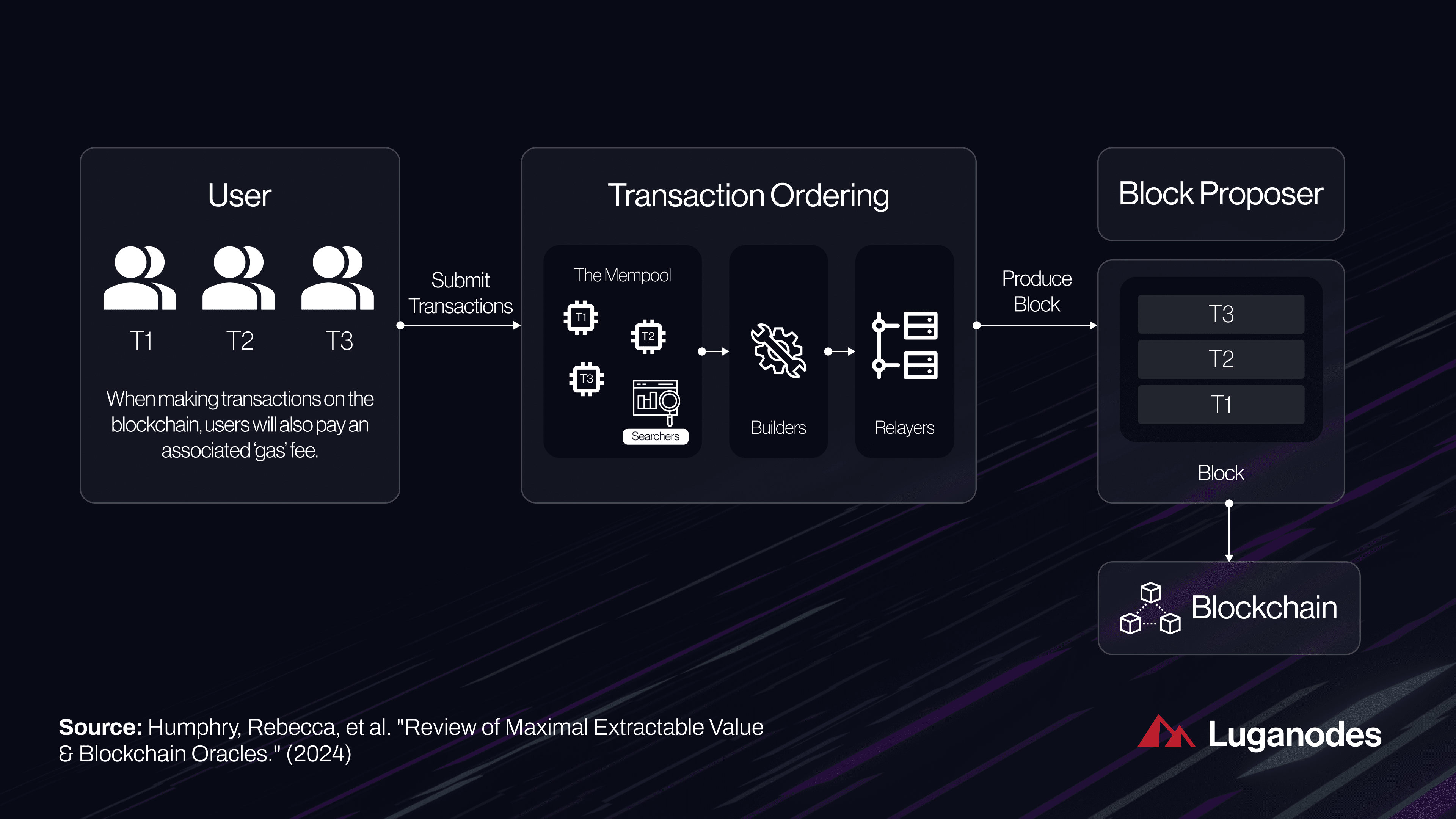

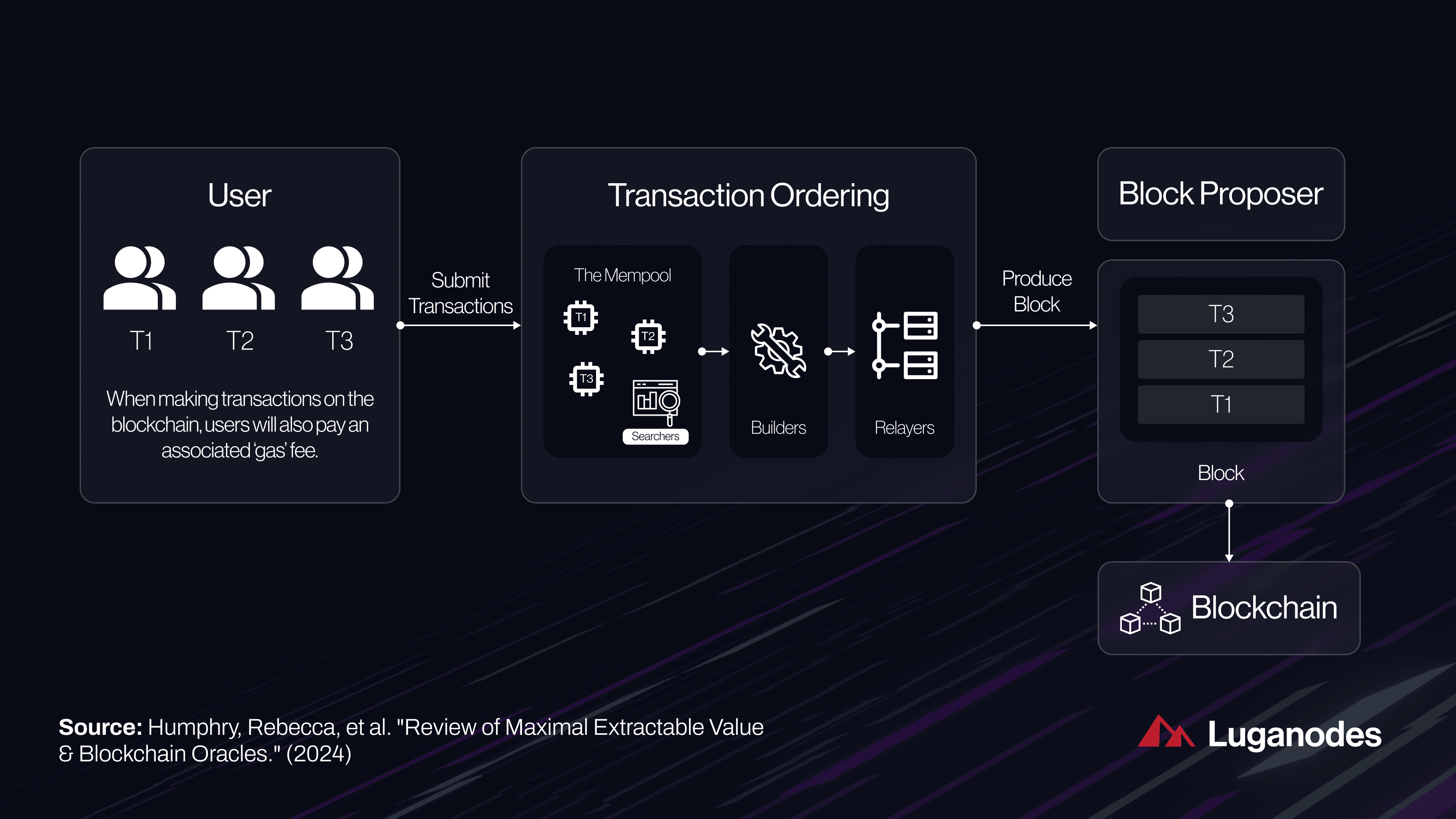

Maximal Extractable Value (MEV) has become one of the most hotly debated phenomena in decentralized finance. MEV is the profit that can be extracted by manipulating the order of transactions within a block, and while it can enhance market efficiency, unchecked MEV extraction undermines fairness in DeFi. As protocols and traders race to capture value, users often find themselves at a disadvantage, suffering from front-running, sandwich attacks, or outright censorship. This dynamic has prompted the rise of MEV redistribution protocols, which seek to rebalance incentives and restore equity across the ecosystem.

Understanding MEV: From Market Efficiency to Exploitation

To appreciate why MEV redistribution matters, it’s crucial to grasp both sides of the MEV paradox. On one hand, as highlighted by research on MEV-smoothing, certain forms of MEV, like arbitrage, can keep DeFi markets liquid and prices fair. On the other hand, manipulative transaction ordering can erode trust and concentrate profits among a handful of validators or searchers.

The challenge is not eliminating MEV altogether but ensuring its benefits are distributed fairly. Without intervention, users may face higher slippage or failed trades, while validators with privileged access reap outsized rewards. In response, innovative protocols have emerged to share or redistribute this value more equitably.

