MEV rebates are shaking up the DeFi landscape, and if you’ve been around the block(chain), you know this shift is long overdue. For years, Maximal Extractable Value (MEV) has been the playground of miners and validators, leaving everyday users to pick up the tab for front-running, sandwich attacks, and other predatory tactics. But now, with rules-based MEV redistribution entering the arena, the game is changing. Let’s dig into how new mechanisms are flipping DeFi user incentives and why this is such a big deal for protocol fairness.

Why MEV Rebates Matter: From Extraction to Empowerment

Traditionally, MEV has been a zero-sum game. Validators or miners would squeeze every drop of value from transaction ordering, often at the expense of users. This led to a market that, while efficient in some ways, was rife with negative externalities. Regular traders faced higher slippage, unpredictable execution, and a sense that the deck was stacked against them. According to Paradigm’s analysis of baselayer market neutrality, this dynamic threatened to undermine DeFi’s core promise of open, fair access.

Enter MEV rebates and rules-based redistribution. Instead of letting extracted value vanish into validator profits, innovative protocols like RediSwap and Dextr are capturing MEV and channeling it back to the users and liquidity providers who make these markets possible. This isn’t just a feel-good story – it’s a pragmatic response to real risks. By refunding a portion of MEV, these systems reduce the impact of toxic order flow, boost user retention, and create a new class of blockchain loyalty rewards.

How Rules-Based MEV Redistribution Works

Let’s break down what actually happens under the hood. Rules-based MEV redistribution is about setting transparent, auditable rules for how extracted value is shared. This isn’t a black box – it’s a set of on-chain mechanisms that:

Key Steps in MEV Redistribution Explained

-

1. MEV Extraction at the Protocol LevelProtocols like RediSwap and Dextr integrate mechanisms to capture MEV opportunities—such as arbitrage—directly within their smart contracts, ensuring value is not lost to external actors.

