For DeFi protocol developers, the challenge isn’t just about mitigating MEV extraction risks, but about transforming MEV into a force for ecosystem-wide fairness. As we move into 2025, MEV redistribution is no longer a theoretical ambition – it’s a critical feature for any protocol aiming to foster user trust and competitive advantage. Let’s break down how developers can implement fair MEV redistribution mechanisms that align incentives and close the gap between extractors and everyday users.

MEV: The Double-Edged Sword in DeFi Protocols

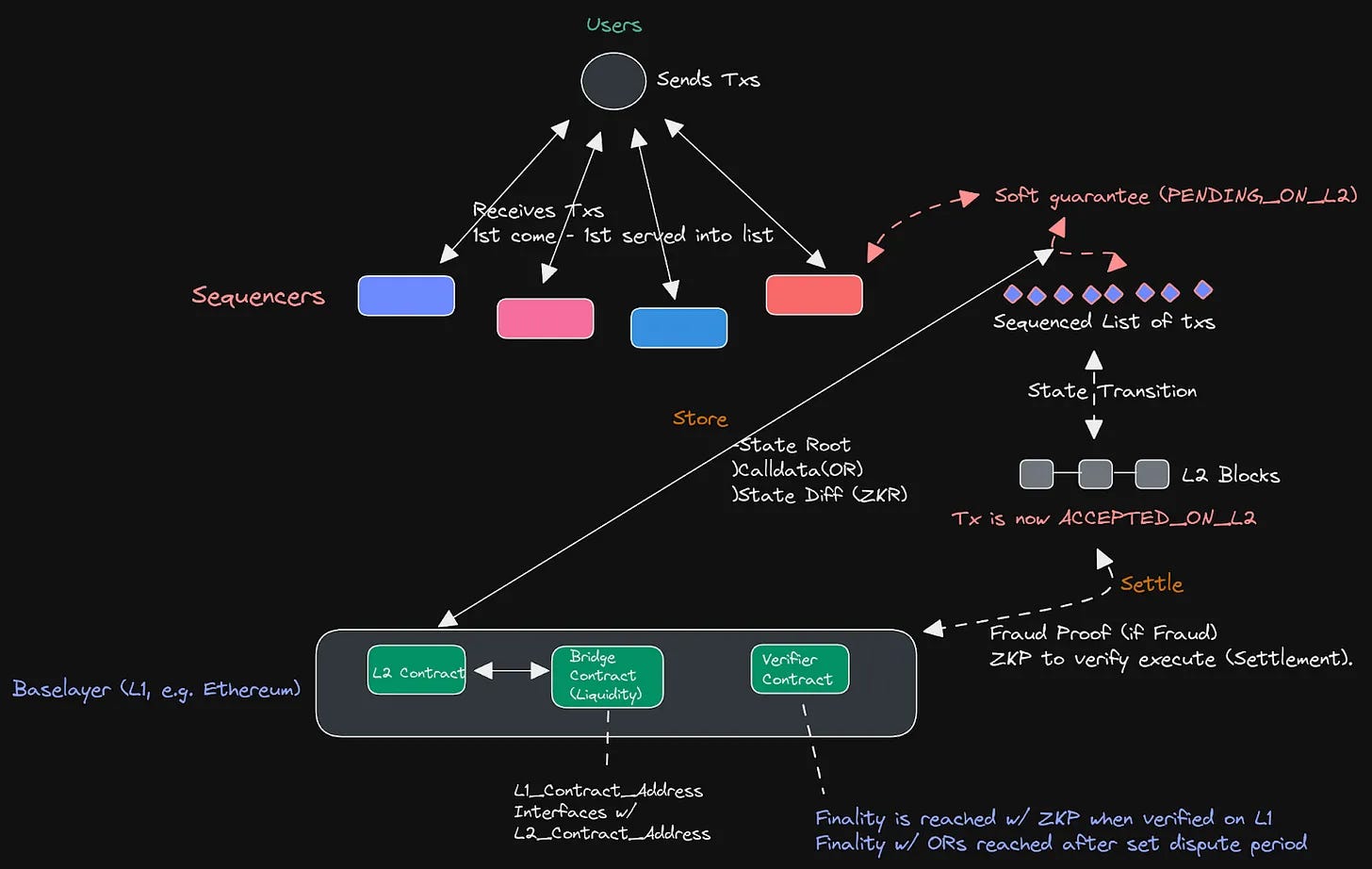

At its core, Maximal Extractable Value (MEV) represents the value that block producers can extract by strategically ordering, including, or excluding transactions within a block. While MEV can drive liquidity and efficiency in markets, unchecked extraction often leads to front-running, sandwich attacks, and price slippage, all at the expense of regular users. Recent research shows that Layer 2 expansion has merely shifted, not eliminated, these opportunities (Ancilar Technologies, 2025). For protocol designers, this means ignoring MEV is no longer an option.

The real innovation lies in building mechanisms that capture and redistribute this value transparently. By embedding MEV-aware logic directly into smart contracts or protocol layers, developers can turn what was once a risk into a revenue-sharing engine, aligning incentives for traders, liquidity providers, and even validators.

Key Strategies for Fair MEV Sharing

The landscape of MEV redistribution for protocol developers is rapidly evolving. Here are actionable strategies that leading projects are deploying right now:

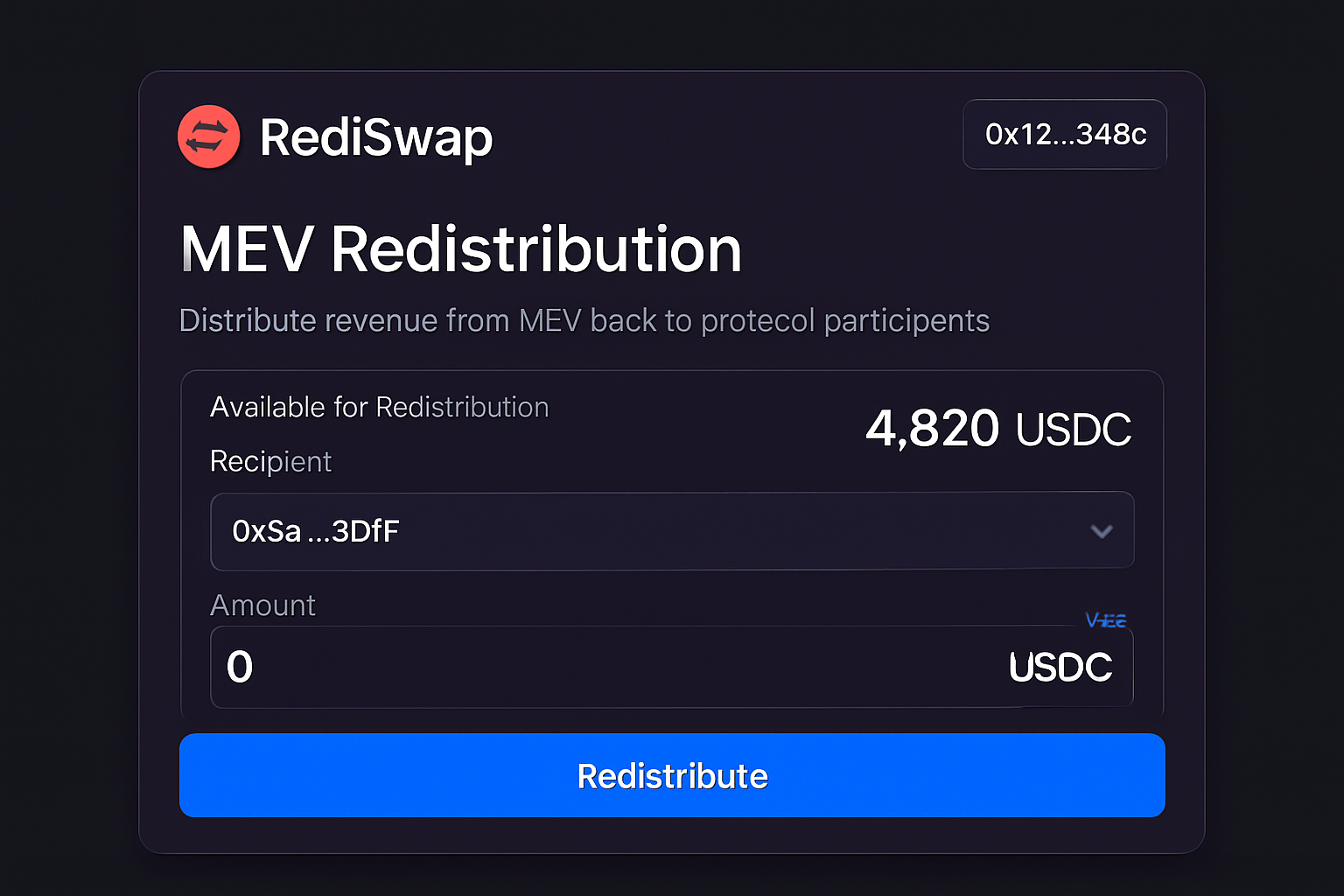

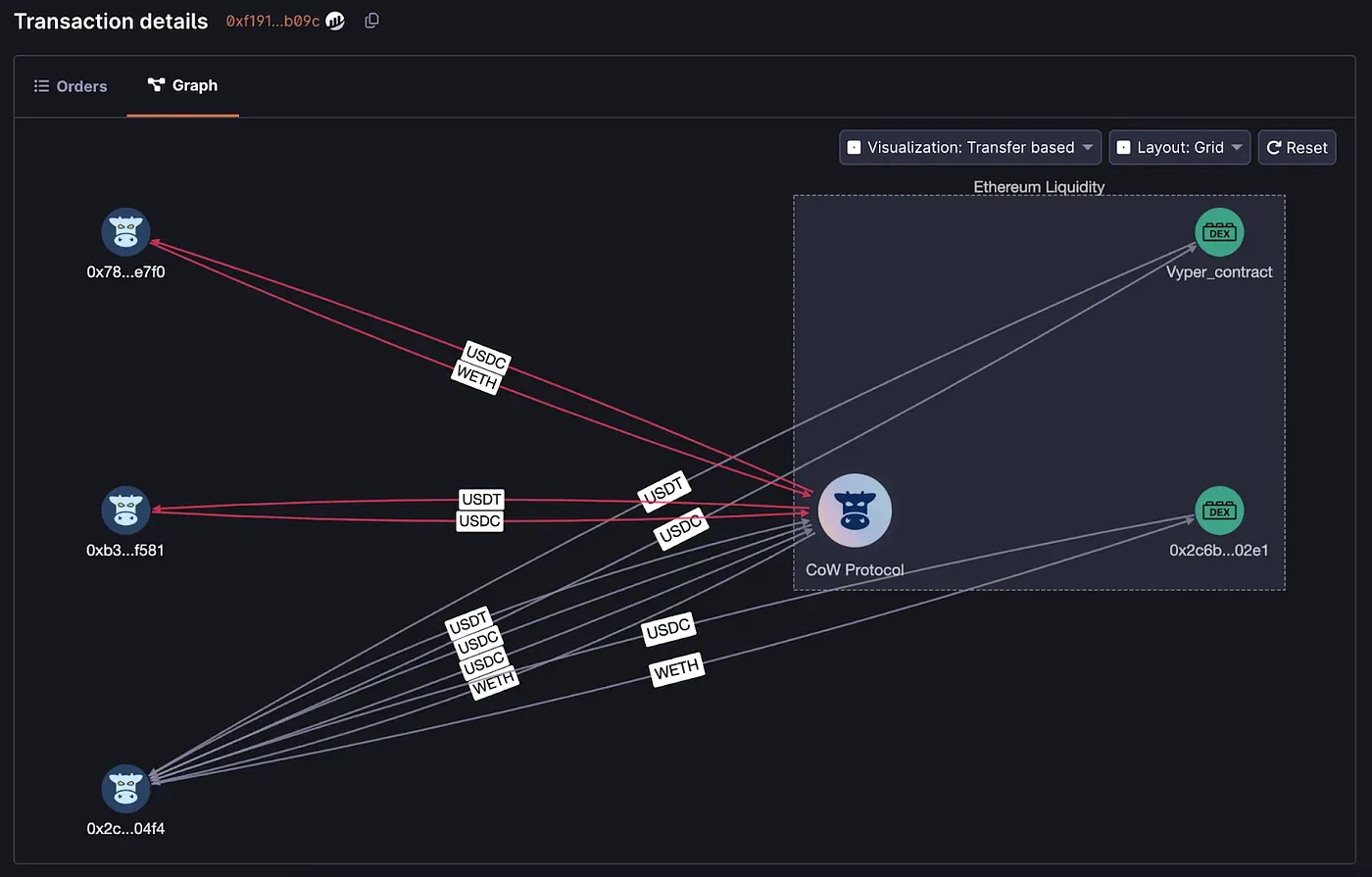

- MEV Rebates and Redistribution Protocols: Capture arbitrage or liquidation profits at the protocol level and share them with