For years, Maximal Extractable Value (MEV) has been the silent drain on DeFi users’ returns – a hidden tax extracted by miners and validators through clever transaction ordering. If you’ve ever wondered why your swaps get sandwiched or why gas spikes at just the wrong time, MEV is usually to blame. But lately, something remarkable is happening: MEV rebates are flipping the script and putting power (and profits) back into the hands of users.

What are MEV Rebates and Why Do They Matter?

Let’s cut through the jargon. MEV rebates are mechanisms that recapture some of the profits from MEV activities – like front-running or sandwiching – and return them directly to the very users whose transactions created that value in the first place. Instead of letting miners or sequencers pocket all the gains, these systems reward you for simply participating in DeFi.

This isn’t just a feel-good story about fairness. It’s a pragmatic shift in how incentives work across decentralized protocols. Platforms that implement MEV rebates see:

- Higher user retention: When users know they’re not being fleeced, they stick around.

- Bigger trading volumes: Rebates act like cashback for trading fees, drawing more activity.

- A stronger sense of trust: Transparency around value flows builds community confidence.

If you want to dig deeper into how this works across different chains and protocols, check out our guide on MEV rebates and protocol fairness.

The MorphLayer Approach: Turning Extraction Into Participation Rewards

MorphLayer stands out as a pioneer here. Their protocol bakes MEV rebate logic right into its core infrastructure. Here’s what sets MorphLayer apart:

- Automated Rebate Distribution: Users receive a portion of captured MEV automatically after each trade or interaction – no need for manual claims or complex calculations.

- Transparent Tracking: Every rebate is logged on-chain, so you can verify exactly how much value was returned to you vs what was extracted by sequencers or validators.

- Ecosystem Integration: MorphLayer links rebates with other user rewards like Morph Points multipliers, compounding your incentives for active participation (learn more about evolving DeFi rewards here).

This approach doesn’t just plug a leak – it fundamentally reimagines user engagement. Instead of being passive victims of extraction, traders become stakeholders in protocol revenue sharing. The result? More vibrant liquidity, fewer bad actors gaming transaction order flow, and a real sense that DeFi is working for its community rather than against it.

The Ripple Effect: How Rebates Are Shaping DeFi Markets

The rise of MEV rebates isn’t happening in a vacuum. As platforms like MorphLayer demonstrate their effectiveness at redistributing value fairly, we’re witnessing broader shifts across decentralized markets:

- User-centric design is winning out: Protocols that prioritize transparency and fair incentives are rapidly gaining market share.

- Sustainable growth over extractive practices: By reducing exploitative behaviors (like sandwich attacks), these systems support healthier long-term liquidity and participation.

- A new standard for trustless trading: On-chain proof of rebate distribution is setting expectations for future DeFi products – if your platform isn’t sharing the pie, it risks losing its most loyal users.

What’s especially exciting is how these mechanics are already influencing user expectations and protocol roadmaps. We’re seeing a wave of DeFi projects racing to integrate similar rebate logic, not just as a marketing gimmick but as a core part of their value proposition. The message is clear: users want a fair share of the value their activity generates. If you’re not offering it, someone else will.

Let’s be real, no system is perfect, and the evolution of MEV rebates is still unfolding. But MorphLayer’s approach sets a new bar for what’s possible. By making every rebate transparent and tying rewards directly to user participation, they’re flipping the traditional MEV game on its head. Instead of extraction being something that happens to users, it becomes an engine for community growth and protocol sustainability.

What Does This Mean for DeFi Traders and Protocol Designers?

If you’re a trader, you now have more reason than ever to shop around for platforms that put your interests first. MEV rebates aren’t just about getting a few extra tokens, they signal that the protocol values your liquidity and activity. And since everything is tracked on-chain, you can actually verify that you’re getting your cut.

For protocol designers and DAO governors, integrating MEV rebate logic isn’t just an ethical choice, it’s rapidly becoming table stakes in a competitive market. Users are voting with their wallets, and platforms that ignore this shift risk being left behind.

