In the high-stakes arena of Layer 2 rollups, where DeFi trading volumes rival Ethereum’s mainnet yet profits from MEV rebates remain stubbornly low, a quiet revolution is underway. Traders long accustomed to the invisible tax of sandwich attacks and front-running are now tasting the fruits of ordering surplus sharing. MEV rebate mechanisms promise to flip the script, channeling extracted value back to those who generate it: everyday DeFi users. This isn’t charity; it’s a calculated redesign of incentives that could redefine fairness on rollups like Arbitrum, Optimism, and zkSync.

Rollups have exploded in popularity, processing transactions at a fraction of L1 costs while inheriting Ethereum’s permissionless ethos. But with scale comes scrutiny. Research reveals MEV extraction here mirrors mainnet intensity, albeit with slimmer margins due to sequencer centralization and batching efficiencies. Searchers still lurk, arbitraging price discrepancies and sandwiching trades, siphoning billions in latent value. The core issue? Block producers or sequencers capture most of this ordering surplus, leaving traders footing the bill through slippage and lost opportunities.

Decoding MEV on Rollups: From Hidden Costs to Quantifiable Losses

Maximal Extractable Value arises whenever user intents overlap in the mempool, think arbitrage between DEXes or liquidations in lending protocols. On rollups, sequencers dictate ordering, amplifying their leverage. A recent analysis across Arbitrum, Optimism, and zkSync confirms MEV’s ubiquity: trading volumes match Ethereum’s, but extractor profits lag, squeezed by faster finality and private mempools. Yet for traders, the pain is real. A single sandwich can erode 1-5% of trade value, compounding into a stealthy drag on returns.

Traditional mitigations like private RPCs or commit-reveal schemes fall short. They shield but don’t redistribute. Enter MEV redistribution rollups strategies, which auction ordering rights and rebate proceeds. This aligns incentives: searchers bid aggressively, sequencers facilitate, and users reclaim surplus. Galaxy’s breakdown underscores MEV as inherent to permissionless value flow; the question is who pockets it.