-

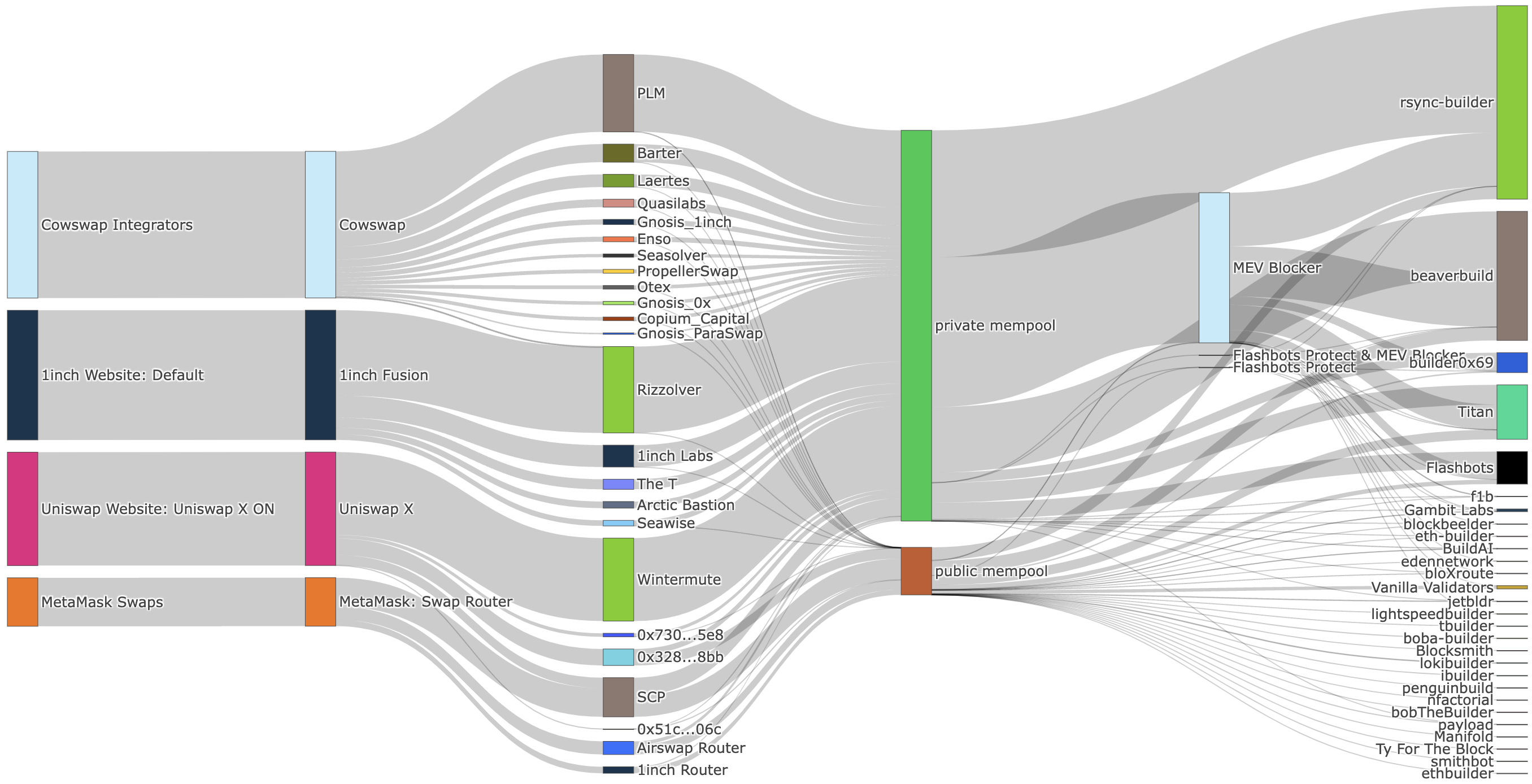

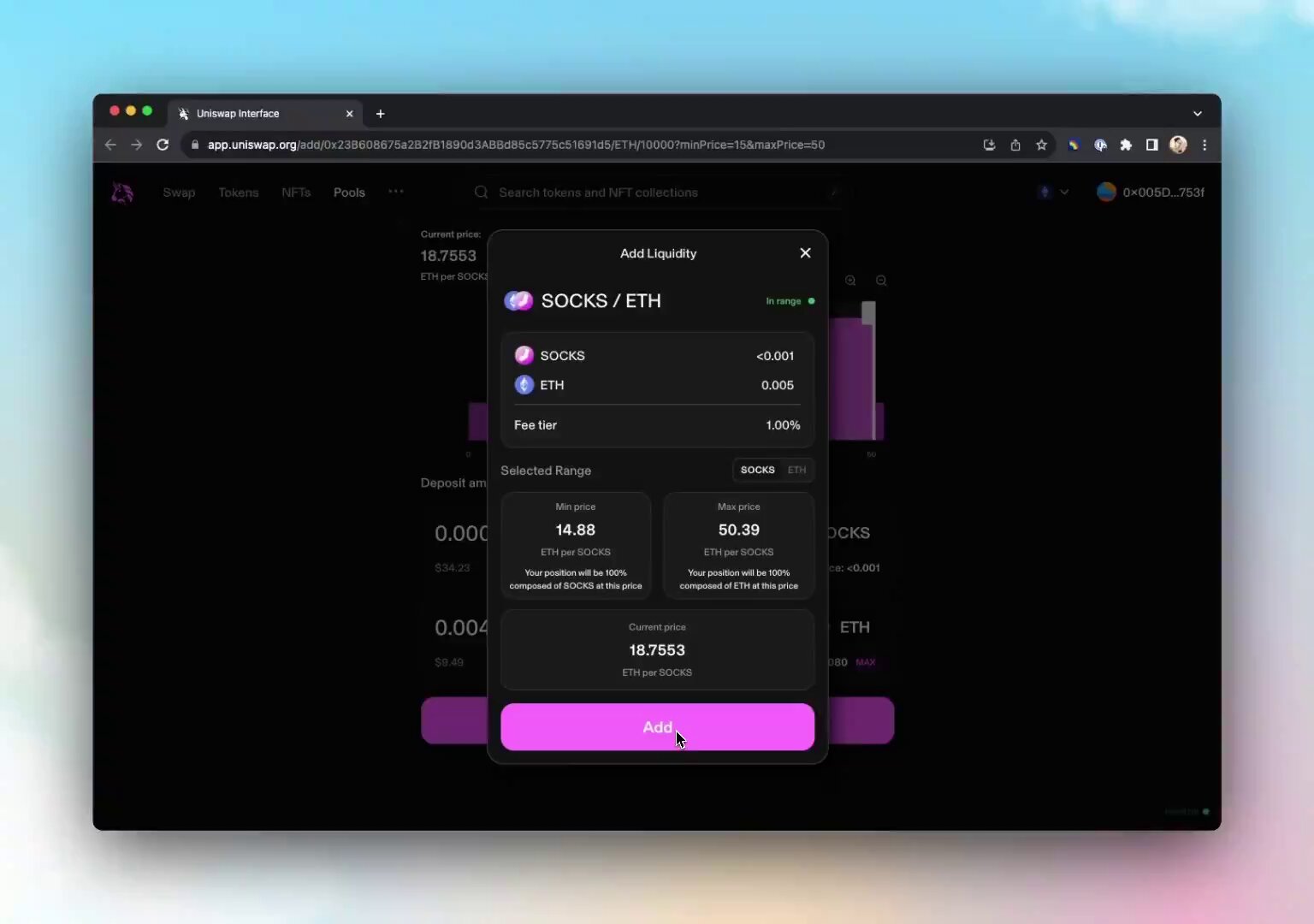

2. User Transaction SubmissionUsers submit their trades via MEV-protected endpoints like Flashbots Protect or MEV Blocker, which bundle transactions to shield them from front-running and sandwich attacks.

-

3. Order Flow Auctions (OFAs)With OFAs, searchers competitively bid to execute user transactions. The highest bidder wins the right to include their transaction, and the MEV profit is shared with the user as a rebate or gas refund.

-

4. Intent-Based ExecutionPlatforms like ParaSwap allow users to specify their trading intent. AI agents then compete to fulfill this intent efficiently, minimizing MEV risks and maximizing user returns.

