It’s no secret that MEV (Maximal Extractable Value) has been a thorn in the side of DEX traders for years. Front-running, sandwich attacks, and backrunning have siphoned untold value from everyday DeFi users, lining the pockets of sophisticated searchers and validators. But 2025 is shaping up to be the year this script flips. Thanks to innovative MEV rebate mechanisms, the same value that was once extracted from users is now being redistributed to them, think cashback rewards, but turbocharged for DeFi.

From MEV Extraction to MEV Cashback: The New DEX Dynamic

Let’s get pragmatic. The old model saw MEV as a zero-sum game, with users losing out whenever their trades became targets for predatory bots. Today, the landscape is rapidly evolving. Platforms like MEV Blocker, Wallchain, and ZeroSwapDEX are pioneering ways to protect users and share the spoils of MEV rather than let it slip away to extractors. This cashback-style approach is gaining traction because it aligns incentives across the board, users, protocols, and even liquidity providers all get a piece of the pie.

MEV Blocker is leading the charge, boasting protection of over $60 billion in DEX trading volume as of May 2025. In February alone, it returned 156 ETH in rebates to traders. That’s not just a headline, it’s real money flowing back to users who would otherwise have lost out to MEV attacks. This isn’t theoretical; it’s happening right now, and it’s shaking up how people approach DEX trading.

