Maximal Extractable Value (MEV) has become a central topic in the world of decentralized finance, shaping the way value flows through blockchain networks. While MEV can unlock efficiencies and new opportunities, its unchecked extraction often leads to unfairness, undermining trust and participation in DeFi protocols. This is where MEV redistribution protocols step in, offering a set of tools and strategies designed to create a more equitable environment for all participants.

What is MEV? The Heartbeat (and Headache) of DeFi

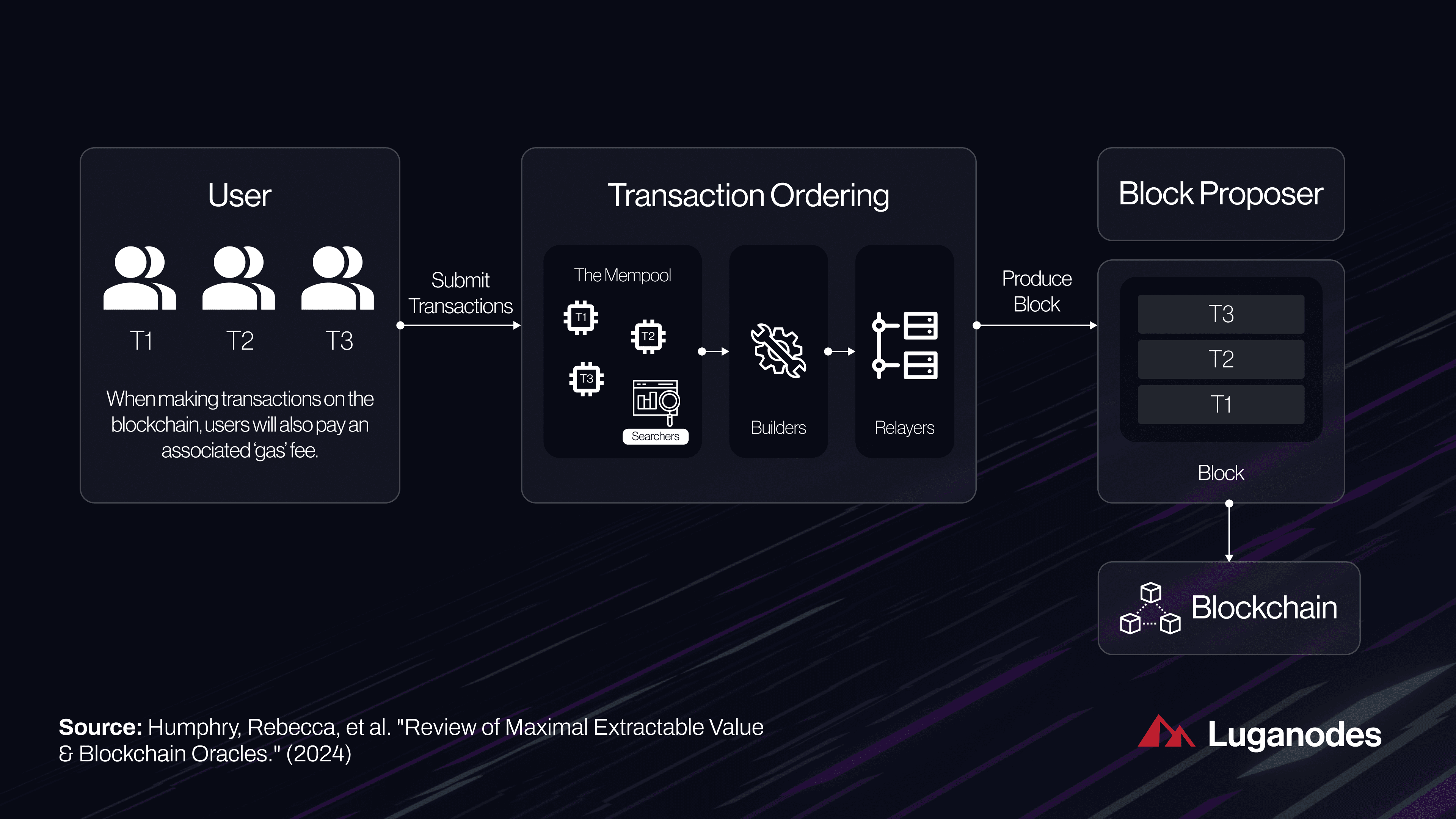

At its core, MEV refers to any extra profit that block producers (such as miners or validators) can extract by reordering, inserting, or censoring transactions within a block. This subtle yet powerful ability means that those with control over transaction ordering can front-run trades, execute sandwich attacks, or otherwise manipulate outcomes for their own gain. As highlighted in recent research from ESMA and thought leaders like Jake Rubin, these practices have real consequences: they erode user trust and introduce negative externalities into DeFi markets.

The paradox? While MEV can sometimes help correct inefficiencies in pricing or liquidity provision, it too often does so at the expense of regular users. That’s why the push for blockchain transparency and equitable MEV distribution has never been stronger.

The Rise of MEV Redistribution Protocols

MEV redistribution protocols are designed to capture the value generated by transaction sequencing games and share it with participants who might otherwise be exploited. Instead of allowing block producers or sophisticated bots to pocket all the profits, these protocols redirect value back to users, liquidity providers (LPs), or even split it among stakers.

This shift is more than just technical – it’s philosophical. By turning MEV from a zero-sum game into a shared resource, DeFi platforms align incentives across their communities. As noted in recent Substack analysis on “5 Myths About MEV, ” mechanisms like an “MEV tax” can reshape incentives so that LPs and traders both capture fairer shares of value created by their participation.

