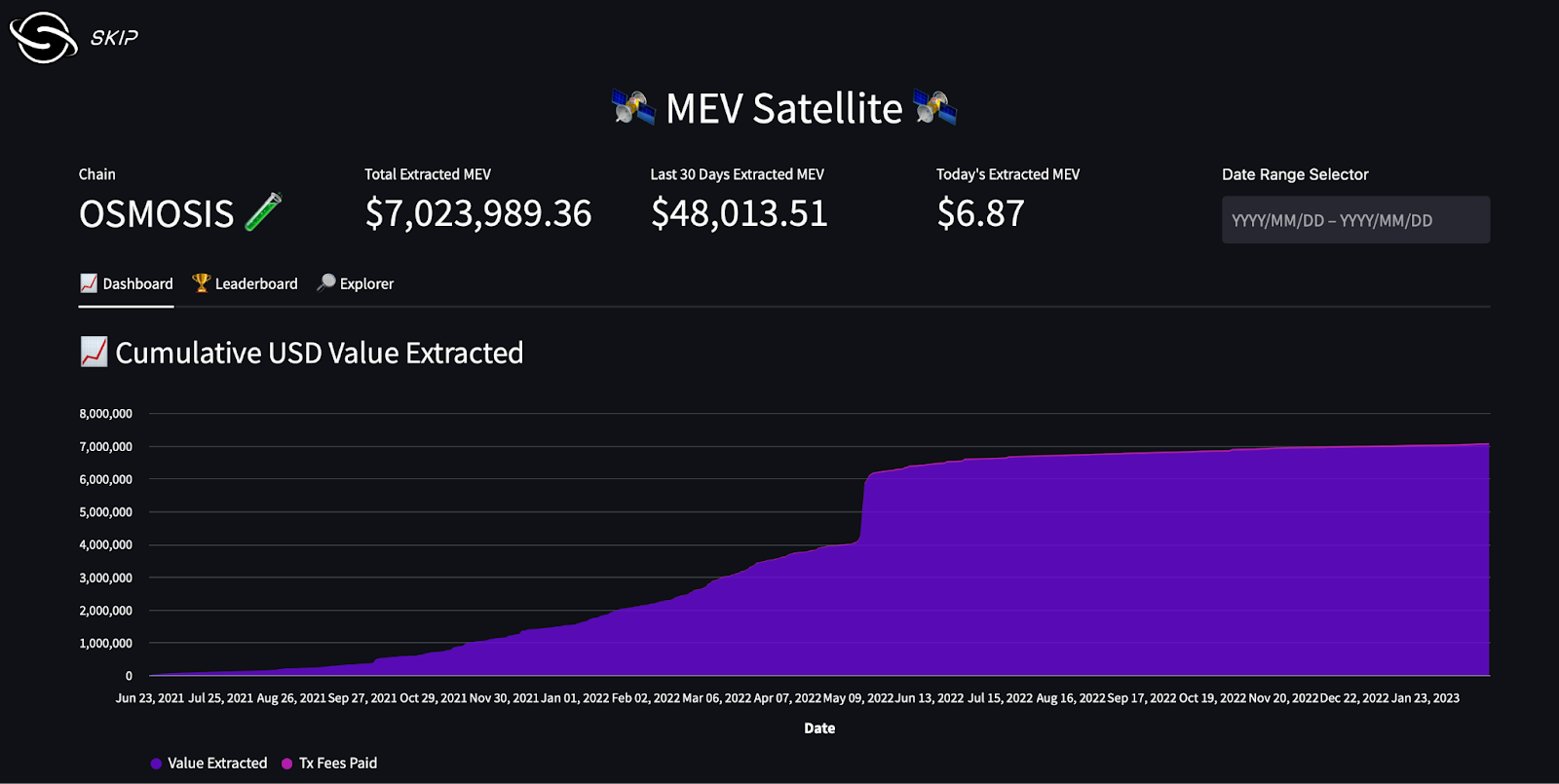

Few topics in decentralized finance (DeFi) have sparked as much debate as Maximal Extractable Value (MEV). For years, MEV has been a double-edged sword: on one side, constructive arbitrage and liquidations keep markets efficient; on the other, toxic practices like front-running and sandwich attacks erode trust and siphon value from ordinary users. The challenge for protocol designers has always been to distinguish between these forms of MEV and enforce fairness at the protocol level. This is where Fairblock’s hybrid MEV model is making waves, offering a cryptographic solution that is already shifting the conversation around on-chain fairness and privacy.

