In today’s DeFi ecosystem, with Ethereum holding steady at $2,417.78 amid a 24-hour dip of $270.55, Maximal Extractable Value (MEV) remains a contentious force. Once viewed as a parasitic tax on transactions, estimated at $1.3 billion annually on Ethereum, MEV extraction through tactics like sandwich attacks and transaction reordering has prompted a paradigm shift toward Maximal Value Redistribution (MVR). This evolution prioritizes MEV redistribution strategies that channel profits back to users, validators, and protocols, fostering fairer MEV sharing in DeFi. Drawing from recent innovations like Mevolaxy’s pivot to MEV staking and MEV Blocker’s 90% rebates, MVR promises to mitigate the hidden costs that erode user trust and inflate gas fees.

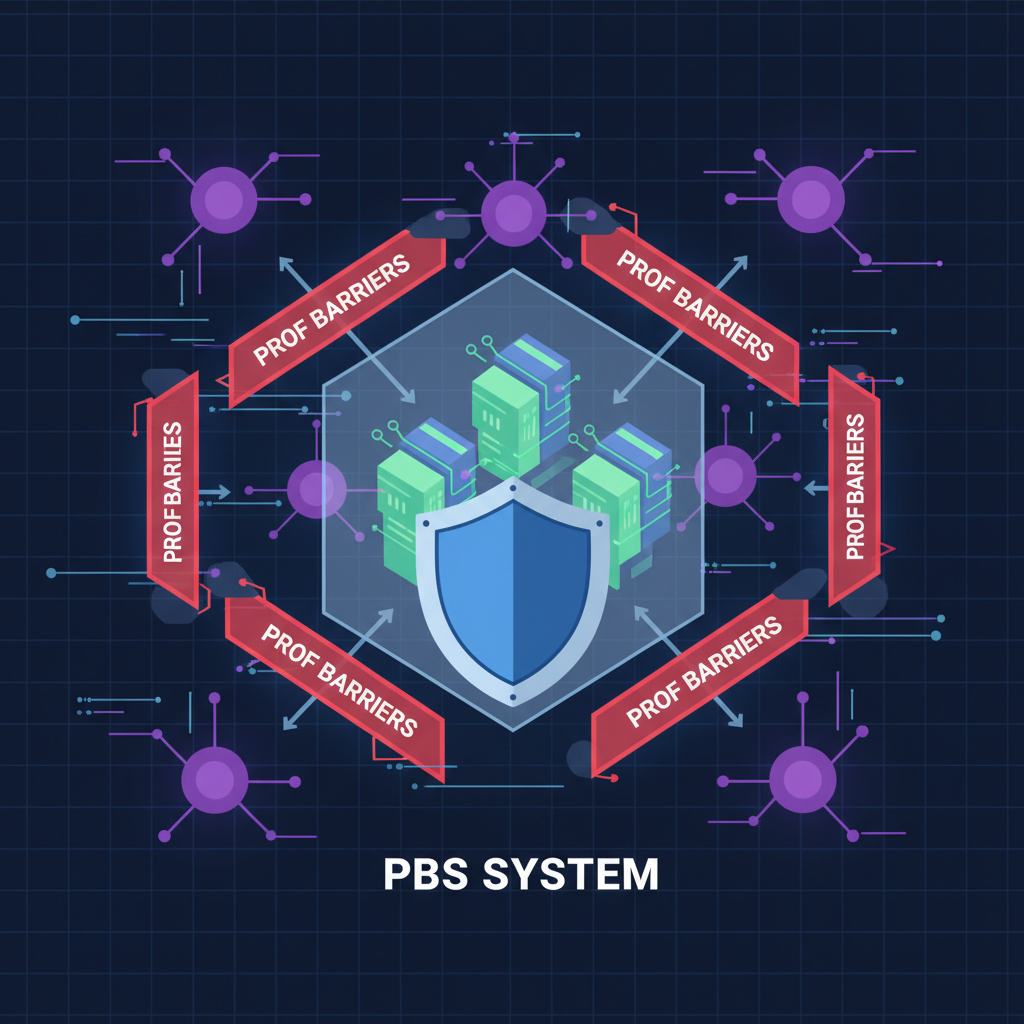

The transition from unchecked MEV capture to structured Maximal Value Redistribution (MVR) addresses core inefficiencies. Traditional MEV, as detailed in Arkham Research’s 2025 guide, empowers searchers and builders to profit by manipulating block contents. Yet, as Ethereum’s Proposer-Builder Separation (PBS) matures, protocols are redesigning incentives for fair MEV accrual models. Recent developments underscore this urgency: Protected Order Flow (PROF) systems curb harmful manipulations, while regulatory proposals like a 0.5% MEV tax warn of potential 45% TVL drops. MVR strategies, prioritized by 2025 adoption in Ethereum PBS, restaking ecosystems, and stake-weighted models, offer a proactive blueprint.

