As decentralized finance (DeFi) protocols mature in 2025, MEV redistribution strategies have become central to protocol design and user experience. The surge in on-chain activity has amplified the competition for Maximal Extractable Value (MEV), making transparent, equitable sharing not just a technical challenge but a market imperative. Recent innovations from platforms like Jito DAO, Unichain, and RediSwap underscore the shift toward protocol-level MEV sharing that aligns incentives across validators, liquidity providers (LPs), and end users.

Why Optimizing MEV Redistribution Matters in 2025

MEV extraction remains a double-edged sword. While it can boost protocol revenues and incentivize network participation, unchecked MEV leads to predatory behaviors such as front-running and sandwich attacks. These practices erode LP yields and undermine user trust. In response, leading DeFi protocols are implementing multi-layered approaches that blend technical innovation with economic realignment, prioritizing fairness, minimizing extraction risk, and fostering sustainable MEV markets.

The following five strategies represent the state-of-the-art toolkit for optimizing MEV redistribution in 2025:

Top 5 Advanced MEV Redistribution Strategies for 2025

-

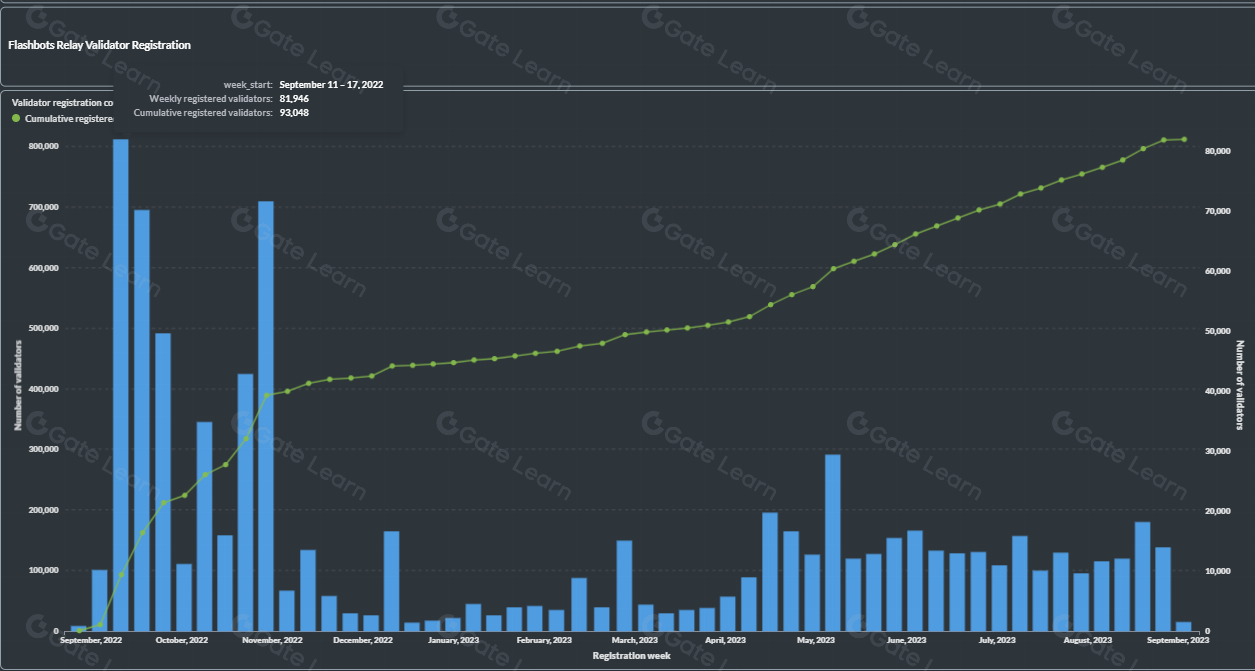

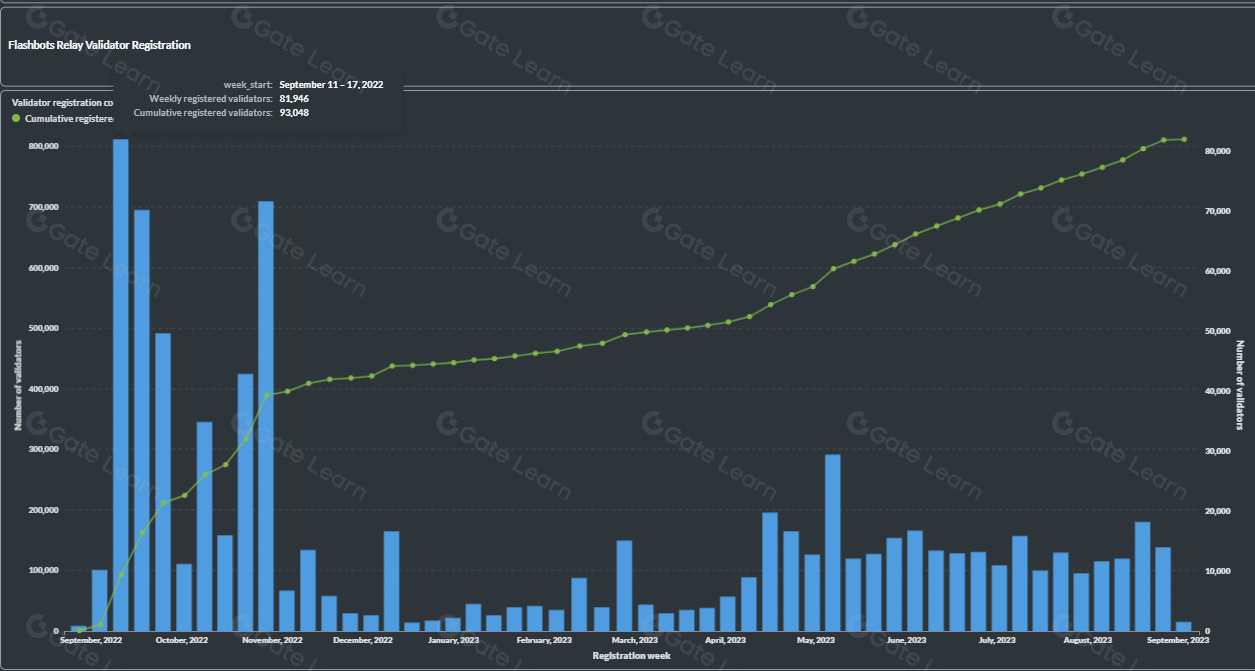

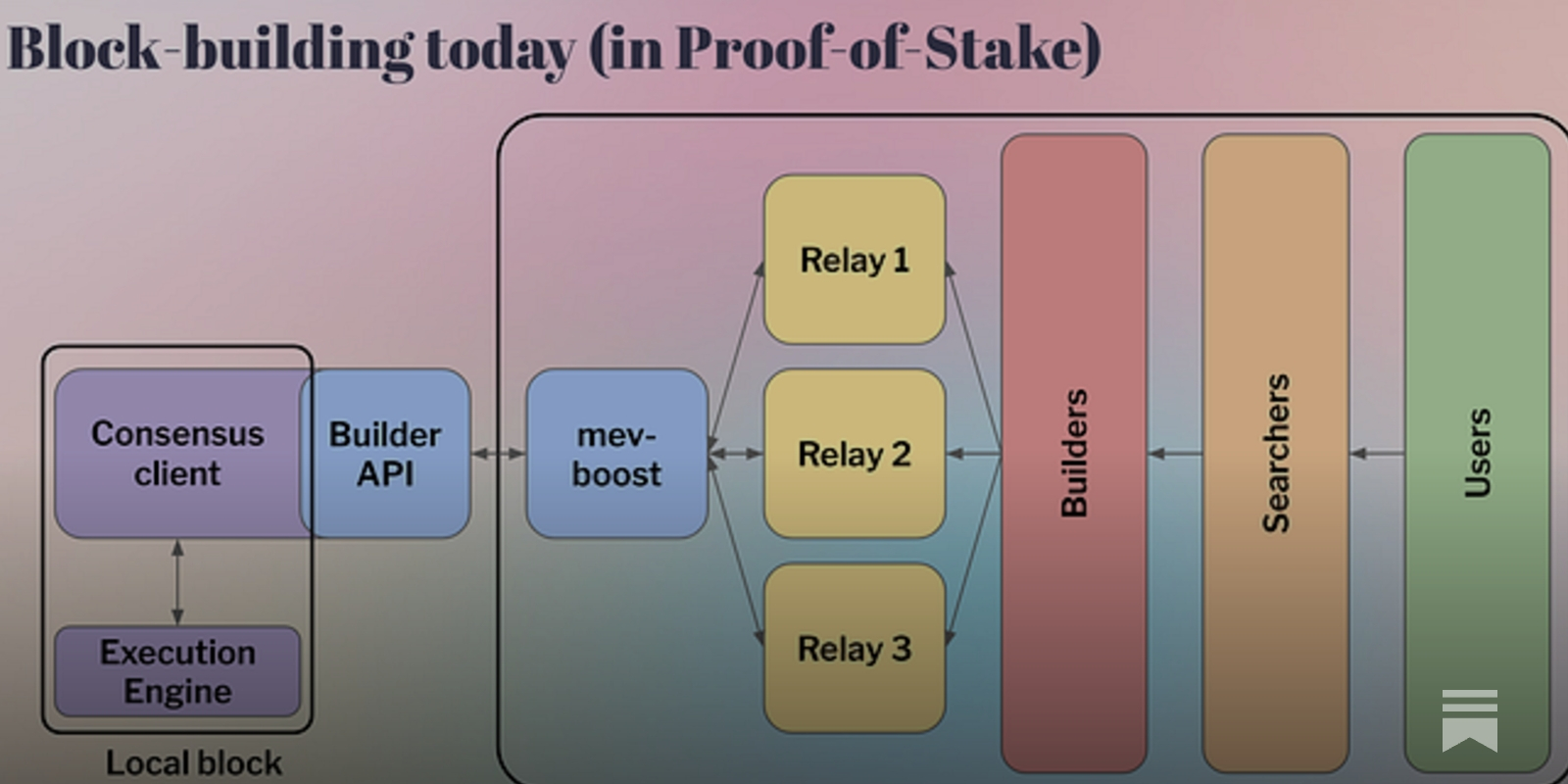

