Maximal Extractable Value (MEV) is no longer just a buzzword for blockchain insiders. As DeFi matures into 2025, MEV rebates and sophisticated redistribution mechanisms are fundamentally reshaping incentives across protocols and user bases. Instead of serving only miners, validators, or aggressive searchers, MEV is being democratized, redirected to liquidity providers (LPs), everyday traders, and even public goods funding. This shift marks a critical evolution in how value is captured, shared, and protected within decentralized finance.

Understanding MEV: From Extraction to Redistribution

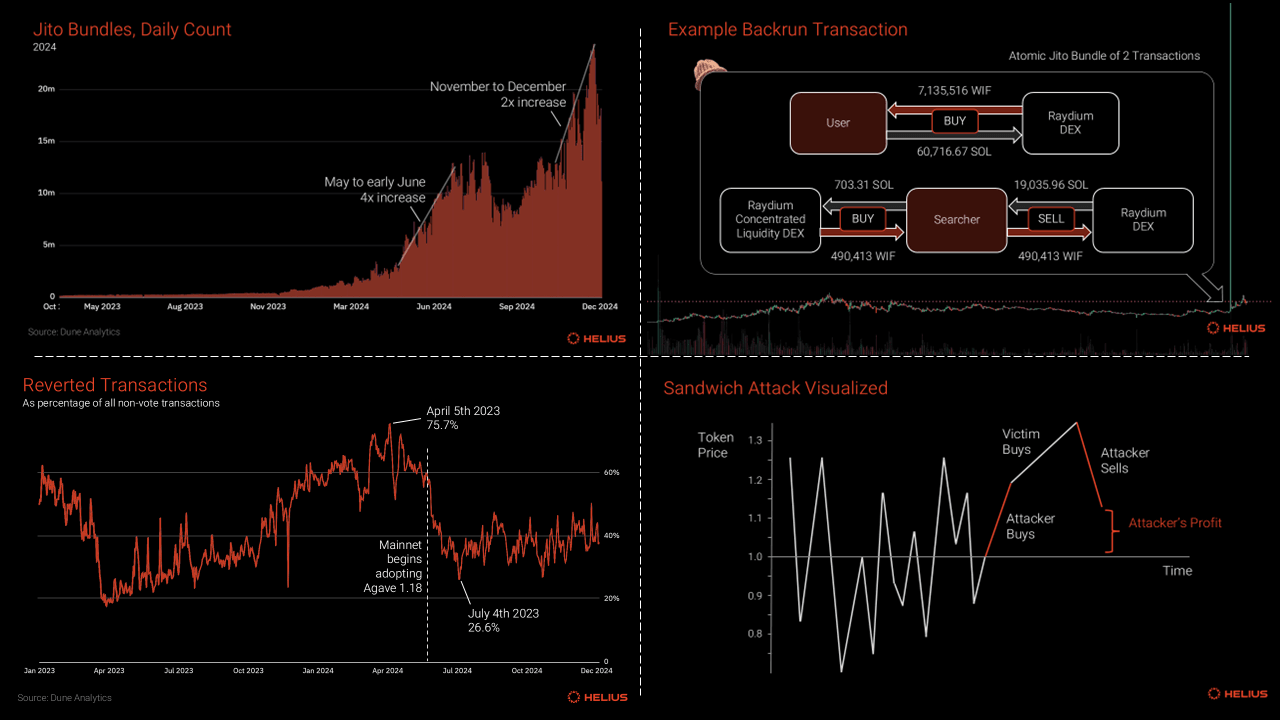

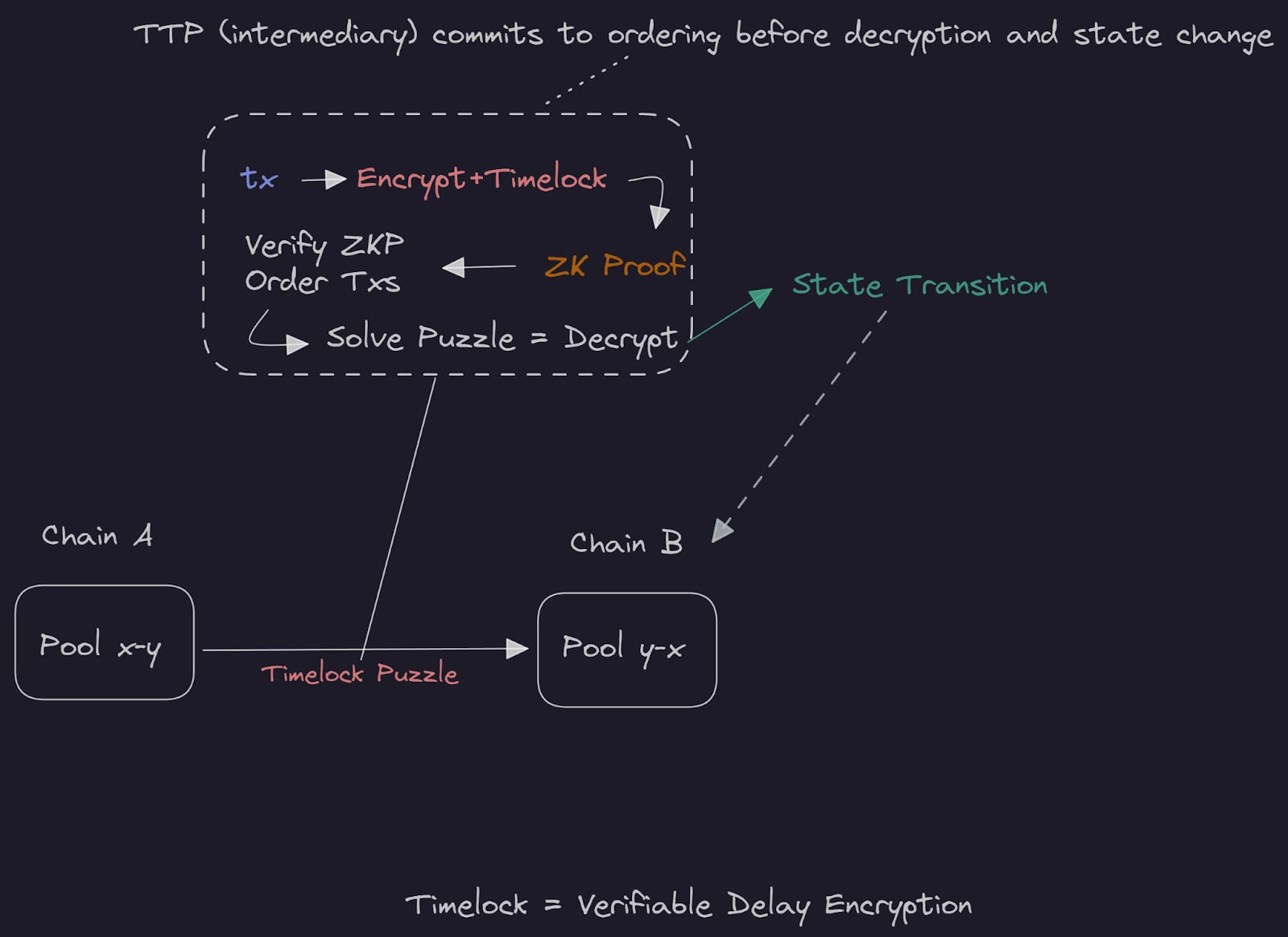

MEV refers to the additional profit that can be extracted by reordering, including, or censoring transactions in a block. Historically, this has led to practices like front-running and sandwich attacks, where regular users lose out as sophisticated actors exploit transaction ordering for gain. In 2025’s DeFi landscape, however, the focus is shifting from unchecked extraction to protocol-level MEV redistribution, aiming for fairness and sustainability.

