Maximal Extractable Value (MEV) has long haunted the DeFi landscape as an invisible tax on users. While Ethereum currently trades at $4,467.07, this thriving ecosystem continues to grapple with the persistent challenge of value extraction by miners and validators. MEV arises when block producers reorder, include, or exclude transactions within a block to maximize their own profits. This practice can inflate transaction costs, degrade user experience, and erode trust in decentralized protocols.

The Mechanics of MEV: Unseen Costs in Every Transaction

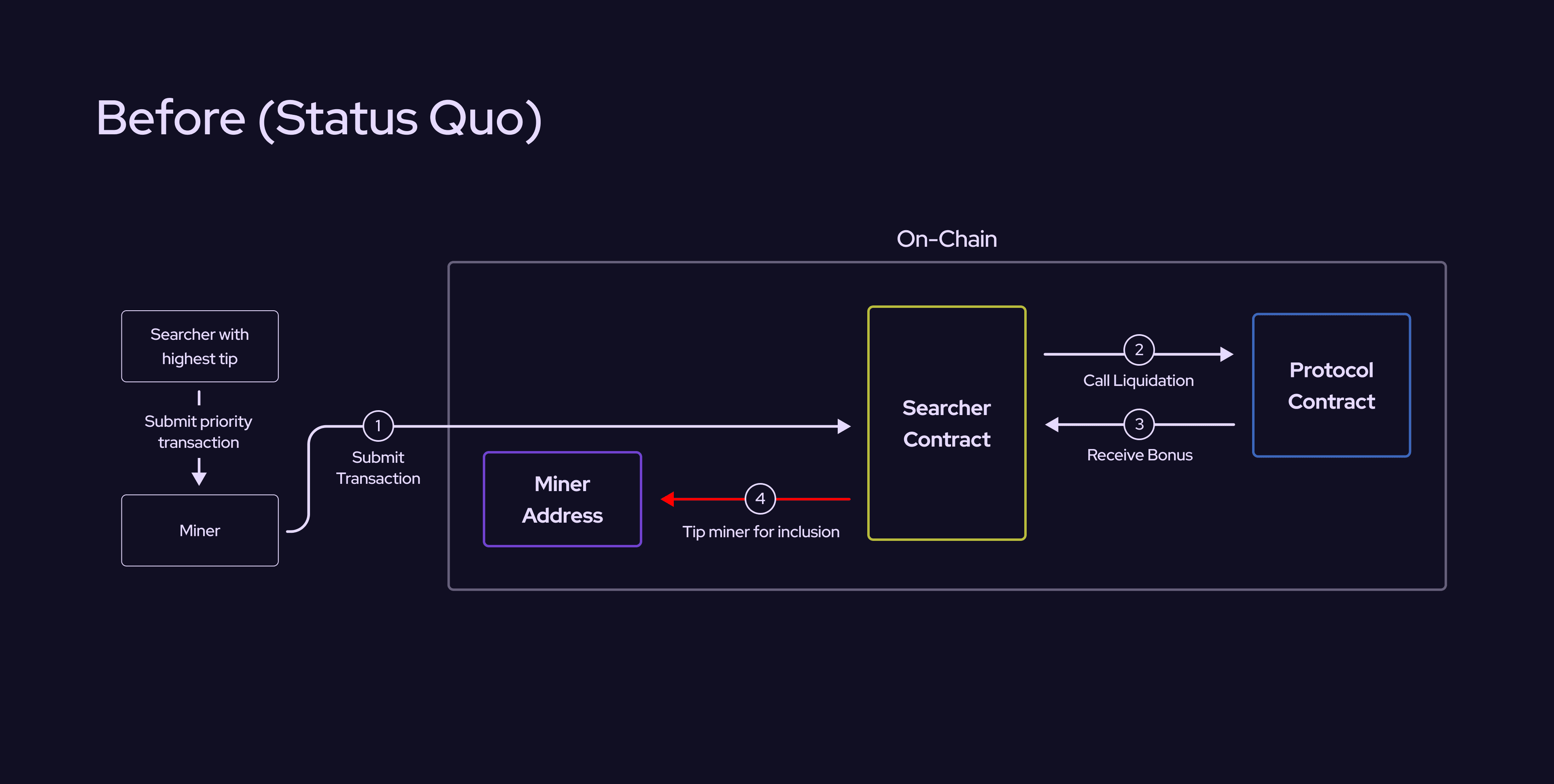

At its core, MEV is the profit opportunity available to those who control transaction ordering on blockchains like Ethereum. Unlike standard block rewards and transaction fees, MEV is extracted through sophisticated strategies such as front-running, backrunning, and sandwich attacks. These maneuvers often result in users receiving less favorable trade prices or paying higher gas fees than anticipated – a phenomenon likened to an “invisible tax” by industry analysts (Cointelegraph). In high-stakes environments like liquidations and arbitrage opportunities, specialized bots race to capture this value before anyone else can react.

The Cost of Invisibility: How MEV Impacts Users

