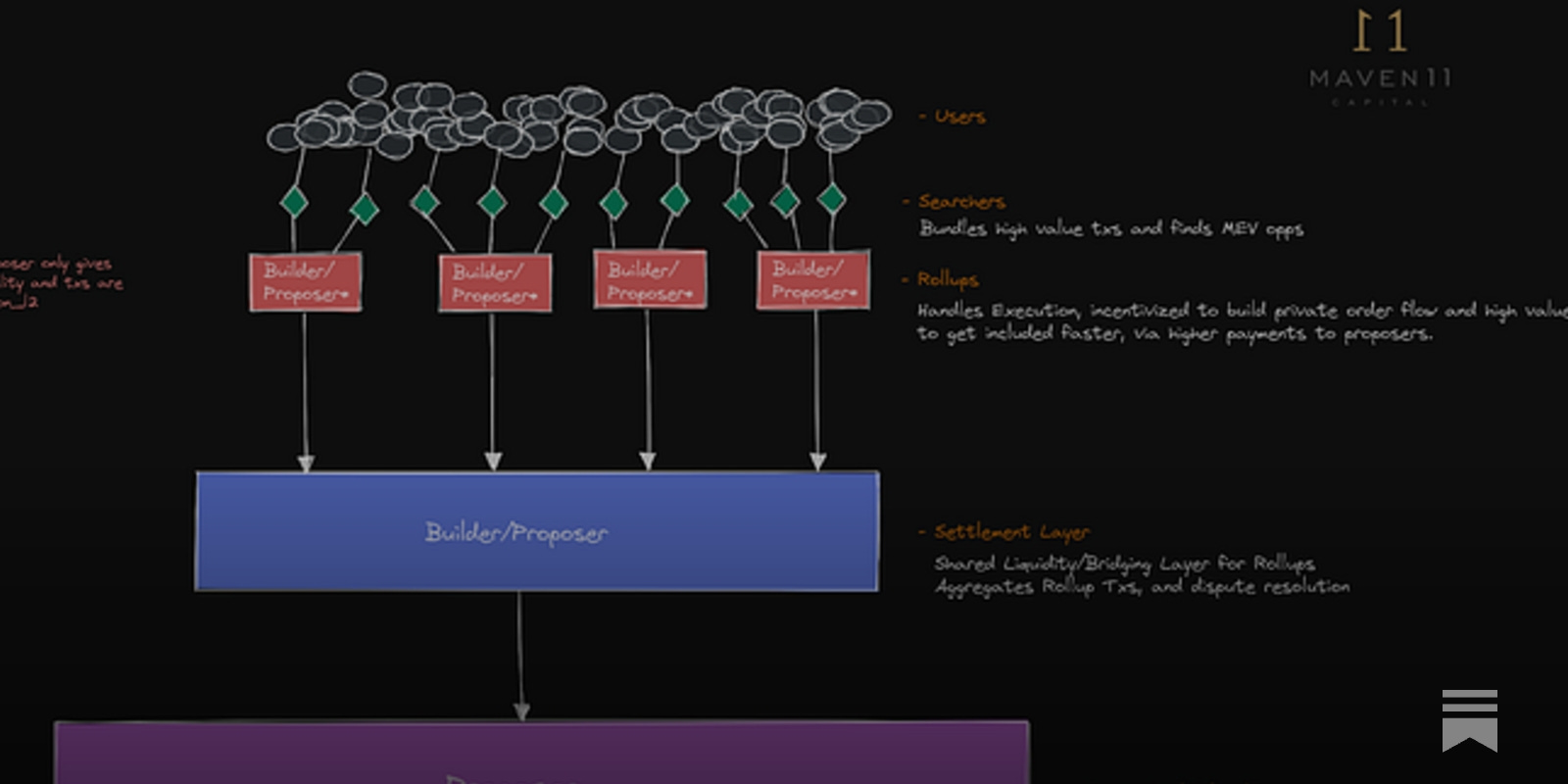

In the rapidly evolving landscape of decentralized finance (DeFi), the challenge of Maximal Extractable Value (MEV) looms large. MEV refers to the profit miners or validators can extract by reordering, including, or excluding transactions within a block. For everyday users, this creates a hidden cost structure: front-running, sandwich attacks, and transaction failures that erode trust and siphon value away from honest participants. The emergence of MEV rebates is fundamentally reshaping this dynamic, offering a blueprint for fairer, more user-centric DeFi protocols.

