Maximal Extractable Value (MEV) has long been a double-edged sword for DeFi participants. While it offers profit opportunities for miners and validators through transaction ordering, it often comes at the expense of regular users, leading to higher costs, slippage, and unpredictable execution. As the DeFi landscape matures, a new wave of MEV rebate mechanisms is reshaping how value is shared, turning what was once an opaque tax into a transparent source of user rewards and protocol sustainability.

MEV Rebates: From Extraction to Redistribution

Traditional MEV extraction concentrated profits among block producers, leaving users to bear the brunt of adverse selection and predatory strategies like sandwich attacks. Today, innovative MEV rebate mechanisms are emerging to capture and redistribute this value across users, liquidity providers, and even protocol treasuries.

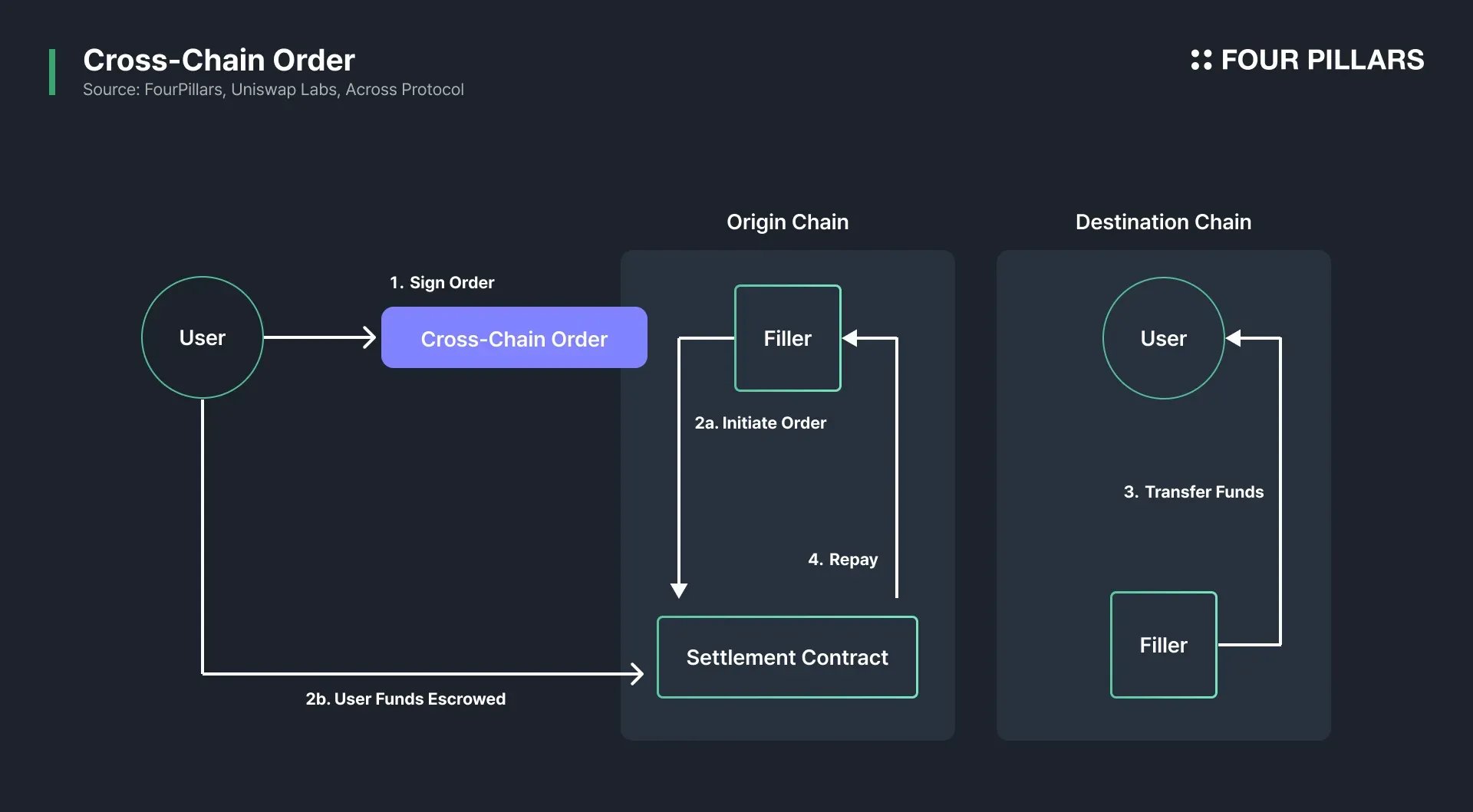

The core idea is simple yet powerful: instead of letting MEV leak as an invisible cost, protocols intercept it and send it back to participants who contribute liquidity or order flow. Mechanisms such as intent-based trading, auction-driven execution, and application-level MEV capture are at the heart of this transformation.

“MEV rebates are not just a technical fix. They’re a market redesign that aligns incentives across the DeFi stack. “

Key Mechanisms Driving MEV Redistribution

Key Mechanisms for MEV Rebate Distribution in DeFi

-

Intent-Based Auction Protocols: Protocols like ParaSwap’s Delta allow users to define precise trading intentions. Transactions are executed via competitive auctions among AI agents, minimizing MEV exploitation and ensuring rebates are returned directly to users.

-

MEV-Redistributing Automated Market Makers (AMMs): Platforms such as RediSwap integrate MEV capture at the AMM level, redistributing arbitrage profits to users and liquidity providers, rather than external arbitrageurs.

