Every day, DeFi users interact with protocols, often unaware of the hidden value their transactions generate in the form of Maximal Extractable Value (MEV). Traditionally, this value has been siphoned away by miners or validators through practices like front-running and sandwich attacks. However, a new wave of MEV rebate mechanisms is flipping this script, redistributing a significant portion of these profits back to users and fundamentally reshaping incentives across decentralized finance.

What Are MEV Rebates and Why Do They Matter?

MEV rebates are a class of mechanisms designed to return a share of the profits derived from MEV activities directly to the users whose transactions create that value. Instead of users being passive victims of extraction, they now become active participants in the economic upside. This shift is not just about fairness, it’s about aligning incentives so that users, liquidity providers, and protocol developers all benefit from healthy market activity.

By integrating MEV rebates, DeFi protocols can:

- Reduce exploitation: Users are compensated for their role in generating MEV, mitigating harms from predatory tactics.

- Boost participation: Financial rewards encourage more on-chain activity and engagement.

- Enhance trust: Transparent redistribution fosters user confidence in protocol governance.

Leading Implementations: From MEV Blocker to RediSwap

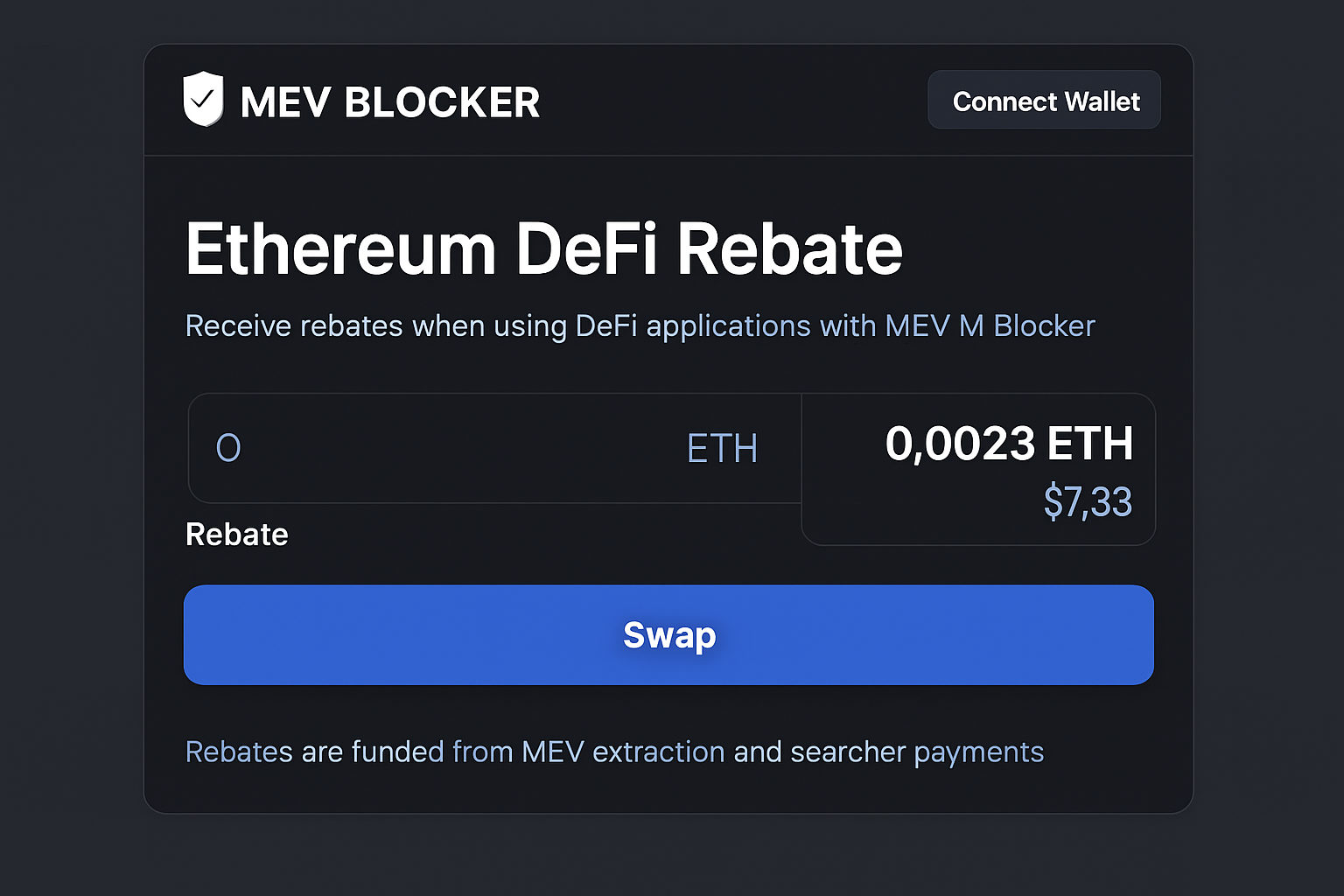

The past year has seen several innovative protocols deploy MEV rebate systems at scale. One standout is MEV Blocker, an RPC endpoint created by over 30 Ethereum teams. It routes user transactions through a private network where searchers bid for the right to backrun trades, then passes up to 90% of those builder rewards back as rebates. In 2024 alone, MEV Blocker distributed exactly 4,079 ETH in rebates, a powerful proof point for this model’s impact on user experience.

