In the high-stakes world of DeFi, Miner Extractable Value, now Maximal Extractable Value under Proof-of-Stake, fuels validator profits but often leaves delegators in the dust. Validators capture the lion’s share through transaction reordering, arbitrage, and liquidations, skewing incentives and eroding trust. Fair-MEV redistribution strategies flip this script, channeling equitable MEV distribution back to all stakeholders. As a swing trader who’s timed countless breakouts, I’ve seen how uneven MEV flows distort markets. Patience and precision pay when protocols realign these rewards.

The MEV Paradox: Efficiency vs. Exploitation

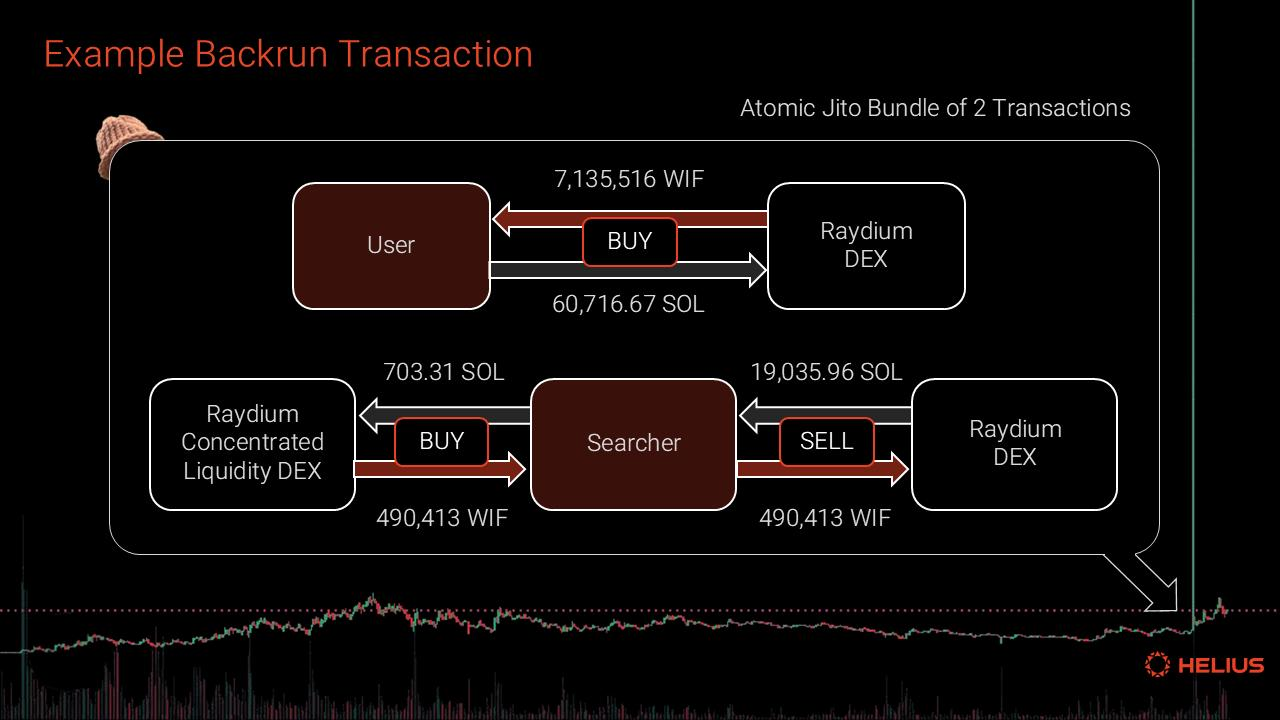

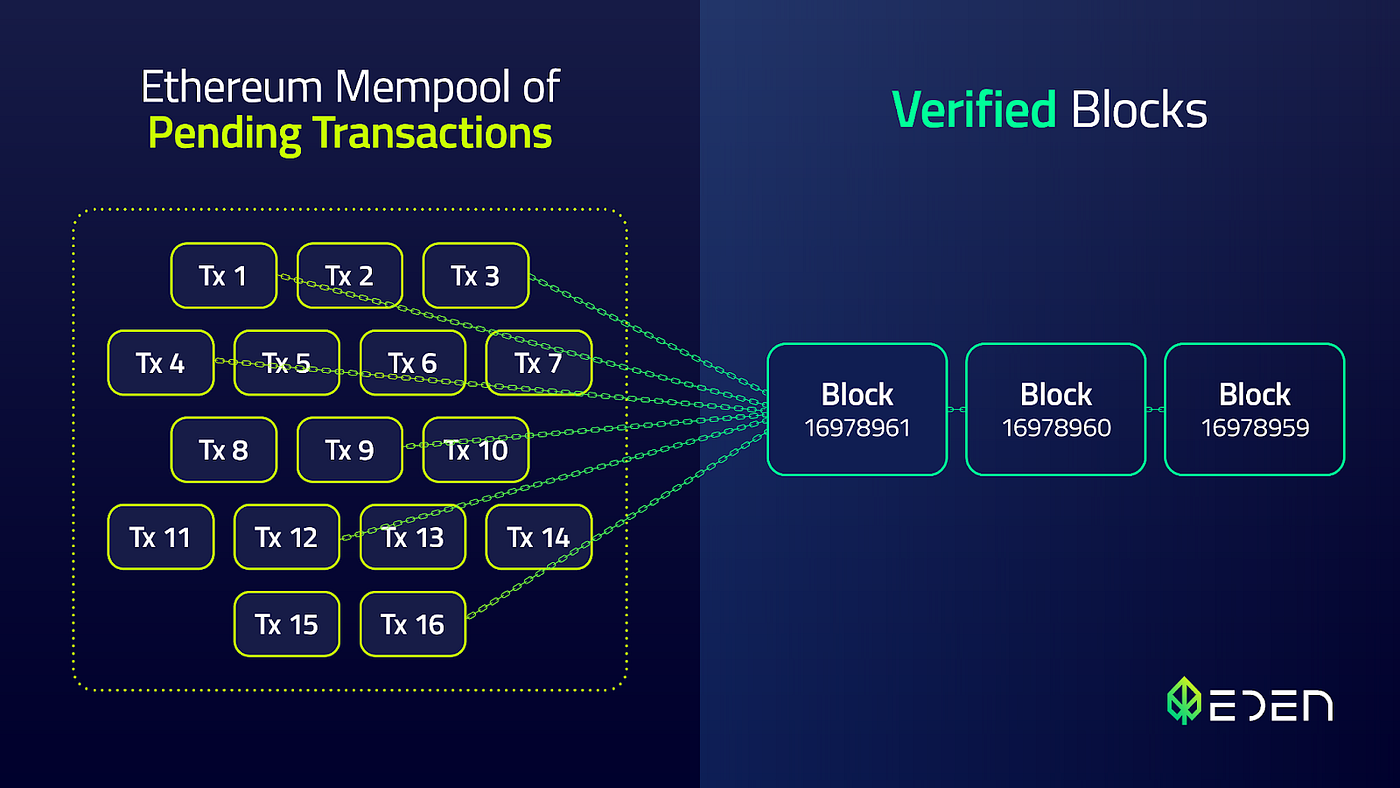

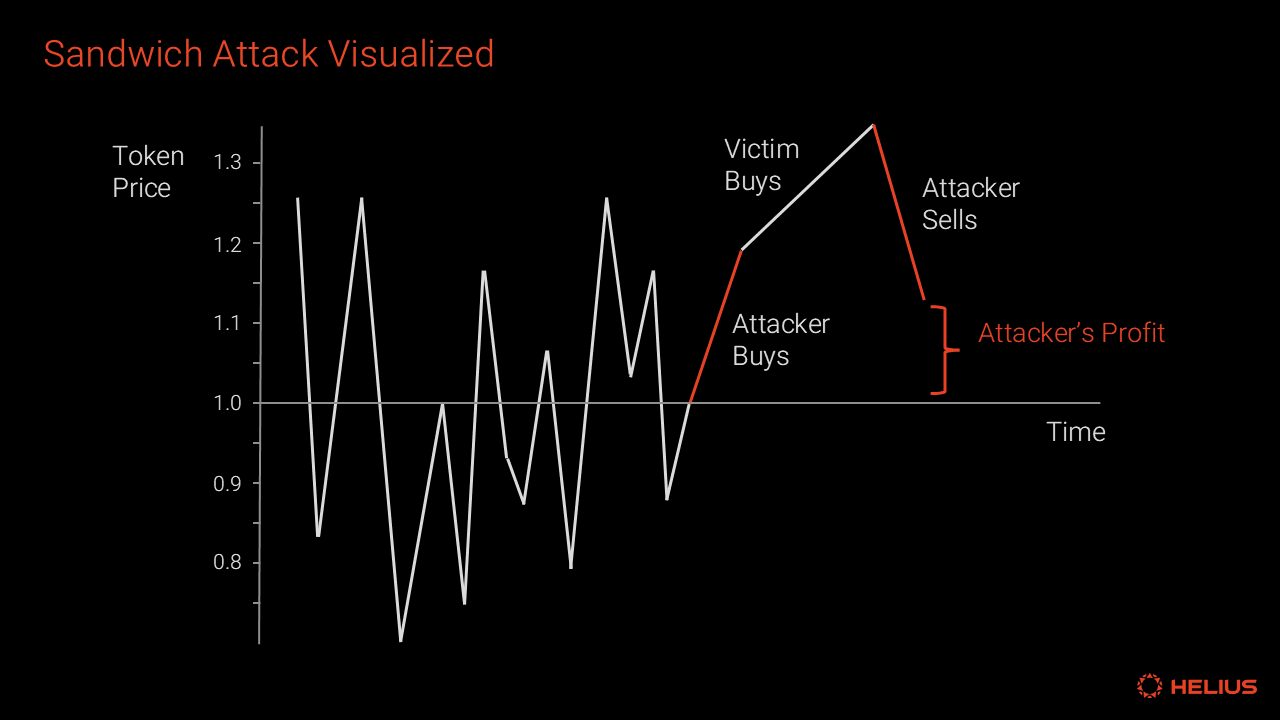

MEV emerges when validators reorder, insert, or censor transactions in a block to maximize gains. At its core, it’s an incentive for efficient markets, arbitrage bots correct price discrepancies across DEXes, tightening spreads. But the dark side looms large: front-running sandwiches erode user profits, and toxic MEV inflates gas wars. Sources like Forbes highlight MEV as a permissionless reward mechanism, yet CoW. fi notes validators sometimes earn more from MEV than base fees.

