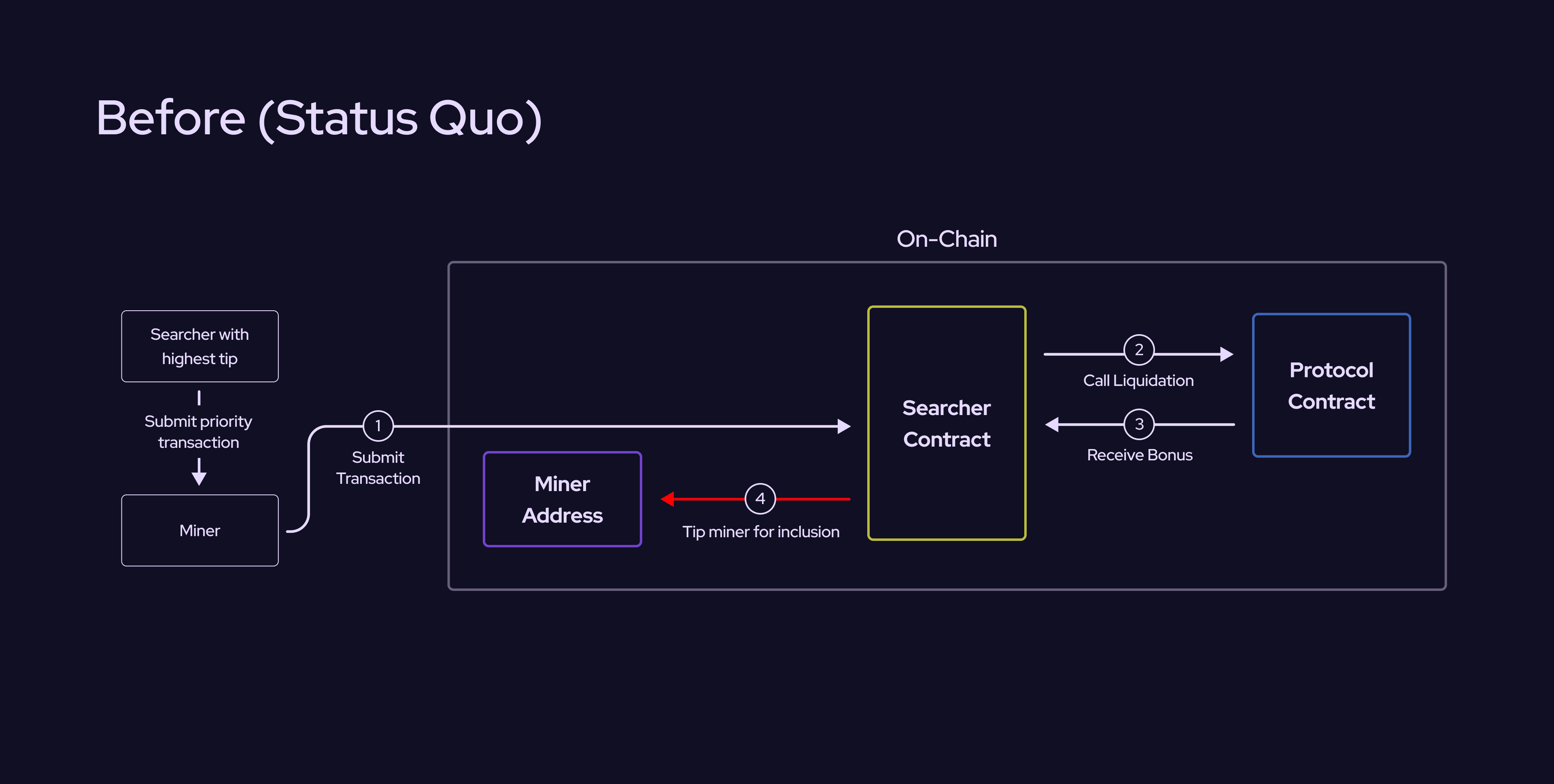

At its core, MEV refers to the additional value that miners or validators can extract by reordering, including, or excluding transactions within a block. Historically, this value was quietly siphoned away from everyday users and into the hands of technically sophisticated insiders. According to ESMA and leading DeFi researchers, this dynamic not only introduces inefficiencies but also undermines user trust in permissionless markets.