“MEV is not inherently bad, it plays a critical role in market efficiency. . . However, some forms of MEV undermine fairness. ”

Key Mechanisms for Fairer DeFi Transactions

The latest generation of MEV sharing mechanisms deploys advanced cryptoeconomic designs to align incentives across all participants. Here are three leading approaches:

How MEV Redistribution Protocols Enhance DeFi Fairness

-

MEV-Smoothing Among Validators: MEV-smoothing redistributes extracted value evenly across all validators in a slot, rather than concentrating rewards on the block proposer. This approach reduces profit disparities, discourages collusion, and ensures validators are incentivized to select blocks with the highest MEV yield, leading to a more equitable and resilient network.

-

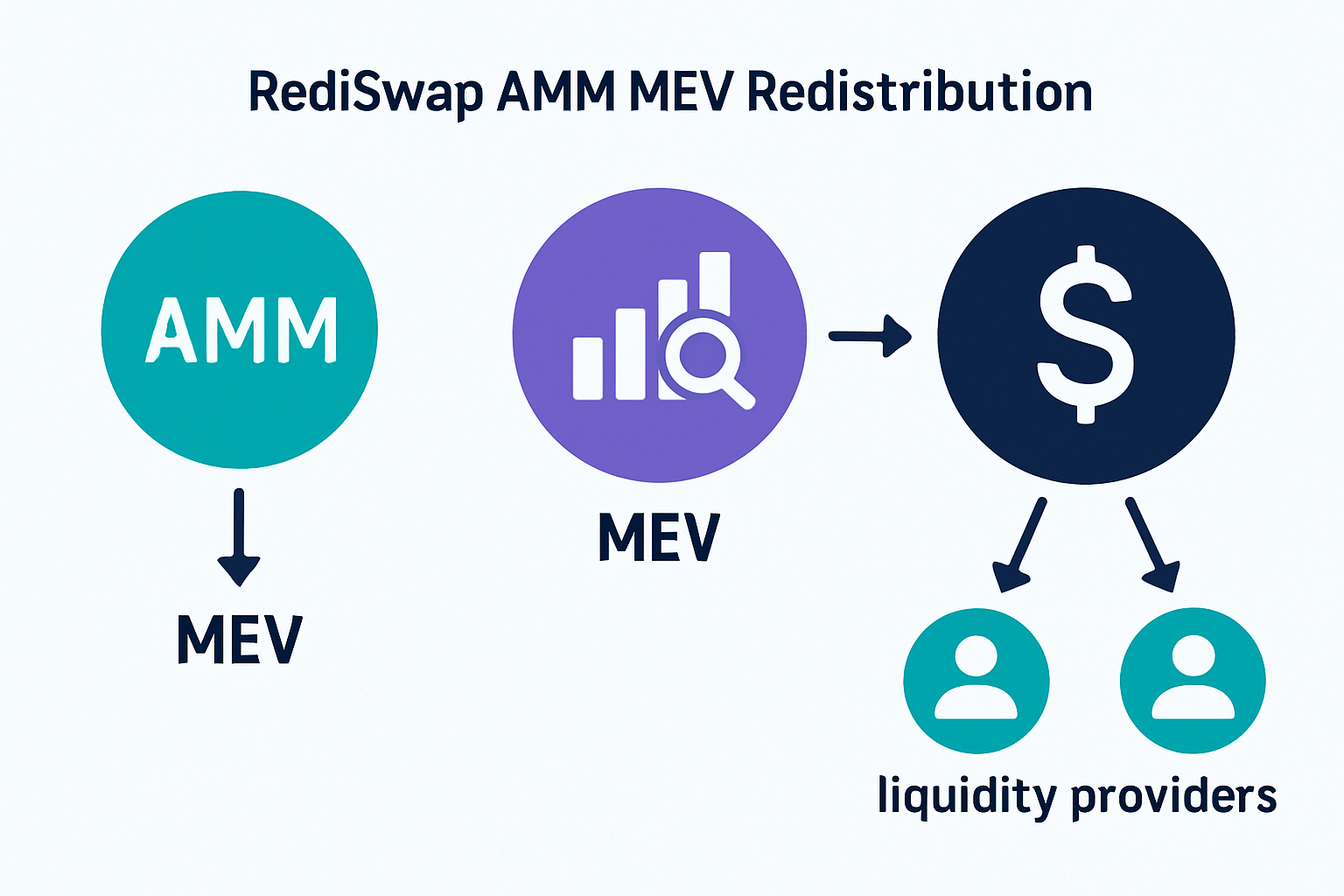

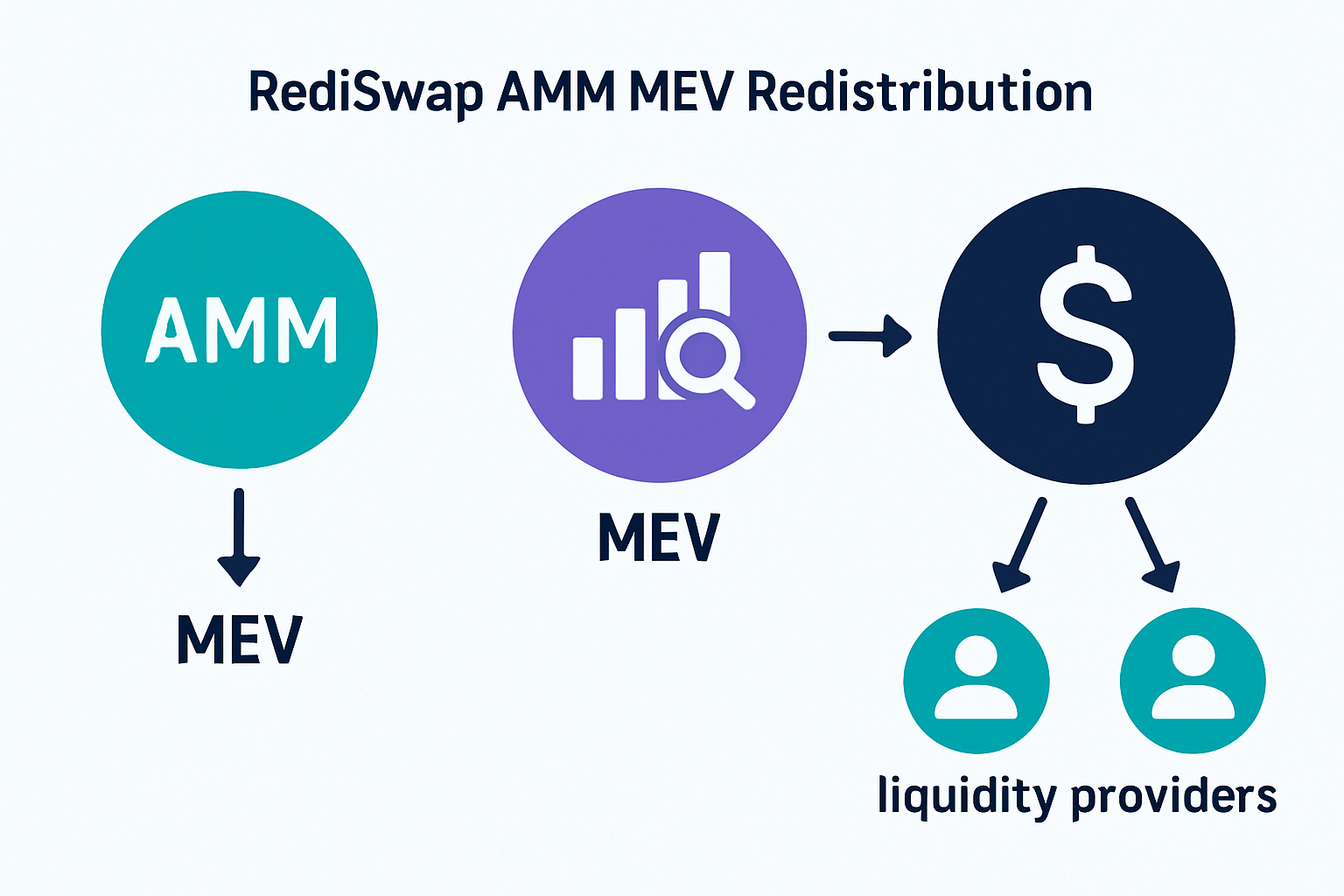

RediSwap’s AMM Design for User-Level Redistribution: RediSwap is an Automated Market Maker (AMM) protocol that captures MEV at the application layer and redistributes it among users and liquidity providers. Its MEV-redistribution mechanism manages arbitrage within the pool, minimizing loss-versus-rebalancing (LVR) and individual user losses, while remaining Sybil-proof and incentive-compatible.