For everyday DeFi participants, the impact of MEV is both subtle and profound. When a user’s swap is sandwiched or their liquidation is sniped by a bot, value that would otherwise accrue to them is siphoned off by intermediaries operating behind the scenes. As reported by FinanceFeeds, this silent drain on user funds can amount to billions annually across major protocols.

Consider the scenario where an Ethereum user initiates a large swap at the current market price of $4,467.07. If their order is targeted by a sandwich attack – where a bot inserts its own trades before and after the user’s transaction – the user may end up paying significantly more for their tokens than intended. Such attacks are not isolated; they are systemic features of permissionless blockchains lacking robust MEV mitigation mechanisms.

DeFi Protocols Fight Back: Redistributing Value with Innovative Mechanisms

Recognizing the corrosive effects of unchecked MEV extraction, leading DeFi protocols have begun implementing mechanisms designed to share or return value directly to users:

Leading DeFi Protocols Redistributing MEV Rewards

-

Chainlink Smart Value Recapture (SVR): Chainlink’s SVR mechanism enables DeFi protocols to reclaim non-toxic MEV, especially from liquidation events. By leveraging parallel price feeds and the Flashbots MEV-Share platform, SVR facilitates auctions where value is captured and redistributed. Notably, its integration with Aave v3 splits captured value 65:35 between Aave and Chainlink for the first six months, directly benefiting users and protocol participants.