Recent research and market data underscore this transformation:

- Jito DAO on Solana: By allocating 3% of all MEV tips to its treasury and TipRouter program, Jito DAO expects an annual revenue boost of $22.8 million while supporting its restaking initiatives.

- Unichain’s Framework: Unichain directs 30, 50% of MEV proceeds straight to LPs via priority fees. Simulations suggest this could recover $140 million annually from predatory strategies while raising LP yields by 18%.

- RediSwap AMM: RediSwap’s application-level mechanism aims to refund arbitrage-derived MEV directly back to users and LPs, cutting original loss-versus-rebalancing for LPs by over 99% in some cases.

This new era isn’t just about plugging leaks; it’s about actively rewarding those who contribute liquidity or generate valuable order flow while disincentivizing harmful extraction tactics.

The Mechanics Behind Protocol-Level Redistribution

The core innovation driving these changes lies in how protocols capture and allocate MEV profits:

Top Protocol-Level MEV Redistribution Strategies

-

Jito DAO (Solana): Treasury and TipRouter MEV Allocation – Jito DAO allocates 3% of all MEV tips collected by the protocol to its treasury and TipRouter, supporting Jito’s restaking platform. This move is projected to generate approximately $22.8 million in annual revenue for the DAO, directly redistributing MEV profits at the protocol level.

-

Unichain: Two-Tier MEV Reallocation Framework – Unichain enables applications to set priority fees that direct 30–50% of MEV proceeds to liquidity providers, with the rest going to validator rewards and user rebates. Early simulations indicate this model could reclaim $140 million annually from predatory MEV strategies and boost LP returns by 18%.

-

RediSwap: Application-Level MEV Capture and Fair Refunds – RediSwap, a novel AMM, integrates an MEV-redistribution mechanism that manages arbitrage within its pools. This design aims to cut liquidity providers’ losses from MEV to under 0.5% of the original loss-versus-rebalancing in most cases, ensuring fairer profit sharing among users and LPs.

