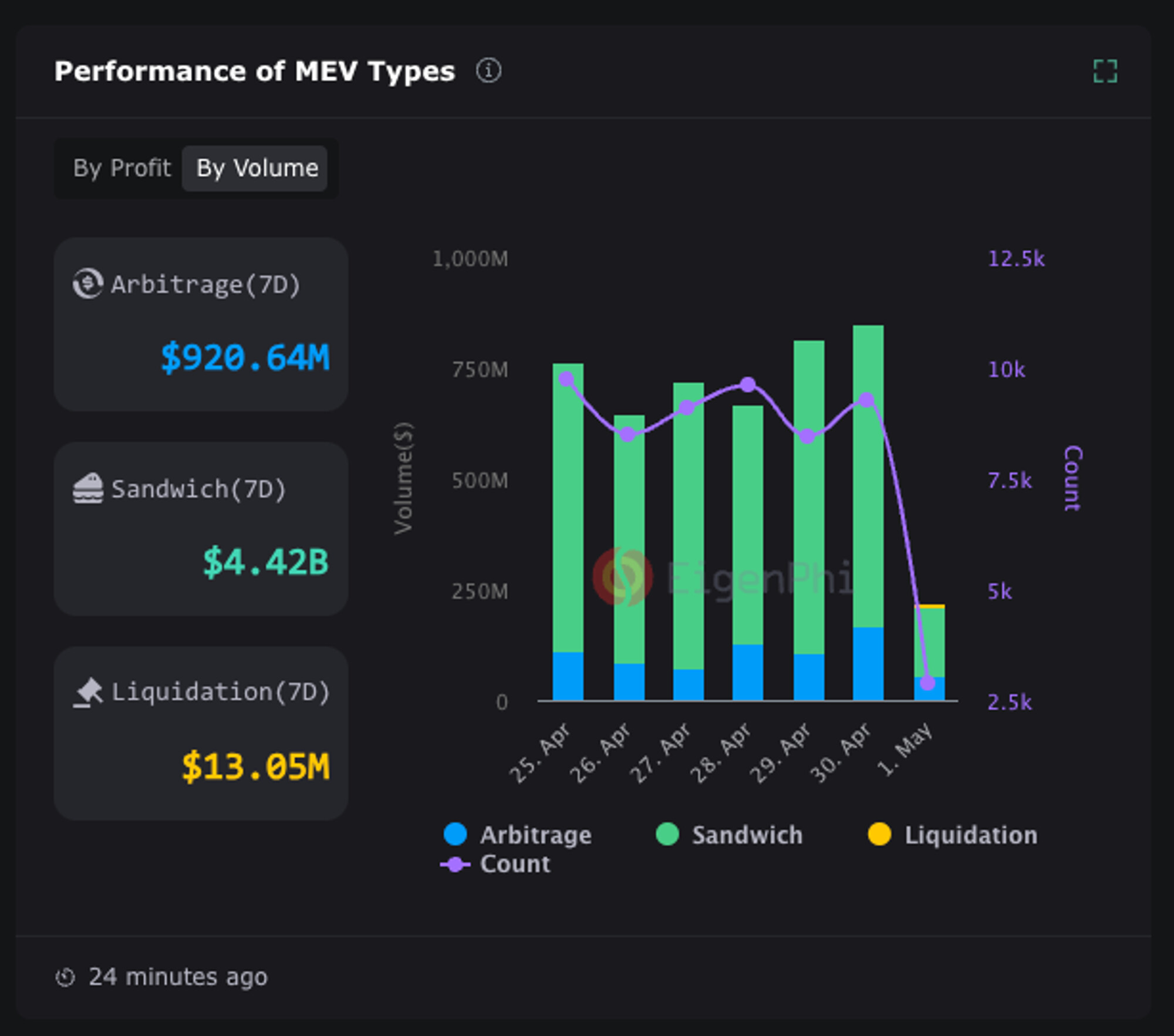

Maximal Extractable Value (MEV) has become a defining feature of decentralized finance, with over $500 million in MEV extracted since The Merge, according to Flashbots. While MEV creates efficiency through arbitrage and liquidations, it also opens the door to exploitative tactics like front-running and sandwich attacks. This duality challenges the core promise of DeFi: transparent and fair access for all participants.

