Decentralized finance (DeFi) was built on the promise of open access, transparency, and fair participation. Yet as the ecosystem matured, Maximal Extractable Value (MEV) emerged as both a powerful efficiency driver and a source of deep controversy. MEV refers to the profits that validators or miners can capture by reordering, including, or excluding transactions within a block. While some forms of MEV help correct price inefficiencies, unchecked extraction often undermines user trust and skews incentives away from sustainable network growth.

The MEV Paradox: Efficiency vs. Exploitation in DeFi

In theory, MEV can be harnessed to improve market efficiency by incentivizing arbitrageurs to close price gaps across protocols. However, as highlighted in Galaxy’s analysis, the same mechanisms can also enable predatory tactics like sandwich attacks and front-running, directly harming regular users. This duality has become known as the MEV paradox: the very transparency that enables trustless DeFi also exposes it to sophisticated exploitation.

Recent research and commentary (Medium · Jake Rubin, Finematics) agree that without robust incentive alignment, networks risk devolving into zero-sum games where only insiders benefit. The challenge is clear: how do we steer MEV from a force of extraction toward one of equitable value sharing?

Pioneering Transparent MEV Redistribution Mechanisms

The last year has seen an acceleration in practical solutions designed to realign incentives through transparent MEV redistribution. Let’s examine some leading approaches shaping this new landscape:

Innovative DeFi Projects Pioneering Transparent MEV Redistribution

-

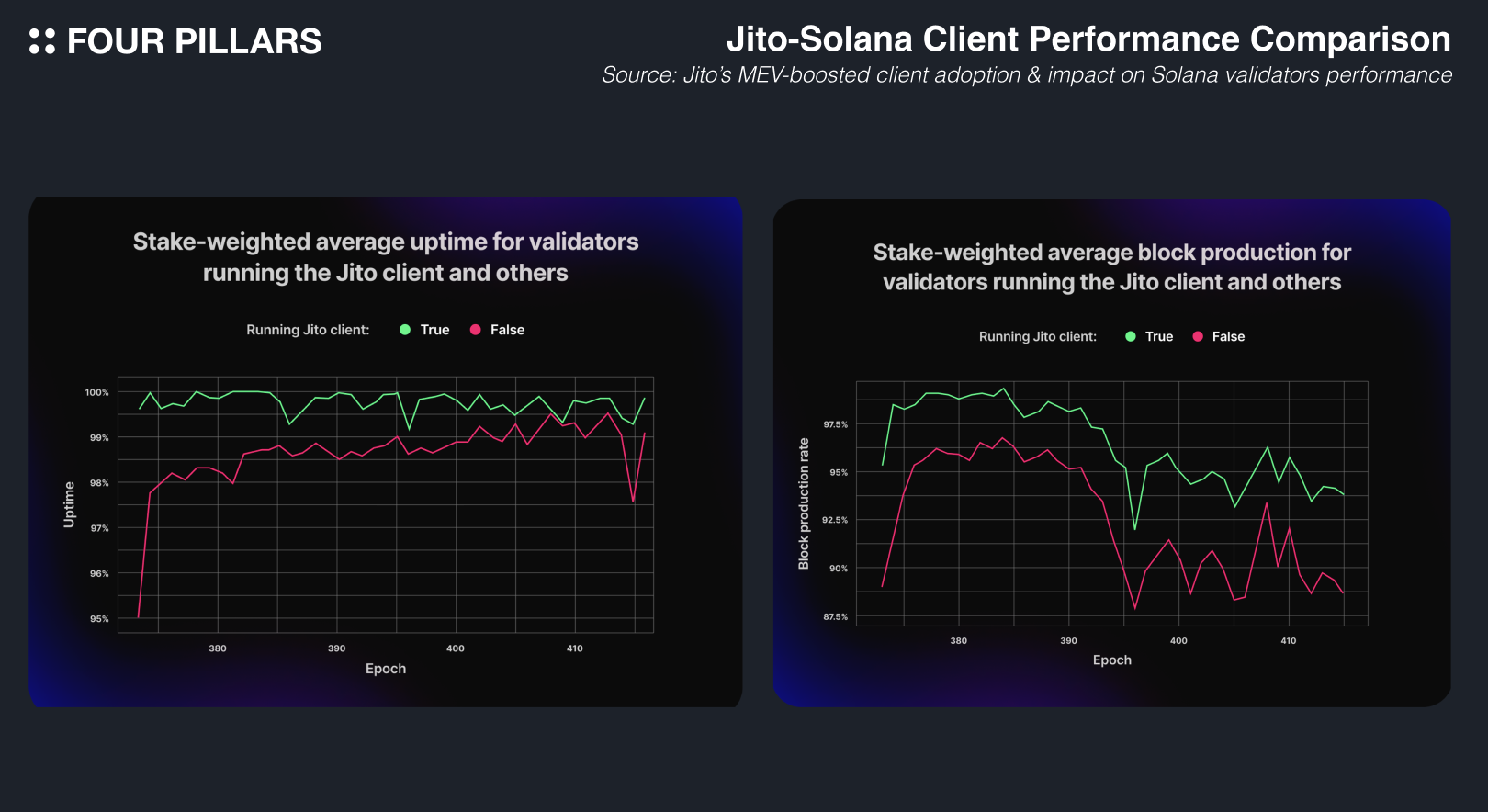

Jito DAO (Solana): In November 2024, Jito DAO proposed allocating 3% of all MEV tips collected by its protocol to the DAO treasury and TipRouter. This transparent redistribution is designed to enhance revenue and support the DAO’s restaking platform, with an estimated annual yield of $22.8 million for the community.

-

Mevolaxy: In August 2025, Mevolaxy shifted from DeFi farming to a transparent MEV staking model. By specializing in sandwich attack strategies, Mevolaxy offers investors a more stable and predictable return, emphasizing transparency in MEV profit sharing.

-

Dextr (Actively Validated Market Maker): Dextr introduced an AVMM that uses low-latency oracles to minimize price impact and disincentivize MEV exploitation. The protocol features a multi-layered insurance model, compensating users affected by MEV, thereby promoting fairness and trust.

-

ZENMEV: ZENMEV developed the Zenbots staking system, allowing users to stake assets and receive a share of redistributed MEV profits. This user-centric approach transforms MEV from a risk into a source of value and transparency for participants.

