In the fast-evolving world of decentralized finance, MEV redistribution auctions are reshaping how protocols capture and share value. As DeFi matures in 2025, Maximal Extractable Value, the profit from reordering or inserting transactions in blocks, once siphoned quietly by searchers and builders, now fuels protocol treasuries through transparent public auctions. This shift not only boosts revenues but also aligns incentives toward a fairer ecosystem, where protocols like Solana’s Jito DAO and Ethereum’s Flashbots turn hidden extraction into sustainable income streams.

Public auctions democratize access to block-building rights, inviting competitive bids that protocols can skim or redistribute. Think of it as an open market for transaction ordering priority: traders and builders vie with ETH, SOL, or other tokens, ensuring the highest value bundles win placement. This mechanism, rooted in game theory, minimizes toxic practices like sandwich attacks while channeling fees back to the network.

Why Public Auctions Outpace Traditional MEV Extraction

Traditional MEV capture often favors sophisticated actors with low-latency infrastructure, leaving everyday users and protocols at a disadvantage. Public MEV auctions blockchain level the field by standardizing bids through protocols like MEV-Boost, where proposers delegate construction to specialized builders every 12 seconds on Ethereum. Validators pocket 95% of bids, reinforcing security via native token demand, while builders retain a sliver for their efforts.

From a protocol designer’s view, this is gold. Auctions transform externalities, arbitrage across DEXs or front-running liquidations, into controlled revenue. Sealed-bid formats, as explored in recent workshops, prevent collusion and ensure efficient allocation, though deployment on decentralized infra remains a challenge. I see this as a thoughtful evolution: not eliminating MEV, which is inherent to block production, but redirecting it purposefully.

In 2025, DeFi protocols adopting these auctions report revenue doublings, proving the model’s viability beyond theory.

Consider the broader implications for DeFi MEV sharing 2025. Techniques like batch auctions or randomized ordering, pioneered on chains like Sei, complement auctions by curbing predatory strategies upfront. Yet auctions shine in their ability to monetize residual value, sharing profits via treasuries, token burns, or user rebates, echoing Flashbots’ MEV-Share ethos from 2023, now scaled protocol-wide.

