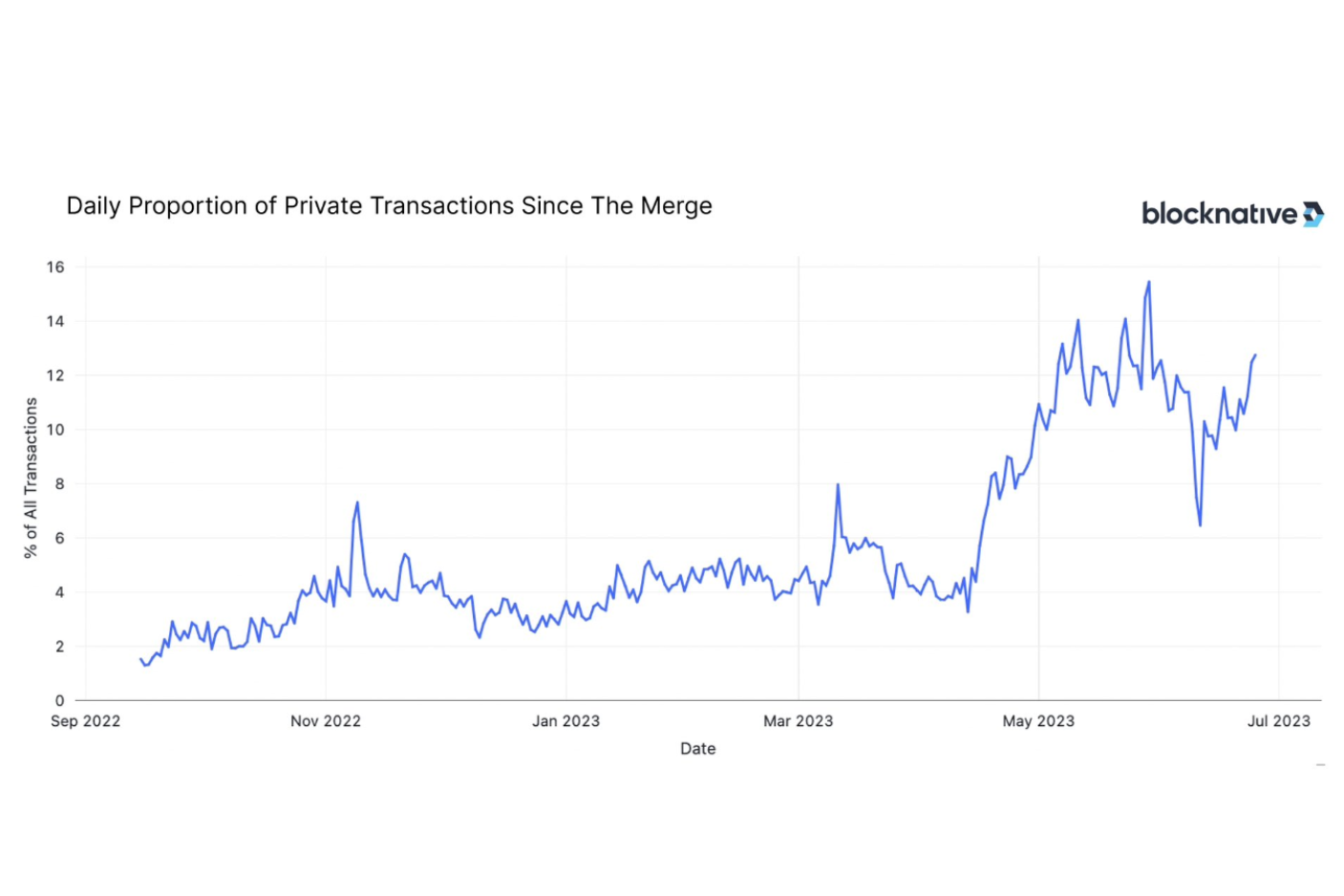

Until recently, the world of DeFi was a wild west for Maximal Extractable Value (MEV): validators and searchers quietly raked in profits by reordering, inserting, or censoring transactions. Regular users? They were often left footing the bill, paying higher prices or suffering from slippage and sandwich attacks. But the tide is turning fast. Orderflow auctions (OFAs) are shaking up the MEV supply chain, creating a new paradigm where users can reclaim value that used to leak out of their pockets.

Let’s break down how we got here and why this shift matters for anyone who cares about fair MEV distribution and blockchain transparency.

Orderflow Auctions: The New Battleground for MEV Redistribution

At its core, an orderflow auction is a competitive market where searchers bid for the right to execute trades alongside user orders. Instead of letting MEV slip away to whoever controls block production, these auctions invite builders and solvers to compete transparently, offering rebates or price improvements directly to users. The result? A meaningful chunk of what would have been pure profit for searchers now flows back to traders themselves.

