DeFi is at a crossroads. As Ethereum trades at $3,026.16 and the MEV landscape matures, the conversation has shifted from extraction to redistribution. In 2025, MEV rebates are no longer a niche feature but a competitive necessity for protocols aiming to attract and retain users. The rise of platforms like MEV Blocker, which returned 4,079 ETH in user rebates throughout 2024 and protected $13.8 billion in trading volume in July alone, signals a new era: one where users expect a share of the value their activity creates.

What Are MEV Rebates, And Why Do They Matter Now?

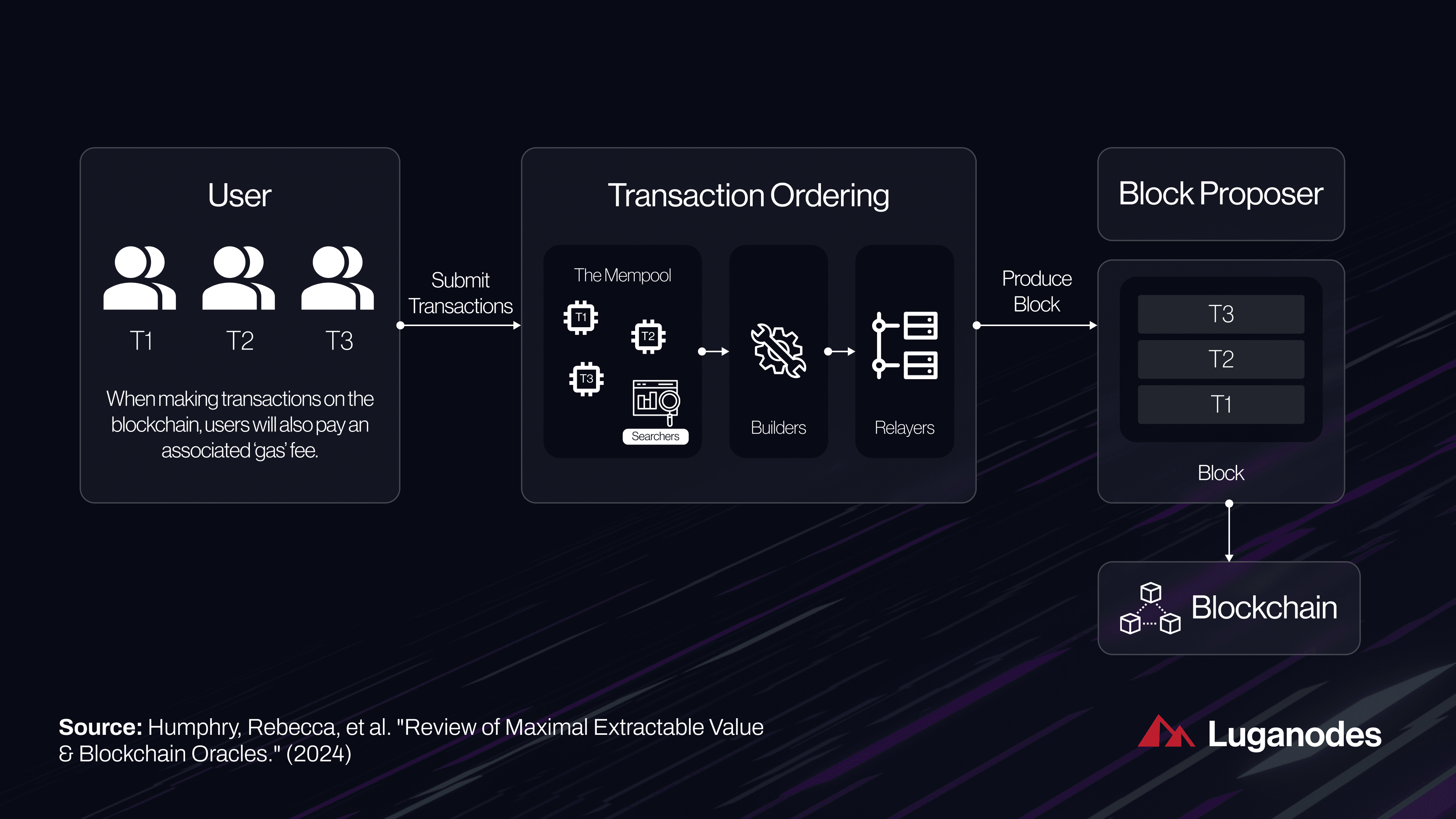

MEV (Maximal Extractable Value) refers to the profit that can be captured by reordering or inserting transactions within a block. Historically, this value was siphoned off by miners or validators, often at the expense of regular DeFi users, think sandwich attacks or front-running on DEXs. But as transparency tools and ethics scoring systems mature (see more here), protocols are under pressure to redistribute this surplus back to those who generate it: traders and liquidity providers.

MEV rebates flip the script by directly sharing extracted value with end-users. Instead of being penalized for their participation through hidden costs, users now benefit from on-chain activity they help generate. This approach aligns incentives across the DeFi stack and fosters protocol loyalty, a key differentiator as competition heats up.