users. RediSwap’s pools are a live example, arbitrage profits are distributed between traders and liquidity providers rather than being siphoned off by external searchers.

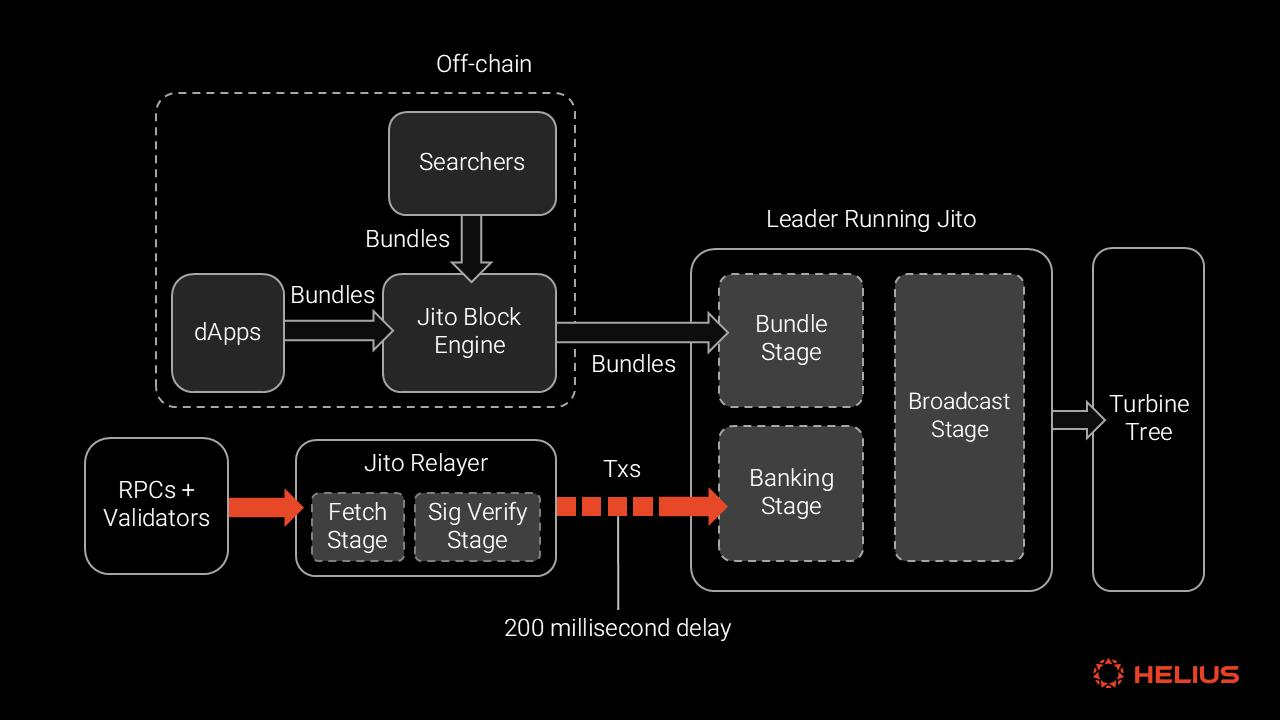

- Protected Order Flow (PROF): Enforce predetermined transaction orderings via bundles that are profitable for both users and block producers. This reduces harmful forms of MEV while ensuring timely inclusion.