-

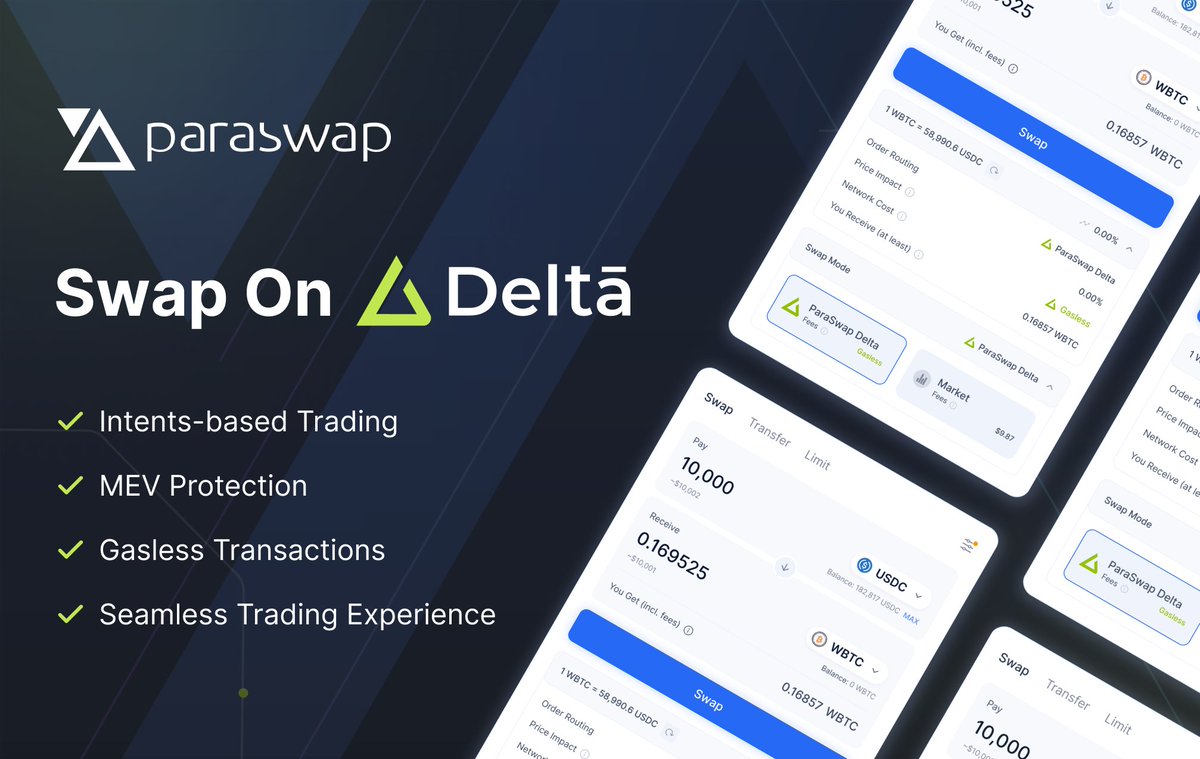

ParaSwap Intent-Based Trading Protocol: ParaSwap’s intent-based model empowers users to define their trading objectives, which are then executed through an auction system managed by AI agents. This approach minimizes MEV exploitation by concealing raw transaction details, ensuring more efficient trades and protecting users from predatory MEV strategies.

-

Pyth Network Express Relay: Pyth Network’s Express Relay connects DeFi protocols with professional searchers via protocol-controlled auctions, bypassing traditional miner involvement. This system enables more competitive bidding for transaction value, allowing protocols to increase liquidation rewards and pass greater savings directly to users.

Chainlink’s Smart Value Recapture (SVR) stands out as one of the most promising solutions. By leveraging parallel price feeds and auctioning off liquidation opportunities via Flashbots’ MEV-Share platform, Chainlink enables protocols like Aave v3 to reclaim non-toxic forms of MEV from liquidations (blog.chain.link). The captured value is then split between Aave and Chainlink, 65% going back into Aave’s ecosystem for six months, directly benefiting protocol participants rather than extractive actors.

ParaSwap’s intent-based trading protocol introduces another layer of defense against predatory MEV strategies. By allowing users to specify their trading intent instead of submitting raw transactions into public mempools, ParaSwap routes these intents through AI-powered auctions that optimize execution while minimizing exposure to harmful reordering (Cointelegraph). This approach not only reduces slippage but also opens up new avenues for fair DeFi protocols built around user-centric incentives.

Ethereum (ETH) Price Prediction 2026–2031: Impact of Fair DeFi and MEV Mitigation

Forecast considers the adoption of MEV-mitigating DeFi protocols and evolving market conditions. Prices in USD.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change YoY (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,280 | $6,800 | +18% | Broad adoption of MEV-mitigating DeFi protocols boosts user confidence and on-chain activity; mild regulatory headwinds. |

| 2027 | $4,350 | $6,180 | $8,200 | +17% | Sustained growth as fair DeFi becomes standard; Layer 2 scaling and institutional DeFi adoption accelerate. |

| 2028 | $4,900 | $7,320 | $10,100 | +18% | Tech upgrades (e.g., Ethereum upgrades, ZK tech) enhance scalability and security; regulatory clarity improves global participation. |

| 2029 | $5,500 | $8,620 | $12,200 | +18% | DeFi protocols return significant value to users, increasing ETH utility; competition from alternative L1s intensifies, but Ethereum holds major DeFi TVL share. |

| 2030 | $6,200 | $10,050 | $14,500 | +17% | Mainstream finance integrates with DeFi; ETH used as collateral across ecosystems; MEV value redistribution seen as industry norm. |

| 2031 | $7,100 | $11,700 | $17,200 | +16% | Ethereum cements its role as the foundation for programmable value; new DeFi primitives and cross-chain MEV solutions expand user base. |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is broadly positive, driven by the widespread adoption of MEV-mitigating DeFi protocols and ongoing technical improvements. Average yearly growth is expected to range from 16%–18%, with higher upside if Ethereum maintains dominance in DeFi and secures regulatory clarity. Minimum price scenarios account for potential bear markets, regulatory setbacks, or disruptive competition. Overall, ETH is positioned for strong performance as fair DeFi protocols return more value to users and foster sustainable ecosystem growth.