Solana and Ethereum Set the Pace in MEV Revenue Strategies

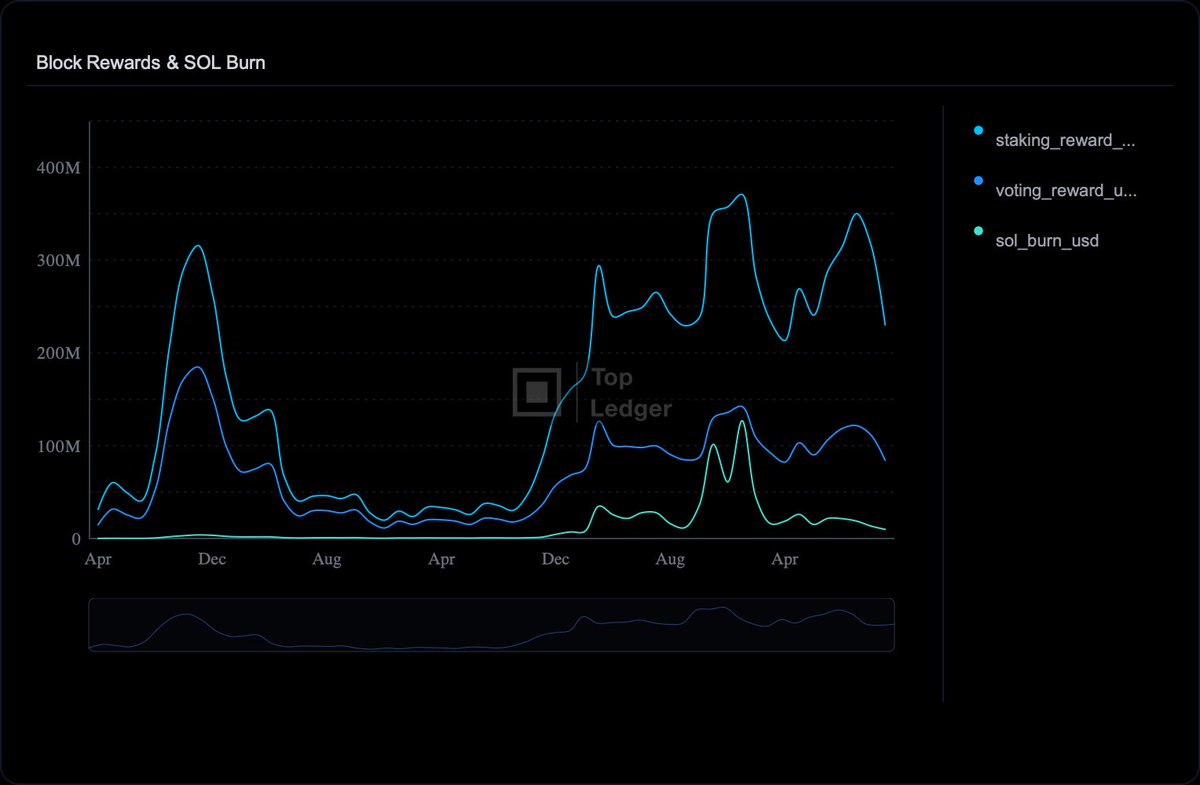

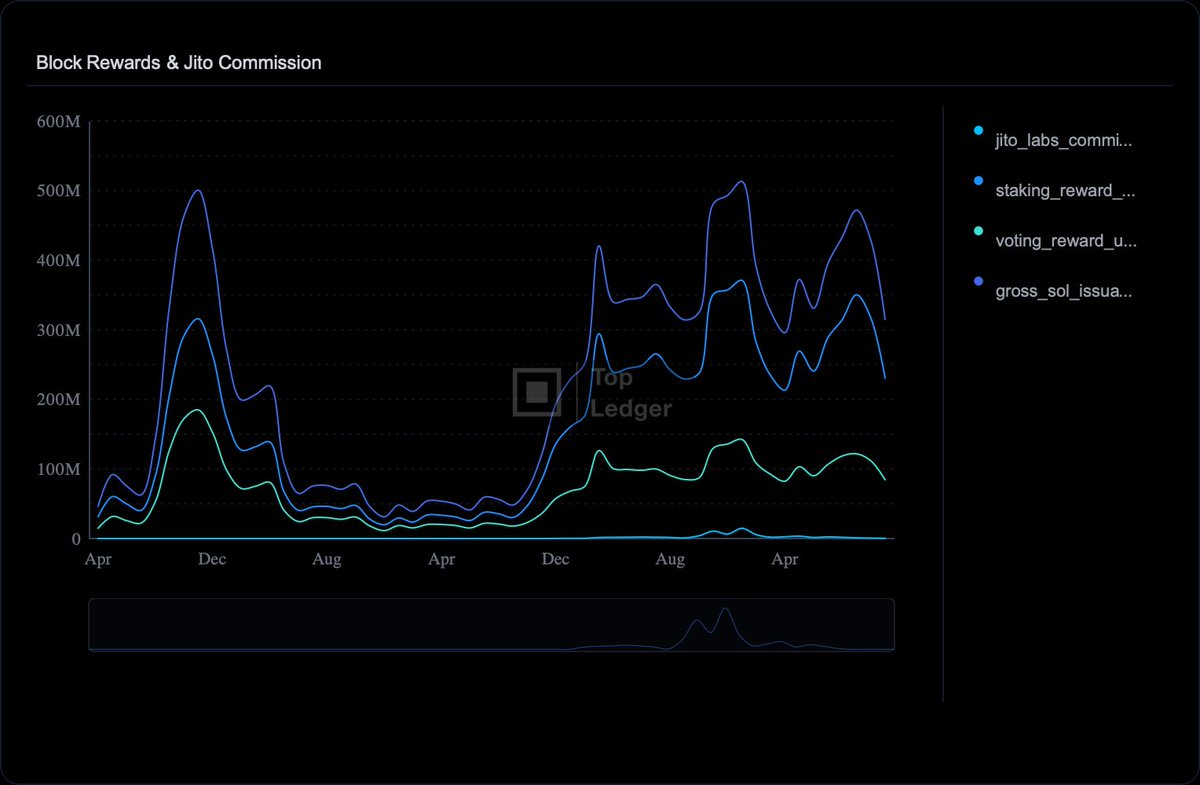

Solana’s Jito DAO exemplifies bold MEV protocol revenue strategies. By proposing 3% of all MEV tips to its treasury and TipRouter for restaking, Jito eyes $22.8 million annually. This isn’t mere extraction; it’s ecosystem reinvestment, funding development while TipRouter optimizes flows for stakers. On Ethereum, Flashbots’ auction system hums continuously, bids in ETH bolstering the chain’s economic moat.

