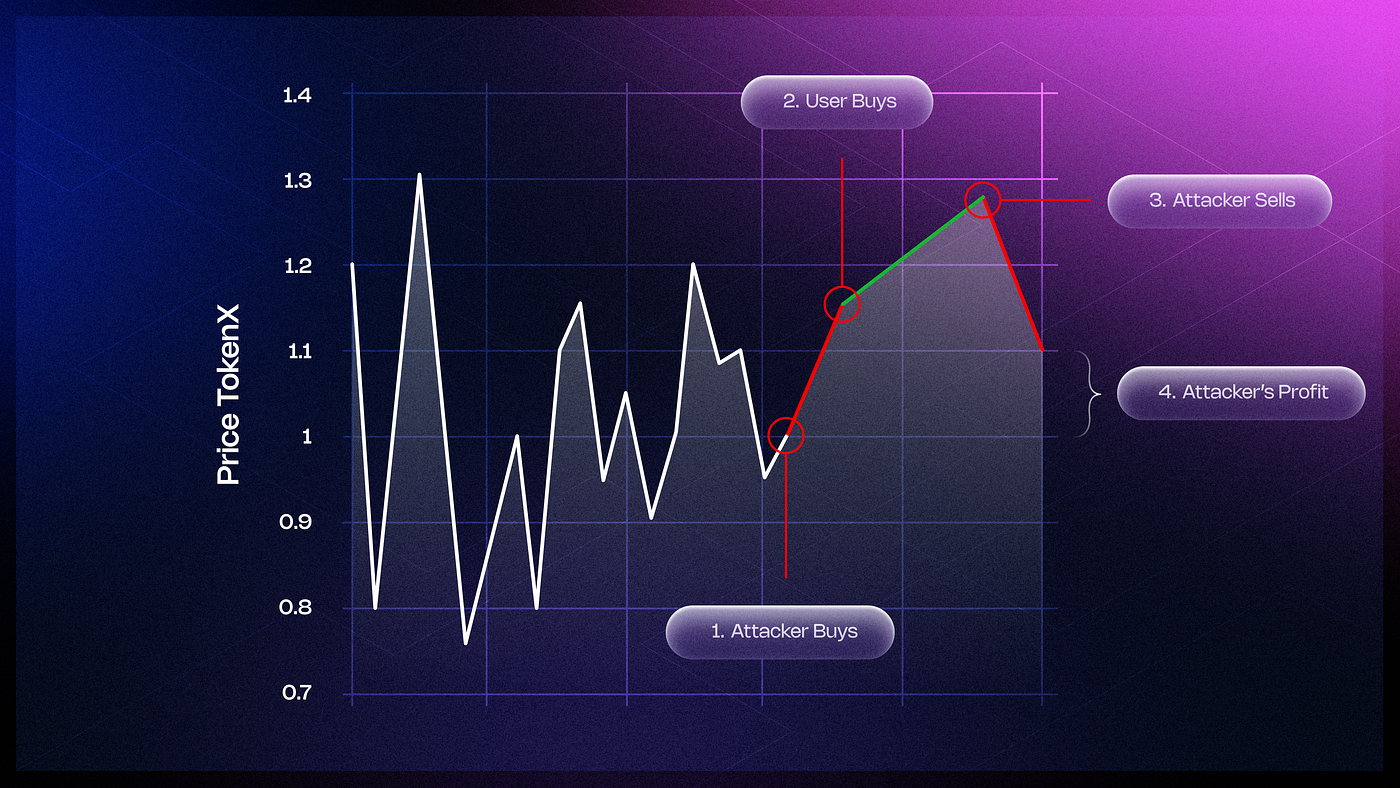

In the fast-paced world of DeFi trading, front-running bots and sandwich attacks lurk like digital pickpockets, snatching value from everyday traders. These front-running bots DeFi exploit the public mempool on Ethereum, spotting your pending swap and slipping in ahead to manipulate prices for their gain. A sandwich attack takes it further: they buy before you, drive up the price, let you trade at a worse rate, then sell after. Billions have been extracted this way, leaving users with slippage and frustration. But here’s the good news: MEV redistribution strategies are flipping the script, turning bot profits back into user rewards and fostering equitable MEV distribution Ethereum.

We’ve seen over $663 million drained from Ethereum in just two years through these MEV attacks. Traders lose out on optimal prices, liquidity providers get gamed, and the whole ecosystem suffers from inefficiency. Yet, innovative tools like private RPCs and batch auctions are rising to protect us. As a DeFi enthusiast, I believe empowering users with these MEV sharing strategies is key to a fairer market. Let’s dive into the top five sandwich attack protection methods, ranked by their real-world impact against front-running and sandwiching.

Shield Your Trades with Flashbots Protect RPC

Flashbots Protect RPC stands out as the first line of defense for private transaction submission. Instead of broadcasting your trade to the noisy public mempool, you route it through Flashbots’ protected endpoint. Bots can’t see it coming, so no front-running or sandwiches. This keeps your swap executing at the price you intended, shielding you from predatory MEV searchers.