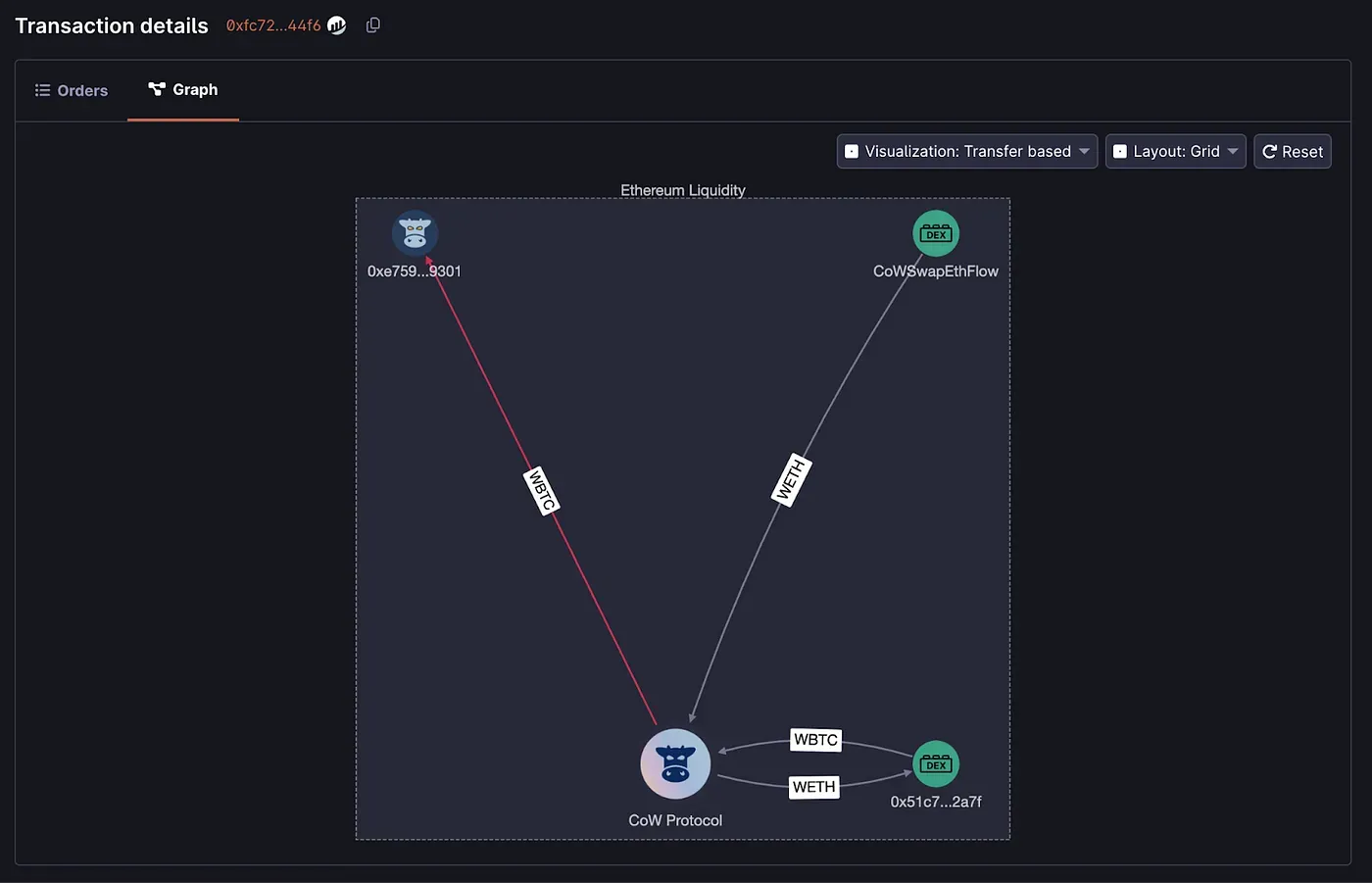

How MEV Rebates Actually Work: Under the Hood

The nuts and bolts are surprisingly elegant. When you route your order through a DEX or wallet with MEV protection (think MEV Blocker, Wallchain, or private RPCs), your transaction is shielded from common attacks like sandwiching and front-running. But here’s the kicker: if there is an opportunity for MEV extraction on your trade (like backrunning), the protocol captures that value and shares it with you as a rebate. It’s not just about protection, it’s about turning the tables so that users benefit from the same mechanisms that used to work against them.

ZeroSwapDEX’s partnership with Wallchain is a case in point. By integrating Wallchain’s SDK and RPC endpoints, ZeroSwapDEX now routes trades privately to block sandwich attacks and delivers any captured MEV back to users as rebates. This rollout started on Polygon and BNB Chain, with more EVM chains in the pipeline. The message is clear: if you’re not using an MEV-sharing protocol, you’re leaving money on the table.

Top MEV Rebate Platforms and Supported Chains

-

MEV Blocker — A leading MEV protection and rebate tool that has protected over $60 billion in DEX trading volume. In February 2025 alone, it distributed 156 ETH in rebates to users. Supported Chains: Ethereum, Polygon, BNB Chain, Gnosis Chain, and more.

-

ZeroSwapDEX (with Wallchain) — ZeroSwapDEX has partnered with Wallchain to integrate MEV protection, redistributing recovered MEV profits back to users. Supported Chains: Polygon, BNB Chain (with expansion to other EVM chains planned).

-

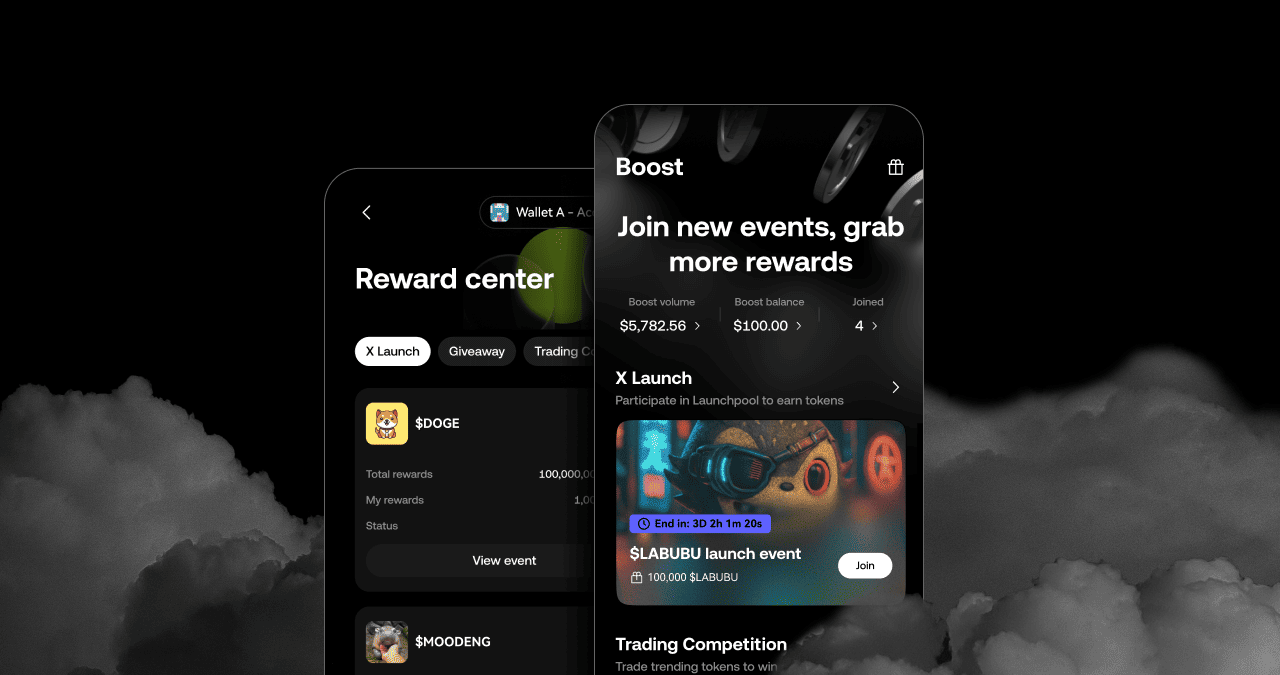

OKX DEX Aggregator (via MetaMask & Consensys SERVO) — OKX’s DEX aggregator now integrates with MetaMask and leverages Consensys’ SERVO for MEV protection, giving users access to over 500 DEXs across 25 blockchains. Supported Chains: Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, and more.

