Maximal Extractable Value (MEV) is at the heart of DeFi’s most heated debates. The question isn’t whether MEV exists – it’s about what kind of extraction is healthy for the ecosystem, and what crosses the line into exploitation. To keep DeFi sustainable, we need to draw a clear distinction between productive MEV and parasitic MEV, then take action to promote one while minimizing the other.

Productive MEV: The Invisible Hand That Stabilizes Markets

Productive MEV refers to activities that enhance market efficiency, liquidity, and protocol health. Think about arbitrageurs who spot price discrepancies across DEXs and act quickly to close those gaps. Their trades bring prices back in line, benefiting all users by reducing slippage and improving price discovery. Similarly, timely liquidations on lending protocols serve a critical function: they prevent undercollateralized positions from jeopardizing the protocol’s solvency, protecting both lenders and borrowers from systemic risk.

This kind of extraction is symbiotic – it rewards those who provide real value to the system while making DeFi safer and more robust for everyone else. In fact, without these actors, many protocols would be more volatile or outright dangerous to use.

Parasitic MEV: Extraction That Erodes Trust and Efficiency

The flip side is parasitic MEV. Here, extraction comes at the direct expense of regular users. Front-running – where a validator or searcher jumps ahead of your trade to profit from your information – is a classic example. Sandwich attacks are even worse: an attacker places trades before and after yours to squeeze out profit, leaving you with a worse execution price.

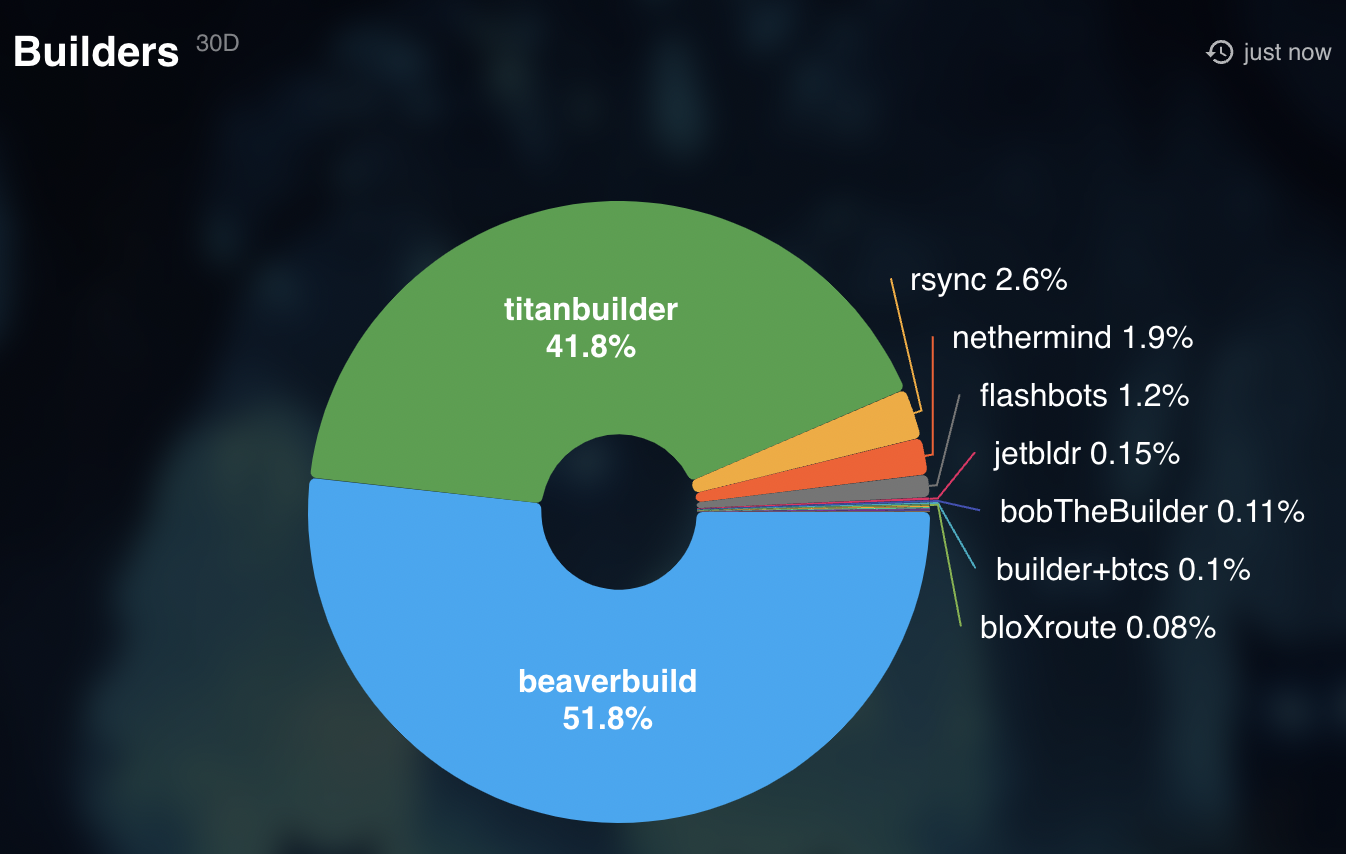

This isn’t just unfair – it actively damages the user experience and makes DeFi less attractive for newcomers. Worse yet, as larger validators gain more resources to exploit these opportunities, we risk creeping centralization that undermines blockchain’s core principles.