Implement On-Chain MEV Auction Mechanisms (e.g., PBS and MEV-Boost): Protocols like MEV-Boost and Proposer-Builder Separation (PBS) enable transparent on-chain auctions for blockspace, allowing MEV to be efficiently captured and redistributed. These mechanisms help ensure fair allocation of MEV revenue, as seen in Ethereum’s PBS and Solana’s Jito DAO implementations.

-

Adopt Protocol-Level MEV Sharing Pools for Validators and Users: Leading DeFi protocols such as Jito DAO (Solana) and Unichain have pioneered MEV sharing pools, directing a portion of MEV proceeds to validators, liquidity providers, and users. This approach boosts protocol revenue and enhances fairness by redistributing value previously captured by extractors alone.

-

Integrate Real-Time MEV Monitoring and Transparency Dashboards: Platforms like mevwatch.info and bloXroute offer real-time dashboards tracking MEV flows, validator participation, and sandwich attack risks. Transparent analytics empower protocols and users to monitor MEV activity and adjust strategies for optimal redistribution.

-

Utilize Encrypted Mempools or Private Transaction Relays to Prevent Front-Running: Solutions like Flashbots Protect and bloXroute Private Relays enable encrypted transaction submission, shielding users from front-running and sandwich attacks. By protecting transaction order flow, these tools preserve value for end-users and enable more equitable MEV redistribution.

-

Incentivize Pro-Social Searchers via Reward Schemes and Governance Participation: Protocols like RediSwap and CoW Protocol implement reward mechanisms and governance incentives for searchers who align with pro-social MEV extraction. These strategies reward ethical behavior, such as refunding arbitrage profits to users and LPs, fostering a healthier DeFi ecosystem.

1. Implement On-Chain MEV Auction Mechanisms (PBS and amp; MEV-Boost)

On-chain auction mechanisms, such as Proposer-Builder Separation (PBS) and solutions like MEV-Boost, have revolutionized how blockspace is allocated. By enabling validators to auction off block-building rights while separating transaction ordering from block proposal, these systems ensure that extracted value is transparently redistributed rather than captured by a select few insiders.

PBS-based auctions help mitigate centralization risks while providing verifiable records of value flow, an essential feature as regulatory scrutiny increases in 2025. Protocols employing these mechanisms report higher LP retention rates and reduced slippage due to fairer transaction sequencing.

2. Adopt Protocol-Level MEV Sharing Pools for Validators and Users

The introduction of protocol-level sharing pools marks a paradigm shift from opportunistic extraction to community-centric value distribution. Platforms like Unichain now direct a significant share of realized MEV back to LPs, offsetting losses from arbitrageurs while boosting on-chain yield opportunities.

This approach not only aligns validator incentives with those of users but also supports long-term ecosystem health by reducing adversarial tactics. For a comprehensive breakdown of how these pools are shaping fairness across DeFi ecosystems, see this analysis on protocol-level redistribution.

