In Ethereum’s DeFi ecosystem, where ETH currently trades at $1,985.05 after a modest 24-hour gain of and $23.79 ( and 0.0121%), validators hold disproportionate power over MEV redistribution strategies. This imbalance fuels DeFi MEV extraction risks, as searchers and builders capture value through tactics like front-running and sandwich attacks, leaving traders and liquidity providers exposed. The upcoming 2026 Glamsterdam Upgrade promises to reshape this dynamic, introducing mechanisms for fair MEV sharing Ethereum and MEV mitigation validators rely on. By decentralizing MEV capture, these innovations aim to foster equitable MEV protocols 2026 demands, reducing centralization while boosting network efficiency.

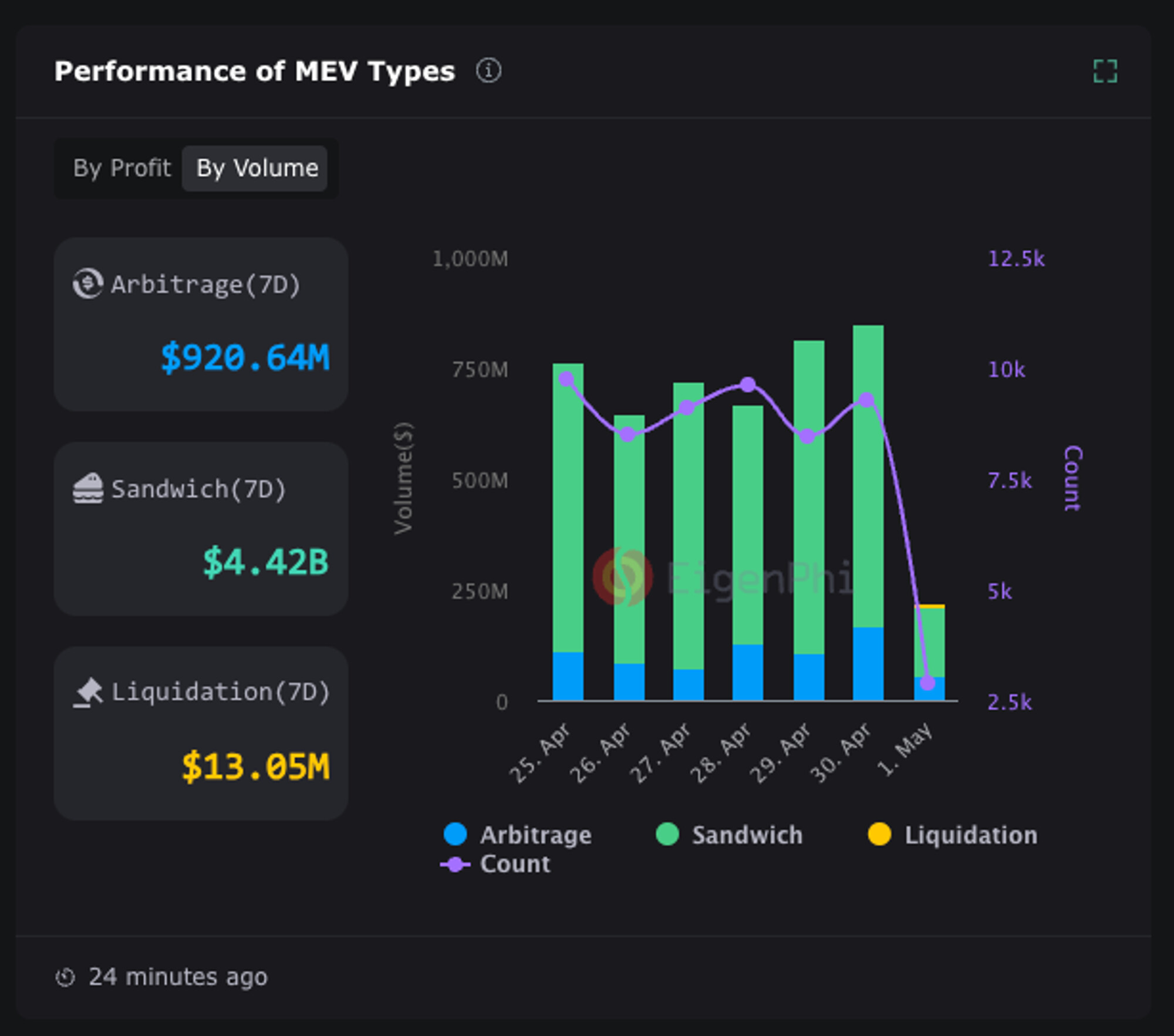

MEV, once termed Miner Extractable Value, now Maximal Extractable Value post-Merge, represents profits from transaction ordering, inclusion, or censorship. Validators, proposing blocks, often outsource building to specialized entities, concentrating rewards. Chorus One data highlights how MEV boosted staking yields to 15% of revenues in early 2023 peaks, underscoring the stakes. Yet, as Ethereum scales via rollups and blobs, unchecked validator incentives threaten fairness, prompting targeted MEV redistribution strategies.

Encrypted Proposer-Builder Separation (ePBS) via Glamsterdam Upgrade

The Glamsterdam Upgrade’s cornerstone, Encrypted Proposer-Builder Separation (ePBS), encrypts block proposals, blinding builders to contents until auction resolution. This shifts traditional block auctions, where proposers selected payloads for maximum fees, toward a privacy-preserving paradigm. Proposers commit to bids without revealing transactions, curbing collusion and front-running. AInvest reports ePBS decentralizes MEV capture, enhancing scalability by outsourcing construction while protecting user intent.