The need for DeFi fairness has never been clearer. Users are demanding transparency in how value is generated and distributed on-chain. The industry’s response? A new wave of protocols designed to redistribute MEV profits through rebates, smoothing pools, and private relays.

The Mechanics of MEV Rebates

Orderflow auctions (OFAs), pioneered by platforms like MEV Blocker, have become a linchpin for equitable value sharing. Here’s how it works: instead of letting searchers or validators pocket all potential MEV from user trades, OFAs enable users themselves to receive rebates based on the competitive bidding for transaction inclusion. This isn’t theoretical – some systems are already refunding up to 90% of builder rewards directly back to users.

This mechanism fundamentally alters the incentive landscape:

Key Benefits of Orderflow Auctions in MEV Redistribution

-

Direct Value Rebates to Users: Orderflow auctions (OFAs) enable platforms like MEV Blocker to refund up to 90% of builder rewards back to users, ensuring that a significant portion of MEV profits is redistributed rather than captured solely by validators or searchers.

-

Lower Transaction Costs: By redistributing MEV profits through competitive bidding, OFAs effectively reduce transaction fees for users, making DeFi participation more affordable and attractive.

-

Enhanced Market Fairness: OFAs introduce transparent competition among searchers, minimizing front-running and sandwich attacks that typically disadvantage regular users.

-

Incentivized Honest Participation: The auction format aligns incentives for searchers and validators, encouraging ethical behavior and discouraging exploitative MEV extraction strategies.

-

Improved Ecosystem Sustainability: By sharing MEV-derived value more equitably, OFAs foster trust and long-term growth in DeFi platforms, attracting a broader user base and supporting ecosystem resilience.

By returning a significant portion of extracted value as on-chain receipts or direct rebates, OFAs realign interests between users and protocol operators. The result is lower effective transaction costs and greater trust in DeFi markets.