MEV Rebates: Turning Extraction into User Rewards

Traditional MEV extraction has favored sophisticated searchers and validators, often at the expense of regular users. However, new mechanisms are flipping this paradigm by distributing a portion of MEV profits back to those who generate the value in the first place. As highlighted by recent industry analysis, these rebate systems are not merely technical patches; they represent a shift toward protocol-level fairness and user empowerment.

Three primary approaches are gaining traction in the market:

Top 3 MEV Rebate Mechanisms Transforming DeFi

-

Private Transaction Routing: This mechanism shields users from front-running and sandwich attacks by routing transactions through private networks. MEV Blocker exemplifies this approach, auctioning the right to backrun user transactions and returning up to 90% of builder rewards as rebates directly to users.

-

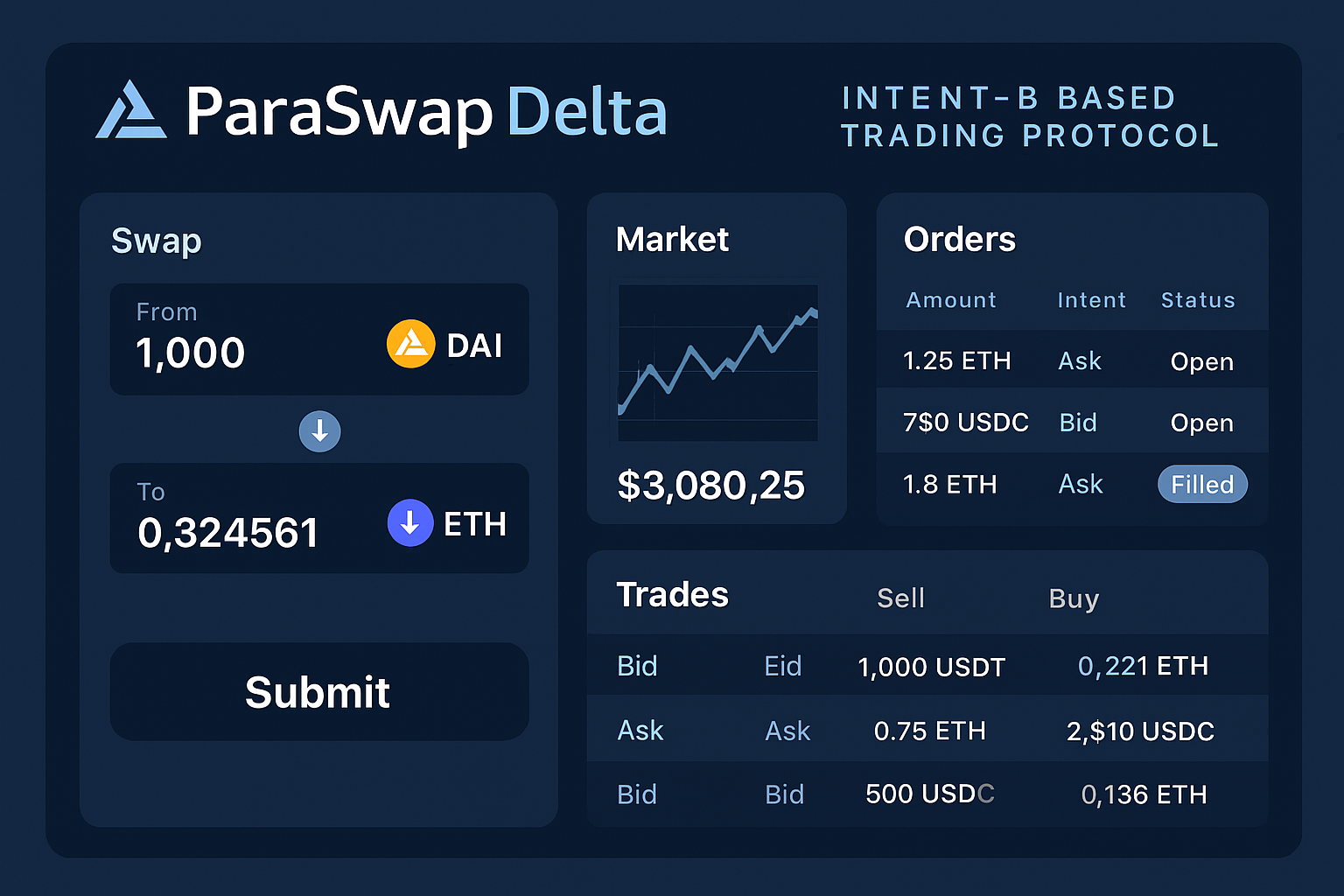

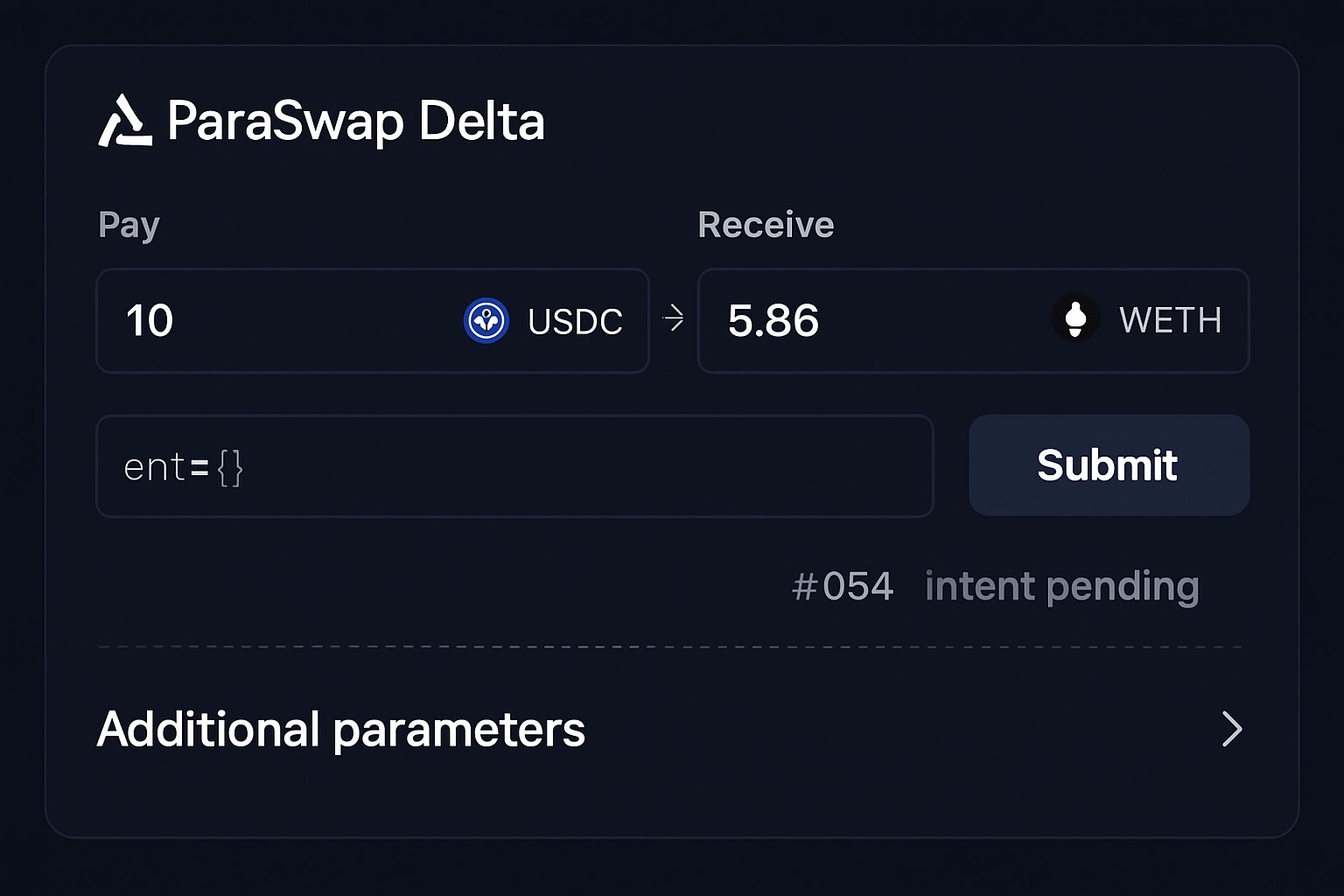

Intent-Based Trading Protocols: Protocols like ParaSwap’s Delta allow users to specify trading intents (e.g., desired price ranges), which are then executed via competitive auctions. This minimizes MEV exploitation by aligning transaction execution with user-defined goals.

-

