What if the way we distribute tokens could fundamentally change who benefits from DeFi and how fairly value flows through a protocol? In the evolving landscape of decentralized finance, U-shaped token distribution models are gaining traction as a promising approach to address fairness, especially when it comes to the thorny issue of Maximal Extractable Value (MEV). Recent innovations like MegaETH’s U-shaped allocation and KPI Rewards system have reignited the conversation about how initial token distribution shapes long-term ecosystem health, governance, and MEV dynamics.

Why Token Distribution Shapes MEV Fairness

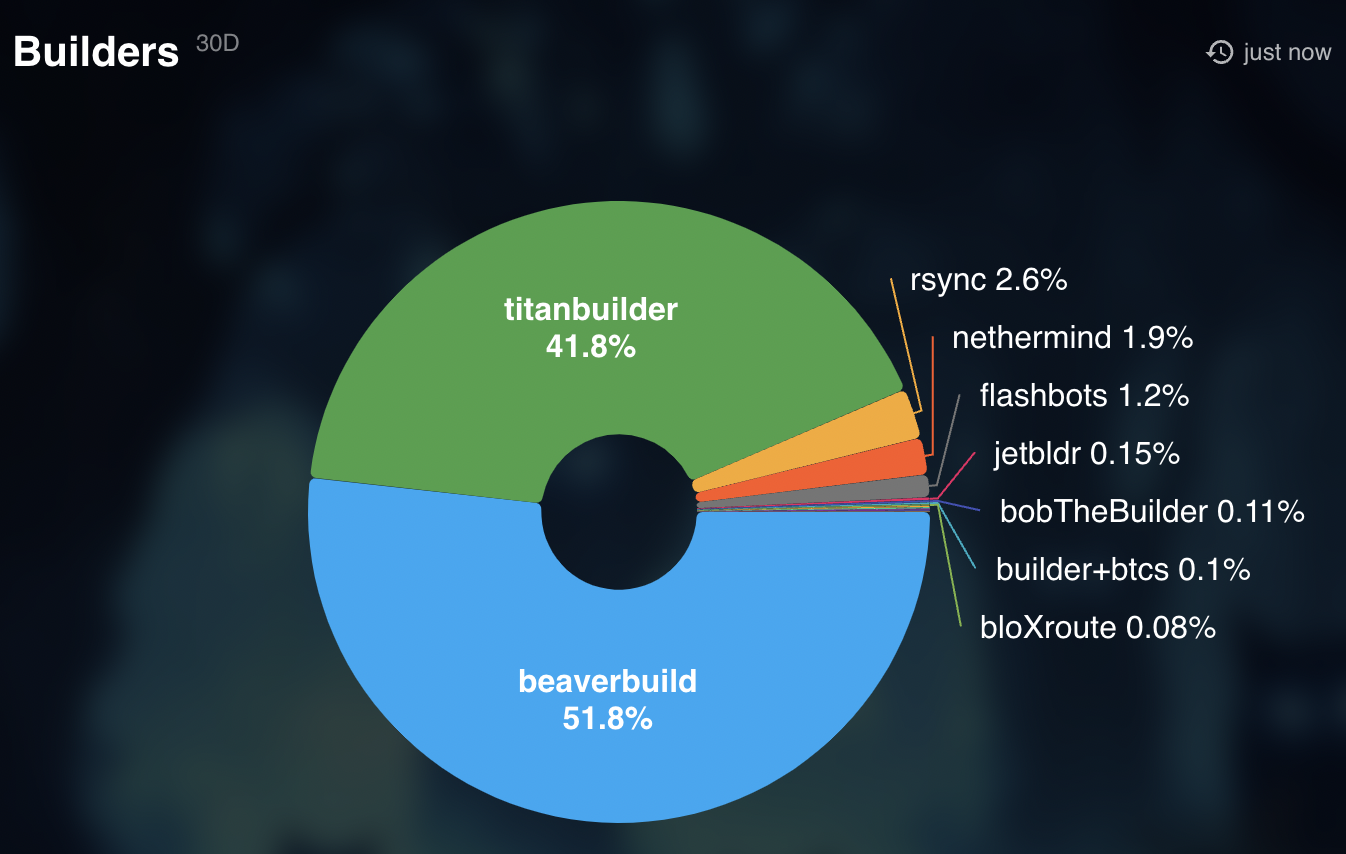

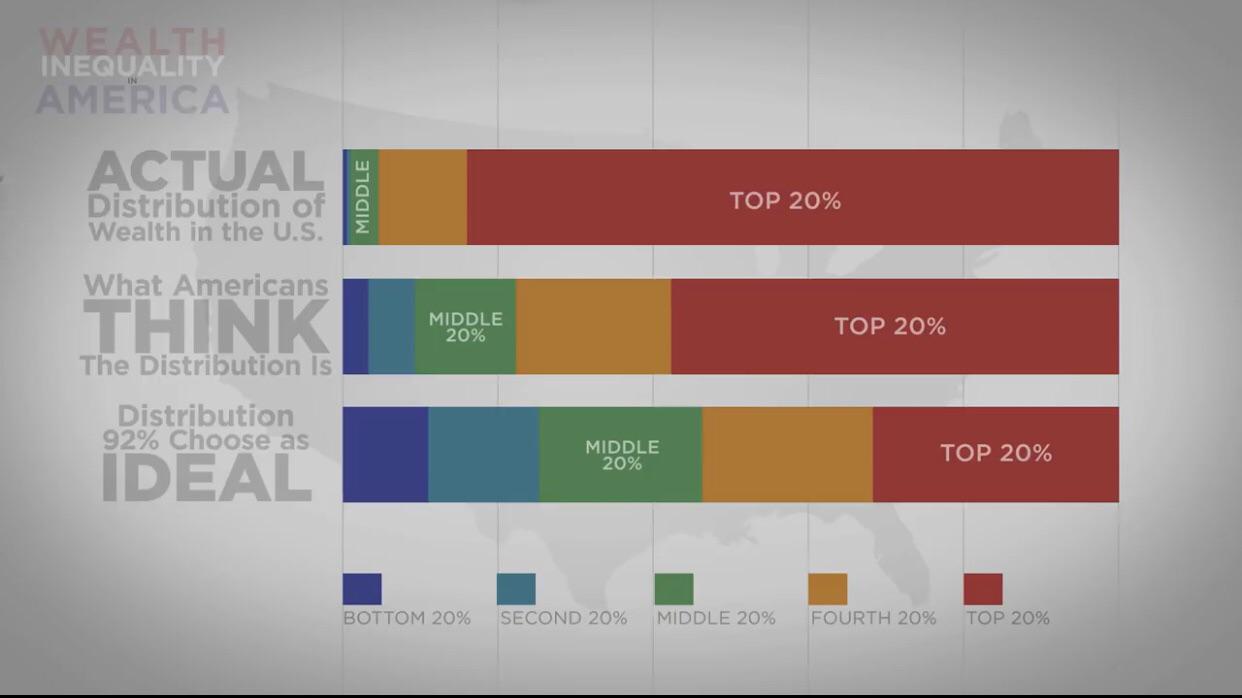

Token distribution isn’t just about who gets rich first. It directly impacts who controls governance, who can participate in protocol upgrades, and crucially, who can influence or extract MEV. Classic launch models, like simple pro-rata or time-based allocations, often end up favoring whales or insiders. This concentration of power makes it easier for large players to collude or exploit transaction ordering for profit, leaving everyday users at a disadvantage.

The U-shaped model, popularized by projects like MegaETH, aims to flip this script. Instead of concentrating tokens in the hands of early insiders or only rewarding massive contributors, it allocates a meaningful share to both small and large participants. Picture the letter “U”: both ends get more than those in the middle. This creates a broad base of engaged stakeholders at both extremes, small retail users and major contributors, while avoiding an oligopoly of mid-sized actors.

