The DeFi ecosystem of 2025 is at a crossroads, and the direction is clear: fairness and transparency are no longer optional. The unchecked era of Maximal Extractable Value (MEV) – where sophisticated actors could profit by reordering or censoring transactions – is giving way to a new paradigm. Today, MEV redistribution protocols are not just technical upgrades; they’re a statement of intent for a more equitable financial future. If you’re building, trading, or providing liquidity in DeFi, understanding how these protocols work is now as essential as knowing your slippage settings.

What Is MEV and Why Has It Been So Problematic?

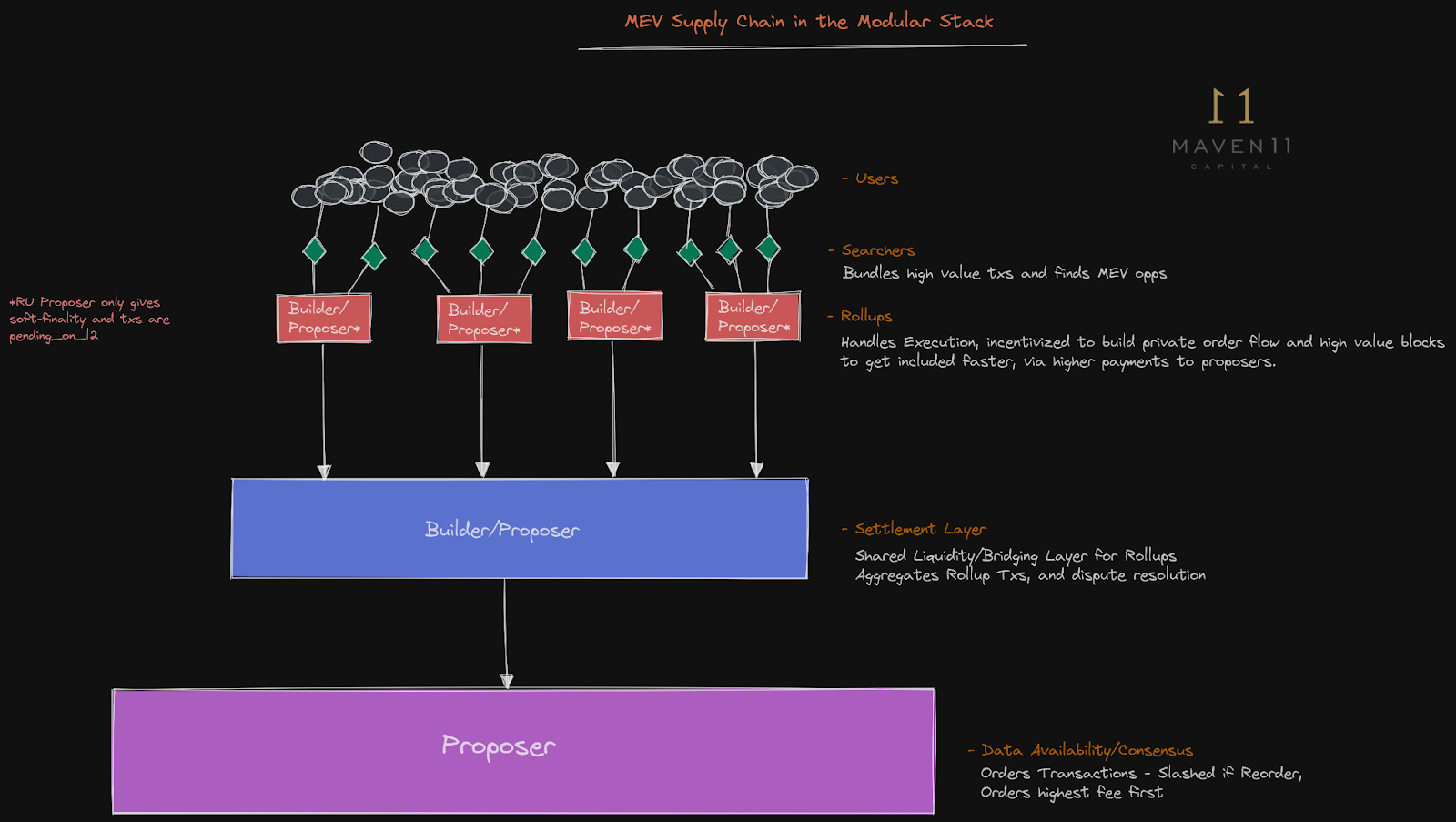

MEV refers to the profits that can be made by manipulating transaction order within a block. This includes front-running, sandwich attacks, and other tactics that drain value from ordinary users and liquidity providers (LPs). For years, this dynamic quietly eroded trust in DeFi, with research showing that institutional players were retreating due to the predatory nature of MEV extraction. The result? Lower liquidity, higher volatility, and an uneven playing field.