Smoothing Out Rewards: Pools and Protocols

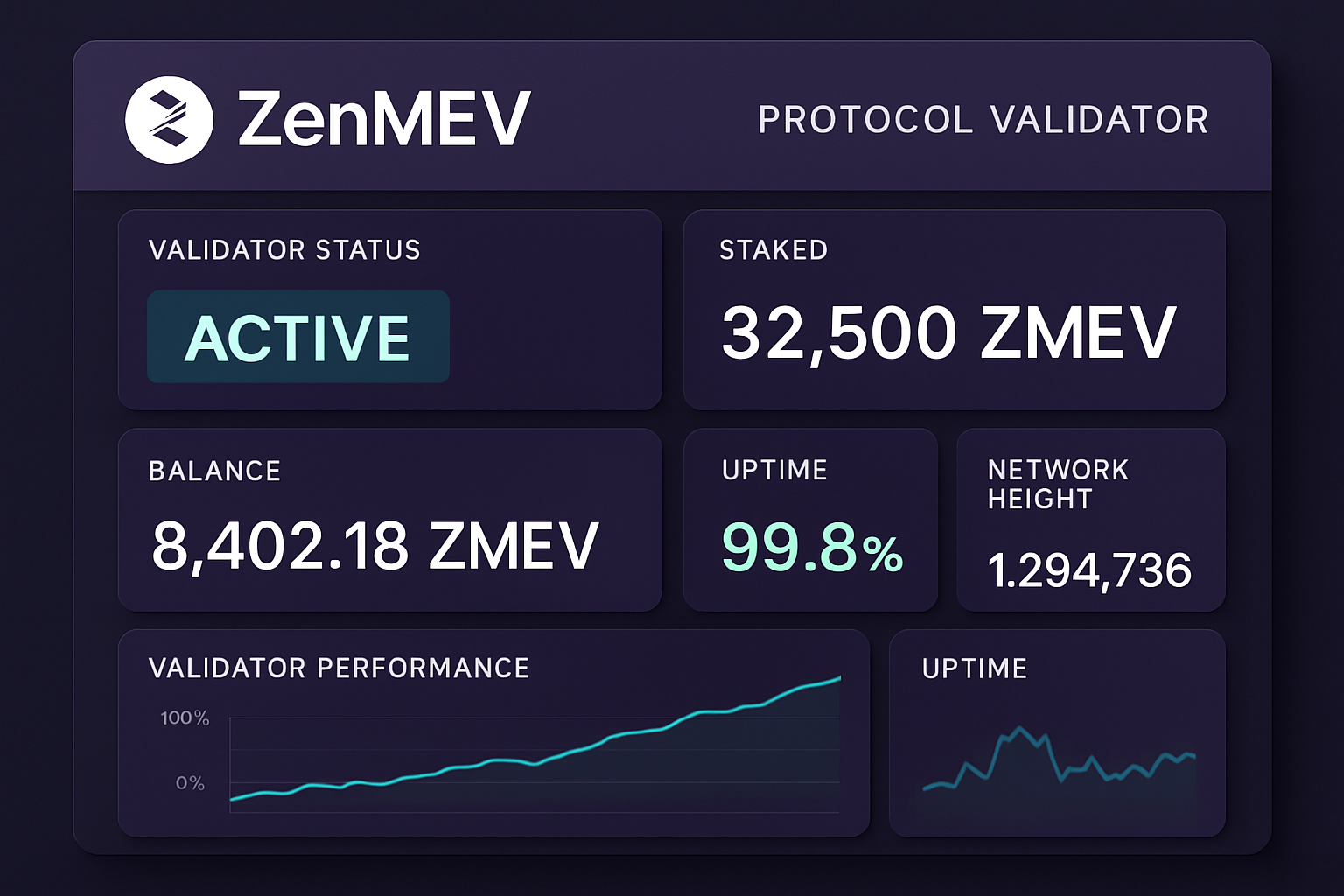

A second major innovation is MEV smoothing. Rather than allowing rewards to concentrate among lucky or well-connected participants, smoothing pools aggregate MEV earnings over time and distribute them evenly among all contributors, be they validators or stakers. This approach not only dampens reward volatility but also acts as an economic bulwark against centralization risks.

The implications here are profound: by ensuring that everyone shares proportionally in the upside of network activity, smoothing pools foster a more resilient and inclusive DeFi ecosystem.