MEV: The Core Challenge for DeFi Fairness

MEV, defined as the value extracted by reordering, including, or excluding transactions within a block, is inherent to transparent blockchains. While some MEV activities are beneficial, others are deeply harmful. The transparency window between transaction broadcast and block finalization is the root cause: it gives searchers, bots, and validators the ability to observe pending transactions, enabling predatory behaviors that undermine user experience and protocol integrity.

Traditional mitigation strategies, such as transaction obfuscation or off-chain order matching, have proven insufficient or introduced new trade-offs. Users have been forced to choose between privacy, performance, and trustlessness. What’s needed is a protocol-level solution that seals transactions until consensus is reached, removing the information asymmetry that makes toxic MEV possible while still allowing healthy, market-making activities to thrive.

Fairblock’s Cryptographic Sealing: How BITE Changes the Game

Fairblock’s innovation lies in its use of Blockchain Integrated Threshold Encryption (BITE). Rather than broadcasting plaintext transactions, users submit encrypted payloads to the network. These remain sealed until after block finalization, at which point a coordinated set of validators decrypts them for execution. This seemingly simple shift has profound consequences:

- No more predatory front-running: With transaction details hidden during block assembly, malicious actors can no longer exploit user intent.

- Programmable privacy: Protocols can define exactly when and how transaction data becomes public, enabling new DeFi primitives and institutional-grade confidentiality.

- Selective MEV enablement: Since only post-consensus transactions are deciphered, healthy MEV (like arbitrage that corrects price discrepancies) can persist without opening the door to toxic behaviors.

This approach is not just theoretical. By integrating BITE into the consensus layer itself, Fairblock eliminates the transparency window that has long enabled harmful MEV extraction. The result is a network where users are protected by default, and where developers can build new applications without fear of leaking critical trading logic or user intent (source).

Hybrid MEV: Balancing Security and Efficiency

Fairblock’s model is best described as a hybrid MEV solution. It does not seek to eliminate all forms of MEV, an impossible and arguably undesirable goal, but rather to distinguish between toxic and constructive MEV at the protocol level. By cryptographically sealing transactions until consensus, Fairblock prevents front-running and sandwich attacks while still allowing beneficial activities like arbitrage and liquidations that enhance efficiency and stability.