-

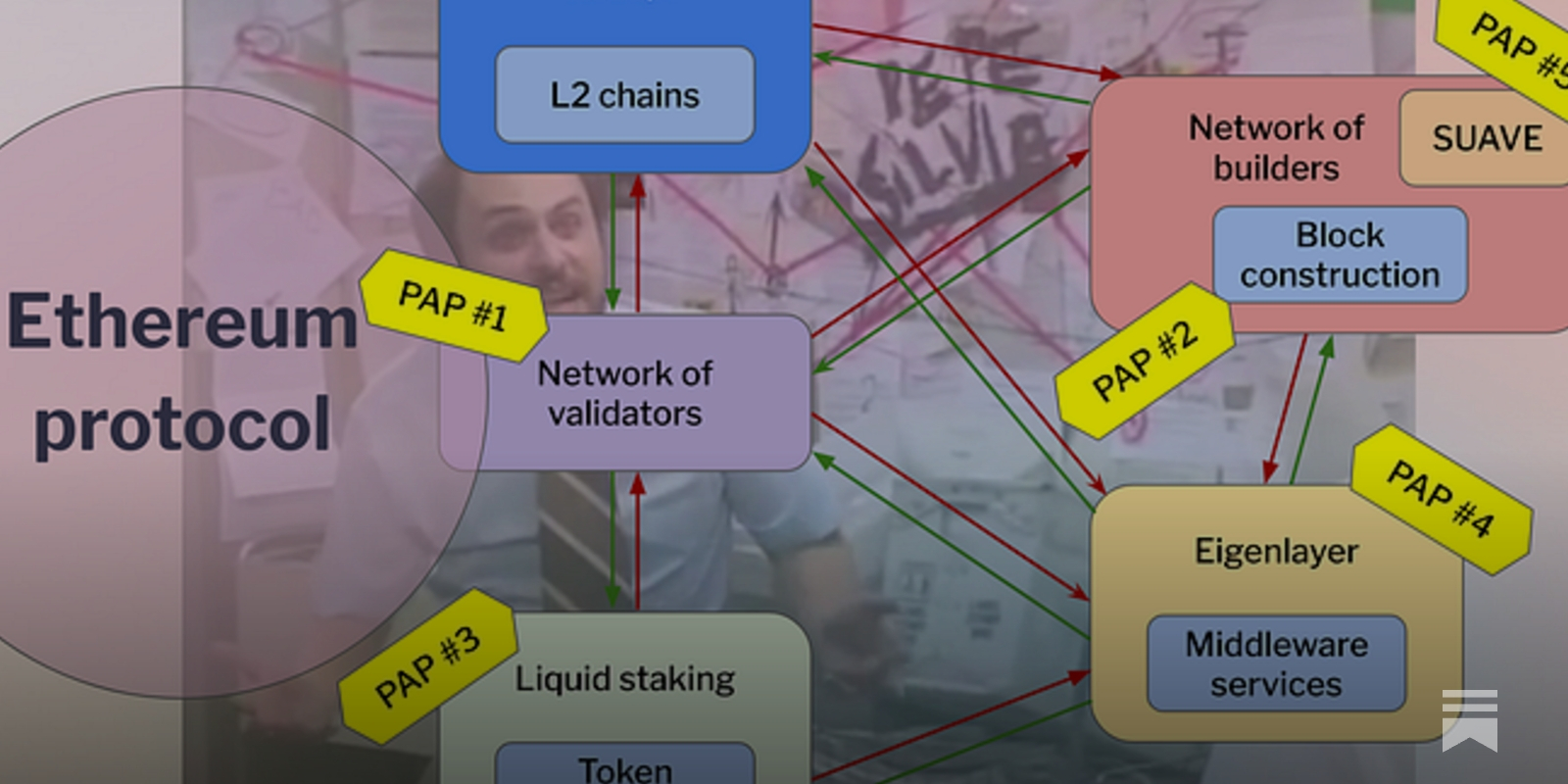

5. Proposer-Builder Separation (PBS)On networks like Ethereum, PBS divides the roles of block proposers and builders. This structure decentralizes MEV extraction, giving users and smaller validators fairer access to MEV profits.

-

6. MEV Rebates and RedistributionCaptured MEV is redistributed back to users and liquidity providers. For example, MEV Blocker refunds up to 90% of builder rewards, directly enhancing user incentives and fairness.

For example, RediSwap’s MEV-redistribution mechanism automatically manages arbitrage within its AMM pools. When a profitable opportunity arises, the protocol captures the surplus and redistributes it to users and LPs, mitigating the pain of classic MEV exploitation. Meanwhile, Dextr’s Actively Validated Market Maker (AVMM) leverages low-latency oracles and trusted operators to minimize price impact and even insures users against MEV-induced losses. These aren’t just theoretical upgrades – they’re live, auditable systems pushing DeFi toward a more equitable future.

Order Flow Auctions and Intent-Based Protocols: The Next Evolution

Beyond simple rebates, Order Flow Auctions (OFAs) and intent-based trading protocols are taking MEV redistribution to the next level. Instead of fighting MEV extraction, these systems harness it for user benefit. OFAs, like those offered by Flashbots Protect and MEV Blocker, create competitive marketplaces where searchers bid for the right to bundle their transactions with yours. The result? Users receive a share of the MEV profits, often as gas rebates or improved execution quality.

ParaSwap’s intent-based protocol is another leap forward. Here, users define their trading intent – say, swapping ETH for DAI with minimal slippage – and submit it to an auction where AI agents compete to provide the best execution. The winning agent carries out the trade while minimizing MEV risk, and users can actually see a portion of the value that would’ve otherwise been siphoned away.

What’s Driving Adoption?