-

MEV Blocker Refunds Users: MEV Blocker is a system that refunds up to 90% of builder rewards directly to transaction originators. By returning the majority of extracted MEV to users, MEV Blocker reduces incentives for exploitative behaviors like front-running, enhancing fairness and trust in DeFi transactions.

1. MEV-Smoothing: Instead of letting just one block proposer capture all the extractable value in a slot, this method pools rewards from all blocks in an epoch and distributes them evenly among validators. By enforcing that validators select blocks with the highest yield during consensus voting, it reduces profit disparities and prevents collusion around high-MEV blocks.

2. RediSwap: At the application layer, RediSwap’s AMM design captures arbitrage-based MEV within its pool and redistributes it between liquidity providers and users, rather than letting external searchers extract it all. The protocol formalizes its mechanism design so that losses from rebalancing (LVR) are minimized for LPs while staying Sybil-proof for arbitrageurs (see technical details).

3. MEV Blocker: This system takes multi-transaction bundles and refunds up to 90% of builder rewards directly back to transaction originators. By returning most extracted value to users rather than intermediaries or attackers, it dramatically reduces incentives for exploitative ordering strategies (read more here).

The Impact: Toward Equitable Blockchain Markets

The adoption of these blockchain MEV strategies is already reshaping fairness in DeFi:

- Profit leveling: By distributing rewards more evenly among validators or refunding users directly, redistribution protocols reduce excessive profit concentration.

- Dampening exploitation: When most value flows back to honest participants instead of manipulators or privileged actors, front-running loses much of its appeal.

- Sustaining trust: Transparent sharing mechanisms help maintain user confidence in DeFi platforms by making transaction outcomes less arbitrary.

This evolution is not just technical; it marks a cultural shift toward prioritizing community benefit over zero-sum extraction.

Yet, even as these protocols gain traction, the landscape remains dynamic. Attackers adapt, and new forms of value extraction inevitably emerge. The challenge for protocol designers is to keep pace with evolving threats while maintaining efficiency and user experience. The best MEV redistribution protocols are those that integrate seamlessly with existing consensus mechanisms and DeFi applications, minimizing friction for end users while maximizing transparency.

For example, MEV Blocker has introduced creative defenses such as generating decoy transactions to frustrate probabilistic exploitation by advanced searchers (source). Meanwhile, application-layer solutions like RediSwap are proving that properly designed AMMs can internalize arbitrage value, aligning incentives between liquidity providers and users rather than externalizing losses to predatory bots.

“Protocol-native MEV brokering enhances blockchain economic fairness by directly integrating extractable value flows into consensus and application logic. ”

What’s Next: Governance, Transparency, and Open Innovation

The future of fairness in DeFi will depend not just on technical fixes but on collaborative governance and open-source experimentation. Community-driven efforts are essential for surfacing new attack vectors and iterating on mechanism design. As more protocols adopt MEV sharing mechanisms by default, we should expect:

Emerging Trends in MEV Redistribution Governance

-

Protocol-Native MEV Brokering: Blockchains like Ethereum and Cosmos are integrating MEV brokering directly at the protocol layer, enabling transparent MEV capture and fairer redistribution among validators and users. This reduces reliance on off-chain actors and improves accountability.