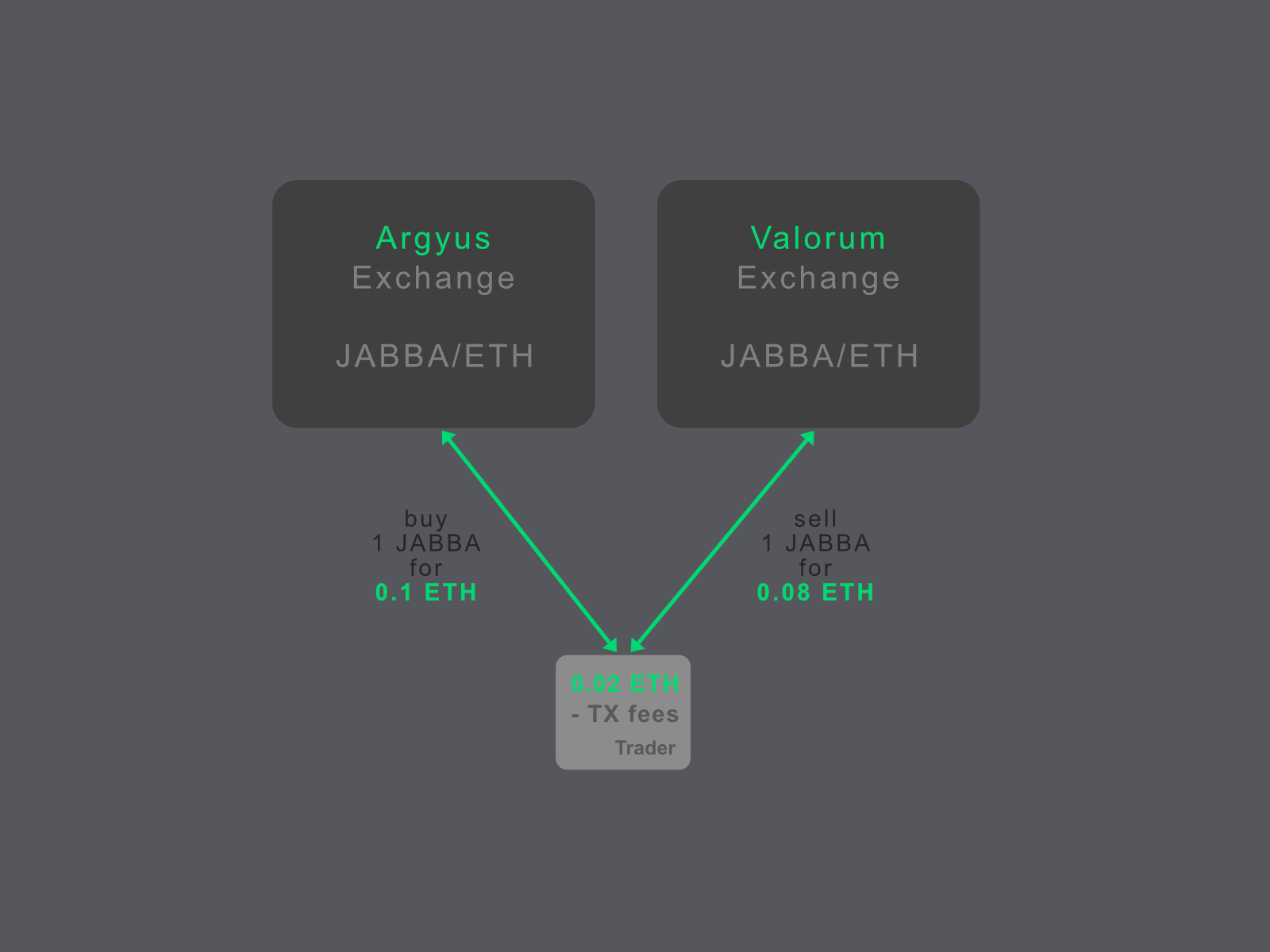

Key Differences: Toxic vs Constructive MEV in DeFi

-

Toxic MEV exploits users via practices like front-running and sandwich attacks, where malicious actors reorder transactions to extract value at the expense of regular users, often leading to increased costs, slippage, and reduced trust in DeFi protocols.

-

Constructive MEV enhances market efficiency through activities such as arbitrage and liquidations. These actions help align prices across markets and maintain protocol solvency, benefiting the overall ecosystem without unfairly targeting individual users.

-

Toxic MEV relies on transaction transparency, exploiting the visibility of pending transactions in the mempool to anticipate and manipulate user actions before block finalization.

-

Constructive MEV operates within protocol rules and typically does not require exploiting confidential user data. Instead, it leverages public market information to provide services like liquidity balancing and price discovery.

-

Fairblock’s hybrid MEV model eliminates toxic MEV by encrypting transactions with Blockchain Integrated Threshold Encryption (BITE). This prevents validators and bots from accessing sensitive transaction details before block finalization, removing the window for malicious exploitation.

-

Fairblock preserves constructive MEV by allowing ecosystem-friendly activities, such as efficient arbitrage and liquidations, to continue. This ensures that the network remains fair and efficient while protecting users from predatory behaviors.

This hybrid approach is already influencing protocol design across DeFi. For example, trading strategies can now be executed without risk of pre-trade exploitation. AI agents operating on-chain can keep their playbooks confidential until after execution. Institutions can finally participate in DeFi markets without exposing sensitive order flow data. The implications are broad: privacy and fairness become default features rather than costly add-ons.

In the next section, we’ll explore how Fairblock’s model is impacting protocol-level MEV redistribution and setting new standards for MEV transparency and user protection across the DeFi landscape.

