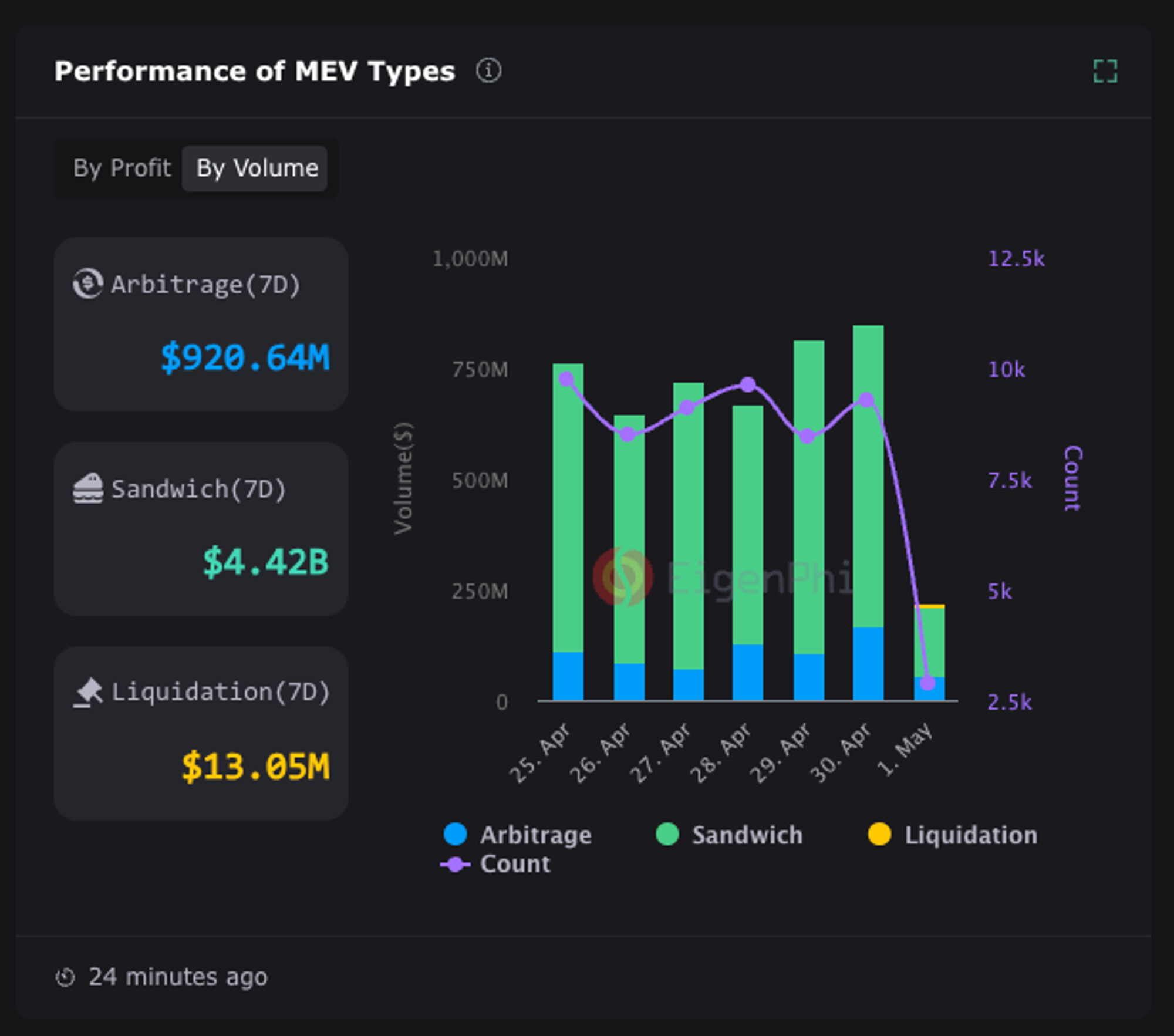

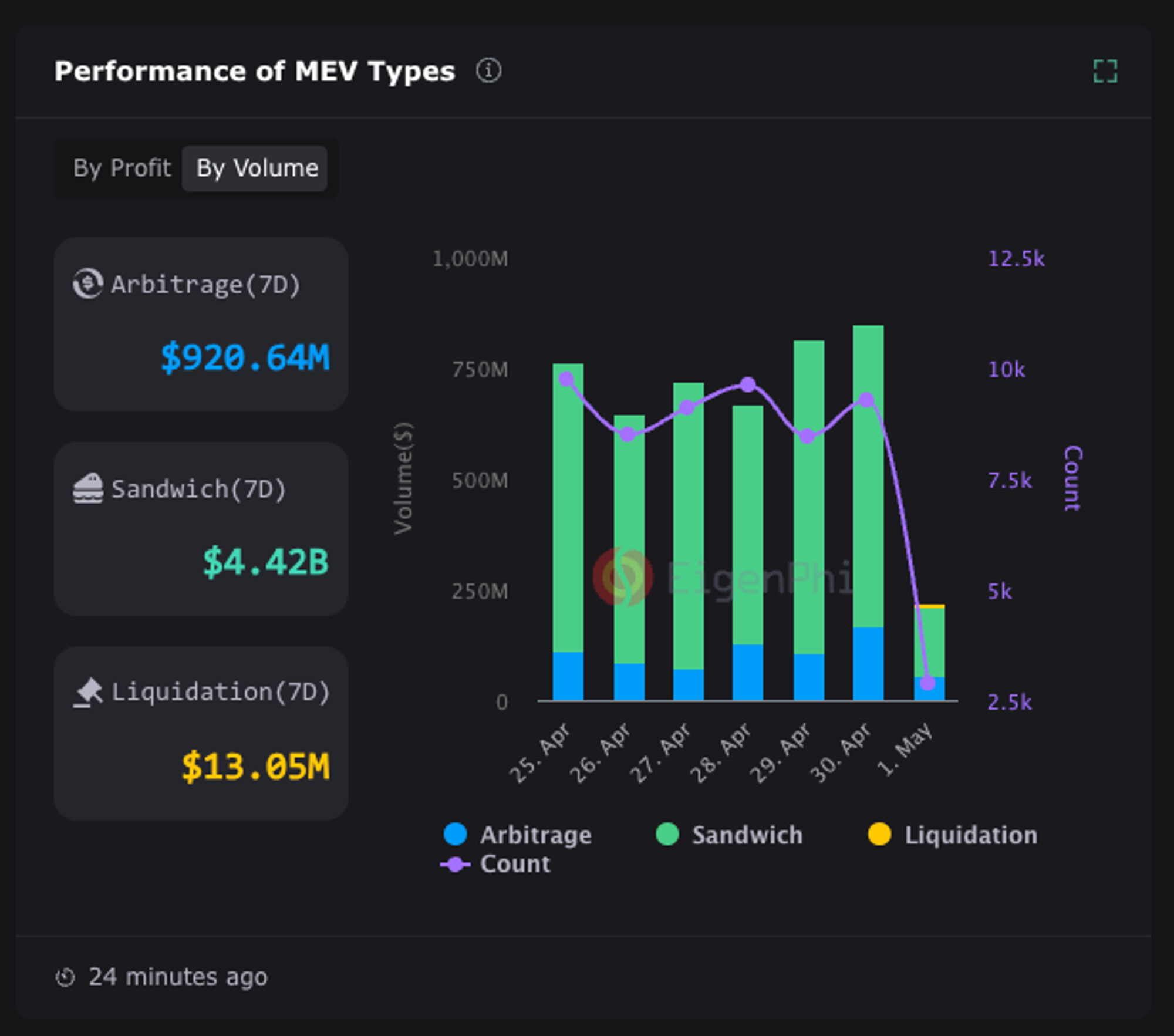

As decentralized finance (DeFi) matures, Maximal Extractable Value (MEV) has emerged as both a source of profit and a major challenge for fairness and transparency. MEV refers to the value that can be extracted by reordering, including, or excluding transactions within a block – often benefiting validators and searchers at the expense of ordinary users. To address these imbalances, a new wave of mechanisms is being deployed across DeFi protocols to ensure that MEV rebates are distributed more equitably among all participants.