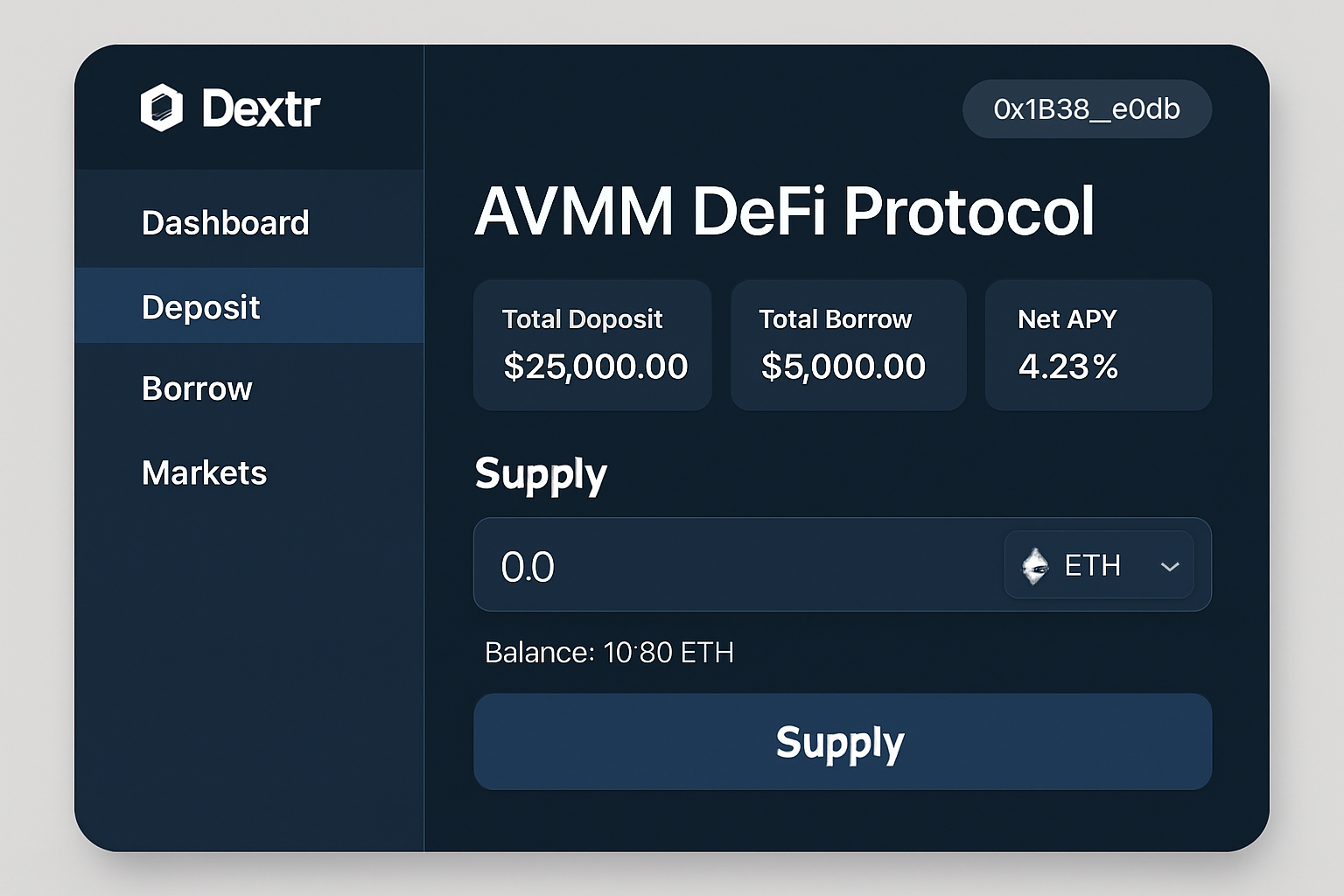

Another approach comes from Dextr’s Actively Validated Market Maker (AVMM). Instead of simply refunding extracted value, Dextr redesigns order matching via low-latency oracles and trusted operators. This minimizes price slippage and disincentivizes classic forms of MEV exploitation. On top of that, Dextr introduces an insurance layer to compensate any users adversely affected by residual MEV events.