Uniswap’s UNIfication proposal takes it further with a Fee Switch and MEV internalization. Trading fees now feed a UNI burn mechanism, capturing lost MEV as cash flow. Activation sparked a 45% UNI price jump and 584% volume spike, underscoring market enthusiasm for deflationary accrual. Arbitrum’s TimeBoost lets traders bid for ordering priority, netting $1 million monthly, effectively doubling revenues at launch and enhancing UX by prioritizing legitimate trades.

Supra’s AutoFi pushes boundaries, automating DeFi actions like arbitrage and liquidations on its testnet. Unlike fee-dependent models, it shares real-time value with node operators and dApps, heralding proactive blockchains. These cases illustrate a pattern: auctions plus application-specific tweaks yield outsized gains, fostering fairer DeFi ecosystems.

Crafting Fair Extraction Through Auction Design

Designing effective fair MEV extraction DeFi auctions demands nuance. Open formats risk bid sniping, so hybrid sealed-bid systems prevail, balancing transparency with competition. Chainlink’s SVR for liquidations shows oracles recapturing MEV, while Arbitrum’s TimeBoost proves user-paid priority can coexist with neutrality.

Game-theoretic models underscore this balance: auctions deter attacks by making extraction predictable and shared, rather than a shadowy zero-sum game. Yet, true fairness hinges on decentralization. Centralized auction houses invite opacity, as noted in recent ACM proceedings, so protocols must prioritize on-chain bidding to evade single points of failure.

Looking ahead, MEV redistribution auctions will integrate with layer-2 scaling and restaking primitives. Solana’s TipRouter hints at this, routing tips to stakers for compounded yields. Ethereum’s ongoing proposer-builder separation evolves too, with bids fueling security post-Merge. Developers should weigh auction types: frequent micro-auctions like Flashbots suit high-throughput chains, while batch formats on Sei minimize latency arbitrage.

Real-World Revenue Impacts and User Benefits

Numbers tell the story vividly. Jito DAO’s 3% tip allocation projects $22.8 million yearly, a war chest for Solana’s restaking ambitions. Arbitrum’s TimeBoost doubled revenues overnight at $1 million monthly, proving traders willingly pay for priority sans toxicity. Uniswap’s Fee Switch not only burned UNI tokens but ignited a 45% price rally and 584% volume boom, realigning MEV from searchers to holders.

Users gain too. DeFi MEV sharing 2025 manifests in rebates: Flashbots’ MEV-Share precursors now protocol-native, refunding portions to traders. This curbs sandwich losses, where front-runners clip 1-5% per swap. Protocols like these foster loyalty, as seen in Supra’s AutoFi sharing liquidation MEV real-time with dApps. It’s a virtuous cycle: higher revenues fund UX upgrades, drawing more volume and MEV.

Critics argue auctions commodify ordering, potentially inflating gas wars. But evidence counters: Ethereum’s bids stabilize at sustainable levels, ETH demand intact. Compared to unchecked extraction, auctions enforce transparency, letting users opt-in via bundles. For protocol designers eyeing MEV protocol revenue strategies, start small – pilot TimeBoost-style priority on L2s before full rollout.

Overcoming Hurdles in Public MEV Auctions

Deployment isn’t seamless. Latency-sensitive chains demand off-chain signaling, risking centralization. Sealed bids mitigate sniping but complicate verification; zero-knowledge proofs emerge as a fix, though gas-heavy. Regulatory shadows loom too – ESMA flags MEV as market abuse adjacent, urging compliant designs. Still, the upside dwarfs risks: protocols reclaiming 10-20% of DEX MEV, per Arkham data, fortify against bear markets.

Hybrid innovations shine brightest. Chainlink SVR recaptures liquidation MEV via oracles, while Sei’s ordering tweaks preempt extraction. Pair these with public MEV auctions blockchain for layered defense. My take: auctions aren’t a panacea but a cornerstone, evolving DeFi from extractive to extractive-yet-equitable.

As 2025 closes, these mechanisms cement DeFi’s maturity. Jito, Flashbots, Uniswap – frontrunners show fair MEV extraction DeFi isn’t theoretical. Protocols ignoring auctions risk erosion; adopters build treasuries, burn tokens, reward users. The blockchain economy bends toward shared value, one bid at a time. Dive deeper via tools at Mev Redistribution, where analytics illuminate your path to optimized flows.