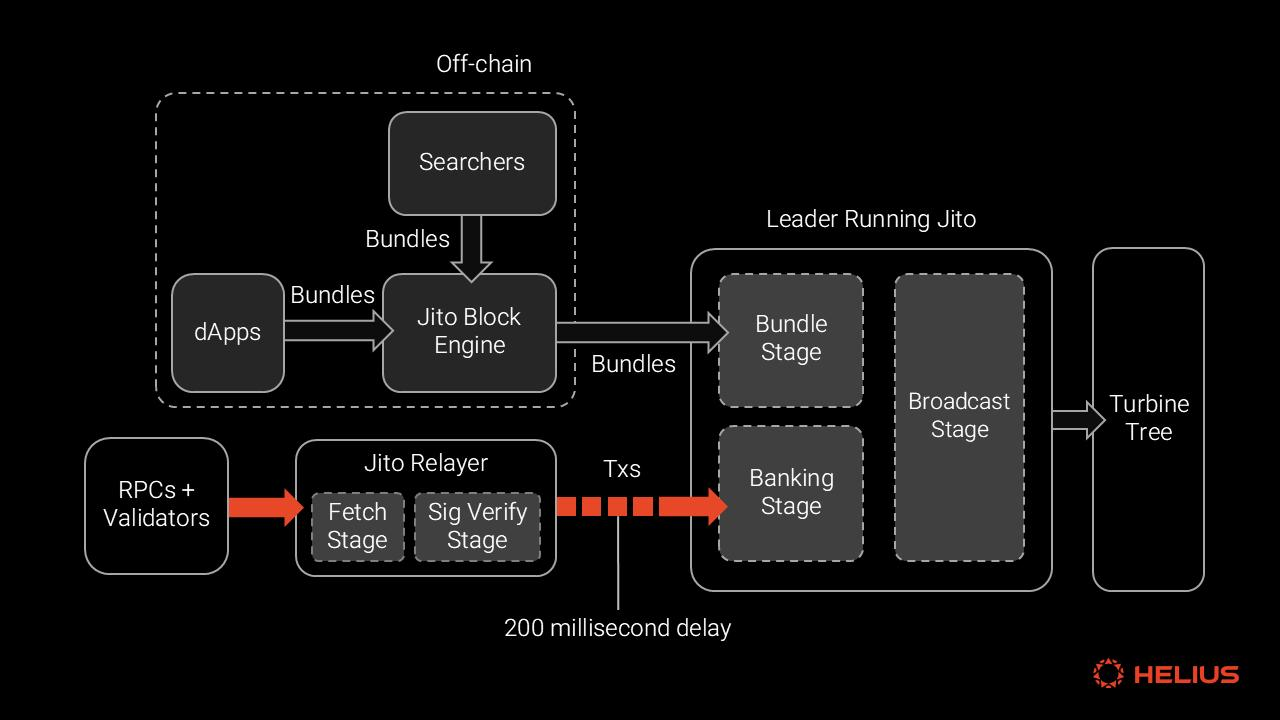

The Role of Private Relays and Protocol-Level Solutions

No discussion about MEV protection would be complete without mentioning private transaction relays such as Flashbots Protect or Eden Network. By routing transactions through encrypted channels before they hit public mempools, these systems drastically reduce opportunities for predatory front-running. For those seeking even stronger guarantees, protocol-level solutions like Blockchain Integrated Threshold Encryption (BITE) are raising the bar, making certain forms of MEV extraction cryptographically impossible at the consensus layer.

Together, these tools represent an inflection point for blockchain value sharing. The era where only insiders captured hidden profits is fading; mechanisms now exist to ensure that every participant can benefit from transparent and equitable redistribution strategies.

As these innovations take hold, the competitive landscape of DeFi is shifting. Protocols that embrace MEV rebate models are seeing increased user loyalty and deeper liquidity, as participants gravitate toward venues where their interests are aligned with the platform’s success. The days of opaque value extraction are being replaced by a new paradigm: open, auditable, and user-centric MEV protocols.

Emerging Standards and Ecosystem Impacts

The proliferation of MEV redistribution mechanisms is also prompting the emergence of industry standards around on-chain receipts and transparent accounting. Projects now publish detailed breakdowns of how much value is captured, who receives it, and under what conditions. This level of granularity not only satisfies regulatory scrutiny but also empowers users to make informed decisions about where to trade or stake their assets.

Orderflow auctions, smoothing pools, and private relays aren’t just technical upgrades, they’re catalysts for a more sustainable DeFi ecosystem. By diffusing rewards across broader participant bases, these systems erode the power of extractive cartels and foster genuine competition among searchers, builders, and validators.

Leading MEV Rebate Protocols Enhancing DeFi Fairness in 2025

-

MEV Blocker: A collaborative tool by CoW Protocol, Gnosis, and Balancer, MEV Blocker refunds up to 90% of builder rewards back to users by capturing value from backrunning opportunities. Its open-source Order Flow Auction (OFA) system is widely adopted for transparent MEV redistribution.

-

Flashbots Protect: As a pioneering private transaction relay, Flashbots Protect routes user transactions through secure channels to prevent front-running. Users benefit from reduced MEV exploitation and receive rebates from captured value, making it a cornerstone for fair DeFi trading.

-

Eden Network: Eden Network offers private transaction ordering and MEV protection, allowing users to submit transactions via its relay for enhanced privacy and fairer value redistribution. It incentivizes honest behavior by sharing MEV rewards among participants.

-

ZenMEV: Leveraging MEV Smoothing, ZenMEV pools MEV rewards and distributes them evenly among validators and stakers. This approach reduces reward variance and centralization risks, ensuring a more equitable DeFi ecosystem.

-

FAIR Blockchain: Integrating MEV protection at the protocol level, FAIR Blockchain uses Blockchain Integrated Threshold Encryption (BITE) to encrypt transactions before they reach the mempool, making front-running and MEV extraction cryptographically infeasible.