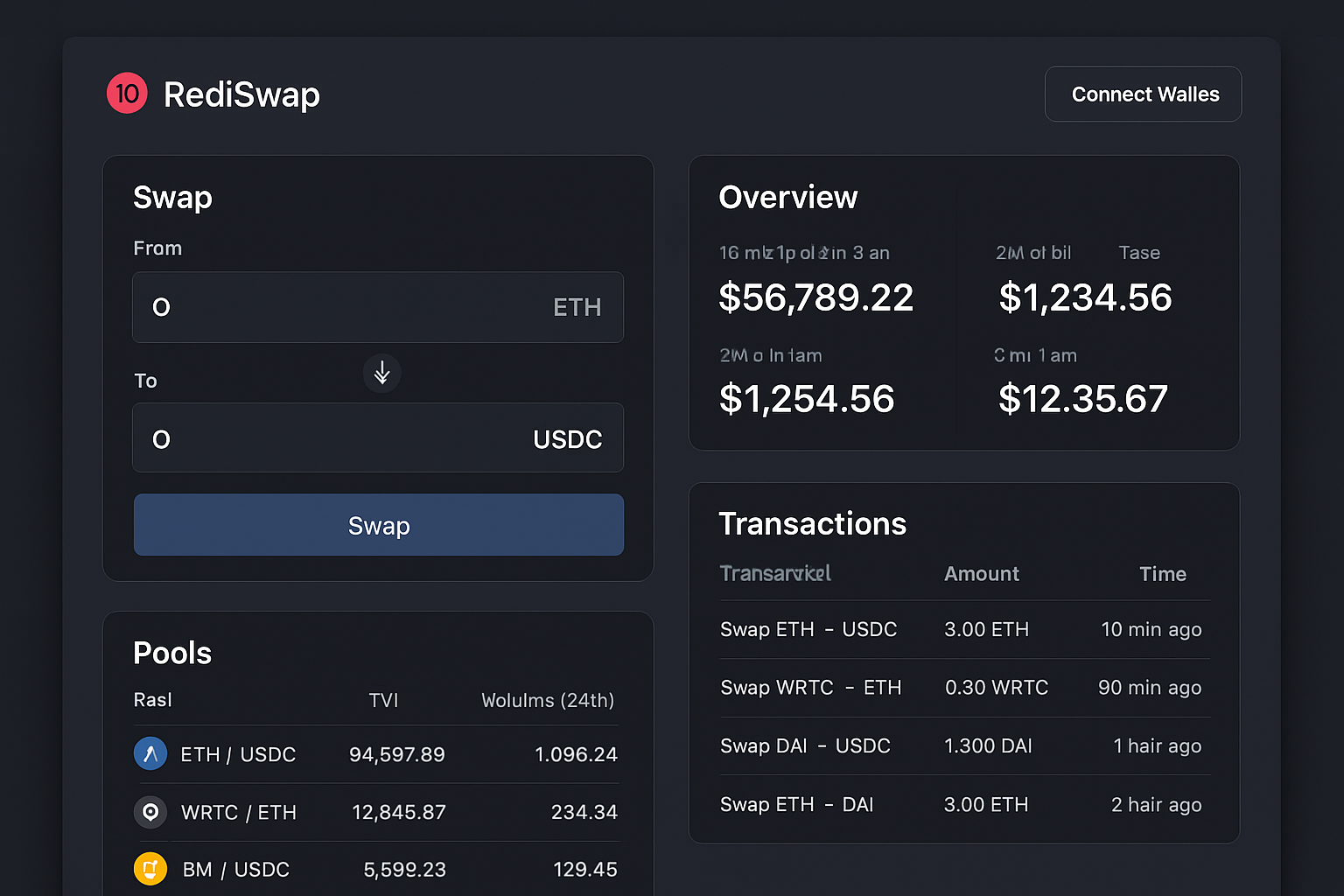

RediSwap takes yet another tack: it captures arbitrage-driven MEV at the AMM level and redistributes it between users and liquidity providers. According to recent empirical studies (arxiv. org/abs/2410.18434), RediSwap’s design delivers better execution than legacy solutions on most trades, demonstrating how protocol-level innovation can directly uplift end-user outcomes.