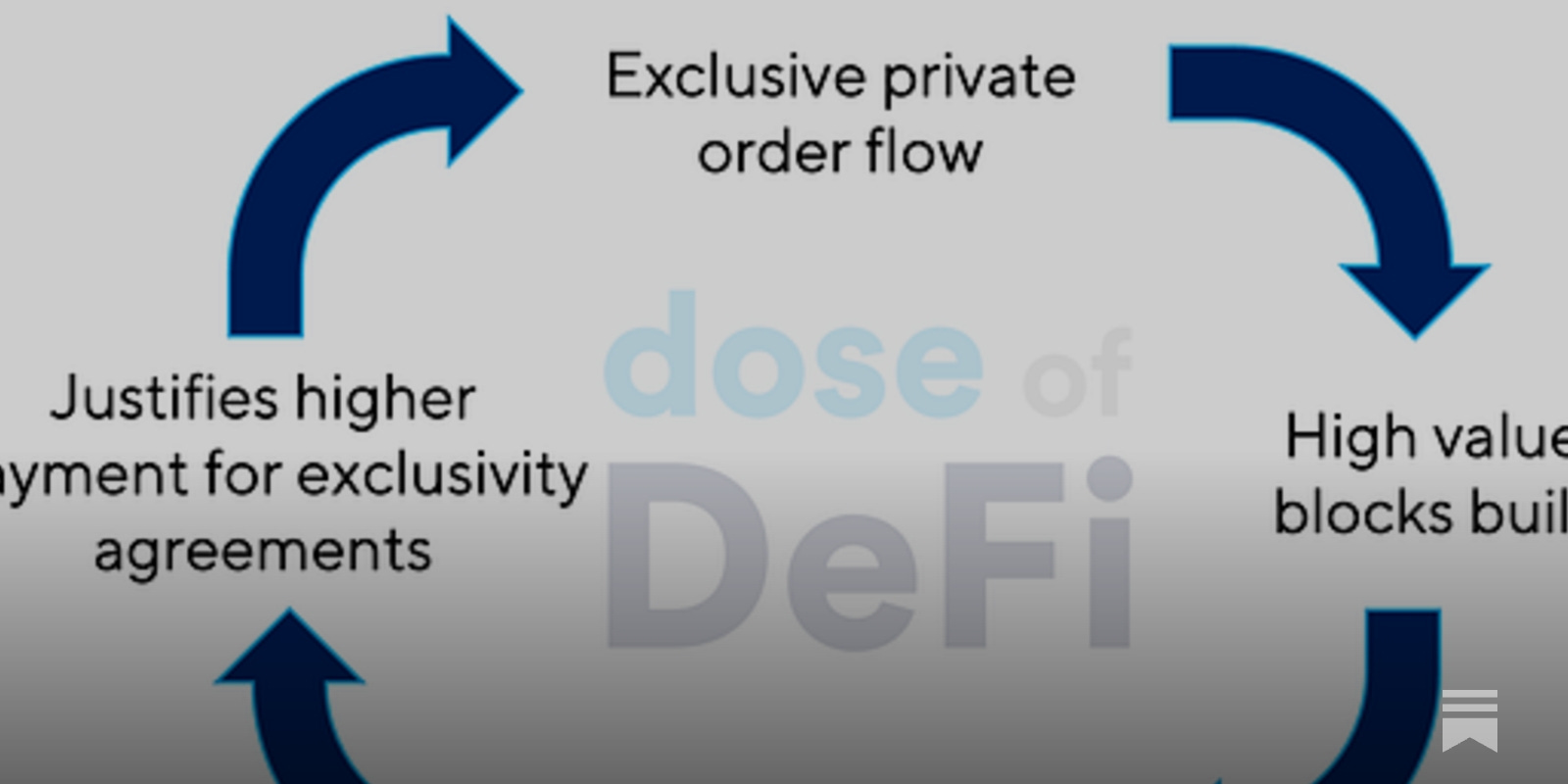

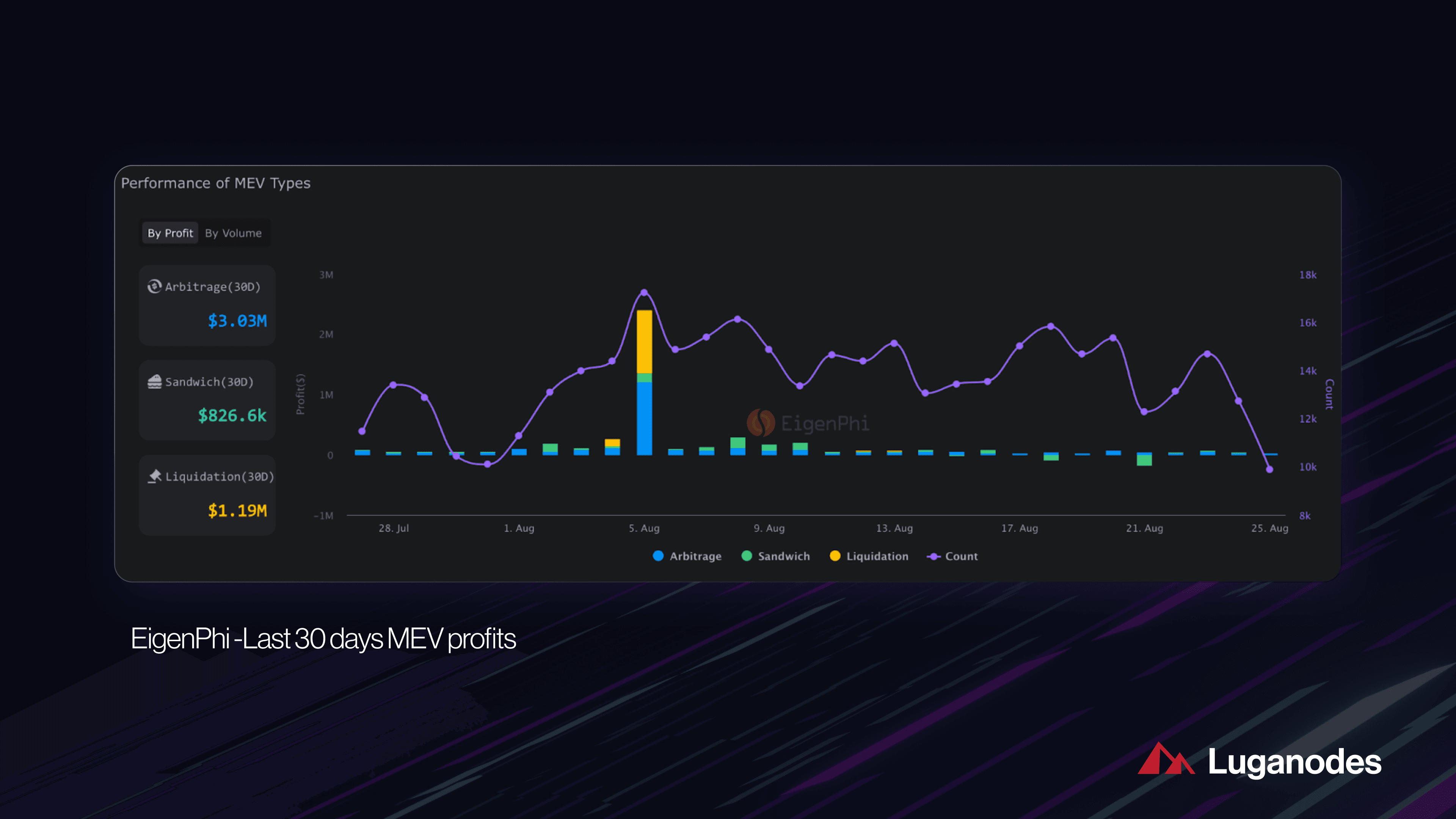

The surge in rules-based MEV redistribution isn’t just about fairness – it’s about aligning incentives across the ecosystem. Protocols want stickier users. Traders want predictable outcomes. And everyone wants to reduce the risk of exploitation that’s plagued DeFi since day one. As more platforms adopt auditable MEV sharing models (think Wallchain or MorphLayer MEV), we’re seeing a flywheel effect: better user rewards drive more participation, which in turn leads to deeper liquidity and healthier markets.

