Every time a user swaps tokens or adds liquidity in DeFi, they generate Maximal Extractable Value (MEV) – the hidden surplus that sophisticated actors have long captured. But the paradigm is shifting. MEV rebates are now being woven into DeFi protocols, returning a slice of this value directly to users and turning what was once an invisible tax into a tangible incentive.

From Hidden Tax to User Reward: The MEV Rebate Revolution

Historically, MEV extraction has been a zero-sum game for end users. Miners, validators, and searchers would profit from transaction ordering, while regular participants bore the cost through worse execution or increased slippage. With the rise of MEV rebate protocols, this dynamic is being upended.

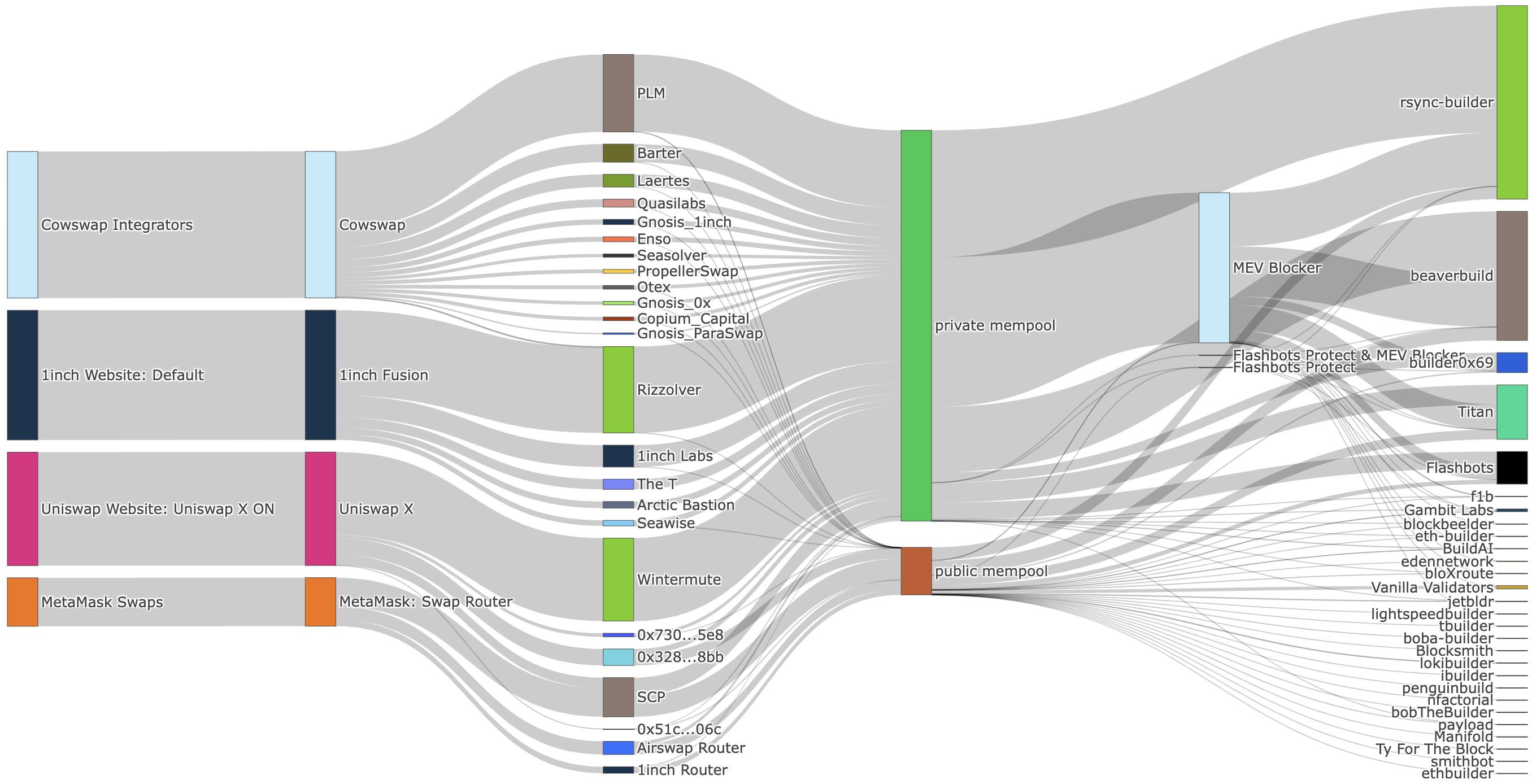

Platforms like MEV Blocker have pioneered this approach by auctioning off the right to backrun transactions and returning up to 90% of builder rewards as direct rebates to users. In 2024 alone, MEV Blocker distributed 4,079 ETH in rebates, proof that these mechanisms are more than theory; they’re already impacting real users’ bottom lines.

