For years, Maximal Extractable Value (MEV) was a silent tax on DeFi users. Validators and miners would reorder, include, or exclude transactions to pocket profits, often at the direct expense of traders and liquidity providers. These hidden costs eroded trust and created a persistent sense of unfairness across decentralized markets. Now, a new wave of innovation is turning the tables. MEV rebates and cashback mechanisms are reshaping incentives in DeFi, transforming what was once a source of loss into a stream of user rewards.

What Are MEV Rebates and Why Do They Matter?

At its core, an MEV rebate is a system that captures some of the value extracted through transaction ordering and returns it to the users whose activity generates that value. This approach aims to realign incentives, making DeFi protocols fairer and more user-centric. Instead of allowing only validators or specialized searchers to benefit from MEV, these mechanisms redistribute a portion of the profits as DeFi user rewards.

This shift is more than just technical. It represents a philosophical turn toward blockchain fairness, transparency, and sustainable growth. With MEV cashback models, DeFi platforms can reduce extraction risks, boost user retention, and create a more level playing field for all participants.

Key Innovations in MEV Sharing Protocols (2025)

The past year has seen rapid progress in MEV-aware infrastructure. Several projects have launched practical solutions that capture and redistribute MEV in real time, often with impressive results:

Top 4 MEV Rebate Protocols Launched in 2025

-

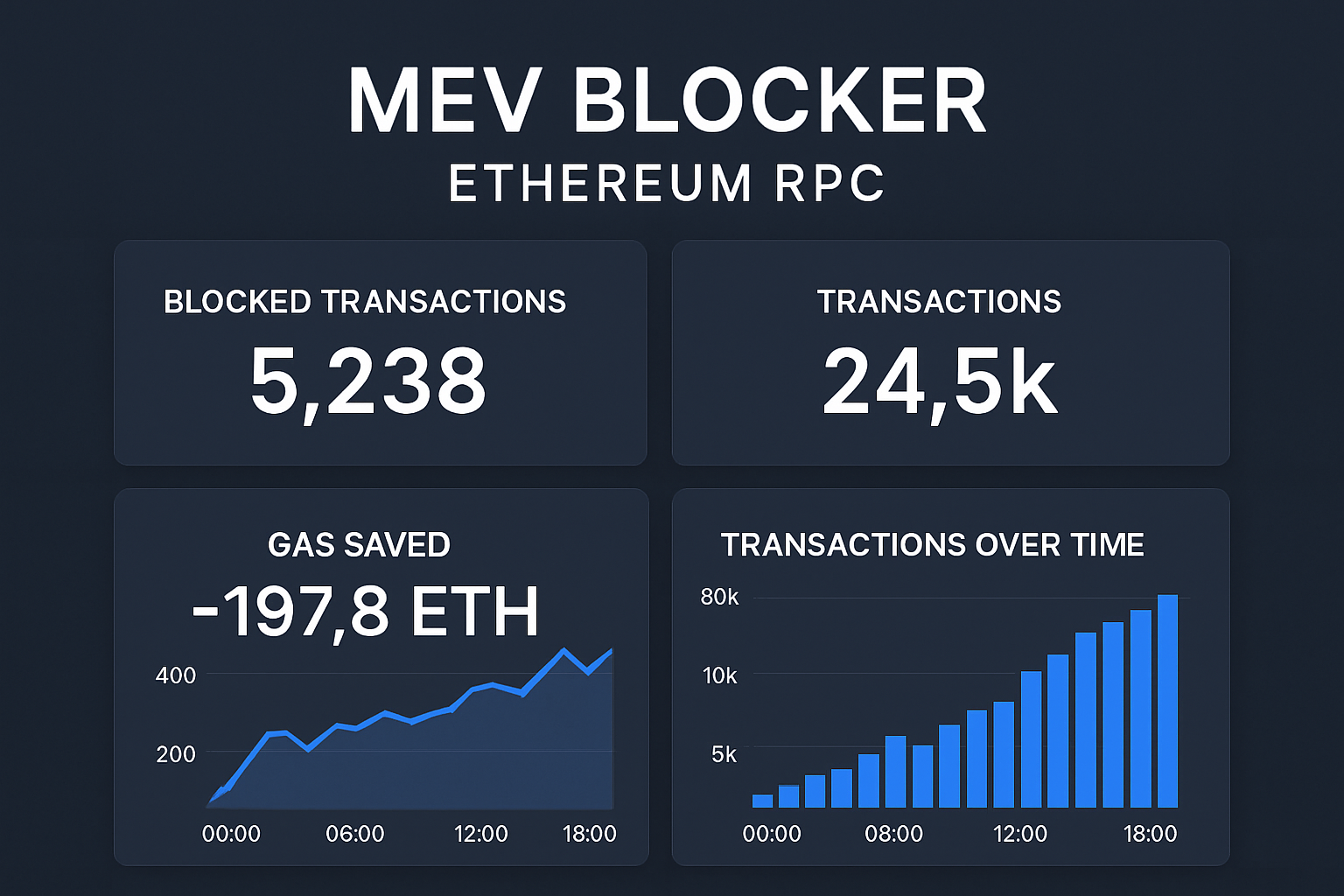

MEV Blocker: Launched by a coalition of over 30 Ethereum teams, MEV Blocker is a free RPC endpoint that protects users from MEV exploitation. It redistributes 90% of captured MEV profits back to users, with 156 ETH in rebates distributed to traders in February 2025, setting a new standard for community-focused MEV protection.