MegaETH’s Take: Balancing Fairness and Contribution

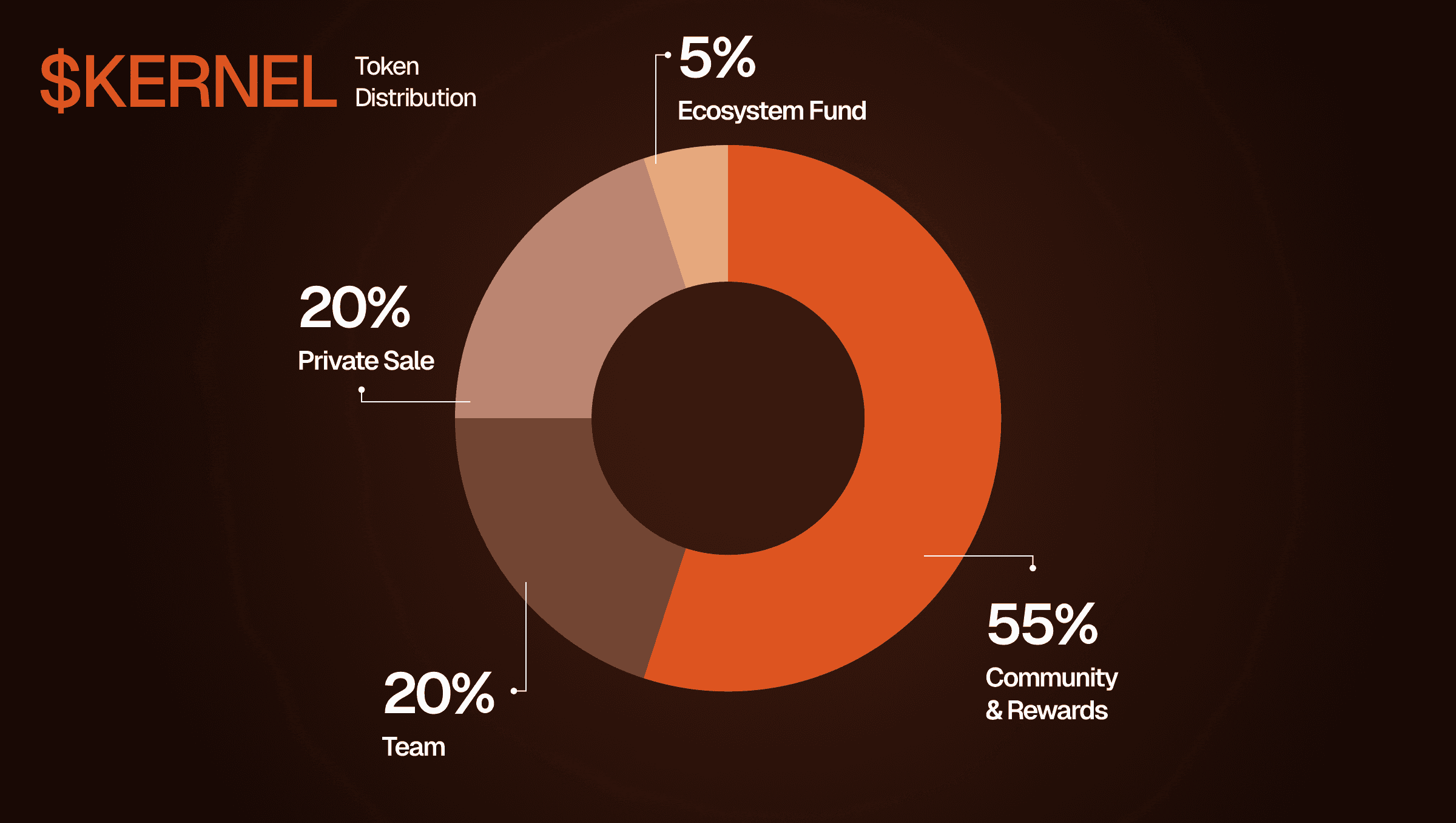

MegaETH’s recent tokenomics reveal is making waves for its nuanced approach to fairness. Their whitepaper outlines not just a modest 9.5% team allocation but also an innovative KPI Rewards system that ties $MEGA issuance directly to network development milestones, not just time elapsed. This means that tokens are distributed as the protocol grows and achieves real-world adoption, aligning incentives across all participants.