-

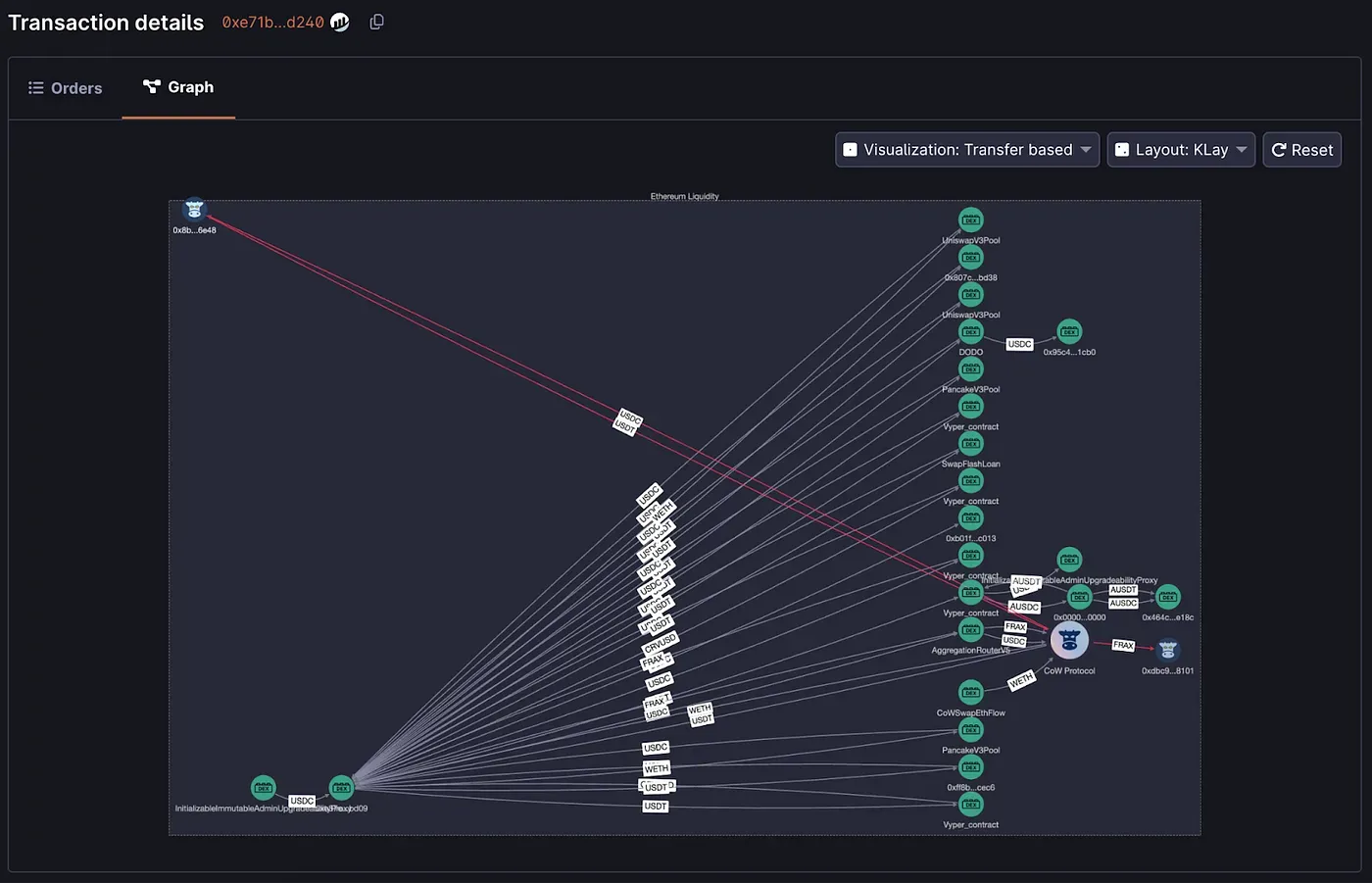

MEV Transparency Tooling: Platforms such as EigenPhi and Flashbots Explorer are providing real-time analytics, dashboards, and open data on MEV extraction, allowing users and developers to monitor MEV flows and ensure greater transparency in DeFi markets.

-

Cross-Protocol Standardization: Initiatives like the MEV-Share protocol and MEV Blocker are working towards standardized APIs and interfaces for MEV redistribution, aiming to unify practices across DeFi protocols and blockchains for consistent user protection.

-

Decentralized MEV Governance: DAOs such as CoW DAO are pioneering decentralized governance models to oversee MEV redistribution rules, empowering communities to vote on fair allocation mechanisms and protocol upgrades.

-

Application-Level MEV Capture: AMMs like RediSwap are embedding MEV redistribution directly into their smart contracts, ensuring that arbitrage-derived MEV is shared with liquidity providers and users, not just external searchers.

- Increased transparency: Tools that monitor transaction ordering and MEV flows in real time will empower users to audit fairness claims.

- Protocol-level standards: Interoperable frameworks for MEV sharing could become a baseline expectation across L1s and L2s.

- User-centric innovation: Expect more products that let users opt into different levels of protection or reward-sharing based on their risk appetite.

The ultimate goal is a DeFi ecosystem where value creation is shared equitably among builders, validators, liquidity providers, traders, and everyday users. This vision requires constant vigilance against new forms of manipulation but also a willingness to embrace market-driven experimentation. By prioritizing fairness at the protocol level, and ensuring all participants have access to relevant data, MEV redistribution can help transform blockchains from zero-sum battlegrounds into sustainable financial commons.

The next wave of DeFi protocols won’t just be measured by TVL or trading volume but by how effectively they align incentives for all stakeholders. As we continue refining these cryptoeconomic tools, the promise of truly fair decentralized finance comes ever closer to reality.