Why MEV Redistribution Matters for DeFi Fairness

The unchecked extraction of MEV can lead to higher transaction costs, front-running, and loss of trust in permissionless financial systems. By redistributing MEV, protocols aim to align incentives between users, validators, and liquidity providers. This shift transforms what was once an invisible tax on users into a potential source of rewards and improved protocol sustainability.

Let’s examine three leading mechanisms currently shaping the landscape of fair MEV redistribution:

Key Mechanisms for Fair MEV Redistribution in DeFi

-

Rules-Based MEV Sharing Protocols (e.g., Flashbots MEV-Share): These protocols use transparent, algorithmic rules to split extracted MEV among validators, searchers, and users. By defining clear distribution formulas, they ensure a fairer allocation of value generated from transaction ordering and inclusion, reducing the concentration of MEV profits and promoting ecosystem trust.

-

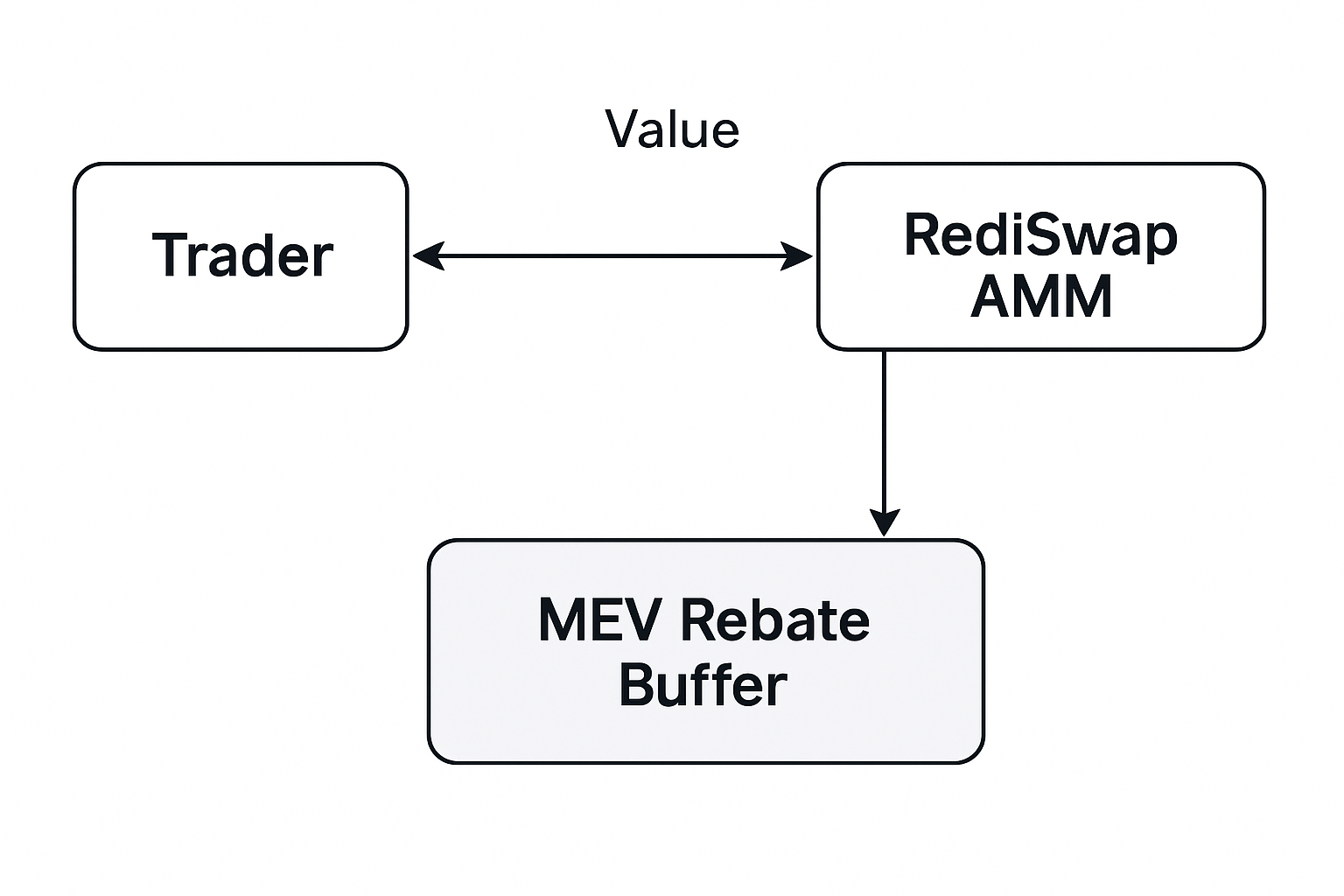

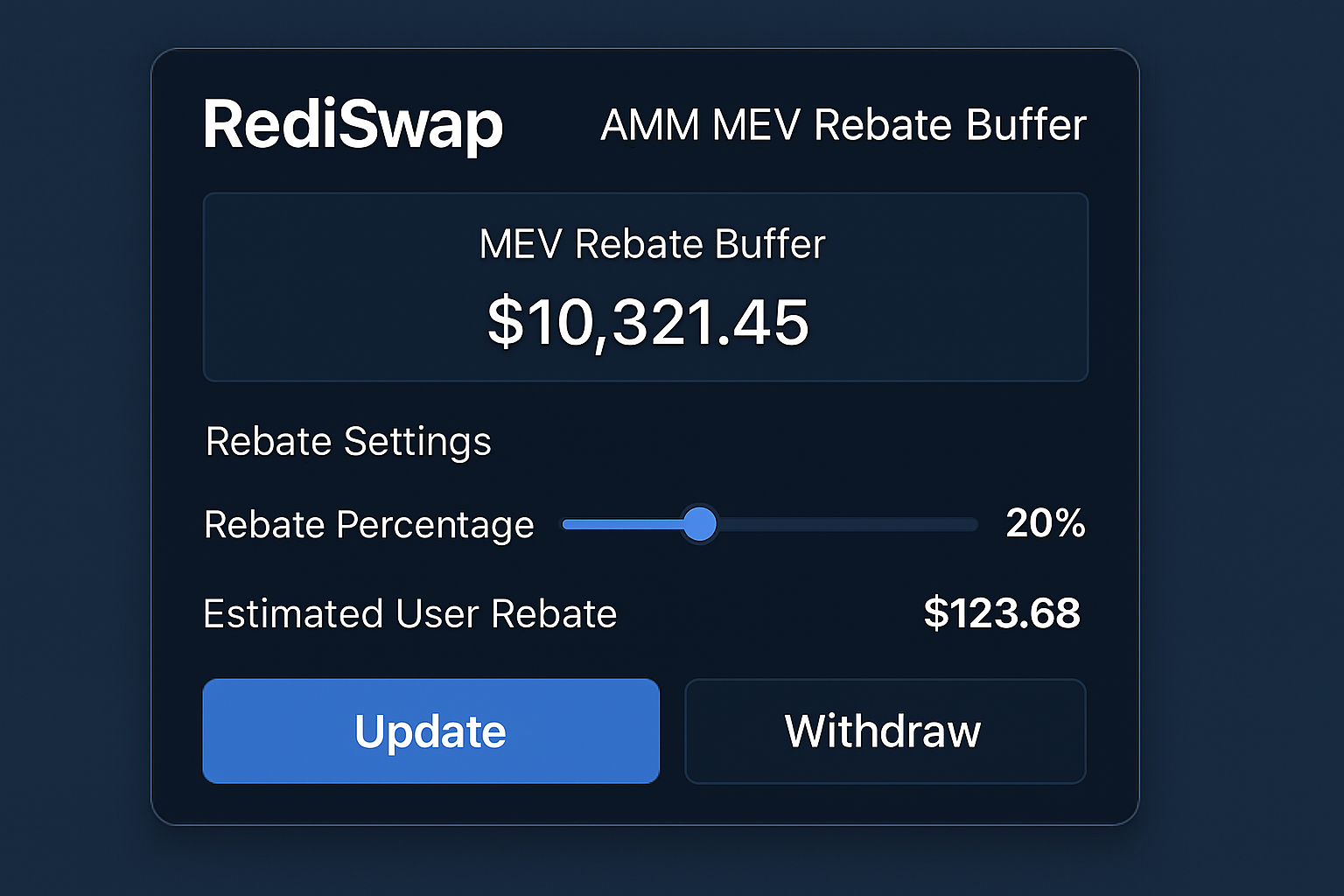

MEV Rebate Buffers in Automated Market Makers (e.g., RediSwap): Certain AMMs, like RediSwap, implement dedicated rebate buffers that collect a portion of MEV generated during trades. These buffers periodically redistribute accumulated value to liquidity providers or traders who helped create the surplus, mitigating extraction risks and better aligning incentives within the pool.