But 2025 marks a pivotal shift. Instead of allowing MEV to concentrate in the hands of validators or miners, leading protocols are implementing mechanisms to share these profits with those who create value: LPs and regular users.

The Rise of Protocol-Level MEV Redistribution

The new wave of MEV redistribution isn’t theoretical. It’s already live on-chain:

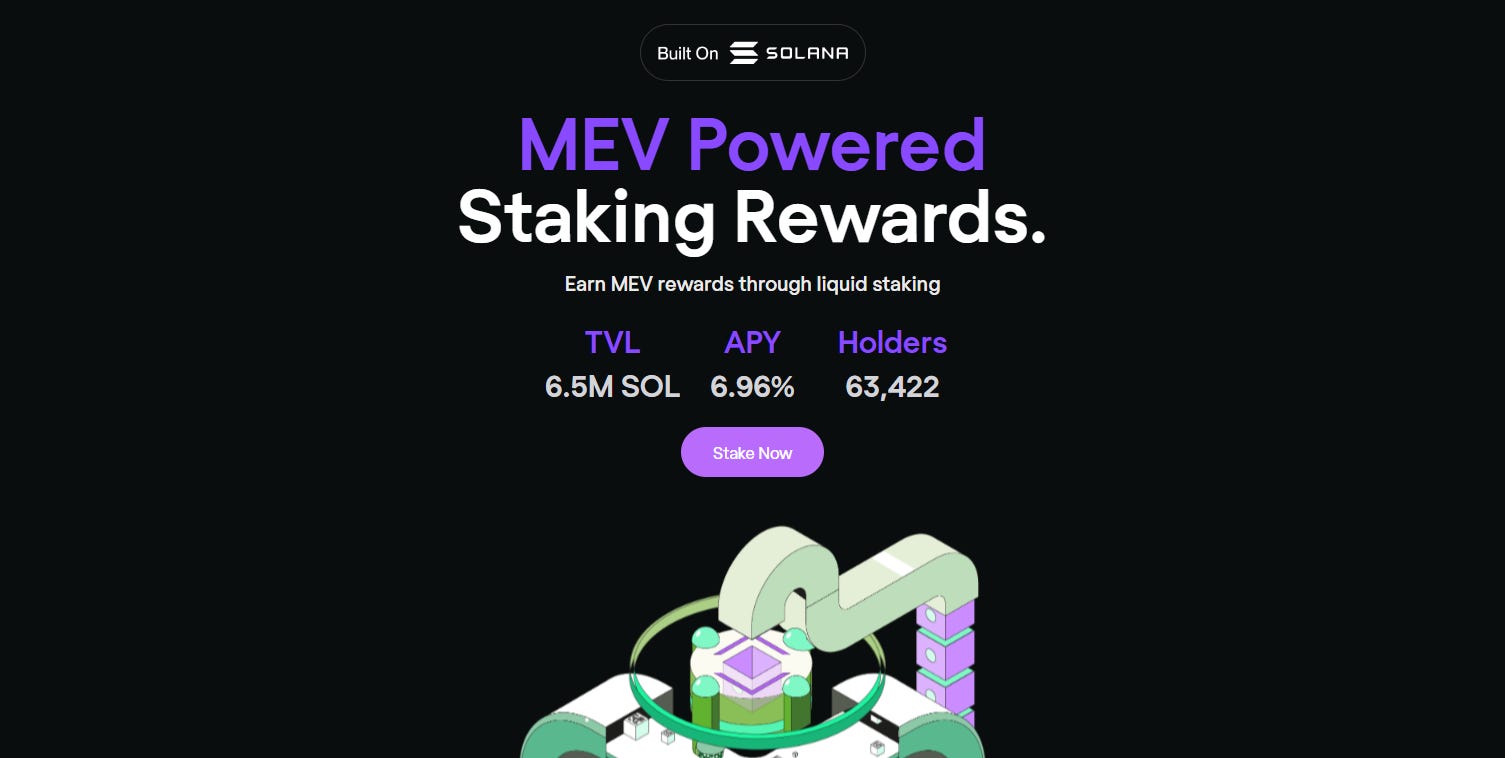

- Jito DAO (Solana): Allocates 3% of all MEV tips to its treasury and community programs, fueling restaking initiatives and projecting an annual revenue boost of $22.8 million.