-

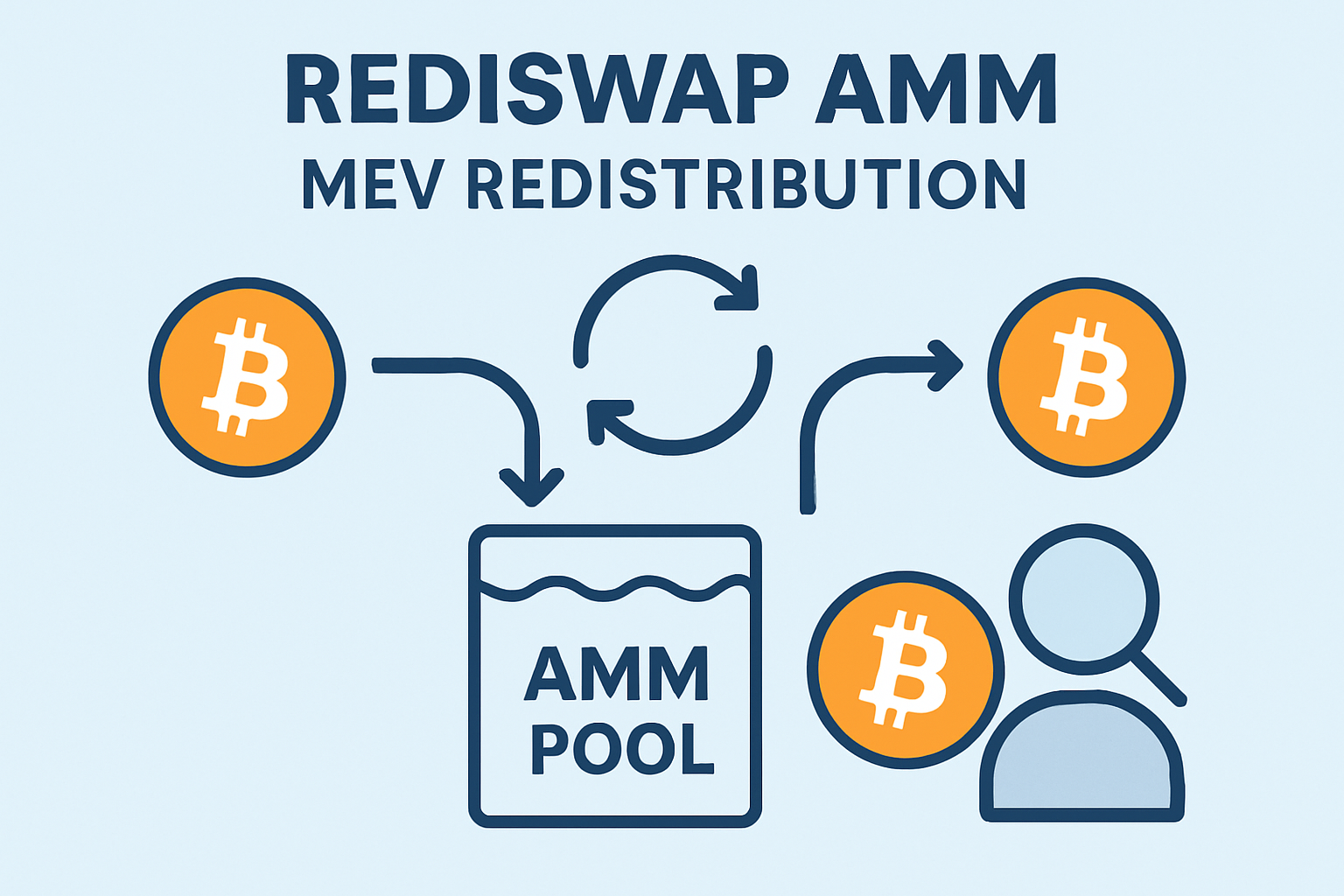

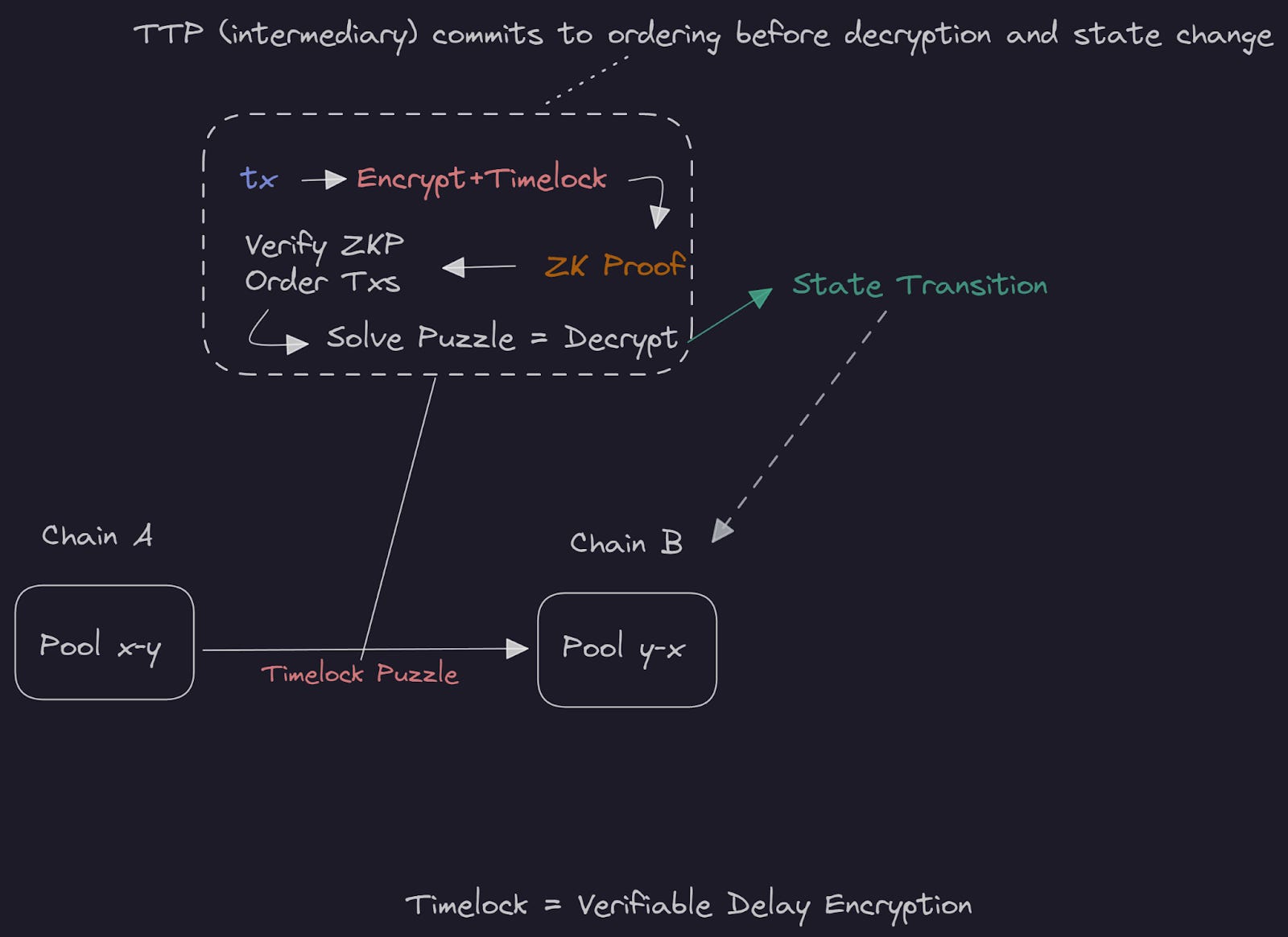

RediSwap Mechanism (Academic Research): RediSwap is an Automated Market Maker (AMM) proposed by researchers to capture MEV at the application level and redistribute it fairly among users and liquidity providers, reducing arbitrage losses and improving trade execution.

