As the DeFi landscape matures, protocol developers are increasingly tasked with not just mitigating the risks of Maximal Extractable Value (MEV), but actively redistributing its proceeds to foster a more equitable and sustainable ecosystem. MEV, which arises from the ability to reorder or censor transactions within a block, continues to be a double-edged sword: it can incentivize innovation yet often erodes user trust and increases costs. To address these challenges, developers must integrate robust MEV redistribution mechanisms directly into their protocols.

Strategic Approaches for Fair MEV Distribution

Modern DeFi protocols now have access to a growing suite of MEV redistribution tools that balance efficiency with fairness. RediSwap, for example, is an application-layer Automated Market Maker (AMM) that intercepts arbitrage flows within its pools and redistributes captured value among both users and liquidity providers. Unlike legacy AMMs where arbitrage profits are externalized, RediSwap’s architecture ensures that value extraction benefits those who contribute to liquidity and trading activity. Empirical studies suggest this approach significantly reduces impermanent loss for LPs while enhancing execution quality for traders (arxiv.org).

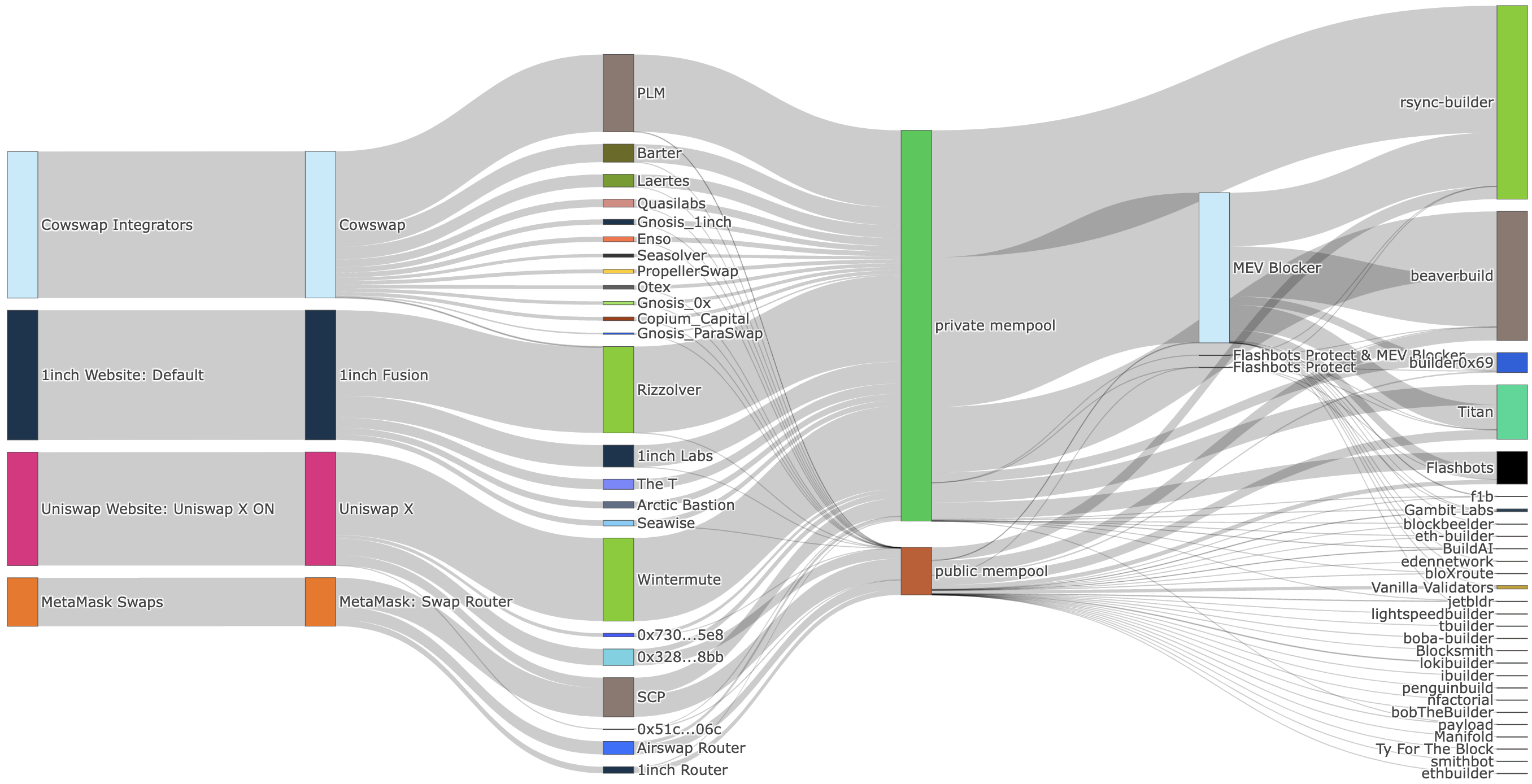

Another notable mechanism is MEV Blocker, which refunds up to 90% of builder rewards directly back to users. By integrating this system at the RPC endpoint level, platforms can shield users from frontrunning and sandwich attacks, two of the most pernicious forms of MEV exploitation, while also improving overall transaction fairness (eigenphi-1.gitbook.io). This model demonstrates how protocol-level interventions can align incentives between builders, searchers, and end-users.

Intent-Based Protocols: Shifting Control Back to Users

The next wave of MEV mitigation leverages intent-based trading protocols. Instead of exposing raw transactions to mempools, where they are vulnerable to manipulation, users define their trading intentions (such as price limits or timing constraints). ParaSwap’s Delta Protocol, launched in August 2024, exemplifies this trend by letting users specify their desired outcomes rather than granular transaction details. This reduces the attack surface for searchers seeking exploitable order flow (cointelegraph.com). For protocol developers, integrating intent-based modules means offering greater user autonomy while minimizing extractable value leakage.

Comparison of Leading MEV Redistribution Solutions in DeFi

| Solution Name | Mechanism Type | User Benefits | Integration Complexity |

|---|---|---|---|