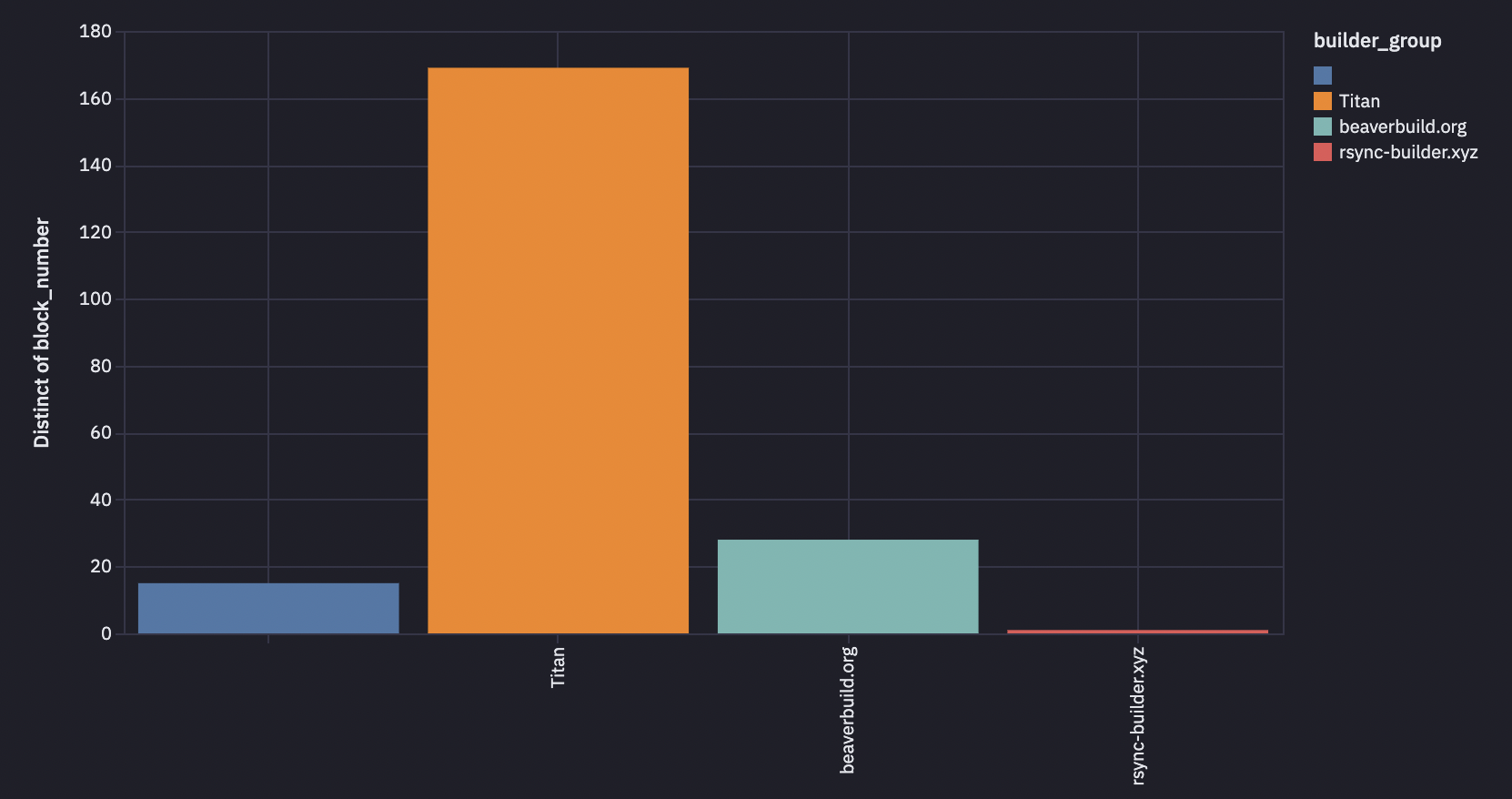

Traditionally, miners or validators captured most of the value through transaction ordering rights. Now, advanced smart contracts intercept these profits at the protocol layer, automatically splitting them between stakeholders according to transparent rules. For instance:

- Priority Fees and Rebates: Unichain lets dApps set custom priority fees that route a share of extracted value back to LPs or even end users as rebates.

- Automated Arbitrage Management: RediSwap internalizes arbitrage opportunities within its AMM pools so that profits are not siphoned off-chain but returned directly within the system.

- Treasury Allocations: Jito DAO channels a portion of tips into collective funds supporting ecosystem growth, a model that aligns incentives between stakers and protocol developers.

This approach not only reduces adverse selection against passive participants but also creates new economic levers for governance tokens and restaking models.

User Incentives: Rebates as a Defense Against Exploitation

User protection is at the heart of modern MEV strategies. Instead of leaving traders vulnerable to toxic order flow or predatory bots, new tools provide direct incentives for safe participation:

Top User-Facing MEV Rebate Tools in DeFi

-

MEV Blocker: Refunds up to 90% of builder rewards directly to users, turning MEV extraction into user rebates. Integrates with major wallets and supports multi-chain DeFi activity. Learn more

-

Order Flow Auctions (OFAs): Platforms like Flashbots Protect and MEV Blocker enable users to route transactions through competitive auctions, redistributing MEV profits as gas rebates, improved execution, and privacy. Widely adopted by DeFi users seeking MEV protection. See OFA platforms

-

PROF (Protected Order Flow): Enforces a fixed transaction ordering for privately submitted trades, preventing harmful MEV like front-running and sandwich attacks. Ensures user bundles are included in blocks as intended. Explore PROF protocol

MEV Blocker, for example, refunds up to 90% of builder rewards straight back to users who might otherwise have been exploited by searchers. Order Flow Auctions (OFAs) turn transaction inclusion into a competitive market where users receive gas rebates or improved execution quality based on searcher bids, not just random luck or miner discretion.

This wave of innovation signals more than just technical progress, it represents an ideological commitment across DeFi builders: aligning incentives so value flows where it’s truly earned rather than simply extracted by those with privileged access or information.

