In the rapidly evolving landscape of decentralized finance, consumer blockchains are redefining how value is distributed and trust is established. The emergence of MEV rebates: mechanisms that redistribute a portion of Maximal Extractable Value (MEV) profits back to users, marks a pivotal shift away from opaque value extraction towards transparent, user-centric incentives. This development is especially relevant as platforms like MorphLayer and MEV Blocker drive adoption by prioritizing user experience, security, and on-chain fairness.

Why MEV Rebates Matter for Consumer Blockchains

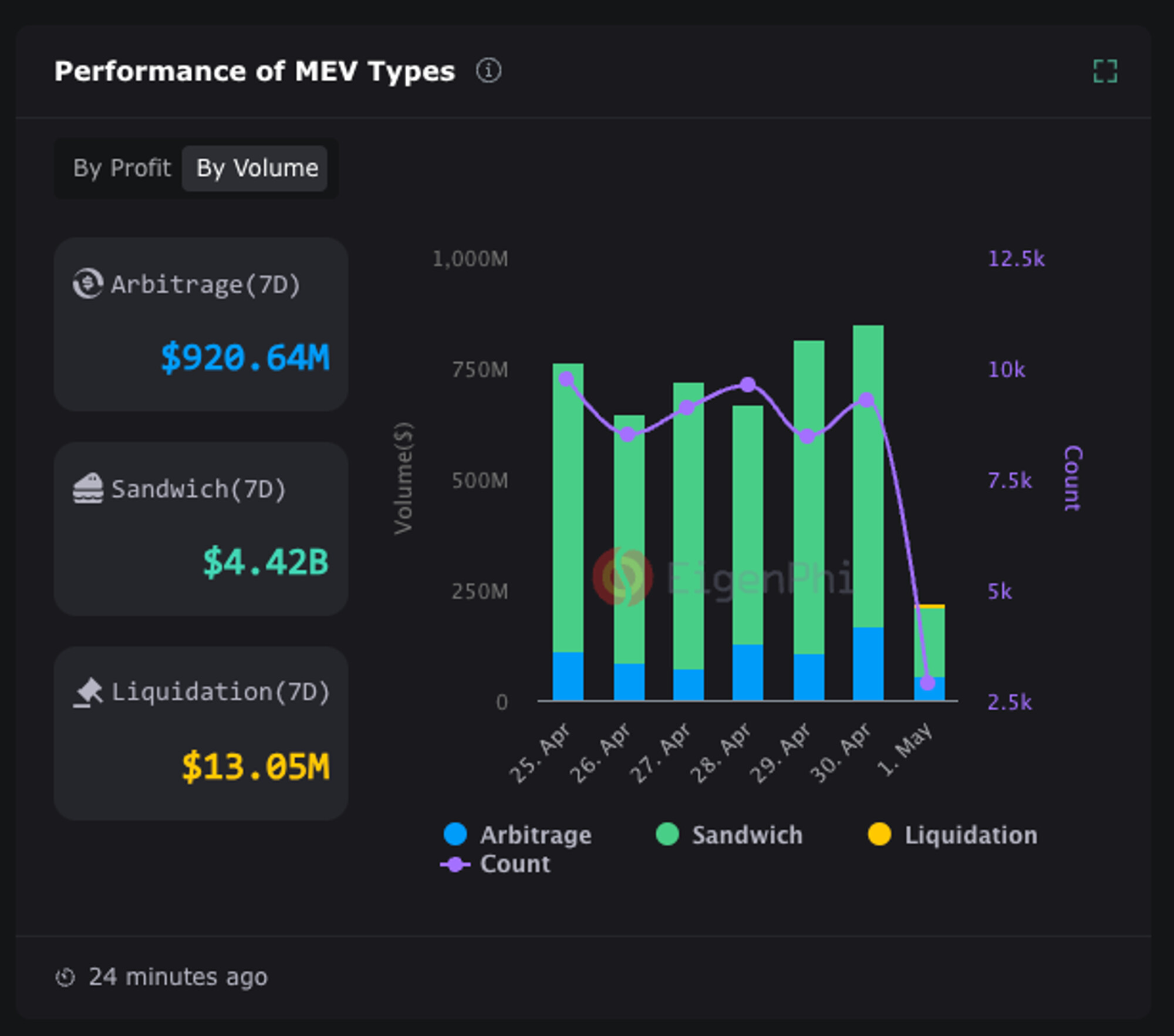

Maximal Extractable Value (MEV) refers to the profit that can be gained by manipulating the order of transactions within a blockchain block. Historically, this has led to practices such as front-running and sandwich attacks, where sophisticated actors profit at the expense of ordinary users. As research shows, just two MEV builders now produce nearly 80% of Ethereum blocks, underscoring how concentrated and opaque these profits have become.

The traditional model has been likened to a stealth tax on DeFi participants: users pay more or receive less due to hidden value extraction by miners or validators. As Dvox succinctly put it, “MEV need not be a stealth tax. Where ordering surplus is created, expose and give the surplus back. ” This ethos underpins the new wave of consumer blockchains that are integrating MEV rebate mechanisms directly into their core protocols.

The Mechanics: How MEV Rebates Enhance Trust

Modern consumer blockchains such as MorphLayer are implementing robust systems for on-chain MEV rebate verification. These systems not only provide direct financial incentives but also foster transparency and security:

Key Benefits of MEV Rebates for DeFi Users

-

Reduced Transaction Costs: MEV rebate mechanisms, such as those implemented by MEV Blocker, return a portion of MEV profits to users, effectively lowering or even offsetting trading fees on decentralized exchanges. This direct financial incentive makes DeFi participation more cost-effective.

-

Protection Against Exploits: Platforms offering MEV rebates often use private transaction relays to shield users from front-running and sandwich attacks, ensuring fair execution and greater security for DeFi traders.

-