Key Benefits of MEV Redistribution Protocols in DeFi

-

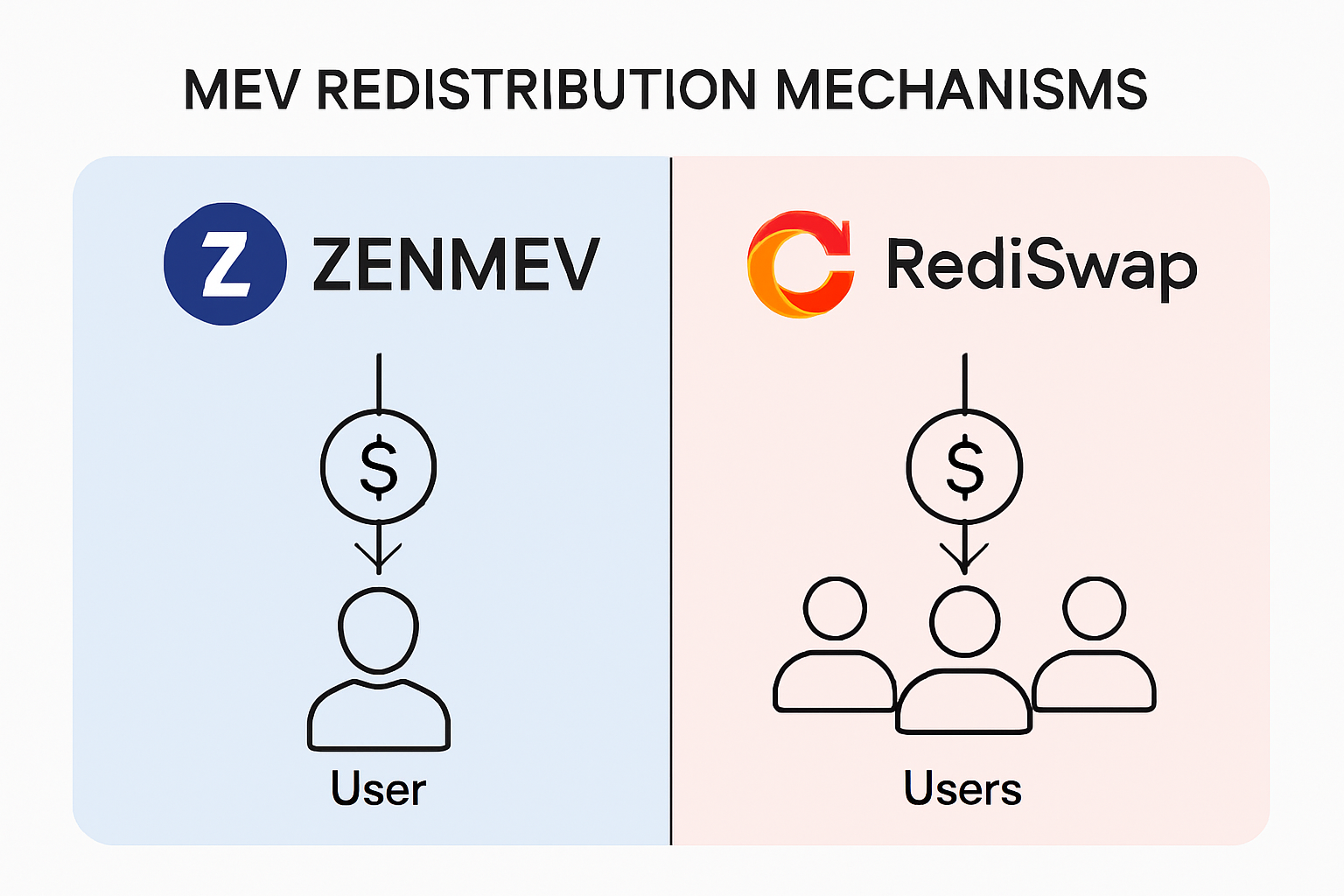

Promotes Equitable Value Distribution: MEV redistribution protocols, such as those implemented by ZENMEV and RediSwap, ensure that profits from transaction ordering are shared fairly among users and liquidity providers, rather than being captured by a select few.

