MEV rebates are quickly becoming the hottest trend in DeFi, and it’s easy to see why. For years, users have been on the losing end of Maximal Extractable Value (MEV) extraction – think front-running, sandwich attacks, and other predatory tactics that siphon value from regular traders. But the narrative is shifting. Protocols are now flipping the script by redistributing MEV profits back to users through cashback and fair distribution models, sparking a new wave of user-centric incentives across the blockchain space.

MEV Rebates: From Exploitation to Cashback

Let’s break down what’s happening. MEV, at its core, is the extra profit that can be squeezed out by reordering, inserting, or censoring transactions within a block. Historically, this value went straight to miners or validators, often at the expense of everyday users. But with the rise of MEV rebates, the game is changing. Now, users are being rewarded for their role in generating MEV, effectively turning what was once a source of loss into a source of cashback.

Take the example of MEV Blocker, which returned 4,079 ETH in rebates in 2024. That’s not just a marketing stunt – it’s a tangible shift toward user empowerment and protocol transparency. This redistribution is more than just compensation; it’s a new incentive layer that’s reshaping how users interact with DeFi platforms.

How Do MEV Rebates Actually Work?

The mechanics behind MEV rebates can look complex, but the core idea is simple: share the profits generated from MEV with the users who make those profits possible in the first place. Here are some of the main models driving this revolution:

Top MEV Rebate Mechanisms in DeFi

-

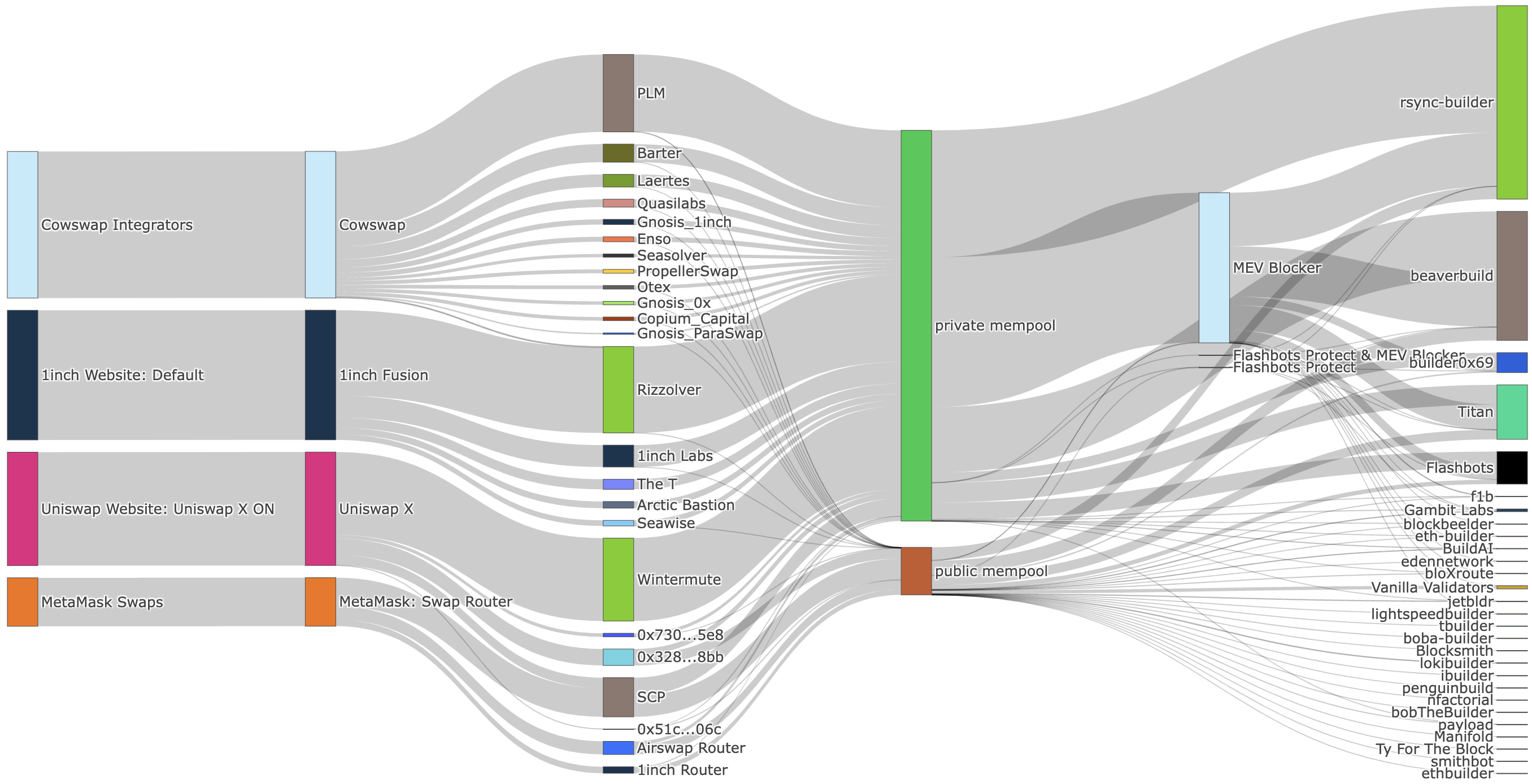

Order Flow Auctions (OFAs): Platforms like MEV Blocker and Flashbots Protect let users submit transactions that are auctioned to searchers. The highest bidder wins the right to execute the transaction, and a portion of the winning bid is rebated directly to the user. This turns MEV into a cashback opportunity and improves execution quality.

-

MEV Smoothing: Projects like ZENMEV pool MEV profits and distribute them evenly among participants—such as validators or liquidity providers. This reduces payout variance and ensures a fairer share of rewards for everyone, not just the lucky few.

-

Protocol-Level Redistribution: Some DeFi protocols, like RediSwap, bake MEV redistribution into their core design. MEV captured at the protocol level is shared with users and liquidity providers, reducing losses from predatory tactics and making the market more efficient for all.

- Order Flow Auctions (OFAs): Users’ transactions are auctioned off to searchers, who bid for the right to include them in a block. The highest bidder wins, and a portion of their payment is rebated directly to the user, turning every transaction into a potential cashback event.

- MEV Smoothing: Instead of letting a few lucky validators scoop up all the profits, MEV is pooled and distributed more evenly among participants. This approach reduces volatility in rewards and promotes fairness, as seen in projects like ZENMEV.

- Protocol-Level Redistribution: Some DeFi protocols, like RediSwap, are baking MEV redistribution directly into their core logic, ensuring both users and liquidity providers share in the upside, not just the risks.

Why User Incentives Matter More Than Ever

So, why does all this matter? Because incentives are everything in DeFi. When users feel like they’re being treated fairly – and even better, when they’re getting cashback on their trades – they’re more likely to participate, provide liquidity, and stick around. This isn’t just theory; it’s playing out in real time as more protocols roll out MEV sharing and DeFi cashback initiatives.

According to recent data, projects that implement MEV rebates see higher user retention and increased transaction volume. It’s simple: when you cut users in on the action, everyone wins. Protocols become more robust, liquidity deepens, and the entire ecosystem moves closer to the ideal of fair value distribution.