This isn’t just theory. Projects like Flashbots’ MEV-Share, MEV Blocker, and CoW Protocol are already putting OFAs into action:

Top DeFi Protocols Using Orderflow Auctions for MEV Redistribution

-

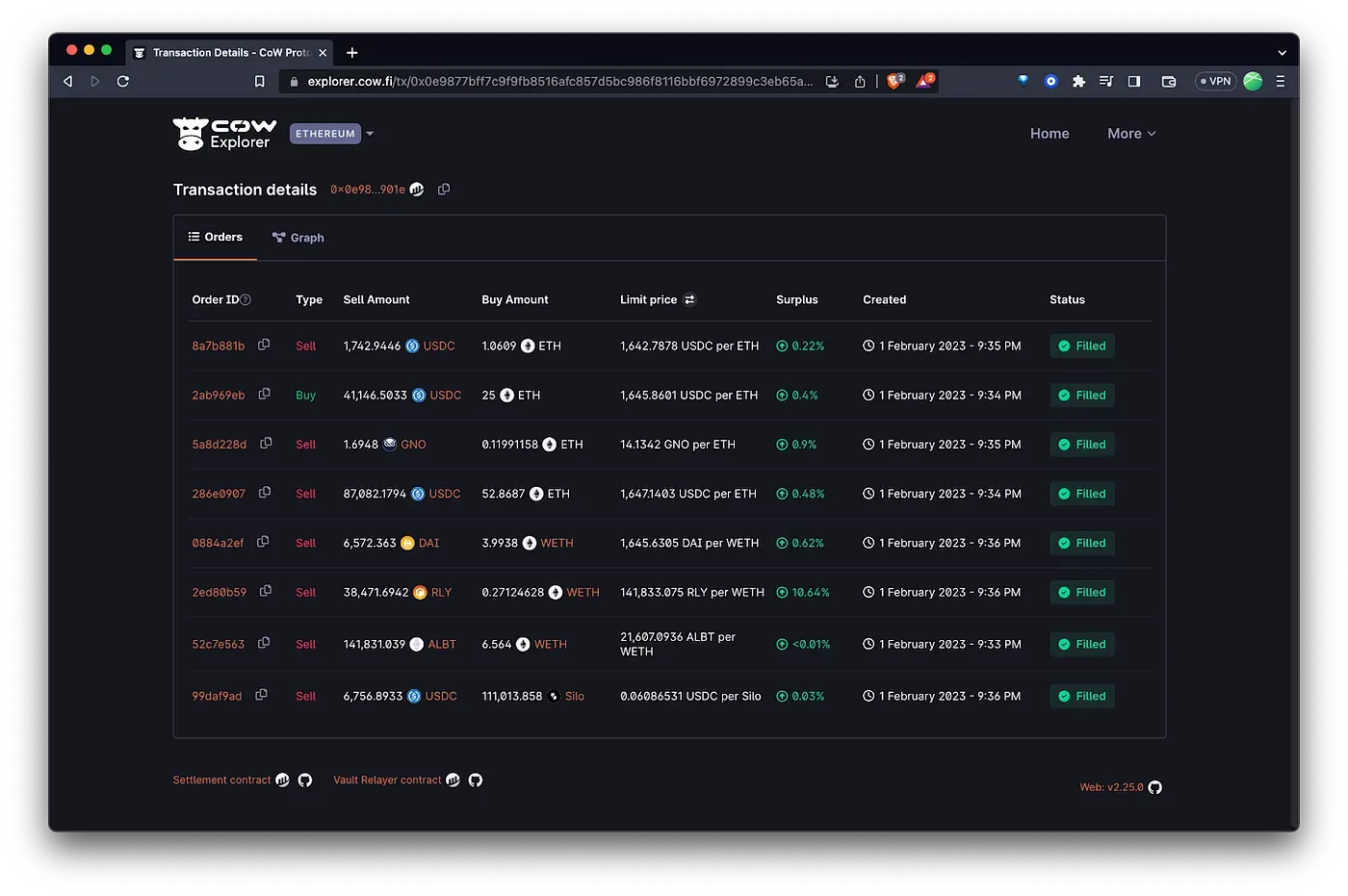

CoW Protocol — CoW Protocol leverages orderflow auctions to maximize user benefits by auctioning off transaction execution rights to competing solvers. This ensures better prices and MEV rebates directly to users, making swaps more fair and efficient.