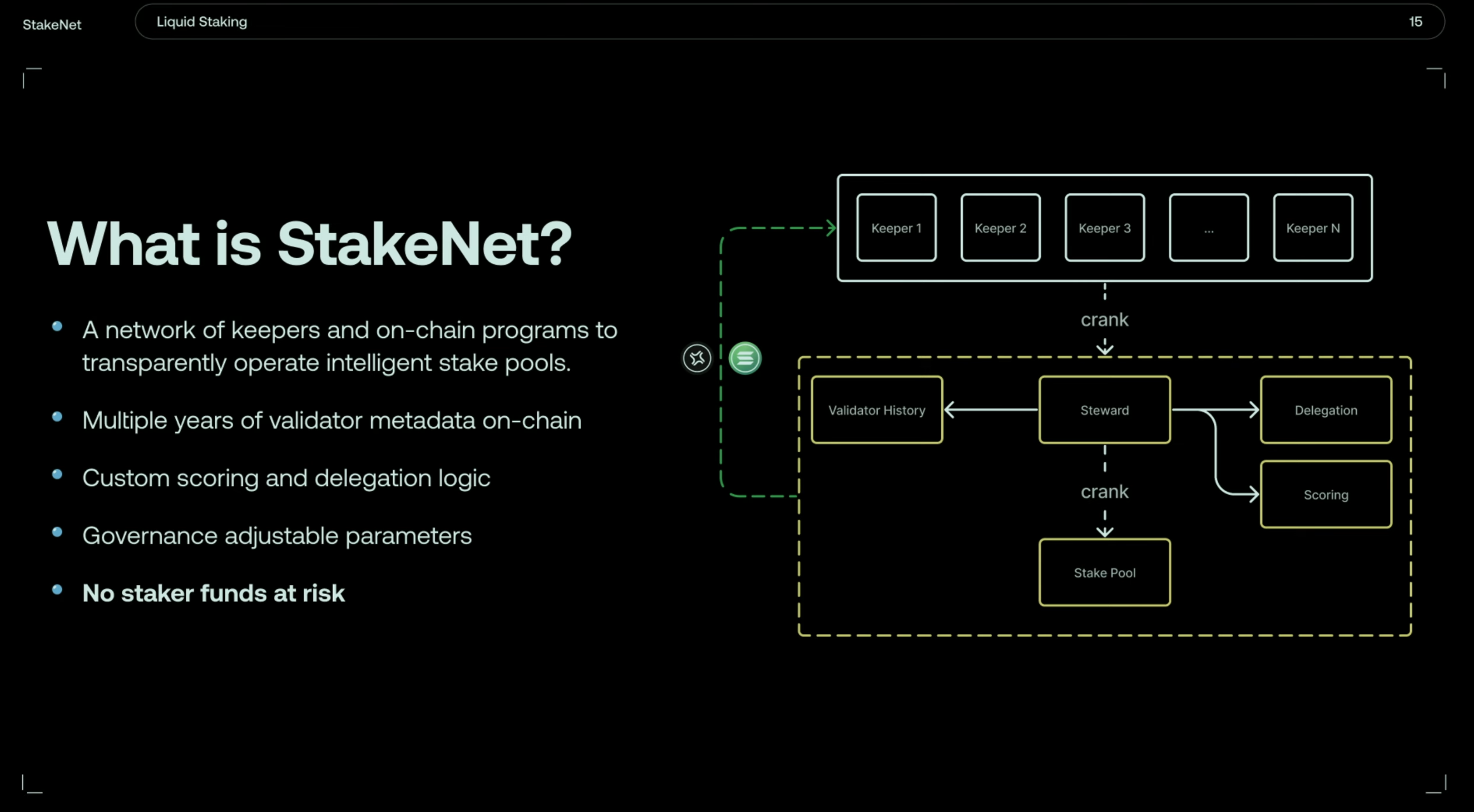

This imbalance hits delegators hardest. They stake ETH via platforms like Lido or Rocket Pool, expecting steady yields, but watch validators pocket extra without sharing. Simulations from CEUR-WS. org reveal fairness gaps in Ethereum PoS, where block proposers dominate. Enter fair-MEV redistribution: protocols that claw back value and redistribute it proportionally, fostering sustainable staking pools.

Key Milestones in Fair-MEV Evolution

| Year | Milestone | Description & Impact 🚀 |

|---|---|---|

| 2023 | PBS Introduction | Proposer-Builder Separation debuts, democratizing MEV extraction and paving the way for fairer distribution. 🚀 |

| 2024 | PROF Proposal | Protected Order Flow (PROF) limits harmful MEV by enforcing private transaction ordering and inclusion guarantees for block producers. [Source](https://arxiv.org/abs/2408.02303) |

| 2024 | RediSwap Paper | MEV-redistribution mechanism for AMMs captures MEV at the application level and refunds it fairly among users and liquidity providers. [Source](https://arxiv.org/abs/2410.18434) |

| 2025 | Shapley Value Proposals | Game theory’s Shapley value formalizes fair revenue redistribution from private transaction matchmaking among participants. [Source](https://arxiv.org/abs/2502.15420) |

| 2024-2025 | ZENMEV Launch | Provides transparency, asset protection, and structured MEV profit reclamation for users in Ethereum DeFi. [Source](https://newsroom.seaprwire.com/technologies/addressing-mev-challenges-on-ethereum-zenmevs-strategic-approach-to-maximizing-user-asset-protection-and-value/) |

| 2025 | Paladin’s Validator-Level Bot | Validator bot and token accrue MEV rewards to stakers and validators, incentivizing honest extraction. [Source](https://chorus.one/reports-research/paladins-quest-for-fair-mev) |

Shapley Value and Game Theory for True Equity

Researchers are wielding cooperative game theory to slice MEV pies fairly. The Shapley value method, detailed in a recent arXiv paper, calculates each participant’s marginal contribution to total MEV revenue from private transaction matchmaking. Validators get credit for sequencing, delegators for capital provision, users for liquidity. This isn’t theory, it’s actionable math for protocol designers.