-

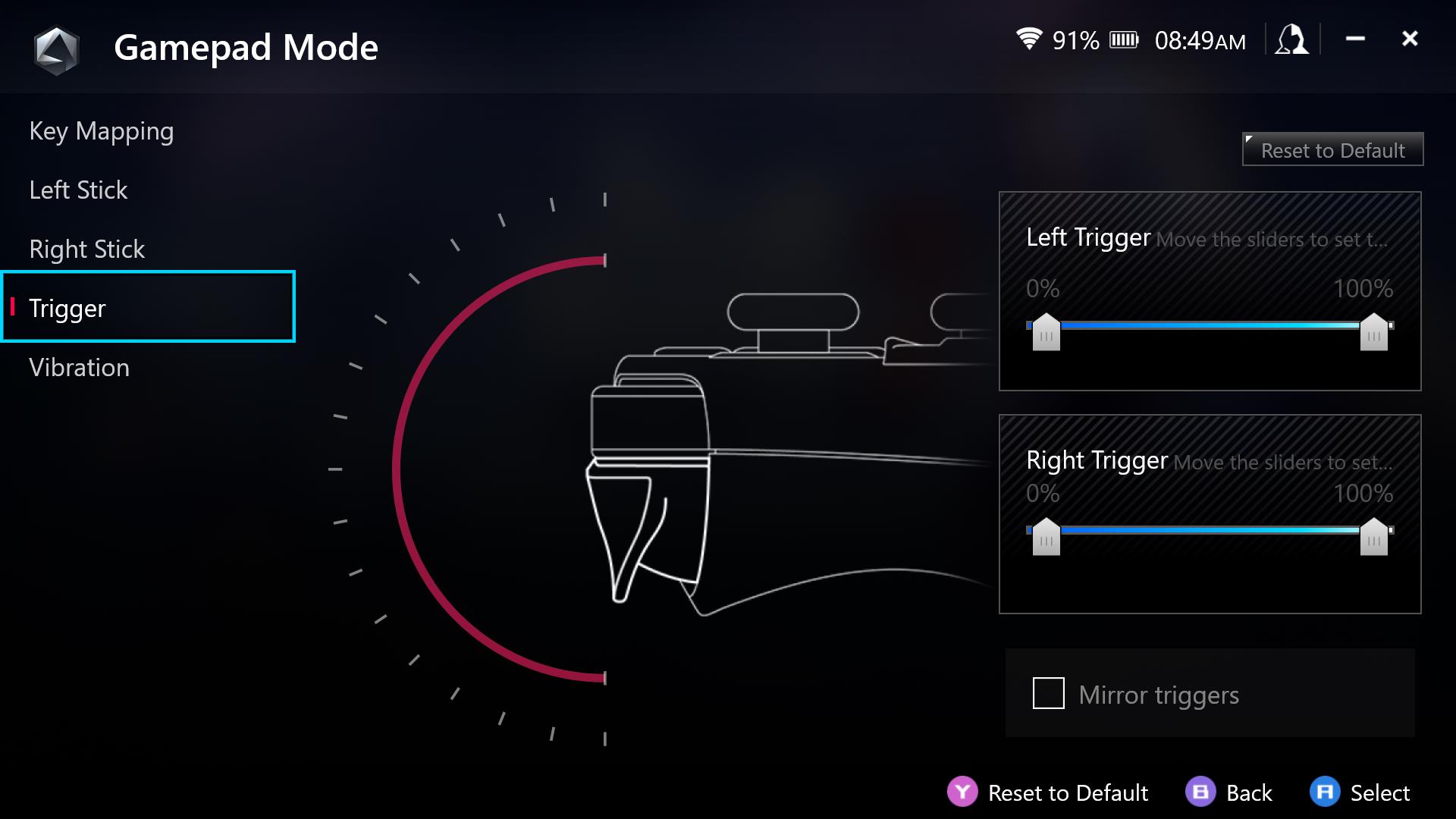

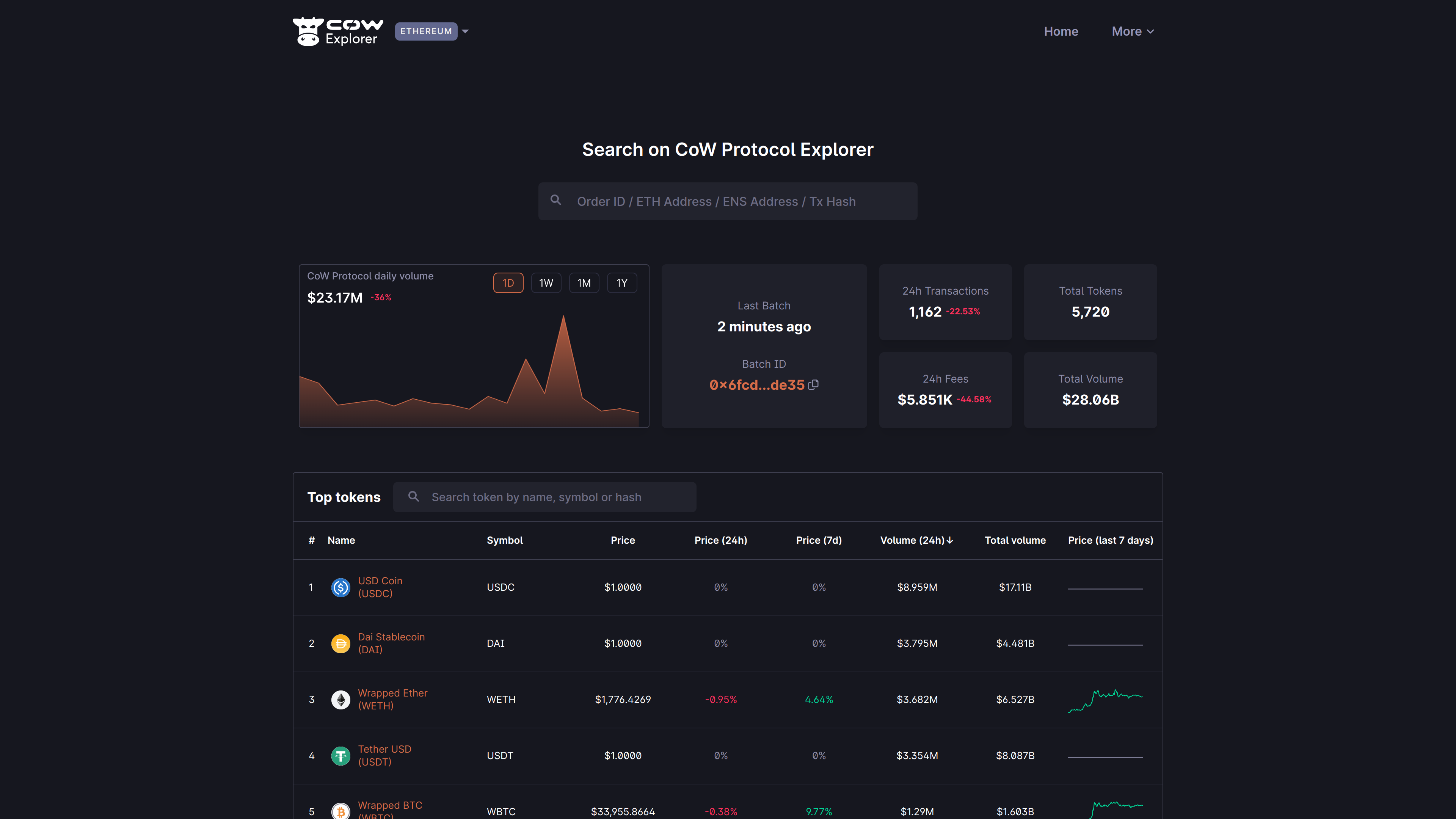

Solver-Based Batch Settlement: CoW Protocol employs solvers that compete to settle user trades. This competition drives optimal execution, redistributing MEV by providing users with improved prices and reducing the impact of MEV attacks.

-

Order Flow Auctions (OFAs): By auctioning off the right to order transactions, protocols ensure that MEV profits are captured and shared with users or the protocol treasury, rather than solely with validators or miners.