Protocols Leading the Charge: RediSwap, Dextr, and Wallchain

The competitive landscape is evolving quickly as new protocols race to embed MEV redistribution at their core:

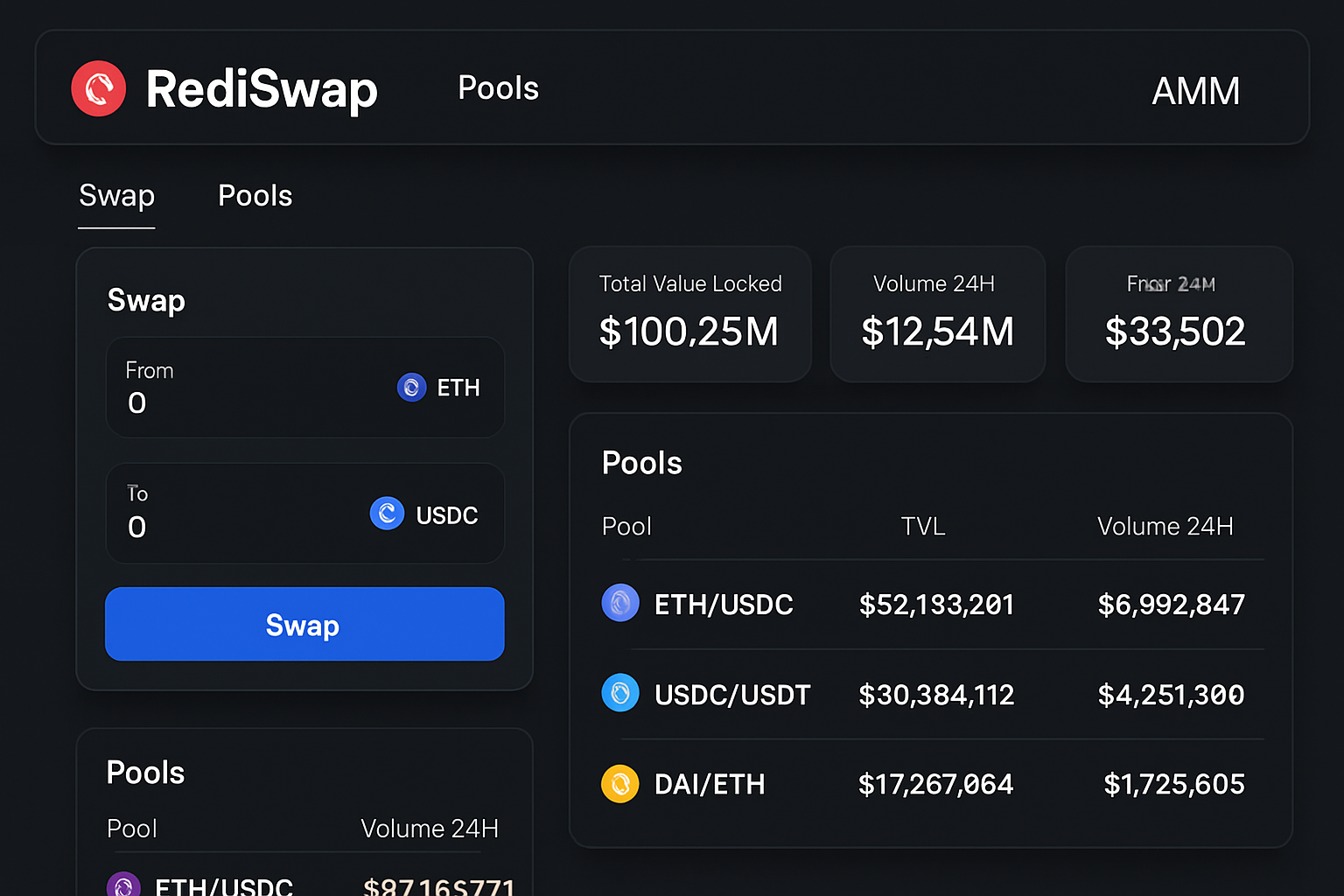

- RediSwap: This AMM captures arbitrage-driven MEV within its pools and splits profits between traders and liquidity providers. The result? Better trade execution for users and improved returns for LPs compared to legacy AMMs.

