For years, Maximal Extractable Value (MEV) was a hidden tax on DeFi users. Validators and sophisticated searchers quietly siphoned value from everyday traders by reordering, including, or excluding transactions for their own gain. The result: DeFi protocols that looked open on the surface, but funneled profits upward while users bore the cost in the form of higher slippage and less favorable trade execution.

MEV Redistribution: Flipping the Script on User Rewards

The emergence of MEV redistribution protocols is changing this narrative. Instead of allowing MEV to be monopolized by validators or bots, a new wave of solutions is actively capturing this value and redistributing it back to users and liquidity providers. Think of it as turning what was once a drain into a cashback mechanism, one that rewards participation and aligns incentives across the ecosystem.

Take MEV Blocker, for example. By routing user transactions through private networks and auctioning off backrun opportunities, MEV Blocker returns a staggering 90% of builder rewards as rebates directly to users. In 2024 alone, this translated into 4,079 ETH distributed back into user wallets, a figure that would have previously lined the pockets of validators or searchers. This shift isn’t just technical; it’s fundamentally altering how value flows in DeFi.

Key Mechanisms Behind Fair MEV Distribution

The core innovation behind these protocols lies in their ability to intercept and redistribute MEV at various points in the transaction lifecycle:

- Private Transaction Routing: Solutions like MEV Blocker shield user trades from public mempool exposure, preventing front-running and sandwich attacks while capturing potential backrun profits for redistribution.

- Rebate Systems: Rebates work much like traditional cashback, users receive a direct share of any MEV generated by their transactions. This not only offsets costs but can transform trading strategies by making certain routes more attractive.

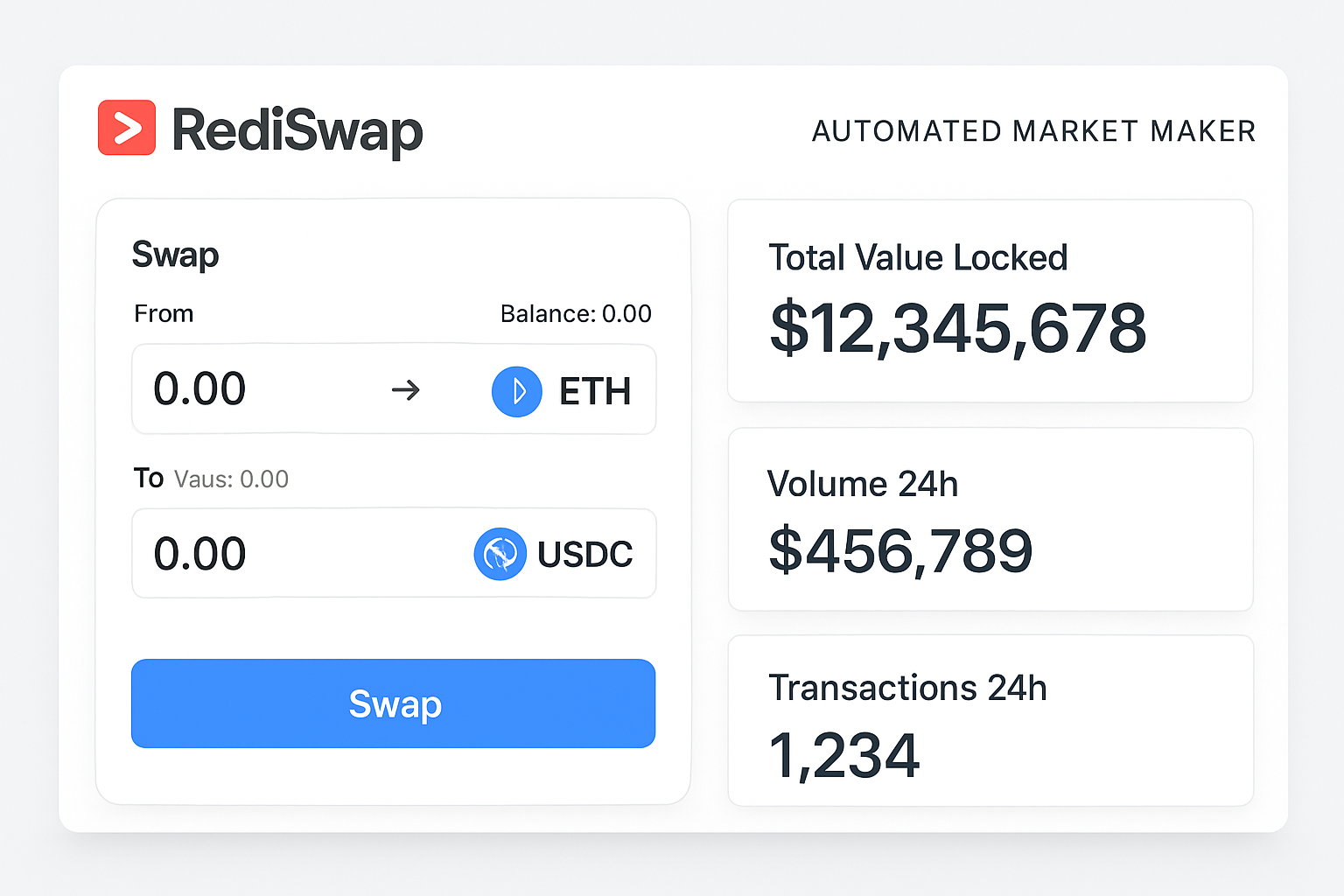

- Application-Level Capture: Protocols such as RediSwap go further by managing arbitrage opportunities within their own AMM pools. Instead of losing out to external bots, these platforms capture arbitrage profits internally and split them between traders and liquidity providers.