3. Integrate Real-Time MEV Monitoring and amp; Transparency Dashboards

The demand for radical transparency has led to the widespread adoption of real-time monitoring dashboards. These tools empower both developers and users by surfacing live data on extracted value flows, transaction ordering patterns, and the effectiveness of anti-MEV measures.

Protocols leveraging open analytics frameworks have observed measurable declines in predatory trading activity as actors adapt their behavior under increased scrutiny. Enhanced monitoring also enables rapid iteration on mitigation tactics, crucial as new forms of extraction emerge each quarter.

4. Utilize Encrypted Mempools or Private Transaction Relays to Prevent Front-Running

Front-running remains one of the most persistent MEV threats, directly impacting user outcomes and undermining trust in DeFi protocols. In 2025, the deployment of encrypted mempools and private transaction relays has become an industry standard for mitigating these risks. By obfuscating transaction details until block inclusion, these mechanisms make it far more difficult for malicious actors to reorder or preempt trades for profit.

Protocols that have integrated encrypted mempools report a substantial decrease in sandwich attacks and value leakage. Moreover, the privacy guarantees offered by these systems are increasingly seen as a competitive differentiator for platforms prioritizing user protection. For developers, adopting encrypted relay infrastructure is no longer optional, it’s foundational to maintaining protocol integrity and attracting sophisticated capital.

5. Incentivize Pro-Social Searchers via Reward Schemes and Governance Participation

Not all MEV searchers are adversarial, many contribute positively by providing liquidity, arbitraging inefficiencies, or supporting protocol health. The most forward-thinking protocols now incentivize pro-social searchers through targeted reward schemes and governance participation rights.

This approach flips the script on traditional MEV dynamics: instead of penalizing all extraction, protocols reward behaviors that align with ecosystem goals. For instance, searchers who submit transactions that increase LP returns or reduce volatility may receive a share of protocol fees or voting power in governance decisions. Such incentives create a feedback loop where value extraction is directly tied to network sustainability.

Building Sustainable MEV Markets: Putting It All Together

The interplay between these five strategies, on-chain auctions, protocol-level sharing pools, real-time transparency dashboards, encrypted mempools, and pro-social incentives, forms the backbone of sustainable MEV markets. Each layer addresses unique vectors of risk while reinforcing fairness across the stack.

For protocol designers and developers seeking actionable guidance on implementation details and best practices, resources like our guide on MEV redistribution mechanisms offer step-by-step frameworks tailored to today’s market realities.

Top 5 Strategies for MEV Redistribution in 2025

-

Implement On-Chain MEV Auction Mechanisms (e.g., PBS and MEV-Boost): Leverage Proposer-Builder Separation (PBS) and MEV-Boost to decentralize block production and auction MEV rights transparently, ensuring fairer value capture and reducing centralization risks. These mechanisms are widely adopted on platforms like Ethereum and Solana to maximize protocol-level MEV redistribution.

-

Adopt Protocol-Level MEV Sharing Pools for Validators and Users: Integrate MEV sharing pools, as seen in protocols like Jito DAO (Solana) and Unichain, to allocate a significant portion of MEV proceeds directly to validators, liquidity providers, and end users, boosting yields and aligning incentives across the ecosystem.

-

Integrate Real-Time MEV Monitoring and Transparency Dashboards: Deploy advanced monitoring solutions (e.g., mevwatch.com dashboards) to provide actionable insights into MEV flows, redistribution efficiency, and protocol health, empowering stakeholders with data-driven decision-making.

-

Utilize Encrypted Mempools or Private Transaction Relays to Prevent Front-Running: Employ technologies like Flashbots Protect and encrypted mempools to shield transactions from predatory MEV strategies, safeguarding users from sandwich attacks and front-running while enhancing overall protocol security.

-

Incentivize Pro-Social Searchers via Reward Schemes and Governance Participation: Design reward mechanisms and governance structures that encourage searchers to act in the protocol’s best interest, such as through MEV rebates, pro-social searcher programs, or governance token incentives, fostering sustainable and equitable MEV extraction.

The path forward is clear: as DeFi matures beyond its experimental roots, only those protocols that embrace holistic MEV redistribution will thrive amid increasing competition and regulatory scrutiny. By combining advanced technical safeguards with transparent economic design, and rewarding actors who drive positive-sum outcomes, the industry can realize its vision of fairer value capture for all participants.