-

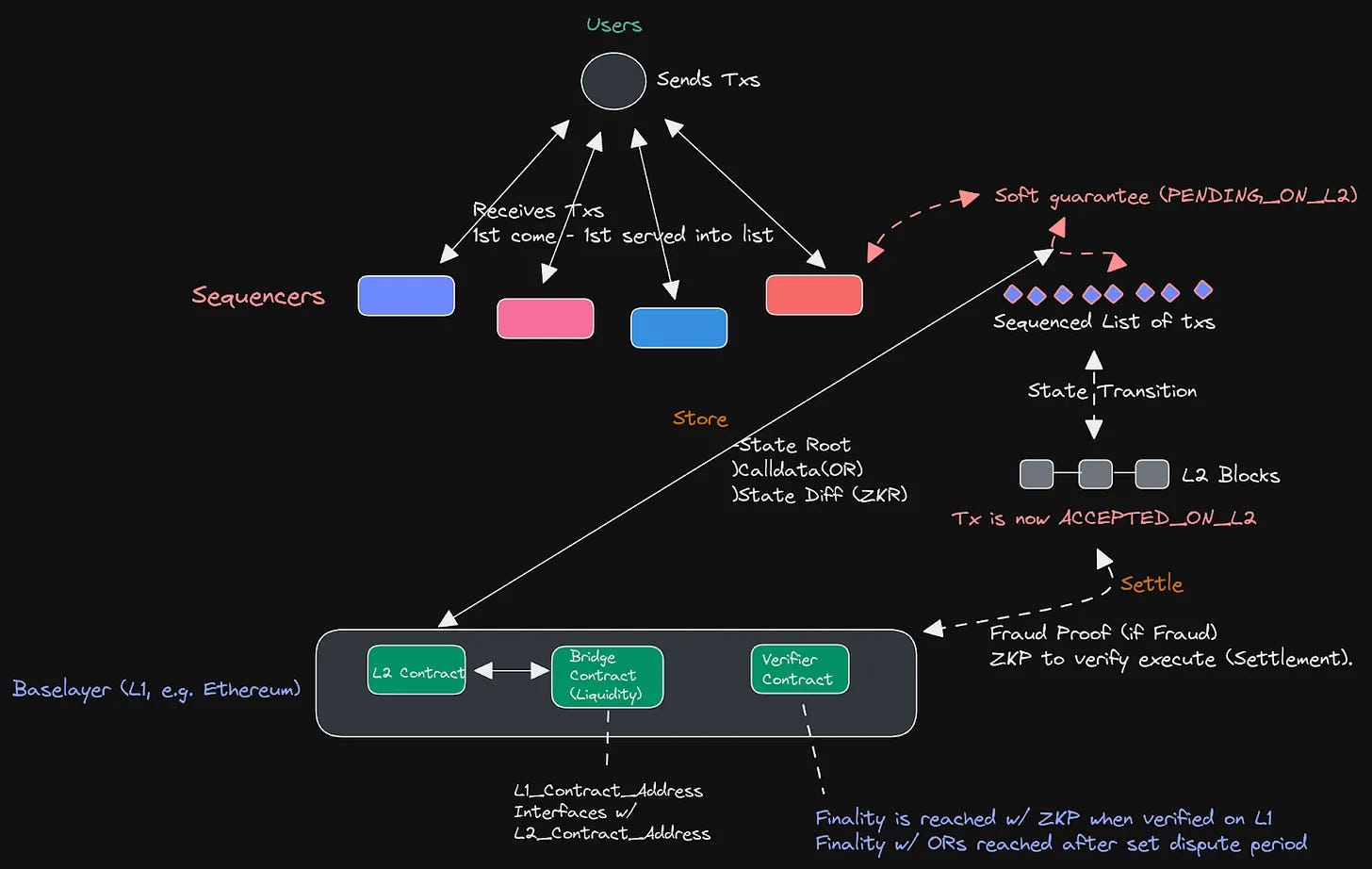

PROF System (Protected Order Flow): PROF is a proposed system that limits harmful MEV in Proposer-Builder Separation (PBS) architectures by enforcing transaction ordering and creating bundles that are profitable for block producers while preventing manipulative ordering.

Jito DAO’s Solana Initiative: In November 2024, Jito DAO proposed allocating 3% of all protocol-collected MEV tips directly to their DAO treasury and TipRouter mechanism. This strategy is projected to generate approximately $22.8 million annually for Jito DAO, supporting both governance and a new restaking platform (source). By routing a portion of extracted value back into community hands, Jito’s model exemplifies how redistribution can fund long-term ecosystem health while maintaining validator incentives.

Dextr’s Actively Validated Market Maker (AVMM): Dextr takes an insurance-backed approach by using low-latency oracles to match trades without slippage, removing much of the traditional arbitrage opportunity for extractors. If users are still impacted by adverse MEV events, a multi-layered insurance pool compensates them directly (source). This not only disincentivizes harmful behaviors but also instills confidence in market fairness.

ZENMEV’s User-Centric Staking Model: ZENMEV introduces Zenbots staking, a system where users stake assets and receive a share of redistributed MEV profits (source). By converting potential losses into direct rewards for participants, ZENMEV reframes MEV as an engine for user empowerment rather than predation.