The Mechanics of Modern MEV Redistribution

The latest wave of MEV rebate mechanisms is both more transparent and more sophisticated than previous iterations. For example, RediSwap’s auction-based approach allows arbitrageurs to bid for MEV opportunities based on their price beliefs, ensuring that surplus is allocated efficiently while remaining auditable by all participants.

This shift toward rules-based MEV redistribution means rewards are no longer opaque or discretionary; they’re governed by smart contracts and verifiable logic. Tools like auditable MEV rewards dashboards give users granular insight into how much value they’re receiving, and why.

- User rebates: Protocols like Uniswap v4 now route part of their transaction fees back to traders via transparent rebate structures.

- LP incentives: Liquidity providers receive a share of extracted MEV in proportion to their pool contribution, aligning risk with reward.

- Validator scoring: Emerging ethics systems score validators based on how fairly they redistribute MEV, influencing user routing choices.

The Impact: From Hidden Tax to User-Centric Rewards

The data speaks volumes: as rebate mechanisms gain traction, DeFi protocols see increased trading volume and stickier user bases. In July 2024 alone, over 416,000 users benefited from anti-MEV protection services, proof that transparent redistribution isn’t just ethical; it’s good business.

This transformation also addresses centralization concerns flagged by industry analysts (read analysis here). By democratizing access to extracted value instead of letting it pool among insiders or large validators, protocols reinforce the foundational ideals of DeFi, open participation and fair competition.

Ethereum (ETH) Price Prediction 2026-2031: Impact of MEV Rebates & DeFi Incentives

Forecast based on the transformative effects of MEV rebates, DeFi adoption, and emerging blockchain technology (as of November 2025, ETH at $3,026.16)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg vs. Prev Yr) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 Q1-Q3 | $2,700 | $3,350 | $4,200 | +10.7% | MEV rebates gain traction, ZK tech adoption rises |

| 2027 | $3,000 | $3,850 | $5,000 | +14.9% | MEV revenue sharing becomes standard, DeFi user base expands |

| 2028 | $3,300 | $4,400 | $6,100 | +14.3% | Mainstream DeFi adoption, regulatory clarity grows |

| 2029 | $3,700 | $5,050 | $7,200 | +14.8% | Institutional entry, improved MEV protections |

| 2030 | $4,200 | $5,800 | $8,600 | +14.9% | New DeFi primitives, cross-chain MEV solutions |

| 2031 | $4,700 | $6,650 | $10,200 | +14.7% | Global DeFi participation, robust MEV governance |

Price Prediction Summary

Ethereum’s price is forecasted to steadily appreciate from 2026 through 2031, driven by the widespread adoption of MEV rebates, DeFi innovation, and enhanced transaction efficiency through ZK technology. While short-term volatility persists, the progressive alignment of user incentives and growth in DeFi activity set a bullish foundation for ETH’s long-term value. The minimum and maximum ranges reflect potential regulatory hurdles or aggressive adoption, respectively.

Key Factors Affecting Ethereum Price

- Adoption of MEV rebates and fair revenue distribution in DeFi protocols

- Integration of zero-knowledge technology reducing transaction costs and boosting scalability

- Expansion of DeFi user base and institutional participation

- Potential for regulatory clarity or challenges impacting DeFi and MEV practices

- Market competition from L2s and alternative smart contract platforms

- Macro-economic conditions and global crypto sentiment

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Protocols that implement MEV rebates are seeing a measurable uptick in user retention and engagement. The reason is simple: when users know they’re not just passive participants but active beneficiaries of the value their trades generate, they’re more likely to stick around, provide liquidity, and even evangelize on behalf of the protocol. This virtuous cycle is especially apparent as Ethereum maintains its position at $3,026.16, underscoring how MEV transparency can directly influence market confidence and activity.

Real-World Protocol Shifts: Case Studies and Emerging Standards

Consider Uniswap v4’s integration of zero-knowledge (ZK) technology. By reducing transaction costs and routing part of the saved value back to users through rebates, Uniswap not only accelerates v4 adoption but also sets a new standard for auditable MEV rewards. These innovations are being closely watched by other protocols, many of which are piloting similar rebate schemes or exploring auction-based redistribution mechanisms like those pioneered by RediSwap.

Meanwhile, platforms such as MEV Blocker have demonstrated that robust anti-MEV protection can coexist with generous rebate programs. Their model, returning thousands of ETH in user rebates while safeguarding billions in trade volume, proves that user-centric MEV flows are both sustainable and scalable.

- Transparency: Users can now track their earned rebates in real time via on-chain dashboards.

- Efficiency: Auction-based systems maximize surplus allocation without sacrificing speed or fairness.

- Sustainability: Sharing extracted value reduces adversarial behavior and aligns all stakeholders for long-term growth.

What’s Next for DeFi User Incentives?

The momentum behind rules-based MEV redistribution isn’t slowing down. With ethics scoring systems now influencing validator selection and protocols racing to offer the most transparent rebate mechanics, the bar for fairness keeps rising. As more users demand proof of equitable treatment, and as analytics tools make it easier to compare protocols on these metrics, expect competition around MEV transparency in DeFi to intensify throughout 2025.

If you’re designing a protocol or trading strategy today, integrating clear, auditable MEV rewards isn’t just best practice, it’s table stakes. The winners will be those who make their incentives obvious, their logic verifiable, and their community central to value creation and distribution.