MEV Blocker: Leading the Charge in User Rebates

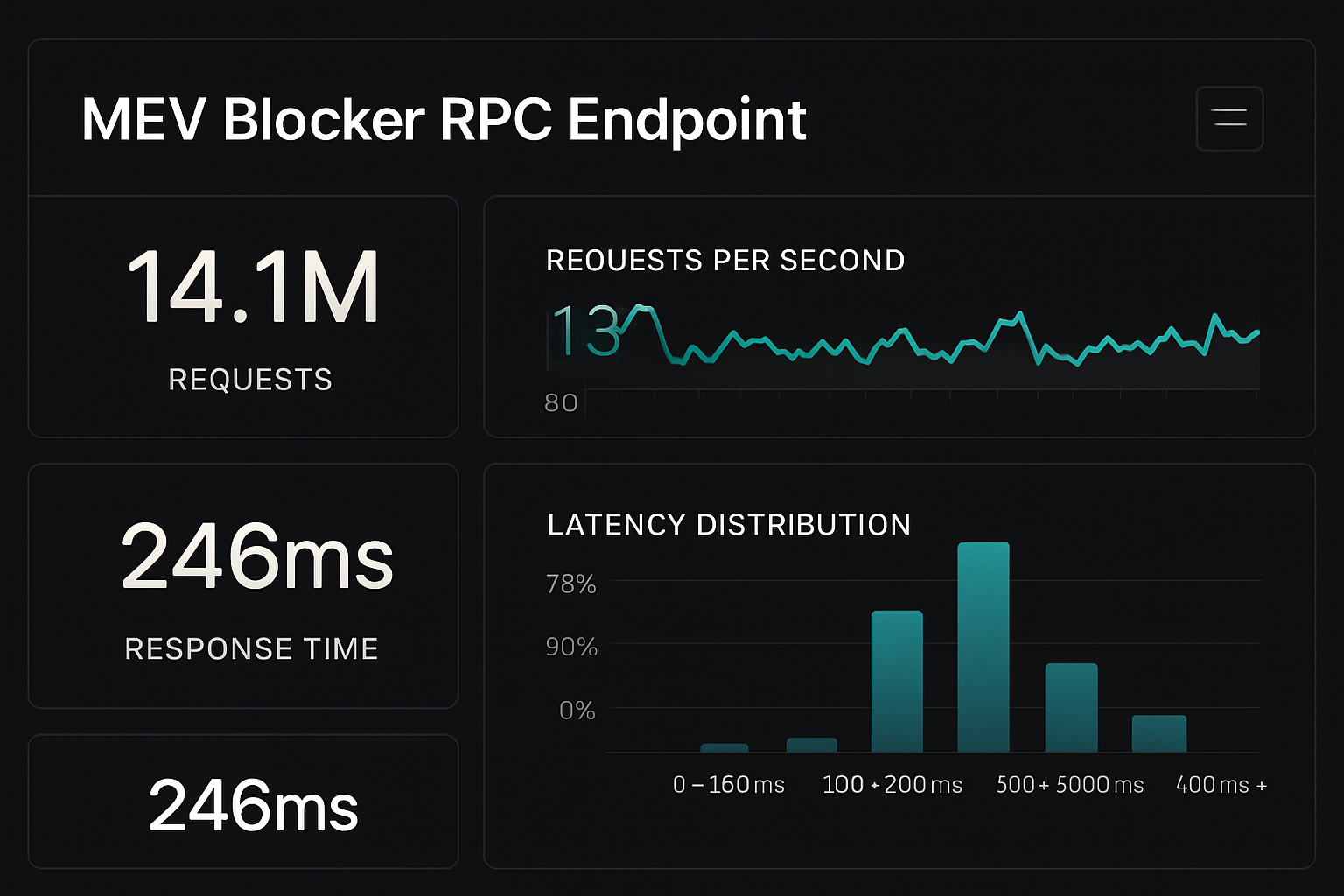

MEV Blocker stands out as the vanguard. Backed by over 30 Ethereum teams, this RPC endpoint routes transactions privately, auctioning backrun rights to searchers. Winners pay up, and 90% flows back as DeFi transaction rebates. In 2024 alone, it disbursed 4,079 ETH, tangible proof of concept. By sidestepping public mempools, it neuters front-running while monetizing MEV for users. Rollup integration amplifies this: lower gas means more frequent, smaller rebates, smoothing trader economics.

Critics argue auctions favor sophisticated searchers, but data counters: rebates democratize gains. Ordinary swaps on Uniswap or 1inch via Blocker endpoints yield refunds proportional to MEV generated, fostering trust. As rollups decentralize sequencers, Blocker-like tools become essential for fair MEV mechanisms Ethereum wide.