-

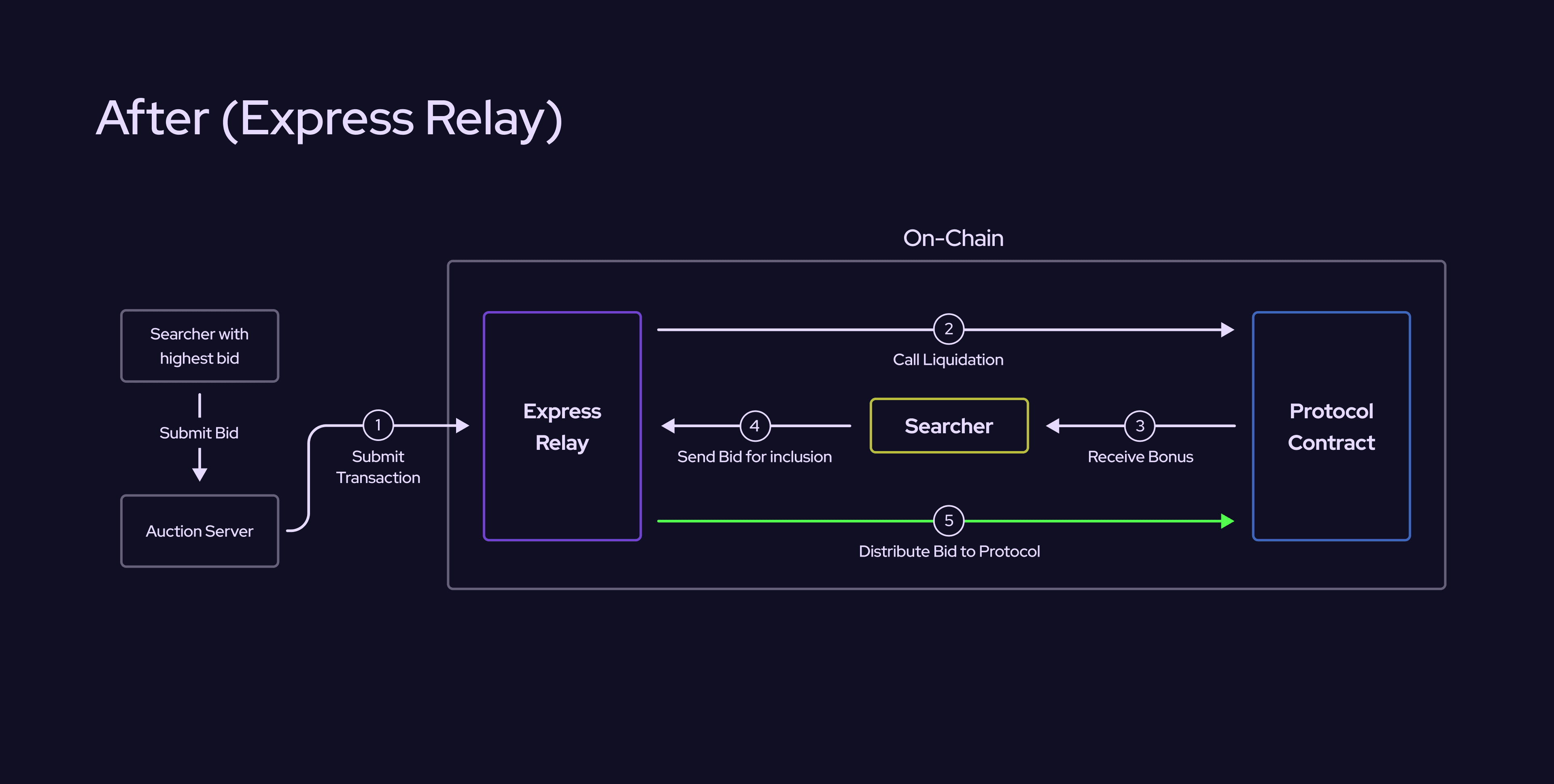

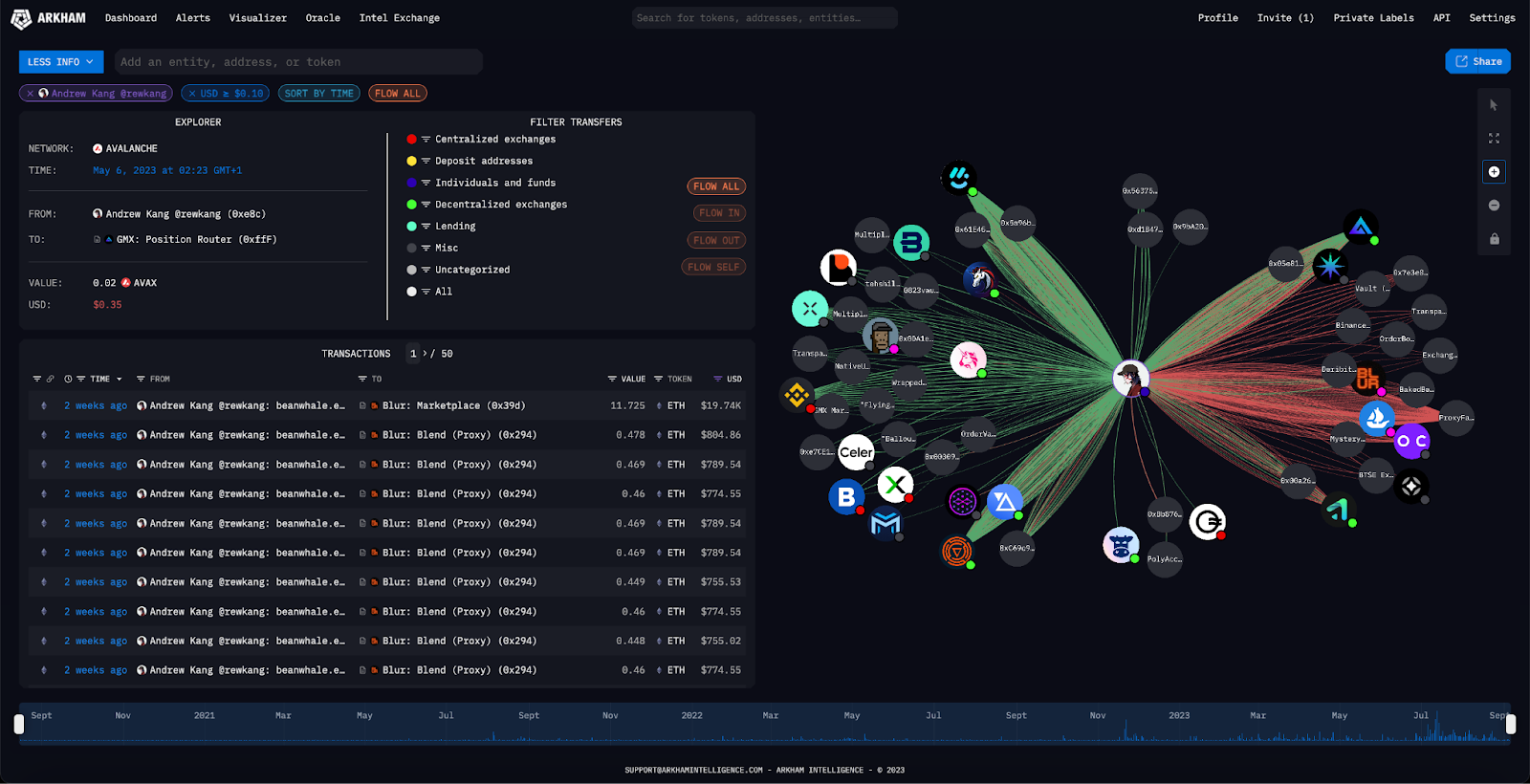

Auditable, On-Chain MEV Payout Systems: Modern protocols are deploying verifiable smart contract mechanisms that automatically track MEV extraction events and issue rebates or rewards to eligible users. These on-chain payout systems provide full transparency, enabling community oversight and ensuring that MEV redistribution is both fair and tamper-resistant.

1. Rules-Based MEV Sharing Protocols

Rules-based MEV sharing protocols, such as Flashbots MEV-Share, introduce transparent algorithms that split extracted value among validators, searchers, and users according to predefined rules. Instead of allowing block producers or sophisticated searchers to capture all surplus from transaction ordering, these systems enforce proportional payouts based on each participant’s contribution or risk.

