In the fast-paced world of DeFi, every trade carries hidden friction. Searchers exploit transaction ordering to siphon profits through sandwich attacks and arbitrage, leaving traders with worse prices and protocols watching value leak away. Wallchain changes this dynamic with its Wallchain MEV redistribution model, turning that friction into shared gains. By embedding directly into swaps on chains like BNB, it captures MEV sharing Wallchain style, redistributing value back to users and dApps. This isn’t just theory; with Ethereum hovering at $2,253.06 amid a 24-hour dip of -1.68%, such mechanisms feel more vital than ever for sustainable trading.

DeFi’s MEV Drain: A Trader’s Silent Tax

Picture this: you execute a swap on PancakeSwap, aiming for a quick profit. But before your transaction lands, a searcher fronts it, buys low ahead of you, then sells high after, pocketing the spread. This DeFi transaction friction capture isn’t rare; on BNB Chain alone, MEV losses hit $95 million yearly. Broader DeFi sees over $100 million extracted annually from lending markets, funneled mostly to validators rather than participants.

Traditional protections like private relays or bundles help, but they fragment liquidity and favor sophisticated players. Flashbots-style bundles keep things private until inclusion, yet everyday traders still suffer. Cross-chain arbitrage adds another layer, where bridging delays amplify costs. Wallchain flips the script with regenerative DeFi MEV, ensuring protocols and users claim their slice without fighting the system.