-

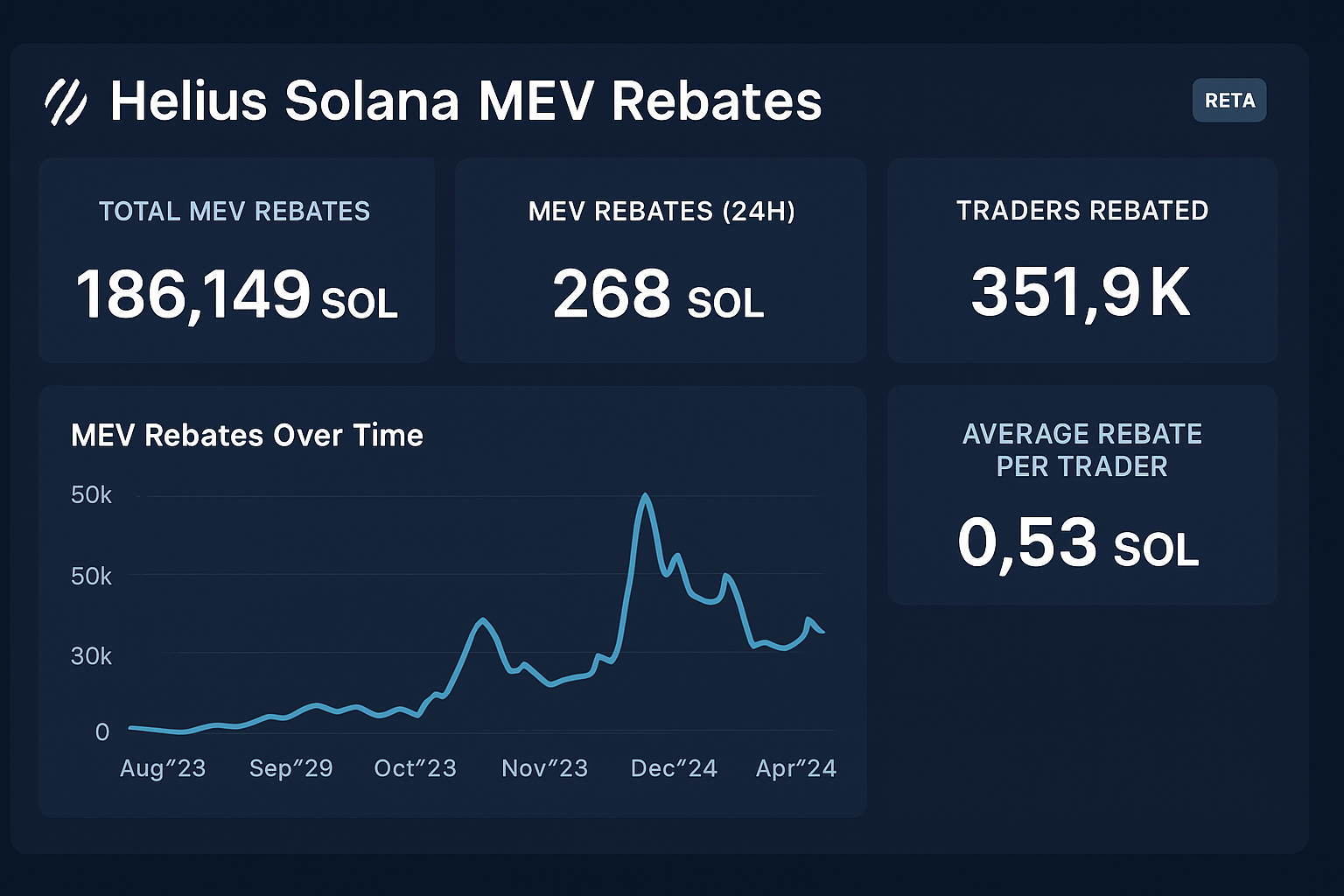

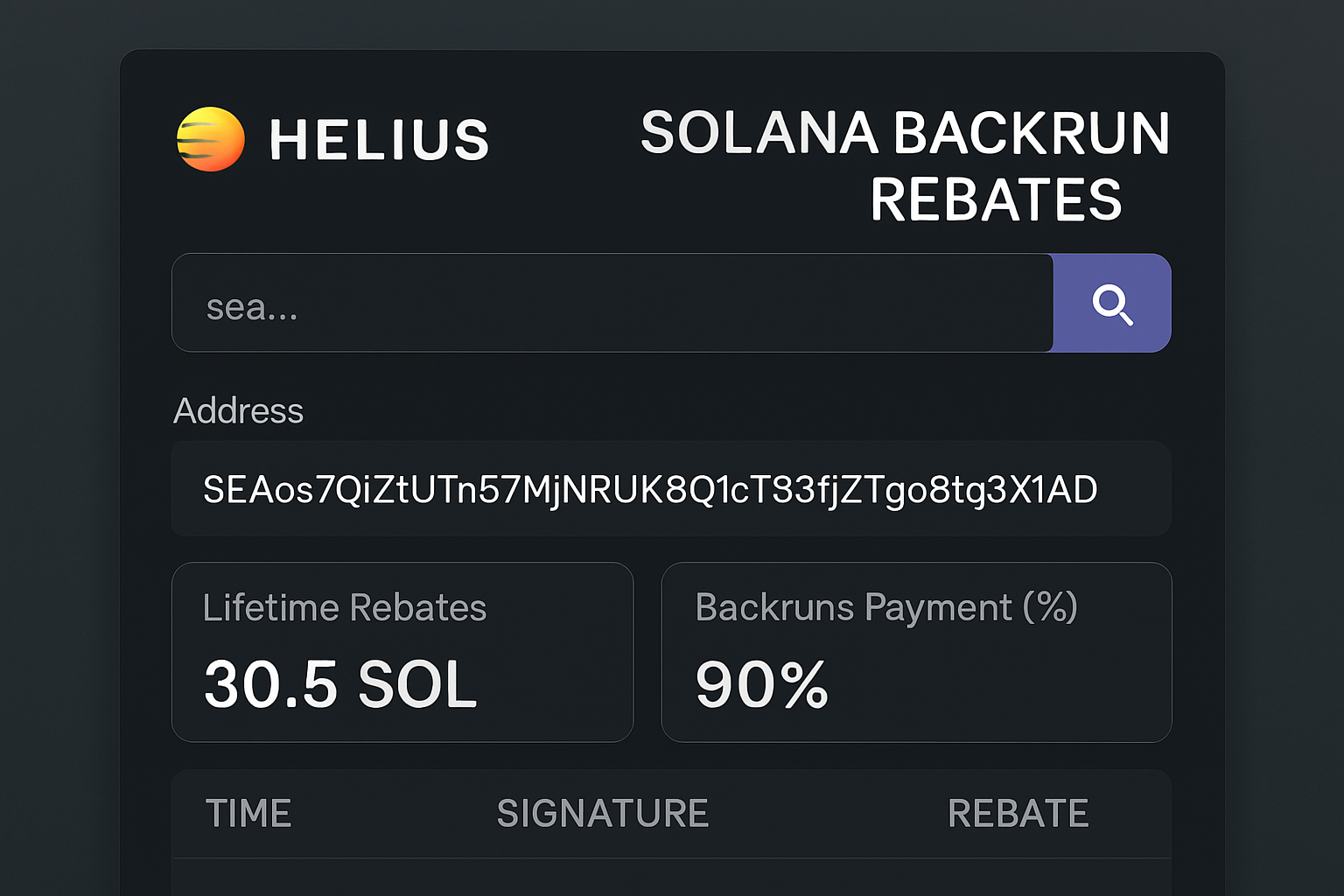

Helius Backrun Rebates: Introduced in August 2025 on Solana, Helius allows users to earn SOL rebates from their transactions by capturing value from post-trade arbitrage. This innovative feature rewards users without exposing them to harmful MEV, marking a significant leap in user-centric DeFi design.

