As decentralized finance (DeFi) matures, the conversation around fairness and transparency in DEX trading has shifted from theoretical debates to practical implementation. The spotlight now falls on MEV redistribution: a critical innovation shaping market integrity on both Solana and Ethereum. By addressing the risks of toxic order flow and leveling the playing field, MEV redistribution is redefining what it means for a blockchain to be fair.

The Mechanics of MEV: Why Redistribution Matters

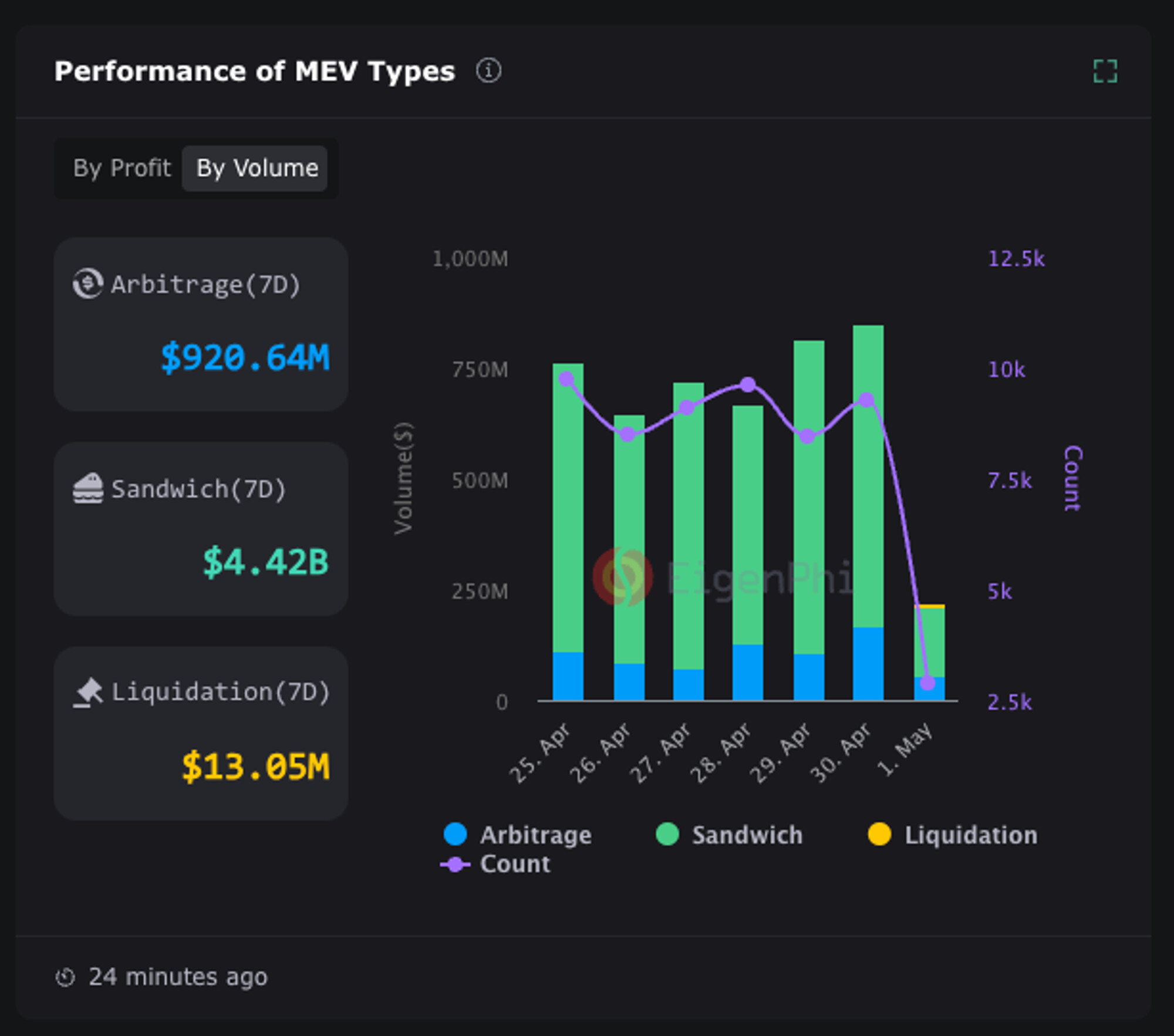

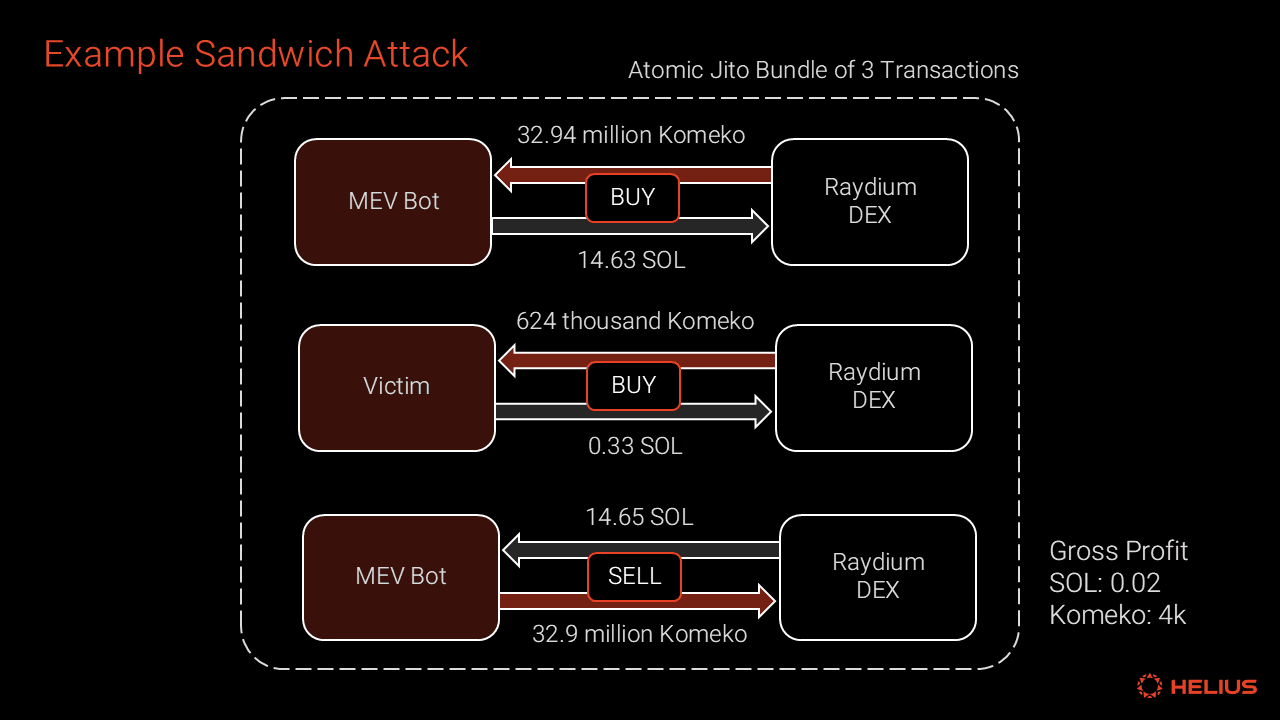

Maximum Extractable Value (MEV) refers to the additional profit validators or miners can capture by reordering, including, or excluding transactions within a block. This phenomenon is not merely academic; it directly impacts every DEX trader by introducing slippage, sandwich attacks, and unpredictable execution costs. On Ethereum, public mempools make these exploits visible and accessible to bots. On Solana, despite the absence of a public mempool, MEV persists via direct node connections and private channels, fueling validator-centric extraction strategies.

The challenge is stark: left unchecked, MEV amplifies inequality between sophisticated actors and everyday users. That’s why redistribution initiatives have become central to DeFi protocol design on both chains.

Solana vs. Ethereum: Divergent Paths, Shared Goals

The architectural differences between Solana and Ethereum have led to distinct approaches in handling MEV:

Key Differences: Jito Auctions vs. Flashbots for MEV Redistribution

-

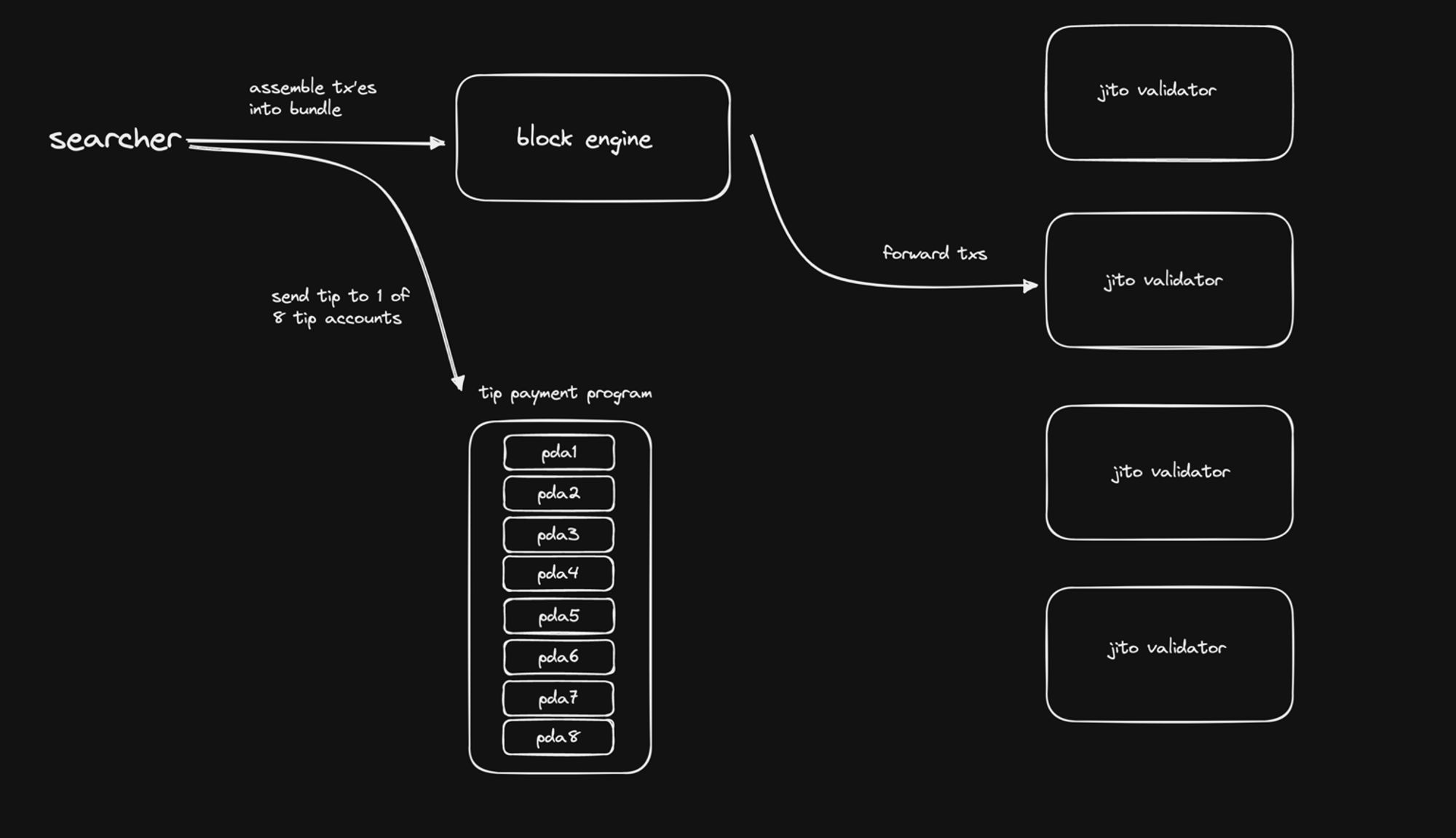

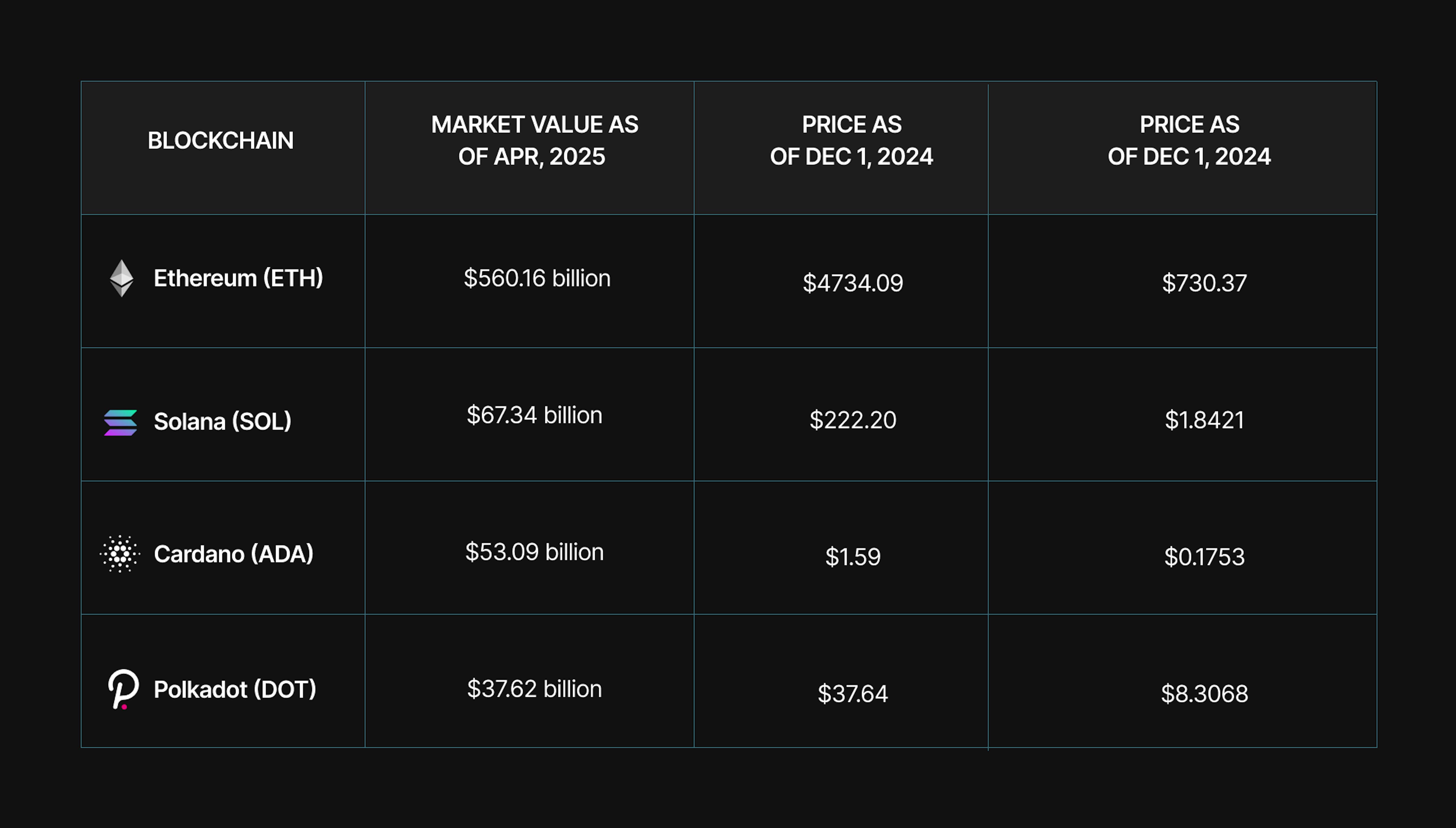

Revenue Split: Ethereum’s Flashbots allows validators to retain 95% of MEV revenue, with block builders receiving 5%. In contrast, Solana’s Jito allocates approximately 60% of MEV to block builders and 40% to validators, reflecting differences in network architecture and economic incentives.

-

Native Token Usage: Flashbots auctions are denominated in ETH, directly supporting Ethereum’s native token demand. Jito auctions use SOL, reinforcing Solana’s economic model and validator incentives.

-

Block Building Frequency: Flashbots conducts auctions every 12 seconds (Ethereum’s block time), while Jito operates at Solana’s much faster block cadence, leveraging its low-latency design for rapid MEV extraction and redistribution.

-

Mempool Architecture: Ethereum uses a public mempool, making transactions visible and enabling open MEV opportunities. Solana lacks a public mempool, with MEV occurring via private mempools and direct node connections, impacting how MEV is identified and captured.

-

Impact on Validator Incentives: Jito is actively adjusting its MEV revenue distribution to increase validator rewards and support network security. Flashbots already provides a high validator share, aligning incentives for network robustness.