The Role of Academic Research in Incentive Alignment

Beneath these production-ready systems lies a layer of rigorous academic innovation focused on sustainable incentive alignment in DeFi:

- RediSwap Mechanism: Proposed by researchers on Arxiv (source), RediSwap is an Automated Market Maker (AMM) that internalizes arbitrage opportunities at the application level, capturing value that would otherwise be lost to external actors, and redistributes it among liquidity providers and users.

- PROF System: The PROF (Protected Order Flow) system aims to limit harmful forms of MEV within Proposer-Builder Separation (PBS) architectures by enforcing fair transaction ordering and creating bundles that are profitable yet non-manipulative for block producers (source). This ensures timely inclusion while guarding against order manipulation.

These advances signal a decisive shift in the DeFi community’s philosophy: MEV is not inherently detrimental, but its impact depends on how value is distributed and incentives are structured. By embedding redistribution directly into protocol design, projects can transform what was once a zero-sum contest into a system where all stakeholders, users, liquidity providers, validators, and governance participants, share in the upside.

Balancing Efficiency with Fairness

For transparent MEV redistribution to achieve its promise of fair DeFi, several key principles must be prioritized:

Best Practices for Transparent MEV Redistribution in DeFi

-

Implement On-Chain MEV Revenue Sharing: Platforms like Jito DAO on Solana allocate a fixed percentage of MEV tips (e.g., 3%) directly to DAO treasuries and user-facing features. This transparent, on-chain approach ensures all stakeholders can verify MEV distribution and aligns incentives across participants.

-

Integrate MEV-Resistant Market Mechanisms: Dextr’s Actively Validated Market Maker (AVMM) uses low-latency oracles and insurance models to prevent MEV exploitation and compensate affected users. Such mechanisms reduce MEV extraction opportunities and protect user interests.

-

Leverage Application-Level MEV Capture and Redistribution: Research-backed solutions like RediSwap automate MEV capture within AMMs and fairly redistribute gains to liquidity providers and traders, minimizing arbitrage-driven losses.

-

Enforce Transparent Transaction Ordering: Systems such as the PROF (Protected Order Flow) protocol limit harmful MEV by enforcing fair transaction sequencing and bundle creation, reducing the potential for manipulative ordering and enhancing trust.

Transparency is foundational. Protocols must openly disclose how MEV is captured and how it flows back to users. This not only builds trust but also enables informed participation and governance. Efficiency remains essential, redistribution mechanisms should minimize friction and avoid excessive overhead that could stifle market activity.

Incentive alignment is the linchpin. As recent models demonstrate, when users see tangible benefits from MEV redistribution (such as staking rewards or insurance payouts), their interests become naturally aligned with network health. Conversely, opaque or extractive models risk user attrition and reputational damage.

Challenges Ahead: Governance, Composability, and User Education

No solution is without trade-offs. As protocols like Jito DAO and ZENMEV scale up their redistribution models, they face important questions:

- Governance: How should communities decide on allocation ratios for redistributed MEV? What safeguards exist against capture by large stakeholders?

- Composability: Can new redistribution schemes integrate smoothly with existing DeFi primitives without introducing unforeseen risks or complexity?

- User Education: Are end-users equipped to understand how MEV affects their outcomes, and do they have access to tools that help them participate meaningfully?

The answers will shape whether transparent MEV redistribution becomes a sustainable pillar of DeFi or simply another fleeting trend.

The Path Forward for Sustainable DeFi Markets

The movement toward transparent MEV redistribution mechanisms, as seen in both production deployments and academic research, represents one of the most important experiments in incentive engineering since DeFi’s inception. By building on these innovations, and fostering open dialogue between developers, researchers, traders, and users, the industry can create markets that are both efficient and just.

This journey is ongoing. But if current momentum holds, the next generation of DeFi platforms may finally resolve the MEV paradox, not by eliminating extractable value altogether but by ensuring its benefits are equitably shared across the entire ecosystem.