| RediSwap | Application-level AMM with internal MEV capture and redistribution | Users and liquidity providers share MEV profits; reduced LP losses; better execution | Medium – requires AMM integration and protocol-level changes |

| MEV Blocker | Multi-transaction MEV redistribution via RPC endpoint | Up to 90% of builder rewards refunded to users; protects from frontrunning and sandwich attacks; easy wallet integration | Low – add RPC endpoint to wallet, minimal protocol changes |

| ParaSwap Delta | Intent-based trading protocol | Mitigates MEV attacks by hiding raw transactions; users define price intentions; improved trade privacy | Medium – requires integration with intent-based protocol |

| Order Flow Auctions (e.g., Flashbots Protect, MEV Blocker) | Competitive auction for order flow; searchers bid for transaction inclusion | Users receive MEV profits and gas rebates; better execution and optimized routing | Medium to High – requires auction mechanism integration |

| Wallchain | Protocol-level MEV arbitrage redistribution integrated with DeFi platforms | Captures and redistributes MEV profits from user swaps; aligns incentives for users and searchers | Medium – protocol integration required |

| MEV-Share (Flashbots) | Selective transaction data sharing with searchers; bundle inclusion via bidding | Users directly receive a share of MEV; improved transparency; customizable privacy | Medium – requires user opt-in and protocol support |

Order Flow Auctions and Collaborative Mechanisms

A pivotal innovation in fair MEV distribution is the adoption of Order Flow Auctions (OFAs). These auctions create competitive markets where searchers bid for the right to bundle their transactions with user trades. The resulting profit is then shared with users through gas rebates or improved pricing outcomes. Flashbots Protect and MEV Blocker are leading examples; they provide transparent routing options that optimize execution quality while redistributing value previously reserved for miners or validators (coincryptorank.com). For developers prioritizing user-centric design, integrating OFA modules can serve as both a defensive measure against predatory strategies and a proactive tool for community alignment.

Beyond auctions and intent protocols, architectural enhancements at the protocol level are crucial for sustained MEV resistance. The introduction of Private, Anonymous, Collateralizable Commitments (PACCs) allows smart contract wallets to make commitments without exposing sensitive transaction details. By shifting MEV opportunities into censorship-resistant channels, PACCs can dramatically reduce the avenues available for value extraction while preserving composability and user privacy (arxiv.org).