The Ripple Effect: Transforming User Incentives Across DeFi

The integration of robust MEV redistribution tools has already begun to transform DeFi user incentives:

- Enhanced Fairness: Rebates ensure that those who generate value get rewarded, not just sophisticated searchers or validators.

- User Retention: Platforms offering transparent rewards see higher retention as users feel tangibly valued for their participation.

- Ecosystem Alignment: When profits are shared equitably among users, LPs, and developers, there’s less friction and more collaboration across stakeholders.

This paradigm shift is also driving new entrants like Wallchain into the spotlight, offering integrated solutions for capturing arbitrage opportunities while returning proceeds directly to DeFi participants.

Wallchain, for example, is pioneering a hybrid approach that combines user swaps with searcher participation, enabling DeFi protocols to internalize MEV profits and share them back through rebates. Every day, users who once unknowingly lost value to MEV now find themselves receiving tangible rewards for their activity, turning what was previously a hidden tax into a visible benefit. This model not only incentivizes more active trading but also encourages deeper liquidity as users recognize the additional layer of returns available through MEV redistribution.

Top DeFi Protocols Offering MEV Rebates and Their Unique Approaches

-

MEV Blocker: This protocol, launched by a consortium of over 30 Ethereum teams, offers an RPC endpoint that protects users from front-running and sandwich attacks. MEV Blocker routes transactions through a private network and auctions the right to backrun user transactions, returning 90% of the builder reward as rebates to users. In 2024, it distributed 4,079 ETH in rebates, making it a leading solution for user-centric MEV redistribution.

-

Dextr’s Actively Validated Market Maker (AVMM): Dextr tackles MEV by transforming order matching and validation. It uses low-latency price oracles and restricts order matching to trusted operators, which minimizes price impact and MEV exploitation. Dextr also features a multi-layered insurance model to compensate users affected by MEV, offering a unique blend of protection and fairness.

-

RediSwap: This Automated Market Maker (AMM) captures MEV at the application level and redistributes profits between users and liquidity providers. RediSwap manages arbitrage opportunities within its pools, ensuring both users and LPs benefit from MEV activities. Studies show RediSwap achieves better trade execution than many existing AMMs in most cases.

The impact on DeFi user incentives is both immediate and far-reaching. As platforms like RediSwap and Wallchain demonstrate, when users feel they are part of the value creation process, engagement levels rise. Liquidity providers, too, benefit from these mechanisms as arbitrage-driven MEV is no longer siphoned away but flows back into the pools that underpin DeFi’s core infrastructure. This alignment reduces adversarial behavior and fosters a more cooperative environment for protocol growth.

Challenges Ahead: Transparency, Complexity, and Governance

Despite these advances in MEV transparency and redistribution, challenges remain. Designing systems that fairly attribute value to individual transactions is non-trivial, especially as on-chain activity becomes more complex. There’s also the risk of centralizing power among sophisticated searchers or validators unless rebate logic remains open-source and auditable.

Moreover, governance over how rebates are calculated and distributed will require ongoing community input. Protocols must balance rewarding genuine contributors while minimizing opportunities for manipulation or gaming the system. As new models like MorphLayer MEV emerge, offering modular solutions for integrating rebates across multiple protocols, the importance of clear rules and transparent reporting will only grow.

What’s Next for DeFi Protocol Rewards?

The evolution of DeFi protocol rewards powered by MEV redistribution is just beginning. As more platforms adopt rebate systems, and as users become savvier about their options, the competitive landscape will shift toward those who can offer not just security or low fees but also meaningful participation in value creation.

This trend could accelerate the adoption of on-chain incentive routing protocols that dynamically adjust rewards based on real-time signals like TVL (Total Value Locked), wallet activity, or liquidity costs. Such innovations promise to make capital allocation within DeFi both smarter and fairer, a win-win for builders and end-users alike.

By returning a share of previously extracted value back to its rightful creators, everyday users, MEV rebates are setting a new standard for fairness in decentralized finance. The protocols that embrace this shift will be best positioned to thrive in an increasingly competitive ecosystem.