Application-Level MEV Redistribution: Automated Market Makers (AMMs) such as RediSwap capture MEV at the protocol level and redistribute profits between users and liquidity providers. This ensures both parties benefit from arbitrage and MEV activities within the pool.

- Private Transaction Routing: Protocols like MEV Blocker shield users from predatory tactics by routing transactions through private networks and auctioning backrun rights, with up to 90% of builder rewards rebated to users.

- Intent-Based Trading Protocols: Solutions such as ParaSwap Delta enable users to specify their trading intent, ensuring execution aligns with their goals and reducing exploitative MEV opportunities.

- Application-Level MEV Redistribution: AMMs like RediSwap internalize arbitrage and systematically share profits between users and liquidity providers, closing the loop on value leakage.

Protocols Leading the MEV Fairness Movement

Several DeFi protocols are pioneering MEV rebate integration, each with distinct strategies tailored to their user base and liquidity models. MEV Blocker, for example, leverages private transaction routing and returns a significant portion of builder rewards directly to users. Dextr’s Actively Validated Market Maker (AVMM) deploys low-latency oracles and trusted order matching to curb price impact and MEV exploitation, while also offering insurance for affected users. RediSwap captures MEV within its pools and shares profits equitably between users and liquidity providers, setting a new standard for AMM design.

Wallchain is another notable entrant, integrating trader signals, back-run arbitrage, and protocol refunds into a single seamless transaction. This approach transforms failed or high-slippage trades into a strategic advantage for both users and protocols, as discussed widely on social media and DeFi research channels.

User Impact: From Passive Losses to Active Rewards

The shift toward MEV redistribution is already generating tangible benefits for DeFi participants. Users now experience:

- Enhanced Fairness: Rebates ensure that value is not monopolized by validators or searchers but shared with those who actually drive protocol activity.

- Improved User Experience: Mitigating front-running and sandwich attacks leads to more predictable transaction outcomes and fosters greater trust in DeFi platforms.

- Increased Retention: Transparent rewards and robust MEV protections are leading to higher user loyalty and engagement across platforms.

Market data from MorphLayer and Monad chains further underscores this trend, with rebate-enabled protocols reporting improved liquidity depth and stickier user bases. As these mechanisms mature, we are witnessing the emergence of MEV loyalty programs and more sophisticated forms of blockchain transaction rebates, setting new benchmarks for ecosystem sustainability.