Proposer-Builder Separation (PBS) with Stake-Weighted Tips: Democratizing Block Profits

At the forefront of stake-weighted MEV distribution, Proposer-Builder Separation (PBS) with stake-weighted tips rearchitects MEV flows. In PBS, proposers select bundles from builders without directly extracting value, relying instead on tips proportional to staked ETH. This mechanism, gaining traction post-EIP-4844, aligns incentives by rewarding larger stakes with higher tip shares, theoretically reducing centralization risks compared to pure auctions. Empirical data from MEV-Boost shows builders capturing over 90% of tips, but stake-weighting introduces fairness: validators with modest stakes still accrue value based on network participation. Critics argue it favors whales, yet in restaking contexts like EigenLayer, it bolsters security while redistributing via AVS rewards. For protocol designers, integrating PBS tips into MVR frameworks enhances liquidity without front-running losses.

MEV Rebate Pools for Transaction Users: Turning Extraction into User Rewards

MEV Rebate Pools for Transaction Users represent a direct assault on the ‘hidden tax’ narrative. By pooling extracted MEV and refunding portions as gas rebates or tokens, protocols like those using Order Flow Auctions (OFAs) transform adversarial searchers into ecosystem benefactors. MEV Blocker’s model, refunding up to 90% of builder rewards, exemplifies this: users submit bundles privately, evading sandwiches, and receive rebates post-inclusion. In 2025, adoption surged with DeFi TVL stabilizing despite ETH at $2,417.78, as rebates lower effective costs by 20-30%. This MEV sharing DeFi approach not only boosts retention but also incentivizes high-volume trading. However, sustainability hinges on pool governance; unchecked emissions could dilute value, underscoring the need for capped distributions tied to protocol revenue.