-

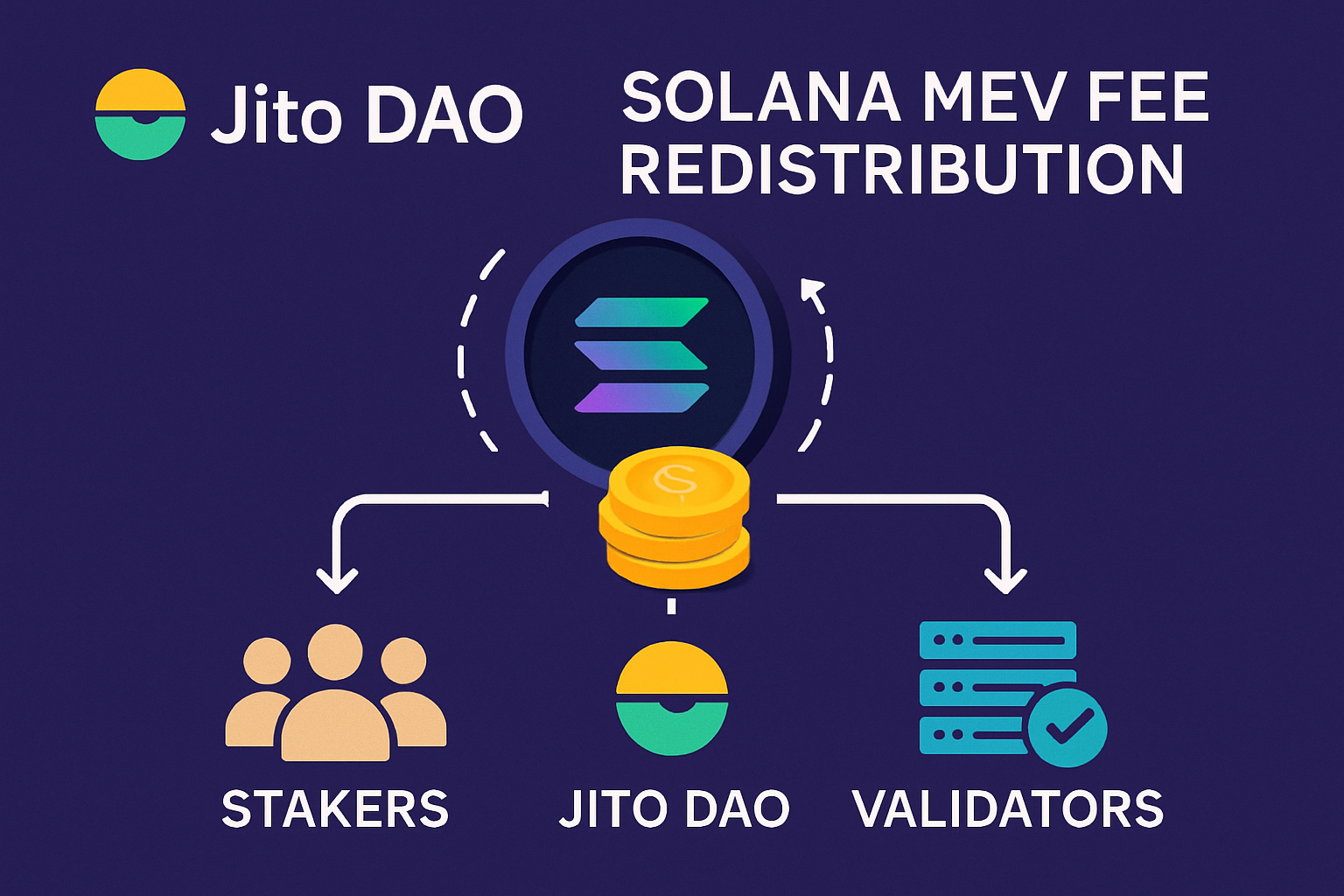

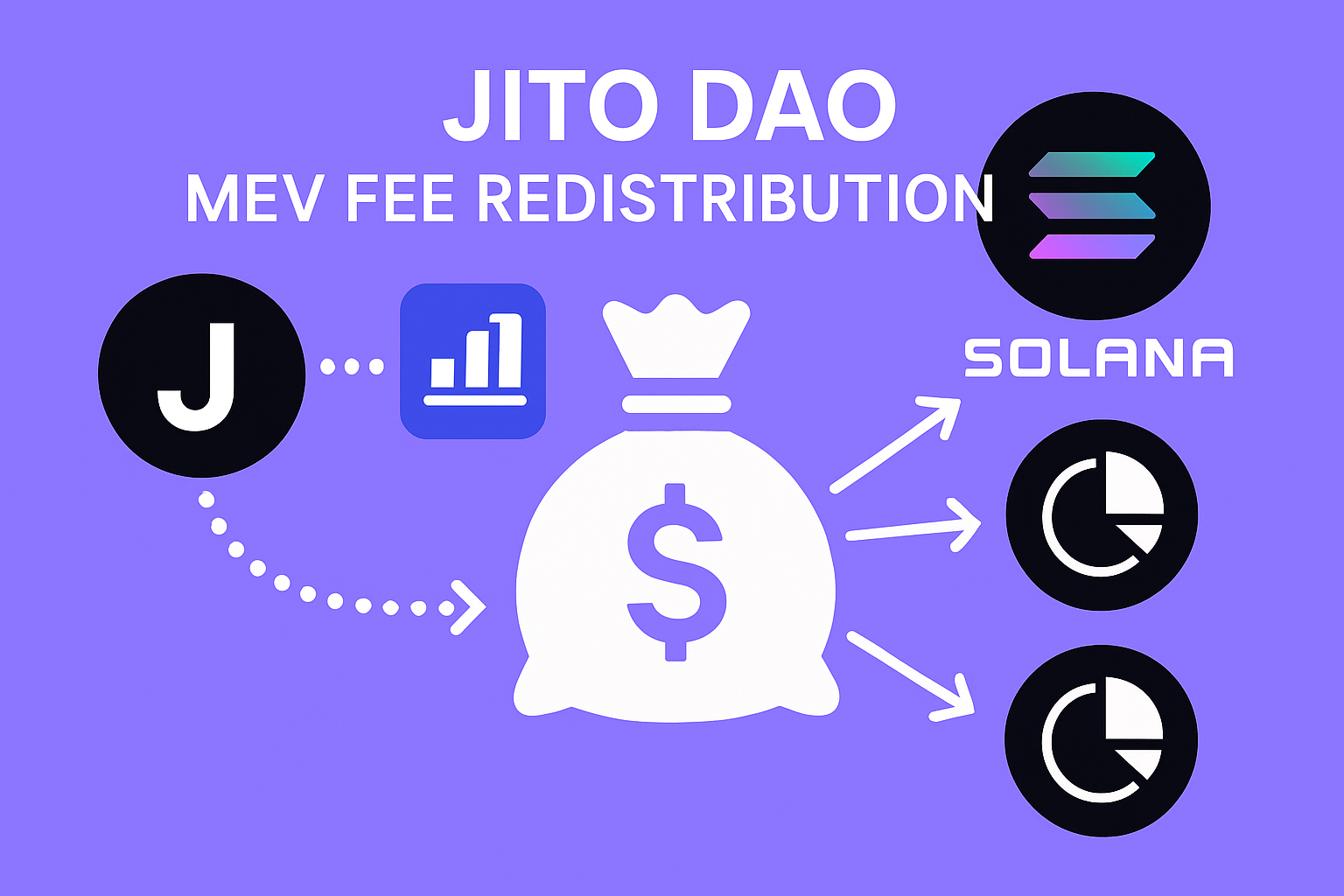

Jito DAO’s MEV Fee Redistribution: Jito DAO implemented a mechanism to allocate 3% of all MEV tips collected by the protocol to its treasury and TipRouter. This approach boosts protocol revenue and supports the Jito restaking platform, while ensuring that MEV profits benefit the wider ecosystem.