Practically, ePBS mitigates validator dominance by democratizing access to high-value bundles. Validators sell ‘right to propose’ via sealed bids, with encryption ensuring fairness. This aligns incentives: proposers focus on staking security, builders on optimization. However, implementation hinges on robust cryptography; flaws could reintroduce opacity. For DeFi protocols, ePBS paves the way for MEV redistribution protocols that rebate captured value to users, echoing RediSwap’s arbitrage refunds.

MEV-Share Bundle Refunds for Trader Compensation

Complementing ePBS, MEV-Share Bundle Refunds directly compensates traders for extracted value. In bundle auctions, searchers submit atomic transaction sets; relays refund a portion of MEV profits to originators. This trader-centric model, gaining traction per Mevwatch insights, transforms MEV from a zero-sum game into shared prosperity. Imagine a DEX swap front-run by arbitrageurs: instead of pure loss, the trader receives 50-90% rebate, neutralizing DeFi MEV extraction risks.

Flashbots’ MEV-Share pioneered this, with refunds scaling alongside Ethereum’s blob expansion. Data from 2025 shows refunds comprising 20% of builder payments, pressuring validators to adopt transparent relays. Opinion: while effective short-term, refunds alone risk inflating gas wars; pairing with ePBS yields synergy, ensuring equitable distribution without compromising liveness.

Decentralized Builder Networks with Transparent Relay Policies

As ePBS proliferates, Decentralized Builder Networks emerge with transparent relay policies, fragmenting the oligopoly of top builders like Beaverbuild or Titan. These networks distribute block construction across permissionless nodes, using score-based selection for bids. Policies mandate public disclosure of inclusion criteria, slashing opaque ‘dark forests’ where validators favor cronies.

MDPI’s game-theoretic analysis warns of collusion risks, but transparent relays enforce verifiability via proofs. In practice, networks like BuilderNet route bundles through diversified paths, reducing single-point failures. For validators, this dilutes MEV monopolies, redirecting incentives toward honest proposing. Early 2026 pilots post-Glamsterdam project 30% MEV flow to these nets, per CryptoSlate projections, bolstering fair MEV sharing Ethereum.