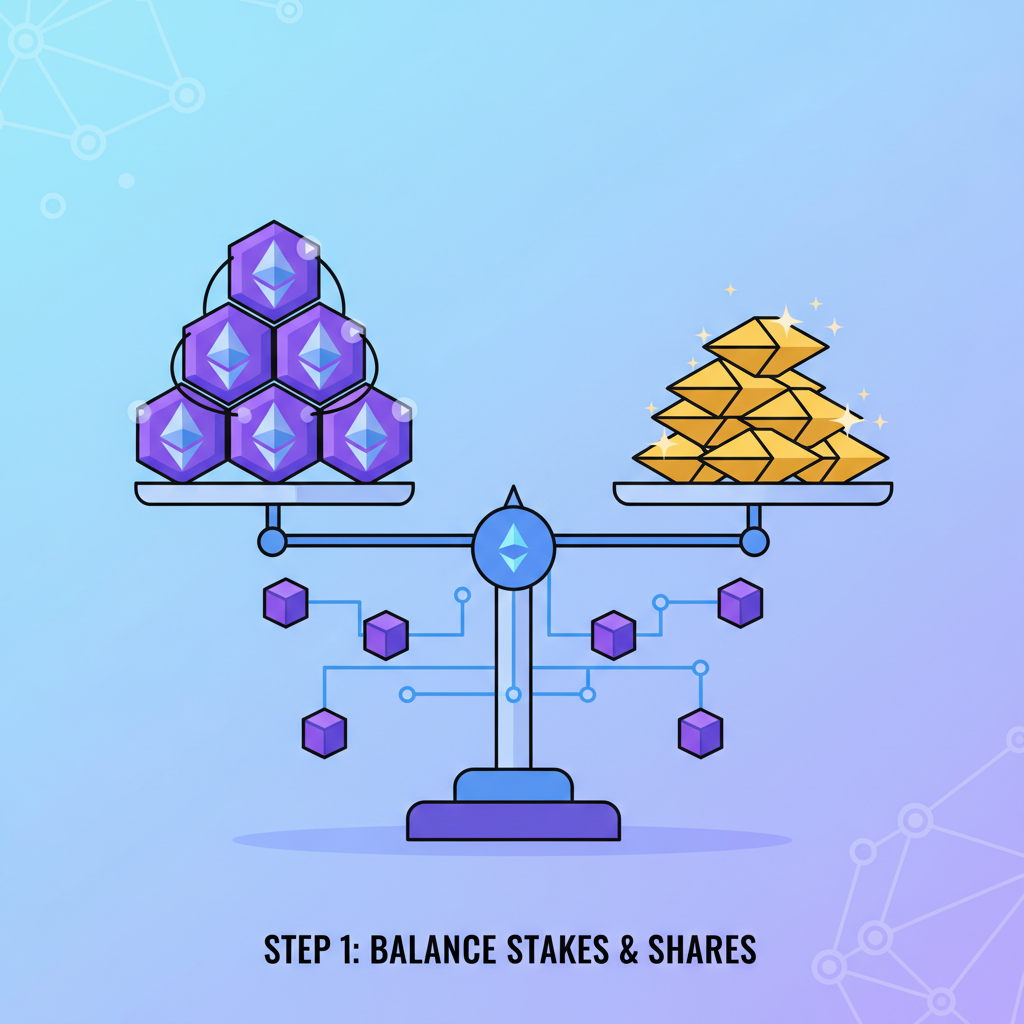

Explore how MEV rebates reshape user incentives Validator Consortium MEV Sharing Protocols elevate MVR through collective bargaining. Groups of validators pool MEV opportunities, distributing proceeds via predefined shares often weighted by uptime or stake delegation. Unlike solo staking, consortia like those in Flashbots’ ecosystem mitigate ‘solo staker exclusion, ‘ where small operators miss bundles. 2025 data reveals consortia capturing 15% more MEV than independents, with shares funneled into community treasuries for DeFi grants. This model thrives in PBS environments, where builders compete transparently, and restaking amplifies reach. Opinionated take: while empowering mid-tier validators, consortia risk cartelization if entry barriers rise; transparent on-chain audits are non-negotiable for true fair MEV accrual models. These initial strategies lay the groundwork for broader MVR adoption, intertwining economic incentives with Ethereum’s maturing infrastructure. Building on these foundations, the remaining strategies push MVR toward systemic resilience, particularly as Ethereum navigates its current price of $2,417.78 and the regulatory headwinds of potential MEV taxes. Restaking-Integrated MVR for EigenLayer Actively Validated Services (AVSs) represents the pinnacle of stake-weighted MEV distribution, layering MEV sharing atop restaked ETH. EigenLayer users restake LSTs to secure AVSs, earning MEV sliced from PBS bundles and redistributed as AVS-specific rewards. With over $15 billion restaked by late 2025, this model captures MEV from DeFi lanes like oracles and bridges, funneling 30-50% back to restakers proportionally. It excels in MEV sharing DeFi by tying value to network security: higher MEV boosts slashing-resistant yields. Unlike siloed staking, restaking amplifies MVR through composability; AVS operators bid for bundles, sharing tips stake-weightedly. Challenges persist in slash coordination, but innovations like PROF integration shield against toxic MEV. Blunt assessment: EigenLayer’s approach scales MVR elegantly, yet over-reliance on restaking concentrates power; diversified AVS designs are essential to avert systemic chokepoints. Guide for developers on MEV redistribution protocols Implementing these strategies demands deliberate protocol design. Consider a step-by-step path for restaking MVR rollout. Across Ethereum’s ecosystem at $2,417.78, these Top 5 strategies-Proposer-Builder Separation with stake-weighted tips, MEV rebate pools, validator consortia, governance-driven burns, and restaking-integrated MVR-signal a maturing DeFi paradigm. Maximal Value Redistribution (MVR) reframes MEV from extractive zero-sum games into collaborative growth engines. Protocols adopting them early, amid restaking booms and rebate surges, position for sustained TVL amid regulatory scrutiny. Validators gain predictable shares, users slash costs, and networks fortify security. The path forward hinges on transparent execution: audit consortia, cap rebate emissions, and evolve governance beyond token-weighted votes. As MEV evolves, so does DeFi’s promise of true economic equity. Comparison of Top 5 MVR Strategies

Strategy

Adoption

Pros

Cons

PBS Stake-Weighted Tips

**High 🔥**

Fair tips ✅

Whale bias ❌

MEV Rebate Pools

**Medium ⚡**

User rebates 💰

Pool dilution 📉

Validator Consortia

**Rising 📈**

Scale 🔄

Cartel risk ⚠️

Governance MEV Burn

**Emerging 🌱**

Deflationary tokenomics 📉💎, counters inflation, quadratic voting for fairness

Vote capture by whales 🐋

Restaking MVR

**High in EigenLayer 🚀**

Security boost 🛡️

Complexity 🧩

Restaking-Integrated MVR for EigenLayer AVSs: Layered Security and Yield