- Ethereum’s Flashbots: A transparent auction system where block-building rights are openly bid every 12 seconds. Validators retain 95% of the MEV revenue; block builders keep 5%. Bids are denominated in ETH, reinforcing demand for the native token while supporting network security. For a deeper dive into how this mechanism supports protocol-level fairness, see VanEck’s January 2025 recap (source).

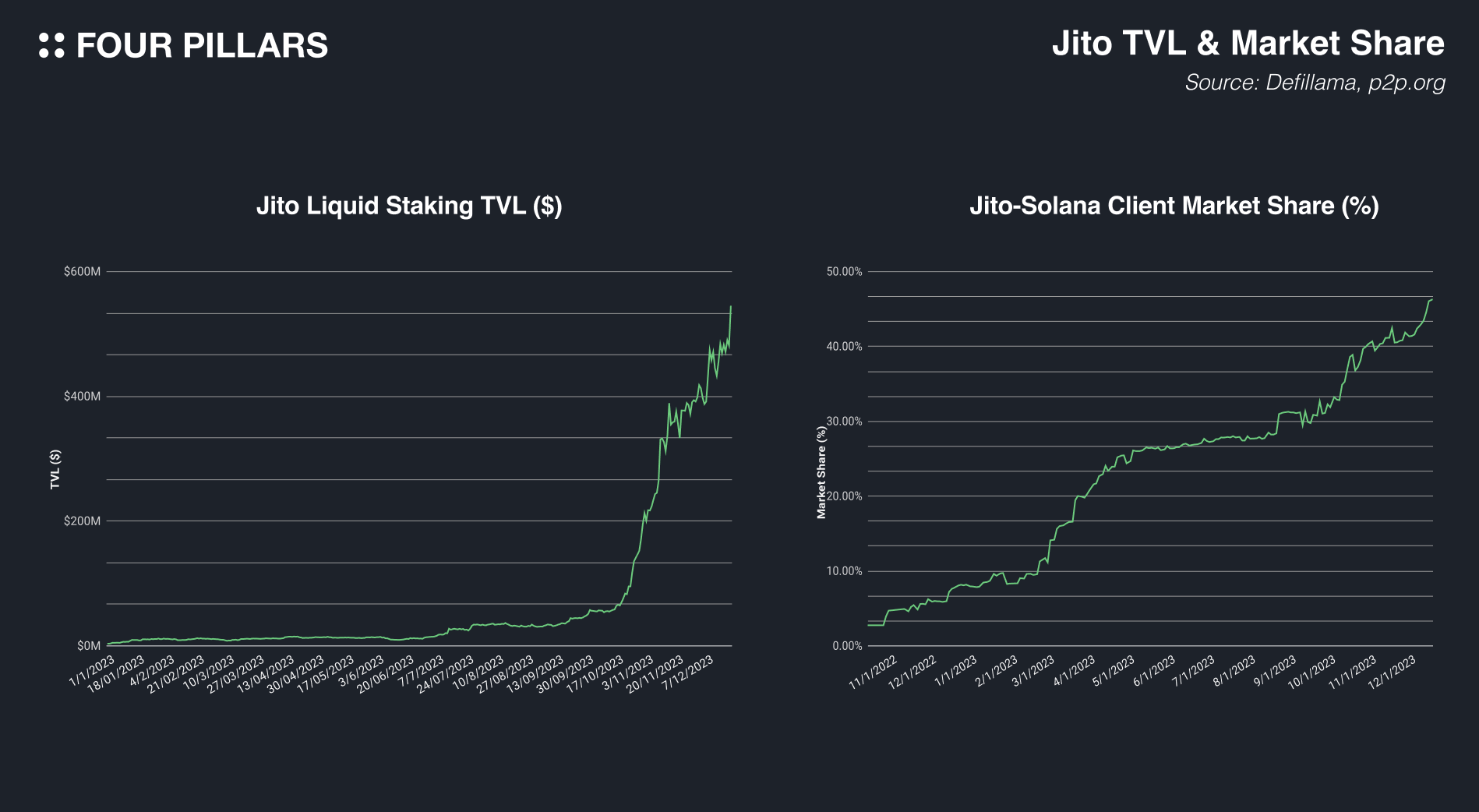

- Solana’s Jito: Here, block-building rights are auctioned in SOL with an estimated 60% of MEV value captured by builders and 40% retained by validators. The split reflects Solana’s high-throughput design but also highlights ongoing efforts to optimize validator incentives as competition intensifies.

