As the decentralized finance (DeFi) sector matures, the conversation around fairness and transparency is intensifying. At the center of this debate lies Maximal Extractable Value (MEV), a phenomenon that continues to shape both the incentives and risks for DeFi users, protocol designers, and validators. With Ethereum trading at $3,733.83 as of today, the stakes for sustainable and equitable MEV management have never been higher.

What Is MEV and Why Does Redistribution Matter?

MEV refers to the profit that privileged actors (miners, validators, block builders, and searchers) can extract by manipulating the order, inclusion, or censorship of transactions within a block. While MEV can help address certain inefficiencies in DeFi protocols, unchecked extraction often leads to harmful behaviors like front-running, sandwich attacks, and value siphoning from everyday users. This undermines the core principles of decentralization and trustless finance.

MEV redistribution protocols have emerged as a solution to this challenge. By capturing and equitably sharing MEV profits among network participants, these protocols aim to level the playing field and reinforce the pillars of DeFi fairness. For developers, understanding and implementing these mechanisms is now essential for protocol integrity and user trust. For a deeper dive into the mechanics of MEV redistribution, see this guide.

Core Mechanisms of MEV Redistribution Protocols

Several innovative strategies have been introduced to address MEV extraction and promote equitable value sharing:

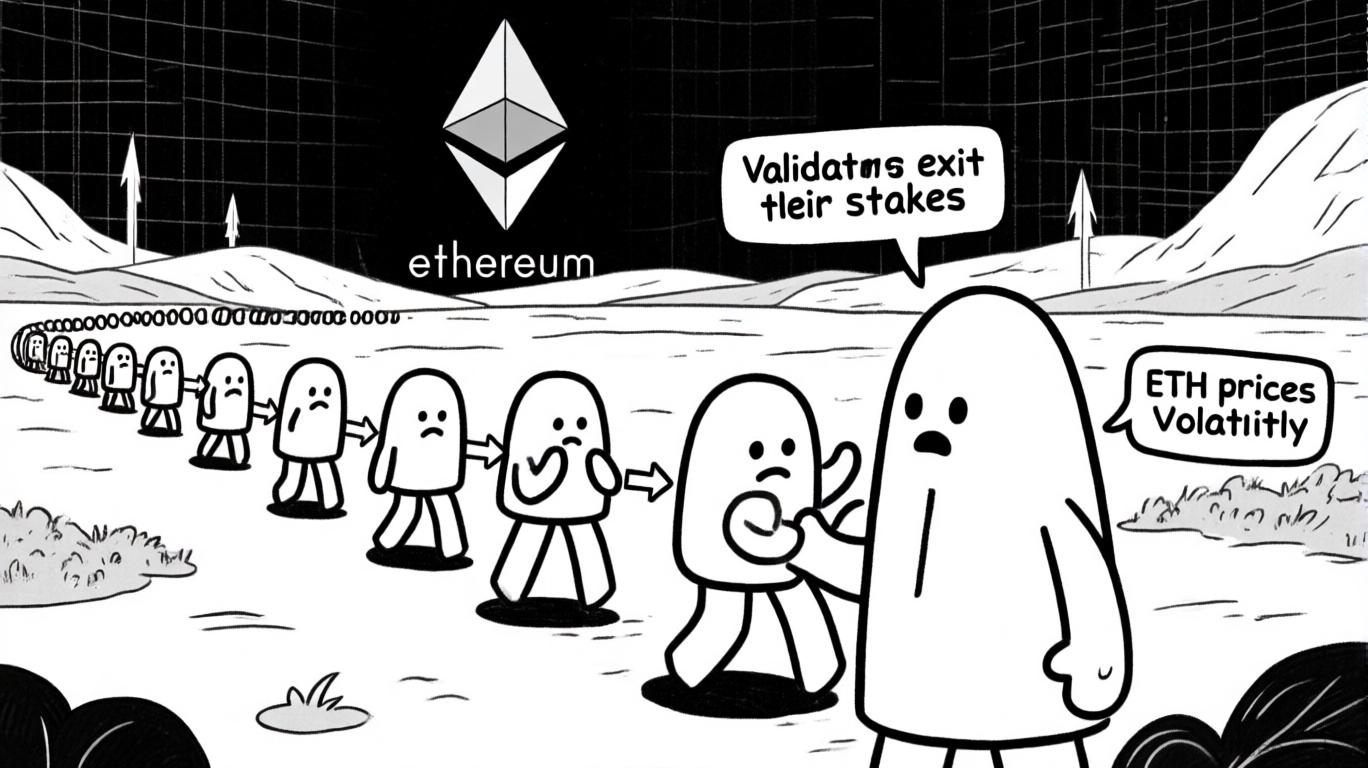

- MEV-Smoothing: This technique pools MEV rewards and distributes them evenly among all validators participating in a given slot. By mitigating reward variance and discouraging self-serving behaviors, MEV-smoothing enhances both fairness and network stability.

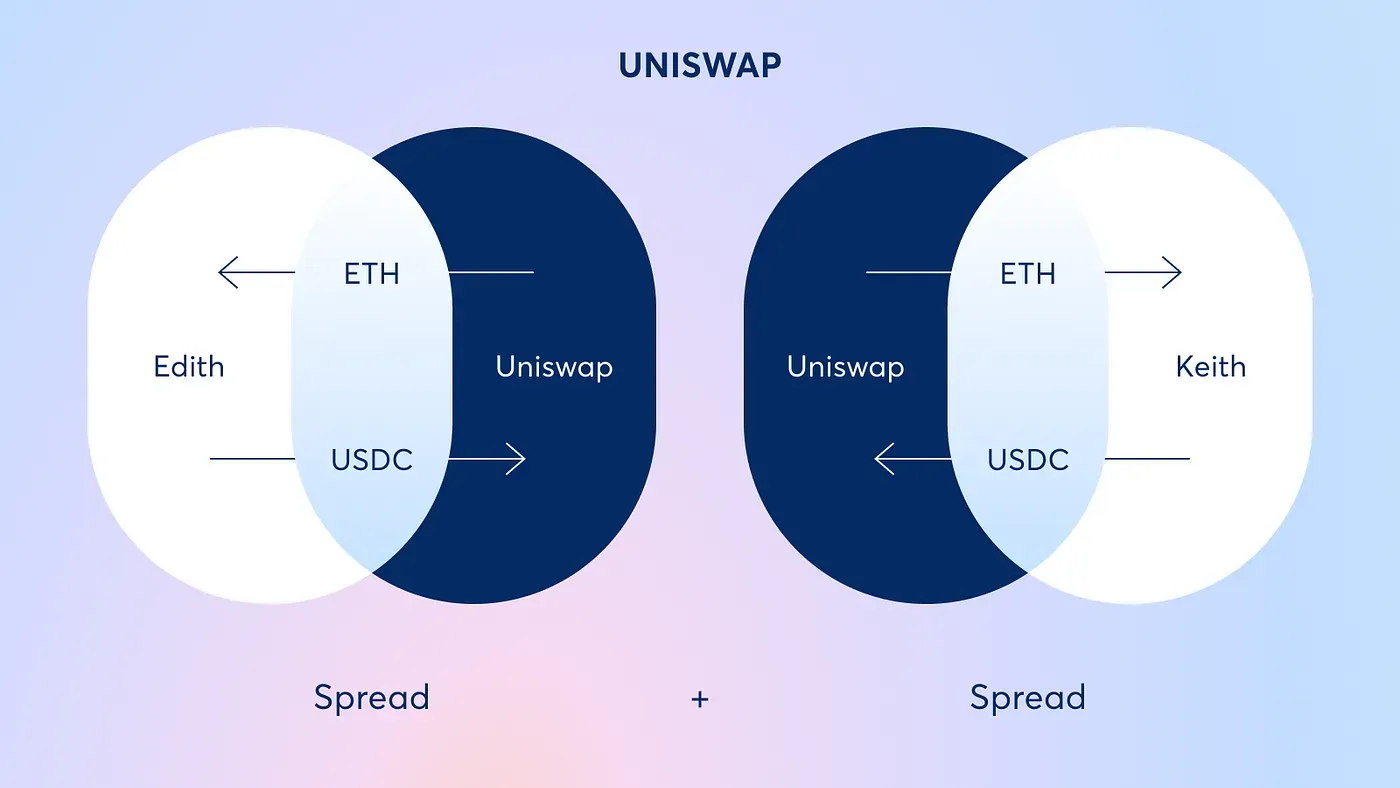

- Order Flow Auctions (OFAs): OFAs introduce competitive auctions where searchers bid for the right to include their transactions alongside user trades. This mechanism enables users to reclaim a significant portion of the MEV generated by their own transactions, reducing extraction risk and improving execution quality.