Similarly, Protected Order Flow (PROF) mechanisms enforce private ordering of transactions, ensuring that the sequence determined by users or applications is maintained through to block production (arxiv.org). This approach not only curtails transaction reordering attacks but also guarantees timely inclusion and predictable outcomes for all participants. For protocol developers, these frameworks offer robust templates for integrating fairness directly into settlement logic.

Circuit Breakers, Atomic Swaps, and Shared Liquidity Models

Advanced DeFi protocols are also leveraging circuit breakers and atomic swap designs to further minimize extractable value. For example, Synthetix integrates circuit breakers that automatically halt trading when anomalous activity, often indicative of MEV attacks, is detected. Meanwhile, atomic swaps ensure that trades either execute in full or not at all, reducing exposure to sandwiching or partial fill exploits (cryptodamus.io). These mechanisms are increasingly embedded at the core contract level to provide real-time protection as market conditions evolve.

The rise of shared liquidity pools represents another strategic shift in MEV redistribution. Protocols like Mitosis aggregate liquidity across rollups and chains, reducing price fragmentation and arbitrage incentives that fuel MEV extraction (university.mitosis.org). By consolidating order books and synchronizing pricing across venues, developers can effectively dampen cross-chain MEV opportunities while improving gas efficiency for users.

Best Practices for Developers Implementing MEV Redistribution

The implementation of fair MEV distribution strategies demands a holistic approach:

Best Practices for Implementing MEV Redistribution in DeFi

-

Integrate MEV Redistribution Protocols like RediSwap: Adopt advanced AMMs such as RediSwap to capture and redistribute MEV among users and liquidity providers, reducing losses and improving execution quality.

-

Utilize MEV Blocker for Transaction Protection: Deploy MEV Blocker to refund up to 90% of builder rewards to users, mitigating frontrunning and sandwich attacks while enhancing platform fairness.

-

Adopt Intent-Based Trading Protocols like ParaSwap’s Delta: Implement intent-based protocols such as ParaSwap’s Delta Protocol to allow users to specify trading intentions, reducing MEV attack vectors by minimizing transaction exposure in mempools.

-

Leverage Order Flow Auctions (OFAs): Integrate OFAs, as provided by Flashbots Protect and MEV Blocker, to enable competitive bidding for transaction inclusion, redistributing MEV profits and offering gas rebates to users.

-

Enhance Protocol Design with PACCs and PROF: Incorporate Private, Anonymous, Collateralizable Commitments (PACCs) and Protected Order Flow (PROF) frameworks to eliminate or limit MEV by ensuring privacy, anonymity, and fair transaction ordering.

-

Implement Circuit Breakers and Atomic Swaps: Follow examples like Synthetix Protocol by integrating atomic swaps and circuit breakers to halt trading during anomalous activity and minimize arbitrage-based MEV.

-

Promote Shared Liquidity Pools with Platforms like Mitosis: Use solutions such as Mitosis to pool liquidity across chains and rollups, reducing fragmented arbitrage and MEV opportunities while improving efficiency.

- Embed redistribution logic at the protocol layer: Ensure that value capture and sharing mechanisms are part of core smart contracts rather than afterthoughts or external plugins.

- Pursue composability with existing DeFi infrastructure: Design solutions that interoperate with established standards like ERC-20/721 tokens and major DEXs.

- Prioritize transparency: Offer clear analytics on MEV flows so users understand how value is captured and redistributed.

- Adopt modular design principles: Allow seamless integration of future anti-MEV tools as new threats emerge.

- Cultivate community governance: Involve stakeholders in tuning parameters related to redistribution rates or auction mechanics to align incentives sustainably.

The path forward is clear: as the sophistication of both attackers and defenders increases, so too must the commitment to equitable value sharing within DeFi markets. By embracing these advanced mechanisms, from OFAs to intent-based protocols, PACCs, circuit breakers, and shared liquidity, protocol developers can transform MEV from a source of friction into a foundation for long-term ecosystem resilience.