As MEV rebates proliferate, the landscape for both users and liquidity providers is rapidly evolving. The best systems don’t just shield users from loss; they actively reward positive-sum participation, transforming MEV from a source of systemic risk into a tool for protocol sustainability and user empowerment.

Consider the impact of mechanisms like Order Flow Auctions (OFAs). By letting searchers compete for transaction inclusion, these auctions return a portion of MEV to users as gas rebates or improved execution. This flips the traditional power dynamic: instead of being passive victims of sandwich attacks, users become active participants in value redistribution. Similarly, PROF enforces fair ordering on private transactions, giving traders confidence that their order flow won’t be manipulated between submission and block inclusion.

These tools are not theoretical; they are already live or in advanced testing phases across major DeFi ecosystems. As protocols race to integrate these systems, we’re seeing measurable improvements in user retention and LP engagement. For instance, Jito DAO’s projected $22.8 million annual revenue from MEV tips isn’t just a windfall for stakers, it’s also being routed into public goods funding and protocol development, setting a new standard for ecosystem alignment.

MEV Democratization: Aligning Incentives Across the Stack

The shift toward MEV democratization is about more than technical upgrades; it’s about rethinking who gets to benefit from value creation in open financial networks. By redirecting profits to LPs, traders, and even protocol treasuries that fund public goods, these mechanisms reduce adversarial behavior and foster healthier market dynamics.

- User rebates lower the effective cost of trading and reduce slippage due to predatory bots.

- LP incentives help offset impermanent loss by capturing part of the arbitrage value that would otherwise leak out of pools.

- Treasury allocations enable long-term investments in security, research, and ecosystem growth.

The result? A more resilient DeFi environment where participation is safer and more rewarding for all classes of users, not just those with deep technical expertise or privileged access to mempools.

What’s Next for Protocol-Level MEV Redistribution?

The next frontier lies in refining these models so they scale efficiently across chains and application types. Expect continued experimentation with hybrid models, combining on-chain auctions with off-chain privacy layers, and greater transparency around how MEV flows are measured and allocated. As protocols publish real-time data on captured and redistributed value, community governance will play an increasing role in setting parameters for fairness versus efficiency trade-offs.

Emerging Trends in MEV Redistribution for DeFi

-

Cross-Chain MEV Rebates: Protocols like Jito DAO on Solana are pioneering MEV fee redistribution, allocating a portion of MEV tips to both treasury and user-facing programs. As cross-chain interoperability grows, expect similar rebate models to be adopted across multiple blockchains, enabling users to receive MEV rewards regardless of the chain they transact on.

-

Programmable Fee Splits: Platforms such as Unichain are introducing dynamic fee split frameworks, allowing applications to set custom MEV distribution ratios. For example, Unichain’s model directs 30–50% of MEV proceeds to liquidity providers, with the remainder allocated to validators and user rebates. This programmability enables more granular, use-case-specific incentive structures.