Key Differences: Productive vs. Parasitic MEV in DeFi

-

Parasitic MEV exploits users: Front-running and sandwich attacks on DEXs (e.g., Uniswap) allow malicious actors to profit by manipulating transaction order, often increasing costs for regular users.

-

Parasitic MEV undermines trust and decentralization: Repeated exploitative practices can lead to user distrust and centralization, as larger validators or miners (such as those using Flashbots) have more resources to capture MEV, potentially crowding out smaller participants.

Current Solutions: Fighting Parasitic Extraction Without Killing Market Efficiency

The good news? The industry isn’t standing still. Protocols are experimenting with ways to curb harmful forms of MEV without stifling productive activity:

- FIFO transaction ordering: Ensures transactions are processed in the order received, limiting front-running opportunities.

- Private mempools: Keep transaction details hidden until finalized so attackers can’t easily target victims.

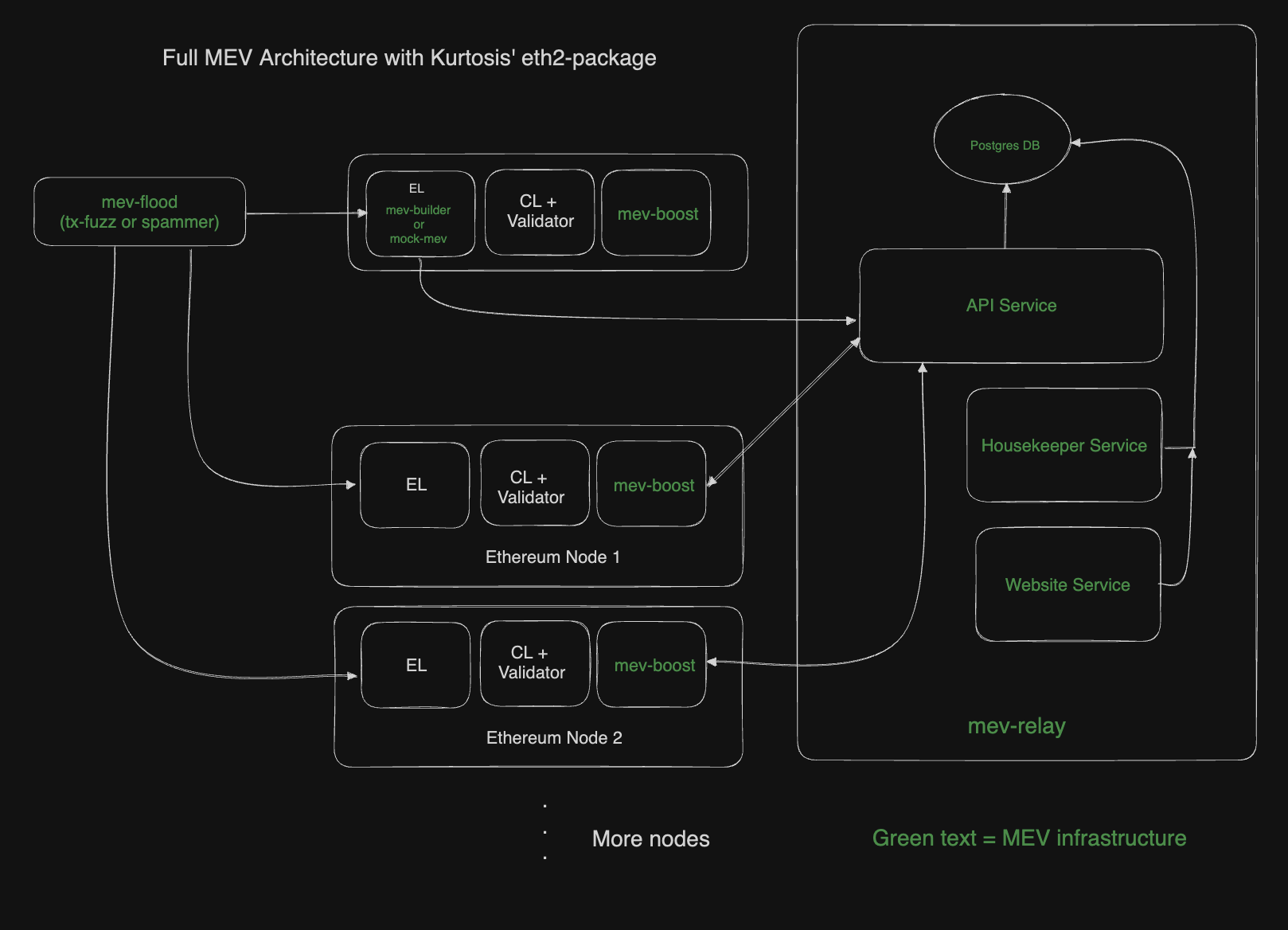

- MEV-sharing tools like Flashbots: Allow for transparent auctioning of block space so searchers compete fairly rather than relying on predatory tactics.

The goal isn’t zero extraction but smarter extraction – rewarding those who stabilize markets while closing loopholes that enable exploitation.