Flashbots MEV-Share and CoW Protocol: Complementary Redistribution Models

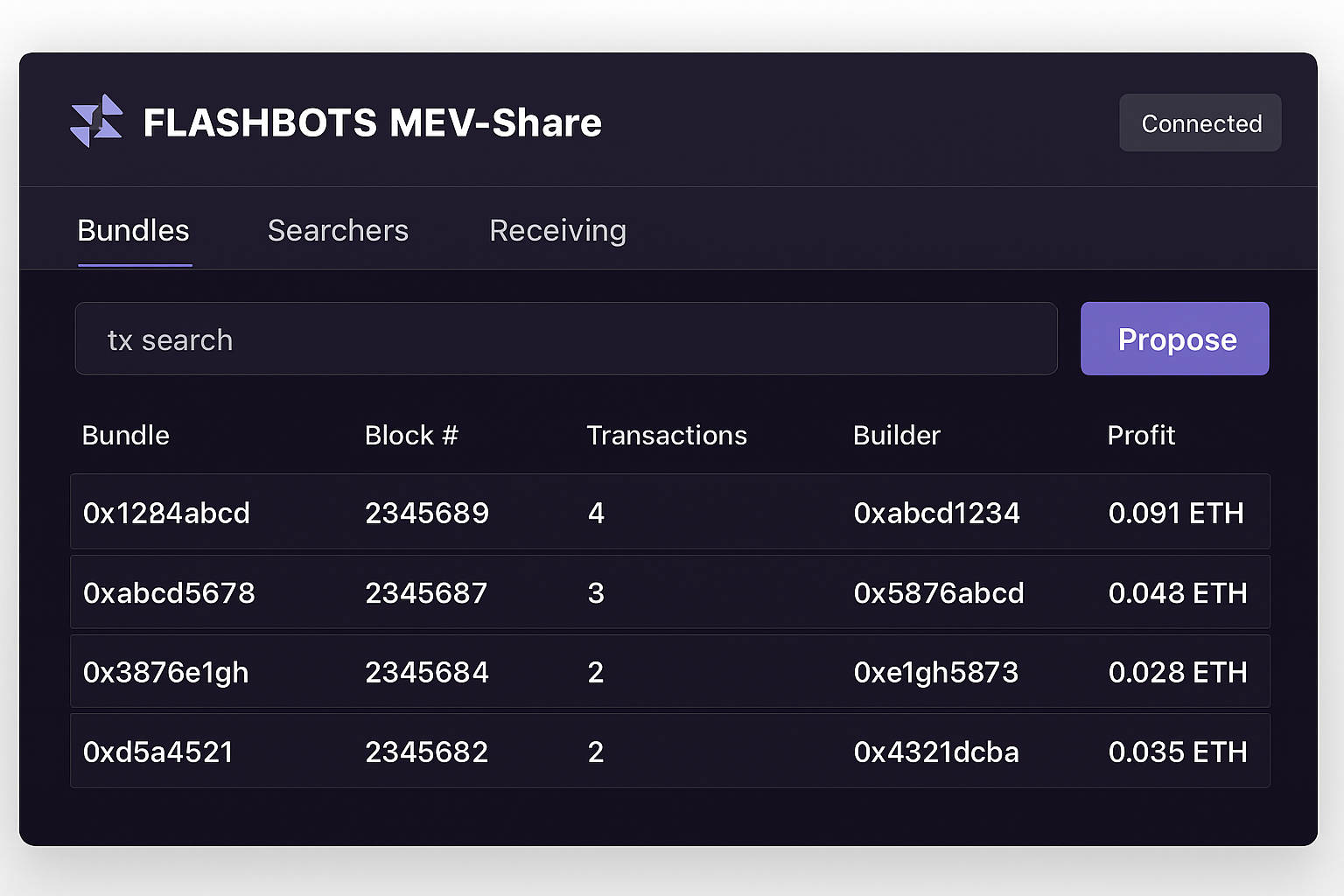

Flashbots’ MEV-Share evolves the playbook. By tipping bundles with refund hints, it rebates MEV-derived value to originators, blending transparency with extraction. Though Ethereum-native, rollup adapters extend its reach, curbing cross-rollup arbitrage losses. Seongwan Park’s deep dive highlights its forum origins and MEV track buzz, positioning it as evolutionary infrastructure.