What Is Flashbots MEV-Share?

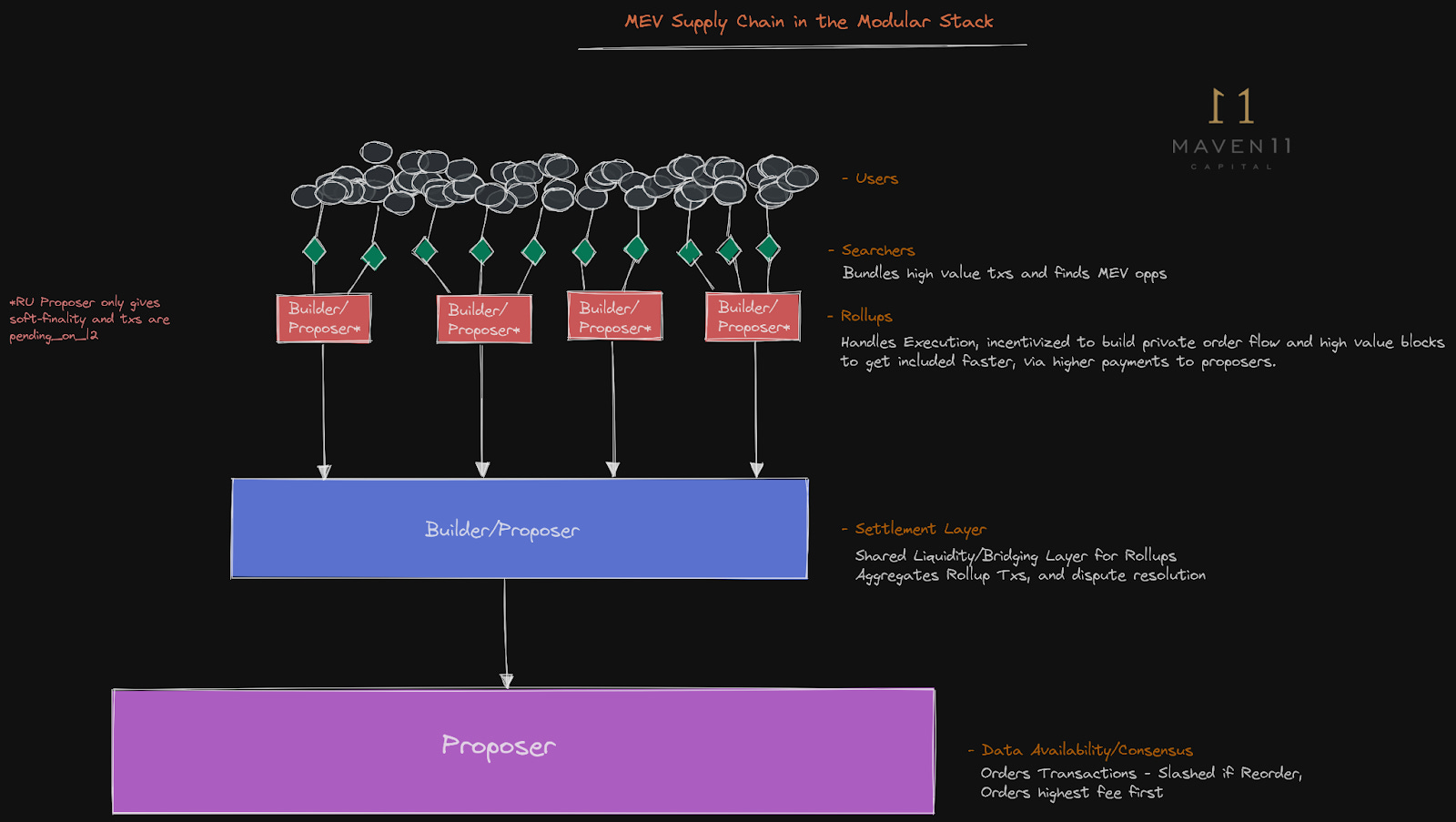

The Flashbots MEV-Share protocol is an open-source initiative designed to address these fairness issues. Instead of allowing validators or miners to capture all MEV profits, MEV-Share enables users to selectively share transaction data with searchers, entities that identify and capitalize on MEV opportunities. Searchers then bid on the right to bundle these transactions, redistributing profits among users, validators, and other stakeholders. This model internalizes the value created by users’ transactions, aiming for a more equitable distribution of MEV gains.