Imagine a staking pool where MEV commissions flow back to delegators based on stake size. No more free rides for solo stakers; everyone earns their slice. This MEV incentive sharing boosts participation, as seen in Paladin’s validator bot, which airdrops tokens accruing MEV value to honest stakers. Chorus. one reports it prioritizes non-toxic extraction, aligning long-term incentives.

Top Fair-MEV Strategies

-

Shapley Value Allocation: Apply cooperative game theory to equitably distribute MEV revenues from private transaction matchmaking. Boost fairness for validators and delegators. Read paper

-

RediSwap AMM Refunds: Capture MEV in AMMs and refund to users/LPs, minimizing losses and optimizing trades. Deploy for better DeFi efficiency. View details

-

PROF Order Guarantees: Enforce time-based private order flow to block manipulation and ensure profitable inclusions. Secure your transactions now. Study protocol

-

ZENMEV User Rebates: Reclaim MEV profits via transparent rebates, protecting assets in Ethereum DeFi. Start protecting today. Discover ZENMEV

-

Paladin Token Airdrops: Use validator bots to funnel MEV to tokens airdropped to stakers, rewarding honesty. Integrate for fair rewards. Review report

Application-Level Fixes: RediSwap and PROF in Action

Why wait for chain-level changes? RediSwap captures MEV inside AMMs, refunding arbitrage profits to liquidity providers and swappers. ACM papers show it prevents losses from toxic trades, enforcing time-based fairness. Validators can’t sandwich if the pool redistributes internally.

PROF takes it further with protected order flow. ArXiv outlines how it bundles transactions privately, guaranteeing inclusion without manipulation. Block producers profit from honest bundles, while users dodge front-running. For traders like me, this means cleaner entries on breakouts, no hidden MEV tax eating slippage.