The Rise of Private Orderflow and Sandwich Protection

The surge in private orderflow MEV solutions is impossible to ignore. Wallets and dApps are racing to integrate RPCs like Flashbots Protect, MEV Blocker, Blink, and Merkle, all aiming to keep user orderflow out of public mempools where bots lurk. These private channels don’t just offer theoretical protection; they’re actively measuring and returning value. For example, in benchmark studies across major RPCs, users consistently saw improved execution prices plus tangible rebate payouts, sometimes enough to rival traditional DEX trading fees or even yield strategies.

This isn’t just about security; it’s about creating new forms of MEV APY. Imagine earning passive income simply by routing your trades through rebate-enabled infrastructure. As more DEXs aggregate these protections (see OKX’s recent MetaMask integration with Consensys’ SERVO), expect user expectations to shift rapidly, cashback is no longer just for credit cards or TradFi brokers; it’s becoming table stakes in DeFi.

As the DeFi ecosystem matures, DEX traders are waking up to a new reality: MEV rebates and cashback MEV DeFi aren’t just perks, they’re fast becoming a baseline expectation. The shift is palpable. Protocols that ignore MEV redistribution risk falling behind as users flock to platforms where their orderflow is protected and their trades actively generate value.

Here’s where the competitive edge comes in. By plugging into private orderflow solutions and MEV-sharing protocols, both dApps and wallets can offer their users a meaningful advantage. It’s not just about “not getting sandwiched” anymore; it’s about earning something extra on every trade. In a world where every basis point counts, this can be the deciding factor for power users and whales alike.

What Users Need to Know (and Do) Right Now

If you’re trading on DEXs in 2025, you can’t afford to ignore the rise of MEV rebates. Here’s what you should be doing today to take advantage of this new wave:

How to Start Earning MEV Rebates on DEXs

-

Use wallets or dApps with MEV protection RPCs like MEV Blocker. MEV Blocker routes your trades through private relays, shielding you from front-running and sandwich attacks—and pays out rebates from recovered MEV. As of May 2025, it has protected over $60 billion in DEX trades and distributed 156 ETH in rebates in February 2025 alone.

-

Trade on DEXs that have integrated MEV rebate mechanisms, such as ZeroSwapDEX with Wallchain. ZeroSwapDEX users benefit from Wallchain’s system, which captures and redistributes MEV profits back to traders. This integration is live on Polygon and BNB Chain, with more EVM chains coming soon.

-

Connect your MetaMask wallet to DEX aggregators like OKX that offer MEV protection via Consensys’ SERVO. This setup gives you access to over 500 DEXs across 25 blockchains, with built-in defense against MEV attacks and the potential for rebates on your trades.

-

Switch your wallet’s RPC endpoint to a private MEV-protected RPC (such as those provided by MEV Blocker, Flashbots, Blink, or Merkle). This simple change can help you avoid toxic MEV and qualify for cashback-style rebates on your DEX trades.

-

Stay updated on new integrations and rebate programs from major DEXs and wallets. As MEV rebate solutions become more common, leading platforms frequently announce new features and supported chains—so follow their official blogs and social channels to maximize your earning opportunities.

First, check if your wallet or favorite DEX aggregator supports private orderflow routing or integrates with protocols like Wallchain or MEV Blocker. Many leading wallets now offer a simple toggle for protected orderflow RPCs, it’s as easy as flipping a switch. Second, stay informed on which platforms are actually paying out rebates (not all are created equal). And third, keep an eye out for new features like automated backrun rebates or protocol-level MEV APY, which can supercharge your trading returns with zero extra effort.

Transparency is also key. Platforms like MEV Blocker are publishing detailed stats on protected volume and distributed rebates, giving users real data to compare. This level of openness is critical for building trust in an industry where opaque extraction has long been the norm.

Where MEV Rebates Go Next

Looking ahead, expect MEV sharing protocols to become deeply embedded in the DeFi stack. As more chains and protocols adopt these mechanisms, competition will drive innovation, think customizable rebate splits, dynamic APY models, and even loyalty programs based on your total protected volume. The days of passive value loss to searchers are fading fast.

For developers, the opportunity is enormous. Integrating SDKs like Wallchain’s or leveraging open-source rebate infrastructure is now a must-have feature, not an afterthought. For traders and liquidity providers, MEV APY will become a new metric to track, right alongside APR and gas efficiency.

Bottom line: if you’re still trading on DEXs without MEV protection and rebate flows, you’re subsidizing someone else’s profit. The new DeFi playbook is all about sandwich protection DEX features, backrun rebates, and transparent MEV redistribution. Get in, route smart, and let your trades work for you, not against you.