-

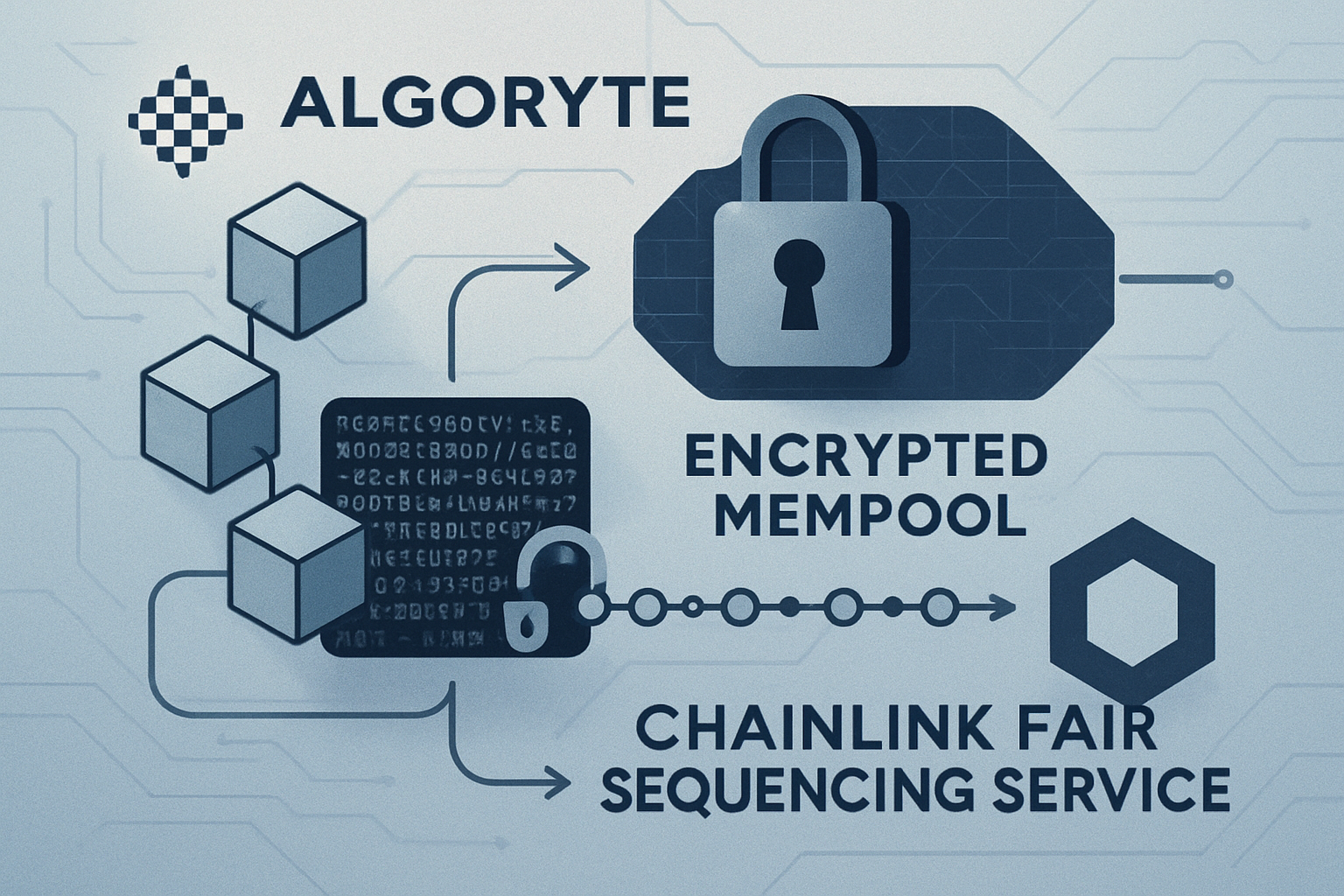

Reduces Front-Running and Exploitation: By leveraging encrypted mempools (e.g., Algoryte) and fair sequencing (e.g., Chainlink FSS), these protocols make it much harder for malicious actors to manipulate transaction order for unfair gain.

-

Increases Transparency and Trust: Protocols like Flashbots SUAVE and CoW DAO provide visibility into transaction ordering and MEV extraction, fostering user confidence and encouraging broader participation in DeFi.

-

Stabilizes Transaction Fees: By minimizing exploitative practices such as sandwich attacks, MEV redistribution protocols help keep transaction costs more predictable and fair for all participants.

-

Enhances Network Integrity and Security: Mechanisms like Proposer-Builder Separation (PBS) reduce centralization risks and reinforce the underlying security of DeFi platforms, making the ecosystem more robust.

Pillars of Fairness: How Redistribution Works

The landscape of MEV sharing strategies is evolving rapidly. Here are some leading approaches powering today’s fairer DeFi ecosystems:

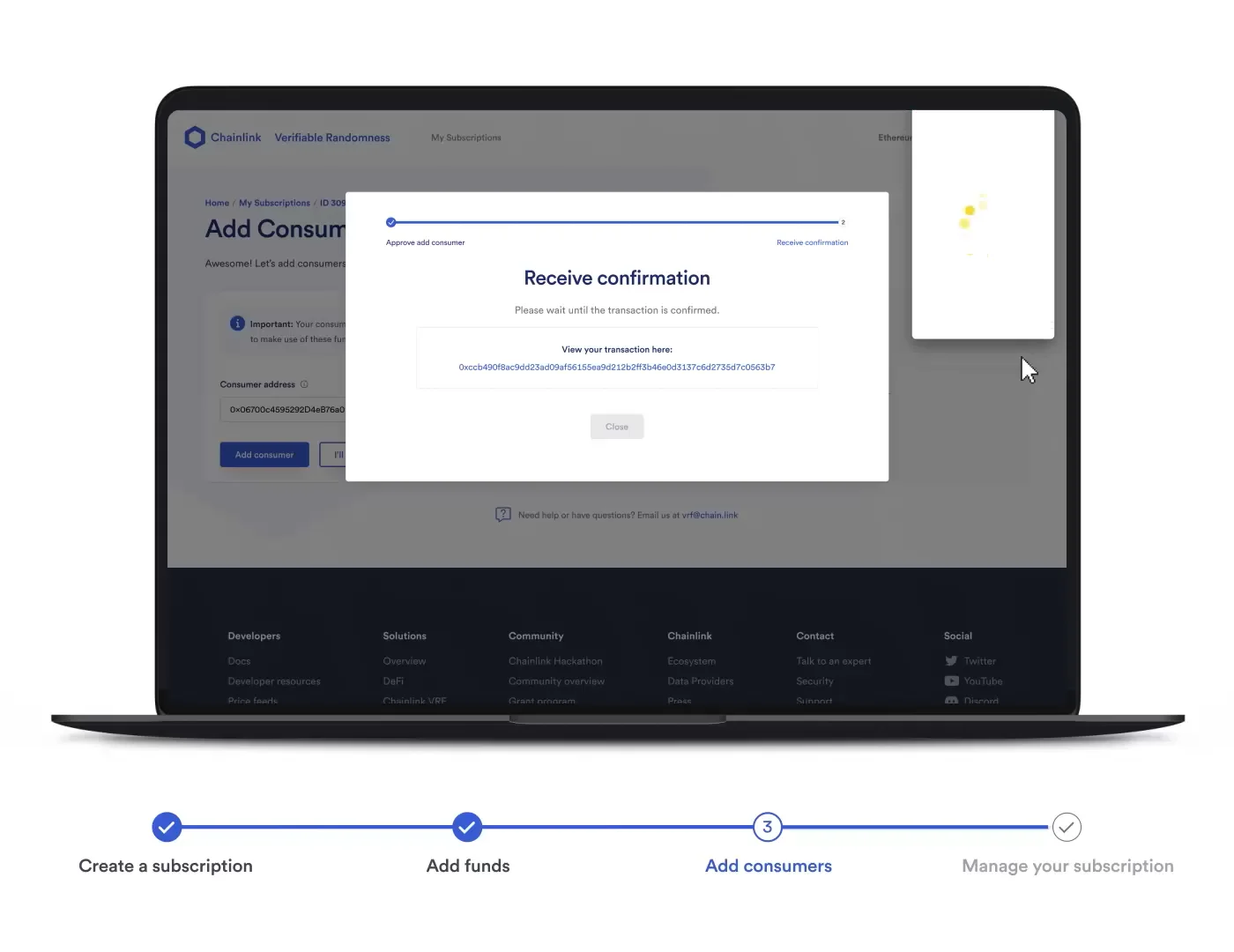

- Fair Transaction Ordering: Protocols like Chainlink FSS use unbiased sequencing to prevent front-running and ensure everyone gets equal treatment when submitting transactions.

- MEV Smoothing: Platforms such as ZENMEV aggregate all extracted value into a pool that’s then shared among validators – reducing income disparities and discouraging harmful competition.

- Encrypted Mempools and Private Order Flow: By encrypting transaction details until inclusion on-chain (as Algoryte does), these systems hide sensitive information from would-be exploiters.