It is increasingly clear that MEV rebates are not a fleeting innovation but a foundational element in the next generation of DeFi infrastructure. As protocols race to differentiate themselves on user protection and fairness, the competitive landscape is shifting toward those who turn MEV from a hidden tax into a transparent reward. This evolution is especially pronounced on chains like Monad and MorphLayer, where MEV-aware mechanisms are driving protocol adoption and deepening liquidity pools.

Protocols with MEV rebates are seeing measurable gains in user trust, trading volume, and long-term retention. The data speaks to a new equilibrium where users are no longer passive victims of value extraction, but active beneficiaries of protocol growth.

From Rebates to Loyalty: The Rise of MEV-Driven User Programs

Forward-thinking platforms are now experimenting with MEV loyalty programs that go beyond one-off rebates. These programs reward recurring users based on their contribution to protocol activity, creating a virtuous cycle of engagement and value sharing. For example, some AMMs distribute a portion of captured MEV as periodic bonuses or use it to offset trading fees, directly tying protocol success to user satisfaction.

Leading DeFi Protocols Pioneering MEV Rebates

-

MEV Blocker: Developed by a consortium of over 30 Ethereum teams, MEV Blocker offers an RPC endpoint that routes user transactions through a private network, shielding them from front-running and sandwich attacks. 90% of builder rewards are returned as rebates to users, setting a new standard for MEV fairness.

-

RediSwap: As an innovative Automated Market Maker (AMM), RediSwap captures MEV at the application layer and redistributes arbitrage profits between users and liquidity providers (LPs). This ensures both parties benefit directly from MEV activities within its pools.

-

Dextr’s Actively Validated Market Maker (AVMM): Dextr employs low-latency price oracles and restricts order matching to trusted operators, minimizing MEV extraction. It also features a multi-layered insurance model to compensate users impacted by MEV, reinforcing user trust and loyalty.

-

ParaSwap Delta: ParaSwap’s intent-based trading protocol allows users to define their trading preferences, which are then executed through an auction system. This model minimizes MEV exploitation and aligns execution outcomes with user-defined intentions, promoting transparency and fairness.

-

Wallchain: Wallchain integrates MEV arbitrage redistribution directly into user transactions, intercepting failed or high-slippage trades and refunding a portion of MEV gains to both traders and protocols. This approach turns rebates into a proactive user loyalty strategy across integrated DeFi platforms.

Wallchain’s integrated approach, which intercepts failed or high-slippage transactions and redistributes value, is a standout case. This mechanism not only protects users but also incentivizes protocol-aligned behavior, reinforcing the symbiotic relationship between platforms and their communities. As discussed in recent research, these strategies are rapidly becoming best practices for sustainable DeFi growth.

Challenges and What’s Next for MEV Fairness Mechanisms

Despite remarkable progress, challenges remain. Coordinating rebates across fragmented liquidity, ensuring on-chain transparency, and minimizing gaming of the system require ongoing innovation. As more protocols adopt blockchain transaction rebates, robust monitoring and open analytics will be essential to maintain user trust and prevent new forms of exploitation.

The future will likely see a convergence of intent-based trading, private order flow, and automated redistribution mechanisms. This synergy could pave the way for protocol-level MEV insurance or dynamic fee models that respond in real time to market conditions. As infrastructure matures, we can expect even broader adoption of MEV fairness mechanisms across both established and emerging chains.

MEV redistribution is not just about plugging leaks; it is about fundamentally re-architecting how value flows in decentralized markets. The protocols that embrace this ethos are poised to lead the next wave of DeFi innovation.

For those seeking to deepen their understanding or integrate these mechanisms into their own projects, comprehensive guides and market analyses are available at Mev Redistribution. Staying informed and engaged is essential as the ecosystem rapidly evolves toward greater fairness and efficiency.