Redefining Transaction Fairness in Blockchain Markets

Traditional public mempools are notorious for exposing user transactions to predatory strategies. Malicious actors can reorder or insert their own trades ahead of others, siphoning value from unsuspecting users. With MEV-Share, this playing field shifts dramatically:

Key Benefits of MEV-Share for DeFi Fairness

-

Democratizes MEV Profits: MEV-Share enables ordinary users to receive a share of the MEV generated by their transactions, breaking the monopoly previously held by miners and validators.

-

Mitigates Front-Running and Sandwich Attacks: By leveraging programmable privacy and competitive order flow auctions, MEV-Share reduces the risk of predatory transaction practices that undermine fairness.

-

Increases Transparency in MEV Extraction: The protocol makes MEV extraction more visible to all participants, fostering trust and accountability in DeFi markets.

-

Aligns Incentives Across Stakeholders: MEV-Share distributes MEV value among users, searchers, and validators, promoting a more equitable and sustainable ecosystem.

-

Reduces Negative Externalities: By integrating MEV value into the network through competitive auctions, MEV-Share helps lower network congestion and gas price manipulation.

- Programmable privacy: Users decide how much information about their transactions is revealed to searchers.

- Competitive order flow auctions: Searchers must bid competitively for transaction inclusion, driving up rewards for users.

- Direct user profit participation: Instead of being passive victims of MEV extraction, users can now earn a portion of the value their trades generate.

This approach not only mitigates front-running but also incentivizes honest behavior among searchers and validators. By aligning economic incentives across network participants, Flashbots aims to create a more sustainable DeFi ecosystem that rewards transparency and collaboration rather than exploitation.