Key Factors Affecting Ethereum Price

- Adoption rate of MEV-mitigating and value-returning DeFi protocols

- Ethereum’s continued technical upgrades (scalability, security, interoperability)

- Regulatory developments affecting DeFi and ETH’s classification

- Competition from alternative Layer 1 blockchains and cross-chain solutions

- Institutional and mainstream participation in DeFi markets

- Macro market cycles and global economic trends

- User confidence and network effects from fairer value distribution

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Pyth Network’s Express Relay: Reimagining Liquidation Rewards

Pyth Network’s Express Relay offers yet another innovative approach by connecting DeFi applications directly with professional searchers via protocol-controlled auctions (FinanceFeeds). This system bypasses traditional miners entirely during critical operations like liquidations, enabling more competitive reward distribution and allowing savings to be redirected toward end-users through higher incentives or reduced costs.

These collaborative efforts signal a paradigm shift in the DeFi space: protocols are no longer passive victims of MEV extraction but are actively designing architectures that internalize and redistribute value. By cutting intermediaries out of the equation and leveraging auction-based systems, platforms like Chainlink, ParaSwap, and Pyth Network are transforming what was once a zero-sum game into a more equitable ecosystem for all participants.

Emerging Trends: From Backrun Rebates to User Rewards

One notable trend is the rise of backrun rebates, where protocols share a portion of MEV profits generated from backrunning transactions with users. Instead of allowing searchers or block producers to capture all surplus, these rebates are distributed to those whose activity creates MEV opportunities in the first place. This approach not only aligns incentives but also encourages greater user participation and loyalty to fair DeFi protocols.

Additionally, some platforms are experimenting with automated market makers (AMMs) that incorporate MEV-aware designs. These AMMs dynamically adjust fee structures or execution routes based on real-time MEV forecasts, ensuring that users receive optimal pricing even in volatile markets. As Ethereum remains at $4,467.07, such innovations could play a pivotal role in maintaining trust and efficiency as DeFi scales further.

Challenges Ahead: Ensuring Fairness Amid Complexity

Despite these advances, significant hurdles remain. Designing mechanisms that fairly allocate MEV without introducing new vectors for manipulation is inherently complex. Protocols must balance transparency with security, ensuring that auctions or intent-based systems do not inadvertently leak sensitive information or create perverse incentives for sophisticated actors.

Moreover, as more value is directed back to users through MEV sharing initiatives, there is growing pressure on governance frameworks to define how rewards are distributed and who qualifies as a beneficiary. Community-driven approaches will be essential to maintain legitimacy and adaptability in this rapidly evolving landscape.

Practical Steps to Reduce MEV Exposure in DeFi

-

Utilize DeFi protocols with MEV-mitigation featuresPlatforms like Aave v3 (integrated with Chainlink’s Smart Value Recapture) are actively reclaiming non-toxic MEV from liquidations and redistributing value back to users. Engaging with such protocols can help minimize the invisible tax typically imposed by MEV extraction.

-

Trade using intent-based protocolsLeverage platforms such as ParaSwap, which offers an intent-based trading protocol designed to reduce MEV attacks. By expressing trading intent rather than submitting raw transactions, users can benefit from AI-driven execution strategies that limit MEV exploitation.

-

Choose DeFi apps leveraging advanced relaysOpt for applications integrated with Pyth Network’s Express Relay. This system connects protocols directly with searchers via protocol-controlled auctions, reducing the role of miners in MEV extraction and passing more value back to users.