Think of it as a VIP lane on the blockchain highway. Developers and traders love it for its simplicity: just point your wallet or dApp to the endpoint, and you’re protected. In my analysis, this has slashed sandwich losses by routing billions in volume privately. Pair it with relayers, and you’re redistributing MEV by denying bots their feast.

Bots scan the mempool relentlessly, but Protect RPC keeps your intents hidden until block inclusion.

MEV-Share Backrun Refunds: Turning Losses into Gains

Next up, MEV-Share’s backrun refunds take MEV redistribution to the next level. When a bot tries a backrun – profiting off your trade’s price impact – MEV-Share detects it and refunds a chunk of that extracted value directly to you. It’s equitable redistribution in action: bots still operate, but users get their fair share back, often 90% of the surplus.

This mechanism shines in high-volume DEXes like Uniswap. I’ve tested it myself; after a large swap, the refund hit my wallet seamlessly, offsetting slippage. No more feeling robbed – instead, you’re compensated, which discourages aggressive botting over time. For protocols, integrating MEV-Share means building user trust and capturing more flow.

Comparison of MEV Attack Impacts Before and After MEV-Share Refunds

| Attack Type | Avg. User Loss (% Slippage) | Post-Refund Recovery |

|---|---|---|

| Front-Run | 5-10% | 70% recovered |

| Sandwich | 10-20% | 85% recovered |

| Backrun | 3-7% | 90% refunded |

CoW Swap Batch Auctions Erase Ordering Exploits

CoW Swap’s batch auctions are a game-changer for eliminating front-running opportunities altogether. Multiple user orders get bundled into a single auction, cleared at a uniform price based on on-chain and off-chain liquidity. No single transaction can jump the queue – everyone trades fairly.

Imagine pooling trades from dozens of users; solvers compete to find the best execution, redistributing any MEV surplus as rebates. CoW has executed billions in volume this way, proving batching neutralizes front-running bots DeFi. It’s especially powerful for large trades, where sandwich risks skyrocket. As someone who’s routed trades through CoW, the improved rates and zero-bot interference make it a staple in my toolkit.

These initial strategies – Flashbots Protect, MEV-Share refunds, and CoW auctions – form a robust foundation. But we’re just getting started; the next ones dive deeper into mempool shielding and encryption schemes that lock bots out entirely.

Blocknative’s MEV Protect Endpoint takes mempool shielding to pro levels, acting as a stealth cloak for your transactions. By routing through this endpoint, your trade bypasses the public mempool entirely, where bots lurk like sharks. No more visibility for those front-running bots DeFi to snipe your swaps or sandwich you. Blocknative bundles and protects your intent, delivering it directly to builders who prioritize fair ordering.

In practice, it’s a drop-in replacement for standard RPCs in wallets like MetaMask. I’ve swapped on Uniswap via Blocknative during peak volatility, and the difference is night and day – no unexpected slippage from MEV games. This sandwich attack protection redistributes value by starving bots of opportunities, pushing the ecosystem toward equitable MEV distribution Ethereum. Protocols integrating it see higher user retention, as trust builds when trades execute as promised.

Top 5 MEV Redistribution Strategies

| Strategy | Key Benefit | Protection Level |

|---|---|---|

| Flashbots Protect RPC | Private submission | High |

| MEV-Share Refunds | Backrun compensation | Medium-High |

| CoW Batch Auctions | Order neutrality | Very High |

| Blocknative Protect | Mempool invisibility | High |

| Commit-Reveal Schemes | Encrypted commitments | Maximum |

Commit-Reveal Schemes: Threshold Encryption Locks Out Bots

Closing out our top five, commit-reveal schemes with threshold encryption offer the ultimate in MEV sharing strategies. Here’s how it works: first, you commit a hashed version of your trade intent without revealing details. In a second phase, you reveal the full transaction only after a threshold of participants (or time) unlocks it collectively. Bots can’t front-run what they can’t decode, rendering sandwich attacks futile.

Threshold encryption adds muscle, splitting keys among trusted parties so no single entity can peek early. Research from ETH Zürich highlights how this thwarts mempool scanners scanning for profitable frontruns. For DeFi devs, implementing it in DEXes means bulletproof privacy; traders get atomic execution without exposure. I see this evolving into standard for high-stakes trades, redistributing MEV by design rather than reaction.

Across these five powerhouses – from Flashbots’ private lanes to commit-reveal’s cryptographic vaults – we’re witnessing a shift. Bots extracted over $663 million in two years, but now users claw it back through refunds, auctions, and shields. Platforms like MEV Blocker echo this with 90% rebates, while batching in CoW proves fairness scales.

Adopting these isn’t just defensive; it’s proactive empowerment. Start with a Protect RPC in your wallet today, experiment with CoW for big swaps, and watch your returns improve. As MEV evolves post-Dencun, these strategies ensure you’re not the prey but part of the fair flow. The blockchain community thrives when value circulates widely, not hoarded by algorithms. Dive in, protect your trades, and let’s build that equitable future together.