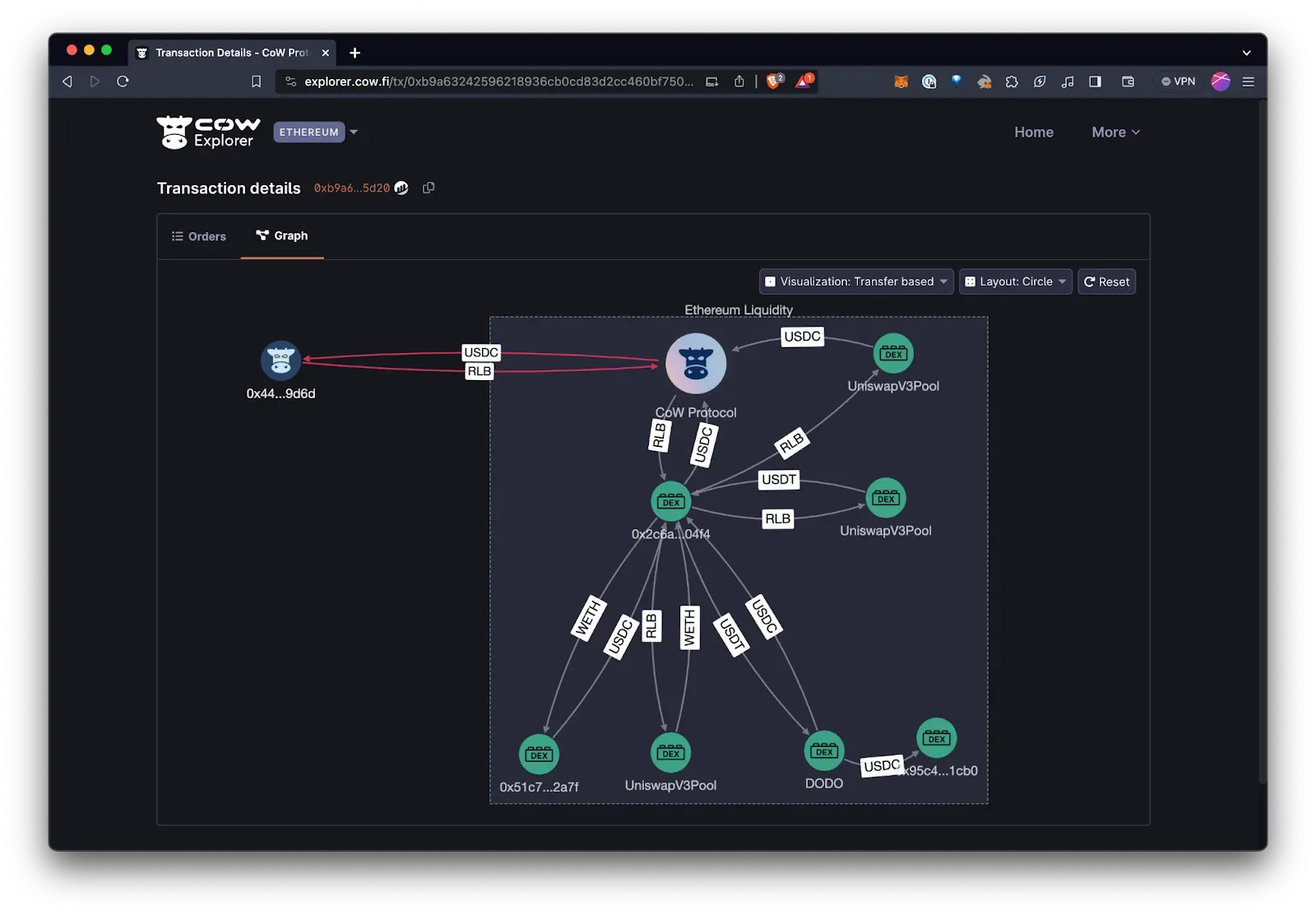

CoW Protocol takes a batch-auction approach, settling intents off-chain to minimize ordering games. Captured surplus funds rebates and fee cuts, directly boosting user yields. On rollups, this shines: reduced latency pairs with MEV protection, retaining liquidity amid sequencer risks. Both protocols underscore a truth I’ve observed across two decades in finance, DeFi thrives when value accrues to participants, not intermediaries. See how these rebates transform incentives.