The result is a more predictable and equitable distribution model that discourages predatory behaviors while rewarding those who contribute positively to network health. For example, if a user’s transaction generates surplus value due to its position in the block, part of that surplus is automatically returned as an MEV rebate. This approach not only incentivizes user participation but also reduces the negative externalities traditionally associated with MEV extraction.

2. MEV Rebate Buffers in Automated Market Makers

The rise of MEV rebate buffers, exemplified by AMMs like RediSwap, represents another innovation in aligning incentives within DeFi markets. These buffers act as dedicated pools that accumulate a portion of the MEV generated from trading activity or arbitrage opportunities within the protocol.

At regular intervals or upon reaching certain thresholds, these accumulated funds are redistributed back to liquidity providers or traders who contributed to the creation of surplus value. This mechanism helps mitigate extraction risks – especially for those providing liquidity – by ensuring they share in the upside created by their participation rather than bearing all downside risk from opportunistic actors.

How Rebate Buffers Work in Practice

- Accumulation: A fraction of each trade’s potential MEV is siphoned into a buffer contract.

- Payout: Periodically or via governance triggers, buffer contents are distributed proportionally among eligible participants.

- Transparency: All buffer flows are visible on-chain for community oversight.

This not only improves DeFi fairness but also strengthens long-term protocol sustainability by making liquidity provision more attractive and less risky.

