In the evolving landscape of decentralized finance (DeFi), one of the most significant shifts is the drive toward MEV redistribution liquidity – a set of mechanisms designed to share Maximal Extractable Value (MEV) with liquidity providers (LPs). Traditionally, MEV has been viewed as a double-edged sword: while it can bring efficiency by closing price gaps and incentivizing market activity, it often comes at a direct cost to LPs and regular users. The latest wave of protocol innovation is challenging this paradigm, aiming to redirect value back to those who supply capital and take on risk.

Why MEV Redistribution Matters for DeFi LP Returns

To understand why fair MEV protocols are gaining momentum, consider the traditional model: when arbitrageurs profit from price discrepancies in an AMM pool, those profits usually come at the expense of LPs through impermanent loss or adverse selection. This dynamic has led to persistent concerns that DeFi yields are unsustainable – especially when MEV extraction is concentrated among miners or sophisticated searchers.

The new generation of protocols turns this narrative on its head. By capturing MEV at the protocol level and redistributing it to LPs, these platforms are not only boosting returns but also making DeFi more resilient against extractive practices. This approach aligns incentives for all participants, fostering a more robust ecosystem where providing liquidity remains attractive even as competition intensifies.

Pioneering Protocols: How MEV Redistribution Works in Practice

KyberSwap’s FairFlow mechanism, for example, has set a new benchmark by redirecting 70% of captured arbitrage profits back to LPs. Built atop Uniswap V4 infrastructure, FairFlow aggregates arbitrage gains and distributes them weekly in dual tokens, no staking required. Early performance data is compelling: the ETH-cbBTC pool on Base saw an annualized return of 21% over 189 hours with FairFlow enabled, compared to just 16% in a standard pool. This clear delta demonstrates how protocol-level MEV capture can translate directly into higher sustainable yields for LPs.

Learn more about KyberSwap’s FairFlow results here.