But let’s not sugarcoat it: the real magic of rules-based MEV redistribution is in how it transforms the user experience. Instead of being passive victims of transaction ordering surplus, DeFi participants are now partners in the value created by their own activity. This is a radical departure from the old model, where MEV was something to be feared rather than embraced.

What’s especially exciting is the diversity of approaches. Wallchain MEV protection integrates directly with DeFi platforms, capturing arbitrage profits and redistributing them in near real-time. Protocols like MorphLayer MEV are pushing the envelope further with customizable, on-chain rulesets that let communities vote on how MEV is shared. The result is a landscape where user incentives are not just protected, but actively enhanced.

Auditable MEV Sharing and the Role of Transparency

Transparency is the new gold standard. With auditable MEV sharing, users can verify exactly how much value was extracted, who benefited, and how it was split. This isn’t just good optics, it’s a powerful tool for building trust and accountability in protocols. Users can now demand proof that their loyalty is rewarded, not exploited.

This trend is reinforced by the growing popularity of transaction ordering surplus dashboards and analytics tools. These platforms let users track MEV flows, compare rebate rates, and even shop around for the most user-friendly protocols. The data-driven approach is driving competition and innovation, as protocols vie to offer the best deals for their communities.

Top Protocols Offering Auditable MEV Sharing & Rebates

-

MEV Blocker — A collaborative initiative by CoW Protocol, Gnosis, and Beaver Build, MEV Blocker refunds up to 90% of builder rewards directly to users. It offers a transparent dashboard and supports multiple wallets, making MEV rebates accessible and auditable for everyone.

-

Flashbots Protect — As a pioneer in MEV transparency, Flashbots Protect routes transactions through private RPC endpoints, shielding users from front-running and sharing MEV rewards via a public, auditable system.

-

RediSwap — This innovative AMM integrates a rules-based MEV redistribution mechanism, ensuring arbitrage profits are refunded to users and liquidity providers. RediSwap offers on-chain proof of MEV sharing, promoting fairness and transparency.

-

Dextr — Leveraging an Actively Validated Market Maker (AVMM) and multi-layered insurance, Dextr compensates users for MEV-related losses and provides auditable MEV rebates, all while ensuring minimal price impact.

-

ParaSwap — With its intent-based trading protocol, ParaSwap submits user trades to an auction where agents compete for best execution, minimizing MEV exploitation and enabling transparent, rules-based rebates.

Implications for DeFi Loyalty and Market Growth

Let’s talk big picture. As MEV rebates and rules-based redistribution become the norm, we’re seeing the emergence of true blockchain loyalty rewards. Users who provide liquidity, trade, or simply route their order flow through certain protocols are now eligible for tangible kickbacks. This isn’t just a retention play, it’s a fundamental shift in how value is distributed in open finance.

The upshot? DeFi markets are getting stickier, safer, and more attractive for both newcomers and veterans. Protocols that embrace transparent, user-centric MEV sharing see higher engagement and deeper liquidity pools. It’s a virtuous cycle that strengthens the entire ecosystem.

What’s Next: Challenges and Opportunities

No innovation comes without friction. Protocol designers must balance the need for fair redistribution with the risks of centralization or strategic manipulation. There’s also the question of cross-chain MEV, how do you ensure fair value sharing when liquidity and order flow jump between networks?

Still, the momentum behind rules-based MEV redistribution is undeniable. As more protocols implement these systems, expect to see a wave of experimentation around governance, incentive design, and real-time analytics. The ultimate winners will be those that make MEV sharing as seamless, and as auditable, as possible.

For a deeper dive into the mechanics of MEV rebates and their impact on protocol fairness, check out our detailed guide.

Bottom line: MEV rebates aren’t just a technical fix, they’re a catalyst for a fairer, more user-aligned DeFi future. If you haven’t started tracking your MEV rewards yet, now’s the time to get on board.