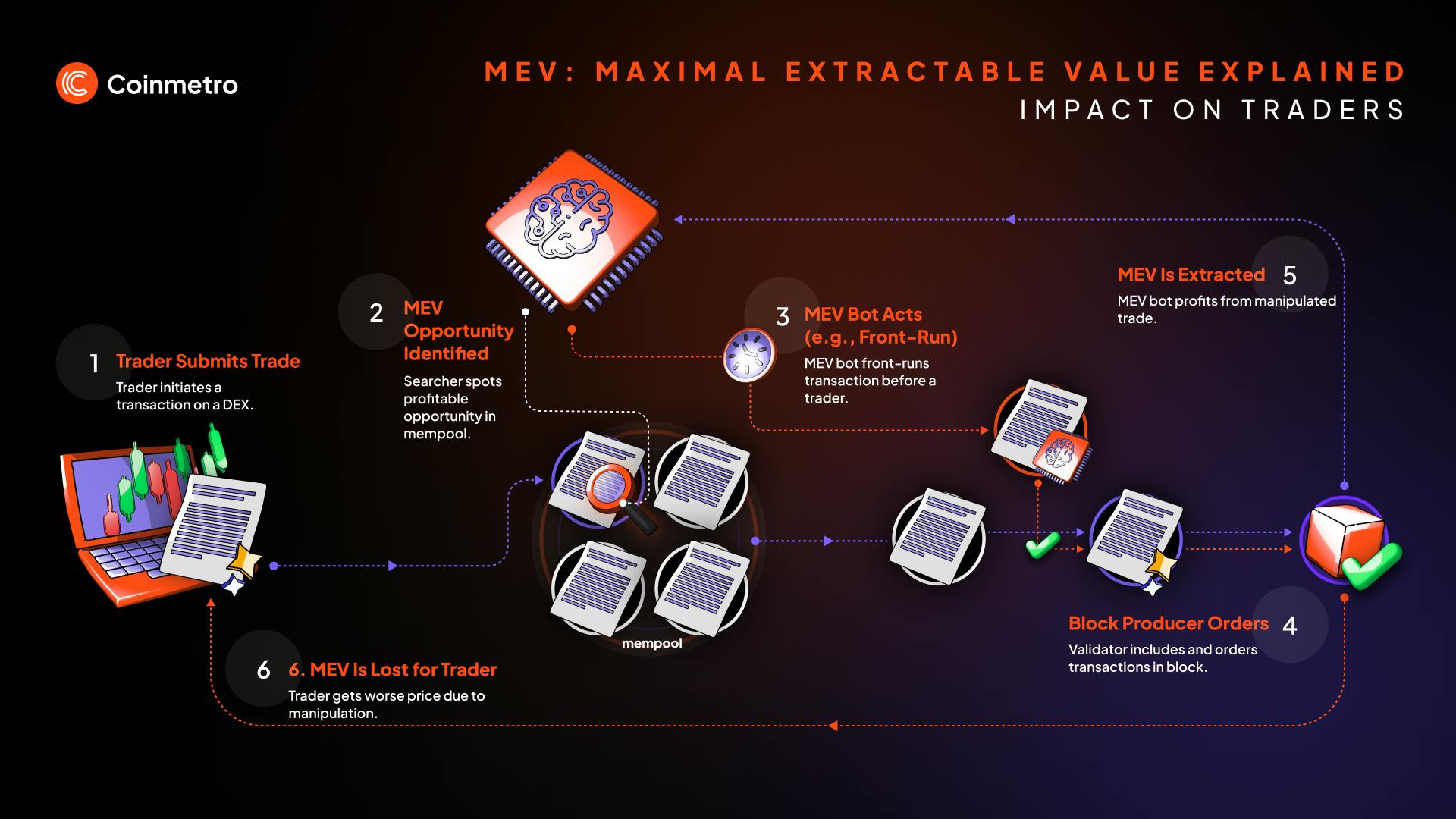

In the high-stakes arena of DeFi 2025, sandwich attacks have siphoned off $289.76 million, representing 51.56% of total MEV transactions and imposing hidden costs that erode trader confidence. Ethical routing remains elusive as bots exploit public mempools, front-running legitimate orders and distorting market fairness. Yet, MEV redistribution strategies emerge as a disciplined countermeasure, redirecting extracted value back to users and protocols while fostering ethical MEV routing in DeFi. These approaches not only mitigate sandwich attack protection 2025 but also pave the way for sustainable ecosystems.