Protocol-Level MEV Redistribution: A New Standard for DeFi Fairness

With the advent of Fairblock’s cryptographic sealing, the conversation around protocol-level MEV redistribution is entering a new era. Previously, attempts to redistribute MEV often centered on reactive solutions, redistributing profits from searchers or validators after extraction had already occurred. This approach, while well-intentioned, failed to address the root cause: information asymmetry at the protocol layer. Fairblock’s model, by contrast, neutralizes toxic MEV before it can be extracted, shifting the focus from redistribution to prevention and constructive sharing.

As a result, protocols building atop Fairblock can now embed MEV fairness directly into their core logic. For instance, DeFi applications can programmatically allocate a share of constructive MEV (such as arbitrage profits) to liquidity providers, DAO treasuries, or even back to end-users. Because transaction intent is sealed until finalization, there is no longer an unfair advantage for insiders or bots, redistribution becomes transparent, auditable, and equitable by design.

This sets a new benchmark for MEV protocol standardization. Instead of each protocol inventing bespoke mitigation strategies, Fairblock offers a shared cryptographic foundation that enforces fairness network-wide. As more projects adopt this model, we’re likely to see a rapid convergence toward best practices in MEV handling and transparency, aligning incentives across users, developers, and validators.

Programmable Privacy and Institutional Adoption: Unlocking New DeFi Use Cases

Beyond MEV mitigation, Fairblock’s programmable privacy is catalyzing a wave of innovation in DeFi and beyond. By allowing protocols to define when and how transaction data is revealed, Fairblock enables use cases that were previously impractical or impossible on fully transparent chains. For example:

Five Real-World Use Cases Enabled by Fairblock’s Programmable Privacy

-

1. Front-Running-Resistant Decentralized Exchanges (DEXs): By encrypting trade orders until after block finalization, Fairblock enables DEXs to prevent front-running and sandwich attacks, protecting users from predatory MEV practices and ensuring fairer price execution.

-

2. Confidential DeFi Strategies and Vaults: DeFi protocols can leverage Fairblock’s programmable privacy to allow users to deploy complex investment strategies or participate in yield vaults without exposing their intent or trade logic to competitors or MEV bots.

-

3. Secure On-Chain Auctions and NFT Drops: Fairblock’s encrypted execution model enables truly private bidding in on-chain auctions and fair NFT drops, preventing information leakage and manipulation by bots or insiders before bids or purchases are revealed.

-

4. Institutional-Grade DeFi Participation: Institutions can confidently provide liquidity or execute large trades on DeFi platforms built on Fairblock, knowing their transaction sizes and strategies remain confidential until settlement, reducing the risk of market impact and information leakage.

-

5. Privacy-Preserving AI Agents and Automated Trading: Fairblock allows on-chain AI agents and trading bots to operate without exposing their algorithms or intent, enabling secure, competitive automated trading and advanced DeFi automation while maintaining transparency post-execution.

Institutions, historically wary of public blockchains due to information leakage, can now participate in on-chain markets with confidence. Confidential stablecoin settlements, private auctions, and even AI-powered trading agents are all feasible with the assurance that sensitive data remains protected until execution. This programmable privacy is not merely a feature; it is rapidly becoming a requirement for next-generation DeFi protocols competing for institutional liquidity and user trust.

The Road Ahead: Toward Sustainable MEV Markets

The significance of Fairblock’s hybrid MEV model extends far beyond technical innovation, it is actively reshaping the social contract between blockchain participants. By embedding cryptographic fairness at the protocol layer, Fairblock is catalyzing an ecosystem where toxic extraction is obsolete, and value flows are transparent, auditable, and aligned with user interests.

This paradigm shift has not gone unnoticed by researchers or builders. As highlighted in recent overviews (docs.fairblock.network), validator-coordinated decryption and optional Trusted Execution Environments (TEEs) offer robust defense-in-depth without sacrificing performance or composability. The result: DeFi protocols can now operate at scale without exposing themselves, or their users, to predatory MEV risk.

Ultimately, Fairblock’s approach signals an inflection point for MEV fairness in DeFi. By providing cryptographic sealing at consensus, programmable privacy, and protocol-level redistribution tools, it offers a blueprint for sustainable, equitable on-chain markets. As adoption grows and standards coalesce around these principles, the DeFi ecosystem will move closer to realizing its founding vision: open, fair, and efficient financial infrastructure for all.