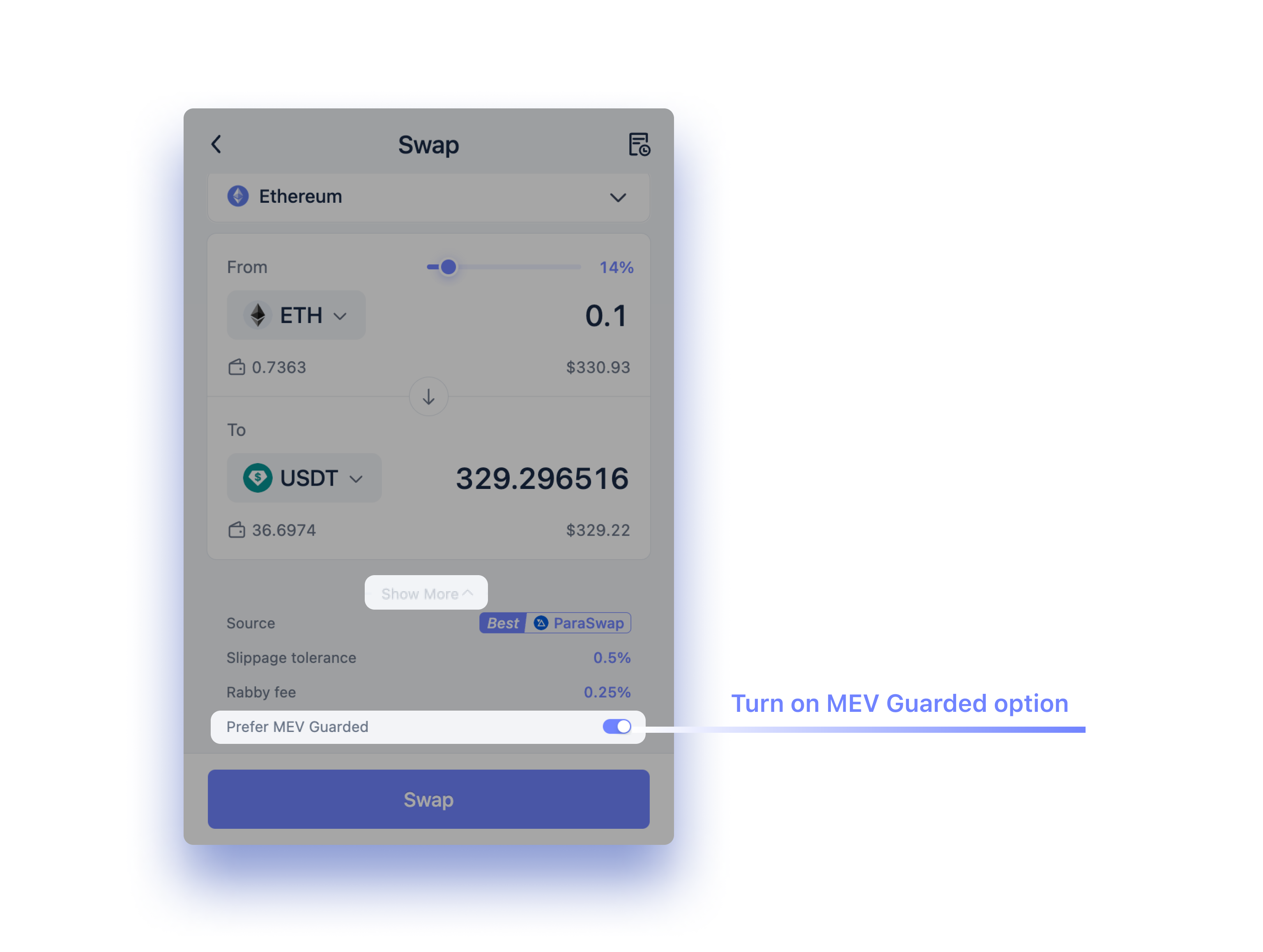

Curious about the technical nuts and bolts? Some developers are integrating MEV rebate SDKs directly into wallets, enabling wallet MEV cashback and transaction-level payouts with minimal friction. This means users could soon see real-time rebate notifications every time they trade or provide liquidity – a true game-changer for DeFi UX.

What to Watch: Opportunities and Challenges Ahead

Of course, it’s not all smooth sailing. Implementing MEV rebates at scale is technically challenging, and there are still open questions around potential exploits, game-theory dynamics, and regulatory scrutiny. But the direction is clear: user incentives are being redefined, and MEV rebates are leading the charge.