Greater Transparency: MEV rebate systems provide users with clear, verifiable data on protected trading volumes and distributed rebates, as seen on platforms like mevwatch.com, fostering trust through openness.

-

Democratization of MEV Profits: By redistributing MEV gains to users, liquidity providers, and protocol treasuries, rebate mechanisms align incentives and reduce adversarial behaviors, promoting a healthier and more equitable DeFi ecosystem.

- Financial Incentives: By redistributing a share of extracted MEV profits, platforms reduce effective transaction costs. For instance, MEV Blocker has protected over $60 billion in DEX trades while distributing significant rebates, sometimes rivaling or exceeding traditional trading fees. This transforms previously hidden costs into tangible user rewards.

- Enhanced Security: Many rebate protocols use private transaction relays that shield orders from public mempools, preventing front-running and sandwich attacks. Users gain confidence knowing their transactions are executed fairly without predatory interference.

- Transparency: Platforms publish real-time statistics on protected volumes and rebates distributed, a crucial step in building verifiable trust with end users.

- Ecosystem Alignment: By democratizing access to MEV profits among users, liquidity providers, and protocol treasuries, these mechanisms align incentives across all stakeholders and promote healthier market dynamics.

MorphLayer: A Case Study in User-Centric MEV Redistribution

MorphLayer’s recent mainnet launch exemplifies this paradigm shift towards consumer-grade DeFi infrastructure. Unlike generic Layer 2 solutions focused solely on scalability, MorphLayer integrates DeFi loyalty mechanics, rewarding active participants with a share of on-chain surplus generated through transaction ordering. This approach not only attracts new users but also incentivizes long-term engagement, a critical factor for sustainable ecosystem growth.

The platform’s focus on diversity and inclusivity in application design counters the prevailing trend where most Layer 2s cater narrowly to traders or arbitrageurs. By embedding fair MEV redistribution at the protocol level, MorphLayer empowers both creators and consumers while mitigating adversarial behaviors that have historically undermined user trust across DeFi markets.