-

UniswapX — Built by Uniswap Labs, UniswapX employs orderflow auctions to source liquidity and extract MEV in a way that returns value to traders. Its design allows users to receive price improvements and protects them from sandwich attacks.

-

1inch Fusion — 1inch’s Fusion mode utilizes orderflow auctions to match user trades with optimal execution, redistributing MEV profits back to users and offering gasless swaps for a seamless DeFi experience.

-

Flashbots MEV-Share — Flashbots’ MEV-Share is an open-source protocol that enables wallets and dApps to share MEV revenue with users by allowing searchers to bid for orderflow, ensuring a more equitable and transparent MEV landscape.

-

MEV Blocker — MEV Blocker routes user transactions through a curated set of searchers and builders, redistributing MEV profits and protecting users from frontrunning by mixing real and decoy transactions.

Key benefits of OFAs include:

- User empowerment: Users receive direct rebates or better execution instead of being exploited by toxic MEV strategies.

- Enhanced execution quality: Solvers must compete on price improvement, not just speed or connections.

- Transparency: The auction process makes it clear who wins and why, no more black box block building.

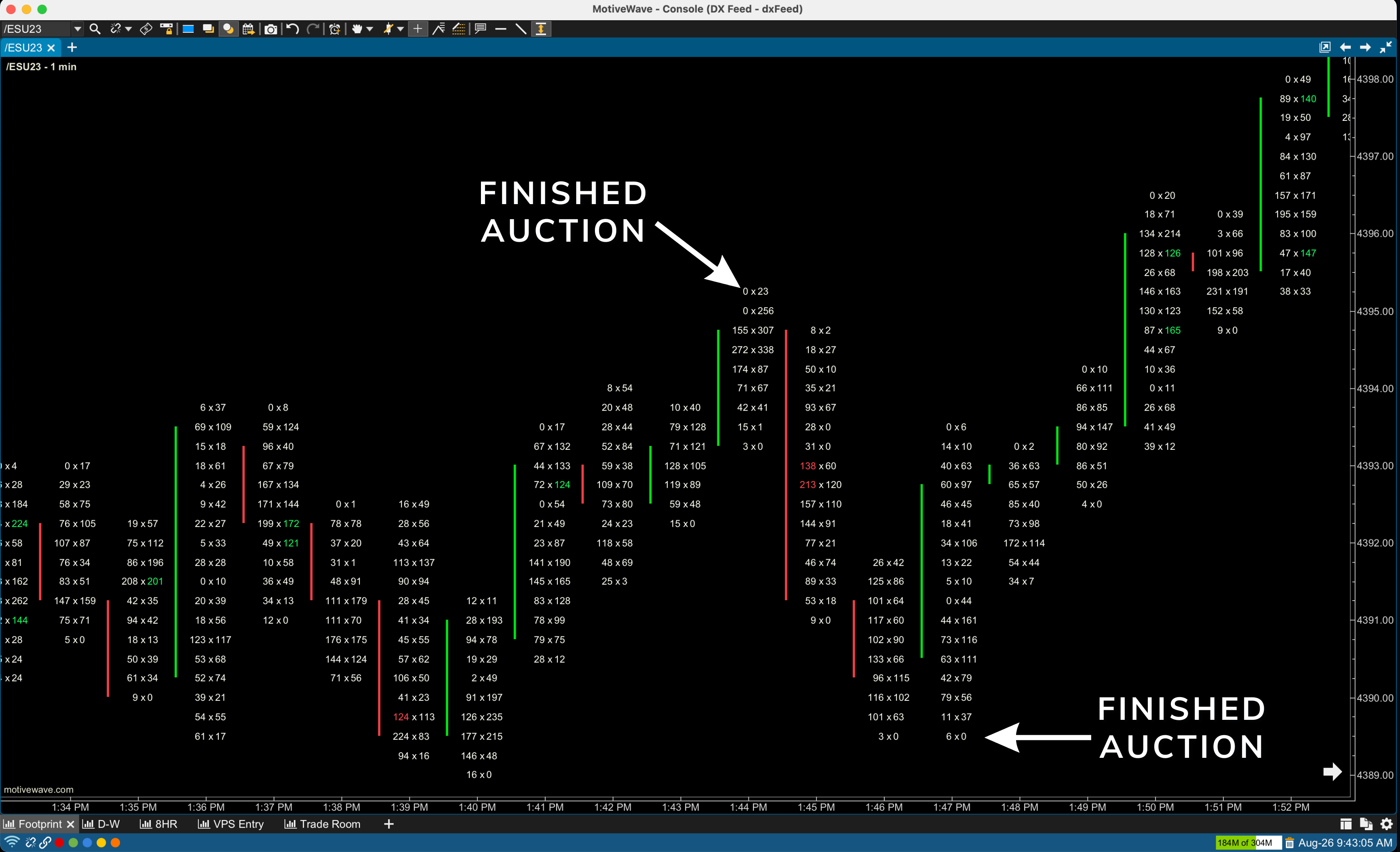

The Mechanics: How Orderflow Auctions Actually Work

The magic starts when a user submits an order through a participating DEX or aggregator (think UniswapX MEV sharing or 1inch Fusion Orderflow). Instead of going straight to the mempool where it’s exposed to predatory bots, the order is routed into an auction environment. Searchers, sometimes called solvers, analyze these orders and submit bids based on how much value they can extract while still offering the best deal possible to the user.

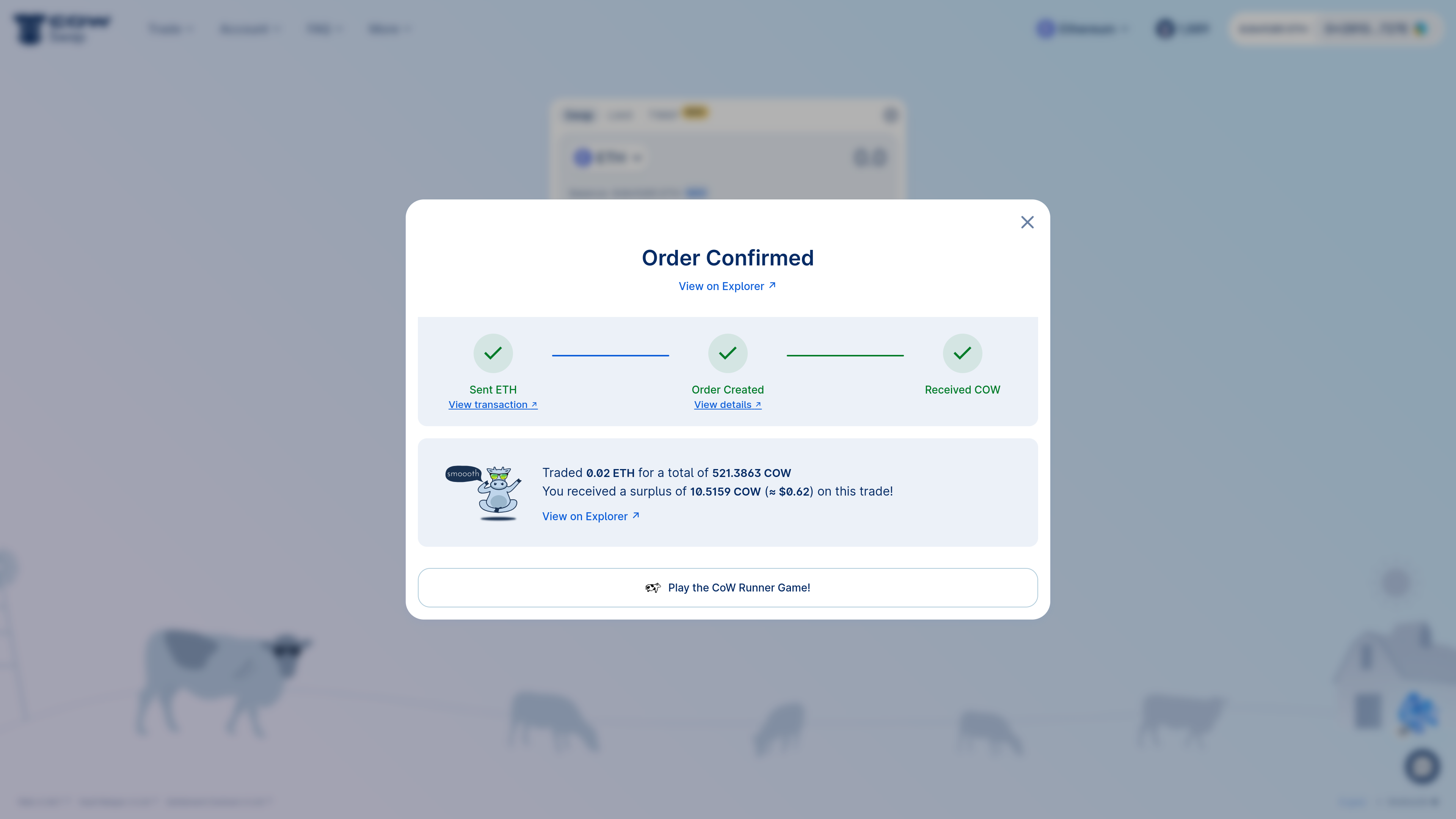

The highest bidder gets inclusion rights but must deliver either price improvement or a direct rebate. This flips traditional MEV extraction on its head: rather than being passive victims, users become active participants in capturing value generated by their own trades.