For a deeper dive into how these mechanisms are reshaping DeFi, check out our guide on MEV rebates and protocol fairness or explore the nuts and bolts in how MEV rebates work.

The ripple effects of MEV rebates are already being felt across the DeFi landscape. As more protocols adopt transparent MEV sharing, the old adversarial relationship between users and validators is giving way to a more collaborative, win-win dynamic. This shift isn’t just philosophical, it’s quantifiable. When users know they’ll get a slice of the MEV pie, they’re more likely to route orders through MEV-protected relays, contribute liquidity, and stick with platforms that reward them for their activity.

Maximizing Your DeFi Cashback: Tips for Users and Developers

Want to make the most of MEV rebates? Whether you’re a trader, LP, or protocol builder, there are practical ways to boost your share of the redistribution:

Top Tips to Maximize MEV Rebates in DeFi

-

Use MEV-Protected Wallets like MEV Blocker or Flashbots Protect to shield your trades from front-running and sandwich attacks. These wallets route your transactions through private relays, ensuring you get a share of the MEV instead of losing value to bots. In 2024, MEV Blocker returned over 4,079 ETH in rebates to users.

-

Integrate MEV Rebate SDKs and APIs like the Wallchain SDK or Flashbots Protect API into your dApps or trading bots. This allows you to capture MEV rebates programmatically and pass savings on to your users or yourself.

-

Opt In to Order Flow Auctions (OFAs) on platforms supporting them, such as Flashbots Protect. By allowing your transaction order flow to be auctioned, you can receive a direct share of the winning bid as a rebate, improving your trade execution and lowering costs.

-

Stay Updated on MEV Smoothing Pools like ZENMEV, which distribute MEV rewards more evenly among participants. Joining these pools can help you earn a steady stream of rebates, especially if you’re a validator or liquidity provider.

For developers, integrating a MEV rebate SDK can be a shortcut to user loyalty. Imagine your wallet or dApp sending push notifications every time a user receives a rebate, instant feedback, instant dopamine. For traders, using platforms like MEV Blocker or wallets that support transaction-level MEV payout can turn every trade into a potential cashback opportunity. And for LPs, choosing protocols with protocol-level MEV distribution means your capital works harder, earning not just swap fees but also a share of MEV rewards.

