In the high-stakes arena of Layer 1 blockchains, MEV revenue sharing L1 mechanisms have emerged as a pivotal force reshaping staker incentives by 2026. What began as a validator-exclusive windfall is evolving into blockchain staker MEV redistribution strategies that promise broader participation and fortified network security. Largest staking pools, as highlighted in analyses from reverie. ooo, already outpace solo operators in capturing Miner Extractable Value, yet the push for equitable models signals a maturing ecosystem where stakers stand to reap substantial rewards.

Ethereum’s Push Toward Enshrined Fairness

Ethereum leads with ambitious upgrades like ePBS under EIP-7732, embedding proposer-builder separation into the consensus layer. This shift aims to democratize block construction, but simulations reveal a stark risk: profit Gini coefficients ballooning from 0.1749 to 0.8358, concentrating gains among elite builders. From a strategic vantage, this underscores the tension in L1 rev-share models; while ePBS curbs some MEV abuses, it risks birthing a new oligarchy unless paired with robust redistribution protocols.

Complementing this, Primev’s MEV-commit protocol, live since late 2024, equips validators with preconfirmation bids averaging 0.02 ETH per block. This peer-to-peer system mirrors MEV-Boost yields, injecting reliable extra income into staking pools. For stakers, it translates to compounded returns, aligning short-term tactics with long-term decentralization goals. Ethereum’s dual-pronged approach exemplifies how MEV equitable distribution DeFi can mitigate zero-sum extraction dynamics noted in Binance’s deep dives.

Ethereum Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:ETHUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

To annotate this ETHUSDT chart in my balanced technical style, start by drawing a prominent downtrend line connecting the swing high on 2026-01-05 at $3,800 to the swing high on 2026-02-10 at $2,500, extending it forward to project potential support near $1,800 by late February. Add horizontal support at $1,700 (recent lows) and $2,000 (prior bounce zone), with resistance horizontals at $2,800 and $3,200. Use fib retracement from the major decline start (2026-01-01, $4,200) to low (2026-02-15, $1,700) for 38.2% ($2,500) and 50% ($2,950) levels. Mark volume spikes with callouts on down days, MACD bearish crossover with arrow_mark_down around 2026-02-01. Rectangle the consolidation zone from 2026-02-05 to 2026-02-15 between $1,900-$2,300. Vertical line for breakdown on 2026-02-12. Entry long above $2,000 with stop below $1,700, target $2,800.

Risk Assessment: medium

Analysis: Bearish trend intact but oversold signals and volume divergence suggest possible bounce; MEV positives provide fundamental floor, but technicals dominate short-term

Market Analyst’s Recommendation: Scale in longs on support tests with stops, avoid aggressive shorts in oversold territory; monitor for break above $2500

Key Support & Resistance Levels

📈 Support Levels:

-

$1,700 – Strong multi-test low from mid-February, volume capitulation zone

strong -

$2,000 – Intermediate support from early February bounce

moderate

📉 Resistance Levels:

-

$2,500 – Recent swing high, 38.2% fib retracement

moderate -

$3,200 – Prior consolidation ceiling from late January

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$2,100 – Bounce from $2000 support with volume confirmation, aligns with minor uptrend

medium risk -

$1,750 – Deep dip buy near strong support $1700, high reward if reversal

high risk

🚪 Exit Zones:

-

$2,800 – Profit target at resistance confluence with fib 50%

💰 profit target -

$1,650 – Stop loss below key support to limit downside

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: decreasing on downside rallies, spikes on breakdowns

Bearish divergence: volume highest on declines, fading on bounces suggesting weakening sellers

📈 MACD Analysis:

Signal: bearish crossover persisting

MACD line below signal with histogram contracting but negative, confirming downtrend momentum

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Flashbots’ early eth2 explorations predicted MEV would supercharge yields, a prophecy now materializing amid these innovations. Stakers ignoring these shifts forfeit a slice of the pie, as pools leveraging MEV-commit report yields edging 20% above baseline staking.