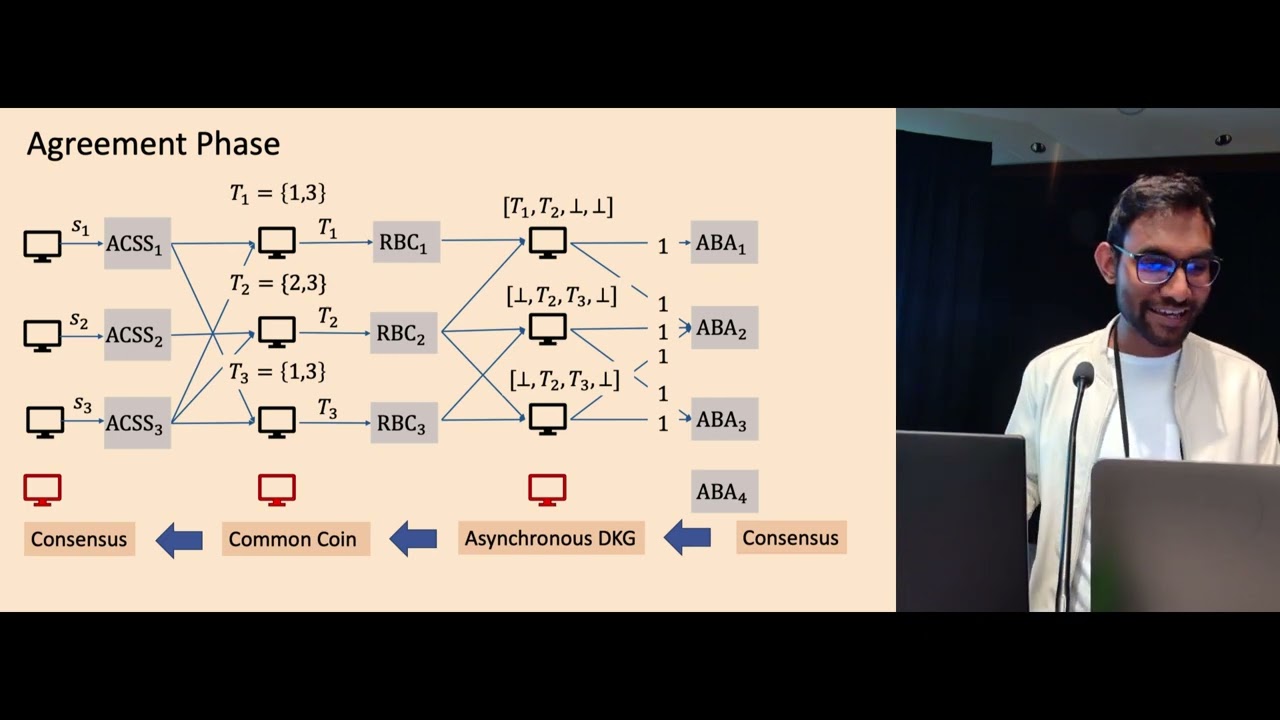

- Private Mempools and Encrypted Transactions: Concealing transaction details until block finalization prevents front-running and other predatory tactics. Private mempools ensure that no participant can gain an unfair advantage by prematurely accessing transaction information.

These approaches, when thoughtfully implemented, can dramatically reduce the negative externalities of MEV while preserving the composability and efficiency that define DeFi markets.

Developer Guide: Integrating MEV Redistribution into DeFi Applications

For protocol developers, the path to effective MEV risk mitigation starts with a rigorous assessment of potential vulnerabilities. Identifying where and how MEV can be extracted from your application is the foundation for strategic defense. Key implementation steps include:

- Assess MEV Vulnerabilities: Map out transaction flows and identify points susceptible to manipulation or value leakage.

- Integrate MEV-Smoothing: Use smart contract logic to pool and redistribute MEV rewards, aligning incentives across participants.

