Decentralized exchanges (DEXes) have long promised a fairer, more transparent trading environment. Yet, beneath the surface, the dynamics of Maximal Extractable Value (MEV) have quietly siphoned value away from everyday users and liquidity providers (LPs), funneling profits to miners, validators, and arbitrage bots. In 2025, however, a new era is emerging: MEV redistribution engines are rewriting the rules of engagement on DEXes, ensuring that those who provide liquidity are finally rewarded for their risk and capital.

How MEV Has Historically Undermined LP Incentives

The appeal of providing liquidity on automated market makers (AMMs) lies in earning trading fees. But the reality has been less rosy. MEV extraction strategies, such as front-running and sandwich attacks, have routinely eroded LP returns. Arbitrageurs exploit stale prices across pools, rebalancing them only when profitable for themselves. The resulting phenomenon, known as loss-versus-rebalancing (LVR), means LPs often earn 5-7% less than they should on major token pairs due to these predatory practices.

This persistent leakage of value has not only discouraged potential LPs but also introduced inefficiencies into DeFi markets at large. For years, protocol designers sought ways to stem these losses without sacrificing the open and permissionless ethos of DeFi.

Innovative MEV Redistribution Engines: Turning Extraction into Shared Rewards

The latest wave of innovation centers around capturing MEV at the protocol level and redistributing it transparently among users and LPs. Let’s examine some leading-edge solutions:

- RediSwap: By integrating an application-level MEV capture mechanism directly into its AMM logic, RediSwap ensures that profits from arbitrage are shared with both traders and LPs, not just opportunistic bots. This approach has been shown to yield improved trade execution quality compared to legacy AMMs.

- CoW Protocol: CoW Protocol’s unique auction system forces arbitrageurs to bid for the right to rebalance pools. The majority of these profits are then funneled back to LPs, protecting them from LVR and potentially saving hundreds of millions annually.

- MEV Blocker: Launched by a consortium of Ethereum teams, this tool routes transactions through a private network and auctions backrunning opportunities, returning up to 90% of builder rewards directly as user rebates.

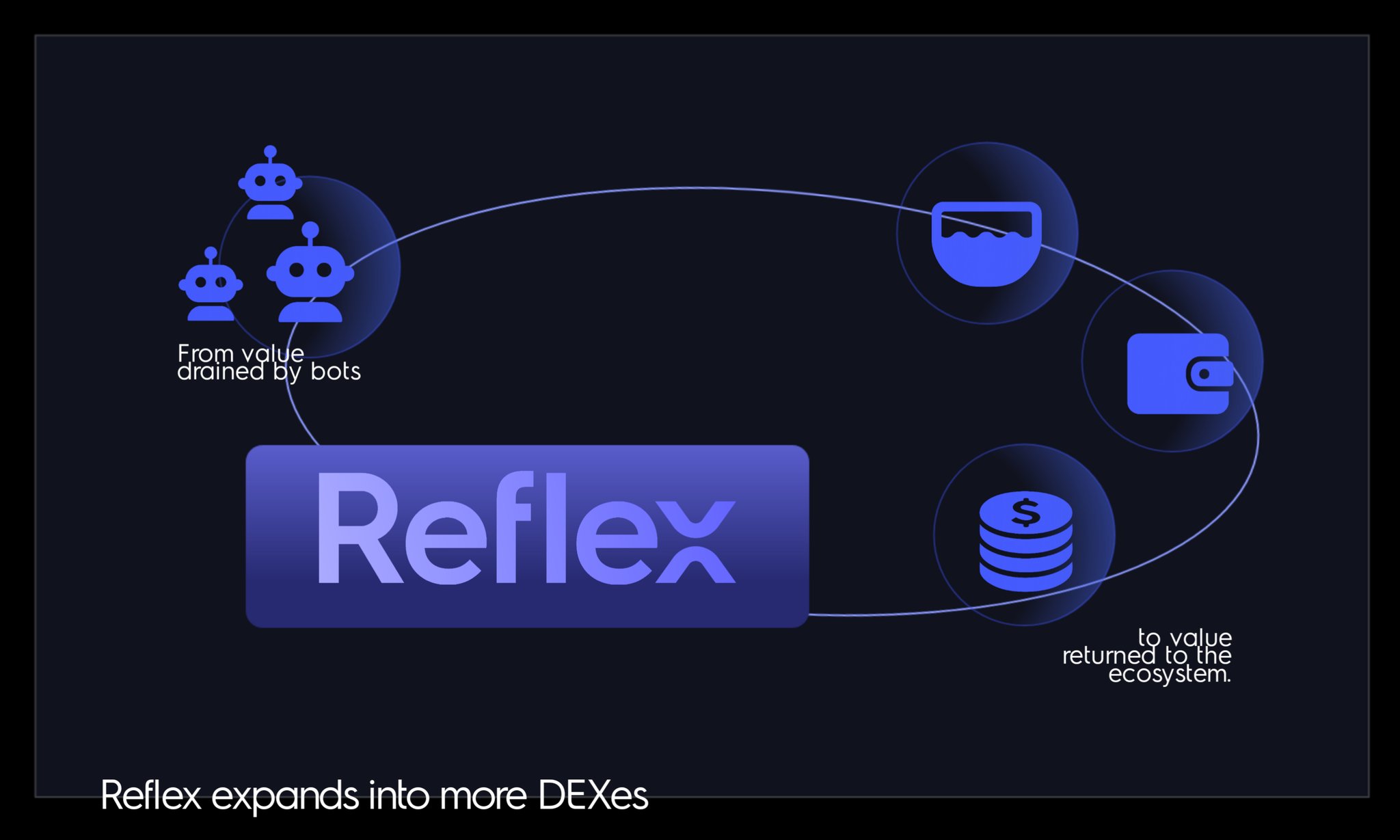

- Reflex x Algebra Integral: Reflex is a fully on-chain MEV engine that integrates seamlessly with Algebra-powered DEXes via modular plugins. Its design allows protocols to capture extraction events without costly redeployments or migrations.