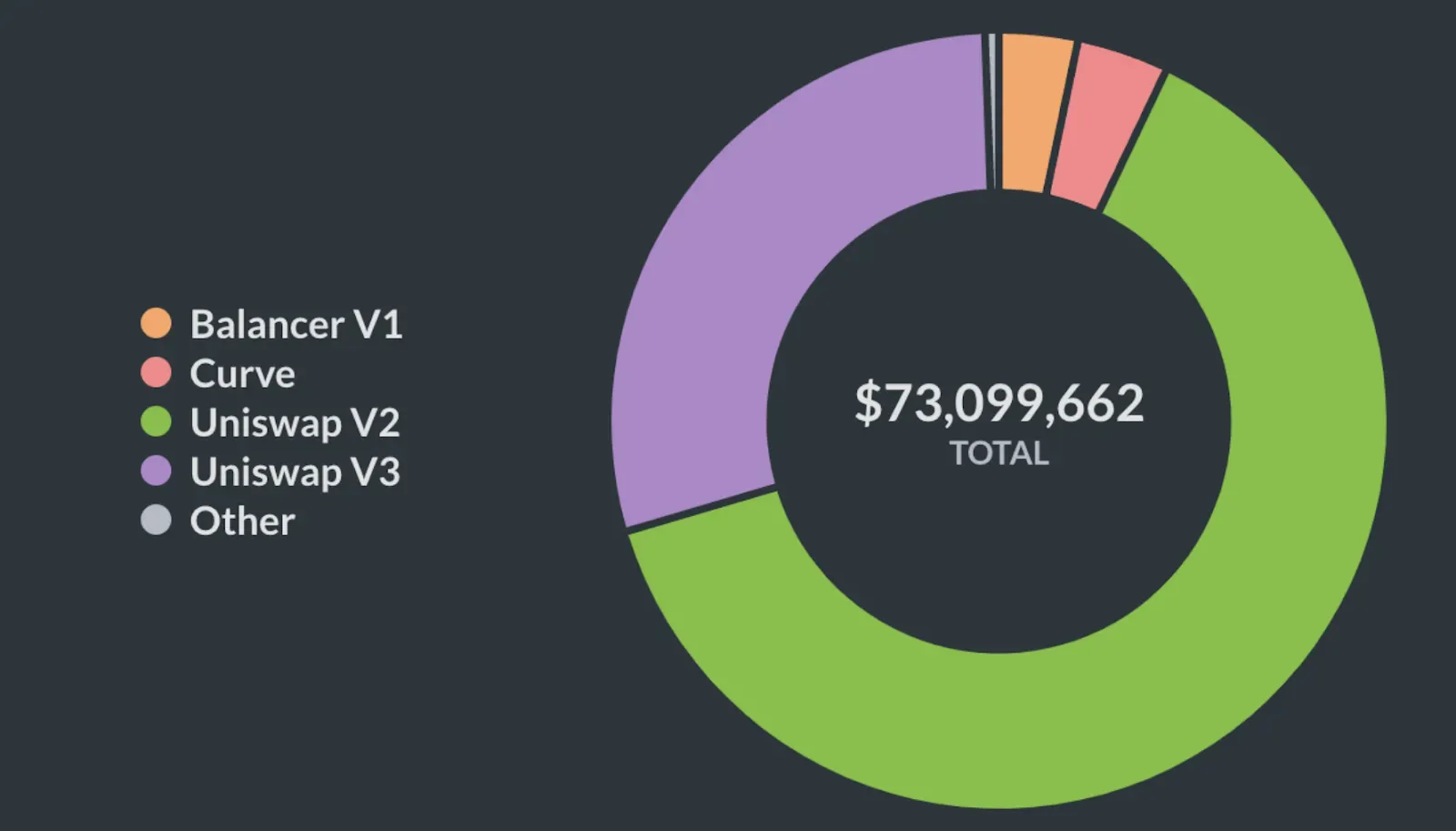

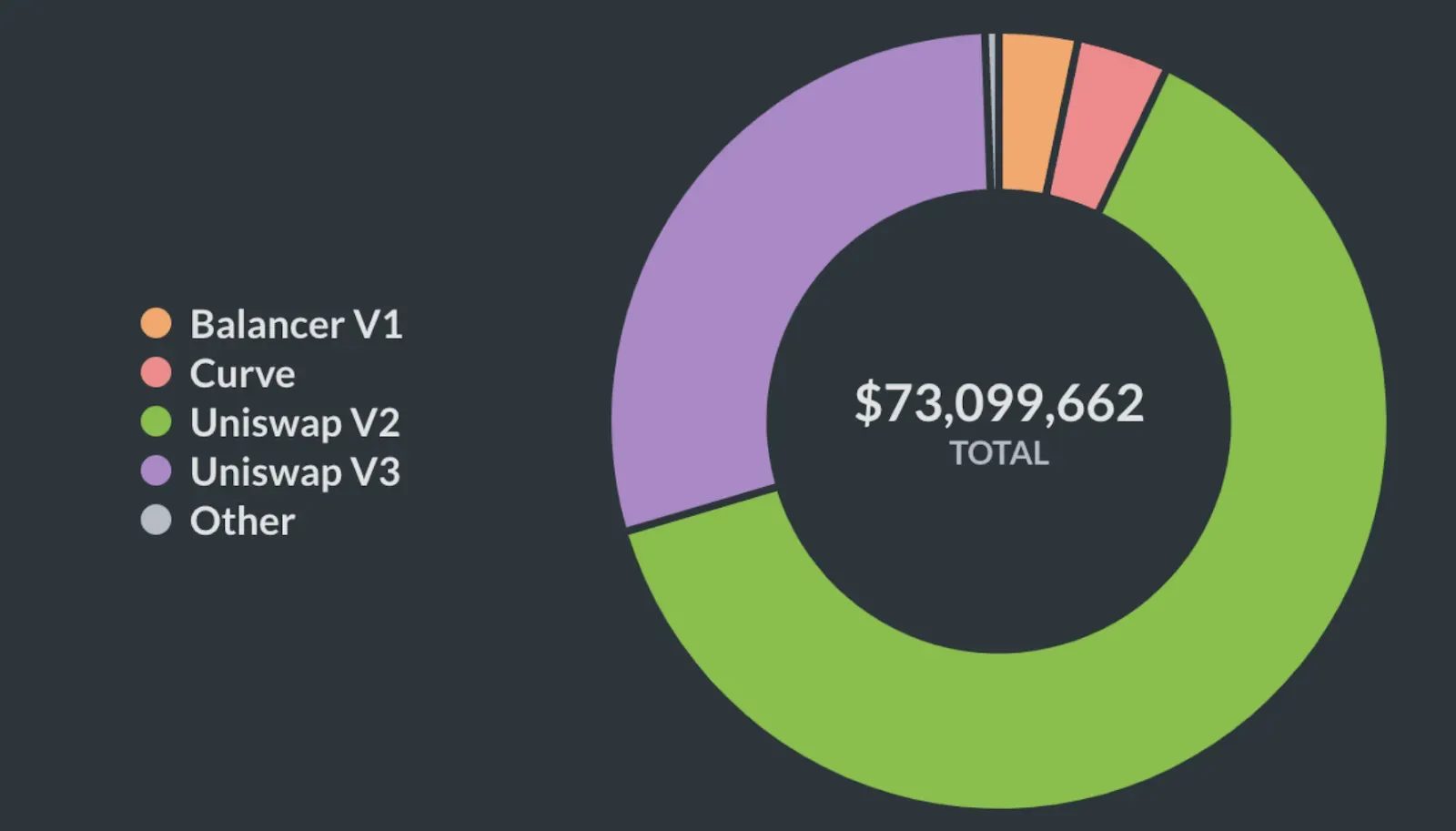

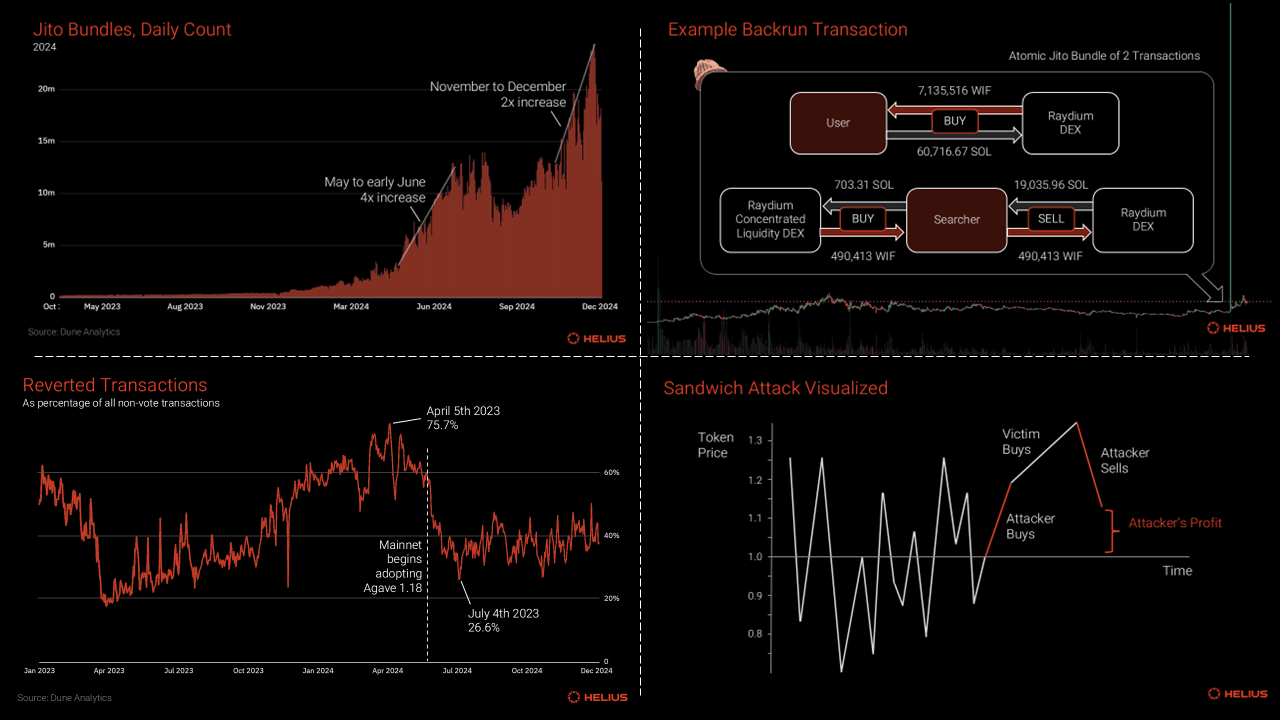

The Scale and Impact of MEV Extraction

The scale of this issue cannot be understated: as noted by Cow. fi and corroborated by research on arXiv, unchecked MEV extraction causes financial losses and undermines consensus stability across blockchains. In extreme cases, it can even threaten network security by encouraging spam or destabilizing validator incentives (ChainCatcher analysis). The negative externalities, network congestion, inflated gas prices, user distrust, are well documented throughout DeFi history.