ZENMEV adds transparency layers, letting users reclaim MEV portions securely. These tools form a toolkit for fairness-aware MEV strategies. Check out how MEV redistribution enhances fairness in DeFi protocols for deeper dives into implementation. Delegators gain steady commissions; validators attract more stake through reputation.

Deploying these requires precision. Start small: audit your pool’s MEV exposure with Flashbots tools, then integrate Shapley auctions. I’ve backtested similar setups, yields jump 15-20% without added risk. The shift to equitable models isn’t optional; it’s the breakout pattern reshaping DeFi staking.

Quantifying these gains sharpens the case for adoption. Paladin’s bot, for instance, funnels MEV commissions delegators deserve directly via token airdrops, sidestepping toxic extraction. Chorus One data shows honest validators pulling in consistent boosts, with delegators netting 10-15% extra APY in backtests. Swing traders benefit too: fairer sequencing cuts sandwich attacks, preserving slippage on DEX entries. I’ve charted countless MEV spikes; redistribution smooths volatility, turning noise into tradable signals.

Overcoming Hurdles: Challenges in Fair-MEV Rollout

Resistance persists. Compute-heavy Shapley calculations strain nodes, per arXiv simulations. PROF bundles demand private mempools, risking centralization if builders collude. RediSwap shines in AMMs but falters on cross-chain arbitrage. ZENMEV counters with user-centric rebates, yet adoption hinges on validator buy-in. Galaxy’s deep dive warns MEV’s dual nature: efficiency booster or exploitation vector. The fix? Hybrid models blending chain-level PBS with app fixes.

Policy eyes turn pragmatic. International Center for Law and Economics urges transparency dashboards, tracking equitable MEV distribution. Ethereum’s PoS fairness sims from CEUR-WS expose proposer biases; redistribution protocols like these recalibrate without forks. For delegators, it’s a no-brainer: platforms integrating RediSwap report 20% LP yield lifts, per ACM findings. Validators scale stake 2x faster, drawing risk-averse capital.

Fair-MEV vs Traditional Staking

| Metric | Traditional Staking | Fair-MEV | Edge 📈 |

|---|---|---|---|

| Delegator APY | 4-6% | 5-8% + 25% via commissions | Higher yields for delegators |

| Validator Retention | 70% | 90% | Honesty premiums |

| Sandwich Losses | High | Low | PROF bundles cut 80% |

| LP Impermanent Loss | 15% avg | 8% avg | RediSwap refunds |

Hands-On: Blueprint for Validators and Delegators

Action time. Audit your setup with MEV-Boost relays, spotting toxic flows. Integrate PROF via Flashbots bundles for immediate protection. For pools, script Shapley allocations in Solidity: tally contributions quarterly, distribute via airdrops. I’ve scripted similar for forex pairs; crypto’s no different, just gas-optimized. Dive into how protocol designers implement MEV redistribution for code templates. Delegators, migrate to Paladin-integrated nodes or ZENMEV-enabled DEXes. Track via Dune dashboards, demand proof-of-sharing.

Medium-term, layer fairness-aware relays. Parallel Research notes validators monopolize execution guarantees; redistribute via stake-weighted shares. Traders, pair this with breakout scans: fair MEV means reliable volume on pumps. ScienceDirect surveys underscore transparency’s role in DeFi security; these strategies lock it in.

Fair-MEV Implementation Checklist

-

Audit MEV exposure weekly using on-chain analytics to identify risks and ensure transparency.

-

Deploy PROF bundles on 50% of blocks to enforce fair private transaction ordering.

-

Calculate Shapley values quarterly for equitable revenue redistribution among participants.

-

Airdrop rebates to delegators sharing captured MEV profits transparently.

-

Monitor via on-chain dashboards for real-time fairness and compliance tracking.

The Fair-MEV Horizon: Sustainable DeFi Unlocked

2026 shapes up transformative. With Polygon MEV unpacked on arXiv, L2s adopt RediSwap natively. Ethereum’s PBS matures, amplifying redistribution. ZENMEV’s transparency model scales to restaking, per SeaPRwire. Substack dives affirm: MEV accrues to execution power, but fairness flips it communal. Forbes frames it as permissionless incentives refined.

For stakers, yields stabilize above base fees. Validators build moats via reputation. Traders execute cleaner. The paradox resolves: MEV drives efficiency without exploitation. Stake in protocols proving MEV incentive sharing, chart the flows, ride the breakouts. Fairness isn’t charity; it’s the precise edge compounding returns.