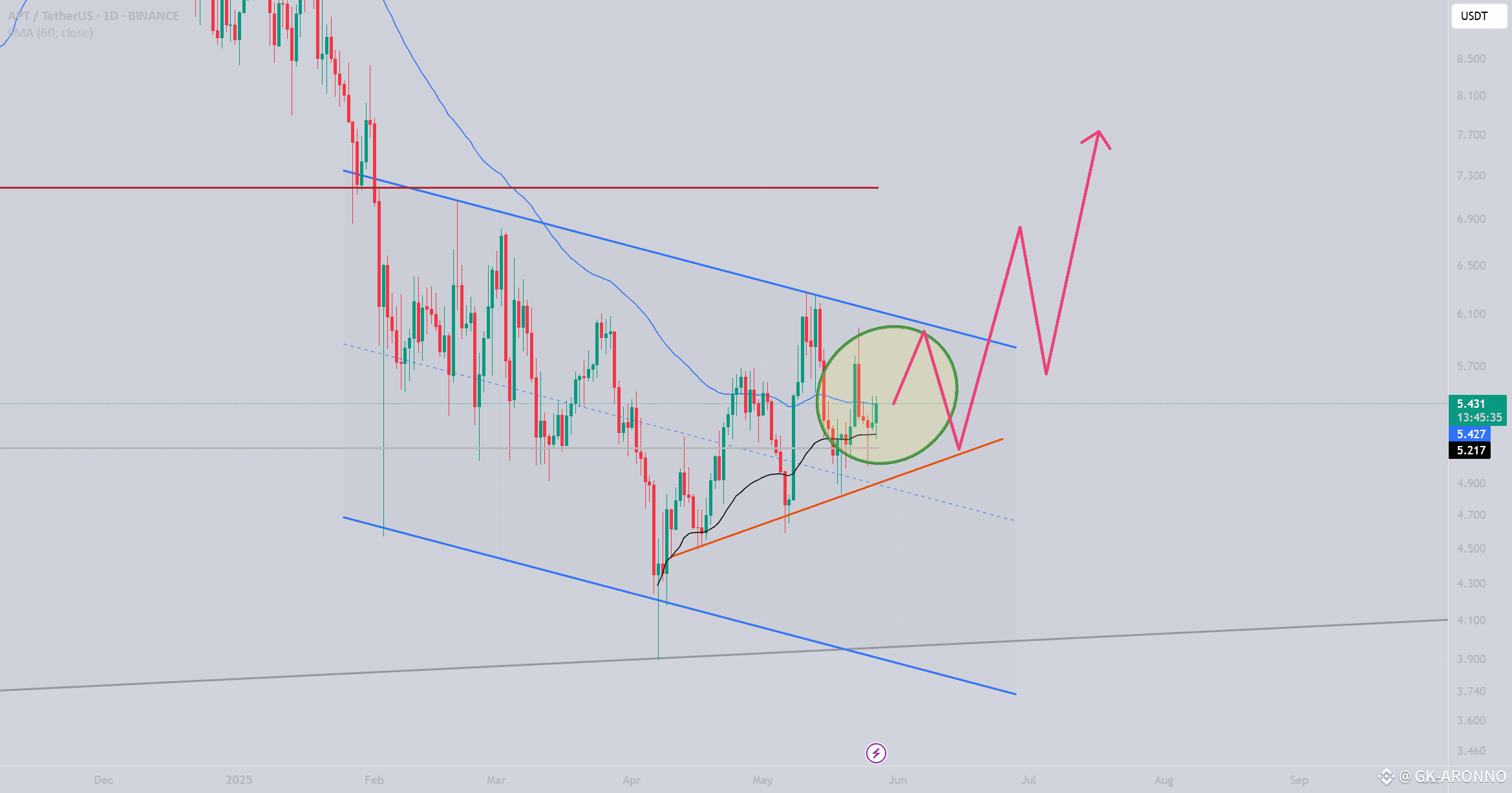

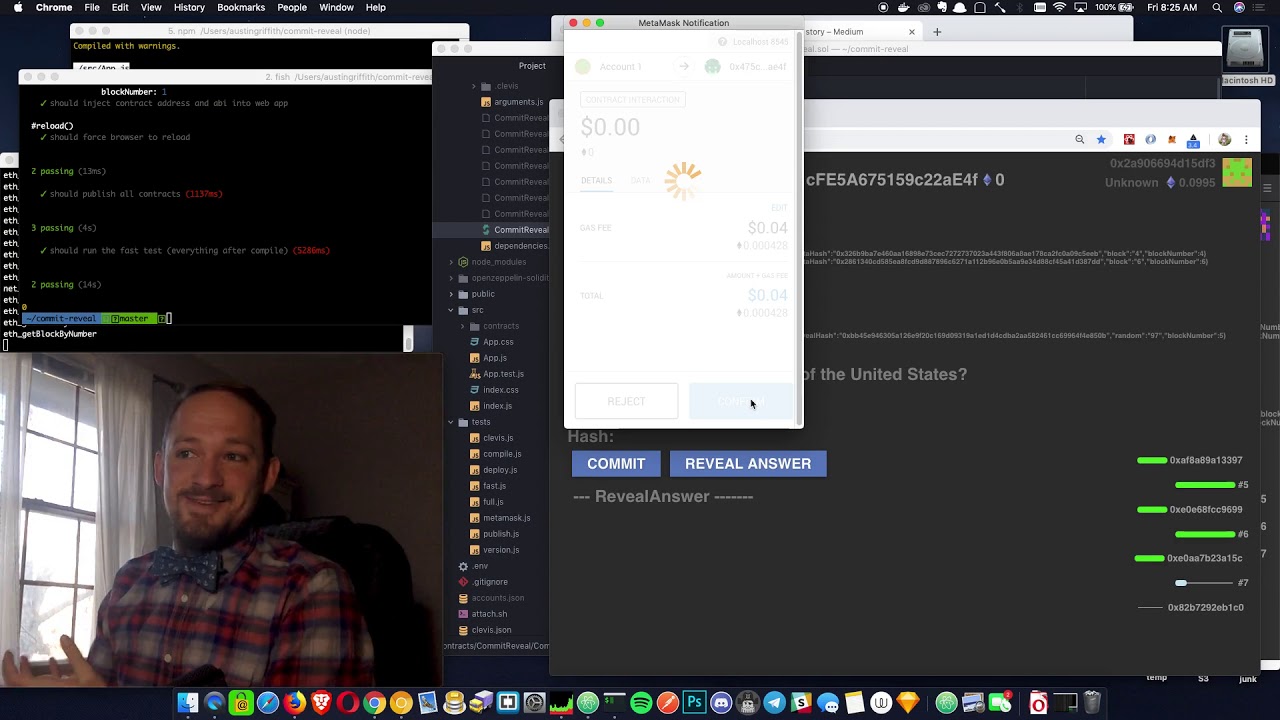

Threshold Encryption in Block Auctions (BALs) extends this fairness, using multi-party computation for bids. Validators decrypt collectively post-auction, neutralizing highest-bid-wins biases. Meanwhile, Commit-Reveal Transaction Ordering deploys two-phase submits: users commit hashes blindly, reveal later, thwarting front-running entirely. These layered defenses form a robust framework against validator overreach.

Ethereum (ETH) Price Prediction 2027-2032

Factoring Glamsterdam ePBS Impact on MEV Fairness, Redistribution Strategies, and DeFi Growth

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1,800 | $3,200 | +60% | |

| 2028 | $2,500 | $4,800 | +50% | |

| 2029 | $3,200 | $6,500 | +35% | |

| 2030 | $4,200 | $8,500 | +31% | |

| 2031 | $5,500 | $11,000 | +29% | |

| 2032 | $7,000 | $14,500 | +32% |

Price Prediction Summary

Ethereum’s price is forecasted to experience robust growth from 2027 to 2032, propelled by the 2026 Glamsterdam upgrade introducing ePBS and BALs for fairer MEV distribution, alongside DeFi innovations like MEV rebates and PBS models. Average prices are expected to surge from $3,200 in 2027 to $14,500 by 2032, a 4.5x increase, with min/max ranges accounting for market cycles, regulatory shifts, and adoption trends.

