In 2025, the DeFi ecosystem is seeing a tectonic shift as transparent MEV markets move from theory to practice. For years, MEV (Maximal Extractable Value) was a shadowy force: users paid an invisible tax as sophisticated actors reordered transactions for profit. This dynamic not only hurt retail traders, but also kept financial institutions at arm’s length from DeFi, wary of unpredictable execution and fairness risks. The new wave of transparent MEV markets is rewriting these rules, and user incentives are at the heart of this transformation.

Why Traditional MEV Extraction Hurt DeFi Users

Historically, MEV extraction happened behind closed doors. Searchers and validators competed in opaque gas wars to capture value from arbitrage, liquidations, and sandwich attacks. The result? Retail users were routinely front-run or sandwiched, losing out on better prices or paying higher slippage. Financial institutions, meanwhile, saw little reason to participate in markets where transaction ordering was unpredictable and privacy was non-existent (see more on the hidden tax effect).

This lack of transparency didn’t just erode trust, it actively distorted incentives. Protocols struggled to attract sustainable liquidity because users couldn’t reliably benefit from their own order flow. Instead, much of the value they generated leaked away to third parties with faster bots or privileged access.

The Mechanics of Transparent MEV Markets

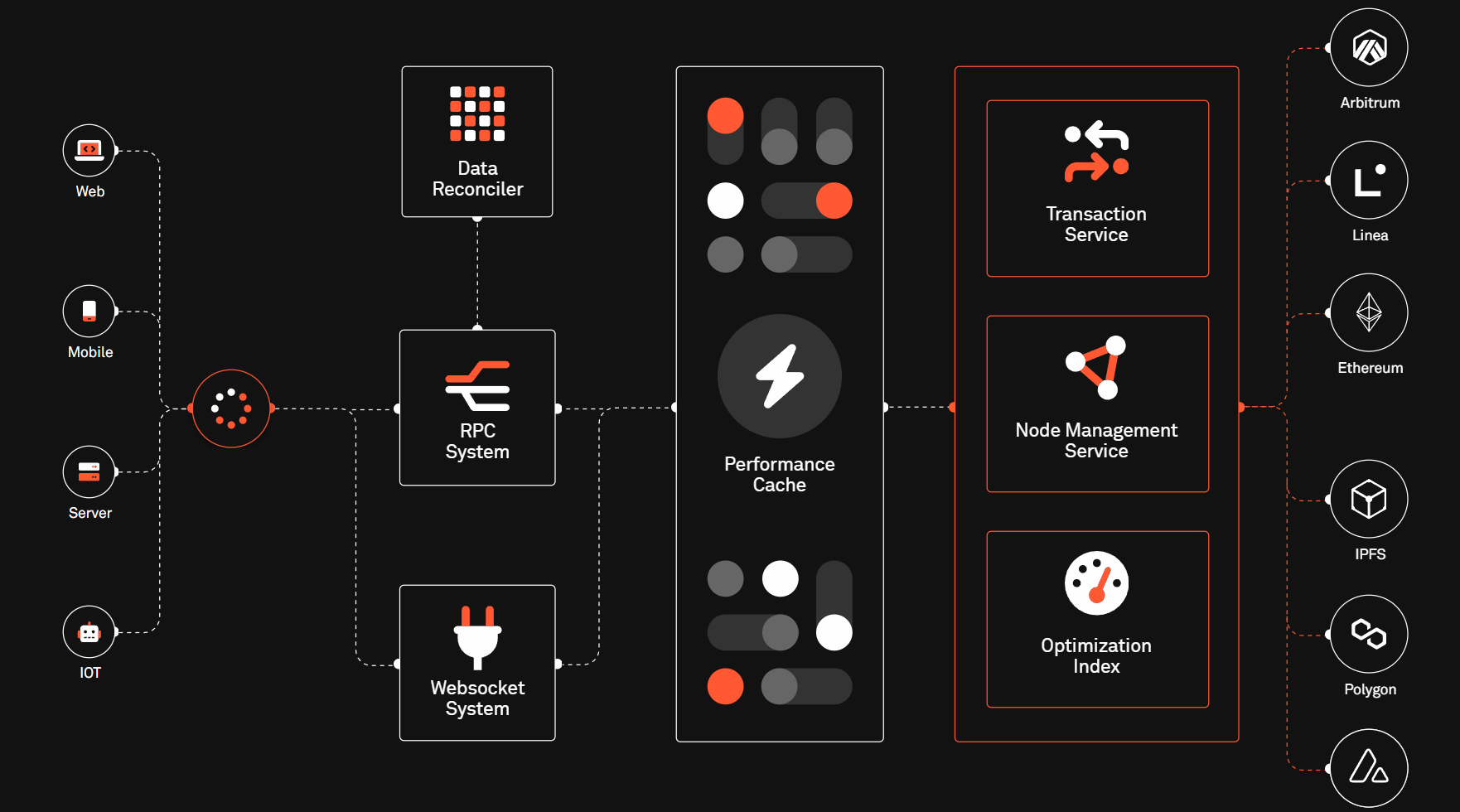

The game changed with the rise of transparent MEV markets. These systems expose the entire process by which MEV is extracted and shared. Mechanisms like Order Flow Auctions (OFAs) batch user transactions and auction them off to builders in an open format. Proposer-Builder Separation (PBS) further decentralizes control by splitting block construction between different actors, reducing single points of manipulation.

What does this mean for users? First, they gain visibility into how their transactions are processed and how much value they create for others. Second, and more crucially, they start receiving rebates or price improvements as a direct reward for their participation (learn how rebates are changing user incentives). Instead of being penalized by hidden costs, users now share in the upside generated by their own activity.

User Incentive Overhaul: From Hidden Costs to Tangible Rewards

This new approach has sparked a profound change in user behavior:

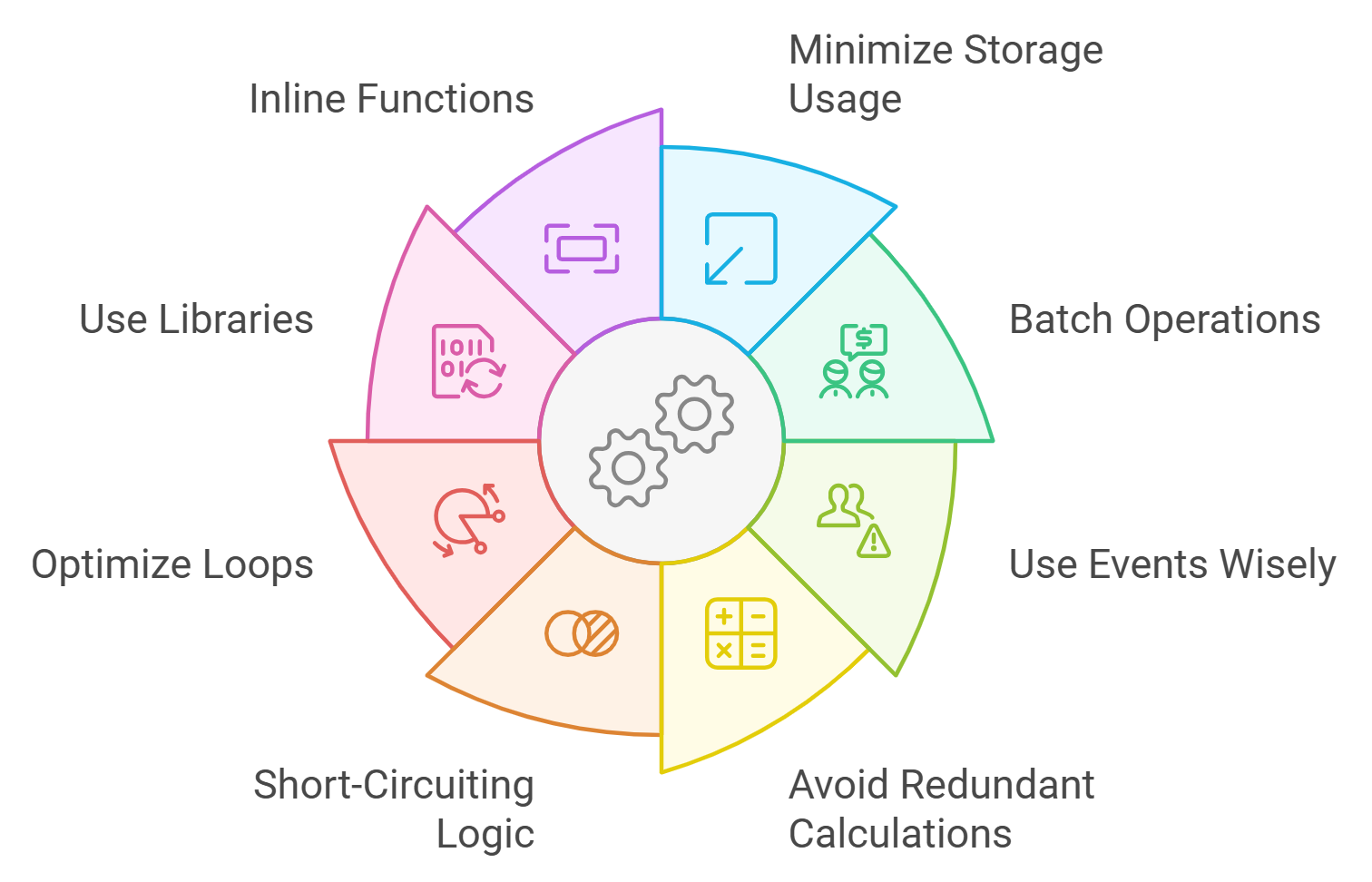

- Enhanced Fairness: Rebates and price improvements turn what was once an invisible cost into a visible benefit, boosting user satisfaction and retention.