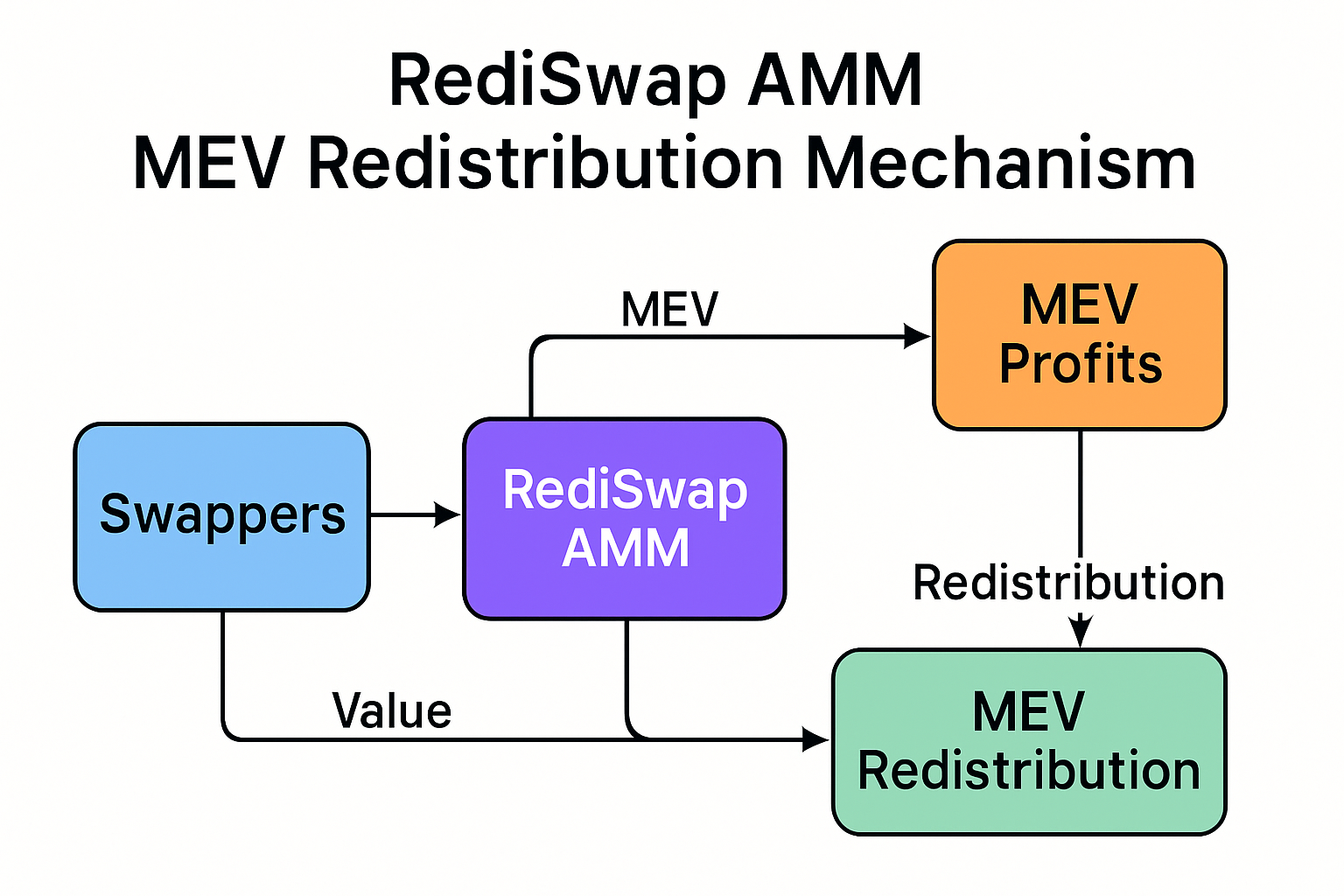

RediSwap, another innovator in this space, deploys an application-level mechanism for Constant Function Market Makers (CFMMs) that manages arbitrage opportunities internally and redistributes profits among both users and LPs. According to recent research, RediSwap achieves better execution than existing solutions in 89% of trades while reducing LP losses due to Loss Versus Rebalancing (LVR) by over 99% in most scenarios. This points toward a future where liquidity provision does not have to be a zero-sum game against sophisticated searchers.

For more technical details on RediSwap’s approach, see their arXiv preprint here.

Key Benefits of MEV Redistribution for DeFi LPs

-

Increased Returns Through MEV Sharing: Protocols like KyberSwap’s FairFlow redirect up to 70% of MEV arbitrage profits back to LPs, boosting annualized returns (e.g., 21% for the ETH-cbBTC pair on Base) compared to standard pools.

-

Reduced Losses from Arbitrage and Rebalancing: RediSwap captures and redistributes MEV at the application level, reducing LPs’ loss-versus-rebalancing (LVR) to under 0.5% in most cases and achieving better trade execution in 89% of scenarios.

-

Mitigation of Impermanent Loss: MEV Capital offers an options-based IL-hedge strategy that lets LPs capture trading fees while hedging against price divergence, protecting returns during volatile market conditions.

-

Enhanced Security and Fairness for LPs: Chainflip integrates MEV mitigation directly into its AMM and governance, using rotating keys and cooldowns to prevent collusion and secure pooled funds, fostering a safer environment for LPs.

-

Alignment of Incentives Across DeFi Ecosystems: MEV redistribution mechanisms help avoid harmful competitive equilibria between staking and lending, ensuring LPs are fairly compensated and encouraging more sustainable liquidity provision across protocols.

Beyond Arbitrage: Hedging Impermanent Loss with Options-Based Strategies

The impact of MEV on DeFi liquidity is not limited solely to arbitrage capture or transaction ordering; impermanent loss remains one of the greatest deterrents for would-be LPs. Addressing this challenge head-on, MEV Capital’s IL-Hedge Liquidity Provider strategy pairs tight-range AMM positions with options contracts that share underlying assets and maturity dates. This combination allows LPs not only to earn trading fees but also hedge against downside risks associated with volatile price moves within pools.

This holistic approach demonstrates that sustainable DeFi yields require both fair profit sharing via MEV redistribution mechanisms and sophisticated risk management tools tailored for capital providers.

Equally noteworthy is the way Chainflip integrates MEV mitigation directly into its protocol design. By embedding a Just-In-Time (JIT) AMM within its State chain runtime and employing a rotating key structure with enforced cooldown periods, Chainflip enhances both security and governance. These features make it significantly harder for any single actor to collude or extract MEV at the expense of LPs, thus reducing systemic risk and improving pooled fund safety. This attention to protocol-level defense is crucial as DeFi scales and the sophistication of MEV strategies continues to evolve.

The Road Ahead: Fair MEV Protocols and the Future of DeFi Sustainable Yields

The momentum behind fair MEV protocols signals a broader paradigm shift for DeFi liquidity. As more platforms adopt transparent, protocol-native mechanisms for capturing and redistributing MEV, the relationship between LPs and value extractors is being fundamentally transformed. Instead of competing against sophisticated searchers or relying on external arbitrageurs, LPs are increasingly positioned as direct beneficiaries of market efficiency improvements.

This trend also dovetails with regulatory scrutiny and industry self-regulation efforts that seek to minimize exploitative behaviors while maximizing ecosystem resilience. By aligning incentives across users, LPs, validators, and developers, MEV redistribution mechanisms help cultivate a healthier market structure, one where sustainable yields are possible without sacrificing fairness or transparency.

What Should DeFi Protocol Designers Consider?

For teams building the next generation of liquidity solutions, several best practices are emerging:

- Transparency: Mechanisms for capturing and redistributing MEV should be open-source and auditable by the community.

- User Experience: Reward distribution must be seamless, ideally requiring no extra staking or complex actions from LPs.

- Risk Management: Integrating options-based hedges or similar tools can further protect LP capital alongside MEV sharing.

- Ecosystem Alignment: Incentive structures should balance rewards across all stakeholders, not just early adopters or insiders.

MEV Redistribution: A New Standard for DeFi Liquidity?

The evidence is mounting: protocols that internalize MEV flows and redistribute them openly are seeing higher retention among liquidity providers and improved yield stability. As highlighted by recent data from KyberSwap’s FairFlow (21% annualized return vs 16% in standard pools) and RediSwap’s dramatic reduction in LVR losses (to under 0.5% of original levels), these innovations aren’t just theoretical, they’re materially impacting returns for everyday participants.

If you’re an LP or protocol designer navigating today’s dynamic markets, understanding how MEV redistribution liquidity works, and how to leverage it, could be key to unlocking more resilient, sustainable yields over time. The future of DeFi will likely be shaped not by who extracts the most value but by who shares it most effectively.