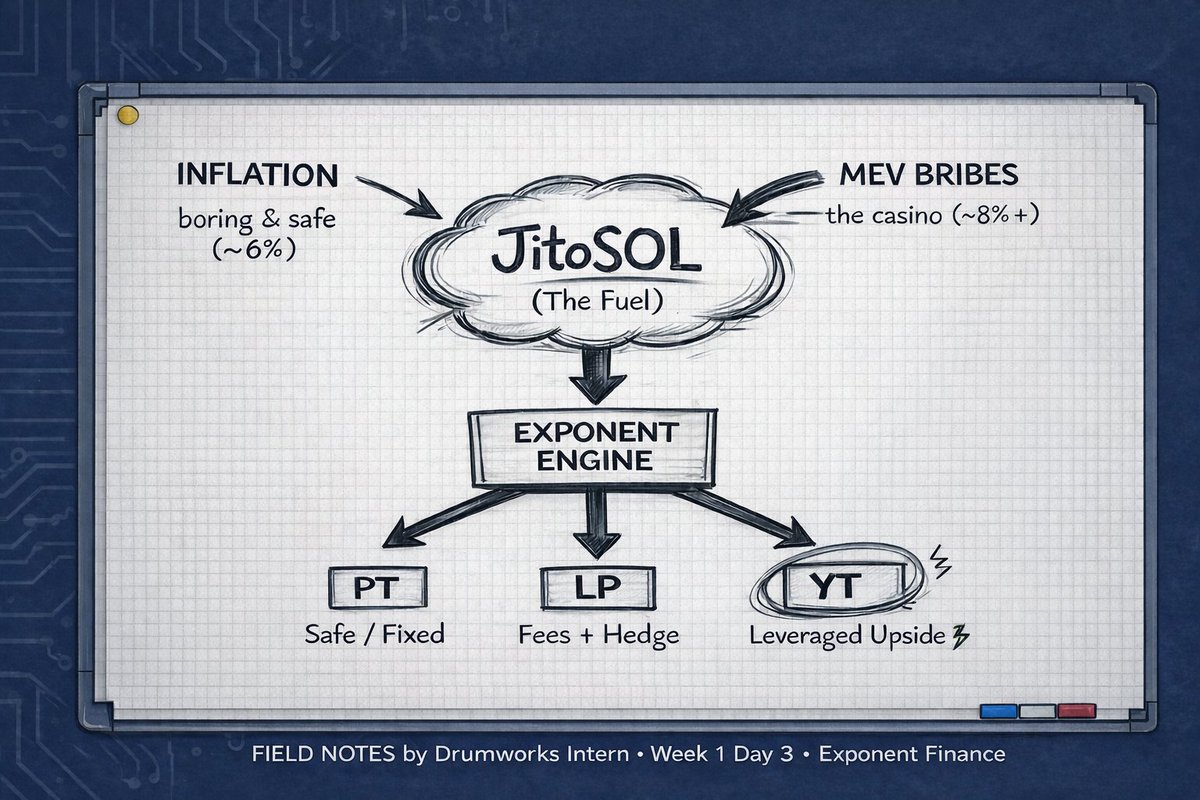

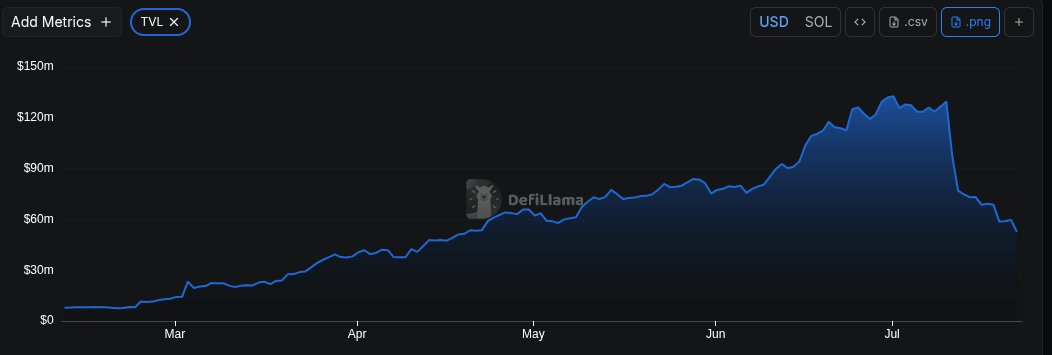

Solana’s High-Throughput Validator Windfalls

Solana flips the script with Jito’s bundle auction system, channeling MEV directly to validators via tips. In 2025 alone, this funneled 4,252,425 SOL, or $543.45 million, into proposer coffers, mimicking high-frequency trading economics. This model thrives on Solana’s blistering throughput, where staker MEV benefits 2026 accrue swiftly but unevenly, favoring infrastructure-heavy operators.

| Blockchain | MEV Mechanism | 2025 Revenue to Validators/Stakers | Key Benefit |

|---|---|---|---|

| Ethereum | ePBS and MEV-commit | ~0.02 ETH/block avg | Preconfirmations boost yields |

| Solana | Jito Bundles | 4.25M SOL ($543M) | Direct tip flows |

| Unichain | Flashblocks TEE | 30% MEV loss reduction | Latency arbitrage curb |

| Avalanche | Dynamic Fee Splits | Up to 20% to treasury | Governance flexibility |

This table distills the divergence: Solana prioritizes velocity, delivering immediate MEV revenue sharing L1 to active validators, while stakers in pools capture proportional shares. Critics, echoing NBER’s Working Paper 32949, warn of systemic risks if extraction spirals, yet Solana’s scale validates the potency of unfiltered revenue passthrough.