-

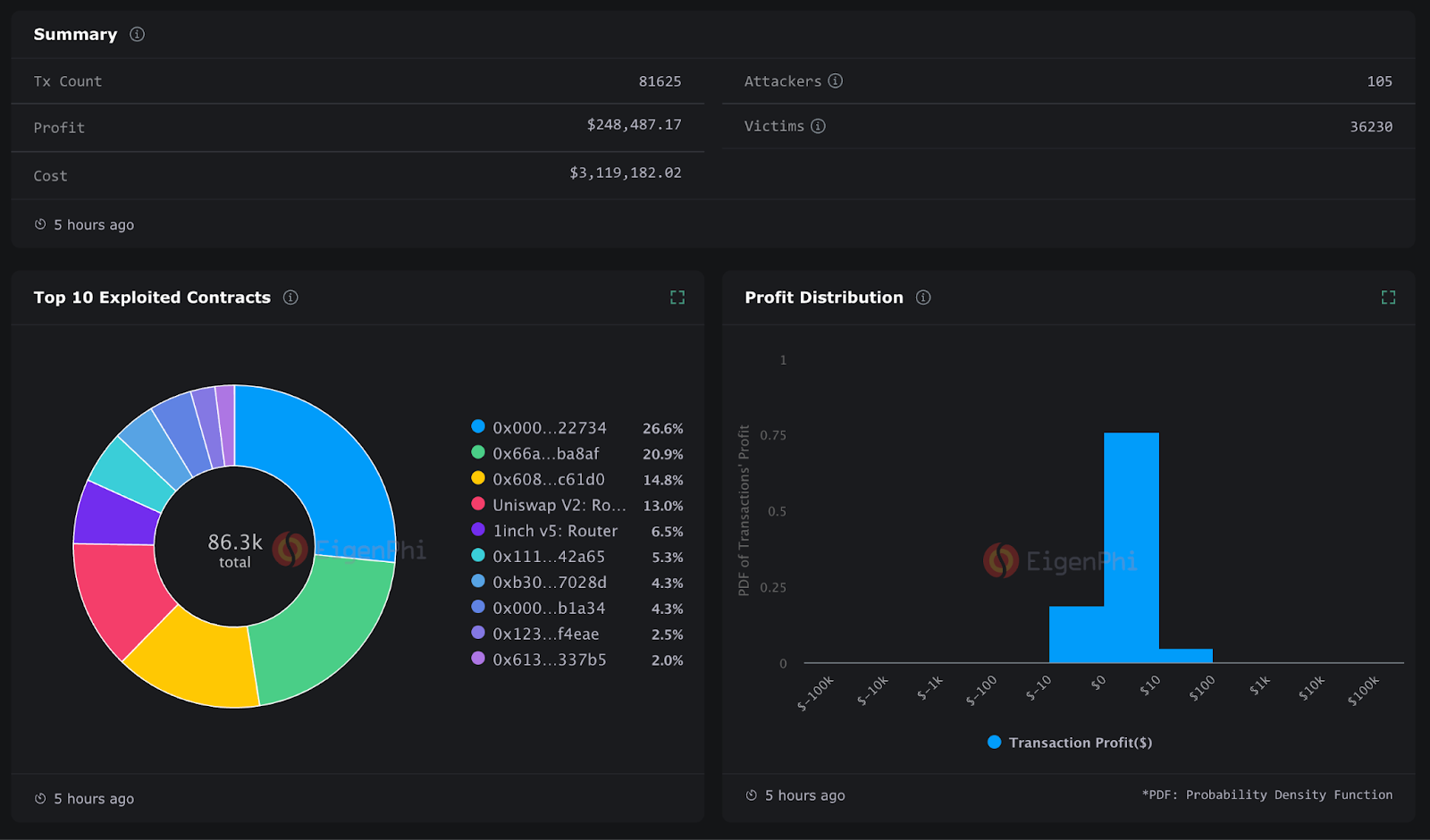

Monitor transaction timing and network conditionsBe strategic about when you transact. High network congestion can increase MEV risks, such as front-running or sandwich attacks. Use analytics tools like EigenPhi or MEV Explore to assess current MEV activity and optimize transaction timing.