The Impact on DEX Trading: Toward Fair Ordering Protocols

The introduction of fair ordering protocols, coupled with MEV redistribution mechanisms like Flashbots and Jito, has begun to neutralize many predatory trading strategies that once dominated DeFi markets:

- Reduced DEX Trading Slippage: By limiting front-running opportunities and redistributing extracted value back into the ecosystem, these systems help contain slippage, a persistent pain point for retail traders.

- Mitigation of Toxic Order Flow: Open auctions for block space mean that only competitively priced (and thus less exploitative) order flows are prioritized. This reduces the prevalence of sandwich attacks targeting volatile or illiquid assets.

- Sustainable Validator Incentives: With enhanced revenue streams tied directly to network health rather than extractive practices, validators have stronger incentives to support robust DeFi infrastructure instead of prioritizing short-term personal gain.

Navigating Trade-offs: Efficiency vs. Equity in Execution Layer Innovation

No solution is without trade-offs. As protocols experiment with new forms of execution layer innovation, questions remain about optimal splits between builders and validators, and how these choices affect network decentralization over time. However, what is clear is that MEV redistribution marks a strategic pivot toward user-centric markets.

Protocols are now moving beyond basic mitigation, actively engineering environments where DeFi transparency and equitable access become core features rather than afterthoughts. The evolution of MEV redistribution, especially as seen in Jito and Flashbots, signals a future where DEX participants can rely on predictable, fair execution even during periods of heightened volatility.

This shift is especially relevant for traders navigating markets with high DEX trading slippage or those exposed to toxic order flow. By removing the informational asymmetries that once allowed MEV bots to thrive unchecked, these systems restore confidence in decentralized markets and help attract new liquidity providers who might otherwise be deterred by opaque or hostile trading environments.

What’s Next? The Road Ahead for MEV Redistribution

Looking forward, several trends are likely to define the next phase of MEV management on Solana and Ethereum:

Upcoming Innovations in MEV Redistribution & Fair Ordering

-

SUAVE by Flashbots: SUAVE (Single Unifying Auction for Value Expression) is an upcoming protocol from Flashbots designed to create a universal, cross-chain MEV marketplace. It aims to decentralize block building and auction processes, enabling fair ordering and MEV redistribution across Ethereum and other major blockchains.

-

Jito’s Dynamic MEV Sharing Upgrades: Jito continues to evolve on Solana, with planned upgrades to its MEV sharing mechanism. These enhancements will further balance MEV rewards between validators and block builders, supporting network security and incentivizing fairer DEX trading.