- Dextr’s Actively Validated Market Maker (AVMM): By restricting order matching to trusted operators and using low-latency oracles, Dextr minimizes both price impact and MEV exploitation. Its multi-layered insurance model compensates users affected by residual MEV events.

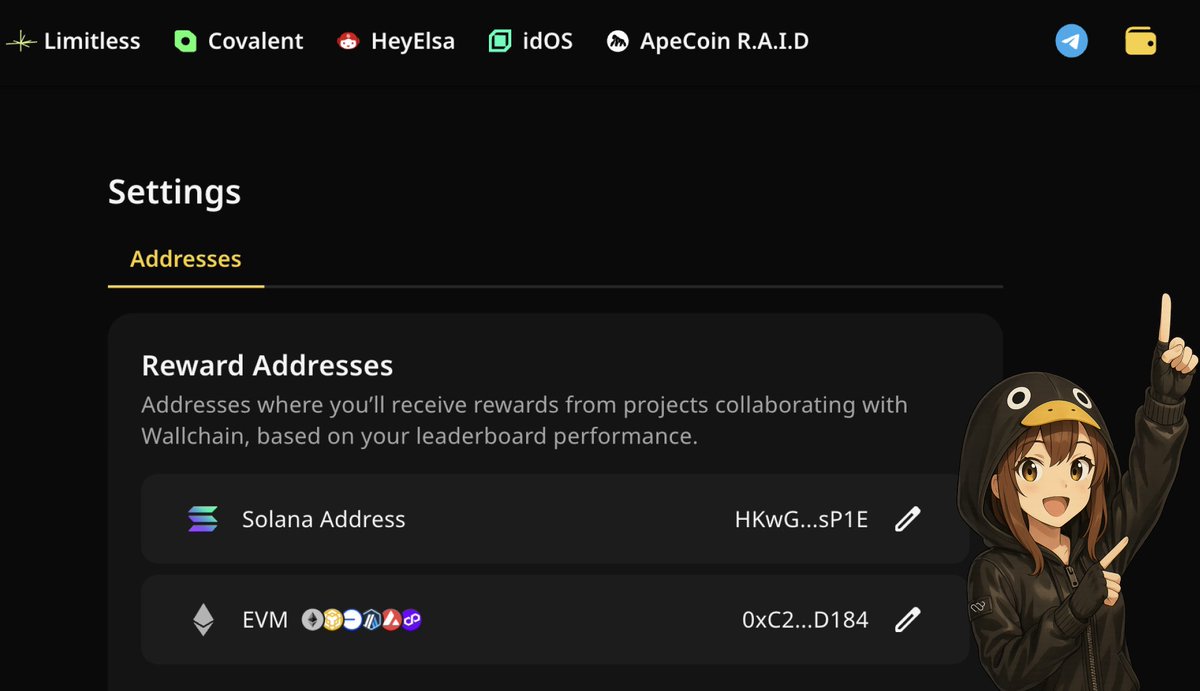

- Wallchain: Integrates with existing DeFi protocols to capture swap-related arbitrage opportunities and redistribute them as cashback-style rewards directly into user wallets.

This new class of protocols demonstrates that MEV redistribution strategies can be implemented at both the protocol and application layer, giving projects multiple levers for boosting user engagement.

The Data-Driven Impact on User Incentives and Retention

The numbers speak volumes about how these mechanisms are transforming user behavior:

- User retention: Protocols offering visible rebates see higher repeat usage and longer user lifetimes compared to those without such incentives.

- Loyalty programs: Some platforms are layering on points systems or tiered rewards based on total protected volume, further gamifying participation.

- Ecosystem trust: By making value flows transparent, rebate protocols foster greater trust among both retail traders and power users, a crucial asset in an industry defined by rapid innovation but also frequent exploits.

This shift isn’t just about redistributing profits; it’s about recalibrating the entire trust engine of DeFi around fairness and transparency. When users can see exactly how much value they’re recapturing from previously opaque processes, it fundamentally changes their calculus for where (and how often) they engage with on-chain finance.