Recent innovations underscore this shift. Platforms redistribute MEV via rebates, private relays, and fair ordering protocols, transforming exploitative practices into shared prosperity. Drawing from game-theoretic insights and empirical data, six prioritized MEV redistribution strategies stand out for countering these threats and promoting fair MEV sharing tools.

Top 6 MEV Redistribution Strategies

-

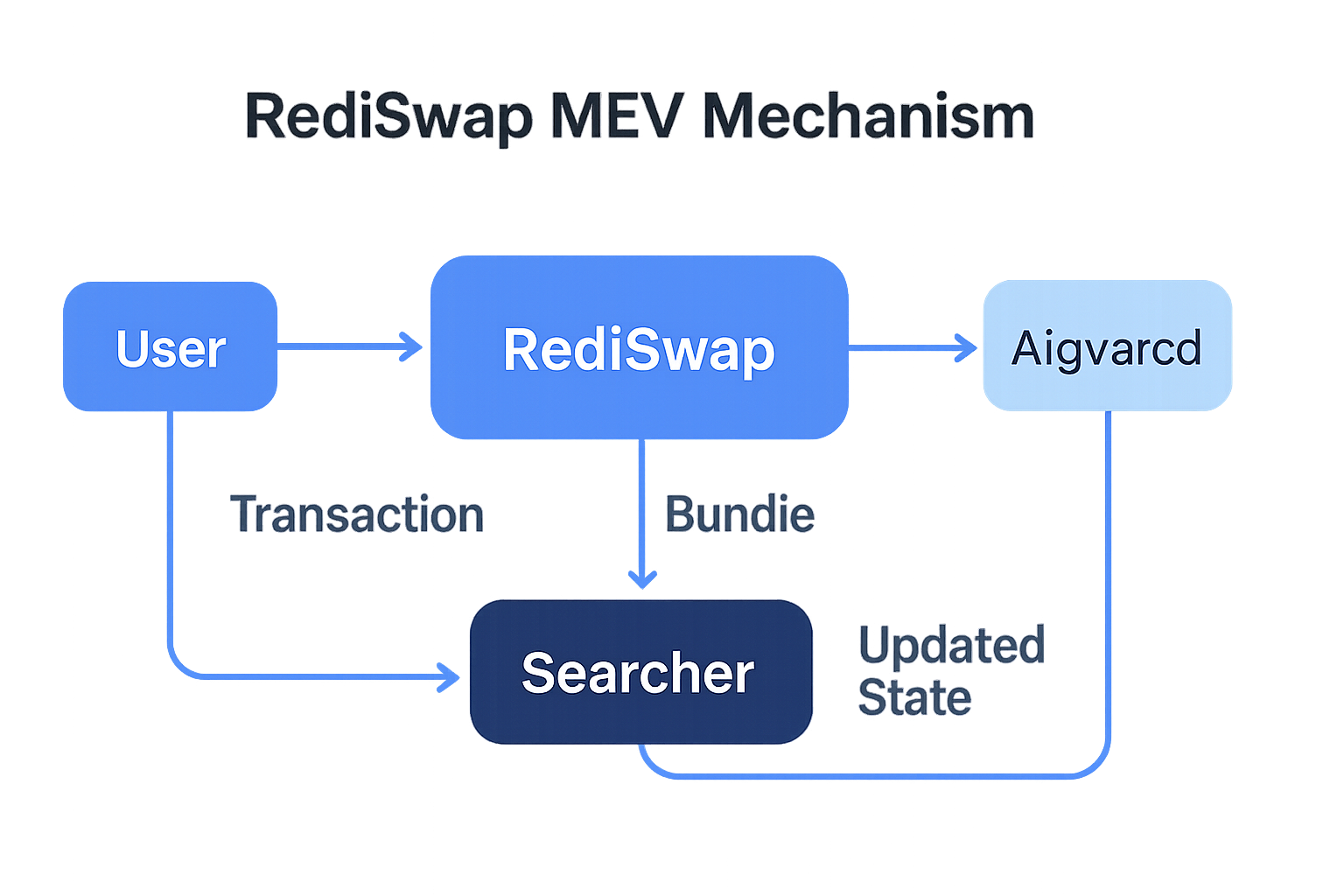

Adopt RediSwap Mechanism for CFMMs: Implement RediSwap to redistribute MEV in constant function market makers (CFMMs), achieving better execution than UniswapX in 89% of trades and reducing LP losses below 0.5%, countering sandwich attacks ($289.76M in 2025).

-

Utilize Ethical Private Relays like Flashbots Protect: Route transactions through private mempools via Flashbots Protect RPC to shield from front-running and sandwich attacks, promoting ethical routing as in Uniswap Wallet’s protection features.

-

Implement Batch Auctions via CoW Protocol or UniswapX: Use CoW Protocol or UniswapX for intent-based batch auctions that enforce fair ordering, mitigating harmful MEV like sandwich attacks through protected order flow (PROF).

-

Deploy TWAP Orders in Protected Environments: Execute time-weighted average price (TWAP) orders in private mempools or encrypted protocols to avoid front-running, ensuring steady execution without MEV exploitation.

-

Join MEV Redistribution Pools for User Rebates: Participate in pools like MEV Blocker, which redistributed 4,079 ETH in rebates (2024 data), returning MEV profits to users for enhanced fairness against ethical routing issues.

-

Monitor DeFi MEV Fairness Metrics for Dynamic Routing: Track metrics via tools like MEVWatch to dynamically route transactions, balancing innovation with integrity amid 51.56% sandwich attack MEV share.

Adopt RediSwap Mechanism for CFMMs