-

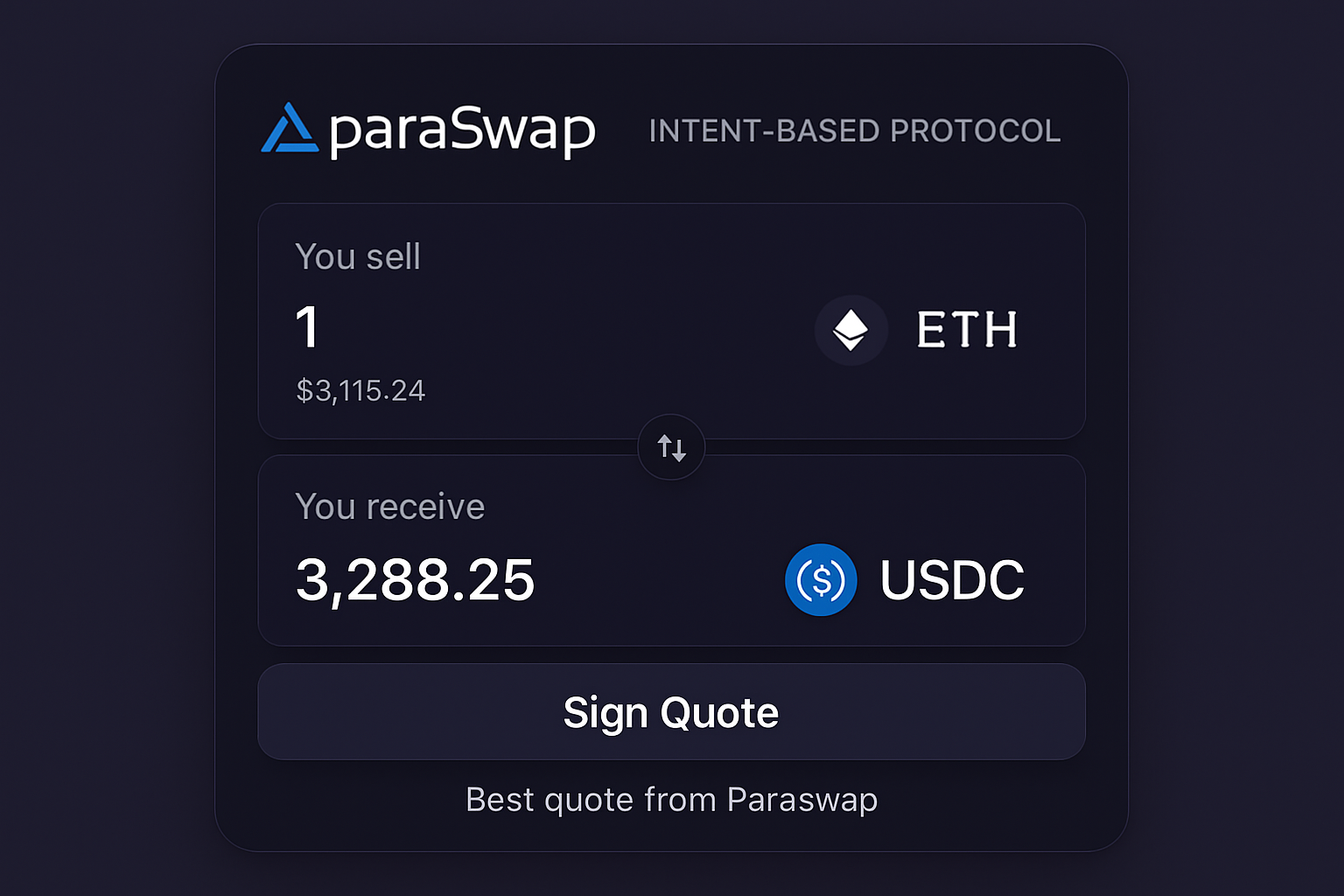

ParaSwap’s Intent-Based Protocol: ParaSwap launched an intent-based trading protocol in 2025, enabling users to define their trading intentions and reduce exposure to MEV attacks. This approach enhances transaction fairness and user protection, setting a new benchmark for MEV mitigation in DeFi.

MEV Blocker, for instance, is a free RPC endpoint backed by over 30 Ethereum teams. It routes transactions through a private searcher network, redistributing up to 90% of captured MEV back to users. In February 2025 alone, users received a total of 156 ETH in rebates, an unprecedented milestone that signals the real-world impact of these systems.

On Solana, Helius Backrun Rebates introduced SOL rewards for users whose trades create arbitrage opportunities, all without exposing them to toxic MEV practices. Similarly, Jito DAO has begun allocating a portion of protocol-collected MEV tips to its treasury and TipRouter, directly benefiting its ecosystem and supporting new platform features.