By integrating competitive auctions directly into the transaction flow and allowing users to participate in profit sharing, MEV-Share offers a practical countermeasure against these challenges. Early data suggests that such mechanisms can significantly reduce harmful behaviors while enhancing overall efficiency in DeFi markets (Flashbots Documentation).

User Empowerment Through Transparent Redistribution

Historically, ordinary users had little recourse when their transactions were targeted by sophisticated bots or validators seeking extra profit. The introduction of protocols like MEV-Share marks a shift toward greater user empowerment:

- User-driven value distribution: Individuals providing liquidity or engaging in swaps can now claim part of the value generated by their activity.

- Sustainable market design: By democratizing access to MEV profits, DeFi platforms can attract broader participation while minimizing exploitative dynamics.

- Ecosystem resilience: Reducing adversarial behaviors strengthens both trust and technical robustness across networks.

This evolution is still in its early stages; as noted in recent market analysis (ChainCatcher report), widespread adoption will determine whether these innovations deliver lasting improvements in fairness and efficiency.

Real-world deployment of MEV sharing protocols like Flashbots MEV-Share is already reshaping expectations for transaction fairness in blockchain markets. By internalizing the value users create and distributing it transparently, these protocols are forcing a critical reevaluation of how DeFi platforms handle order flow, privacy, and incentive alignment.

Emerging Challenges and the Path Forward

Despite its promise, MEV-Share is not a silver bullet. The protocol’s effectiveness will depend on several factors: adoption by major wallets and dApps, ongoing research into privacy-preserving order flow auctions, and the willingness of validators to participate in transparent MEV redistribution. There are also open questions around how programmable privacy might interact with regulatory requirements or user experience standards as DeFi matures.

