In the fast-evolving landscape of decentralized finance (DeFi), the concept of fairness is being radically redefined. At the heart of this transformation is Maximal Extractable Value (MEV), a phenomenon that has historically allowed miners, validators, and sophisticated searchers to extract profits by reordering or selectively including transactions within blocks. While lucrative for insiders, this practice often leaves retail users and liquidity providers at a disadvantage, manifesting as increased slippage, higher transaction costs, and a subtle yet persistent erosion of trust in DeFi protocols.

MEV Rebates: Turning Users into Beneficiaries

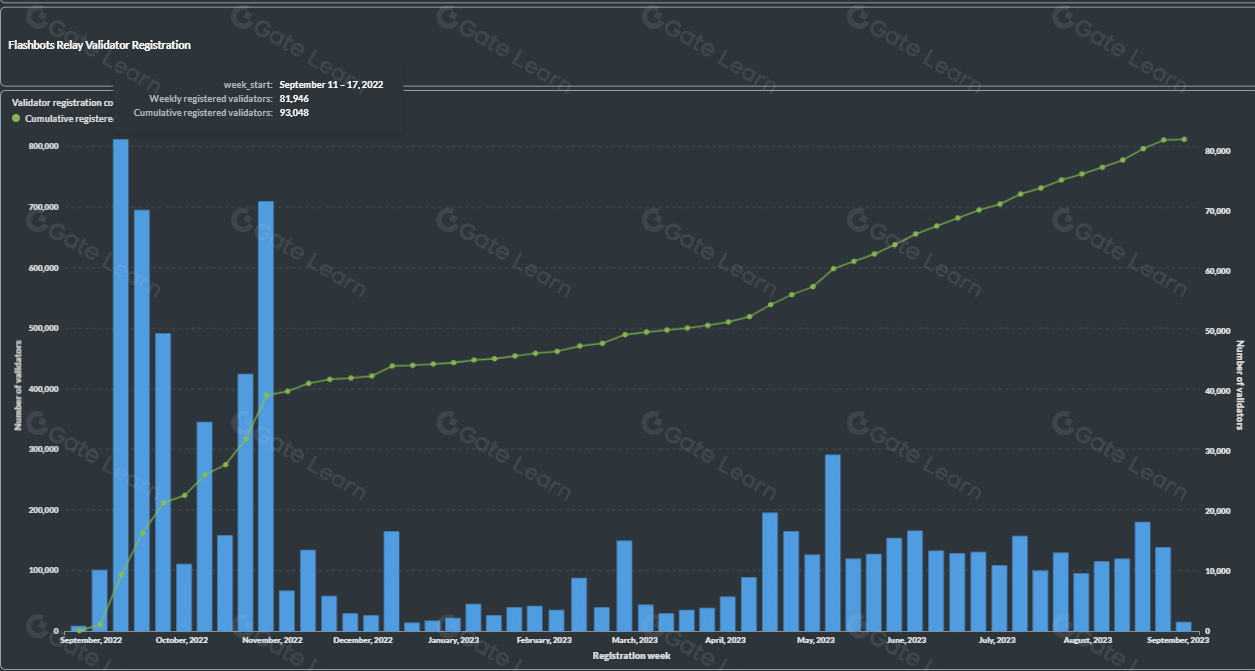

The introduction of MEV rebates marks a significant shift in user incentives across DeFi platforms. Rather than treating users as passive sources of value to be extracted, rebate mechanisms ensure that those initiating transactions receive a share of the profits generated by their activity. For example, platforms like MEV Blocker have pioneered protective relays where searchers can safely backrun trades. In this model, an impressive 90% of the searcher’s bid is returned directly to the user as an MEV rebate, with only 10% reserved for validator incentives.

This approach has real impact: since April 2023, MEV Blocker has protected over $64 billion in DEX volume, processed more than 15.9 million transactions, and distributed upwards of 1,700 ETH in rebates to users (see real-world protocol examples). By embedding rebates at the transaction layer, these systems not only mitigate harmful extraction but also foster deeper user engagement and loyalty.