- Adopt Order Flow Auctions: Build or integrate OFA systems to let users capture a share of the MEV their transactions generate.

- Utilize Private Mempools: Implement transaction privacy measures to prevent exploitative behaviors before block confirmation.

- Stay Informed: Engage with the latest research and community discussions on MEV mitigation strategies to ensure your protocol remains robust and competitive.

For more actionable strategies, explore our detailed resource on developer-focused MEV integration.

MEV Redistribution and the Future of DeFi Fairness

The adoption of MEV redistribution protocols is rapidly becoming a standard for responsible DeFi development. As Ethereum’s price hovers at $3,733.83, the market’s appetite for transparent and equitable value flows is only increasing. Developers who prioritize MEV sharing strategies not only protect their users, but also contribute to the long-term health and sustainability of DeFi as a whole.

MEV redistribution protocols are not just a technical upgrade, they represent a fundamental shift in how value and risk are managed across decentralized systems. As more protocols adopt these designs, we observe a tangible reduction in the adversarial behaviors that once plagued DeFi’s early years. Users benefit from improved execution quality and lower slippage, while validators and liquidity providers see more predictable, less volatile reward streams.

Key Benefits of MEV Redistribution in DeFi

-

Enhanced Fairness for All Participants: MEV redistribution protocols, such as MEV-smoothing on Ethereum, ensure that rewards from transaction ordering are shared equitably among validators and users, reducing the concentration of profits and promoting a more level playing field.

-

Reduced Front-Running and Exploitation: By leveraging private mempools and encrypted transaction mechanisms (e.g., Flashbots), DeFi protocols can prevent malicious actors from exploiting transaction order, protecting users from unfair losses and slippage.

-

Direct User Rewards Through Order Flow Auctions: Protocols like CoW Protocol use Order Flow Auctions (OFAs) to allow users to receive a portion of the MEV generated by their trades, turning what was once an exploitative practice into an opportunity for user benefit.

-

Greater Network Stability and Security: By distributing MEV rewards more evenly, these protocols discourage manipulative validator behavior and reduce reward variance, leading to a more stable and secure DeFi environment.

-

Increased Trust and Transparency: MEV redistribution mechanisms foster a sense of trust among DeFi users and developers, as profits are distributed openly and fairly, aligning with the core principles of decentralization and transparency.

One of the most notable market effects is the emergence of sustainable MEV markets. Rather than a zero-sum contest where only the fastest or most privileged actors win, value is shared in a manner that aligns incentives and fosters ecosystem resilience. This is particularly important as DeFi protocols grow in complexity and scale, making it imperative to minimize extraction risks and maintain user trust.

Best Practices for Developers: Building Fairer DeFi Protocols

Developers aiming to implement MEV redistribution should consider several best practices to maximize impact:

- Transparency by Design: Make MEV flows and redistribution logic auditable. Open-source smart contracts and clear documentation help build user confidence.

- Continuous Monitoring: Use analytics to detect new MEV vectors as protocols evolve. Ongoing audits are essential as attackers adapt.

- Community Involvement: Empower users to participate in governance decisions related to MEV sharing strategies. This democratizes risk management and aligns stakeholder interests.

- Layered Defenses: Combine multiple mitigation tools, such as OFAs, private mempools, and batch auctions, for comprehensive protection.

For a deeper exploration of protocol-level design choices, see this analysis.

Looking Ahead: The Evolving Role of MEV in DeFi

The trajectory for MEV risk mitigation is clear: as the technology matures, so too will the sophistication of both attackers and defenders. Protocols that proactively adopt redistribution mechanisms will be better positioned to maintain fairness, attract liquidity, and foster sustainable growth. The current price of Ethereum at $3,733.83 underscores the scale of value at stake, and the responsibility developers have to safeguard that value for all participants.

Ultimately, MEV redistribution protocols are a powerful tool for enhancing DeFi fairness, reducing systemic risk, and promoting blockchain transparency. The next wave of DeFi innovation will be defined not just by new financial primitives, but by the community’s commitment to equitable value sharing and robust MEV risk mitigation. For further guidance on integrating these principles into your projects, explore our resource on MEV redistribution in DeFi ecosystems.