-

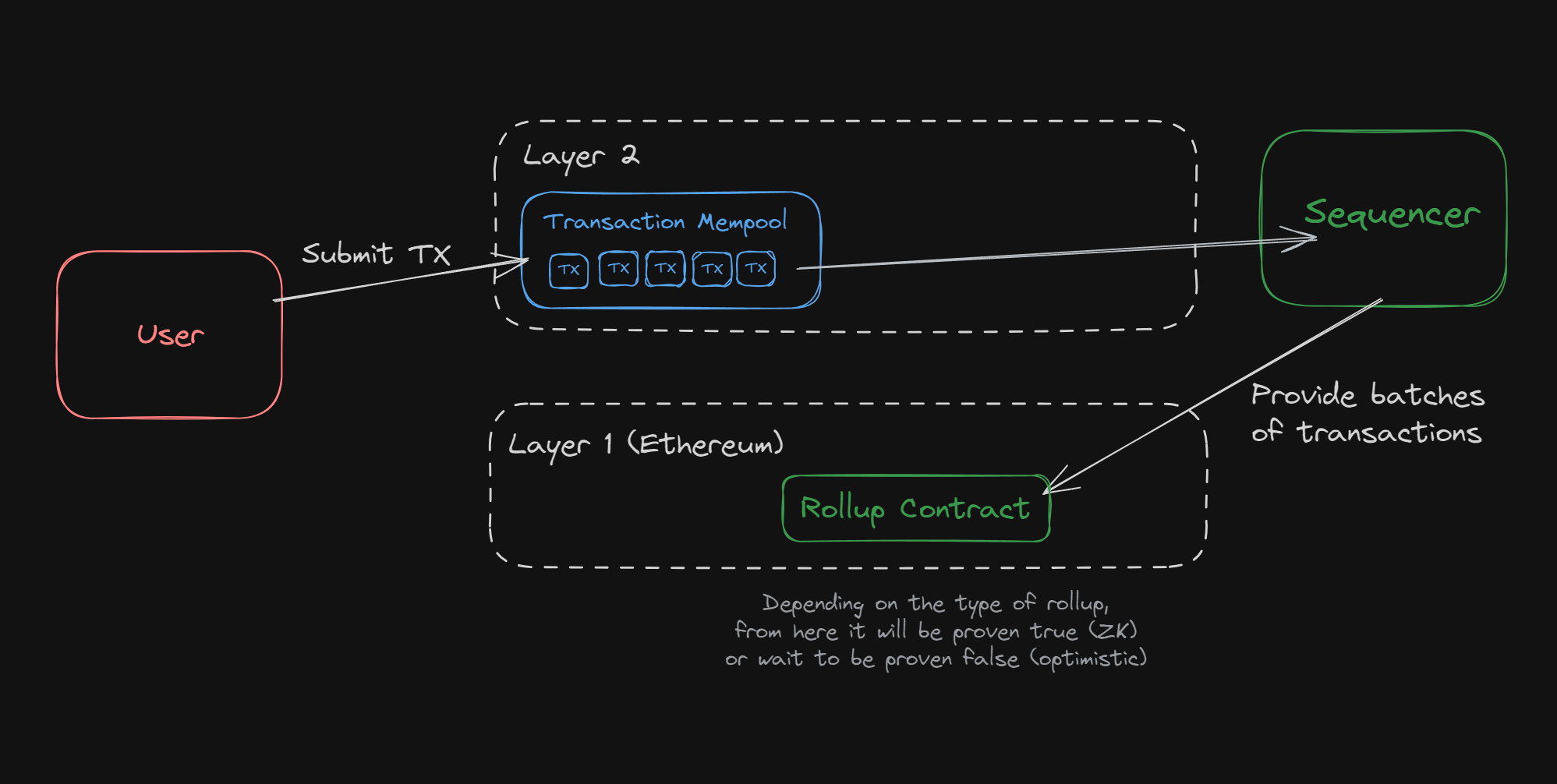

Fair Sequencing Services (FSS) on Layer 2s: New Fair Sequencing Services are being developed for Ethereum Layer 2 solutions (such as Arbitrum and Optimism), aiming to control transaction ordering at the sequencer level. This minimizes front-running and sandwich attacks, fostering a more equitable trading environment.

-

MEV-Resistant DEX Designs: Platforms like CowSwap and UniswapX are pioneering MEV-resistant architectures. By using batch auctions and off-chain order matching, these DEXs reduce the impact of MEV extraction and provide fairer execution for traders.

-

MEV Taxation and Redistribution Protocols: Protocols such as EigenLayer are exploring programmable MEV taxation and redistribution. These systems automatically allocate a portion of captured MEV to network participants, aligning incentives and supporting sustainable blockchain economics.

- Dynamic Revenue Splits: As validator competition heats up, expect ongoing recalibration of profit-sharing models, potentially with more granular splits reflecting real-time network conditions or validator performance.

- Protocol-Level Fair Sequencing: Layer 2 solutions and DEXs are experimenting with built-in fair ordering mechanisms to further minimize exploitative reordering. These innovations may soon become baseline expectations for any credible DeFi protocol.

- Community Governance: The push toward decentralization will likely see more stakeholder involvement in setting MEV policies, ensuring that redistribution schemes evolve alongside user needs and ecosystem growth.

The broader implication is clear: sustainable MEV sharing is now a competitive differentiator. Projects that prioritize it will not only attract users but also set new standards for ethical market design across the blockchain landscape.

Key Takeaways for Traders and Protocol Designers

- MEV redistribution is transforming DEX trading from an adversarial race to a collaborative marketplace.

- The choice of execution layer matters: protocols with fair ordering are rapidly becoming industry benchmarks.

- Sustained innovation in this space will require balancing efficiency, equity, and decentralization as the market matures.

For those building or trading on Solana and Ethereum, understanding the nuances of MEV redistribution mechanisms isn’t just technical due diligence, it’s a prerequisite for long-term success in DeFi’s new era. As these systems continue to evolve, expect greater alignment between network security, user experience, and the foundational values of open finance.