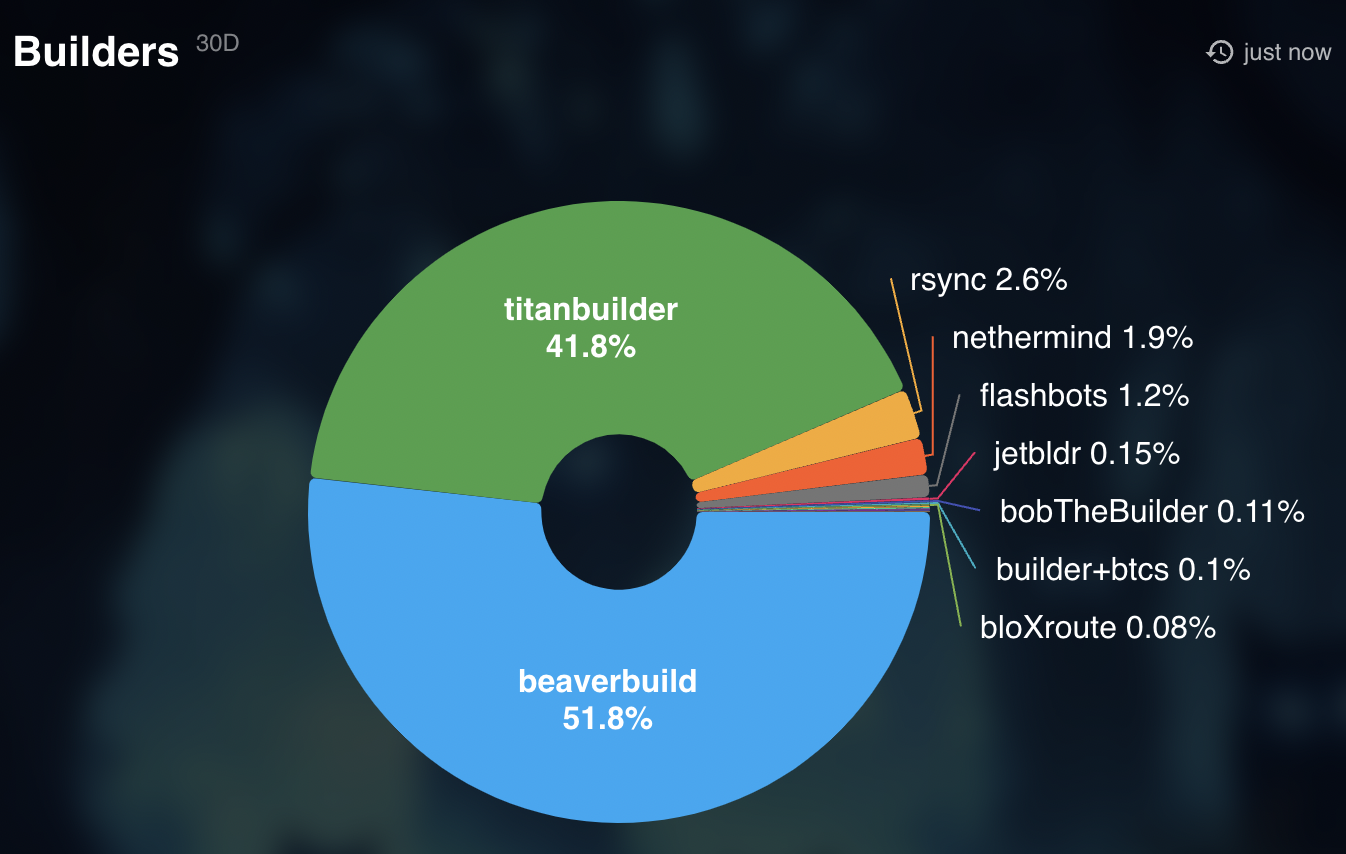

- Proposer-Builder Separation (PBS): Flashbots’ SUAVE introduces privacy-preserving auctions for block building, limiting any single actor’s power over transaction order.

- Dapp-Level Redistribution: Some AMMs like RediSwap capture arbitrage profits internally and refund them directly to users or LPs instead of leaking value out to external searchers.

Together, these methods form the foundation for more inclusive DeFi environments where exploitation is minimized and rewards are distributed fairly based on actual contribution rather than privileged access or technical prowess.