Revenue Sharing Models: Empowering Liquidity Providers

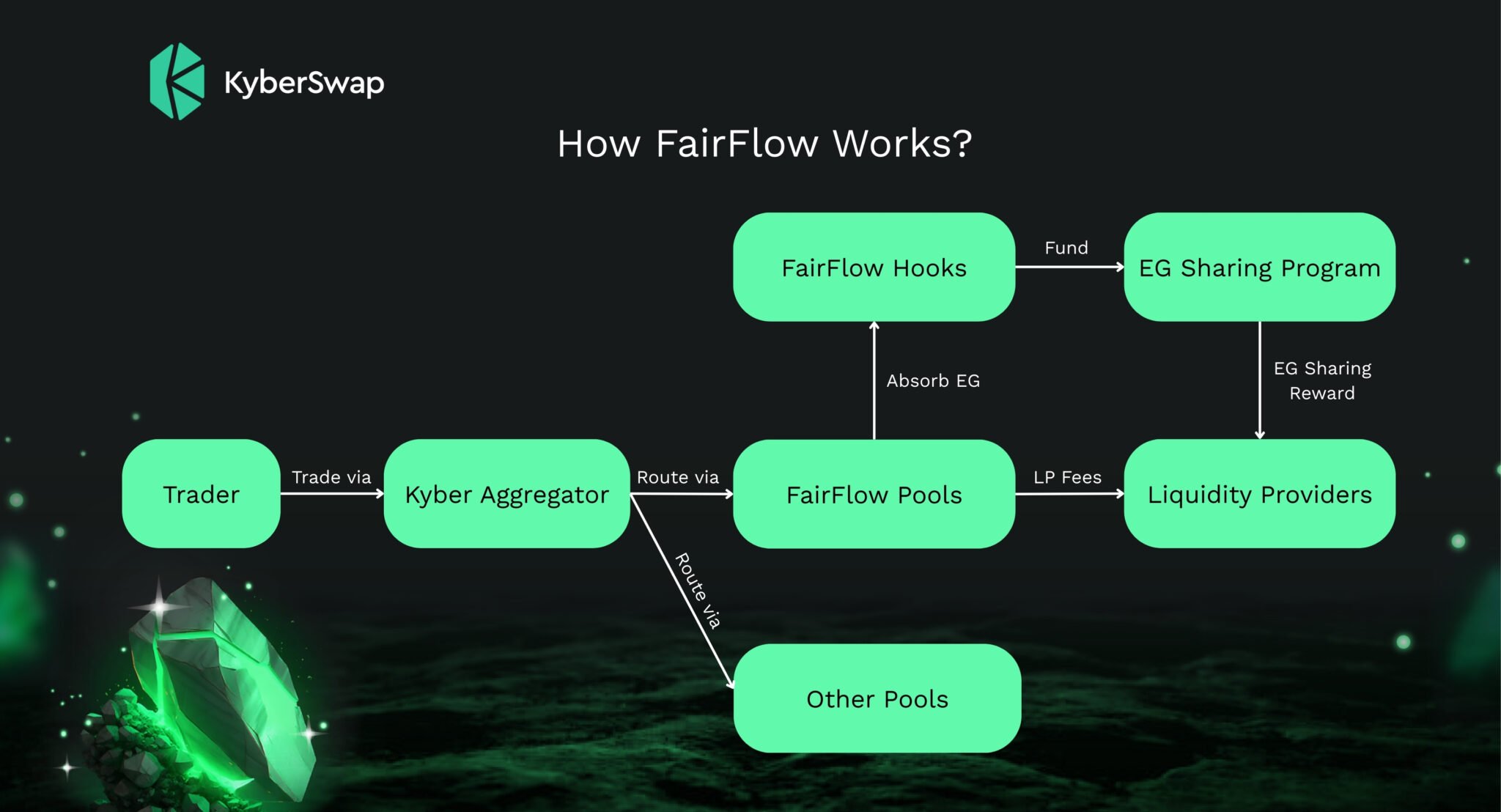

The evolution does not stop with end-users. Liquidity providers (LPs) – whose capital underpins the functionality and depth of DeFi markets – are now being recognized through sophisticated revenue-sharing mechanisms. Consider KyberSwap’s FairFlow system: it redirects 70% of MEV arbitrage profits back to LPs without requiring any token staking or lockups. Arbitrage profits are captured via KyberSwap’s aggregator logic; rewards are then distributed weekly in dual tokens, with 30% allocated for ecosystem development.

This model is already demonstrating tangible results. According to recent data, FairFlow pools outperformed standard pools on competitive networks: ETH-cbBTC pairs achieved an annualized return rate of 21%, compared to just 16% on Base network equivalents over a similar timeframe. This signals that revenue sharing can materially enhance LP returns while reinforcing protocol resilience against opportunistic MEV extraction.

Protocol-Level Redistribution: A New Standard for Fairness

The push for fairer MEV distribution extends up to the protocol level as well. Initiatives like Jito DAO on Solana are experimenting with redistributing portions of MEV fees directly into DAO treasuries and user-facing incentive programs. These efforts aim to create sustainable feedback loops where platform growth benefits all stakeholders – not just those closest to block production or transaction ordering rights.