The Importance of Auditable On-Chain Payout Systems

A final pillar supporting fair value redistribution is the adoption of auditable on-chain payout systems. These smart contract-driven solutions track when and how much MEV has been extracted during specific events (such as block proposals or swaps), then automatically issue rebates or rewards directly to eligible wallets.

This model provides two key advantages: transparency (as all payouts can be independently verified) and trustlessness (removing reliance on off-chain processes or opaque intermediaries). Community members can audit payout logic at any time, ensuring accountability while empowering users with real-time insight into how ordering surplus is shared throughout the ecosystem.

By leveraging auditable, on-chain payout systems, DeFi protocols can foster a culture of transparency and shared accountability. These mechanisms are particularly impactful in scenarios where MEV extraction is significant and ongoing, such as high-frequency trading environments or during periods of network congestion. When users see rebates automatically delivered to their wallets, without the need for manual claims or centralized oversight, it reinforces confidence in the protocol’s commitment to equitable value sharing.

These innovations are not just theoretical. For example, RediSwap’s rebate buffer is fully visible on-chain, allowing anyone to verify how much MEV has been accumulated and distributed. Similarly, rules-based sharing protocols like Flashbots MEV-Share publish their algorithms and distribution formulae openly, supporting community audits and research. This level of openness is essential for maintaining fairness as DeFi scales.

Synergies: Building a User-Aligned DeFi Ecosystem

While each mechanism, rules-based sharing protocols, rebate buffers in AMMs, and auditable payout systems, can operate independently, their combined impact is transformative. When implemented together, these approaches create a robust framework for user-aligned DeFi incentives, reducing the risks associated with unchecked MEV extraction while rewarding active participation.

Mechanisms for Fair MEV Redistribution in DeFi

-

Rules-Based MEV Sharing Protocols (e.g., Flashbots MEV-Share): These protocols use transparent algorithms to split extracted MEV between validators, searchers, and users based on predefined rules. By automating the division of value generated from transaction ordering, they ensure a fairer and more predictable distribution across all participants.

-

MEV Rebate Buffers in Automated Market Makers (e.g., RediSwap): Some AMMs, like RediSwap, feature dedicated rebate buffers that collect a portion of MEV generated within the pool. These buffers periodically redistribute accumulated value to liquidity providers or traders who help generate the surplus, reducing extraction risks and better aligning incentives.

-

Auditable, On-Chain MEV Payout Systems: Protocols are deploying verifiable smart contract mechanisms that track MEV extraction events and automatically issue rebates or rewards to eligible users. This approach ensures transparency, enables community oversight, and builds trust in the fair redistribution of value.

The synergies are clear: rules-based protocols set fair expectations; rebate buffers ensure continuous value accrual for participants; auditable payouts guarantee transparency at every step. This holistic approach not only mitigates predatory behaviors but also encourages broader participation from users who might otherwise be deterred by opaque value flows or extraction risks.

What’s Next for MEV Rebates?

The evolution of MEV rebates is far from complete. As new forms of trading strategies emerge and market conditions shift, protocols will need to iterate on these redistribution mechanisms to address novel threats and opportunities. Community-driven governance will play a crucial role in refining parameters, such as buffer sizes or payout schedules, to adapt to changing network dynamics.

Moreover, the integration of real-time analytics and open-source tooling will further empower users to monitor their share of ordering surplus blockchain-wide. As more projects adopt these principles, and as best practices around MEV redistribution solidify, the ecosystem stands to benefit from greater efficiency, reduced extraction risk, and an improved reputation for fairness.

The future of DeFi depends on aligning incentives across all participants, from validators to everyday traders. By embracing transparent MEV redistribution through rules-based protocols, rebate buffers like those pioneered by RediSwap, and verifiable on-chain payouts, the industry takes a decisive step toward sustainable growth.

If you’re interested in learning more about how these mechanisms are transforming user incentives and protocol design in practice, explore our detailed guide at How MEV Rebates Are Transforming DeFi User Incentives And Protocol Fairness.