- Unichain: Implements a two-tier system where 30, 50% of MEV proceeds flow directly back to LPs through priority fees. Simulations indicate this could help LPs recover $140 million annually from predatory strategies while raising yields by 18%.

- RediSwap AMM: Pioneers direct refunds for arbitrage-derived MEV. In some cases, this mechanism reduces original loss-versus-rebalancing for LPs by over 99%, turning what was once an exploit into a source of yield.

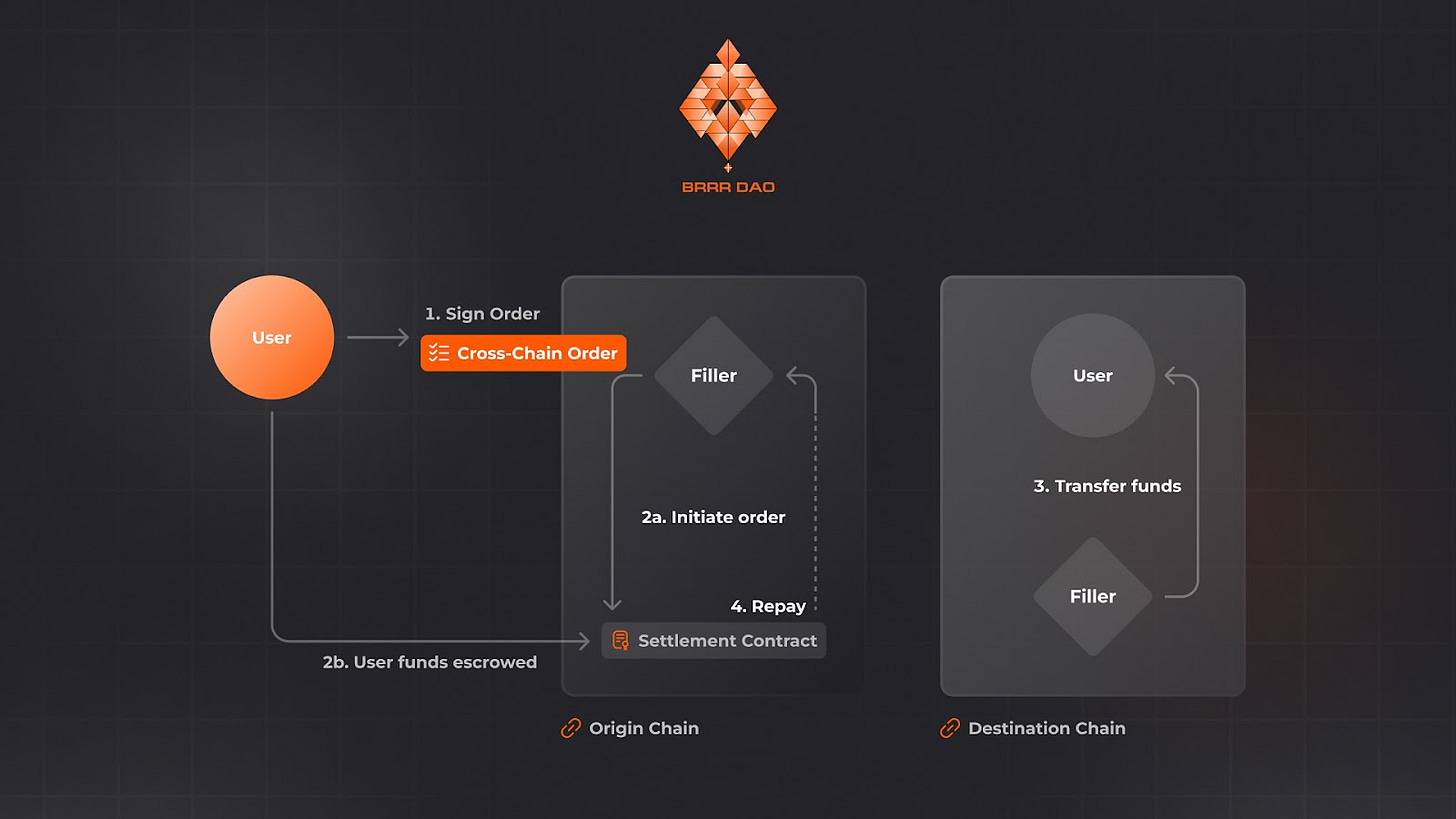

This isn’t just about plugging leaks – it’s about fundamentally realigning incentives so that everyone who contributes to the protocol benefits from its growth.