This user-first philosophy is echoed across emerging projects striving for greater transparency in DeFi rewards distribution. Detailed analytics dashboards allow participants to verify their earned rebates in real time, a marked improvement over legacy systems where value flows were largely invisible or difficult to audit. For further insights into how these mechanisms are transforming DeFi incentives at both protocol and wallet levels, see our guides on MEV fairness and wallet experience transformation.

As the market matures, the interplay between MEV rebates and user trust is increasingly quantifiable. Platforms that provide on-chain MEV rebate verification not only give users direct evidence of rewards but also set a new standard for accountability in decentralized finance. This is particularly salient as protocols like MorphLayer and MEV Blocker continue to publish transparent statistics on protected trade volumes and distributed rebates, giving users unprecedented clarity into the mechanics of value redistribution.

On-Chain Verification: Building Confidence Through Transparency

One of the most significant innovations in consumer blockchain MEV is the movement towards on-chain verification of rebates. By leveraging smart contracts and open analytics dashboards, users can independently verify that rebates are calculated fairly and distributed as promised. This level of transparency is a marked departure from opaque legacy models, where miners or validators captured surplus with little oversight.

The result is a more equitable system where users can trust not just in code but in data, verifiable, immutable records of MEV flows and rebate distributions. This approach aligns closely with evolving rules-based MEV redistribution, which aims to codify fairness directly into protocol logic.

Evolving User Incentives: From Hidden Costs to DeFi Loyalty Mechanics

The integration of DeFi loyalty mechanics, where active participation leads to increased rewards, has profound implications for user retention and ecosystem health. Instead of passively absorbing hidden costs from transaction ordering, users now benefit directly from platform growth and activity. This model transforms what was once a zero-sum game into a positive feedback loop: greater participation leads to more surplus generated, which in turn funds further rebates.

This shift is not merely theoretical. As seen with MorphLayer’s mainnet launch and its focus on consumer adoption, platforms are already demonstrating that fair MEV sharing can drive both user acquisition and long-term engagement. The proliferation of analytics tools further strengthens this effect by making it easy for users to track their rewards and understand how their actions contribute to broader network value.

Real-World DeFi Loyalty Programs Using MEV Rebates

-

MEV Blocker: A collaborative initiative by CoW Swap, Gnosis, and Balancer, MEV Blocker protects users from front-running and sandwich attacks by routing transactions through private relays. It redistributes a portion of captured MEV as rebates directly to users, providing tangible cashback-like rewards for DeFi traders.

-

Flashbots MEV-Share: Flashbots launched the MEV-Share protocol, allowing Ethereum users to share in MEV profits generated by their transactions. By opting into MEV-Share, users receive rebates from MEV extraction, turning a previously hidden cost into a loyalty incentive.

-

Morph Layer 2 Mainnet: Morph, a consumer-focused Ethereum Layer 2, integrates MEV rebate mechanics at the protocol level. Users and ecosystem participants benefit from redistributed MEV surplus, enhancing user retention and incentivizing active participation across DeFi applications built on Morph.