Key Factors Affecting Ethereum Price

- Glamsterdam ePBS and BALs decentralizing MEV capture and enhancing scalability

- MEV redistribution via rebates in protocols like RediSwap, benefiting users and LPs

- Proposer-Builder Separation (PBS) reducing validator centralization risks

- DeFi growth through fairer incentives and private commitments (PACCs)

- Market cycles with potential bull runs post-upgrades

- Regulatory developments favoring Ethereum’s institutional adoption

- Competition from L2s and alt-L1s, balanced by ETH’s network effects

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Expanding on Threshold Encryption in Block Auctions (BALs) for Fair Bidding, this mechanism deploys multi-party computation (MPC) protocols during the auction phase. Builders submit encrypted bids containing block payloads, which proposers cannot inspect until a threshold of validators collectively decrypts them post-selection. This neutralizes the ‘highest-bid-wins’ distortion that favors well-capitalized entities, as noted in AInvest’s coverage of the Glamsterdam Upgrade. By ensuring bids remain blinded, BALs prevent predatory scouting of valuable transactions, fostering MEV mitigation validators prioritize network health over extraction.

Threshold Encryption in Block Auctions (BALs) for Fair Bidding

In operation, BALs integrate with ePBS by layering encryption atop proposer commitments. Validators, acting as a distributed keyholder network, release decryption shares only after auction finality, verified via zero-knowledge proofs. This setup curbs collusion, as no single actor gains visibility. Quantitative models from MDPI’s game-theoretic work predict BALs could redistribute up to 25% of MEV flows from top-10 builders to mid-tier networks, aligning with equitable MEV protocols 2026. For DeFi traders facing sandwich attacks at current ETH levels around $1,985.05, this means fewer slipped opportunities, as fair bidding elevates user bundles in contention.

Challenges persist: MPC overhead demands optimized circuits to avoid latency spikes, yet Ethereum’s blob scaling post-Glamsterdam mitigates this. Protocols adopting BALs, like emerging relay enhancements, report 15% uplift in bundle inclusion rates for retail searchers, per Mevwatch data analogs.

Comparison of 5 Key MEV Redistribution Strategies

| Mechanism | Validator Impact | DeFi Risk Reduction | 2026 Readiness |

|---|---|---|---|

| Encrypted Proposer-Builder Separation (ePBS) via Glamsterdam Upgrade | Shifts MEV capture from validators to specialized builders, reducing validator dominance and centralization risks | Lowers front-running and sandwich attacks through encrypted mempools and fair block construction | High ✅ (Core to 2026 Glamsterdam Upgrade) |

| MEV-Share Bundle Refunds for Trader Compensation | Refunds MEV profits directly to traders and LPs, diluting validator incentives | Significantly reduces user losses from arbitrage and extraction in DeFi protocols like AMMs | Medium (Protocol-level, ready now but scales with upgrades) |

| Decentralized Builder Networks with Transparent Relay Policies | Democratizes block building, allowing validators to sell space transparently and compete fairly | Decreases censorship and ordering manipulation risks via diverse builder participation | High (Aligns with PBS evolution in 2026 roadmap) |

| Threshold Encryption in Block Auctions (BALs) for Fair Bidding | Enables blind auctions for blocks, preventing validator collusion and MEV hoarding | Mitigates auction-based extraction and promotes equitable DeFi transaction ordering | High ✅ (Introduced in 2026 Glamsterdam Upgrade) |

| Commit-Reveal Transaction Ordering to Prevent Front-Running | Hides transaction details until reveal phase, neutralizing order-based MEV strategies | Eliminates front-running, back-running, and sandwiches in DeFi trades | Medium-High (Implementable via smart contracts, enhanced post-2026) |