The Next Chapter: Beyond Rebates

The future? Expect to see even more creative incentive models built atop these foundations, think dynamic rebate multipliers based on loyalty or cross-protocol collaborations where rebates follow users across ecosystems. We’ll likely see integrations with AI-powered routing (as hinted by Wallchain) to optimize both execution quality and rebate size automatically.

Top Protocols Pioneering MEV Rebates in DeFi

-

MorphLayer: Directly integrates MEV rebate mechanisms into its protocol, ensuring users receive a share of value that would otherwise be extracted by miners or validators. MorphLayer’s approach boosts user retention and trust by prioritizing transparent, user-centric incentives.

-

Wallchain: Leverages AI-powered anti-MEV routing to protect users from predatory transaction ordering, while offering transaction rebates to users. Wallchain’s unique approach flips the traditional MEV flow, returning value to users and enhancing DeFi fairness.

-

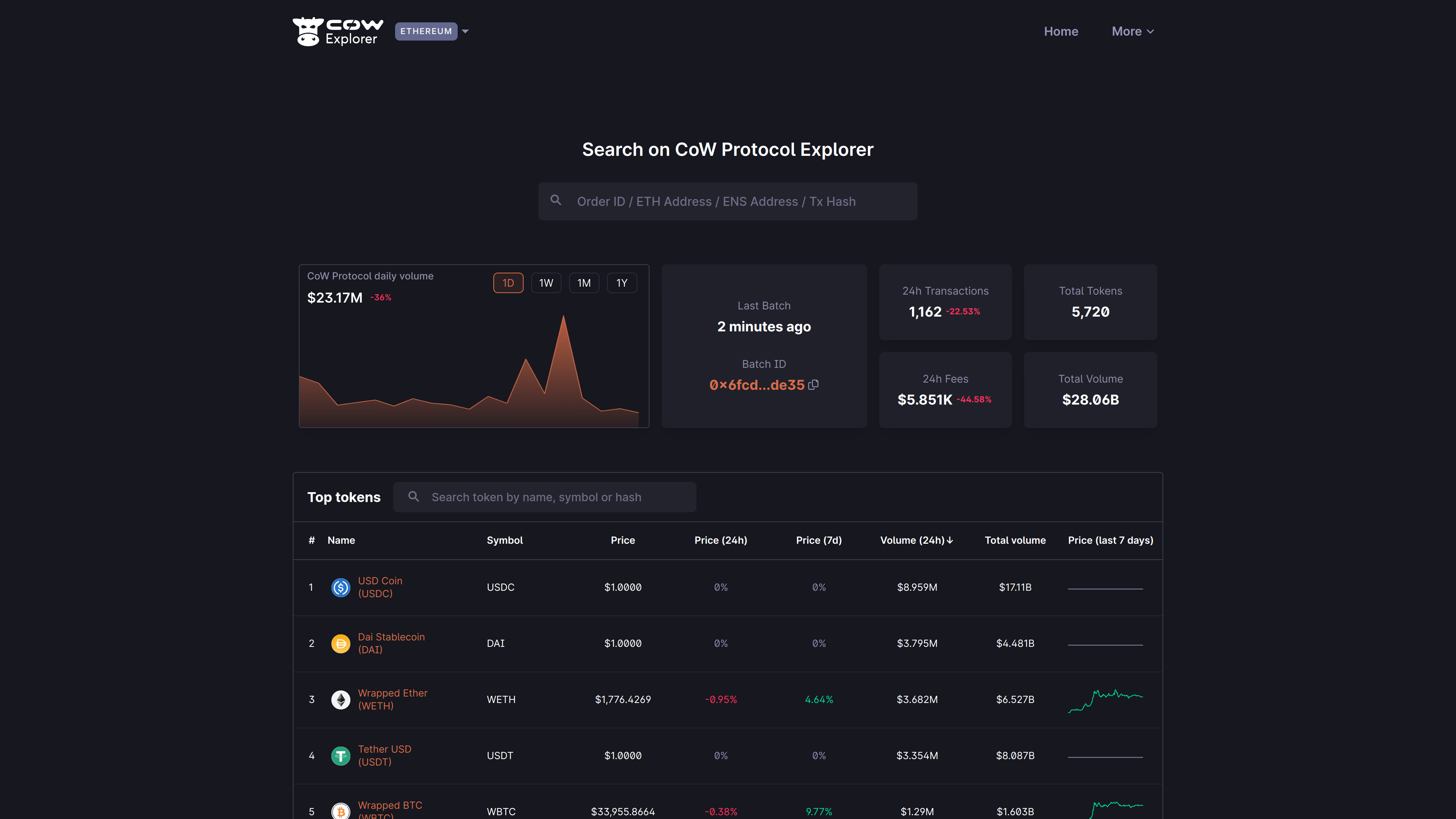