This trend is mirrored by academic research proposing formal frameworks for equitable revenue distribution using cooperative game theory concepts such as the Shapley value. These frameworks offer rigorous methodologies for allocating profits among transaction creators based on their marginal contributions – ensuring both fairness and incentive compatibility within increasingly complex DeFi ecosystems.

The integration of these models signals a paradigm shift in how value flows through decentralized systems. By aligning incentives across users, liquidity providers, and protocol developers alike, MEV rebates and revenue sharing mechanisms are setting new standards for transparency and equity in blockchain finance.

As these MEV redistribution models mature, their impact is being felt not only in yield metrics but also in user sentiment and protocol stickiness. By returning a share of the extracted value to those who create economic activity, DeFi platforms are fostering a sense of ownership and participation that was previously absent from the MEV equation. This shift is particularly evident in protocols that have implemented real-time rebate buffers or dynamic revenue-sharing pools, where users can track their accrued rewards transparently and withdraw them with minimal friction.

Top DeFi Protocols Leading MEV Rebates & Revenue Sharing

-

MEV Blocker: Offers user-focused MEV rebates by routing transactions through protective relays. Users receive up to 90% of searcher bids as rebates, with over 1,700 ETH distributed since April 2023. The platform has safeguarded $64 billion in DEX volume, enhancing user returns and reducing slippage.

-

KyberSwap (FairFlow): Pioneers revenue sharing for liquidity providers by redistributing 70% of MEV arbitrage profits to LPs, no token staking required. Rewards are distributed weekly in dual tokens, and FairFlow pools have outperformed standard pools, with the ETH-cbBTC pair achieving 21% annualized returns in recent data.

-

Jito DAO (Solana): Implements protocol-level MEV fee redistribution, allocating a portion of MEV earnings to the DAO treasury and user-facing programs. This approach aims to boost ecosystem growth while ensuring a fairer distribution of MEV profits across Solana participants.

-

CoW Swap: Integrates MEV protection and rebates by batching user trades and leveraging batch auctions. This design minimizes frontrunning and shares a portion of MEV savings with users, improving execution quality and fairness.

-

Flashbots SUAVE: Develops open infrastructure for MEV extraction and sharing, including user rebates. SUAVE aims to decentralize MEV capture, allowing users and protocols to benefit from MEV revenue rather than solely validators or miners.

Sequencer revenue distribution is another emerging frontier. With rollups and Layer 2 solutions gaining traction, sequencers now play a pivotal role in transaction ordering. Forward-thinking projects are exploring ways to share sequencer revenues with both users and liquidity providers, further decentralizing the power traditionally held by validators or miners. For instance, some MEV-proof DEXs like CoW Swap and Flashbots SUAVE have begun experimenting with direct user rebates as an integral part of their protocol design, positioning MEV as a powerful new yield engine for DeFi participants (more on protocol fairness here).

These innovations are also influencing broader market dynamics. As more value is returned to users and LPs, competitive pressure mounts on legacy protocols that have yet to implement fair MEV sharing mechanisms. This is driving a new wave of protocol upgrades focused on transparency, user incentives, and minimizing extraction risks, ultimately raising the bar for what constitutes fairness in blockchain finance.

Challenges Ahead: Navigating Complex Incentives

Despite clear progress, several challenges remain. Designing incentive systems that are robust against manipulation while remaining simple enough for broad adoption is non-trivial. There is also an ongoing debate about the optimal split between user rebates, LP rewards, validator/sequencer incentives, and protocol development funds. Overly aggressive revenue sharing could threaten network security by under-incentivizing block producers; conversely, insufficient sharing risks alienating users and capital providers.

Academic proposals such as Shapley value-based allocation frameworks offer promising solutions by rigorously modeling each participant’s marginal contribution to overall MEV generation. However, operationalizing these models at scale requires careful engineering, especially as transaction volumes grow and composability between protocols increases.

The Road Ahead: Toward Sustainable Fairness in DeFi

The direction of travel is clear: fair MEV distribution will be table stakes for any protocol hoping to attract long-term liquidity or active user bases in 2025 and beyond. As more projects adopt transparent rebate buffers, dynamic revenue pools, and formal game-theoretic allocation models, we can expect further democratization of value flows within DeFi.

This ongoing evolution not only benefits direct participants but also strengthens the overall resilience of decentralized markets by aligning interests across all layers, from end-users to infrastructure providers. For those seeking deeper insights into how these mechanisms are transforming incentives at every level of the stack, including practical guides for integrating MEV rebates into your own project, explore our dedicated resources on MEV rebate mechanisms here.