-

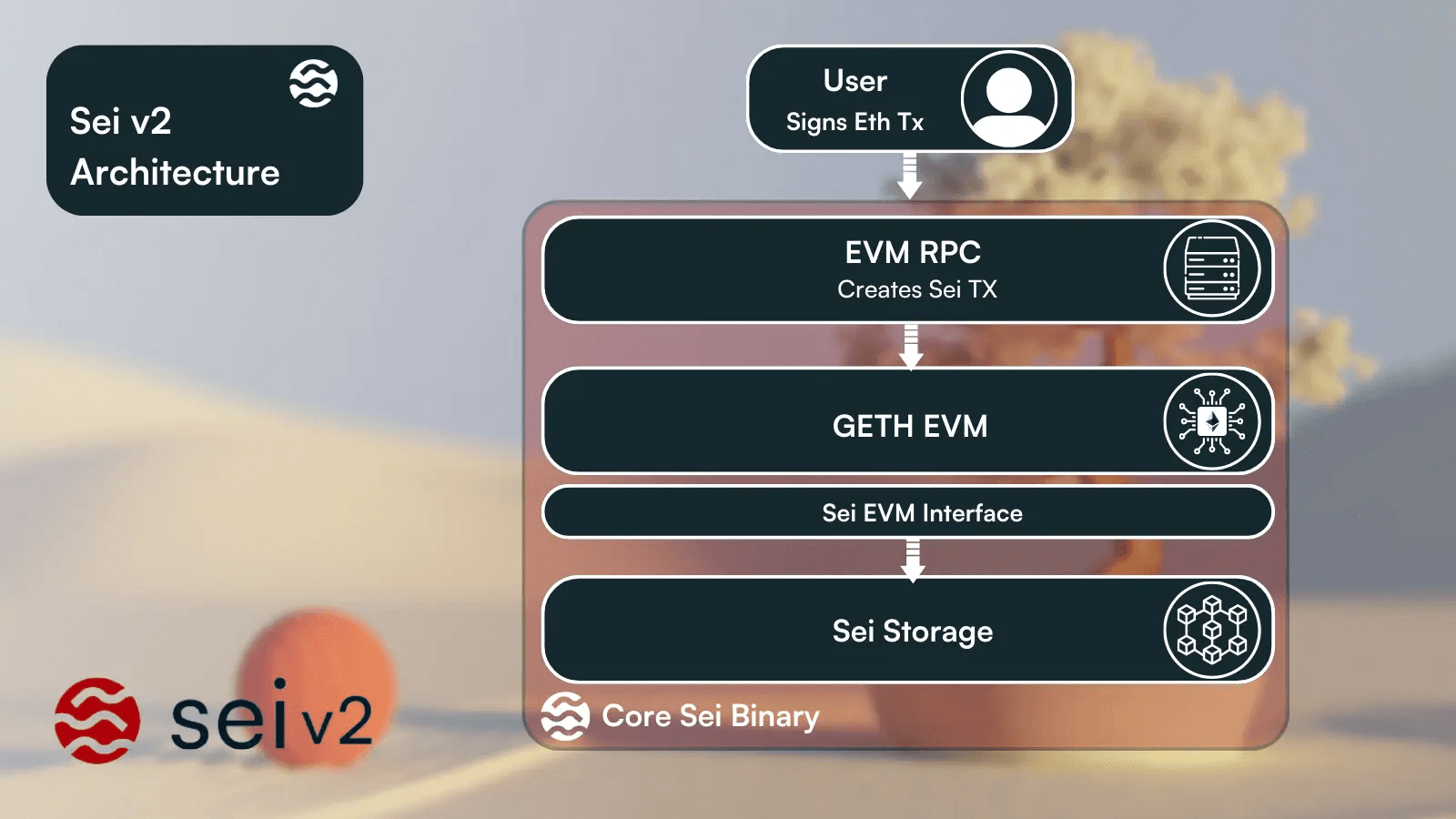

Application-Specific Ordering: Networks like Sei implement application-specific transaction ordering, enabling protocols or validators to capture and redistribute MEV revenue from transaction sequencing subscriptions.

Several mechanisms have gained traction in 2024-2025, each with unique implications for user rewards:

- Intent-Based Protocols: Platforms like ParaSwap’s Delta protocol let users specify trade intentions, which are then matched via competitive auctions among AI agents. This minimizes exploitable gaps and ensures that surplus from efficient execution is shared with users.

- MEV-Aware AMMs: RediSwap and similar automated market makers incorporate logic to capture arbitrage profits internally, redistributing them to liquidity providers rather than external searchers.

- Solver Competition: CoW Protocol leverages solver auctions to optimize trade routing. Solvers compete to find the best path for users, with any captured surplus (ordering surplus) flowing back to traders.

- Auction-Based Bundling: On chains like Solana, Jito’s auction-based bundling aligns validator and infrastructure incentives with token holders by redistributing MEV revenue through transparent market processes.

This shift is supported by advances in on-chain order flow auctions and application-specific transaction ordering, which further democratize access to MEV-derived rewards.

Protocols Leading the Charge in Fair MEV Sharing

The rise of rebate-driven models is visible across several high-impact protocols:

- ParaSwap Delta Protocol: Uses auction-based execution to minimize user losses from MEV and return surplus directly to traders.

- RediSwap: Employs internal arbitrage management so that value stays within the pool, boosting liquidity provider returns.

- CoW Protocol: Distributes solver-generated surplus back to users by design, reinforcing fair pricing and reducing negative externalities from traditional MEV extraction.

For a deeper look at these mechanisms in practice, see our recent analysis on how MEV rebates are transforming DeFi user rewards in 2024.

The Market Impact: Efficiency, Liquidity and User Experience

The impact of these rebate systems is increasingly quantifiable. On Ethereum Layer 2s alone, sequencer profits from order flow auctions are estimated at ~$100M annualized, much of which is now being recycled into user-facing rewards rather than siphoned off by extractors. Protocols that implement fair MEV sharing report:

- Lower transaction costs due to minimized front-running risk

- Improved price discovery as more value is kept within the ecosystem

- Stronger liquidity provision, as LPs benefit from reduced impermanent loss and more predictable returns

- Increased user trust, driven by transparent redistribution of ordering surplus

This evolution is not just theoretical, it is actively shaping DeFi markets today. As standalone networks specializing in order sequencing proliferate beyond Ethereum (see Sei and Solana), the playbook for sustainable, equitable MEV markets is being rewritten in real time.

