Maximal Extractable Value (MEV) has evolved from a niche concern to a defining challenge for fairness in decentralized finance. As DeFi protocols scale, unchecked MEV extraction – where validators or miners profit from reordering or censoring transactions – can erode trust, concentrate power, and undermine user experience. In 2025, the community focus has shifted decisively toward MEV redistribution strategies that transform what was once a zero-sum game into a collaborative value-sharing model.

Let’s examine how three leading approaches are reshaping the landscape for fairer DeFi markets: Proposer-Builder Separation (PBS) and MEV-Boost Relays, MEV Auctions and Shared Sequencer Models, and On-chain MEV Redistribution Protocols.

Proposer-Builder Separation (PBS): Reducing Extraction Risk at the Consensus Layer

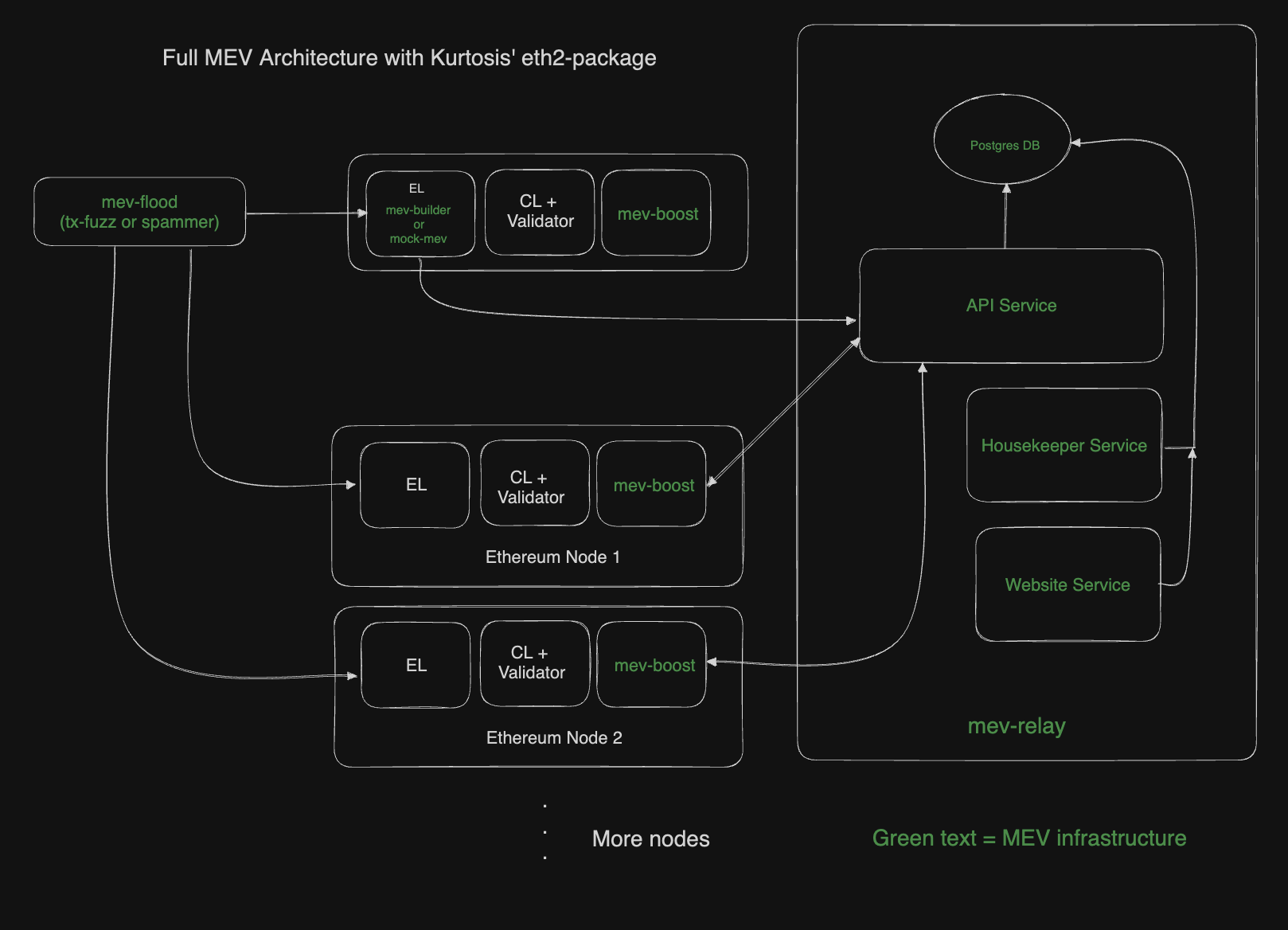

PBS is a structural innovation that splits block production responsibilities between two roles: proposers (who choose blocks to add to the chain) and builders (who assemble blocks from transaction orderings). This separation, popularized by Ethereum’s MEV-Boost relays, creates an open marketplace where builders compete to maximize block value while proposers select the highest-bidding block without direct access to transaction contents.

The result? Extraction risk is minimized for regular users. By introducing competitive relay networks and transparent bidding processes, PBS ensures that MEV profits are less likely to be captured by a small set of insiders. Instead, rewards can be distributed more equitably among validators, stakers, and even public goods funds. This model has inspired similar designs in other major chains seeking to align incentives for all participants.