How MEV Rebates Are Reshaping DeFi User Experience

The arrival of robust MEV redistribution strategies means that DeFi users can now expect more than just protection from predatory practices, they can actually profit from participating in the ecosystem. By sharing transaction fee rebates and aligning incentives, protocols are fostering deeper engagement and loyalty.

This trend is driving new forms of competition among DeFi platforms. Protocols that offer fairer value capture and transparent reward structures are quickly gaining traction with both retail and professional users. As intent-based trading protocols like ParaSwap reduce exposure to front-running and sandwich attacks, the DeFi landscape is becoming not only safer but also more rewarding for everyday participants.

Why This Matters for DeFi’s Future

The implications are profound. With anti-MEV routing and MEV sharing protocols, DeFi is moving toward an era where value flows back to those who create it. This evolution could fundamentally alter how users perceive risk and reward in decentralized markets, and may set the stage for broader adoption as user trust grows.

As these systems mature, the conversation is shifting from mere protection to proactive empowerment. MEV rebates are no longer just a defensive measure against value extraction; they are a positive-sum innovation that can redefine the economics of DeFi participation. Users who once viewed MEV as an unavoidable cost are now seeing it as a source of tangible benefit, with protocols competing to deliver the best rebate rates and most transparent sharing models.

In practice, this means that traders and liquidity providers are starting to factor MEV cashback into their decision-making. Platforms that offer clear, predictable MEV rewards are attracting more volume and liquidity, creating a virtuous cycle where user engagement drives protocol growth and vice versa. The emergence of transaction fee rebates as a core feature is also pushing wallets and aggregators to integrate MEV-aware routing, giving users more control and clarity over their on-chain activity.

What’s Next for MEV-Aware DeFi?

Looking ahead, the evolution of MEV redistribution strategies will likely accelerate. We’re already seeing proposals for rules-based MEV distribution, where protocols automate the allocation of extracted value according to transparent, community-approved formulas. Projects like RediSwap are experimenting with application-level MEV capture, refunding value directly to users and liquidity providers. Meanwhile, the conversation around MEV sharing protocols is expanding to include governance, as DAOs debate how best to allocate these new revenue streams for long-term sustainability.

For users, the takeaway is clear: DeFi user rewards are no longer a theoretical promise but a practical reality. By choosing platforms that prioritize MEV fairness and transparency, users can actively benefit from the very forces that once disadvantaged them. This shift is not only making DeFi more attractive to newcomers but is also encouraging existing users to deepen their engagement and explore new strategies in pursuit of additional rewards.

Building a Fairer, More Inclusive DeFi Market

The rise of MEV rebates is a testament to the power of open innovation in crypto. By surfacing hidden costs and turning them into visible, shareable rewards, DeFi protocols are setting new standards for blockchain fairness and user-centric design. The next phase will likely see even broader adoption of MEV-aware infrastructure, with more chains and protocols integrating anti-MEV routing, transparent distribution models, and user-friendly dashboards for tracking rewards.

For a deeper dive into the mechanisms and real-world impact of MEV rebates, see our guide on how MEV rebates are transforming DeFi user rewards and explore strategies for maximizing your share of this emerging value stream.

Top 5 Ways to Maximize MEV Cashback & Rebates in 2025

-

Use MEV Blocker’s Private RPC Endpoint – MEV Blocker is a free RPC endpoint supported by over 30 Ethereum teams. By routing your Ethereum transactions through MEV Blocker, you protect yourself from MEV exploitation and receive up to 90% of MEV profits as rebates. In February 2025, MEV Blocker distributed 156 ETH in rebates to users.

-

Leverage Helius Backrun Rebates on Solana – Helius offers a feature that captures value from post-trade arbitrage opportunities on Solana, returning SOL rebates to users without exposing them to toxic MEV. This is an effective way to earn passive rewards from your transactions.

-

Participate in Jito DAO’s MEV Fee Redistribution – Jito DAO on Solana allocates a portion of all MEV tips collected by the protocol to its treasury and TipRouter. By interacting with Jito-powered DeFi platforms, you can benefit from MEV fee redistribution and support ecosystem growth.

-

Trade with ParaSwap’s Intent-Based Protocol – ParaSwap’s intent-based protocol allows you to define your trading intentions, reducing your exposure to MEV attacks. This not only enhances transaction fairness but can also increase your eligibility for MEV rebates by minimizing losses to front-running.