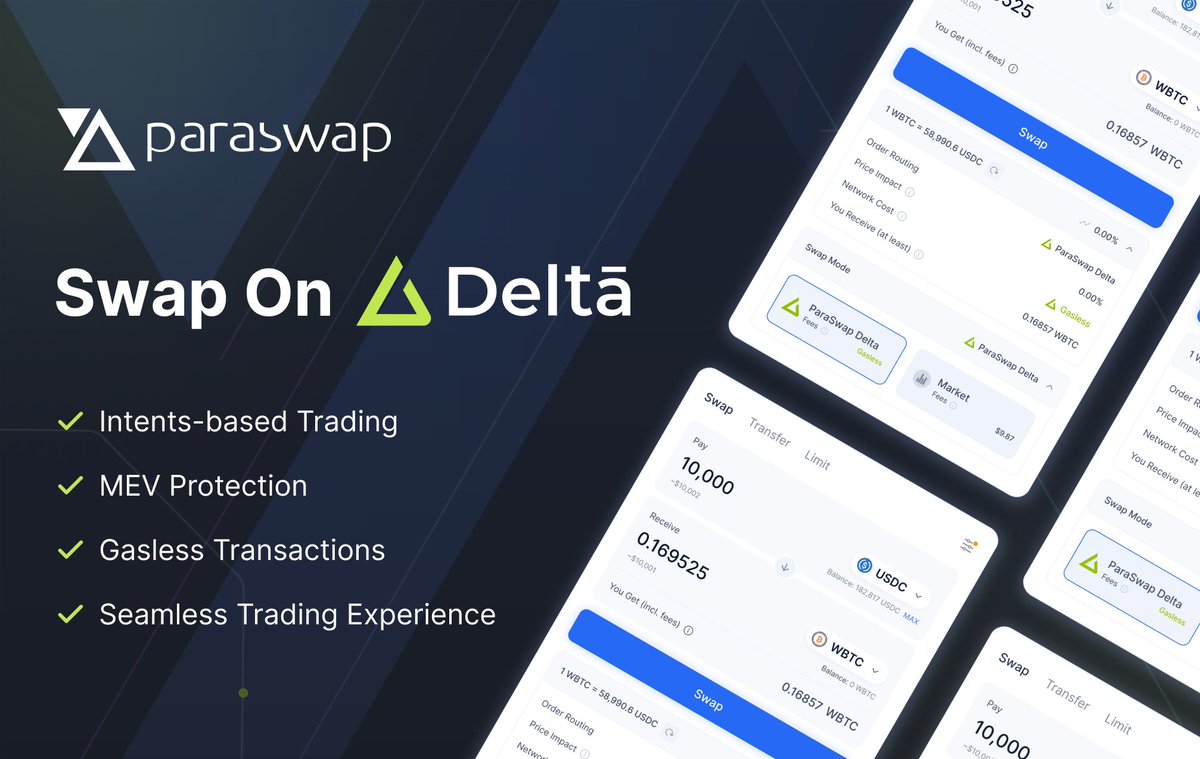

- Intent-Based Trading: Allowing users to submit trade intents (not raw transactions) puts control back in their hands. ParaSwap’s Delta protocol uses an auction system to process these intents efficiently while reducing exposure to predatory bots.

- Order Flow Auctions (OFAs): Create competitive environments where searchers bid for transaction inclusion rights. The resulting payments are rebated back to end-users as gas refunds or improved execution prices.

- PACC Commitments: Enable private, anonymous commitments so wallet holders can transact without revealing order details, effectively shutting down many forms of transaction-order manipulation.

The Rise of Transparent and Standardized MEV Mechanisms

The push towards transparent and standardized approaches is reshaping how protocols address DeFi MEV mitigation. Tools like EigenPhi and Flashbots Explorer provide real-time analytics on MEV flows so both users and developers can monitor extraction patterns across protocols. Meanwhile, cross-protocol standards like MEV-Share aim to unify APIs for redistribution logic, making it easier for new projects to plug into proven frameworks without reinventing the wheel.

This transparency isn’t just about optics; it’s about accountability. When protocol participants can see exactly how much value is being extracted, and how much is being returned, the market naturally gravitates toward platforms with clear rules and fair distribution models.