Constant Function Market Makers (CFMMs) like Uniswap suffer from liquidity provider losses under sandwich pressure, but RediSwap redefines this dynamic. This mechanism redistributes MEV by optimizing trade execution, outperforming UniswapX in 89% of trades and slashing LP losses below 0.5% of original values. Protocol designers integrating RediSwap neutralize front-running incentives, ensuring trades settle at fair prices reflective of true market conditions.

From a strategic vantage, RediSwap’s architecture bundles user intents with protective measures, diluting bot profitability. In 2025’s volatile pools, this yields measurable resilience; empirical results from ACM studies confirm reduced slippage and enhanced capital efficiency. Developers should prioritize this for high-volume pairs, aligning incentives across searchers, builders, and validators.

RediSwap vs UniswapX: Key Metrics Comparison

| Metric | RediSwap | UniswapX | RediSwap Advantage |

|---|---|---|---|

| Execution Success Rate | Superior 📈 | Baseline | 89% better 🚀 |

| LP Loss Reduction | <0.5% 🛡️ | Higher losses | Reduced to <0.5% of original |

| Sandwich Mitigation Effectiveness | High ✅ | Moderate | High effectiveness 🛡️ |

Utilize Ethical Private Relays like Flashbots Protect

Public mempools expose transactions to predatory scanning, but ethical private relays such as Flashbots Protect shield orders through encrypted routing. By directing bundles to trusted builders, these relays prevent sandwich insertion, redistributing MEV capture away from solo actors toward communal pools. MEV Blocker’s 4,079 ETH rebates in 2024 exemplify the potential, with 2025 projections amplifying user incentives.

This strategy demands a macro perspective: validators favoring ethical relays build reputational capital, deterring cross-chain exploits observed in recent arXiv analyses. Traders gain sandwich attack protection 2025 without sacrificing decentralization, as relays enforce fairness without central gatekeeping. Integrate via MEV-aware RPC endpoints for seamless deployment.