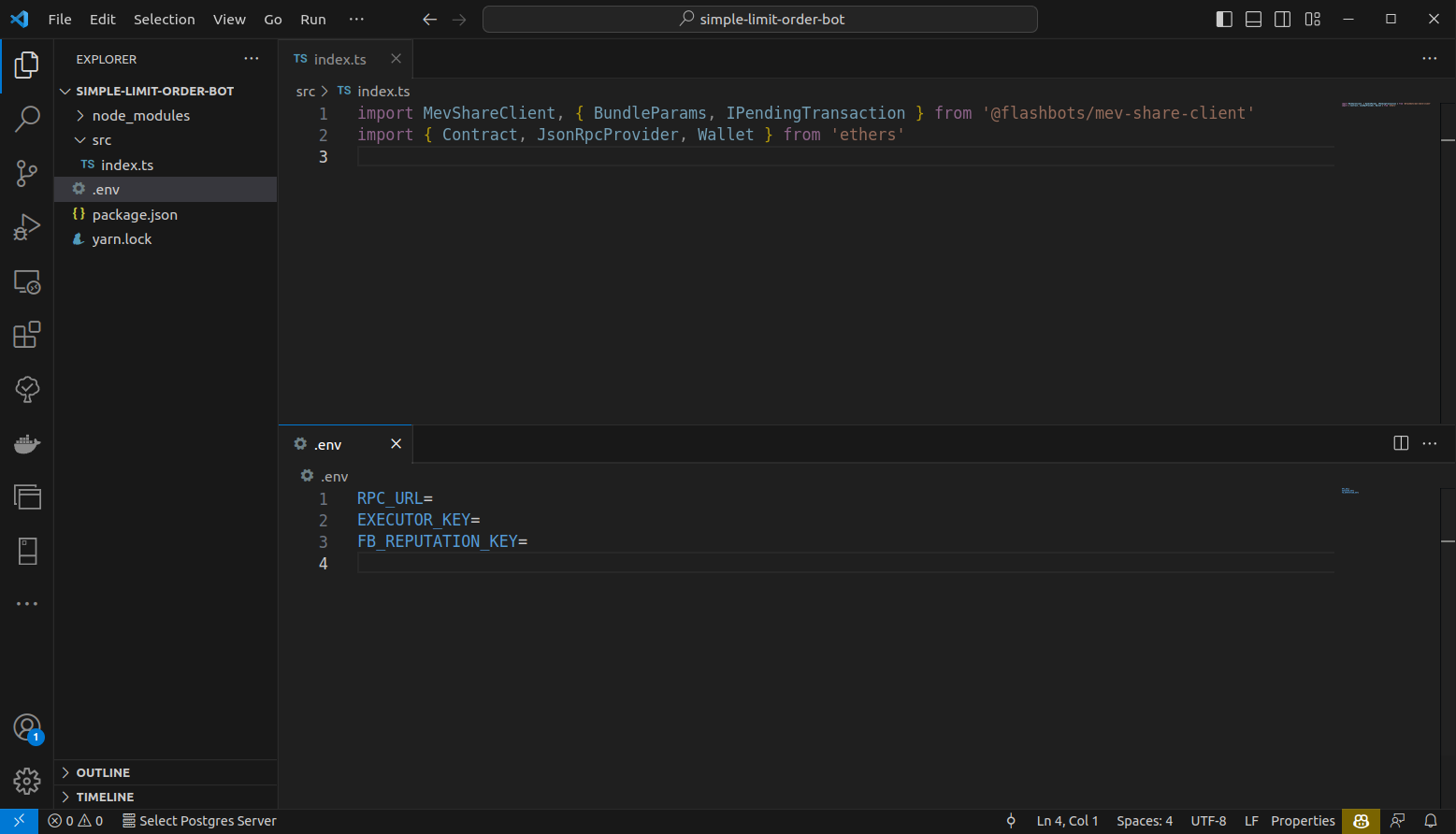

For developers and protocol designers, integrating MEV-Share means rethinking transaction workflows from the ground up. The upside? A potential reduction in predatory MEV behaviors, improved user trust, and a more robust market structure for decentralized finance.

Key Considerations for DeFi Projects Evaluating MEV-Share

-

Transparency and Fairness: MEV-Share introduces programmable privacy and order flow auctions that can reduce front-running and sandwich attacks, improving transaction fairness for users. Projects must assess how these mechanisms align with their fairness goals.

-

User Profit Participation: Unlike traditional systems where MEV profits accrue mainly to validators or miners, MEV-Share enables users to share in MEV profits. Consider how this profit-sharing model can incentivize user engagement and liquidity provision.

-

Integration Complexity: Adopting MEV-Share may require technical adjustments, including integration with the Flashbots ecosystem and changes to transaction flow. Evaluate the development resources and compatibility with existing infrastructure.

-

Impact on Network Efficiency: MEV-Share aims to reduce network congestion and gas price manipulation by internalizing MEV through competitive auctions. Analyze potential impacts on transaction throughput and cost predictability.

-

Security and Risk Management: While MEV-Share mitigates some predatory behaviors, new attack vectors or operational risks may emerge. Projects should review security implications and risk profiles before adoption.

-

Regulatory and Compliance Factors: As MEV practices attract regulatory attention, assess how MEV-Share’s transparency and user profit distribution align with evolving compliance standards in DeFi.