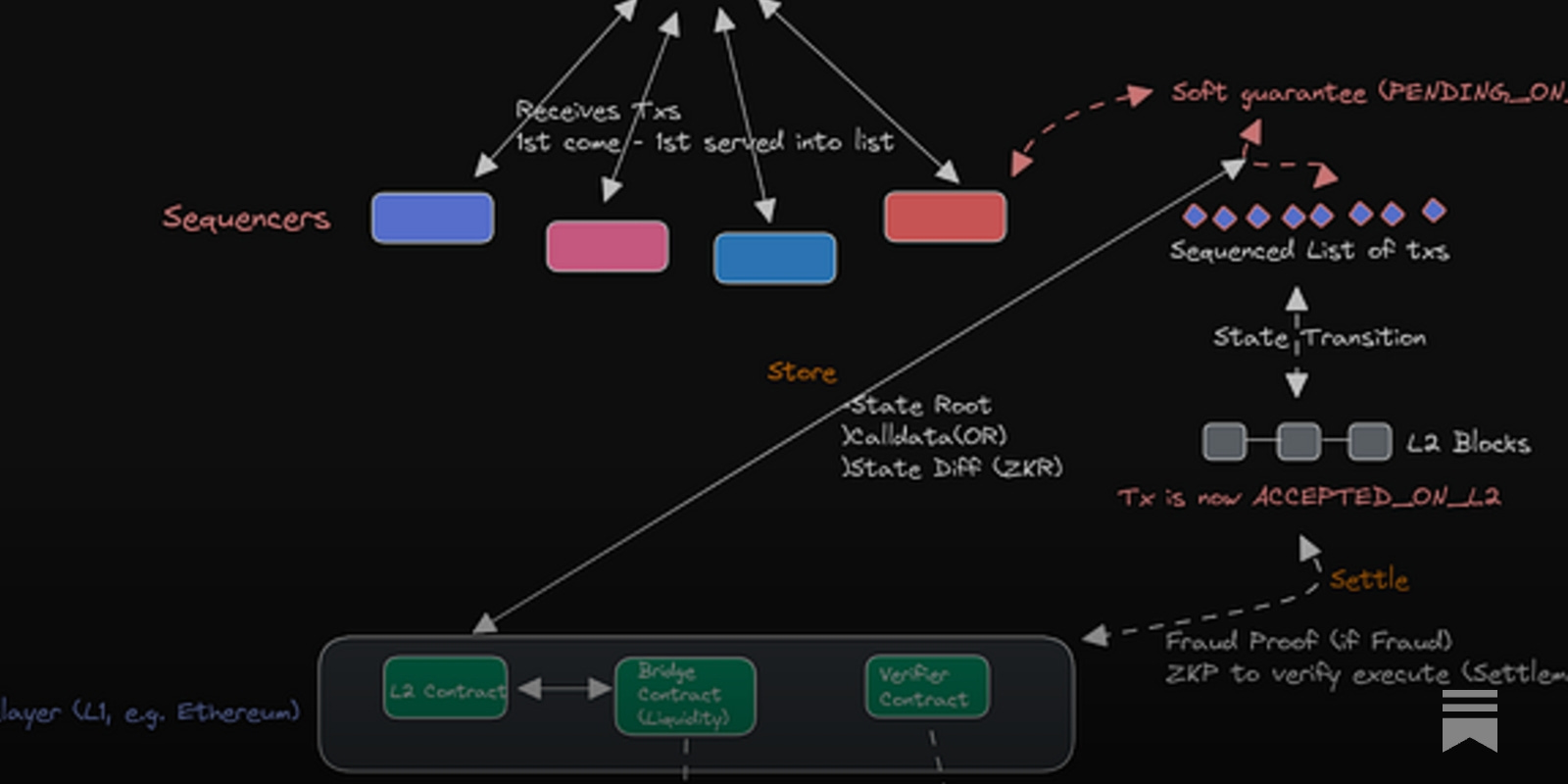

Wallchain’s Core Mechanism: Bundling Intents and Searchers

At its heart, Wallchain integrates with DeFi platforms to bundle user swaps alongside searcher strategies. This blockchain MEV recapture strategies approach uses the Meta-Intent Flow Auction, launched in October 2023. Users submit intents, not raw transactions; the auction matches them with optimal MEV paths, auctioning execution rights to searchers who bid with redistributed profits.

Covering over 90% of BNB Chain’s order flow via integrations with PancakeSwap, ApeSwap, ZeroSwap, LiFi, and BabyDoge, it’s practical firepower. Searchers still profit, but a portion flows back, reducing slippage for traders. Think of it as monetizing influence collectively, backed by a $2 million raise from Cypher Capital in March 2023 to scale Web3 innovations.

This model echoes ideas from RediSwap for CFMMs, deciding bundle inclusion and ordering dynamically. Yet Wallchain stands out by prioritizing user protection without centralization risks, fostering trust in high-volume environments.

Why Traders Win in the Wallchain Era

For individual traders, the appeal is immediate: lower effective slippage means more profits retained. In a market where ETH trades between $2,115.33 and $2,328.65 over 24 hours, ending at $2,253.06, every basis point counts. Protocols benefit too, gaining revenue streams to fund development or buybacks.

Wallchain’s rollout proves viability. By combining user intents with searcher MEV in single transactions, it minimizes exposure to predatory tactics. This regenerative loop could extend beyond BNB, tackling rollup MEV risks or lending exploits highlighted in recent analyses.

Ethereum (ETH) Price Prediction 2027-2032

Short-term bearish outlook to $2,100, medium-term rebound to $2,500 by Q2 2026. Projections based on 2026 average price of $2,300, incorporating Wallchain MEV redistribution for DeFi efficiency gains.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from prev) |

|---|---|---|---|---|

| 2027 | $1,900 | $2,100 | $2,800 | -9% |

| 2028 | $2,500 | $3,500 | $5,000 | +67% |

| 2029 | $3,200 | $4,800 | $7,000 | +37% |

| 2030 | $4,000 | $6,200 | $9,200 | +29% |

| 2031 | $5,000 | $8,000 | $12,000 | +29% |

| 2032 | $6,500 | $10,000 | $15,000 | +25% |

Price Prediction Summary

Ethereum is expected to experience short-term bearish pressure dipping to around $2,100 in 2027 before a strong rebound driven by the 2028 Bitcoin halving cycle, MEV efficiencies from Wallchain, and DeFi growth, leading to average prices climbing progressively to $10,000 by 2032 amid bullish market cycles and technological advancements.