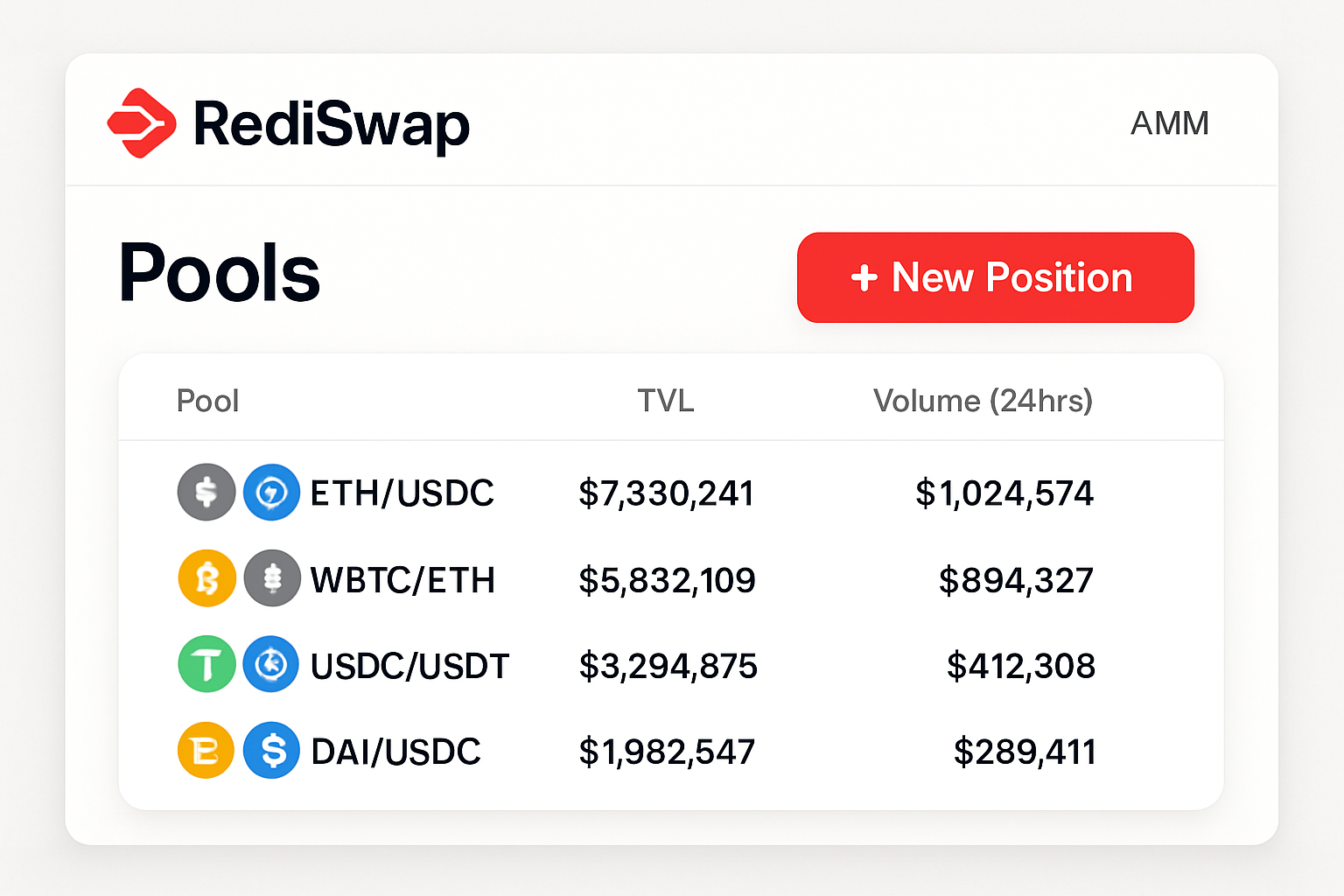

RediSwap pushes boundaries at the AMM level, internalizing arbitrage and splitting proceeds with LPs and swappers. ArXiv studies affirm superior execution versus vanilla Uniswap, proving app-level MEV rebates viable on rollups. These aren’t silos; they interlock, pressuring sequencers toward rebate mandates.

These innovations signal a broader shift: rollups aren’t just scaling Ethereum; they’re engineering equity into the MEV stack. Yet implementation hurdles persist. Sequencer centralization on Arbitrum and Optimism creates chokepoints, where operators could theoretically withhold rebates. Decentralized sequencers, as zkSync experiments, offer a fix, but demand robust governance to enforce ordering surplus sharing. Without it, rebates risk becoming optional theater.