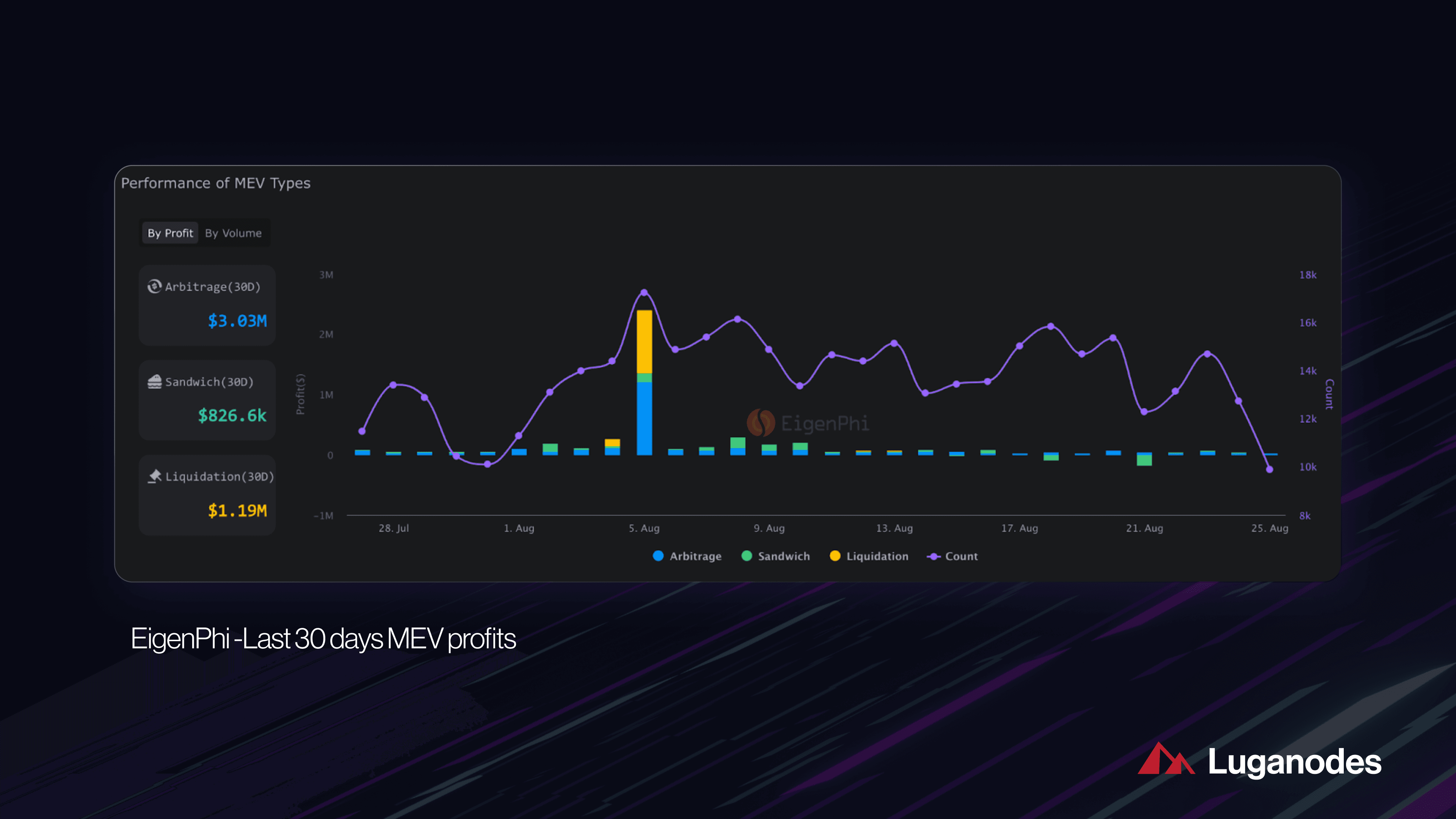

Case Study: Early Impact Metrics

Initial data from pilot integrations shows measurable improvements in both user returns and transaction latency. Users participating in MEV-Share auctions have reported higher realized profits on swaps and fewer instances of front-running compared to legacy mempool execution. Validators, meanwhile, gain access to new revenue streams without compromising network security or transparency.

This early traction underscores a broader shift toward MEV redistribution in DeFi: rather than treating MEV as an externality to be minimized at all costs, leading protocols are now exploring mechanisms to harness it for collective benefit.

The evolution of MEV value distribution is also attracting attention from institutional players who see fairer markets as a prerequisite for mainstream adoption. As more projects experiment with transparent order flow auctions and user-centric profit sharing models, competitive pressure will likely push others to follow suit, or risk losing liquidity to more equitable venues.

What’s Next for Transaction Fairness?

The coming year will be decisive for the future of transaction fairness blockchain. Key metrics to watch include:

- User participation rates: Are more wallets enabling opt-in MEV sharing?

- Total value redistributed: How much additional value flows back to users versus traditional miners/validators?

- Incidence of negative externalities: Are sandwich attacks and frontrunning measurably declining?

If these trends hold, and if protocols like Flashbots MEV-Share continue to iterate based on real-world feedback, DeFi could move closer than ever before to its founding ideals of transparency, efficiency, and fairness.