-

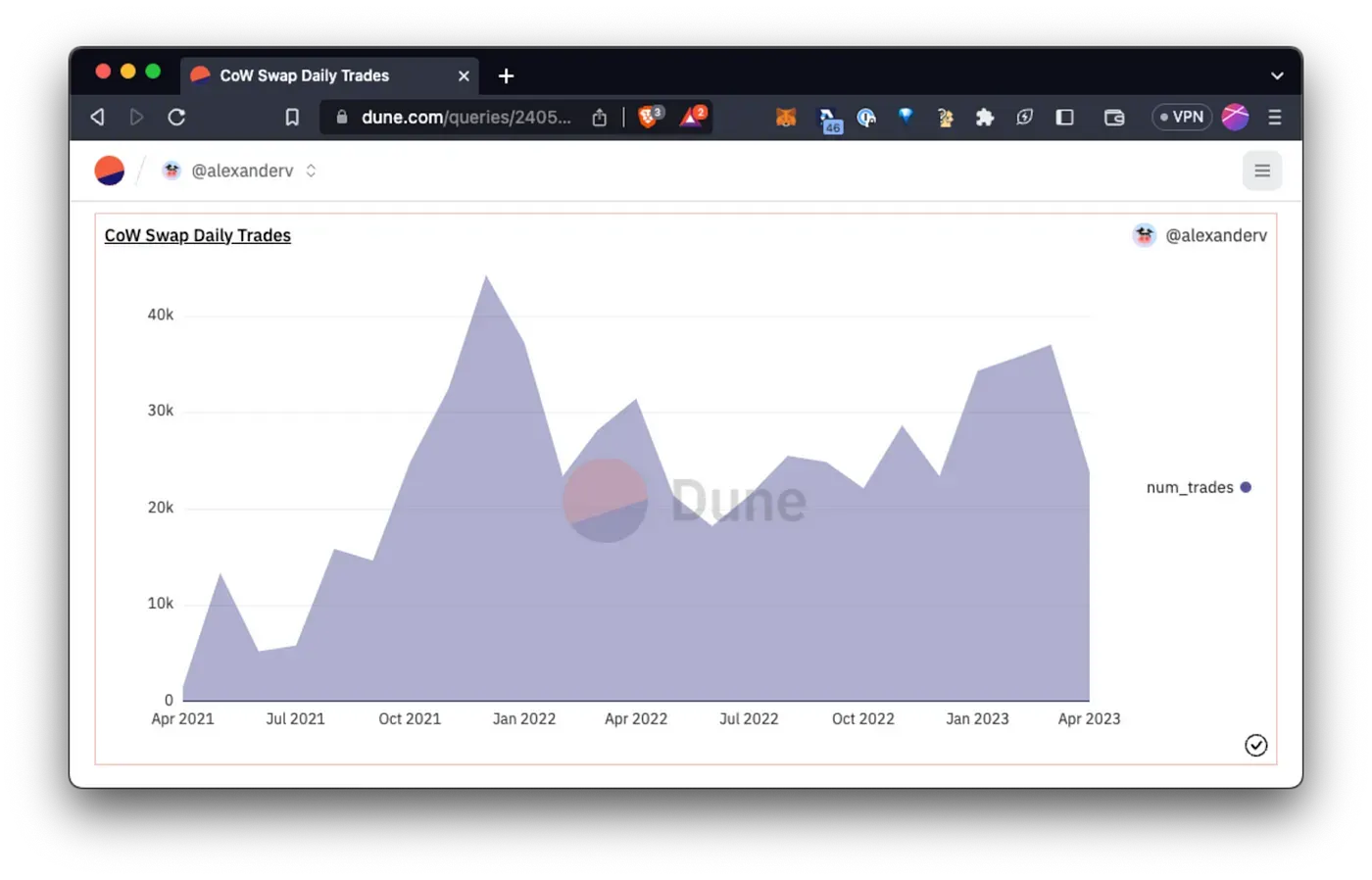

CoW Swap: As a decentralized exchange aggregator, CoW Swap leverages batch auctions and MEV protection to minimize user losses from MEV. Rebates from captured MEV are distributed to users, effectively lowering trading costs and building platform loyalty.

-

Balancer: The Balancer protocol incorporates MEV protection and rebate features into its liquidity pools and trading interface, passing a share of MEV-derived value back to both traders and liquidity providers as part of its loyalty incentives.

What’s Next for Consumer Blockchain MEV?

The rapid adoption of MEV rebate strategies signals a broader industry recognition that user-centric value distribution isn’t just good ethics, it’s good business. As more consumer blockchains adopt these mechanisms, expect to see heightened competition around transparency standards, user experience design, and innovative incentive structures tailored for retail participants.

For developers and protocol designers, this means an increased focus on integrating seamless rebate tracking, robust private mempool protections, and flexible distribution schemes that adapt to evolving market dynamics. For end users, it means lower effective trading costs, greater safety against predatory practices, and an active stake in the platforms they help grow.

The era where MEV operated as an invisible tax is ending. With transparent redistribution at the heart of new consumer blockchains like MorphLayer, DeFi is entering a phase where fairness isn’t just promised, it’s proven on-chain.