The Governance Layer: DAOs and Community Control

No fair sharing mechanism survives without robust governance. Decentralized Autonomous Organizations (DAOs) such as CoW DAO are pioneering community-driven allocation rules for redistributing captured value, a model that empowers token holders instead of centralized teams. For more on how DAOs shape fairer ecosystems through transparent rule-making processes, see our guide on how MEV redistribution protocols improve fairness in DeFi transactions.

Strong governance frameworks are critical for sustaining trust as MEV redistribution becomes a protocol-native feature. By leveraging on-chain voting and transparent proposal systems, DAOs can rapidly iterate on allocation formulas, adjust parameters in response to evolving market conditions, and enforce community-approved upgrades. This active participation ensures that the interests of all stakeholders, users, liquidity providers, and even validators, are represented in the ongoing evolution of MEV sharing strategies.

Best Practices for Protocol Developers

To implement effective MEV extraction risk reduction and fair value sharing, developers should focus on:

- Integrating Real-Time Analytics: Use open-source dashboards or third-party tools to monitor MEV activity within your protocol. This data-driven approach helps identify vulnerabilities and measure the impact of mitigation efforts.

- Modular MEV Capture Logic: Design smart contracts with plug-and-play modules for capturing and redistributing MEV. This enables rapid adaptation as new attack vectors or redistribution models emerge.

- User-Centric Design: Prioritize user experience by offering opt-in privacy features (like PACCs), gas rebates from order flow auctions, or clear disclosures about how extracted value is shared.

- Cross-Protocol Collaboration: Participate in standardization initiatives such as MEV-Share to ensure your protocol remains compatible with ecosystem-wide best practices for transparent MEV mechanisms.

Treating MEV not as a threat but as an opportunity to align incentives will distinguish sustainable protocols from those vulnerable to extractive practices. As DeFi matures, users will increasingly demand platforms that openly share surplus value and minimize hidden costs.

Staying Ahead: Continuous Improvement and Community Engagement

The pace of innovation in DeFi means no mechanism remains optimal forever. Protocol teams must commit to continuous monitoring and iterative upgrades, actively soliciting feedback from users, searchers, and liquidity providers. Regular audits of both code and incentive flows are essential for catching emergent forms of extraction before they become systemic risks.

Education also plays a pivotal role. By demystifying how MEV works, and how it’s shared, protocols can build stronger community buy-in while attracting sophisticated users who value transparency over opaque profit-taking.

Actionable Steps for Transparent MEV Sharing in DeFi

-

Integrate MEV Redistribution Protocols: Implement solutions like RediSwap that capture MEV at the protocol level and redistribute profits to users and liquidity providers, ensuring fair value sharing.

-

Adopt Protected Order Flow Mechanisms: Utilize systems such as PROF (Protected Order Flow) to enforce transaction ordering and create profitable bundles, reducing harmful MEV extraction while maintaining block producer incentives.

-

Implement Intent-Based Trading Protocols: Leverage frameworks like ParaSwap Delta that process user intents through auctions, minimizing MEV attacks by hiding raw transaction details.

-

Enable Order Flow Auctions (OFAs): Incorporate OFA models where searchers competitively bid to include their transactions, as seen in leading DEXs, redistributing MEV profits and improving execution for users.

-

Support Private, Anonymous Commitments: Integrate Private, Anonymous, Collateralizable Commitments (PACCs) to prevent transaction-order manipulation and eliminate MEV by securing user commitments privately.

-

Leverage MEV Transparency Tools: Use analytics platforms like EigenPhi and Flashbots Explorer to monitor MEV flows, audit redistribution, and maintain transparency for users and developers.

-

Participate in Cross-Protocol Standardization: Align with initiatives such as MEV-Share and MEV Blocker to adopt standardized APIs and interfaces, promoting consistent MEV redistribution practices across DeFi protocols.

-

Engage in Decentralized MEV Governance: Join or establish DAOs like CoW DAO to enable community-driven decision-making on MEV redistribution rules and protocol upgrades.

The bottom line? Fair MEV sharing strategies are now table stakes for any serious DeFi project. By embedding redistribution logic at the protocol layer, collaborating across ecosystems, and empowering users through governance, developers can transform a once-exploitative force into a foundation for long-term growth and trust.

If you’re building or upgrading a protocol in 2025, now is the time to put these principles into action, and help shape a more equitable future for decentralized finance.