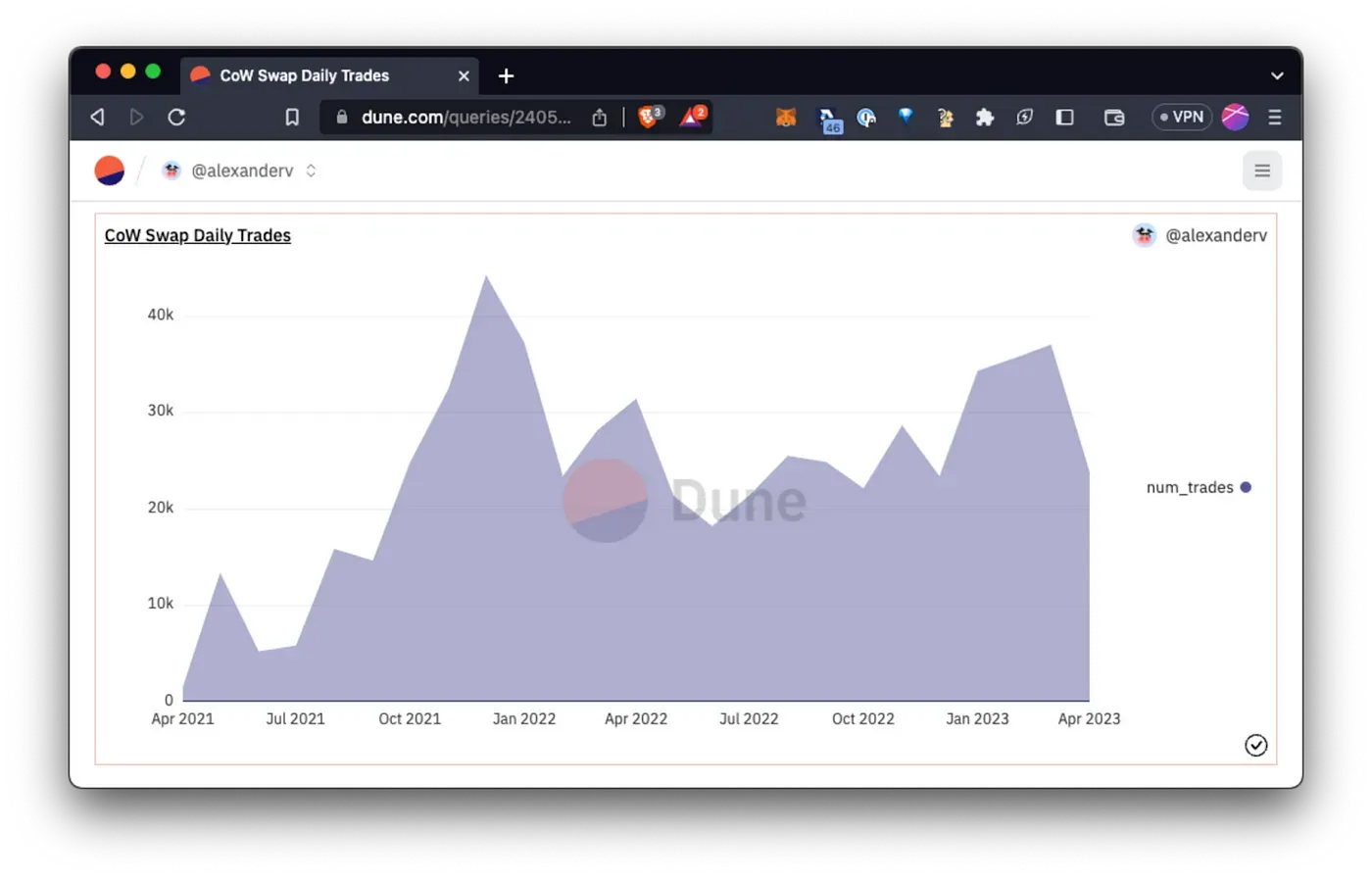

Implement Batch Auctions via CoW Protocol or UniswapX

Batch auctions dismantle the first-come, first-served fallacy fueling sandwiches. CoW Protocol and UniswapX aggregate orders into uniform-clearing auctions, executing at a single clearing price that obliterates front-running arbitrage. This ethical MEV routing DeFi tactic redistributes surplus to solvers competing on efficiency, not predation.