MEV rebates are also catalyzing a new era of protocol design, where transparency and user alignment are non-negotiable. No longer is MEV a hidden tax; it is a measurable, shareable resource. This shift has forced protocols to rethink how sequencer revenue and ordering surplus are handled, with a growing number opting for on-chain receipts and open accounting of MEV flows.

For example, application-specific ordering on Sei routes subscription revenue directly to protocols or validators, converting what was once a volatile, per-transaction extraction into a steady, protocol-aligned revenue stream. On Solana, Jito’s auction-based bundling has become a case study in aligning infrastructure incentives with token holders, ensuring that MEV revenue is not only visible but also fairly distributed among participants.

Challenges and Open Questions in MEV Redistribution

Despite these advances, the path to universal fair MEV sharing is not without friction. Protocols must balance the technical complexity of on-chain auctions, solver competition, and intent-based order flow with the need for seamless user experience. Fragmentation across chains and the emergence of specialized block builders create additional coordination challenges.

Moreover, as MEV rebate buffers grow, the question of how surplus is divided between users, LPs, and protocol treasuries becomes more acute. Some models, like CoW Protocol, exclude solver participation in surplus profits to maintain incentives, while others experiment with dynamic splits based on real-time market conditions. The evolution from batch to combinatorial auctions, as seen in recent research, may further refine how ordering surplus is shared.

Key Challenges for MEV Rebate Adoption in DeFi

-

Complex Integration with Existing Protocols: Incorporating MEV rebate mechanisms, such as those used by CoW Protocol or ParaSwap’s Delta, often requires significant changes to protocol architecture, posing technical and operational hurdles for established DeFi platforms.

-

Incentive Alignment Across Stakeholders: Ensuring that validators, users, and liquidity providers all benefit from MEV rebates is challenging. As seen in Jito’s auction-based bundling on Solana, misaligned incentives can reduce participation or lead to new forms of value extraction.

-

Economic Sustainability and Revenue Distribution: Protocols must balance fair MEV redistribution with maintaining sufficient revenue for infrastructure providers and protocol development, as highlighted in the Sei Blog’s analysis of application-specific ordering.

-

Regulatory and Compliance Uncertainty: The evolving regulatory landscape, especially in jurisdictions monitoring MEV practices, creates uncertainty for protocols seeking to implement rebate mechanisms, as noted by the European Securities and Markets Authority.

-

Potential for New Attack Vectors: Introducing rebate mechanisms may inadvertently open up new avenues for manipulation or exploitation, such as sophisticated front-running or gaming of rebate distributions, as discussed in the RediSwap MEV-redistribution paper.

What’s Next for MEV User Rewards?

The next phase for MEV rebates will likely see increased composability between protocols, standardized DeFi transaction receipts, and greater user control over how their order flow is monetized. As standalone networks for order sequencing and block building mature, expect to see even more granular and customizable MEV redistribution models emerge.

For users and liquidity providers, this means that participating in DeFi no longer entails accepting MEV as an unavoidable drag. Instead, MEV becomes a source of predictable, protocol-driven rewards: a shift that could unlock new layers of capital efficiency and user loyalty.

“The future of DeFi is one where every participant can track, claim, and optimize their share of MEV-derived value. “

Protocols that embrace transparent MEV sharing are already seeing tangible gains in user retention and market depth. As order flow auctions, solver competition, and MEV rebate buffers become industry standards, the DeFi ecosystem is poised for a more sustainable and equitable phase of growth.

For further reading on these trends and real-world protocol case studies, see how MEV rebates are transforming DeFi user incentives and protocol fairness.