The Future: MEV Distribution as a Market Standard

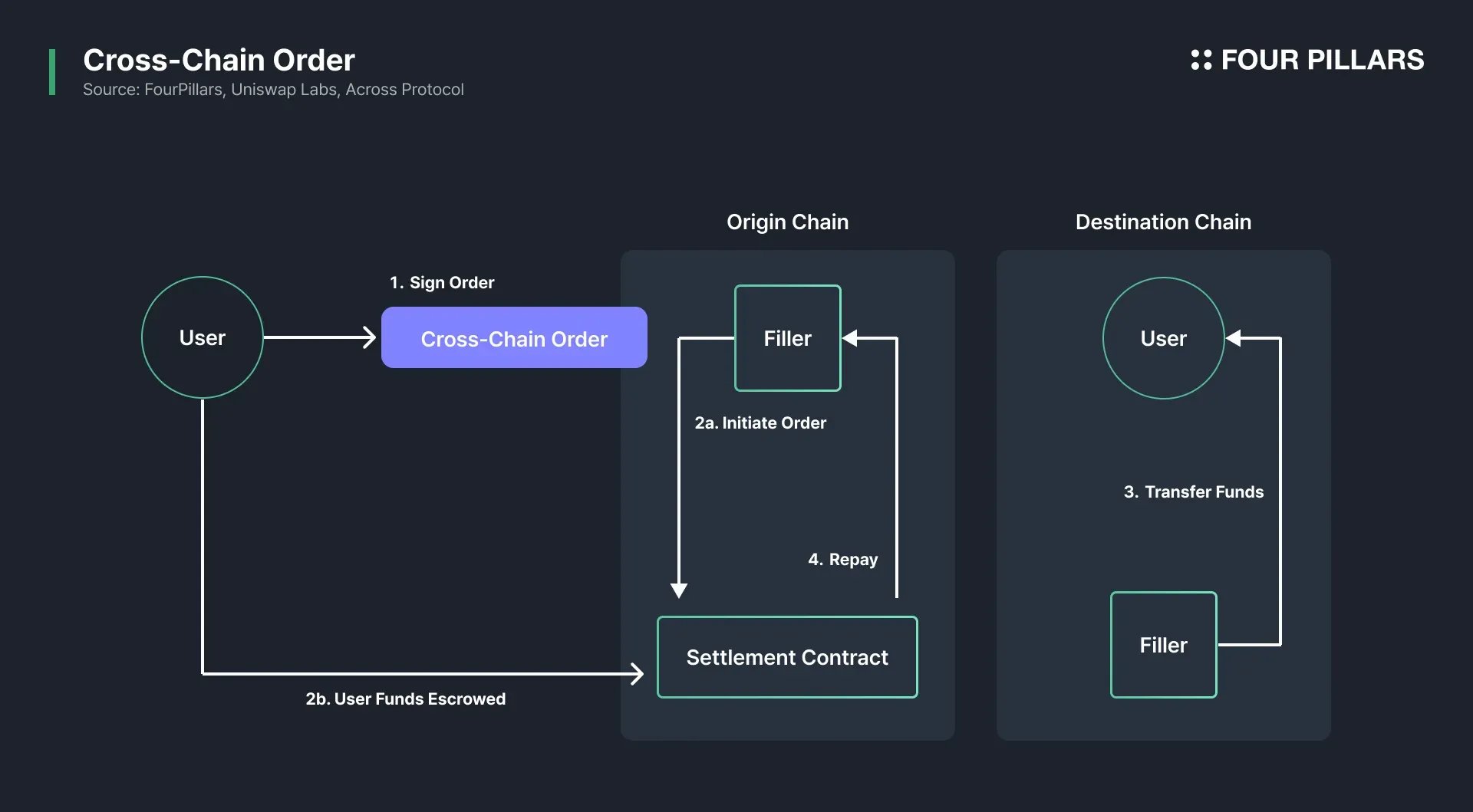

It’s not a stretch to say that MEV rebates are on track to become a market standard. As user expectations shift, protocols that don’t offer some form of MEV cashback may find themselves left behind. The next wave of DeFi innovation will likely focus on making these rebate flows even more seamless, think auto-compounding MEV rewards, cross-chain MEV sharing, and deeper integration into wallet UX.

There’s also a growing push for transparency and auditability. Users want to know not just that they’re getting paid, but how much MEV is being captured and distributed, and whether the process is truly fair. Platforms that provide clear dashboards, real-time analytics, and open-source rebate logic will win trust, and market share.

Key Takeaways for DeFi Users

- MEV rebates are real and growing: With thousands of ETH already returned in 2024, this is more than a passing trend.

- DeFi cashback is now a user expectation: Protocols that share MEV will attract and retain more users.

- Transparency matters: Choose platforms that openly report their MEV distribution stats and mechanisms.

- The tech is evolving fast: Stay updated on new SDKs, wallet integrations, and cross-chain MEV sharing tools.

MEV rebates are more than just a technical fix, they’re a cultural shift toward fairness, transparency, and user empowerment in DeFi. As protocols race to outdo each other on MEV distribution and cashback, users are in the best position yet to benefit from the value they help create. Want to see how these trends are playing out on Monad and MorphLayer chains? Check out our coverage on MEV rebates across new DeFi ecosystems. And if you’re building, don’t miss our hands-on guide to MEV rebate SDK integration.