This shift toward protocol-level MEV sharing is transforming how DeFi protocols compete for liquidity, and how they retain it over time.

The New Economics: How Liquidity Providers Are Benefiting

The impact for LPs is profound:

- Increased Returns: Instead of leaking value to external actors, protocols now redistribute captured MEV as additional income streams, on top of standard swap fees, to their LP base.

- Reduced Impermanent Loss: By internalizing arbitrage profits via mechanisms like RediSwap’s application-level capture or CoW’s auction model, protocols can significantly mitigate LVR-driven losses for their LPs.

- A Fairer Playing Field: As exploitative practices like front-running are curbed through on-chain engines such as ReflexMEV or privacy-focused RPC endpoints like MEV Blocker, DEXes become more attractive destinations for both retail and institutional capital.

This evolution isn’t just technical, it’s fundamentally changing what it means to be an LP in DeFi. No longer passive victims in the game of transaction ordering, today’s liquidity providers can participate in new incentive structures designed around transparency and fairness. For a deeper dive into how these mechanisms work under the hood, see our guide on how MEV rebates work across DeFi networks.

The competitive advantage of DEXes now hinges on their ability to capture and redistribute MEV efficiently. Protocols that can demonstrate a tangible boost in LP rewards, while minimizing risk, are seeing surges in both liquidity and trading volume. This is a direct response to the new generation of on-chain MEV engines, which are no longer theoretical: they’re live, audited, and distributing millions in rebates every month.

Top DEXes Implementing MEV Redistribution in 2025

-

RediSwap: Innovative AMM capturing MEV at the application level. RediSwap redistributes MEV profits between users and liquidity providers, reducing loss-versus-rebalancing (LVR) and enhancing trade execution. Key stat: Demonstrated improved trade execution over traditional AMMs in most scenarios. Read more

-

CoW Protocol: AMM with MEV auctions for arbitrage rights. CoW Protocol forces arbitrage bots to bid for pool rebalancing, returning most profits to LPs and protecting them from MEV bots. Key stat: Estimated to save LPs $500 million annually by redistributing MEV. Learn more

-

MEV Blocker: User-centric MEV protection across DEXes. Developed by a consortium of Ethereum teams, MEV Blocker routes transactions privately and returns 90% of builder rewards as rebates. Key stat: Distributed 4,079 ETH in rebates to users in 2024. See details

-

Reflex x Algebra Integral: On-chain MEV engine for Algebra-powered DEXes. Reflex captures and redirects MEV into protocol revenue, seamlessly integrated via Algebra Integral’s modular V4 plugin. Key stat: Enables MEV redistribution without redeployments or liquidity migrations. More info

Transparency is another crucial benefit. LP dashboards now offer granular breakdowns of fee income versus MEV-derived rewards, empowering providers to make more informed decisions about where to allocate capital. ReflexMEV’s integration with Algebra Integral, for example, enables seamless upgrades and real-time metrics without interrupting existing liquidity positions, a technical feat that would have seemed impossible just two years ago.

For protocols like RediSwap and CoW Protocol, the shift is not just about protecting LPs from predatory bots but about redefining the social contract between users, protocols, and liquidity providers. The result is a feedback loop: as LPs see improved net returns, including rebates from previously lost MEV, they’re incentivized to deepen their positions. This increased depth, in turn, leads to tighter spreads and better execution for traders, a win for the entire ecosystem.

What’s Next: The Future of MEV Sharing Protocols

The pace of innovation shows no sign of slowing. With modular plugin architectures like Algebra Integral enabling rapid deployment of new MEV capture strategies, and with community-driven governance deciding how profits are shared, expect even more dynamic incentive models ahead. Some protocols are already experimenting with real-time rebates, where LP rewards update block-by-block based on observed extraction events.

This is catalyzing a broader conversation around how protocol-level MEV sharing can power sustainable DeFi growth. As user awareness grows and analytics tools mature, it’s likely we’ll see greater pressure on all DEXes to adopt transparent redistribution mechanisms as a baseline feature, not a premium perk.

Key Takeaways for Liquidity Providers

- Demand transparency: Choose platforms that provide clear reporting on MEV-derived rewards versus swap fees.

- Stay informed: Track updates from leading protocols as new redistribution engines evolve rapidly.

- Diversify exposure: Consider spreading capital across multiple DEXes employing different MEV sharing strategies for optimal results.

This shift toward fairer decentralized exchange incentives isn’t hypothetical, it’s happening now. As the battle for liquidity intensifies throughout 2025 and beyond, those who understand the nuances of MEV sharing protocols, loss-versus-rebalancing mitigation, and on-chain transparency will be best placed to thrive in the next era of DeFi market structure.