- Insurance Models: Dextr’s AVMM introduces multi-layered insurance against negative MEV events, compensating users if they’re adversely affected by transaction ordering or price impact.

This toolbox isn’t just theoretical, it’s already reshaping user experiences across major platforms. For detailed breakdowns of real-world implementations and performance data, check out our analysis here.

The Practical Impact: User Retention, Protocol Loyalty, Ecosystem Health

The practical benefits are hard to overstate:

- User Retention Upgrades: Platforms offering transparent MEV rebates are seeing stickier user bases. When traders know they’re getting a fair shake, and even earning passive rewards, they’re far less likely to jump ship for competitors.

- Ecosystem Alignment: Fair profit-sharing encourages cooperation between liquidity providers, developers, and regular users. This reduces adversarial behavior (like toxic order flow) and creates positive-sum dynamics across protocols.

- Sustainable Growth: By democratizing access to MEV-derived rewards, these protocols lower barriers for new entrants and foster healthier competition among DEXs and aggregators.

This is not just theory; nearly 10,000 unique addresses have already benefited from Wallchain’s distribution model alone, a number that continues to grow daily as more platforms adopt similar strategies.

Wallchain is a standout example, integrating directly with DeFi protocols to capture hidden MEV opportunities and return profits to users in the form of cashback. By combining user swap data with searcher strategies, Wallchain effectively eliminates the edge of malicious bots and ensures that value flows back to the community instead of being siphoned off by a privileged few. According to recent reports, almost 10,000 unique addresses have already received rewards from Wallchain’s redistribution model, a clear signal that user-centric MEV sharing isn’t just a technical upgrade but a competitive differentiator for DeFi platforms.

For traders and liquidity providers, these innovations mean that every transaction has the potential to generate additional value. Instead of accepting slippage or adverse execution as an unavoidable cost, users now have tools and incentives to recapture some of what was previously lost. This shift not only improves individual returns but also makes DeFi trading more attractive compared to traditional finance, where such rebates are rare or non-existent.

Top MEV Redistribution Protocols & Their User Benefits

-

MEV Blocker: This protocol, launched by a consortium of over 30 Ethereum teams, returns 90% of builder rewards as rebates to users. In 2024, MEV Blocker distributed 4,079 ETH in rebates, protecting users from front-running and sandwich attacks while boosting DeFi earnings.

-

Wallchain: Wallchain integrates directly with DeFi platforms to capture and redistribute MEV profits. By combining user swaps with searcher strategies, it eliminates malicious bots and channels hidden profits back to users. Wallchain has already benefited nearly 10,000 unique user addresses.

-

RediSwap: As an innovative AMM, RediSwap captures MEV at the application level and splits profits between users and liquidity providers. This ensures better trade execution for users and increased rewards for LPs, outperforming many traditional AMMs in user benefit distribution.

Challenges and Future Directions in MEV Sharing Protocols

Of course, the journey toward fair MEV distribution isn’t without its hurdles. Designing robust incentive mechanisms that balance user rewards with protocol security is complex. There’s always a risk that poorly calibrated systems could lead to new forms of exploitation or centralization. Transparency in how rebates are calculated and distributed remains paramount, users must be able to verify that rewards are legitimate and equitably shared.

Another challenge is interoperability: as more protocols implement their own versions of MEV sharing, the ecosystem risks fragmentation unless standards emerge for cross-platform rebate tracking and aggregation. Projects like Flashbots and research into order flow auctions are paving the way for more unified solutions, but there’s still work ahead before seamless multi-protocol MEV sharing becomes reality.

Why This Matters for DeFi’s Next Growth Phase

The implications go beyond short-term trading incentives. By putting real economic power back into users’ hands, MEV redistribution protocols help DeFi fulfill its promise of openness and fairness. They lower barriers for new market entrants by mitigating extraction risks and create more resilient ecosystems less prone to manipulation by insiders.

If you’re building or trading in DeFi today, paying attention to which platforms offer transparent MEV rebates isn’t just smart, it’s essential for maximizing your returns while supporting healthier market dynamics. The days when miner extractable value was an invisible tax on participation are numbered; with every new protocol adopting fair distribution models, we move closer to an equitable financial system where everyone shares in the upside.

To dive deeper into the mechanics behind these transformations, and see how specific protocols stack up, explore our comprehensive guides on how MEV rebates are transforming user incentives and the mechanisms behind fair value redistribution in DeFi networks.