Their custom U-shaped allocation system, as discussed widely on social media and in research circles, is designed to reward both grassroots contributors (like early users or community builders) and larger ecosystem partners without letting either group dominate governance or MEV opportunities. By spreading out voting power and ownership more equitably, MegaETH hopes to make it harder for any single cohort, especially whales, to coordinate on extracting undue MEV from ordinary users.

Does Diversified Ownership Really Prevent MEV Exploitation?

The logic behind U-shaped distributions is compelling: if no single group can easily amass enough tokens to control block production or validator sets, then collusion becomes much harder, and so does front-running or sandwich attacking regular users’ trades. However, recent academic research adds nuance here: even with fair initial allocations, token tradability tends to drive wealth concentration over time. As tokens change hands in secondary markets, some degree of centralization is almost inevitable.

This insight doesn’t invalidate U-shaped models, it highlights why they should be combined with technical solutions like threshold encryption (as seen in FAIR blockchain) or onchain contribution scoring mechanisms that reward ongoing positive-sum behavior rather than one-off speculation. Ultimately, true fairness in MEV redistribution may require blending smart design at launch with adaptive mechanisms that respond as the ecosystem matures.

Projects like MegaETH are setting a new standard by not just rethinking who gets tokens, but also how those tokens are earned and retained. Their KPI Rewards system, which ties token issuance to network development metrics, encourages long-term engagement and discourages the kind of speculative flipping that accelerates wealth concentration. By keeping both grassroots users and major contributors invested in the protocol’s success, U-shaped models aim to foster a culture where MEV rewards flow more evenly through the ecosystem.

Key Benefits and Drawbacks of U-Shaped Token Distribution for MEV Fairness

-

Promotes Broad Token Ownership: U-shaped models allocate tokens to both small and large participants, reducing wealth concentration and encouraging a more inclusive DeFi ecosystem.

-

Mitigates MEV Exploitation Risks: By dispersing tokens across a wide user base, collusion among large holders is less likely, helping to limit MEV extraction opportunities.

-

Supports Decentralized Governance: A diverse token holder base prevents dominance by a few entities, fostering fairer governance and decision-making within protocols like MegaETH.

-

Vulnerable to Wealth Concentration Over Time: Despite fair initial allocations, token tradability can lead to eventual concentration, as shown by agent-based model studies.

-

Requires Complementary Technical Solutions: U-shaped distribution alone cannot fully prevent MEV; projects like FAIR blockchain use transaction encryption to further enhance fairness.

Yet, as promising as these models are, they aren’t a silver bullet. The reality is that token markets are dynamic, holders buy, sell, and consolidate their positions over time. Even the fairest launch can’t fully insulate a protocol from gradual centralization if secondary market forces go unchecked. That’s why many in the DeFi research community advocate for a layered approach: start with a fair launch like U-shaped distribution, then reinforce it with technical safeguards such as transaction encryption or randomized block producer selection.