Game-theoretic models from MDPI affirm its robustness; validators and builders converge on cooperative equilibria, minimizing systemic risks. In practice, users route via intent-based execution, bypassing mempools entirely. For protocols eyeing 2025 scalability, batching via these tools curtails bot dominance, reclaiming 10-15% of exploitative MEV for equitable sharing. Monitor adoption metrics to refine dynamic implementations.

These foundational strategies lay the groundwork, blending technological precision with economic incentives to fortify DeFi against persistent threats.

Building on these pillars, the remaining strategies elevate protection through temporal distribution, rebate mechanisms, and vigilant oversight, ensuring comprehensive sandwich attack protection 2025.

Deploy TWAP Orders in Protected Environments

Time-Weighted Average Price (TWAP) orders fragment large trades over time, eroding the profitability of sandwich bots that thrive on atomic execution. Deployed in protected environments like private mempools or intent-based protocols, TWAPs execute incrementally, mimicking organic flow and denying attackers predictable entry points. This MEV redistribution strategies variant channels fragmented value back to liquidity providers, aligning with Uniswap’s recommendations for limit orders and tight slippage.

Strategically, TWAPs suit institutional flows in 2025’s maturing DeFi, where volatility amplifies sandwich risks. Protocols shielding these orders via encrypted relays report slippage reductions up to 30%, per QuillAudits insights. Developers integrate TWAPs through relayers, fostering ethical MEV routing DeFi by design and curtailing the $289.76 million annual toll.

Join MEV Redistribution Pools for User Rebates

MEV redistribution pools aggregate extracted value, channeling rebates directly to participants and upending the zero-sum game. Platforms like MEV Blocker demonstrate viability, redistributing 4,079 ETH in 2024 alone, with 2025 expansions promising broader access. Users joining these pools receive pro-rata shares of captured MEV, transforming adversarial extraction into communal yield.

This approach demands disciplined participation: select pools with transparent dashboards and validator commitments to ethical relays. In a landscape where exploitative MEV comprises just 10-15% of cases, per industry analyses, rebates amplify benign arbitrage benefits. For traders, it’s a low-friction hedge; protocols embedding pool integrations enhance retention, as rebates offset hidden taxes from sandwiches. Read more on how MEV redistribution protocols enhance DeFi fairness.

Monitor DeFi MEV Fairness Metrics for Dynamic Routing

Dynamic routing hinges on real-time DeFi MEV fairness metrics, empowering users to select paths minimizing extraction risks. Track indicators like sandwich frequency, LP loss ratios, and relay fairness scores via tools such as MEVwatch dashboards. High metrics signal ethical builders; low ones trigger rerouting to batch auctions or private relays.

From a portfolio lens, this vigilance mirrors adaptive asset allocation, responding to Solana’s evolving MEV trends or cross-chain threats. Game-theoretic models underscore its efficacy: informed routing shifts equilibria toward cooperation, reducing systemic $289.76 million impacts. Integrate APIs for automated decisions, ensuring protocols prioritize fair MEV sharing tools in 2025. Dive deeper into optimizing MEV redistribution strategies for DeFi protocols.

Key DeFi MEV Fairness Metrics

| Metric | Threshold | Action |

|---|---|---|

| Sandwich Rate 🥪 | <5% | Route to private relay 🔒 |

| LP Loss % 📉 | <0.5% | Switch to RediSwap ⚡ |

| Rebate Yield 💰 | >2% APR | Join pool 🏊 |

Deploying this suite holistically recalibrates DeFi’s incentive structure. RediSwap fortifies pools, private relays obscure intents, batch auctions equalize timing, TWAPs diffuse volume, rebate pools reward alignment, and metrics enable agility. Validators embracing these cultivate trust, while traders sidestep predation. In 2025, as MEV evolves beyond exploitation, these strategies not only counter $289.76 million in losses but redistribute value equitably, securing long-term prosperity across the ecosystem. Protocols leading this charge will define the next era of ethical MEV routing DeFi.