The Real-World Impact: Why Fairness Matters Now More Than Ever

The adoption of MEV redistribution isn’t just about technical elegance; it has tangible effects on user experience and market integrity. When users know their transactions won’t be front-run or sandwiched out of profit opportunities, they’re more likely to participate actively in DeFi markets. This increased confidence leads to deeper liquidity pools, lower volatility in trading fees, and ultimately more resilient financial ecosystems – all key components for mainstream adoption.

If you’re curious about how specific redistribution mechanisms work under the hood or want actionable steps for integrating them into your protocol design, check out our detailed breakdown at this dedicated resource.

Transparency and fairness are no longer optional in DeFi – they’re prerequisites for growth. Protocols that embrace MEV sharing strategies are already seeing measurable improvements in user retention and ecosystem health. For example, by redistributing MEV back to liquidity providers and traders, platforms can transform what was once a source of friction into a driver of collaboration. This shift doesn’t just benefit end users; it also reduces the negative externalities that can harm network security and reputation.

Let’s break down some of the practical advantages that MEV redistribution protocols bring to the table:

Real-World Cases of MEV Redistribution Boosting Fairness

-

Chainlink Fair Sequencing Services (FSS): By introducing unbiased transaction ordering, Chainlink’s FSS prevents front-running and sandwich attacks. This has led to a more level playing field for DeFi users, with transactions processed transparently and predictably, reducing unfair cost spikes.

-

ZENMEV’s MEV Smoothing: ZENMEV pools all MEV and priority fees earned by validators, then redistributes them evenly among stakers. This approach reduces incentives for selfish validator behavior, resulting in lower transaction costs and greater fairness for all network participants.

-

Algoryte’s Encrypted Mempools: Algoryte uses encrypted mempools to conceal transaction details until execution, effectively eliminating front-running and sandwich attacks. This innovation has led to more predictable transaction fees and a fairer trading environment for users.

-

Flashbots SUAVE (Single Unifying Auction for Value Expression): Flashbots SUAVE implements proposer-builder separation and privacy-preserving mempools. This limits the ability of block proposers to extract MEV at users’ expense, resulting in more equitable value distribution and reduced transaction manipulation.

-

RediSwap’s MEV Redistribution in AMMs: RediSwap captures MEV within its automated market maker pools and fairly refunds it to both users and liquidity providers. This mechanism has increased fairness and helped lower effective trading costs on the platform.

Challenges Ahead, and How the Community Is Responding

The journey toward fully equitable MEV distribution isn’t without its hurdles. Technical complexity, coordination between stakeholders, and evolving attack vectors all present ongoing challenges. For instance, implementing encrypted mempools or proposer-builder separation requires close cooperation between protocol developers, validators, and infrastructure providers. There’s also the constant race to stay ahead of sophisticated searchers who adapt quickly to new defenses.

Yet, the DeFi community is nothing if not resilient. Open-source collaboration has accelerated innovation in this space – from public audits of MEV smoothing contracts to cross-protocol standards for fair ordering. Educational initiatives are helping both newcomers and experienced builders understand why blockchain transparency is so vital for sustainable growth.

Looking Forward: The Future of Fair DeFi Markets

The next wave of advances will likely focus on making these fairness mechanisms even more accessible to smaller protocols and emerging chains. As privacy-preserving order flow becomes standard practice and dapp-level redistribution mechanisms mature, we can expect new forms of value sharing that reward creativity rather than privilege. Ultimately, the success stories from projects like ZENMEV, Algoryte, RediSwap, and Flashbots SUAVE point toward a future where users feel empowered – not exploited – by their participation in DeFi.

If you’re building or using DeFi protocols today, now is the time to advocate for (or demand) transparent MEV handling. The tools exist; it’s up to all of us to ensure they become industry standard.

Fairness isn’t just a feature, it’s the foundation on which truly open financial systems must be built.

For a deeper dive into specific protocol designs or implementation guides for your team, visit our comprehensive resource on how MEV redistribution protocols improve fairness in DeFi transactions.