Quantifying the Trader Edge: Rollup-Specific MEV Dynamics

Let’s drill into the numbers. MEV on rollups isn’t a rounding error. Analyses spanning Arbitrum, Optimism, and zkSync reveal extraction rates rivaling L1, with sandwich attacks claiming up to 5% of DEX volume in peak hours. Profits thin out due to batch posting, but the user toll mounts: a $10,000 swap might forfeit $200-500 unseen. Rebate protocols reverse this calculus. MEV Blocker’s 4,079 ETH in 2024 rebates averaged $1-5 per protected transaction, scaling with volume. CoW’s batching slashes effective slippage by 20-30%, per their audits, while RediSwap’s internal arb nets LPs 15% higher yields.

MEV Impact on Major Rollups

| Rollup | Est. Annual MEV Extracted (ETH) | Sandwich Prevalence % | Avg. User Loss per Trade ($) | Rebate Potential with Blocker (ETH) |

|---|---|---|---|---|

| Arbitrum | 150k | 45% | $2.50 | 13k |

| Optimism | 90k | 38% | $1.80 | 8k |

| zkSync | 60k | 25% | $1.20 | 5k |

Traders gain compounding edges. Frequent small rebates fund gas fees, turning MEV from drag to tailwind. Liquidity providers stick around longer, tightening spreads. Protocols capture flywheel effects: higher TVL begets more MEV, amplifying rebates in virtuous loops. I’ve seen parallels in TradFi derivatives markets, where rebate programs juiced volumes 25%; DeFi rollups could double that through composability.

Strategies for Capturing MEV Rebates

-

Route via MEV Blocker RPCs: Send transactions through MEV Blocker‘s private RPC endpoint to avoid front-running and sandwich attacks. It auctions backrun rights, redistributing 90% of builder rewards as rebates to users—over 4,079 ETH distributed in 2024.

-

Batch trades on CoW Protocol: Use CoW Protocol‘s batch auctions for MEV protection, minimizing front-running while receiving rebates and reduced fees from captured surplus.

-

Use RediSwap pools: Swap in RediSwap AMM pools that capture arbitrage MEV at the app level, sharing profits between traders and liquidity providers for superior execution.