Technical Innovations: Raising the Bar for Fairness

The push for fairness isn’t limited to financial flows. New technical primitives are making it much harder for bad actors to game the system:

- FAIR Blockchain (SKALE Labs): The first Layer 1 chain designed with built-in resistance to most forms of MEV. By leveraging Blockchain Integrated Threshold Encryption (BITE), transaction data remains encrypted until block finalization – shutting down front-running at its source.

- Unichain’s Trusted Execution Environment (TEE): By using TEE-based block building, Unichain guarantees that transaction ordering is dictated solely by transparent priority fees rather than opaque backroom deals between builders and searchers.

If you’re looking for actionable steps on how protocol designers can implement these mechanisms themselves, check out our detailed guide on MEV redistribution implementation strategies.

The Impact: From Extraction to Empowerment

The early data from these deployments is promising. Not only are LP yields rising across leading protocols – but harmful activities like sandwich attacks are becoming less profitable or outright impossible on platforms with robust protection mechanisms. This shift isn’t just academic; it’s restoring confidence among both retail users and institutions who had previously been driven away by unfair practices.

Protocols that embrace MEV redistribution are seeing measurable improvements in user retention, liquidity depth, and trading volumes. By returning a share of extracted value to LPs and end users, these platforms are incentivizing participation while leveling the playing field for smaller traders. The result is a positive feedback loop: greater fairness attracts more liquidity, which in turn enhances protocol utility and resilience against manipulative actors.

Top MEV Redistribution Protocols & Their User Benefits (2025)

-

Jito DAO (Solana): Allocates 3% of all MEV tips to its treasury and TipRouter program, supporting restaking and community initiatives. This approach projects an annual revenue boost of $22.8 million and ensures MEV profits benefit both stakers and the broader Solana ecosystem.

-

Unichain: Implements a two-tier MEV reallocation system, directing 30–50% of MEV proceeds to liquidity providers (LPs) via priority fees. Simulations indicate LP yields could rise by 18%, potentially recovering $140 million annually from predatory MEV strategies.

-

RediSwap AMM: Features an application-level mechanism that refunds arbitrage-derived MEV directly to users and LPs. This innovation has reduced LPs’ loss-versus-rebalancing by over 99% in some cases, setting a new standard for user-centric MEV protection.

-

FAIR Blockchain by SKALE Labs: The first MEV-resistant Layer 1 blockchain, using Blockchain Integrated Threshold Encryption (BITE) to keep transaction data encrypted until block finalization. This prevents front-running and other exploitative MEV tactics, ensuring fair access for all users.

-

Unichain’s Trusted Execution Environment (TEE): Utilizes TEE-based block building for fair, transparent transaction ordering based solely on priority fees. This technical innovation further enhances DeFi integrity and user trust by minimizing extractive MEV opportunities.

MEV analytics tools are also evolving rapidly in 2025. Modern dashboards now offer real-time insights into redistribution flows, sandwich attack frequencies, and the effectiveness of new mitigation strategies. For developers and advanced traders, these analytics provide actionable data to fine-tune strategies or adjust protocol parameters on the fly. The transparency provided by these tools is essential for holding both protocols and validators accountable.

What This Means for DeFi Builders, Traders, and LPs

If you’re building on-chain or managing capital in DeFi today, the implications are immediate:

- Protocol designers should prioritize integrating MEV sharing strategies as a core feature, waiting risks losing market share to fairer competitors.

- Liquidity providers can now factor MEV rebates into their expected yield calculations, making once-marginal pools newly attractive.

- Traders benefit from tighter spreads and fewer predatory attacks, improving execution quality across the board.

The competitive edge is shifting toward protocols that not only optimize for efficiency but also demonstrate a commitment to equitable value distribution. For those interested in practical implementation details or comparative analyses of different approaches, our resource on MEV redistribution protocol enhancements is an excellent next step.

Looking Ahead: The Future of Fair DeFi Markets

The momentum behind MEV redistribution protocols isn’t slowing down. As more chains experiment with encrypted mempools, TEE-based ordering, or automated rebate mechanisms, expect continued pressure on legacy systems that fail to adapt. The days when deep-pocketed searchers could quietly siphon off millions at the expense of everyday users are fading, and being replaced by a culture where transparency and shared incentives drive growth.

This is not just an incremental upgrade; it’s a philosophical shift that puts users first. If you want to stay ahead of the curve, whether as a developer looking to build fairer products or as a trader seeking sustainable yield, now is the time to understand how MEV sharing will shape your strategy going forward.

The landscape is changing fast. Those who embrace these new standards of fairness will be best positioned to thrive as DeFi matures into its next phase.