- Lower Transaction Costs: Batch auctions reduce congestion and optimize gas fees, making trading more affordable even during volatile periods.

- Improved Price Discovery: Open bidding among searchers leads to tighter spreads and better execution quality for all participants.

- Bigger Liquidity Pools: Predictable outcomes attract larger traders and liquidity providers who previously avoided DeFi due to perceived manipulation risks (see protocol examples here).

The bottom line? User incentives are finally aligned with protocol success, everyone has skin in the game when it comes to fair value redistribution.

How Protocols Are Engineering Fairness in 2025

Protocol teams are no longer treating MEV as an unavoidable tax, they’re actively building fairness into their core infrastructure. The most forward-thinking DeFi projects now integrate transparent MEV auctions directly into their transaction pipelines, ensuring that value is surfaced and shared rather than siphoned off. Automated Market Makers like RediSwap, for example, redistribute captured MEV between traders and liquidity providers, while platforms such as Dextr employ low-latency oracles and insurance models to minimize the impact of predatory strategies.

This protocol-level shift is key: when users see rebates and improved execution as standard practice rather than a lucky exception, trust accelerates. Liquidity grows deeper, and even institutional players, historically wary of front-running risk, are starting to dip their toes back into DeFi. The result is a positive feedback loop: more participation brings more competition for order flow, which in turn leads to tighter pricing and higher rebates for everyone involved.

Top Protocols Pioneering Transparent MEV Sharing

-

MEV Blocker: A consortium of 30+ Ethereum teams launched MEV Blocker, providing an RPC endpoint that protects users from front-running and sandwich attacks. 90% of builder rewards are returned as user rebates—in 2024, this totaled 4,079 ETH in distributed rebates.

-

Dextr’s Actively Validated Market Maker (AVMM): Dextr leverages low-latency price oracles and restricts order matching to trusted operators, sharply reducing MEV exploitation. Its multi-layered insurance compensates users harmed by MEV-related incidents.

-

RediSwap: This Automated Market Maker (AMM) captures MEV at the application layer and redistributes profits between users and liquidity providers, ensuring fair value sharing from MEV activities.

Transparency also means accountability. With open auctions and public rebate data, users can verify that they’re getting a fair shake. This has forced searchers and builders to compete on efficiency instead of exploiting information asymmetries, a major win for the ecosystem’s integrity.

What This Means for Traders and Institutions

For active traders, transparent MEV markets have unlocked new strategies that simply weren’t possible in the old model. Swing traders can now factor expected rebates into their risk/reward calculations, while arbitrageurs face a more level playing field thanks to open order flow bidding. Even passive LPs benefit from improved pool returns as less value leaks out through sandwich attacks or toxic flow.

Institutions are paying attention too. The combination of auditable execution paths and predictable incentive structures addresses two of the biggest historical blockers: compliance risk and reputational exposure from unfair trading environments (see how rules-based redistribution builds trust). As permissionless lending protocols like Euler and Morpho integrate transparent MEV handling, capital efficiency improves without sacrificing user protections, a vital step toward mainstream adoption.

Navigating the New Incentive Landscape: Practical Steps

If you’re a DeFi participant in 2025, trader or builder, the action plan is clear:

- Opt-in to protocols with visible MEV sharing mechanisms. Look for platforms publishing rebate stats or integrating OFAs/PBS by default.

- Monitor your transaction rebates. Use analytics dashboards to track how much value you’re recapturing from your own order flow.

- Participate in governance. Vote on proposals that increase transparency or refine auction mechanisms, these directly impact your bottom line.

- Diversify across multiple venues. Competition among protocols keeps incentives strong; don’t leave value on the table by sticking with legacy systems that haven’t upgraded yet (read more about protocol comparisons).

The Road Ahead: Sustainable Incentives and Ongoing Innovation

The shift toward transparent MEV markets isn’t just a technical upgrade, it’s a cultural turning point for DeFi. By embedding fairness at every layer, these systems are closing the gap between institutional standards and on-chain reality. Expect further innovation around programmable execution rails, cross-chain auctions, and dynamic rebate schedules as competition heats up over user loyalty.

The winners in this new era will be those who build, and demand, systems where value flows back to its true source: the users who power decentralized finance every day.