The Data Speaks: Price Improvement and User Gains

The impact isn’t just philosophical, it’s measurable. Research from Uniswap Labs introduces frameworks for quantifying price improvements delivered via OFAs (see Uniswap Interface research summary above). Early data shows that users are already seeing significant cost reductions compared to legacy systems where all MEV was siphoned off by arbitrageurs.

This shift isn’t limited to one protocol either. Across platforms like CoW Swap, UniswapX, and 1inch Fusion, we’re witnessing a surge in both total volume routed through OFAs and aggregate user rewards paid out thanks to competitive bidding among searchers.

Quantitative frameworks now allow us to see exactly how much users are benefiting from this new approach. For instance, Uniswap’s research on price improvement in orderflow auctions highlights that users can receive direct rebates or tighter execution spreads, which previously would have been captured as profit by MEV searchers alone. This means the average DeFi trader is no longer a passive victim of opaque market mechanics but an empowered participant in a more equitable value chain.

The best part? These improvements are not just theoretical or anecdotal. Protocols are publishing real-time dashboards and analytics so users can track their own MEV rewards and compare execution quality across platforms. The transparency is unprecedented, and it’s pushing the entire industry toward higher standards of fairness and efficiency.

The Expanding Ecosystem: Who’s Leading the Charge?

Orderflow auctions are gaining serious traction across DeFi’s most influential protocols. CoW Protocol has become a poster child for OFA-driven MEV redistribution, auctioning user orderflow to solvers and returning profits to traders. Meanwhile, Flashbots’ MEV-Share enables wallets and dApps to collaborate directly with searchers in a permissionless environment, maximizing user value while protecting against toxic MEV extraction. And don’t overlook 1inch Fusion Orderflow or UniswapX, both have introduced innovative auction-based routing that puts user benefit front and center.

- CoW Protocol: Pioneering batch auctions that route trades through competitive solver bids.

- UniswapX: Integrating OFAs for seamless MEV sharing with every swap.

- 1inch Fusion: Leveraging intent-based orderflow auctions to optimize trade execution and redistribute rewards.

The User Experience: Simpler, Safer, More Profitable

If you’re a DeFi trader today, participating in an OFA-enabled protocol is nearly seamless, you just submit your trade as usual, and the auction magic happens behind the scenes. Instead of worrying about getting sandwiched or front-run, you can check your transaction receipt and see exactly how much extra you received thanks to competitive bidding among solvers. It’s a win-win: better outcomes for you, stronger incentives for honest actors in the ecosystem.

How OFAs Shield Users & Boost Rewards in DeFi

-

Direct MEV Profit Sharing: OFAs like Flashbots’ MEV-Share enable users to capture a portion of the MEV generated by their trades, turning what was once a hidden cost into a real reward.

-

Protection Against Toxic MEV: Solutions such as MEV Blocker mix real and decoy transactions, making it harder for malicious actors to front-run or sandwich user trades.

-

Better Trade Execution: CoW Protocol auctions user orders to competing solvers, ensuring users get optimal prices and lower slippage on DEX trades.

-

Lower Transaction Costs: By creating competition among searchers and builders, OFAs drive down the implicit costs of trading, so users keep more of their funds.

-

Greater Transparency & Fairness: OFAs make the MEV supply chain more open, letting users see how value is extracted and shared, promoting a fairer DeFi ecosystem.

This new paradigm also aligns incentives between protocols, traders, wallet providers, and professional searchers, encouraging collaboration instead of zero-sum competition. The result is a healthier DeFi market where everyone has skin in the game when it comes to fair value distribution.

What Comes Next: Challenges and Where To Watch

No technology shift comes without growing pains. Orderflow auctions must continually adapt to new forms of strategic behavior from sophisticated searchers looking for edge cases or loopholes. There’s also an ongoing debate about optimal auction design: Should all orderflow be auctioned? How transparent should bids be? Can we further minimize latency without sacrificing fairness?

The answers will shape not just who captures MEV but how sustainable this new redistribution model becomes over time. What’s clear is that as more protocols adopt OFAs, and as users demand greater transparency, the days of unchecked MEV extraction are numbered.

If you want to stay ahead of the curve (and maximize your own share of redistributed value), keep your eyes on emerging standards like Flashbots’ open-source frameworks and CoW Protocol’s ever-evolving batch auction mechanics. And above all: ride the volatility but respect the risk, because in this new era of DeFi, opportunity favors those who understand both sides of every trade.