-

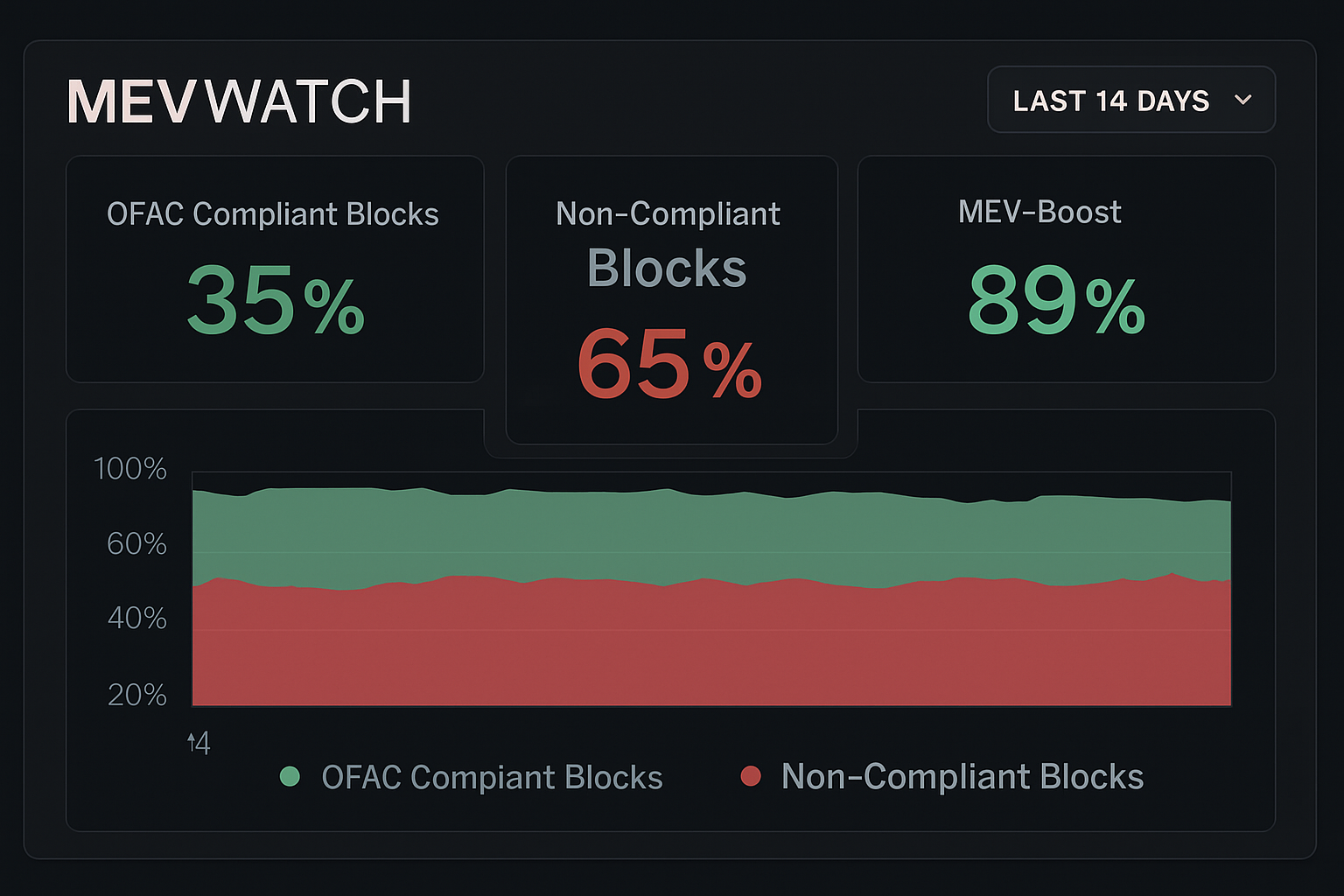

Monitor MEVWatch dashboards: Track real-time MEV activity, rebates, and incentives via MEVWatch to optimize strategies and claim user rewards on rollups.

-

Integrate Flashbots bundles: Build custom bots using Flashbots MEV-Share bundles to share in transparent MEV extraction and receive rebates directly.

Challenges and the Path Forward: Building Resilient Fair MEV Mechanisms

Resistance lingers. Searchers decry rebate auctions as bid wars, inflating costs. Validators gripe over lost tips. Yet evidence mounts: Blocknative’s critique of private mempools concedes MEV-Share’s refund model outperforms outright bans. Galaxy’s surplus distribution thesis holds firm; permissionless systems breed MEV, so redistribute strategically. Rollups must prioritize: embed rebate hooks in sequencer specs, standardize RPCs, and audit for collusion.

Policy angles sharpen the debate. The International Center for Law and Economics frames MEV as validator excess, urging Ethereum Improvement Proposals for enshrined rebates. DWF Labs questions rollup futures sans MEV alignment, warning of liquidity flight to rebate-rich chains. CoW DAO labels it a transaction tax; fair enough, but rebates make it voluntary revenue sharing.

Looking ahead, 2025 beckons hybrid models. Imagine zk-proofs attesting rebate fairness, or shared sequencers pooling MEV for universal refunds. RediSwap’s app-layer success hints at protocol-native rebates, sidelining infrastructure debates. For DeFi traders, the playbook clarifies: prioritize rebate-enabled frontends, diversify across rollups, and treat MEV as an asset class. Platforms ignoring this forfeit users to savvier rivals. Mev Redistribution’s tools, from analytics to integration guides, position you at this inflection. As rollups mature, MEV redistribution rollups won’t be optional; they’ll define sustainable scale, ensuring ordering surplus fuels traders, not just sequencers. The surplus is yours to claim.