-

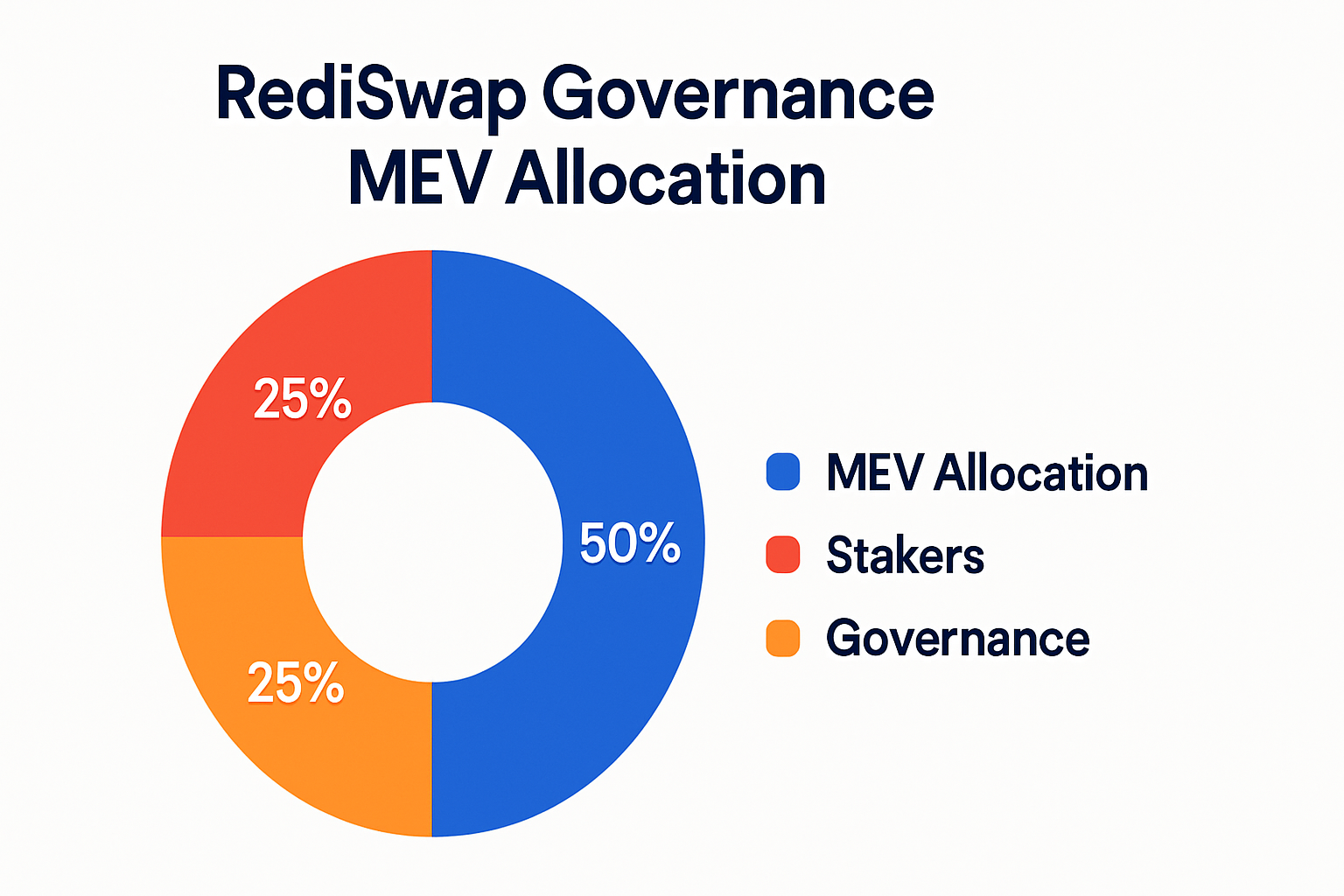

Governance-Controlled Allocation Targets: DeFi protocols are increasingly leveraging on-chain governance to determine how MEV revenues are distributed. RediSwap and similar platforms allow token holders to vote on allocation targets, such as increasing rebates for liquidity providers or funding protocol development, ensuring MEV redistribution aligns with community priorities.

-

Order Flow Auctions (OFAs) for User Rebates: Systems like Flashbots Protect and MEV Blocker utilize OFAs to maximize user rebates by auctioning transaction order flow to searchers. This approach is expected to expand, offering users gas rebates, improved execution, and enhanced privacy across more DeFi platforms.

-

Programmable MEV Protection and Enforcement: Innovations like PROF (Protected Order Flow) are setting new standards for MEV mitigation by enforcing private transaction ordering and inclusion guarantees. These programmable enforcement mechanisms are likely to become integral to DeFi infrastructure, reducing harmful MEV extraction and supporting fairer redistribution.

If you’re building or trading in DeFi today, understanding these shifts isn’t optional, it’s essential for staying competitive as incentives realign across the stack. Explore more about practical strategies and emerging best practices at our dedicated guide to MEV rebate innovation.