CoW Protocol: Implements batch auction settlement and MEV protection, redistributing captured value back to users via rebates and fee reductions. CoW Protocol’s design minimizes front-running and sandwich attacks, making DeFi trading more equitable.

-

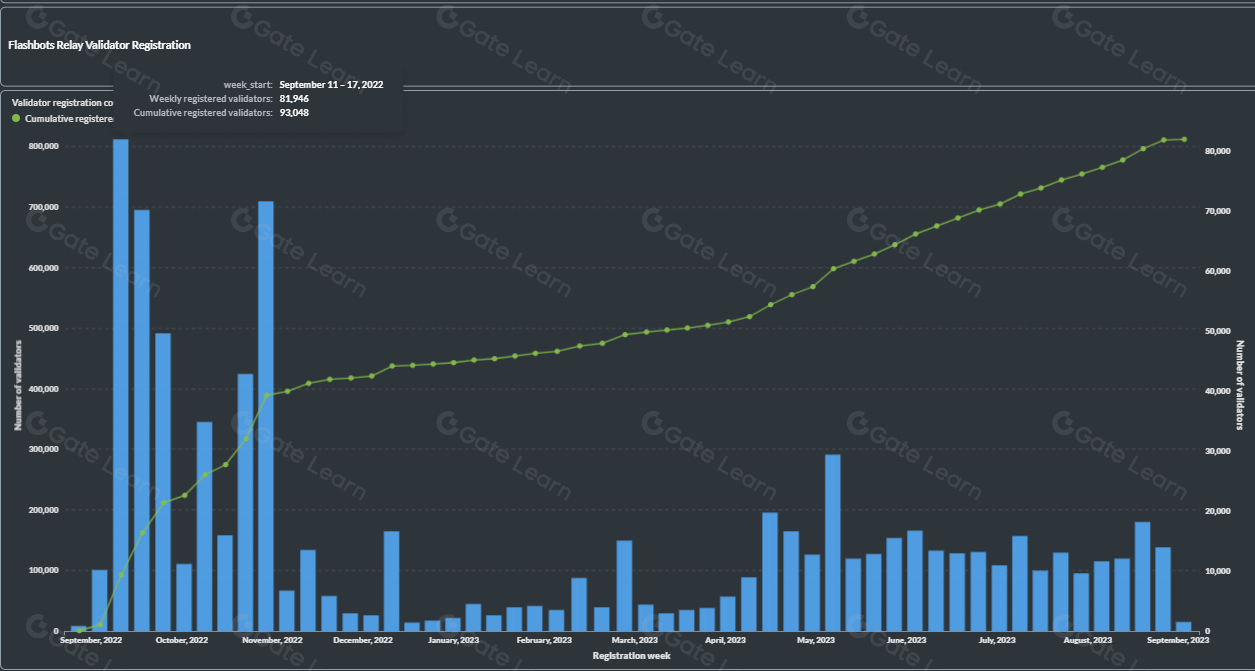

Flashbots: Pioneers transparent MEV extraction and rebates through its MEV-Share and MEV-Boost solutions. By enabling users to share in the value of MEV, Flashbots fosters a more open and user-friendly DeFi environment.

-

Balancer: Introduces MEV-aware liquidity pools and partners with MEV protection services to return a portion of extracted value to liquidity providers and traders, promoting a fairer DeFi ecosystem.

If you want to stay ahead of the curve or start building with these ideas, check out our in-depth guide on how MEV rebates are transforming DeFi user incentives. The landscape is moving fast, but one thing’s certain: MEV transparency and redistribution are here to stay, reshaping what it means to participate, and win, in decentralized finance.