-

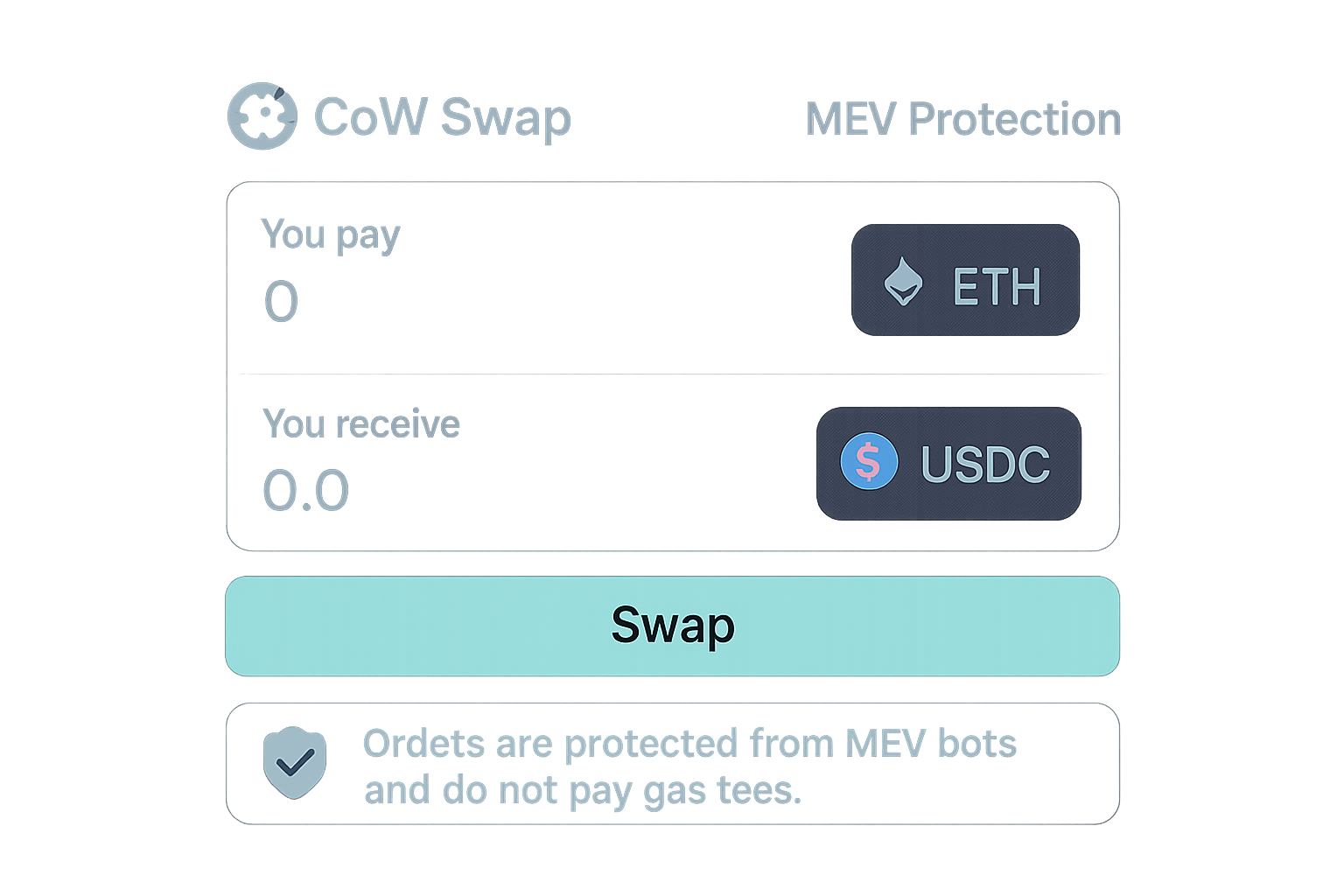

Choose DApps with Built-In MEV Protection & Rebates – Many leading DeFi protocols (such as CoW Swap and UniswapX) are integrating MEV protection and rebate mechanisms. By selecting DApps that transparently redistribute MEV profits, you can maximize your cashback and ensure a fairer trading experience.

Ultimately, the integration of MEV rebates and sharing mechanisms is not just a technical upgrade; it’s a cultural shift that puts users back at the center of DeFi. As these tools become standard, expect the lines between protocol, user, and value creator to blur, ushering in a more collaborative and sustainable era for decentralized finance.