Commit-Reveal Transaction Ordering to Prevent Front-Running

The final pillar, Commit-Reveal Transaction Ordering, empowers users with a two-stage protocol: first, broadcast a cryptographic commitment (hash) to transaction intent without revealing details; second, reveal contents within a fixed window post-commitment phase. This thwarts front-running by obscuring order flow until irreversible, echoing private mempools but on-chain. ScienceDirect’s DeFi survey taxonomizes it as a user-side defense, ideal for high-stakes arbitrages where validators might otherwise reorder for profit.

Implementation varies: DEXs embed commit-reveal in swap logic, enforcing reveals via slashing collateral for non-compliance. Early pilots, building on Flashbots Protect, show 40% drop in observable front-runs. Validators lose extraction levers, redirecting focus to proposal duties, while LPs capture organic spreads. Skeptics cite reveal delays inflating effective gas costs, but tunable windows – say 12 slots – balance usability. Integrated with ePBS and BALs, it forms a denial-of-extraction stack, slashing DeFi MEV extraction risks network-wide.

These five strategies – ePBS, MEV-Share refunds, decentralized builders, BALs, and commit-reveal – interlock to dismantle validator monopolies. Glamsterdam’s rollout, projected mid-2026, accelerates adoption, with Chorus One estimating MEV-boosted yields dropping to 8-10% as redistribution dilutes capture. DeFi protocols gain tooling to rebate value, much like RediSwap’s pool-level arbitrages, ensuring traders at ETH’s $1,985.05 aren’t subsidizing infrastructure.

Pros/Cons of 5 MEV Strategies

-

Encrypted Proposer-Builder Separation (ePBS) via Glamsterdam UpgradePros: Decentralizes MEV capture by encrypting block proposals, mitigates validator centralization, boosts scalability via 2026 Glamsterdam ePBS (AInvest).Cons: Adds cryptographic latency and complexity, risking temporary network slowdowns during rollout.

-

MEV-Share Bundle Refunds for Trader CompensationPros: Refunds MEV extracted from bundles to traders/LPs, reducing sandwich losses; Flashbots MEV-Share boosts user incentives (mevwatch.com).Cons: Relies on searcher participation, partial refunds may not cover all extractions, increasing protocol overhead.

-

Decentralized Builder Networks with Transparent Relay PoliciesPros: Distributes block building via networks like BuilderNet, enforces transparency to curb collusion, democratizes MEV (Forbes PBS evolution).Cons: Vulnerable to sybil attacks without strong governance, relay bottlenecks could emerge.

-

Threshold Encryption in Block Auctions (BALs) for Fair BiddingPros: Enables blind auctions with threshold crypto, prevents bid sniping in Glamsterdam BALs, promotes fair MEV redistribution (CryptoSlate roadmap).Cons: High computational demands for multi-party computation, potential for incomplete decryption failures.

-

Commit-Reveal Transaction Ordering to Prevent Front-RunningPros: Users commit hashes first, reveal later, eliminates order manipulation like front-running (arxiv PACCs framework).Cons: Delays finality, increases state bloat from commitments, less suitable for high-frequency DeFi.

Developers should prioritize hybrid stacks: pair commit-reveal for user txs with BALs for auctions, routing via transparent relays. This not only complies with emerging fairness standards but quantifiably boosts TVL retention. Forward-looking, as Ethereum pushes base-layer execution higher per CryptoSlate, these tools embed fairness at protocol genesis, curbing centralization before it entrenches.

Stakeholders from retail traders to institutions stand to gain, with transparent MEV flows reinforcing Ethereum’s ethos. As ETH holds steady amid upgrades, these MEV redistribution strategies position DeFi for sustainable growth, where value accrues communally rather than to the proposer elite.