Combining Distribution With Onchain Safeguards

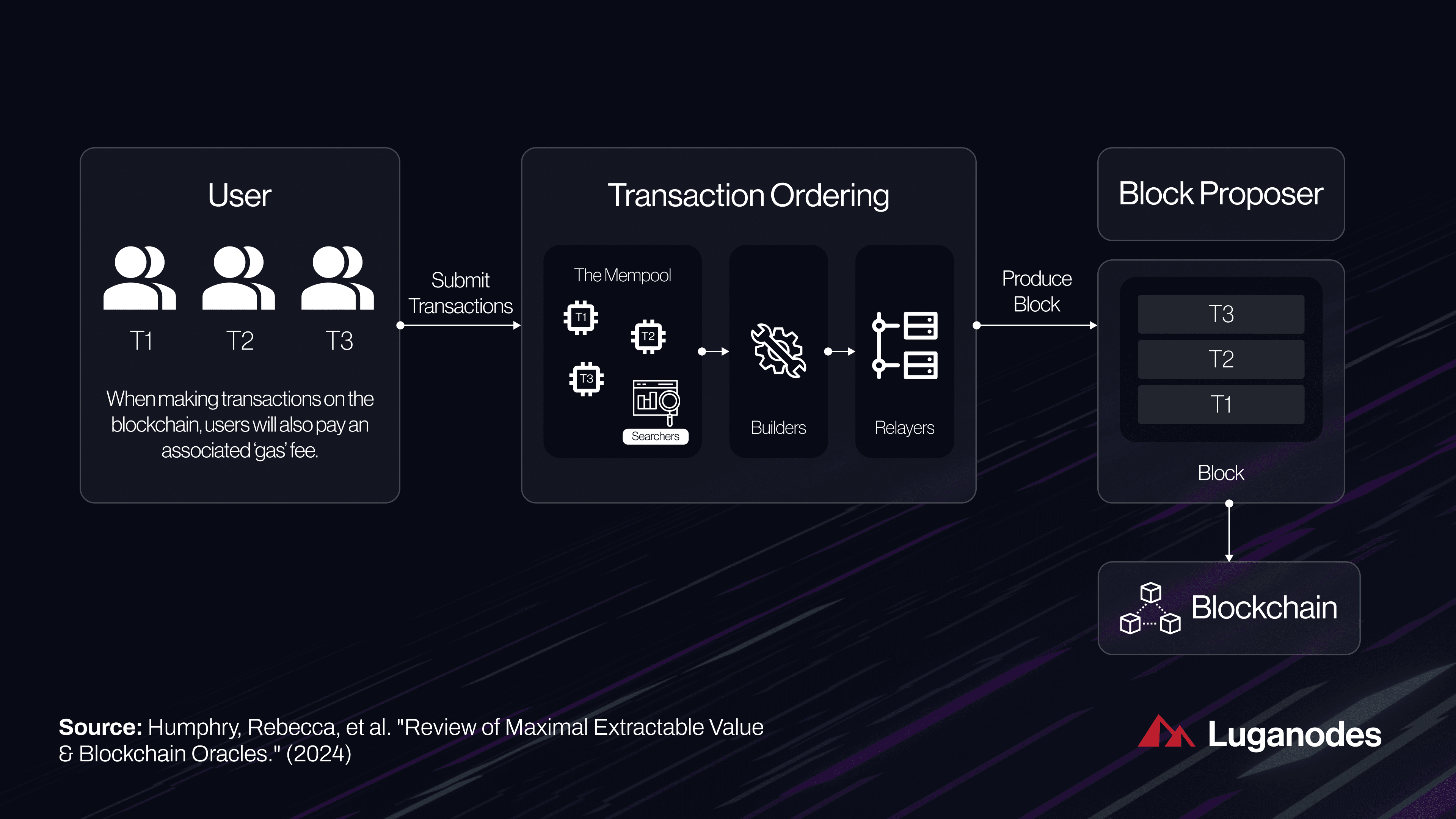

Innovative technical solutions are now emerging to bolster these fair launch strategies. For example, threshold encryption protocols like BITE (used by FAIR blockchain) keep transaction details confidential until block finalization. This makes it significantly harder for any group, no matter how many tokens they hold, to front-run or manipulate trades for MEV gains. When paired with broad-based distribution models, these technologies can help ensure that no one entity can game the system at scale.

Another promising avenue is onchain contribution scoring, which rewards users not just for holding tokens but for actively supporting network health, running validators, providing liquidity, or building useful tools. By aligning rewards with positive-sum behaviors rather than simply capital allocation or early access, protocols can further dilute the power of would-be MEV extractors.

Looking Forward: A Blueprint for Fairer DeFi

The conversation about MEV fairness is evolving rapidly as new data and real-world experiments come online. What’s clear is that U-shaped token distribution offers a compelling starting point, one that distributes both governance power and economic upside more widely than traditional approaches. But to truly protect users from MEV extraction and ensure sustainable value flow within DeFi ecosystems, protocols must adopt an integrated approach: smart initial allocations backed by ongoing technical innovation.

If you’re interested in practical steps for building fairer DeFi systems or want to explore more about how protocol design impacts MEV redistribution, check out our deep dives on U-shaped distribution models and MEV-aware protocol design strategies. As always, transparency and community input will be key in shaping the next wave of equitable finance.