MEV Auctions and Shared Sequencer Models: Transparent MEV Sharing in Action

Auction-based models such as those pioneered by Flashbots and SUAVE introduce formalized marketplaces for transaction ordering rights. In these systems, searchers bid openly in auctions or via shared sequencers to win inclusion opportunities alongside user transactions. The winning bids are then redistributed according to pre-defined rules – often sending a significant portion back to users or liquidity providers who would otherwise be targets of front-running or sandwich attacks.

This approach brings two key benefits:

- Transparency: All participants can observe auction outcomes and distribution logic on-chain.

- User empowerment: Instead of being passive victims of MEV extraction, users receive direct rebates or fee reductions sourced from auction proceeds.

The rise of shared sequencer networks is especially relevant for cross-rollup DeFi activity, where synchronizing order flow across multiple chains compresses arbitrage windows and limits predatory strategies. For an in-depth look at protocol integration techniques, see our guide on how protocol designers can implement MEV redistribution.

On-chain Protocols Automating Equitable Distribution: JitoSOL, MEV-Share and Manifold Finance

The final pillar is the emergence of fully on-chain protocols that automate the capture and redistribution of MEV proceeds among stakeholders. Solutions like JitoSOL (on Solana), MEV-Share (an open-source framework), and Manifold Finance’s suite enable protocols themselves to detect profitable opportunities (e. g. , arbitrage) within their own liquidity pools or order books. The captured value is then shared transparently among LPs, traders, stakers, or even DAO treasuries – turning what was once extractive into something regenerative.

This shift aligns incentives across protocol users, reducing adversarial behavior while enhancing platform stickiness through tangible rewards. It also provides robust data trails for blockchain analytics platforms focused on equitable MEV sharing metrics.

As on-chain MEV redistribution protocols mature, they are setting new standards for transparency and fairness in DeFi. Unlike off-chain or opaque rebate schemes, these solutions operate entirely within smart contracts, ensuring that every distribution event is auditable and resistant to manipulation. For example, JitoSOL automatically routes a share of extracted MEV back to SOL stakers, while MEV-Share’s modular design allows any protocol to plug in customizable distribution logic tailored to its user base.

Top MEV Redistribution Tools Transforming DeFi Fairness

-

Proposer-Builder Separation (PBS) and MEV-Boost Relays: PBS, implemented via MEV-Boost relays, separates block proposers from builders, reducing centralization and limiting MEV extraction by any single actor. This structure enables fairer distribution of MEV rewards and increases transparency in block production across Ethereum and other EVM chains.

-

MEV Auctions and Shared Sequencer Models (e.g., Flashbots, SUAVE): Flashbots pioneered off-chain MEV auctions, while SUAVE introduces shared sequencer models. These approaches create open, competitive markets for transaction ordering, redistributing MEV profits transparently among users, validators, and searchers.

-

On-chain MEV Redistribution Protocols (e.g., JitoSOL, MEV-Share, Manifold Finance’s MEV Capture): Protocols like JitoSOL on Solana, Manifold Finance, and MEV-Share automate the capture and redistribution of MEV. They allocate MEV-derived rewards directly to stakeholders—such as stakers, liquidity providers, and users—enhancing fairness and aligning incentives on-chain.

Protocols deploying these systems report measurable improvements in user retention and liquidity depth. When users know they are protected from predatory extraction, and can even benefit from it, they are more likely to provide liquidity or trade at scale. This positive feedback loop drives network effects that reinforce protocol growth and stability.

Best Practices: Implementing Fair MEV Redistribution

For DeFi architects and developers looking to integrate equitable MEV sharing, the following best practices have emerged:

- Leverage PBS frameworks: Adopt open-source relay infrastructure (e. g. , MEV-Boost) to separate block production duties and minimize proposer bias.

- Utilize shared sequencer auctions: Integrate with networks like Flashbots or SUAVE for transparent order flow auctions that return value directly to users.

- Automate on-chain distribution: Deploy smart contracts (such as those by Manifold Finance or JitoSOL) that algorithmically split captured MEV among all stakeholders according to clear governance rules.

The combination of these approaches not only reduces the surface area for exploitative behavior but also aligns incentives between validators, searchers, LPs, and everyday traders. For further technical deep-dives on implementation patterns, check out our resource on how protocol developers can implement fair MEV redistribution mechanisms in DeFi.

The Road Ahead: Analytics and User Empowerment

The future of fairness in DeFi will be shaped by continuous innovation in both analytics tooling and protocol design. As more projects adopt real-time dashboards tracking redistributed value, and as users gain agency over their own order flow, market dynamics will shift toward greater efficiency and trust. Expect new metrics for “equitable MEV sharing” to become standard benchmarks in protocol evaluation.

This is not just a technical upgrade; it represents a cultural shift toward open collaboration over zero-sum extraction. With robust strategies like PBS, auction-based sequencers, and automated on-chain redistribution now battle-tested at scale, the barriers to entry for fair participation are finally coming down.

If you’re designing or evaluating DeFi platforms in 2025, prioritizing integrated MEV redistribution is no longer optional, it’s foundational for sustainable growth and user loyalty. The tools exist; the data proves their impact; now is the time for broad adoption across the ecosystem.