Emerging Paradigms in Unichain and Avalanche

Unichain’s verifiable block building, powered by Flashbots and TEEs, introduces 200-ms Flashblocks to slash MEV latency. Targeting 1-second blocks with sub-200ms aspirations, it projects 30% fewer arbitrage losses than Ethereum, fostering a fairer arena for LPs battered by real-time discrepancies, as Chorus One details. Stakers benefit indirectly through stabilized DeFi yields, a subtle yet profound blockchain staker MEV redistribution.

Avalanche counters with dynamic subnet fee splits, empowering creators to allocate 20% to treasuries under AIP-47. This governance tweak, amid slight issuance front-loading, maintains deflationary pressure at -0.05% in early 2025. For stakers, it crafts predictable revenue streams, blending MEV mitigation with community-driven economics. Modular MEV insights from Maven 11 highlight cross-chain arbitrage as the next frontier, where these models position Avalanche advantageously.

These L1s collectively signal a paradigm where MEV evolves from validator privilege to staker commonwealth, demanding savvy portfolio allocation amid FCA-noted ecosystem risks.

Stakers attuned to these dynamics can construct portfolios that capture staker MEV benefits 2026 without succumbing to centralization traps. Largest pools, per reverie. ooo’s Ethereum-Cosmos comparison, amplify extraction efficiency, yet discerning operators prioritize protocols blending direct revenue with systemic safeguards. Parallel Research’s deep dive frames MEV as an optimizer of block profits, urging stakers toward pools versed in searchers’ revenue shares via MEV-Share or Geth.

Navigating Centralization Risks in Revenue Models

While Solana’s Jito tips deliver explosive yields-4,252,425 SOL in 2025 alone-economic concentration looms large. NBER’s Working Paper 32949 defines MEV as block-added value summation, but unchecked, it fosters validator dominance akin to ePBS’s projected Gini surge. Ethereum’s MEV-commit counters this with cryptographic preconfirmations, averaging 0.02 ETH per block, distributing gains more evenly than Solana’s tip deluge. Unichain’s TEE-enforced Flashblocks, curbing 30% of arbitrage losses, sidestep front-running pitfalls that incrypted links to REV metrics, protecting LP stability and indirect staker returns.

Avalanche’s fee splits offer governance nuance, routing 20% to treasuries while sustaining deflation at -0.05%. This flexibility echoes Chorus One’s LP challenges, proposing MEV-optimized ordering to preserve DeFi liquidity. Stakers in Avalanche subnets gain from burn mechanics and issuance tweaks under AIP-47, fostering resilient yields amid cross-chain plays detailed in Maven 11’s modular MEV systematization.

Flashbots’ eth2 analysis foresaw MEV yield boosts, now quantifiable: Ethereum pools with MEV-Boost report 15-25% uplifts, Solana validators 2-5x base staking via Jito. Yet FCA research notes ecosystem-wide risks-price discrepancies fueling sandwiches, regulatory scrutiny per Grimmelmann’s $2 billion exploit tally. Prudent stakers diversify, weighting Ethereum for protocol maturity, Solana for throughput alpha, Unichain for latency edges, Avalanche for subnet autonomy.

Portfolio Strategies for MEV-Optimized Staking

Disciplined allocation demands hybrid pools integrating MEV tools. Cosmos-inspired models, where pools proxy extraction, outperform solos; Ethereum’s largest operators echo this, per reverie. ooo. Target 40% Ethereum for ePBS stability, 30% Solana for tip velocity, 20% Avalanche for deflationary tailwinds, 10% Unichain for frontier mitigation. Binance’s zero-sum to collaborative shift underscores proposer-builder relays as staker multipliers, with MEV-Boost proliferating revenue tiers.

Opinion: Pure yield-chasing ignores Binance-noted transitions; true alpha lies in risk-adjusted L1 rev-share models blending direct tips, preconfirms, and loss reductions. Pools ignoring TEEs or auctions forfeit edges, as high-frequency Solana dynamics demand infra investment stakers delegate wisely. Flashbots writings project eth2 MEV doubling base APYs, a 2026 reality for proactive delegators.

Grimmelmann’s regulatory lens flags mitigations as double-edged: curbs like Unichain’s sequencing tame exploits but may stifle innovation. Stakers must audit pool transparency, favoring those disclosing searcher splits and builder auctions. Incrypted’s REV evolution signals metric shifts, rewarding protocols quantifying shared value beyond raw tips.

This mosaic of MEV equitable distribution DeFi empowers stakers as ecosystem stewards. Ethereum’s ePBS refines fairness, Solana unleashes scale, Unichain engineers equity, Avalanche governs inclusivity. Forward-thinkers positioning now-allocating to MEV-proficient pools-harness 2026’s redistribution wave, fortifying portfolios against extraction volatilities while amplifying decentralized security. The MEV commonwealth beckons, rewarding the strategic over the speculative.