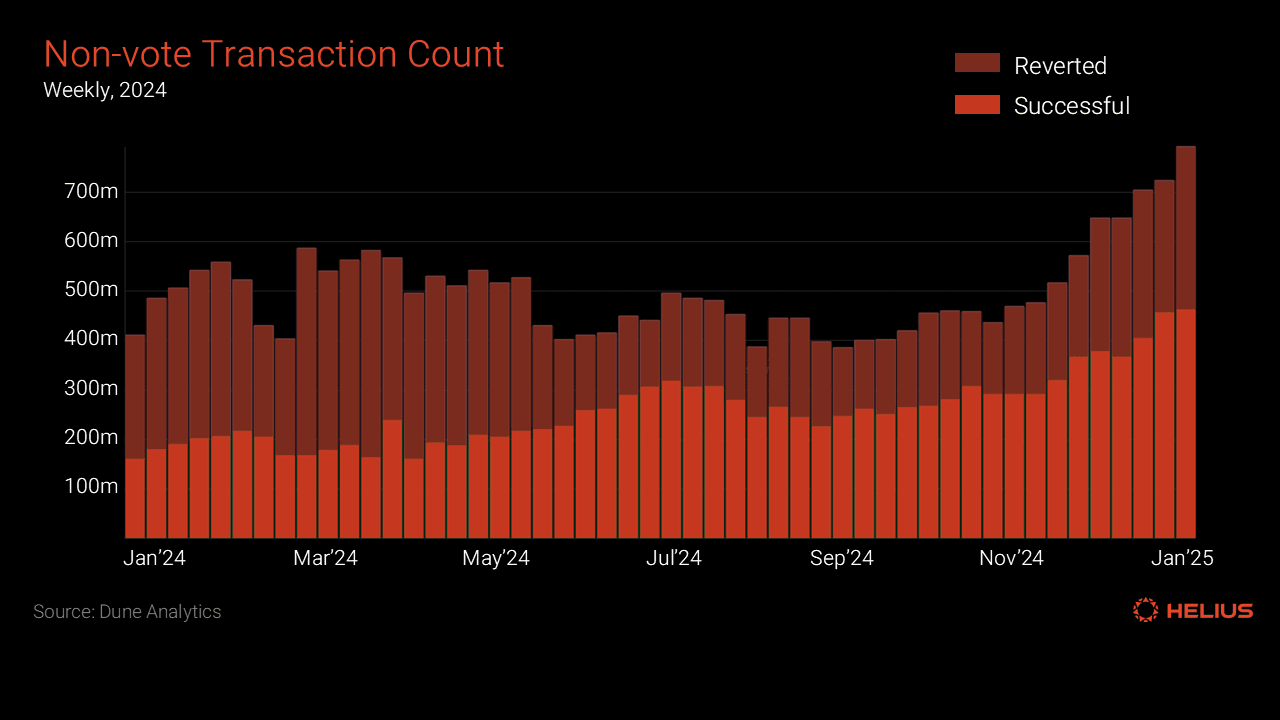

The knock-on effects are already visible: lower slippage for traders, reduced sandwich attack prevalence, and a measurable uptick in protocol-level trust metrics. As more users experience tangible benefits, be it through direct rebates or improved execution quality, the flywheel effect accelerates adoption across the sector.

What’s Next for MEV Redistribution?

The future trajectory points toward even tighter integration between MEV protection mechanisms and core blockchain infrastructure. Zero-knowledge proofs (ZKPs) are being explored to increase privacy without sacrificing auditability. Meanwhile, governance frameworks are evolving to let token holders vote on how MEV proceeds should be distributed, blurring the line between user and stakeholder.

This evolution also opens up new research frontiers: How should protocols balance immediate rebates versus long-term sustainability? What role should automated market makers play in capturing or redistributing MEV? And crucially, how can on-chain receipts be standardized so that users can compare value sharing across different platforms?

If DeFi’s promise is an open financial system for all, then fair MEV redistribution is its proving ground, a test of whether transparency can truly align incentives at scale.

For those eager to dive deeper into practical strategies for maximizing user rewards while minimizing risks from predatory extraction, see our advanced guide on how MEV rebates are transforming DeFi user incentives.

Community Pulse: Where Do You Stand?

Do you think current MEV rebate mechanisms are sufficient for DeFi fairness?

MEV rebate mechanisms like Order Flow Auctions, MEV smoothing, and private transaction relays are designed to redistribute value and protect users from front-running in DeFi. Are these solutions enough to ensure a fair system, or is more innovation needed?

Ultimately, as market data evolves and best practices solidify around blockchain value sharing, expect ongoing innovation at both the protocol and application layers. The winners will be those who combine technical sophistication with an unwavering commitment to equitable outcomes, delivering not just efficiency but real empowerment for every participant in the decentralized economy.