Key Factors Affecting Ethereum Price

- Wallchain MEV redistribution capturing trade friction for user profits and DeFi retention

- Ethereum scaling via layer-2 rollups and upgrades reducing MEV risks

- 2028 Bitcoin halving igniting bull market cycle

- Regulatory clarity enabling institutional inflows

- Growing DeFi lending and arbitrage opportunities

- Macro trends in adoption and competition from cross-chain ecosystems

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Critics might argue it commoditizes searchers, but I see evolution. MEV supply chains have matured from raw extraction to structured sharing; Wallchain accelerates that thoughtfully.

Searchers adapt or fade; the real win lies in aligning incentives across the ecosystem. As Ethereum holds at $2,253.06 after dipping 1.68% in the last 24 hours, with swings from $2,115.33 to $2,328.65, protocols need tools like Wallchain to stabilize user confidence amid volatility.

Beyond BNB: Scaling Wallchain’s Vision

Wallchain’s foothold on BNB Chain sets the stage for broader adoption. Imagine extending regenerative DeFi MEV to Ethereum Layer 2s, where rollup security battles custom MEV risks. Or cross-chain bridges, where arbitrage delays erode profits; Wallchain’s bundling could preempt those by auctioning intents pre-bridge. Recent studies on cross-chain MEV underscore the frontier, with models revealing how bridging times dictate opportunity costs. Wallchain’s Meta-Intent Flow Auction sidesteps this elegantly, treating intents as composable assets.

This scalability draws from lessons in the MEV supply chain’s evolution. Early days favored raw extraction via miner collusion; now, unbundling actors like relays and bundles democratizes access. Wallchain joins innovators like RediSwap, which optimizes CFMM bundles, but pushes further by redistributing to end-users, not just validators. In lending markets alone, over $100 million yearly gets rerouted; Wallchain could claw back a meaningful share for borrowers and protocols.

Funding fuels this expansion. The $2 million from Cypher Capital in March 2023 targets R and D for fresh MEV solutions, hinting at wallet integrations or protocol-native modules. Traders on platforms like PancakeSwap already see slippage drop, proving DeFi transaction friction capture works at scale.

Tangible Gains: A Trader’s Playbook

Let’s break down why MEV sharing Wallchain empowers everyday participants. First, reduced sandwich exposure: bundled execution neutralizes front-running. Second, protocol rebates: dApps like ApeSwap channel MEV back as fee discounts or token rewards. Third, predictive edges: auction transparency lets traders anticipate optimal paths.

Wallchain MEV Benefits

-

Lower Slippage: Protects trades from sandwich attacks and front-running, reducing execution costs for traders on BNB Chain.

-

Revenue Sharing: Redistributes captured MEV profits directly to users and protocols, turning losses into gains.

-

Seamless Integrations: Plug-and-play with PancakeSwap and ApeSwap, covering 90% of BNB Chain order flow.

-

MEV Recapture: Captures value via Meta-Intent Flow Auction without private relays or complex setups.

These aren’t abstract. On BNB, covering 90% order flow means most swaps benefit passively. For protocols, it’s a revenue pivot; instead of MEV draining to outsiders, it recirculates, funding liquidity incentives or governance. I view this as blockchain MEV recapture strategies at their finest, regenerative by design.

Challenges persist, of course. Auction efficiency demands low-latency searchers, and chain congestion could inflate gas. Yet Wallchain’s track record on BNB mitigates these, with backing from Alliance builders signaling robustness. As DeFi matures, expect integrations with wallets for one-click protection, turning MEV from tax to tailwind.

The shift feels inevitable. In a landscape where $95 million vanishes yearly on one chain alone, Wallchain redistributes not just value, but power. Traders retain more from each swap, protocols thrive sustainably, and searchers compete on merit. With ETH steady at $2,253.06, this model equips the ecosystem to weather dips and surges alike, fostering a fairer DeFi frontier.