-

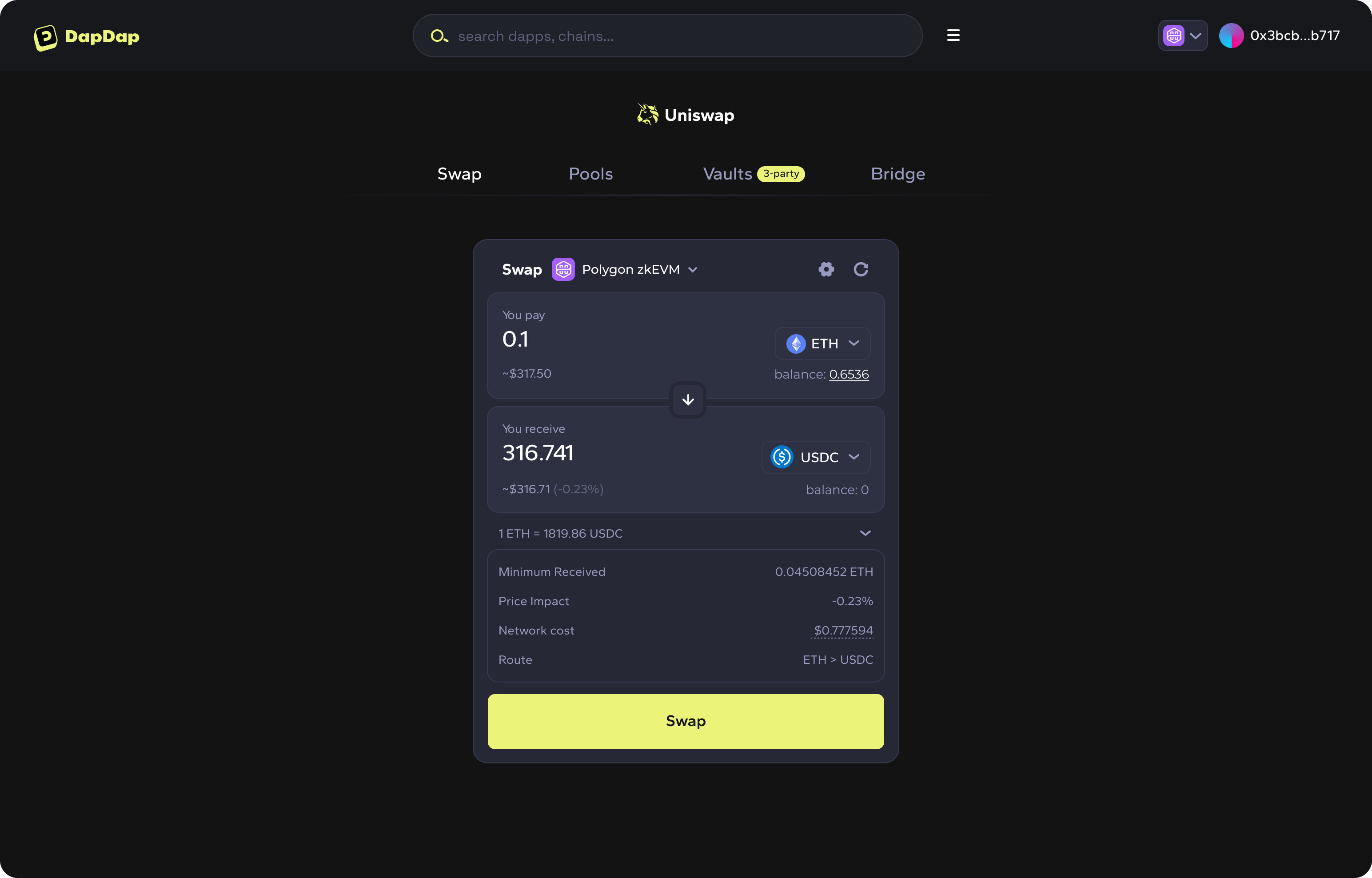

Set slippage tolerances conservativelyWhen trading on decentralized exchanges like Uniswap or Balancer, always set the lowest acceptable slippage. This reduces the likelihood of your transaction being targeted by MEV bots seeking to profit from price manipulation.

The Road Ahead: A More Equitable DeFi Economy

The movement toward MEV user rewards represents more than just technical progress – it reflects a deeper commitment within the Web3 community to fairness and sustainability. As innovative solutions mature and adoption widens, we may see an era where the “invisible tax” of MEV becomes increasingly visible – not as an unavoidable cost but as a shared resource fueling protocol growth and user empowerment.

The next phase will demand vigilance from both developers and users alike. Staying informed about new mitigation tools, advocating for transparent governance models, and supporting platforms prioritizing equitable value distribution will be key to realizing the full promise of decentralized finance.