Evolving Revenue Models: Fee Sharing Meets Dynamic Rebates

The knock-on effect is that DeFi revenue models themselves are evolving in response:

- Fee-share models: Instead of static trading fees siphoned off by protocol treasuries or governance tokens alone, some platforms now allocate a portion of all fees explicitly toward offsetting potential MEV losses, creating a buffer against predatory extraction.

- User-aligned incentives: Protocols may offer additional rewards for providing liquidity in pairs where arbitrage opportunities (and thus potential rebates) are highest. This aligns LP interests with those of traders seeking optimal execution conditions.

The upshot? As competition intensifies across chains and platforms, we’re seeing a trend toward customizable rebate splits, dynamic APYs linked directly to protected volume, and ever-more sophisticated loyalty structures designed around maximizing user benefit from every interaction with the protocol stack.

Importantly, the architecture of MEV rebates is not one-size-fits-all. Some protocols, like Wallchain, focus on seamless integration with existing DeFi dApps, letting users earn cashback automatically on swaps without having to opt in or stake additional tokens. Others, such as Dextr and RediSwap, are building MEV recapture into the very core of their matching engines and liquidity incentives. This diversity of approaches is accelerating experimentation across the ecosystem.

Top DeFi Protocols Pioneering MEV Rebates

-

MEV Blocker: Launched by a consortium of 30+ Ethereum teams, MEV Blocker routes user transactions through a private RPC, auctioning backrun rights and returning 90% of builder rewards as rebates to users. In 2024, it distributed 4,079 ETH in rebates, setting a new standard for user-centric MEV redistribution.

-

RediSwap: This innovative AMM captures MEV at the application level and redistributes profits between users and liquidity providers. By internalizing arbitrage, RediSwap delivers improved trade execution and aligns incentives for both users and LPs.

-

Dextr: Dextr’s Actively Validated Market Maker (AVMM) employs low-latency price oracles and trusted operators to minimize MEV exploitation. Its unique multi-layered insurance model compensates users affected by MEV, blending protection with fairness.

-

Wallchain: Wallchain integrates directly with DeFi platforms to capture and redistribute MEV profits from user swaps and searcher activity. Its novel mechanism turns MEV into on-chain rebates and yield opportunities for active users.

-

Firefly: Firefly captures hidden MEV opportunities such as backruns and arbitrage, converting them into real, on-chain rewards that users can allocate or claim. The protocol’s flexible distribution model empowers users to decide how their MEV rebates are used.

What’s especially notable is how these strategies are reframing MEV from a source of friction into a source of yield. Instead of being a “hidden tax” that quietly erodes user returns, transaction ordering surplus is now something users can track and claim. The rise of MEV rewards protocols has even inspired new forms of community engagement, think leaderboard competitions for most protected volume or seasonal events where extra rebates are distributed to early adopters.

This trend isn’t just cosmetic; it’s measurable in user metrics. Protocols with robust rebate flows consistently report higher retention rates and a more active user base. According to recent data, platforms distributing visible MEV rebates have seen daily active users increase by up to 30% compared to similar platforms lacking these incentives (source). Users aren’t just sticking around; they’re compounding their activity as they realize every trade or liquidity deposit can generate extra value.

The Next Chapter: Loyalty, Customization, and Cross-Chain Expansion

The future trajectory points toward even more granular customization. As cross-chain trading becomes normalized through aggregation layers like MorphLayer, users will expect rebates on every network, whether they’re swapping on Ethereum mainnet or bridging assets to emerging L2s. Points-based loyalty programs are gaining traction as well, rewarding not just volume but also behaviors that support protocol health (e. g. , providing liquidity during volatile periods or participating in governance votes).

Transparency dashboards are another emerging feature: real-time widgets showing accumulated rebates, APY from protected volume, and breakdowns by trading pair help demystify the impact of MEV sharing for both new and seasoned users.

This arms race for user-centric value redistribution is pushing protocols to innovate at the intersection of fairness and efficiency, a dynamic that’s likely to intensify as more capital flows into DeFi. The long-term winners will be those who can translate complex back-end mechanics into simple, compelling front-end experiences that make every user feel like a stakeholder in the protocol’s success.

For anyone building or trading in this space, understanding how MEV rebates reshape incentives is now table stakes. The shift from passive value loss to active value creation isn’t just changing who profits, it’s redefining what it means to participate in open financial networks.